How to Start a Real Estate Investment Company: Step-by-Step Guide

How to Start a Real Estate Investment Company: Step-by-Step Guide

Learn how to start a real estate investment company with our expert tips. Start building wealth today—discover the essential steps now!

Domingo Valadez

Oct 21, 2025

Blog

Starting a real estate investment company isn't about jumping straight into property scouting. The real work begins with a solid strategic foundation—that means crafting a detailed business plan, carving out your investment niche with sharp market analysis, and setting firm financial goals. This is what guides your decisions and, more importantly, attracts capital.

Building Your Real Estate Investment Blueprint

Before you even glance at a property listing or think about funding, you need to build your company's blueprint. This isn't some static document you file away and forget. Think of it as a living roadmap that informs every single decision, from the properties you target to the partners you bring on.

A well-thought-out plan gives you clarity and direction. It’s also the core of your pitch to investors and lenders. Honestly, without one, you’re just navigating the market blind. This planning stage forces you to tackle the tough questions head-on: Who are you serving? What specific corner of the market will you own? How will you stand out when there’s so much competition? Answering these builds the framework you need to last.

Define Your Investment Niche

First things first, you have to pick a lane. One of the biggest mistakes I see new investors make is trying to be a jack-of-all-trades. That approach just scatters your energy and leads to so-so results. The key is to focus your efforts and become a genuine expert in one specific area.

Your niche could be anything from a property type to a specific location or investment strategy. For instance, you could:

- Zero in on a Property Type: Become the go-to person for Class B or C multi-family apartment buildings, small-bay industrial warehouses, or even medical office buildings.

- Establish a Geographic Focus: Dominate a particular city, a booming suburb, or even just a few specific neighborhoods you know have serious growth potential.

- Master an Investment Strategy: Specialize in value-add projects where you're renovating and repositioning properties, or stick to acquiring stabilized, cash-flowing assets for long-term holds.

When you narrow your focus like this, you build incredibly deep market knowledge, a much stronger network, and a knack for spotting those undervalued deals that everyone else misses.

Conduct In-Depth Market Analysis

Once you’ve got a niche in mind, it's time to back it up with hard data. A real market analysis is more than just a quick look at recent sales prices. You need to dig into the economic guts of the area to make sure it can support your investments for the long haul.

I’m talking about tracking key indicators like population growth, job creation across different industries, and any big local infrastructure projects. Are new companies moving in? Is the city pouring money into public transit or new parks? These are the vital signs of a healthy, growing market. This research doesn’t just validate your chosen niche; it gives you the compelling data points you need for your business plan.

Your business plan is more than just a document for lenders; it's your personal compass. It forces you to translate your vision into an actionable strategy, ensuring that every move you make is deliberate and aligned with your ultimate goals.

Create a Powerful Business Plan

Your business plan is the document that pulls it all together. It’s where you lay out your vision, strategy, and financial projections in a clear, persuasive story. It needs to be detailed enough to satisfy a skeptical lender yet straightforward enough to guide your day-to-day work. A killer business plan is absolutely essential when you're figuring out how to start a real estate investment company.

To help you get started, here's a look at the core components your plan must include.

Core Components of Your Real Estate Investment Business Plan

This table summarizes the essential elements every real estate investment company's business plan should include to ensure clarity and attract investors.

Putting these pieces together creates a comprehensive document that not only guides you but also builds confidence in anyone you're asking for money.

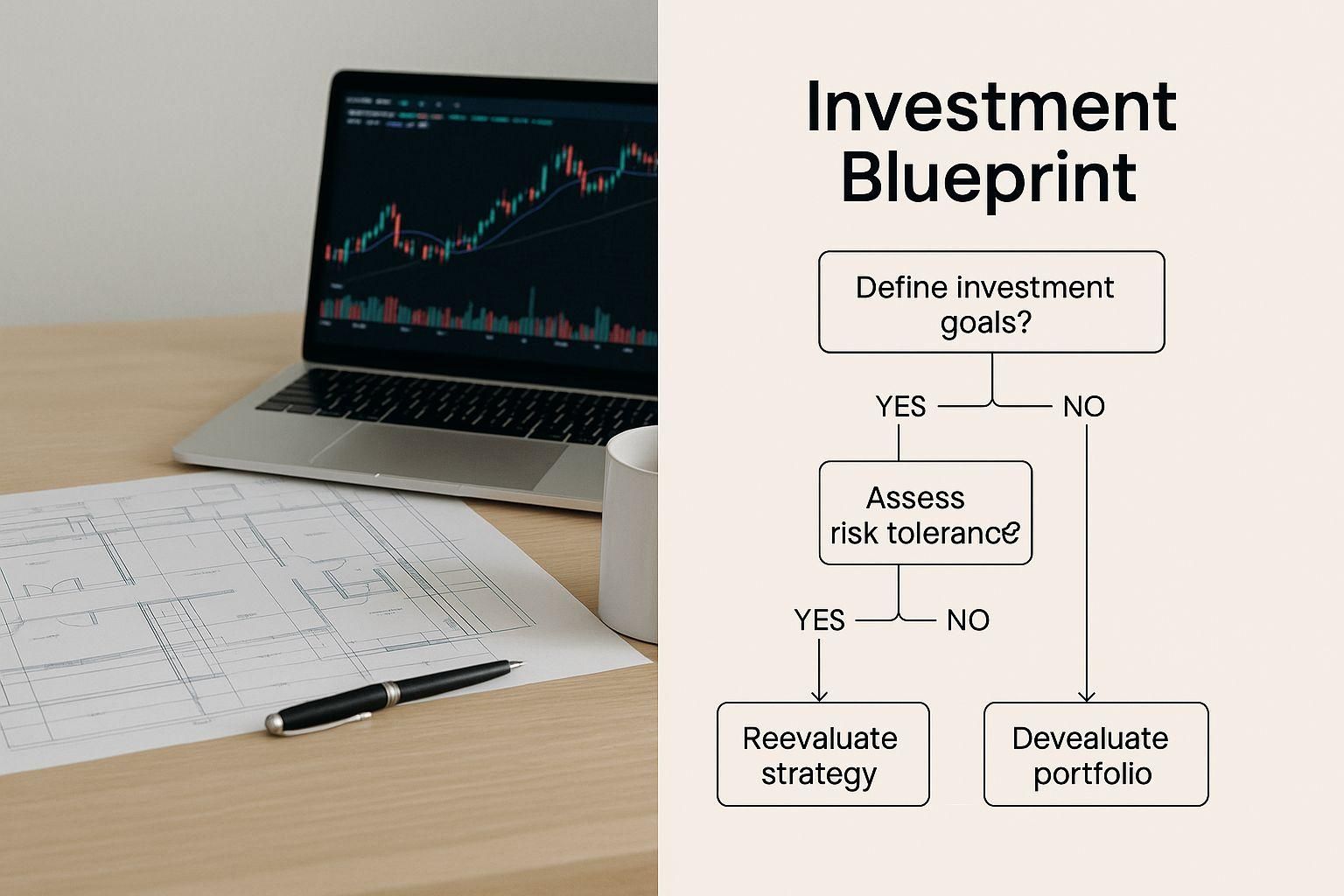

This infographic provides a great visual of the key decisions you'll be making as you put together your investment blueprint.

As the decision tree shows, the niche you choose at the beginning has a ripple effect on everything that follows—your market analysis, financial projections, and overall strategy. For a more structured approach, you can check out our comprehensive real estate business plan template to get you started. Remember, this plan is your single best tool for raising capital; it proves you've done the work and have a legitimate path to profitability.

Choosing the Right Business Structure

With your strategic blueprint mapped out, it’s time to build the legal and financial foundation for your real estate investment company. This isn't just about filing paperwork; the structure you choose has huge implications for your personal liability, tax obligations, and your ability to bring on investors down the road.

Getting this right from day one is one of the most important things you can do. It protects your personal assets and paves the way for smart, scalable growth. Think of it like pouring the foundation for a house—get it wrong, and you'll be dealing with cracks and problems for years to come. A poor entity choice can leave your personal savings exposed to business debts or hit you with a surprise tax bill that kills your cash flow.

Comparing the Go-To Business Entities

For most folks starting in real estate, the choice usually comes down to a few common options. The trick is to find that sweet spot between bulletproof asset protection and operational simplicity.

- Limited Liability Company (LLC): This is the crowd favorite for a reason. An LLC creates a legal wall between your personal assets and your business liabilities. If a tenant sues the company, your home and personal savings are generally off-limits. It also offers "pass-through" taxation, meaning profits flow directly to you to be taxed on your personal return, neatly sidestepping the double taxation that corporations often face.

- S Corporation (S-Corp): An S-Corp also gives you liability protection and pass-through taxation, but with a twist. The big difference is how you get paid. You can draw a "reasonable salary" and take any remaining profits as distributions, which aren't subject to self-employment taxes. For a high-volume business, this can add up to serious tax savings, but it does mean more administrative legwork like running payroll and holding formal meetings.

- Sole Proprietorship: This is the easiest to set up because, legally, you are the business. But that simplicity comes at a steep price: zero liability protection. If your business gets into hot water, your personal assets are completely on the hook. For that reason alone, I almost never recommend this for serious real estate investing.

When you're weighing your options, it's critical to grasp concepts like understanding the corporate veil and its implications, which directly impacts how protected your personal assets truly are.

Making the Call: What’s Right for You?

So, how do you pick one? Let’s walk through a real-world scenario.

Say you're buying your first rental property—a duplex you plan to hold for the long term. An LLC is practically perfect. It gives you that essential liability shield without burying you in corporate paperwork. All the rental income simply passes through to your personal tax return. Easy.

Now, imagine your strategy is to scale a house-flipping business quickly. An S-Corp suddenly looks much more attractive. With a higher volume of deals and bigger profits, saving a bundle on self-employment taxes by taking distributions could be a game-changer for your bottom line. The extra admin work is a small price to pay for that kind of financial upside.

A rookie mistake I see all the time is commingling funds—using a personal checking account for business expenses. This is the fastest way to "pierce the corporate veil," which can completely undo the liability protection you set up the LLC or S-Corp for in the first place. Always, always keep your accounts separate.

Your Post-Formation Checklist

Getting your entity registered is a huge first step, but you're not done yet. To keep your company in good standing and ensure that liability shield stays strong, you have a few more essential tasks to knock out.

- Get an Employer Identification Number (EIN): This is basically a Social Security Number for your business. You can get one for free from the IRS website, and you'll need it to open a business bank account, file taxes, or hire anyone.

- Open a Dedicated Business Bank Account: This is absolutely non-negotiable. Every dollar in and out of the company must go through this account. It makes bookkeeping a thousand times easier and reinforces the legal separation between you and your business.

- Secure Local Licenses and Permits: Real estate is a highly regulated field. Your city or state will likely require a business license, and if you're landlording, you may need specific rental permits. A quick call to your local government's business department will tell you exactly what you need to operate legally.

Once you’ve checked these boxes, you’ve officially transformed your idea into a legitimate, protected company that’s ready to start building a portfolio.

Securing Capital for Your First Deals

Let's talk about the fuel for your real estate engine: capital. Without it, the most brilliant deal analysis is just a fun academic exercise. This is the hurdle where so many aspiring investors trip up, but getting funded isn’t some secret art reserved for the well-connected. It’s about strategy, building real relationships, and telling a story that makes sense.

Getting from a plan on paper to a property with your name on the title means knowing where the money is and how to ask for it. You don’t need a finance degree, but you absolutely need to speak the language of people who write checks. That means having a pitch backed by hard numbers that clearly shows the opportunity.

The Traditional Route: Banks and Credit Unions

For most people just starting out, the first thought is a traditional lender. Think of your local bank or credit union. These institutions are the bedrock of real estate finance, but they play a conservative game built entirely around managing risk.

To get a "yes" from them, you have to be buttoned up. We're talking a strong personal credit score, a hefty down payment (usually 20-25% for an investment property), and a business plan that proves the property can and will make money.

Here's a pro tip: start building a relationship with a local commercial loan officer before you even have a deal. Walk in, introduce yourself, and explain what you're looking for. It changes the dynamic completely when you're a person, not just a file number.

Tapping into Private Capital

This is where the real magic can happen. Private money gives you the speed and flexibility that banks just can't match. This capital comes from regular people—doctors, lawyers, successful business owners—who are looking for better returns than they're getting in the stock market.

Securing private money is all about trust. It's a relationship business. Your investors are betting on you just as much as they're betting on the deal.

- Friends and Family: This is the most common starting point. Just because they know you doesn't mean you can be casual. Treat their investment with the seriousness it deserves—get everything in writing with proper legal documents.

- Networking Groups: Get out there. Go to local real estate investor meetups and chamber of commerce events. You're not just there to ask for money; you're building a network of people who understand the industry.

- Your Professional Circle: Think about the people you already know. That lawyer who did your will? Your accountant? They might be looking to diversify their own portfolios.

The key is to plant seeds long before you need the harvest. Talk about what you're doing, share your vision, and build genuine connections.

Crafting a Winning Pitch Deck

Whether you're sitting down with a loan officer or a private investor, your pitch deck is your number one tool. It’s the visual story of the deal, your business, and why this is a can't-miss opportunity.

A great pitch deck doesn't just throw numbers on a slide; it builds a case. It needs to be clean, professional, and straight to the point.

Your pitch deck is your first impression. It has to answer the three big questions—'Why this deal? Why this market? Why you?'—in the first few minutes. If an investor is confused after two slides, you've lost.

A solid deck should always include:

1. Executive Summary: A one-page snapshot of the entire opportunity.

2. The Problem/Opportunity: What market gap are you filling?

3. The Property: Great photos, key stats (square footage, year built, etc.).

4. The Financials: This is the core. Purchase price, reno budget, projected rents, and the key metrics like Cash-on-Cash Return and IRR.

5. The Team: Who are you? Why are you the right person to pull this off?

Getting Creative with Financing

Sometimes the straightest path isn't the best one. Creative financing can get a deal done when you're short on cash, which is how many investors scale their portfolios quickly.

- Seller Financing: You'd be surprised how often this works. The seller essentially acts as your bank, financing a portion of the deal. If they're motivated and you present a solid offer, it's a win-win.

- Joint Ventures (JVs): This is all about partnership. You find the deal and have the expertise to manage it, and your partner brings the cash. You both agree on a profit split upfront.

- Hard Money Loans: Think of these as short-term, high-speed loans based on the property's value, not your personal credit. The interest rates are higher, but they can be funded in days, not months. They're perfect for a fix-and-flip where time is money.

Knowing what's happening in the broader financial world is critical when you're deciding how to start a real estate investment company. For instance, in a higher interest rate environment, debt funds often become more active, offering solid returns as property values adjust. This can open up unique funding opportunities, especially in hot sectors like logistics and data centers. To get a better handle on this, you can read the full research on current real estate financing tactics to see how you can position your new company for success.

Assembling Your Professional Support Team

You can’t build a real estate empire by yourself. I’ve seen countless entrepreneurs try, and the story is always the same: they get bogged down in the details and burn out. Long-term success in real estate isn't just about finding killer deals; it’s about building a rock-solid network of professionals and a smart tech stack to back you up.

Think of it this way: your time is your most valuable asset. Every hour you spend trying to interpret a dense legal contract or chasing down a late rent check is an hour you’re not spending on finding your next property or raising capital. Your goal is to build a well-oiled machine where every person—and every tool—has a specific, critical job to do.

Your Core Professional Circle

Before you even glance at software subscriptions, you absolutely have to get the right people in your corner. These are the experts who will save you from making catastrophic mistakes and provide the specialized knowledge you simply can't have on your own. Honestly, vetting these partners is one of the most important things you'll do when starting out.

Here are the non-negotiables for your team:

- A Real Estate Attorney: This is your first line of defense. A sharp attorney will scrutinize every purchase agreement, lease, and partnership contract to make sure your interests are protected. Don't cheap out and hire a generalist; find someone who lives and breathes real estate transactions.

- An Investment-Savvy Accountant: Any old CPA won't do. You need an accountant who truly understands the nitty-gritty of real estate tax law, from depreciation schedules to the mechanics of a 1031 exchange. Their strategic advice can literally save you tens of thousands of dollars every single year.

- A Knowledgeable Agent or Broker: A great agent does far more than just unlock doors. They are your boots on the ground, feeding you off-market deals, pulling accurate comps, and providing the kind of local insight you can’t find online.

- A Reliable Property Manager: If rental properties are your game, a top-notch property manager is the key to scaling without losing your mind. They handle the daily headaches—tenant screening, rent collection, late-night maintenance calls—so you can focus on growing the business.

Building Your Technology Stack

In today’s market, having the right technology is just as crucial as having the right people. A smart tech stack puts all those repetitive, soul-crushing tasks on autopilot, keeps your information organized, and delivers the data you need to run the business like a pro. It’s the engine that lets your professional team truly shine.

For example, if you're a real estate sponsor managing a few deals with a dozen or more investors, spreadsheets just won't cut it for long. That's exactly where a platform like Homebase becomes essential. This kind of software brings all your investor relations under one roof, letting you manage communications, send out distributions, and handle legal documents from a single, secure portal.

Building a strong support system is an investment, not an expense. The cost of a good lawyer or the right software is insignificant compared to the cost of one bad deal or a major operational failure.

Key Professional vs Technology Solutions

Finding the right balance between human expertise and powerful technology is where the magic happens. Your team provides the strategy, relationships, and nuanced judgment, while the software provides the efficiency and scale. This table shows how they can work together to handle core functions within your company.

By pairing these professionals with modern tools, you create a powerful, scalable system. This setup allows you to punch above your weight, manage a growing portfolio with a lean team, and give your investors a polished, professional experience right from the start.

How to Find and Analyze Investment Properties

With your company structured and your capital lined up, the real fun begins: the hunt for properties. This is where your business plan gets its first real-world test. Finding and vetting investments isn't about scrolling through Zillow for hours; it’s a disciplined process of sourcing deals and running the numbers with surgical precision.

This is the stage that separates the pros from the hobbyists. It demands a mix of relentless networking, creative sourcing, and an absolute commitment to data-driven analysis. Every potential deal has to go through a financial stress test before you even think about making an offer.

Cultivating Your Deal Flow Pipeline

The best deals are rarely found—they're cultivated. If you’re only looking at public listings on the MLS, you’re swimming in the most crowded part of the pool and likely paying a premium. To get an edge, you have to build a pipeline that brings you opportunities nobody else sees.

Start treating your professional network like gold. Make it a habit to connect with brokers, property managers, attorneys, and contractors. Be crystal clear about your buying criteria. When they know you’re a serious buyer who can actually close, they'll bring deals to you before they ever hit the market.

Another fantastic, yet often overlooked, strategy is direct-to-seller marketing. Think about targeted mail campaigns to owners of tired or under-managed properties in your target neighborhoods. This proactive approach puts you in the driver's seat, letting you negotiate directly with motivated sellers.

Mastering Off-Market Sourcing Strategies

Going off-market is how you find properties with equity already baked in. These are the deals that aren't publicly advertised, which gives you a massive advantage right out of the gate.

- Work with Wholesalers: These are the ground-pounders who specialize in finding distressed properties and getting them under contract. They then assign that contract to a buyer (like you) for a fee. It's a great way to tap into a steady stream of leads.

- Drive for Dollars: It sounds old-school, but it works. Block out time to systematically drive through your target neighborhoods, looking for tell-tale signs of neglect—overgrown lawns, boarded-up windows, or mail overflowing from the mailbox. These are often clues to a motivated or absentee owner.

- Attend Local Auctions: Foreclosure and tax-lien auctions can be a goldmine for properties at a steep discount. A word of caution: this isn't for beginners. It requires serious due diligence beforehand and, typically, all-cash purchases.

For anyone focusing on wholesaling, it's worth noting how much technology is changing the game. Using modern AI video tools for real estate wholesalers can dramatically improve how you find and market properties to potential buyers.

Running the Numbers The Right Way

Finding a potential deal is only half the battle. The most critical skill in this business is financial analysis. Your ability to accurately forecast a property's performance will either make or break you. Gut feelings are great, but they don’t pay the bills—cash flow does.

You need to get fluent in the key real estate metrics. Don't let the jargon intimidate you; just focus on a few core calculations that tell the most important parts of the story.

A classic rookie mistake is taking the seller's expense numbers at face value. Always, always build your own pro forma using realistic, market-rate expenses for things like property management, maintenance reserves, and vacancy. This is the only way to get a true picture of a property's potential.

For every single deal you look at, you need to calculate these three metrics, no exceptions:

- Net Operating Income (NOI): This is your total income (rent plus any other fees) minus all your operating expenses. It's calculated before you factor in your mortgage payment, giving you a pure look at the property's profitability.

- Capitalization Rate (Cap Rate): You get this by dividing the NOI by the Purchase Price. The cap rate is a fantastic tool for comparing the relative value of different properties. Generally, a higher cap rate suggests higher risk but also a higher potential return.

- Cash-on-Cash Return: This is your annual pre-tax cash flow divided by the total cash you invested out-of-pocket. This metric tells you exactly what return you're getting on your actual money in the deal, which is what you and your investors will care about most.

It's also smart to keep an eye on the bigger picture. In 2024, for example, global real estate deal value jumped by 11% to $707 billion, showing a strong recovery. This trend, largely fueled by private capital, saw niche sectors like data centers produce incredible returns. When your analysis aligns with these broader economic currents, you're better equipped to spot genuine opportunities and validate your assumptions. Mastering these skills is what turns you from a property speculator into a sophisticated real estate investor.

Got Questions? We've Got Answers

Stepping into the world of real estate investing brings up a ton of questions. It's only natural. Here, I'll tackle some of the most common ones I hear from people just getting started, giving you straight-up answers to help you get moving.

How Much Money Do I Genuinely Need to Start?

This is always the first question, and the honest answer is: it really depends on your game plan. You don't always need a massive bank account to get in the game.

- House Hacking: Believe it or not, you can get into a multi-family property with a down payment as low as 3.5% using an FHA loan. The catch? You have to live in one of the units yourself.

- Wholesaling: This route is more about hustle than cash. Your main job is to find a deal, get it under contract, and then sell that contract to another buyer for a fee. Your biggest costs here are your time and marketing efforts.

- Partnerships: Got the skills to find and manage a great deal but don't have the funding? A joint venture (JV) is your best friend. You find the deal, and your partner brings the cash to the table.

It’s not about how much money you have, but about picking the right strategy for the money you can access.

Do I Need to Get a Real Estate License?

A license is definitely not a must-have to be an investor, but it can be a nice tool in your belt. It gives you direct access to the Multiple Listing Service (MLS), which means you can save a good chunk of change on commissions when you're buying for yourself.

On the flip side, a license comes with annual fees, ongoing education requirements, and a whole set of legal duties. If your strategy is all about finding deals on the MLS, it might be worth the effort. But if you’re focusing on off-market properties, that time is probably better spent networking and marketing.

A lot of newcomers think a license gives them instant credibility. Here's the truth: your credibility comes from your track record and your ability to actually close deals, not a certificate on the wall. Build your portfolio first.

What's the Biggest Mistake New Investors Make?

I see it time and time again: the number one killer is bad due diligence. It's easy to get caught up in the thrill of a potential deal and just skim the numbers. New investors often take the seller's word for it or wildly underestimate how much renovations will actually cost.

This is how you end up with a property that bleeds money every month or has nightmarish hidden problems. The fix? Build a rock-solid due diligence checklist and follow it to the letter for every single property—no exceptions, no matter how shiny it looks. Learning how to properly vet a deal is the most important part of figuring out how to start a real estate investment company.

Ready to run your real estate investments without the chaos? Homebase brings everything together in one place to handle fundraising, investor relations, and distributions. You get to focus on what you do best—closing deals—while we handle the paperwork. See how Homebase can help you scale your business with flat, predictable pricing and amazing support.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Your Guide to Hard Money Commercial Lending in 2026

Blog

Unlock deals with our guide to hard money commercial lending. Learn how syndicators can leverage asset-based financing for rapid acquisitions and growth.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.