Investor Management Services to Grow Your Real Estate Portfolio

Investor Management Services to Grow Your Real Estate Portfolio

Discover how our investor management services can streamline your real estate syndication, build trust, and help you scale effectively.

Domingo Valadez

Aug 6, 2025

Blog

Picture this: you're trying to conduct a symphony, but instead of a proper score, you have random musical notes scrawled on a pile of sticky notes. That’s pretty close to what it feels like to run a real estate syndication using a jumble of spreadsheets and emails.

This is where investor management services come in. Think of them as the professional conductor your business has been waiting for—a central command center that brings order to the complex flow of capital, communications, and compliance.

What Are Investor Management Services?

At its heart, an investor management service is a purpose-built platform that swaps operational chaos for professional-grade efficiency. It’s much more than just a piece of software. It’s a complete system built specifically for real estate sponsors and syndicators to manage every single aspect of their investor relationships.

Instead of wrestling with endless email threads, confusing spreadsheets, and documents scattered across different folders, these services bring everything together into one secure, easy-to-use hub.

This move toward organized systems reflects a much broader trend. The financial advisory world now serves around 68.4 million clients, with a staggering $144.6 trillion in total assets under management—a 12.6% jump in just one year. While your syndication might not be that big (yet!), this highlights a clear expectation from investors: they want their capital managed professionally and transparently. You can learn more about these industry-wide dynamics to see just how important this is.

From Manual Chaos to Platform Control

Let’s be honest, the administrative side of syndication can be a real grind. The main job of an investor management service is to automate and organize those critical but time-consuming tasks that can easily overwhelm a growing business. This frees you up to do what you do best: find great deals and nurture your investor relationships, not fight with paperwork.

Here’s a look at the operational shift from the old way to the new way.

Using a dedicated platform isn't just a minor upgrade; it’s a fundamental change in how you operate, making your business more scalable and professional.

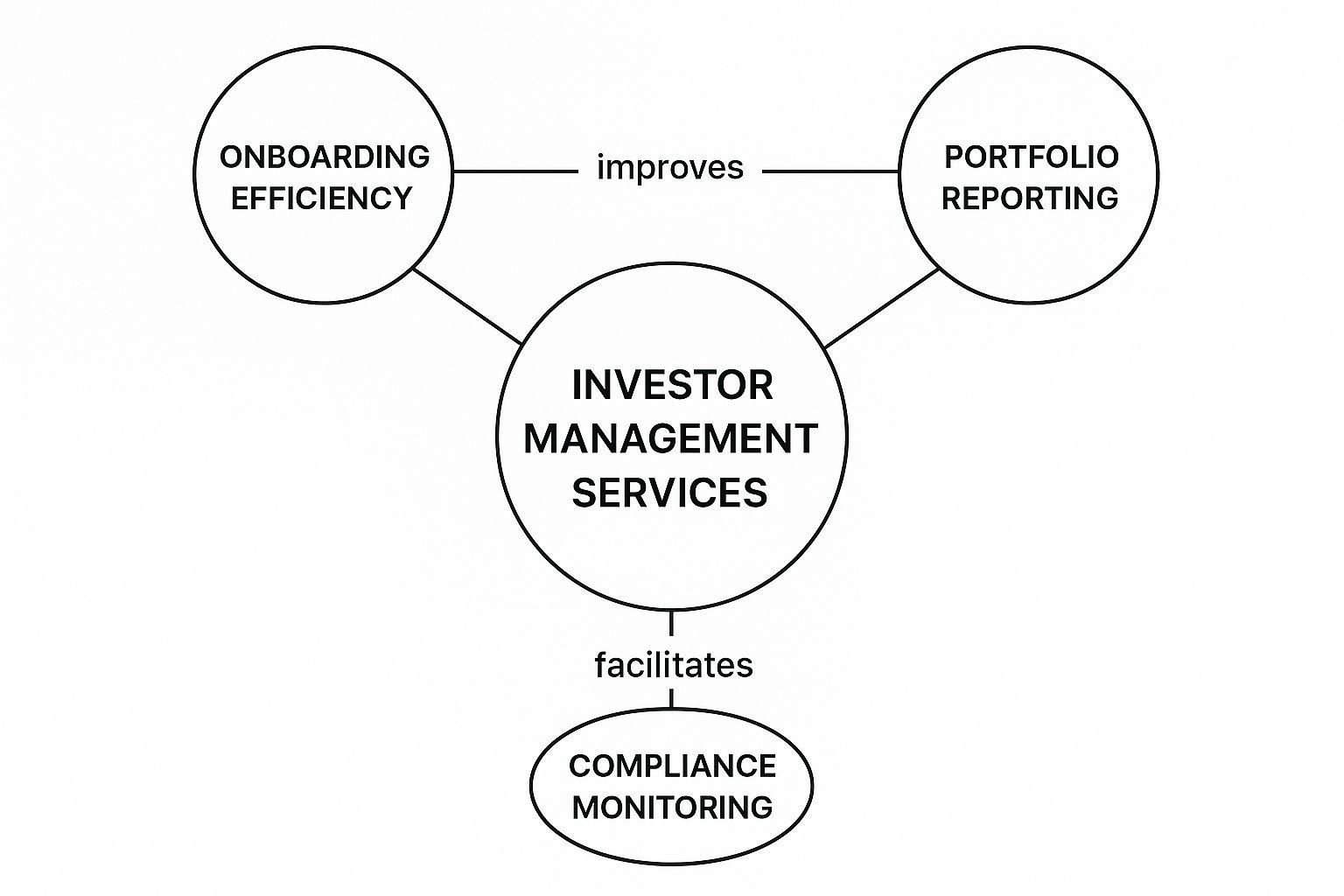

As the diagram shows, a central platform acts as the connective tissue, linking everything from onboarding and reporting to compliance and communication into a single, cohesive system.

When you centralize these tasks, you're not just saving hundreds of administrative hours. You're also building a brand. You present a polished, professional image to your partners, which builds incredible trust. That perceived competence is often the tiebreaker for an investor deciding between two similar deals. Adopting a real system is a direct investment in your reputation and your ability to grow.

The Core Tools of Your Investor Management Platform

Think of a professional investor management service as your real estate syndication command center. It's not just one tool, but a complete, integrated toolkit designed to tackle all the specific, and often painful, parts of managing capital partners. Instead of duct-taping different apps together, these platforms bring everything under one roof for a smooth, cohesive operation.

The heart of this entire system is the investor portal. This is your private, secure digital lounge where you and your partners meet. They can log in whenever they want to see performance dashboards, grab important documents like K-1s or operating agreements, and check on how their money is working for them. In today's market, this kind of on-demand transparency isn't a "nice-to-have"—it's an absolute must.

A great platform, however, is much more than a digital filing cabinet. It’s an active, intelligent system built to handle every stage of the investor journey with real professionalism.

Your Centralized Hub for Scaling the Business

Beyond the portal, a few key components do the heavy lifting. These are the engines that automate the grunt work, cut down on human error, and make you look like a seasoned pro to your investors, every single time.

Here's what you'll typically find under the hood:

* An Integrated CRM: This isn’t just any generic CRM. It's a Customer Relationship Management system specifically designed for the world of real estate syndication. It tracks every touchpoint, from the first curious email to a fully funded commitment, making sure no valuable relationship ever gets lost in a messy spreadsheet.

* Painless Capital Calls: Imagine automating the entire capital call process. The system sends out the notifications, tracks the funds as they come in, and gives you a real-time view of who has funded and who hasn't. This feature alone eliminates an administrative nightmare.

* Automated Distributions: This is a true game-changer. The platform handles the complex math of distribution waterfalls, automatically calculating and processing payments. It nails the preferred returns, IRR hurdles, and sponsor promotes, ensuring every investor gets paid accurately and on time.

It's absolutely critical that your platform can pull in and unify data from different places. For more background on the technical side of this, you can read about solving common data integration problems, but for a syndicator, it’s what turns a simple portal into a powerful operational hub.

Think about the headache of tax season. Manually creating and sending K-1s to dozens of investors is a massive, stressful job just waiting for an error. A solid platform automates all of it, securely pushing the correct documents to each investor's portal with a few clicks. That one feature can save you weeks of work and a whole lot of anxiety.

From Initial Fundraising to Final Reports

The best platforms are with you for the entire ride. When you're raising capital, you can set up polished deal rooms to show off your new opportunity. Potential investors can browse the offering memorandum, review due diligence files, ask questions, and even complete their subscription agreements and verify their accreditation—all online.

This slick, automated experience feels incredibly professional and effortless for the investor. It sends a clear message: you respect their time and are serious about stewarding their capital. It's that perception of competence that helps turn a first-time investor into a reliable, long-term partner, giving you the fuel you need to scale your real estate portfolio. These core tools don't just manage investors; they build the trust and efficiency that are the bedrock of a successful business.

Unlock Growth With Centralized Investor Relations

When you move past a patchwork of different tools, you start to see the real power of dedicated investor management services. Adopting a central platform isn't just a minor operational change; it's a strategic upgrade for your entire real estate syndication business. This shift is built on three core pillars: rock-solid efficiency, a stellar investor experience, and the capacity for unlimited growth.

The first thing you'll notice is a massive leap in operational efficiency. By letting the system handle administrative chores like distributions, tax reporting, and routine communications, you get back hundreds of hours. This isn't just about saving time—it’s about drastically cutting down the risk of human error. A single misplaced decimal on a spreadsheet can erode an investor's trust, but an automated system delivers accuracy and consistency, protecting your reputation and your bottom line.

Elevate the Investor Experience

Think of a professional, on-demand investor portal as your ultimate trust-building tool. When investors can log in whenever they want to see performance dashboards, grab documents, and watch their capital work for them, it creates a powerful feeling of transparency and confidence. This kind of professional setup immediately signals that you're a serious, organized operator.

This improved experience is your key to retention. An investor who feels informed and valued is far more likely to roll their capital into your next deal. It changes the dynamic from a one-off transaction to a genuine, long-term partnership. To see what this looks like in the real world, check out our detailed guide on the functions of an https://www.homebasecre.com/posts/investor-management-platform.

An exceptional investor experience is your most potent marketing tool. It generates the kind of loyalty that fuels repeat investments and enthusiastic referrals, creating a virtuous cycle of growth that spreadsheets and email simply cannot replicate.

Build a Foundation for Limitless Scalability

Maybe the most important benefit of all is scalability. With a robust system in place, you can confidently bring on more investors and take down more deals without your back office breaking a sweat. Growth stops being a source of stress and potential mistakes and instead becomes a smooth, manageable process. You're free to focus on what you do best—finding the next great asset—knowing the administrative side can handle the load.

This ability to scale is non-negotiable in today's market. With the global asset management market projected to reach an incredible $164.5 trillion, much of that growth is flowing into alternative assets like real estate. To get your slice of that pie, you need the infrastructure to manage growth without dropping the ball.

While your platform handles existing investors, you can focus on finding new ones. Exploring effective strategies for LinkedIn lead generation, for example, can help expand your network. A centralized system gives you the capacity to onboard all those new partners effortlessly. In the end, investor management services don't just help you cope with growth—they turn it into your greatest advantage.

How to Choose the Right Investor Management Partner

Picking an investor management partner is one of the most important decisions you'll make for your syndication business. This isn't just about buying a piece of software. You're choosing a core part of your operational foundation—the very system that will manage your most critical relationships and sensitive financial data. Looking past the sticker price to what really drives value is absolutely key.

What you need is a practical, no-nonsense way to vet your options. Let's be honest: a cheap platform that constantly frustrates your investors or can't perform basic functions isn't a bargain. It's a liability waiting to happen. The goal here is to find a true partner that makes your day-to-day operations smoother, keeps your investors happy, and helps you scale your business.

Assess the Complete User Experience

The first acid test for any platform is how it feels to actually use it, both for your team and for your investors. Think of it from two angles. For your internal team—the people who live in this software every day—it has to be intuitive. If setting up a new deal or pulling a simple report turns into a multi-hour ordeal, the software is adding to your workload, not lightening it.

Then there's the investor side. Their experience has to be professional and effortless. A clunky, confusing investor portal makes you look disorganized and can quickly erode the trust you've worked so hard to build. A great portal, on the other hand, is clean, simple to navigate, and gives investors instant access to their dashboards and documents. It sends a powerful message: you're a competent sponsor who has their act together.

Scrutinize Security and Compliance Protocols

When you're dealing with people's personal information and large sums of money, security isn't just a feature—it's everything. Any reputable investor management services provider will have bank-level security measures in place to protect this data. But don't just take their marketing material at face value. You need to ask pointed questions.

Here’s what to look for:

- Bank-Level Encryption: All data, whether it's sitting on a server or moving across the internet, should be locked down with standards like AES-256 encryption.

- Two-Factor Authentication (2FA): This is a non-negotiable, adding a crucial second layer of security to everyone's account.

- Regular Security Audits: The provider should be bringing in outside experts to perform penetration tests and find vulnerabilities before a hacker does.

- Compliance Certifications: Look for certifications like SOC 2, which proves the company has been independently audited and meets high standards for security and operational integrity.

If a provider gets cagey or evasive when you ask about their security measures, that’s a massive red flag. A true partner understands that protecting your data is their job, and they should be completely transparent about how they do it.

Verify Integration and Scalability

Your investor platform doesn't operate in a silo. It has to play nicely with the other tools that run your business, especially your accounting software. Ask potential vendors about their integration capabilities. A platform that automatically syncs with a tool like QuickBooks can save you countless hours of manual data entry and prevent costly mistakes.

Think about the future, too. How will this platform support you when you're doing twice as many deals? A pricing model that charges you more for every new investor or deal can quickly become a financial anchor, punishing you for your own success. Look for a scalable pricing structure, like a flat-fee model, that lets you grow your portfolio without your software bill exploding. You want a partner who can keep up as you grow.

To help you stay organized during your search, use this checklist to compare your options side-by-side. It will force you to think through the features that matter most for your specific business needs.

Platform Evaluation Checklist

Using a structured approach like this ensures you're making a decision based on a comprehensive evaluation, not just a flashy sales demo or a low initial price. It helps you find a partner that will truly support your business for the long haul.

A Global Perspective on Investor Management

It’s easy to get tunnel vision and only focus on your local market, but adopting professional tools isn't just about keeping up with the firm across town. It’s about recognizing a global shift in how real estate deals are done. To truly compete, you have to understand that the demand for polished investor management services is part of a much bigger picture.

Think of it this way: you're not just competing for local capital anymore. The marketplace for real estate investment is becoming more connected every day. This reframes the decision to adopt a dedicated platform. It’s no longer an optional expense; it’s a strategic move to position your firm on a much larger stage where professionalism is the price of entry.

The Worldwide Drive for Professional Operations

The investment management world is exploding. We're looking at a market currently valued around $987 billion, with projections shooting past $1.343 trillion. North America is at the forefront, commanding 36.3% of the market, but don't count out other players. Europe holds a significant 27.2% share, with major hubs in Germany and the UK leading the way. If you're curious, you can dig into the specifics of these global investment trends to see just how massive this wave is.

What does all this data really mean for you? It’s a clear signal that the pressure to run a tight, professional operation is coming from all corners of the globe.

Investors, whether they’re in New York, London, or Singapore, are getting used to a higher standard. They expect a seamless, tech-driven experience from the sponsors handling their money. Your collection of spreadsheets and clunky email chains just won't cut it anymore.

Getting a handle on these dynamics is everything. When you bring on a serious investor management service, you’re not just buying software. You’re aligning your entire operation with global best practices. This makes your firm far more appealing to the local high-net-worth individual, but it also opens the door to national and even international investors who are actively looking for that level of operational excellence.

This is how you go from being a small-time operator to a business built for the big leagues. It's about laying a foundation that's strong enough to support your ambitions, no matter how big they get.

Answering Your Top Questions

As you start thinking about moving away from spreadsheets and into a professional platform, a lot of practical questions will pop up. That's completely normal. You need clear, straightforward answers to feel good about making the switch.

This section tackles the most common questions I hear from real estate sponsors who are considering investor management services. My goal is to give you the clarity you need to move forward with confidence, covering everything from timing and data security to deal complexity and cost.

When Should I Get an Investor Management Platform?

The perfect time to invest in a platform is right before you feel the administrative burn. So many sponsors wait until the chaos is out of control, but that’s a reactive move. A proactive approach is always better.

Think of it like this: you'd install a professional kitchen before opening a restaurant, not while a line of hungry customers is waiting for their food.

Here are a few signs that it's time to make a move:

* You're managing more than 15-20 investors across your deals.

* You're launching your second or third syndication.

* You're starting to find more and more errors in your spreadsheets.

* You're spending more time on paperwork than on finding your next deal.

Getting a system in place early on builds a professional foundation from day one. It shows your investors you're serious, which helps build the kind of confidence that attracts more capital as you grow.

How Secure Is My Sensitive Investor Data?

This is a big one, and for good reason. Top-tier platforms treat your data security as a core feature, not just a checkbox. They know that handling sensitive financial and personal information is a massive responsibility, and any provider worth their salt will be proud to show you their security playbook.

A good platform will have a multi-layered security strategy. Look for things like bank-level encryption (AES-256) that protects data whether it's stored or being sent. Another non-negotiable is mandatory two-factor authentication (2FA), which adds a critical defense against someone trying to get in who shouldn't be. Most of these services are also built on secure cloud infrastructure from giants like Amazon Web Services (AWS), which have their own world-class security teams.

When you're talking to potential vendors, don't be shy. Ask for their security documentation and compliance reports, like a SOC 2 certification. If they're open and transparent about their security, it's a great sign they're committed to protecting you and your investors.

Can These Platforms Handle Complex Deal Structures?

Yes, absolutely. This is precisely what modern investor management services are built for. They’re designed to handle the sophisticated financial gymnastics common in real estate syndications—something generic accounting software or spreadsheets just can't do without breaking.

These platforms are engineered to manage the tough stuff, including:

* Multi-tiered distribution waterfalls with various hurdles and promote splits.

* Preferred returns for different classes of investors.

* Complex sponsor promotes and catch-up provisions.

* Different legal setups like LLCs and LPs.

The best way to see if a platform can walk the walk? Give a potential provider your most complicated deal structure and ask them to show you, live. Watching them model your real-world scenario is the ultimate stress test and a step you shouldn't skip in your due diligence.

What Is the Typical Cost of These Services?

The pricing for these platforms is usually set up to grow with your business, but the models can be quite different from one provider to the next. You really need to understand how you'll be charged as your assets under management (AUM) and investor count increase.

Most often, you'll see subscription models based on how many active investors or deals you have. Some platforms charge a base fee plus a per-investor fee, which can get expensive fast as you scale. Other providers offer a more predictable flat-fee model. This approach is fantastic because your software costs stay the same even as you add more deals and investors to your portfolio.

It's critical to see this cost not as an expense, but as an investment in your company's efficiency, professionalism, and ability to grow. Think about the hours you’ll save on admin work and the costly errors you’ll avoid—that’s where you'll see the real return.

Ready to stop wrestling with spreadsheets and start scaling your real estate business? Homebase offers an all-in-one platform with a simple, flat-fee pricing model designed for syndicators like you. Manage unlimited deals and investors, streamline fundraising, and deliver a professional experience your partners will love. Schedule a demo with Homebase today!

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.