Master the Investor Onboarding Process: Your Complete Guide

Master the Investor Onboarding Process: Your Complete Guide

Transform your investor onboarding process with proven strategies. Learn from fund managers who've streamlined KYC, compliance, and automation.

Domingo Valadez

Jun 20, 2025

Blog

Why Modern Investor Onboarding Is Make or Break

The world of fundraising has changed, and the old ways of bringing investors on board are no longer just inefficient—they're a liability. Your first impression isn't your pitch deck; it's your investor onboarding process. A clunky, paper-based system sends a clear message about how you manage complexity and value your partners' time. In an environment where every advantage matters, a slow or confusing onboarding experience can kill momentum and jeopardize a deal before it even starts.

Think about it from the investor's perspective. After they've committed to a significant investment, they're suddenly met with a disjointed process of endless emails, confusing forms, and zero clarity on what comes next. This friction doesn't just create frustration; it seeds doubt. This initial experience often predicts how communications and operations will be handled for the life of the investment. Smart firms recognize this and treat onboarding as a key part of their brand and competitive strategy, not just an administrative chore.

The New Reality of Fundraising Timelines

The fundraising cycle itself has become more challenging, putting even more pressure on the onboarding phase. In real estate fundraising, for example, the average capital raise cycle has stretched to about 24 months, nearly double what it was in 2019. At the same time, regulatory demands are increasing. Starting in 2025, new FinCEN regulations will impact over 172,000 reporting entities, adding another layer of compliance complexity. This mix of longer fundraising periods and stricter rules makes a manual, error-prone onboarding system a major risk. You can dive deeper into these reliable investor onboarding trends and challenges to see the full picture.

To put the difference into perspective, let's compare the old way of doing things with a modern, automated approach.

Traditional vs. Modern Investor Onboarding Comparison

A side-by-side comparison showing the key differences between traditional manual onboarding processes and modern automated systems.

As the table shows, a modern system doesn't just speed things up; it transforms the entire experience. What used to take weeks of manual effort, follow-ups, and potential errors can now be completed in a matter of days, or even hours, with far greater accuracy and security.

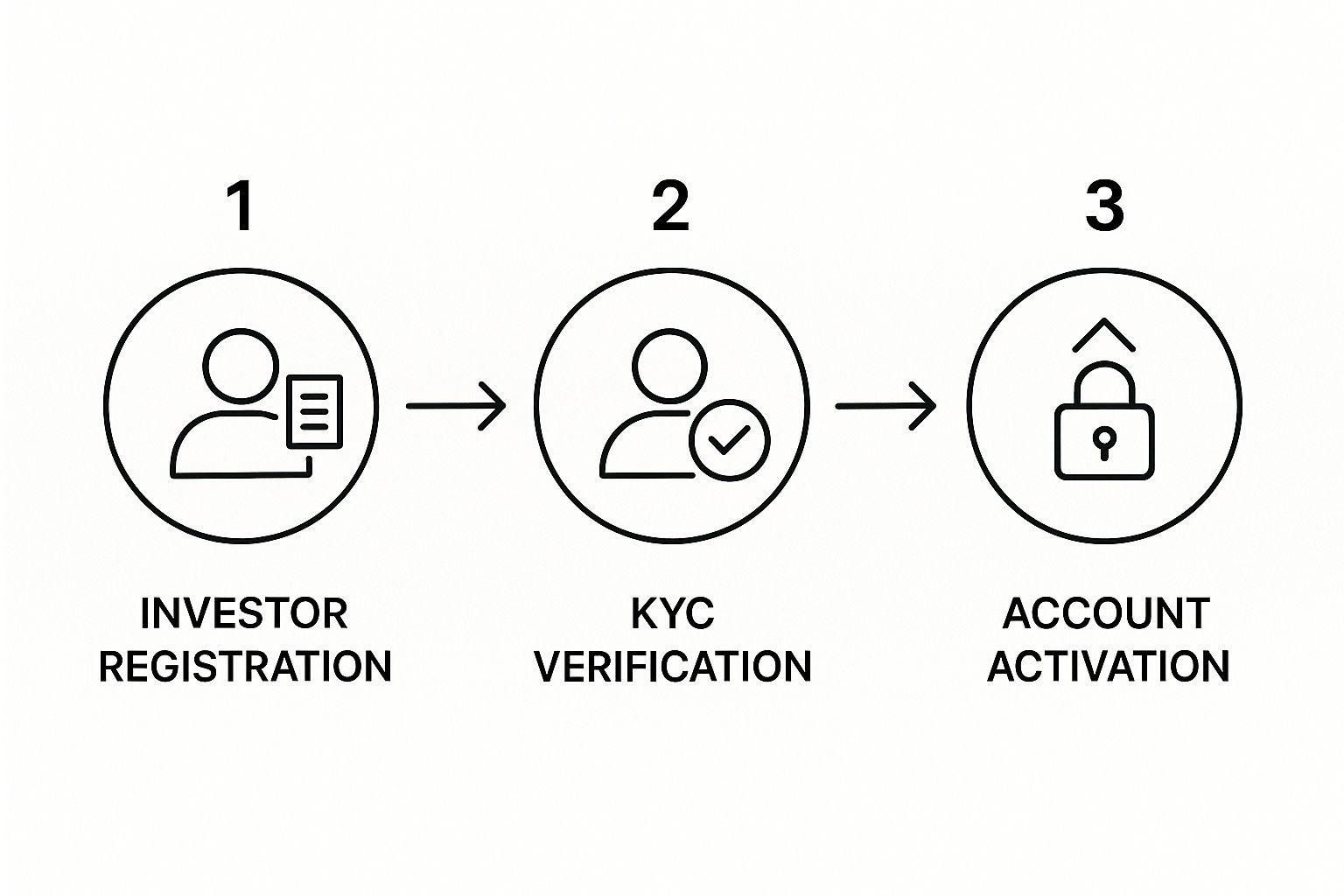

From Registration to Activation

A modern investor onboarding process follows a clear, logical sequence to build trust and maintain momentum. This flow typically moves from initial registration to final account activation, keeping the investor informed and engaged at every point.

The visualization above simplifies the core stages, but it highlights the critical handoffs between collecting investor information, performing necessary verifications, and ultimately providing access to their investment portal. Each step is an opportunity to either impress an investor with efficiency or frustrate them with delays.

Building Your Foundation Without the Usual Mistakes

Before you get distracted by shiny new automation tools, it’s essential to get your own house in order. A solid investor onboarding process is the bedrock of everything that follows. I’ve seen many firms rush this planning stage, only to build a system that creates more headaches than it solves. To move from chaotic spreadsheets to a smooth, professional workflow, you have to start with an honest look at what you’re currently doing. This isn’t just about listing steps; it’s about digging deep to find the hidden bottlenecks that frustrate investors and eat up your team’s time.

Here’s a real-world scenario I see all the time: a fund manager spends two weeks in a back-and-forth email chain with an investor just to fix a single typo on a subscription document. Many write this off as "the cost of doing business," but it's really a symptom of a broken process. A proper audit might reveal the root cause is a poorly designed form or the lack of a simple data check upfront. If you just automate that same flawed process, all you've done is speed up the frustration.

Mapping a Realistic Onboarding Journey

After you’ve identified the pain points, it’s time to map out a realistic timeline and workflow. One of the biggest mistakes is creating a one-size-fits-all plan. The onboarding journey for a tech-savvy individual putting in $50,000 is completely different from an institutional entity investing through a complicated trust structure.

Your plan needs to reflect these differences. For instance:

- Individual Accredited Investor: This path can be a simple, straightforward digital workflow. It might involve a portal invitation, an e-signature on the subscription agreement, and an automated KYC/AML check. The whole thing could take just a few days.

- Institutional or Trust-Based Investor: This journey will naturally have more manual touchpoints. You’ll need to collect and carefully review formation documents, identify every beneficial owner, and possibly coordinate with their legal team. This process might realistically take several weeks.

Mapping these distinct paths does two important things: it sets clear expectations for both your investors and your internal team, and it helps you get buy-in from your colleagues. When you can show them a thoughtful plan that directly solves their biggest frustrations—like chasing down documents or manually verifying accreditation—you turn skeptics into supporters. This foundational work is what separates an onboarding system that looks good on paper from one that genuinely delivers, building the investor confidence you need for long-term loyalty.

Automation That Actually Makes Sense

Automation is often pitched as a magic button, but anyone who's tried to set up a generic system knows it can easily cause more problems than it solves. The key to a great investor onboarding process isn’t just about making tasks automatic; it’s about designing smart workflows that handle the real-world complexities of your business while keeping the human connection that builds trust. It's a delicate balance between being efficient and making your investors feel valued, not just like another number.

Mapping the Investor Journey with Smart Triggers

A truly effective system maps out the entire investor journey, from their first show of interest to the final signed documents, using decision trees that adjust to different investor types. For instance, when an investor says they are using a self-directed IRA, your workflow should automatically send them a specific set of forms and instructions made for IRA custodians. This prevents you from sending them down a generic path that doesn't fit their situation.

Here’s a practical look at how this works:

* Initial Interest: An investor fills out an interest form on your site. This action automatically creates their profile in your Homebase portal and shoots them a personalized welcome email.

* Document Submission: The moment they upload their first documents, a trigger lets your compliance team know it's time to start the review. If something is missing, the system sends a polite follow-up reminder after 24 hours.

* Accreditation Verified: Once they're verified, another trigger moves the investor to the “Ready to Sign” stage, unlocking the subscription agreement for an e-signature. This keeps the momentum going without burying them under every single document at once.

This kind of setup ensures the process moves along smoothly without you having to manually check in at every step.

Finding the Automation Sweet Spot

While automation is a game-changer, it shouldn't be used for everything. The trick is to automate the repetitive, predictable jobs—like form submissions, document tracking, and routine status updates. But when an investor has a complex question about the deal structure or a unique legal issue pops up, that's your cue for a personal phone call or a detailed, non-automated email from a principal. This hybrid approach shows you're both efficient and genuinely care.

More and more businesses are adopting this kind of technology because it gets results. By 2025, 81% of organizations are planning to invest in onboarding technology, a trend we're also seeing in the investment space. AI-powered onboarding has even been shown to cut down time-to-productivity by 50%, speeding up the crucial early stages of engagement. You can dive deeper into these fascinating onboarding statistics to learn more. To get real efficiency and smooth workflows in your investor onboarding, think about how using powerful API integration examples can link different systems together, creating a single, cohesive platform.

Making KYC and Verification Actually Painless

Let's be honest: the Know Your Customer (KYC) and investor accreditation steps are where most onboarding processes grind to a halt. For investors, it can feel intrusive and overly bureaucratic. For you, it’s a high-stakes compliance hurdle that often devolves into a frustrating paper chase. But this critical part of the investor onboarding process doesn't have to be a painful experience for either side. The secret is to reframe it from a hurdle into a confidence-building measure.

Instead of just sending a blunt request for sensitive documents, guide your investors through why these steps are necessary. A simple, well-worded introduction can make a world of difference: "To protect all members of this investment and comply with federal regulations, we have a straightforward verification process. Our secure portal makes this as simple as possible." This small shift in communication changes the dynamic from a demand to a shared responsibility.

Handling Documentation and Verification Gracefully

The real friction often comes from the back-and-forth over documentation. A common scenario is receiving a blurry photo of a driver's license or an incomplete accreditation letter. A manual process means another email chain, another delay, and another crack in the investor's confidence.

An automated system like Homebase can preempt these issues. By using smart forms with clear instructions and example formats, you reduce the likelihood of user error from the start. This is particularly important for satisfying regulators while respecting investor time.

Here's an example of the kind of guidance provided by regulators that your process needs to reflect.

The guidance seen here underscores the importance of having a robust, documented procedure. It's not just about collecting documents; it’s about having a defensible process that meets specific regulatory standards. If a verification does fail, your approach is critical. Don't send a cold, automated rejection. Use it as an opportunity for a personal touchpoint. A call or personalized email explaining the issue and offering clear, actionable solutions maintains the relationship and keeps the door open.

To truly smooth out the often complex requirements of investor verification, exploring advanced tools like compliance automation software can provide an even deeper layer of efficiency. These platforms integrate directly into your workflows, handling complex checks in the background. If you're looking for more specific strategies, you can learn more about perfecting your KYC verification process in our detailed guide. By combining clear communication with smart technology, you can turn a potential deal-breaker into a seamless, professional experience that strengthens investor trust from day one.

Document Management That Doesn't Drive Everyone Crazy

Let's be blunt: disorganized document management kills more investment deals than bad market timing. It's the silent deal-killer, creating friction and doubt during the most critical phase of the investor onboarding process. We’ve all been there—endless email chains with conflicting versions of a subscription agreement, investors getting confused by legal jargon, and the last-minute scramble to get a final signature. This chaos isn't just inefficient; it signals to your investors that your operational house may not be in order.

A robust system isn't about having the fanciest folders. It's about empathy for the user experience, whether that’s a tech-savvy millennial expecting a slick digital interface or a traditional investor who just wants things to be simple and clear. The goal is to make a complex process feel effortless.

The Power of Progressive Disclosure

One of the most effective strategies we've seen successful firms adopt is progressive disclosure. Instead of overwhelming an investor with every single legal document, risk disclosure, and operating agreement at once, you share information in logical stages. Think of it as a guided tour rather than handing someone a 300-page manual on their first day.

Using a platform like Homebase, you can design this journey. For example:

* Stage 1 (Initial Commitment): The investor gets access to the executive summary and the main subscription agreement. This is the core of the deal, presented cleanly without distractions.

* Stage 2 (Post-Signature): Once the agreement is e-signed, the system automatically unlocks the more detailed documents—the full Private Placement Memorandum (PPM), operating agreements, and K-1 explainers.

* Stage 3 (Funding): After funds are initiated, they receive their welcome packet and finalized, countersigned documents for their records.

This staged approach prevents information overload and keeps momentum. It respects the investor’s time and focuses their attention on what matters at each step.

Mastering Version Control and Security

Nothing erodes trust faster than version control issues. An investor reviewing "Subscription_Agreement_FINAL_v3_reviewed_final.docx" feels anything but confident. Centralized document management within a secure portal is the only way to solve this. When everyone is working from a single source of truth, you eliminate confusion and reduce risk. There is only one version: the current one.

Furthermore, secure sharing protocols are non-negotiable. Emailing sensitive financial and personal documents is a significant liability. A dedicated investor portal provides bank-level security, ensuring that documents are not only organized but also protected, satisfying both legal requirements and your investors’ expectations for privacy. This combination of strategic disclosure and fortress-like security transforms your document workflow from a liability into a powerful tool for building investor confidence.

Tracking What Actually Matters

Most firms track something, but few track the right things. It's easy to get lost in dashboards filled with charts that look impressive but offer zero actionable insight into your investor onboarding process. To truly improve, you need to move beyond tracking superficial numbers and focus on data that reveals bottlenecks, measures investor satisfaction, and demonstrates real business impact. This means shifting from historical record-keeping to proactive, continuous improvement.

Moving Beyond Vanity Metrics

The number of documents signed per week is a vanity metric; the average time it takes for an investor to complete the subscription process from start to finish is an actionable one. If that number is high, you have a clear signal to investigate specific stages for friction. For managing ongoing investor relationships and tracking key interactions, tools designed for effective customer relationship management with Odoo CRM can be incredibly helpful. This focus on performance metrics helps you pinpoint exact areas for improvement.

A structured approach has a proven effect on an investor’s journey. Research shows that formal onboarding processes help new participants reach full engagement 34% faster than informal methods. This acceleration is crucial, as it directly correlates with investor confidence and their willingness to commit capital without delay. You can explore more about these onboarding performance findings and see how they apply across industries.

To help you get started, here are some of the most important metrics you should be tracking to gauge the health of your investor onboarding flow.

Tracking these metrics gives you a clear, data-backed picture of where your process is succeeding and where it’s falling short, allowing for targeted improvements rather than guesswork.

Gathering Honest Feedback

The most valuable data often comes directly from your investors, but you have to ask for it correctly. Instead of a generic "How was your experience?" survey, ask pointed questions at specific milestones. For example, immediately after they complete the KYC verification, you could send a one-question poll: "On a scale of 1-5, how easy was it to provide your verification documents?"

This type of targeted feedback provides granular insights. If you notice a trend of low scores at the document-signing stage, you know exactly where to focus your efforts. Here are a few key metrics worth tracking:

* Time-to-Complete by Stage: How long do investors spend in the KYC, accreditation, and document signing phases?

* Correction Request Rate: How often do you have to ask investors to correct or resubmit information?

* Support Ticket Volume: Are you getting a high number of questions about a specific step in the process?

By tracking what actually matters, you transform your reporting from a passive dashboard into an active tool for improving your investor onboarding process, building stronger relationships, and ultimately, closing deals faster.

Your Practical Implementation Roadmap

Success with your investor onboarding process isn’t about a single magic trick; it's about consistently applying proven strategies. This is where the real work starts. Think of it as a marathon, not a sprint, broken down into manageable phases that give you quick wins while building a foundation for long-term success. The initial excitement might wear off, but that’s when having momentum is most important.

The first phase, which usually takes about 30-60 days, is all about stabilizing the process and grabbing some low-hanging fruit. Don't try to fix everything at once. Instead, focus on the biggest pain points you found during your initial audit. Is it the KYC verification step that’s causing delays? Or maybe the back-and-forth of getting documents signed? By targeting one or two high-impact areas first, you show immediate value, which is vital for getting your team on board and keeping morale high.

Handling Resistance and Maintaining Momentum

When you start making changes, you’ll probably run into some internal resistance. People who are used to the "old way" of doing things might push back. The best way to manage this isn't by issuing orders, but by using data and showing empathy. Show them how the new process cuts down on their manual work or gets rid of those annoying back-and-forth emails.

For instance, you could say, "I know chasing down corrected W-9s is a huge headache. Our new system validates this information upfront, so we'll never have to do that again." This positions the change as a solution to their problems, not just another directive from management.

It's just as important to manage investor expectations during this shift. Be transparent. Let them know you're improving your systems to give them a better, more secure experience. A simple message like, “We’re currently upgrading our onboarding portal to make your investment journey smoother” can turn a potential snag into a positive signal about your firm's dedication to improvement.

Celebrating Milestones and Fostering Innovation

Once your initial changes are live, the next phase is all about refinement and optimization—and this is an ongoing effort. Meaningful milestones aren't just about launching a new feature; they're about hitting key performance indicators (KPIs). Did you cut your average onboarding time from ten days down to three? Celebrate that with your team. Did your rate of correction requests drop below 5%? That’s a huge win that deserves recognition.

This entire process is about building a culture of continuous improvement. Actively ask for feedback from both your internal team and your investors. Small, consistent tweaks—like changing the instructional text on a form or adding a helpful FAQ link—can add up over time. This approach turns your onboarding from a rigid administrative task into a dynamic system that sets your firm apart from those stuck with clunky, outdated processes.

Ready to build an onboarding process that impresses investors and streamlines your operations? Discover how Homebase provides the tools you need to succeed.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.