Types of Investors in Real Estate: 8 Key Profiles to Know

Types of Investors in Real Estate: 8 Key Profiles to Know

Discover the different types of investors in real estate and learn how each can impact your investment strategy in 2025.

Domingo Valadez

Oct 20, 2025

Blog

In real estate syndication, understanding your investor is as critical as understanding your deal. The capital you raise is not a monolith; it comes from diverse individuals and entities, each with unique motivations, risk tolerances, and investment horizons. Treating all potential investors the same is a common pitfall that leads to inefficient fundraising and mismatched partnerships. A clear grasp of the different types of investors in real estate allows sponsors to refine their outreach, structure more appealing opportunities, and build a robust network of capital partners.

This guide moves beyond generic labels to provide a strategic blueprint for sponsors and operators. We will dissect eight primary investor personas, detailing their typical capital capacity, preferred deal structures, and communication styles. For those looking to understand the broader landscape, exploring various 10 key real estate investment strategies provides essential context for aligning deals with investor goals. By recognizing who you're talking to, from a high-net-worth individual seeking passive income to a family office focused on legacy wealth, you can tailor your pitch and foster stronger, more successful long-term relationships. This targeted approach is the cornerstone of effective capital raising in a competitive market.

1. Fix-and-Flip Investors

Fix-and-flip investors are one of the most visible types of investors in real estate, often popularized by television shows like Flip or Flop. Their strategy is straightforward: purchase an undervalued or distressed property, complete renovations to force appreciation, and sell it quickly for a profit. This approach is active, hands-on, and requires a keen eye for both a property's potential and its hidden costs.

These investors thrive on market inefficiencies and their ability to execute a value-add plan efficiently. Success hinges on a deep understanding of local market values, renovation costs, and project management. For example, a flipper might purchase a foreclosed home for $200,000, invest $60,000 in strategic modernizations like a new kitchen and updated bathrooms, and resell it for $350,000 within nine months.

Key Characteristics and Strategy

Fix-and-flippers operate on short timelines, typically holding a property for just 6-12 months. Their capital is often tied up in a single project, making speed and efficiency paramount to profitability and their ability to move on to the next deal. Their risk tolerance is moderate to high, as they are exposed to market fluctuations, contractor issues, and unforeseen repair costs.

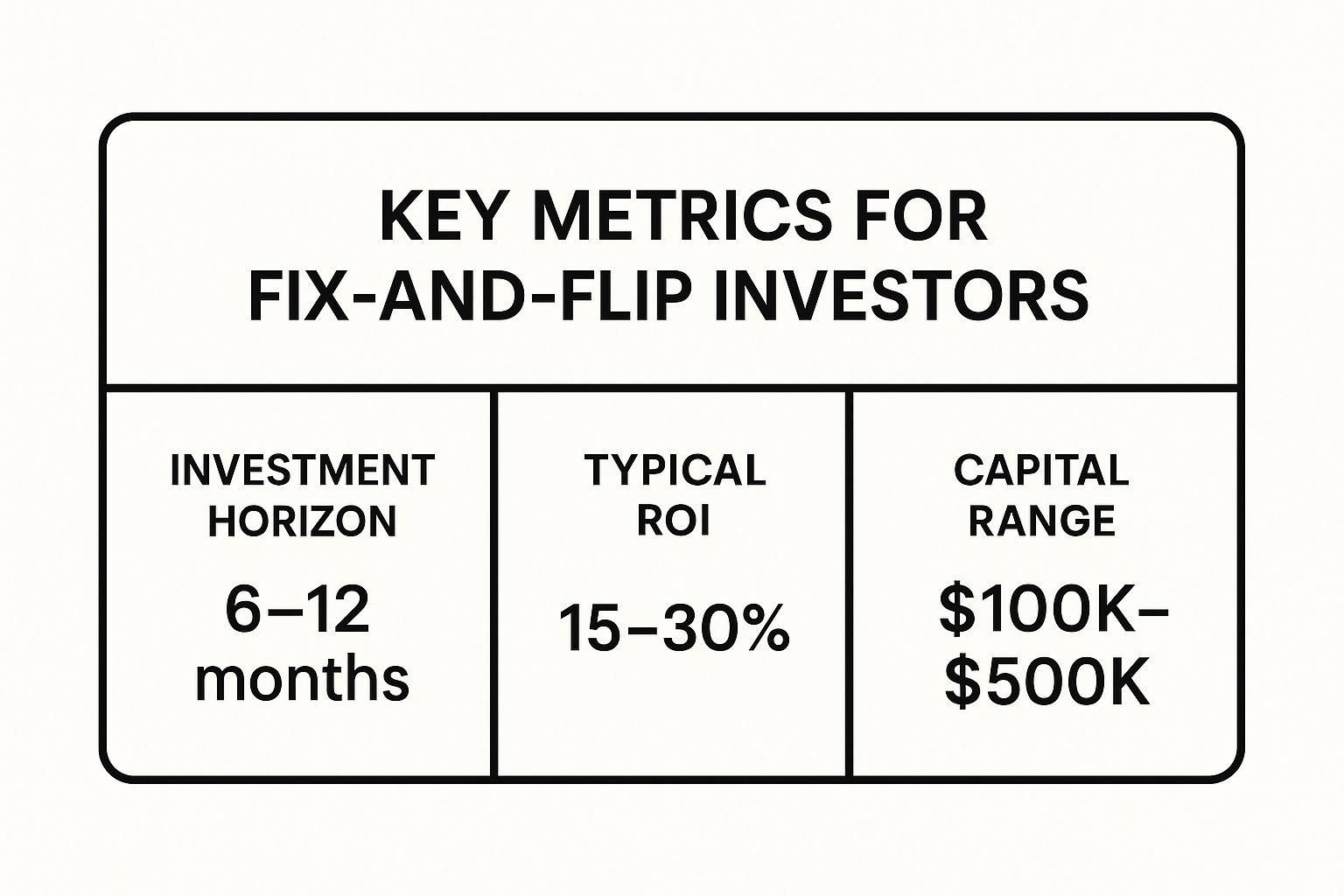

The following infographic highlights the typical financial and temporal metrics for this investor profile.

As the data shows, the model relies on generating significant returns within a year, which requires a substantial, but not institutional, amount of upfront capital per project.

Syndication Fit and Actionable Tips

While fix-and-flip investors often work solo or in small partnerships, they can be excellent partners in certain syndication models, especially for single-asset funds focused on heavy value-add residential properties.

To effectively engage them, sponsors should highlight:

* The 70% Rule: Frame deals by showing the purchase price is no more than 70% of the after-repair value (ARV) minus estimated repair costs.

* Clear Scope of Work: Present a detailed renovation plan and budget, including a 15-20% contingency for unexpected expenses. This demonstrates foresight and risk management.

* High-ROI Improvements: Focus marketing materials on cosmetic upgrades with proven returns, such as kitchens, bathrooms, and enhanced curb appeal.

2. Buy-and-Hold Rental Property Investors

Buy-and-hold investors are the quintessential long-term players in real estate, focusing on acquiring properties to generate consistent rental income and build wealth through appreciation over many years. Popularized by figures like Robert Kiyosaki, this strategy is the bedrock of passive income creation. It involves purchasing a property, renting it out, and using the cash flow to cover expenses while the asset's value grows and the mortgage balance shrinks.

This approach is less about quick profits and more about sustainable, long-term wealth accumulation. For instance, an investor might buy a duplex for $300,000, rent each unit for $1,500, and generate a steady cash flow after covering the mortgage, taxes, insurance, and maintenance. Over decades, this single asset can build significant equity and provide a reliable income stream, making it one of the most stable types of investors in real estate.

Key Characteristics and Strategy

Buy-and-hold investors operate on a long-term horizon, often holding properties for 10, 20, or even 30 years. Their primary metrics are cash flow, cash-on-cash return, and long-term equity growth. Their risk tolerance is typically low to moderate, as they are insulated from short-term market volatility by stable rental income. Success depends on careful tenant screening, property management, and financial discipline, including maintaining reserves for vacancies and repairs. For those interested in long-term strategies, exploring diverse rental property financing options is a crucial first step.

Syndication Fit and Actionable Tips

Buy-and-hold investors are a perfect fit for syndications focused on stabilized, cash-flowing assets like Class B or C multifamily properties or commercial real estate with long-term tenants. They are attracted to deals that promise predictable returns and professional management, freeing them from day-to-day operational hassles.

To effectively engage them, sponsors should highlight:

* Strong Cash Flow Projections: Present clear, conservative underwriting that details projected net operating income and cash-on-cash returns. Use realistic vacancy and expense ratios.

* Long-Term Market Fundamentals: Showcase data on the submarket's job growth, population trends, and rental demand to demonstrate the investment's long-term viability.

* Professional Property Management: Emphasize the experience and track record of the property management team, as this is a key factor for passive investors seeking reliable operations.

3. Real Estate Investment Trust (REIT) Investors

Real Estate Investment Trust (REIT) investors represent one of the most accessible types of investors in real estate, offering a way to own a slice of large-scale, income-producing property portfolios through publicly or privately traded shares. This model, pioneered by figures like Samuel Zell, allows individuals to gain exposure to sectors like industrial warehouses, data centers, or multifamily apartments without the complexities of direct property management. The strategy is almost entirely passive, focusing on dividend income and long-term capital appreciation.

REITs are legally required to distribute at least 90% of their taxable income to shareholders, making them a popular choice for those seeking consistent cash flow. For example, an investor could purchase shares in Realty Income (O), known as 'The Monthly Dividend Company', and receive regular income derived from its portfolio of over 11,000 commercial properties. This structure provides liquidity and diversification that is difficult to achieve with direct property ownership.

Key Characteristics and Strategy

REIT investors typically have a long investment horizon, low to moderate risk tolerance, and a preference for passive income over active management. Their capital commitment can range from a few hundred dollars to millions, depending on whether they are individual retail investors or institutions. Their primary risk is market volatility and sensitivity to interest rate fluctuations, as rising rates can make REIT dividends less attractive compared to bonds.

Success for these investors is measured by total return, which combines dividend yield and share price growth. Unlike direct real estate, REITs offer daily liquidity, allowing investors to buy or sell shares easily on major stock exchanges.

Syndication Fit and Actionable Tips

While public REIT investors are not direct targets for private syndications, the principles that attract them are highly relevant. Sponsors can appeal to investors who share the REIT mindset by structuring deals that mimic REIT benefits, such as a focus on passive income and professional management.

To effectively engage investors with this profile, sponsors should:

* Emphasize Strong FFO: Highlight Funds From Operations (FFO) growth potential in your pro forma. This is a key metric REIT investors use to evaluate performance and dividend sustainability.

* Showcase Tenant Quality: Detail the creditworthiness and lease terms of tenants in the property. A portfolio with strong, stable tenants like those found in top-tier REITs is a major selling point.

* Focus on Dividend Sustainability: Present a clear distribution plan with a sustainable payout ratio. Investors accustomed to REITs will analyze your ability to consistently deliver cash flow.

4. Wholesale Real Estate Investors

Wholesale real estate investors are intermediaries who master the art of finding deeply discounted properties. Popularized by figures like Than Merrill and Cody Sperber, their strategy is to find motivated sellers, get a property under contract below market value, and then assign or sell that contract to another buyer, typically a fix-and-flipper or rental investor, for a profit. They never take ownership of the property, acting as a deal-finder rather than a traditional buyer.

This approach requires minimal capital but demands significant effort in marketing, negotiation, and building a reliable network of cash buyers. For instance, a wholesaler might find a distressed property worth $250,000, negotiate a purchase contract with the seller for $170,000, and then assign that contract to a rehab investor for $180,000. They earn a $10,000 assignment fee without ever funding the purchase, closing the gap between motivated sellers and investors seeking deals.

Key Characteristics and Strategy

Wholesalers operate on extremely short timelines, often closing a deal within days or weeks. Their success is not tied to property appreciation but to their ability to consistently generate leads and secure contracts with sufficient spreads for an end buyer. Their financial risk is exceptionally low, as their primary cost is marketing, but their business risk is high; a deal can fall through if they cannot find a buyer quickly, potentially damaging their reputation.

This model is a high-volume, transactional business. It hinges on negotiation skills and a deep understanding of what constitutes a "good deal" for other types of investors in real estate.

Syndication Fit and Actionable Tips

Wholesalers are not typically passive investors in syndications, but they are invaluable as deal-sourcing partners for sponsors. Establishing relationships with reputable wholesalers can provide a consistent pipeline of off-market opportunities that would otherwise be inaccessible.

To effectively partner with wholesalers, sponsors should:

* Provide Clear Buying Criteria: Give wholesalers your exact "buy box," including property type, size, location, and desired price range. This helps them bring you only relevant deals.

* Build a Reputation for Closing: Wholesalers need reliable buyers who can act fast. Prove you can close quickly with cash or pre-approved financing to become their go-to partner.

* Be Transparent About Your Role: Position yourself as an end-buyer looking for value-add opportunities. Acknowledge their role and fee structure to build trust for a long-term partnership.

5. Commercial Real estate Investors

Commercial real estate investors are a sophisticated group who purchase properties used for business purposes. This broad category includes office buildings, retail centers, industrial warehouses, and multifamily apartment complexes (typically 5+ units). Unlike residential investors focused on comparable sales, commercial investors prioritize income generation, evaluating deals based on metrics like net operating income (NOI) and capitalization (cap) rates.

These investors often engage in larger transactions, requiring significant capital and a deep understanding of complex financial models. For example, a commercial investor might acquire a 200-unit apartment complex for $25 million, improve operations to increase its NOI, and then refinance or sell based on the property’s higher valuation. The strategy is fundamentally about optimizing an asset's financial performance over time.

Key Characteristics and Strategy

Commercial real estate investors typically have a long-term investment horizon, often holding assets for 5-10 years or more. Their goal is to generate stable, predictable cash flow from tenant leases while benefiting from long-term appreciation. Their risk tolerance can vary but is generally moderate, as they rely on detailed due diligence, tenant quality, and market analysis to mitigate risks associated with economic cycles and vacancies.

These investors are analytical, focusing on pro forma statements, rent rolls, and economic indicators. They operate at a scale where professional property management is essential, and success depends on their ability to manage assets efficiently, negotiate favorable leases, and identify markets with strong growth fundamentals.

Syndication Fit and Actionable Tips

Commercial real estate investors are the ideal audience for syndications, as these deals often require capital far beyond the reach of a single individual. They are accustomed to passive or semi-passive roles and understand the structure of limited and general partnerships.

To effectively engage them, sponsors should highlight:

* Detailed Financial Projections: Present a comprehensive pro forma with clear assumptions for rent growth, vacancy rates, and operating expenses. Show the calculation of NOI and the target cash-on-cash return.

* Tenant Quality and Lease Structure: Emphasize the creditworthiness of existing tenants and the terms of their leases. For a retail center, this means highlighting anchor tenants like a national grocery store; for industrial, it could be a long-term triple-net (NNN) lease with a major corporation.

* Market-Level Data: Provide a robust analysis of the submarket, including demographic trends, job growth, and new supply coming online. This demonstrates a deep understanding of the factors that will drive the asset's performance.

6. Real Estate Syndication Investors (Limited Partners)

Real estate syndication investors, also known as Limited Partners (LPs), represent a powerful and growing segment of the investment landscape. Their strategy involves pooling capital with other investors to acquire large-scale commercial assets, such as apartment complexes or self-storage facilities, that would be unattainable on their own. In this model, a syndicator or General Partner (GP) finds, underwrites, and manages the asset, while LPs provide the majority of the equity in exchange for a passive ownership stake and a share of the profits.

This approach offers a gateway to institutional-quality real estate without the burden of day-to-day management. For instance, a group of 50 accredited investors might each contribute $100,000 to raise $5 million, enabling the syndicator to purchase a $20 million multifamily property. The LPs then receive regular cash flow distributions and a significant payout when the asset is sold, all while benefiting from the GP's specialized expertise.

Key Characteristics and Strategy

Syndication investors are typically passive, focusing on long-term wealth creation and cash flow rather than active management. Their investment horizon is often medium to long-term, ranging from 3 to 10 years, depending on the asset's business plan. Their risk tolerance can vary, but they generally seek vetted opportunities with experienced sponsors who can mitigate risk through professional asset management and a proven track record.

The core of their strategy is diversification and leverage, using relatively smaller capital outlays to gain exposure across various sponsors, property types, and geographic markets. As an investor type, they are a cornerstone of the commercial real estate market, providing essential capital for value-add and development projects. To understand the full mechanics, explore this comprehensive guide to real estate syndication.

Syndication Fit and Actionable Tips

This investor type is, by definition, the ideal fit for syndication. They are the target audience for nearly every real estate sponsor seeking to raise private capital.

To effectively attract and retain these investors, sponsors should:

* Demonstrate a Flawless Track Record: Showcase past deal performance, including realized returns, and provide transparent reporting from previous projects.

* Ensure Alignment of Interests: Clearly communicate how much of their own capital (often called "skin in the game") the GP team has invested in the deal. A significant GP co-investment builds immense trust.

* Simplify the Complex: Break down the offering memorandum into easily digestible webinars, executive summaries, and Q&A sessions. Clearly explain the fee structure and waterfall distributions.

7. Private Money Lenders / Hard Money Lenders

Private money lenders, often called hard money lenders, are a unique group among the different types of investors in real estate because they invest in debt rather than equity. Their strategy involves providing short-term, asset-backed loans to other investors, typically for fix-and-flip projects or bridge financing where speed is critical. They are the financial engine for many active investors who need capital faster than a traditional bank can provide.

Unlike conventional lenders who scrutinize borrower credit, hard money lenders prioritize the property's value, specifically its after-repair value (ARV). In exchange for their speed and flexibility, they charge higher interest rates (8-15%) and origination fees, known as points. For example, a private lender might fund a $200,000 loan at 12% interest with 2 points for a 12-month term, earning $24,000 in interest plus $4,000 in upfront fees, all secured by a property with a strong value proposition.

Key Characteristics and Strategy

Private money lenders operate on short investment horizons, with loans typically lasting from 6 to 18 months. Their goal is to generate consistent, passive income through interest payments and points while protecting their principal with a secure lien on the real estate. Their risk tolerance is low to moderate; they mitigate risk by maintaining conservative loan-to-value (LTV) ratios, usually under 75%, ensuring a substantial equity cushion if the borrower defaults.

This model allows them to deploy capital, generate strong returns, and then redeploy that capital into new loans once the original loan is repaid. They are not involved in property management or renovations; their role is purely financial, focusing on underwriting the deal and servicing the loan.

Syndication Fit and Actionable Tips

Private money lenders can be excellent sources of debt capital for syndicators, especially for bridge financing before a property is stabilized or for funding extensive value-add renovations. They can fill funding gaps that institutional lenders will not touch.

To effectively engage them, sponsors should highlight:

* A Secure First Lien Position: Emphasize that their investment will be secured by a first-position deed of trust, giving them priority for repayment in a default scenario.

* Conservative Loan-to-Value (LTV): Present the deal with a clear LTV of 70% or less based on the property's "as-is" or after-repair value. This demonstrates a significant equity buffer.

* Clear Exit Strategy: Detail the plan for loan repayment, whether through a sale or a refinance with a long-term conventional lender once the property is stabilized and cash-flowing.

8. Real Estate Crowdfunding Investors

Real estate crowdfunding investors represent a modern, technology-driven approach to property investment. They participate by pooling their capital with many other individuals through online platforms like Fundrise or CrowdStreet. This method democratizes access to large-scale deals, such as apartment complexes or commercial developments, that were once reserved for institutional players or high-net-worth individuals.

These platforms vet and present investment opportunities, allowing investors to choose between debt or equity positions. An investor might deploy $25,000 through RealtyMogul to participate in a $5 million multifamily acquisition, receiving a share of the profits. This model allows for diversification with relatively small amounts of capital, reducing individual risk while opening doors to professional-grade real estate assets.

Key Characteristics and Strategy

Crowdfunding investors are typically passive, relying on the platform's sponsor to manage the asset. Their investment horizons vary widely, from short-term debt deals (12-24 months) to long-term equity holds (5-10 years). Their risk tolerance can range from low (for debt investments secured by real estate) to moderate (for value-add equity deals), and they often prioritize diversification and ease of access over hands-on control.

Capital requirements are significantly lower, with minimums often starting at just a few thousand dollars. This accessibility makes it a popular entry point for newer investors and a portfolio diversification tool for experienced ones. Success for these types of investors in real estate depends on the due diligence performed by the platform and the quality of the sponsors it partners with.

Syndication Fit and Actionable Tips

Real estate crowdfunding investors are, by definition, syndication investors. They are the ideal audience for sponsors who leverage technology to raise capital efficiently. Sponsors can work directly with established platforms or build their own portals to attract this investor base.

To effectively engage them, sponsors should highlight:

* Platform Credibility: Emphasize a strong track record, transparent reporting, and low historical default rates. Investors on these platforms prioritize trust and security.

* Clear Fee Structures: Provide a simple, upfront breakdown of all fees (acquisition, asset management, disposition). Hidden or complex fees are a major red flag for this audience.

* Accessibility and Low Minimums: Market the low barrier to entry. Frame deals with minimum investment amounts like $5,000 or $10,000 to attract a wider pool of capital.

8 Types of Real Estate Investors Comparison

Streamline Your Syndication and Strengthen Investor Relationships

Navigating the complex world of real estate investment requires more than just finding the right property; it demands finding the right capital partners. As we've explored, the landscape is populated by a diverse array of participants, from the high-velocity Fix-and-Flip Investor to the long-term, passive REIT Investor. Each of these types of investors in real estate brings a unique set of expectations, capital capacities, and risk appetites to the table. The key to successful syndication isn't just identifying them, but understanding how to align your offerings with their specific goals.

For sponsors and syndicators, this understanding is the foundation of a scalable capital-raising strategy. A buy-and-hold multifamily opportunity will resonate differently with a Commercial Real Estate Investor focused on Class A office space than it will with a Buy-and-Hold Rental Property Investor looking to diversify their single-family portfolio. Recognizing these distinctions allows you to move beyond generic pitches and create targeted, compelling offerings that speak directly to an investor's core motivations.

From Identification to Actionable Strategy

Mastering these investor profiles transforms your outreach from a speculative numbers game into a strategic, relationship-driven process. Instead of casting a wide, inefficient net, you can segment your network and tailor your communication, deal structure, and reporting to match investor expectations precisely.

Here are the critical takeaways to implement immediately:

- Segment Your Investor Database: Go beyond names and emails. Tag contacts in your CRM based on their likely investor type, risk tolerance, and preferred deal structure. This enables hyper-targeted communication for new opportunities.

- Refine Your Deal Presentation: Create different versions of your investment summary. A hard money lender needs to see a clear, quick path to repayment and a strong collateral position. A syndication LP, in contrast, requires detailed pro-forma financials, sponsor track records, and a transparent distribution waterfall.

- Build an Ecosystem, Not Just a Deal: The most successful sponsors cultivate a network that includes various investor types. A wholesaler can bring you off-market deals, a private money lender can provide bridge financing, and a pool of LPs can fund the long-term acquisition.

Ultimately, your ability to efficiently manage these varied relationships will define your long-term success. The value is not just in closing a single deal but in building a reputation for professionalism and clarity that attracts repeat investment and referrals. By systemizing your operations, you create the bandwidth to focus on sourcing premier assets and delivering exceptional returns, solidifying the trust that underpins every successful real estate venture.

Ready to professionalize your investor management and scale your syndication business? Homebase provides an all-in-one platform designed specifically for real estate sponsors to manage the entire investor lifecycle, from deal rooms to distributions. Explore Homebase today and spend less time on administration and more time building your portfolio.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.