Effortless KYC Verification Process Strategies

Effortless KYC Verification Process Strategies

Streamline your kyc verification process with expert methods that ensure strong security and boost efficiency.

Domingo Valadez

May 1, 2025

Blog

The Evolution of KYC Verification

The KYC verification process is a fundamental part of modern finance and business. Over the past few decades, it has changed dramatically. Early KYC checks were straightforward, mainly focusing on basic identity verification. Businesses typically collected fundamental information such as name, address, and a government ID number.

However, the growing complexity of global finance and the increase in digital transactions demand a more secure and flexible KYC process.

This shift is driven by the need to combat financial crimes like money laundering and terrorist financing. The Know Your Customer (KYC) process has come a long way since its origins in the U.S. Bank Secrecy Act of 1970. This act aimed to prevent money laundering by requiring financial institutions to verify customer identities.

Over time, KYC regulations have become stricter, particularly after the September 11th attacks and the 2008 financial crisis. Today, KYC is a vital part of anti-money laundering (AML) and counter-terrorist financing efforts. Businesses must perform regular reviews according to regulatory requirements and customer risk profiles.

For example, high-risk customers might need more frequent reviews than low-risk customers, often annually or as determined by risk assessments. Learn more about KYC data reviews here: How Often Should You Conduct a KYC Data Review?

Key Milestones in KYC Development

Several crucial events and regulatory changes have shaped the current KYC process. The landscape changed significantly after 9/11 with the Patriot Act, which greatly strengthened KYC requirements for financial institutions. This legislation introduced more stringent customer identification procedures and enhanced due diligence obligations.

The 2008 financial crisis further exposed vulnerabilities in the financial system. This led to even more rigorous KYC and AML regulations worldwide.

The Digital Transformation of KYC

Digital technologies have revolutionized the KYC process. Electronic KYC (eKYC) solutions have emerged as a faster, more efficient alternative to traditional paper-based processes.

eKYC uses digital identity verification methods, such as biometric authentication and document scanning, to streamline onboarding and reduce customer friction. This digital shift enables businesses to verify identities remotely and in real-time, significantly improving the customer experience.

Balancing Compliance and Customer Experience

Modern KYC processes aim to balance strict regulatory requirements with a smooth customer experience. Businesses increasingly adopt risk-based approaches to KYC, tailoring verification procedures to each customer's risk profile.

High-risk customers may undergo more extensive checks, while low-risk customers benefit from simplified and faster onboarding. This method ensures compliance while minimizing unnecessary hurdles for customers. The future of KYC likely involves greater integration of artificial intelligence and machine learning to automate risk assessment and enhance the overall efficiency of the process.

Breaking Down the KYC Verification Process

After exploring the history of Know Your Customer (KYC) regulations, it's important to understand how the process works today. This means looking at each step involved and how it helps verify customer identities and reduce risk. A strong KYC verification process is essential for building trust and ensuring regulatory compliance.

Core Components of KYC Verification

The KYC process typically includes several key stages, creating a solid framework for verifying customer identity and assessing potential risks. These interconnected stages work together to provide a thorough verification procedure, essential for Anti-Money Laundering (AML) compliance and protecting financial systems.

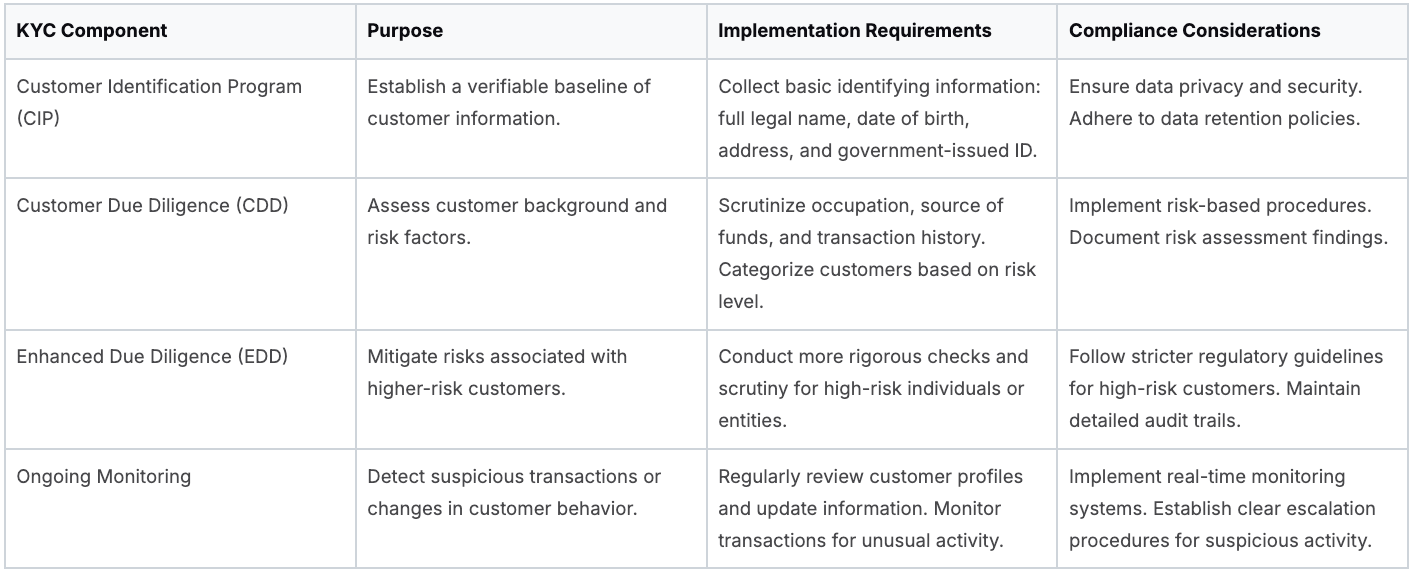

To understand the key components more clearly, let's review them in a structured table format. The following table outlines the core components of a compliant KYC verification process, along with their purpose, implementation requirements, and compliance considerations.

Essential Components of KYC Verification

This table highlights the interconnectedness of each KYC component, demonstrating how they build upon each other to create a comprehensive risk management framework. By addressing each of these components, organizations can effectively manage risk and maintain regulatory compliance.

Understanding KYC Workflows

A standard KYC workflow involves a structured series of steps. Each step builds upon the previous one to create a comprehensive customer verification profile. Understanding these steps helps organizations improve efficiency and streamline their KYC process.

- Data Collection: Gathering necessary information and documentation from the customer is the first step. This can be done through online forms, mobile apps like those offered by Onfido, or in-person interactions. Offering multiple channels caters to different customer preferences and ensures accessibility.

- Verification and Validation: After collecting data, it must be verified using various methods. This can range from manual checks to automated systems that compare the provided information against databases and official records. Automated solutions such as those from Trulioo can greatly enhance speed and efficiency.

- Risk Assessment: Based on the verified information, a risk profile is assigned to each customer. This assessment considers factors like location, industry, and transaction patterns. A risk-based approach allows businesses to focus their resources where they are most needed.

- Ongoing Monitoring and Re-verification: Regularly monitoring customer activity is essential for identifying any changes in behavior or circumstances that may impact their risk level. Re-verification helps maintain accurate data and identify potential warning signs.

This detailed breakdown underscores the importance of a well-structured and thorough KYC verification process. By understanding each step, businesses can effectively combat financial crime, safeguard their reputation, and foster stronger customer relationships. A robust KYC process benefits both businesses and their customers.

The Hidden Economics of KYC Verification

While a robust Know Your Customer (KYC) verification process is undeniably important, many businesses fail to fully grasp the financial implications of implementing and maintaining such systems. This article explores the often-overlooked costs of KYC compliance and illustrates how strategic planning can shift KYC from a cost center to a competitive advantage. This requires a comprehensive understanding of all expenses, from staffing and technology to the potential penalties for non-compliance.

Unmasking the True Cost of KYC

The cost of KYC verification goes far beyond the initial investment in software or personnel. A truly comprehensive analysis must factor in several key cost drivers.

- Staffing: Dedicated teams are often required to manage the various aspects of KYC, from data entry and document verification to risk assessment and ongoing monitoring. Salaries for these specialized teams represent a substantial recurring cost.

- Technology: Implementing and maintaining the necessary technology, whether specialized KYC software or robust databases, demands significant investment. Ongoing maintenance, updates, and security enhancements further contribute to these costs.

- Lost Revenue: Cumbersome KYC processes can create friction during onboarding. This can lead to customer abandonment and lost revenue opportunities, especially if the verification process is lengthy or complex.

- Regulatory Fines: Non-compliance with KYC regulations can result in substantial fines, severely impacting a company's bottom line. These fines can reach millions of dollars, representing a significant financial risk.

- Reputational Damage: Failures in KYC verification can severely damage a company's reputation, eroding customer trust and affecting future business prospects. Rebuilding a tarnished reputation can be a long and difficult process.

The cost of KYC verification is already substantial and continues to rise. Recent studies estimate the total cost of financial crime across global financial institutions to be $274.1 billion, a staggering $60 billion increase in just two years. Fines for non-compliance are also significant, as evidenced by NatWest's £265 million fine from the FCA in 2021 for money laundering failures.

These figures highlight the need for efficient KYC processes. While the true cost of KYC encompasses salaries, technology investments, lost revenue due to onboarding friction, potential regulatory fines, and reputational damage, automation offers a potential solution. Automating KYC processes can significantly reduce costs, often streamlining verification from over 18 minutes down to under 35 seconds. For more detailed statistics, see The True Cost of KYC.

Turning KYC into a Competitive Advantage

Despite the undeniable costs associated with KYC, forward-thinking businesses are leveraging compliance as a competitive advantage.

- Automation: Automated KYC solutions can drastically reduce manual effort, freeing up staff for other critical tasks and significantly speeding up the verification process. This leads to lower operational costs and improved customer satisfaction.

- Streamlined Workflows: Optimizing KYC workflows minimizes friction during onboarding, which can lead to higher conversion rates and increased customer lifetime value. A smooth and efficient onboarding experience can be a powerful differentiator in a competitive market.

- Enhanced Security: Robust KYC processes not only ensure regulatory compliance but also strengthen security, protecting both businesses and their customers from fraud and financial crime. This heightened security builds trust and fosters customer loyalty.

- Data-Driven Insights: The data collected during KYC can provide valuable insights into customer behavior and preferences. This data can inform business decisions, improve marketing strategies, and personalize customer experiences, leading to more targeted product and service offerings. For more on this topic, see Ultimate Guide to Modern Compliance Management Solutions.

By adopting a strategic approach to KYC, businesses can minimize costs, improve operational efficiency, and enhance the overall customer experience. This transforms KYC from a necessary expense into a driver of business growth and a valuable source of data-driven insights.

Understanding the costs and complexities of Know Your Customer (KYC) regulations is essential. But equally important is analyzing how different KYC processes work in practice. This section compares traditional manual KYC with its modern electronic counterpart (eKYC), using data to highlight what truly delivers results.

Manual KYC: The Traditional Approach

Traditional KYC verification relies heavily on manual processes. This often involves physical paperwork, face-to-face interactions, and significant staff resources.

- Physical Document Submission: Customers typically submit physical copies of their identification, which staff then manually review and verify.

- In-Person Verification: Some situations require customers to appear in person to verify their identities.

This reliance on physical presence and manual review creates a time-consuming and often cumbersome process.

- Time-Consuming Process: Manual verification is inherently slower than automated alternatives. This can lengthen onboarding times and lead to customer frustration.

- Prone to Errors: Manual processes are susceptible to human error, impacting the accuracy and consistency of customer data.

While manual KYC might still be necessary for certain regulations or where digital access is limited, its inherent limitations are increasingly problematic in today's fast-paced business environment.

Electronic KYC: The Modern Solution

Electronic KYC (eKYC) uses technology to automate and streamline verification. This offers significant advantages.

- Digital Document Submission: Customers submit digital copies of their documents via secure online portals. This simplifies the process and eliminates physical paperwork.

- Automated Verification: eKYC solutions use technologies like biometric authentication and AI-powered document analysis to automate verification.

This automation translates to a faster, more efficient, and more accurate process.

- Faster Onboarding: Automated verification drastically reduces onboarding time, improving customer experience and accelerating customer acquisition.

- Increased Accuracy: Automated systems minimize human error, improving data accuracy and the reliability of verification results.

The shift toward digital verification is not just a technological trend; it's a customer expectation. 62% of customers now expect a digital identity verification process when opening an account. eKYC is key to meeting these expectations and delivering a seamless onboarding experience.

The adoption of eKYC has significantly improved the efficiency and speed of KYC. Traditional manual processes can take months for onboarding, with 30% of respondents reporting times exceeding two months and 10% over four months. eKYC can process documents in mere seconds, improving client relationships and reducing onboarding abandonment rates. For example, FNZ’s AI-powered eKYC solution boasts verification times under 35 seconds, reducing onboarding costs by over 70% and boosting client conversion. This speed and accuracy are vital for maintaining customer trust and regulatory compliance. More detailed statistics can be found at KYC Resources.

Comparing Traditional and Electronic KYC

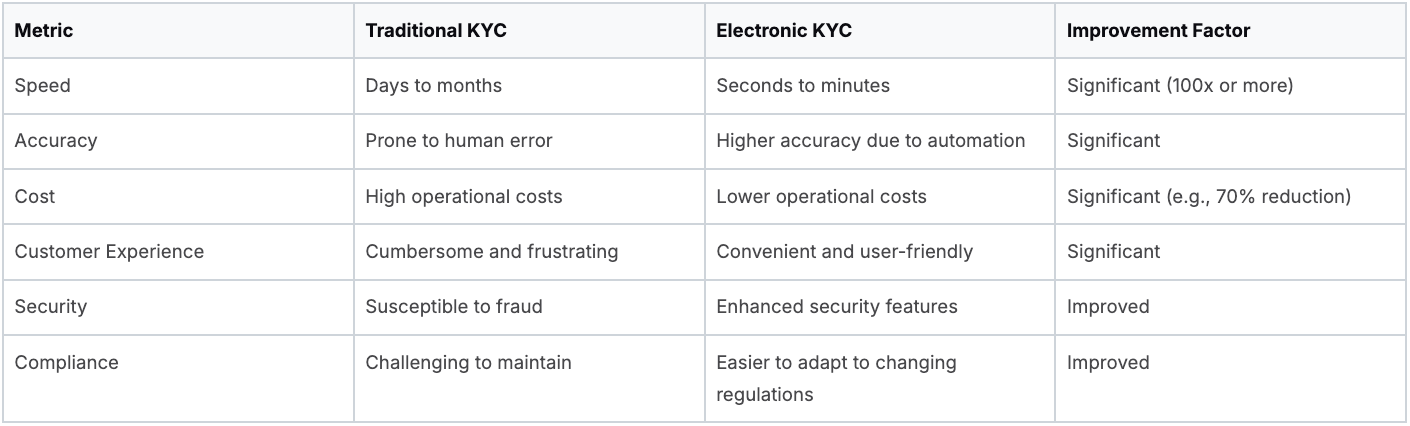

To understand the key differences between traditional and electronic KYC, let's look at a comparison table. The table below summarizes the performance of each method across key metrics.

Traditional vs. Electronic KYC Comparison This table compares key performance metrics between traditional manual KYC processes and modern electronic KYC solutions.

As the table clearly shows, electronic KYC offers considerable advantages in most situations. However, the best approach depends on the specific needs of your business and customer base. For instance, businesses dealing with high-risk clients might require a hybrid approach, combining elements of both traditional and electronic KYC for enhanced due diligence.

Beyond Onboarding: Continuous KYC Verification

The KYC (Know Your Customer) verification process is often seen as a one-time requirement during onboarding. However, a truly effective KYC strategy goes much further. Think of KYC not as a single checkpoint, but as a continuous process of monitoring and verification. This ongoing diligence is critical for mitigating risks, adapting to changes in customer circumstances, and staying ahead of emerging threats.

The Importance of Ongoing Monitoring

Maintaining a secure and compliant business environment requires continuous KYC verification. This ongoing process allows businesses to adapt to evolving risks and protect themselves from potential financial crimes. This proactive approach to KYC builds trust, protects both the business and its customers, and maintains a strong risk management framework.

- Changing Customer Circumstances: A customer's risk profile is dynamic. Changes in employment, location, or financial activity can significantly impact their risk level. Continuous KYC verification keeps businesses informed about these changes and allows them to adjust risk assessments.

- Emerging Threats: Financial criminals are constantly developing new methods. Continuous KYC verification helps businesses adapt to these new threats by incorporating updated data and enhanced security measures. This agility is vital for staying ahead of potential vulnerabilities.

- Regulatory Compliance: Ongoing monitoring is often a regulatory requirement in many industries. By implementing continuous KYC verification, businesses demonstrate their commitment to compliance and proactively mitigate the risk of penalties and reputational damage.

Implementing Continuous KYC Verification

Successfully implementing continuous KYC verification requires a strategic approach that incorporates a variety of tools and techniques. A combination of automated processes and targeted reviews ensures ongoing compliance without overusing resources.

- Risk-Based Review Schedules: Not all customers require the same level of scrutiny. Risk-based review schedules allow businesses to focus resources on higher-risk customers while streamlining the process for lower-risk individuals. This targeted approach optimizes resource allocation and improves efficiency.

- Automated Screening Systems: Using technology is crucial for efficient continuous KYC. Automated screening systems can continuously monitor customer data against watchlists, sanctions lists, and other databases, flagging any potential risks in real-time. This automated approach greatly improves detection speed and accuracy.

- Transaction Monitoring: Real-time transaction monitoring is essential for detecting suspicious activity. Analyzing transaction patterns and flagging unusual behavior allows businesses to quickly identify and investigate potential fraud or money laundering attempts. This proactive monitoring protects both the business and its customers from financial harm.

KYC verification is widely adopted across industries, highlighting its effectiveness in preventing financial crimes. However, KYC alone is not enough. Research shows that 70% of fraud occurs after the initial verification. This underscores the need for ongoing monitoring and periodic due diligence assessments to maintain compliance and detect suspicious activity. Additionally, 62% of customers expect digital identity verification. This shift toward digital KYC not only enhances security but also improves the customer experience. Learn more: KYC Guide.

Turning KYC into a Proactive Risk Management Tool

Continuous KYC verification is not just about meeting regulatory requirements; it's about building a proactive risk management framework. By continuously monitoring customer data and adapting to evolving threats, businesses can identify and mitigate risks more effectively. This proactive approach protects their reputation, strengthens customer relationships, and fosters sustainable growth. It allows businesses to move beyond simply reacting to threats and instead anticipate and prevent them. Embracing continuous KYC demonstrates a commitment to security and builds a culture of proactive risk management.

Mastering the KYC Verification Process

Mastering Know Your Customer (KYC) verification involves transforming it from a regulatory hurdle into a strategic business advantage. This means optimizing workflows, minimizing friction, and using verification data for valuable business insights. This section explores how leading organizations are achieving this balance, creating a KYC process that is both compliant and customer-centric.

Optimizing KYC Workflows for Efficiency

Many organizations view KYC compliance as a costly and time-consuming necessity. However, by focusing on optimization, businesses can significantly reduce the burden and improve overall efficiency. This involves strategically analyzing each step of the KYC verification process and identifying areas for improvement.

- Customer Journey Mapping: Understanding the customer journey through the KYC process is crucial. This involves mapping each step the customer takes, from initial data submission to final verification. Visualizing the process helps organizations identify pain points and areas of friction that contribute to customer frustration and abandonment.

- Friction Analysis: Once the customer journey is mapped, it's essential to analyze the friction points. This means understanding what causes delays, confusion, or frustration for customers during the verification process. Requiring excessive documentation or employing unclear instructions, for example, can create significant friction.

- Continuous Improvement Cycles: KYC processes should not be static. Implementing continuous improvement cycles, such as the Plan-Do-Check-Act (PDCA) cycle, allows organizations to regularly evaluate their KYC workflows. Using data and feedback, businesses can identify areas for optimization and implement necessary changes. This iterative approach ensures the process remains efficient and adaptable.

Implementing Contextual Verification

A one-size-fits-all approach to KYC is rarely effective. Contextual verification allows organizations to tailor the process based on individual customer risk profiles and transaction types. This targeted approach minimizes unnecessary hurdles for low-risk customers while ensuring enhanced due diligence for higher-risk individuals.

- Risk-Based Segmentation: Categorizing customers based on their risk level is crucial for contextual verification. Factors such as customer location, industry, transaction history, and source of funds can all inform risk assessments. This allows businesses to adjust the level of scrutiny applied to each customer, ensuring appropriate due diligence.

- Adaptive Verification Methods: Different verification methods are suited to different risk levels and transaction types. Automated document verification might be sufficient for low-risk transactions. However, biometric authentication might be necessary for higher-value transactions or high-risk customers. Adapting the verification method enhances security and minimizes customer inconvenience.

- Seamless System Integration: Integrating KYC verification seamlessly into existing systems, such as Customer Relationship Management (CRM) systems, is essential. This eliminates manual data entry and reduces the risk of errors. It also creates a single source of truth for customer information.

Leveraging Verification Data for Business Insights

The data collected during KYC verification can be a valuable asset beyond compliance. Organizations can gain deeper customer insights, enhance their risk management capabilities, and drive broader business decisions.

- Enhanced Customer Understanding: KYC data provides a wealth of information about customer demographics, financial behavior, and risk profiles. Businesses can use this data to personalize customer experiences, tailor marketing campaigns, and develop targeted product offerings.

- Proactive Risk Management: Analyzing KYC data can help organizations identify emerging risks and prevent fraud. By monitoring customer transactions and identifying patterns of suspicious activity, businesses can proactively mitigate potential threats and protect themselves from financial crime.

- Data-Driven Decision Making: KYC data can inform a range of business decisions, from improving customer segmentation to optimizing pricing strategies. By leveraging this information, organizations can make more informed, data-driven decisions that contribute to sustainable growth.

Streamline your real estate syndication process and simplify investor onboarding with Homebase's automated KYC and accreditation verification. Learn more about Homebase.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Define Mezzanine Debt Your Guide to the Real Estate Capital Stack

Blog

Unlock bigger deals with less equity. Our guide helps define mezzanine debt, showing syndicators how to use it to bridge funding gaps and maximize leverage.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.