Invest Smart with Real Estate Syndication Platform

Invest Smart with Real Estate Syndication Platform

Discover expert tips on using a real estate syndication platform to secure high-potential property deals and boost your portfolio returns.

Domingo Valadez

May 9, 2025

Blog

Demystifying Real Estate Syndication Platforms

Real estate syndication platforms are changing how people invest in commercial real estate. Traditionally, these investments were limited to the ultra-wealthy, demanding substantial capital and industry connections. However, real estate syndication platforms democratize this process, connecting everyday investors with institutional-quality deals. These platforms function as digital marketplaces, facilitating the entire investment journey.

Understanding the Basics of Syndication Platforms

How do these platforms work? A real estate syndication involves a group of investors pooling their capital to buy and manage a property. The syndicator, also known as the sponsor, identifies the deal, performs due diligence, secures financing, and oversees the property's operation. The platform connects the sponsor with potential investors. This allows individuals to access potentially lucrative deals they might not find independently.

Imagine a group wanting to invest in a large apartment complex. Individually, they may lack sufficient capital or expertise. Through a syndication platform, they can pool their resources, participate in a larger, potentially more profitable deal, and leverage the syndicator's experience. This model also enables portfolio diversification across property types and geographic areas, mitigating risk.

The Evolution of Real Estate Syndication

Real estate syndication has significantly evolved, especially with the rise of modern crowdfunding platforms. These platforms have democratized access, allowing individuals to participate in syndicated deals with relatively low barriers to entry. Traditionally, syndication involved a select group of high-net-worth individuals or institutional investors. However, platforms like Sharestates, Fundrise, and Yieldstreet have used technology and regulatory changes to open opportunities to a broader investor base. Now, investors can contribute as little as $100 to a deal, increasing accessibility for first-time investors. Learn more at REI Ink. This shift makes commercial real estate investing more inclusive.

Key Features and Benefits of Using a Platform

A robust real estate syndication platform offers numerous advantages for both sponsors and investors. For sponsors, platforms streamline fundraising, automate investor communication, and provide efficient deal management tools. This includes features like KYC/AML compliance, document management, and distribution tracking.

Investors benefit from a simplified investment experience. They can browse curated deals, access detailed property information, track investment performance, and communicate directly with the sponsor through the secure platform. This transparency and ease of access are key drivers of growth for real estate syndication platforms.

These platforms are not solely about convenience; they empower individuals to participate in lucrative real estate ventures previously out of reach. By connecting investors with experienced sponsors and streamlining complex processes, real estate syndication platforms are transforming property investment.

Top-Performing Real Estate Syndication Platforms Compared

Not all real estate syndication platforms are created equal. Choosing the right platform can significantly impact your investment experience. It's essential to understand the key differences between industry leaders. This means looking beyond marketing and focusing on factors that truly matter to investors.

Key Features To Compare

Several key features distinguish top-performing platforms. Minimum investment requirements vary, impacting accessibility. Some platforms cater to accredited investors only, while others offer options for non-accredited investors. Understanding fee structures is vital. Some platforms charge upfront fees, while others use performance-based compensation. Platforms often specialize in specific property types, such as multifamily, industrial, or self-storage. This allows investors to target their preferred asset classes.

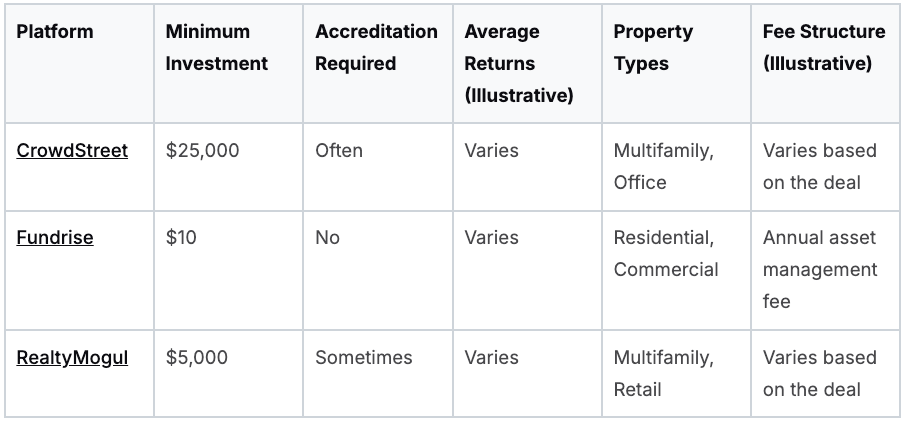

To help illustrate the differences, let's look at a comparison of some of the leading real estate syndication platforms.

Leading Real Estate Syndication Platforms Comparison: Side-by-side comparison of the top real estate syndication platforms, showing key metrics that investors should consider.

This table provides illustrative examples and does not constitute financial advice. Actual terms and conditions vary based on specific deals.

This comparison shows platforms like Fundrise offer low minimum investments, making them accessible to a broader range of investors. Platforms like CrowdStreet often focus on larger projects with higher minimums. This highlights the importance of aligning your investment strategy with a platform's offerings.

Market Growth and Investor Participation

The growth of real estate syndication platforms reflects increasing demand for accessible real estate investments. The global real estate crowdfunding market reached $8.3 billion in 2020 and is projected to reach $13.6 billion by 2027, a growth rate of roughly 9 percent. Find more detailed statistics here. This growth is fueled by platforms connecting investors with opportunities previously limited to institutional investors. Improved transparency and user experience also enhance these platforms' appeal.

Beyond The Numbers: Evaluating Platform Performance

Analyzing historical returns is essential for understanding a platform's track record. Remember, past performance doesn't guarantee future results. Investors should also examine the platform's due diligence process. Thorough due diligence is crucial for mitigating risk and ensuring quality investment opportunities. Transparency in reporting and communication builds trust. These factors, combined with a seamless user experience, create a positive investment experience. Choosing a platform aligned with your individual needs and investment goals is crucial for long-term success.

Why Smart Investors Choose Syndication Platforms

Real estate syndication platforms offer investors significant advantages beyond simple access to deals. These platforms facilitate diversification across various property types and geographic locations, an opportunity often limited for individual investors due to financial constraints. This allows investors to spread capital across a range of asset classes, from multifamily and self-storage to industrial and retail, mitigating risk and potentially boosting returns.

The Power of Passive Income and Diversification

Many investors are drawn to real estate syndication platforms because of the potential for passive income. These platforms connect investors with experienced sponsors who handle the daily management of the properties. Real estate syndication offers a combination of benefits, including passive income and diversification. Real estate syndication lets investors earn without the direct responsibilities of property management, an attractive feature for those looking to diversify income streams. Investors gain access to diverse property types and locations, further mitigating risk.

For example, investing in a multifamily syndication generates cash flow from numerous units, reducing the impact of vacancies compared to single-family investments. Experienced sponsors manage the properties, lessening the risk for passive investors. This allows individuals to build wealth without the typical landlord burdens, such as tenant issues and property maintenance.

Tax Advantages and Professional Management

In addition to passive income, real estate syndication platforms offer substantial tax advantages. These can include deductions for depreciation, interest, and operational expenses, potentially lowering your overall tax liability. Platforms also provide access to professional asset management. Expert sponsors use their industry knowledge and experience to optimize property performance, with the aim of maximizing returns for all involved.

This expertise proves particularly valuable in navigating challenging market dynamics.

Building Wealth Through Syndication

Real estate syndication platforms empower investors to build wealth strategically. Consider the scenario of wanting to invest in a large commercial property but lacking the necessary capital. Syndication platforms enable you to pool funds with other investors, making such investments achievable. Furthermore, the platform manages complex administrative tasks, including investor communication and distribution tracking.

This allows investors to focus on their financial objectives. This efficient approach is a key reason why savvy investors opt for syndication platforms.

Choosing the Right Platform

The key to successful syndication lies in selecting the appropriate platform. Prioritize platforms emphasizing transparency, providing comprehensive property information, and possessing a proven track record of successful deals. These factors contribute to a positive and profitable investment experience. By carefully evaluating these aspects, you can unlock the full potential of real estate syndication platforms and achieve your investment goals.

Navigating Complex Deal Structures Like a Pro

Real estate syndication offers a compelling path to wealth creation, but understanding the intricacies of deal structures is paramount for making sound investment decisions. While these financial frameworks may appear complex at first glance, they can be broken down into manageable components. By grasping these key elements, you'll gain the confidence to evaluate potential investments with the same discerning eye as experienced investors.

Deconstructing Key Financial Terms

Several key terms shape the financial landscape of real estate syndication. The preferred return is a pre-agreed percentage return that investors receive before the sponsor participates in the profits. Think of it as a guaranteed baseline return that prioritizes investor interests. The equity multiple represents the total return on investment relative to the initial capital outlay. For instance, a 2x multiple signifies receiving twice your initial investment back. The waterfall distribution outlines the profit-sharing arrangement between investors and the sponsor after the preferred return has been met, dictating the order and percentage of profit allocation.

Understanding Typical Deal Structures

Real estate syndication deals are typically structured using legal entities like Limited Liability Companies (LLCs) or Limited Partnerships (LPs). The sponsor assumes the role of General Partner (GP), usually investing between 5% and 15% of the equity. Investors participate as Limited Partners (LPs), contributing the remaining 85% to 95%. Profits are distributed through various channels, such as rental income disbursed monthly or quarterly. These deals can range in duration from six months to over ten years, culminating in the sale of the property, at which point investors recoup their initial capital along with any accrued profits. The average preferred return for investors typically hovers around 8% before they are eligible for carried interest. For further information, explore more about syndication structures.

Analyzing the Offering Memorandum

The offering memorandum serves as a comprehensive guide to understanding a specific deal. It provides detailed information about the property itself, the investment terms, and the sponsor's track record. Pay close attention to the projected returns, the fee structure, and the specifics of the distribution waterfall. This document is not merely a formality but rather an indispensable tool for conducting thorough due diligence.

Asking the Right Questions

Beyond the financial figures, asking insightful questions can uncover critical information about a potential deal. Inquire about the sponsor's experience, their market analysis, and their contingency plans. For example, what strategies are in place if the property underperforms? Understanding the sponsor's risk mitigation strategies is crucial.

Identifying Red Flags

While real estate syndication platforms offer attractive investment opportunities, it's important to be vigilant about potential warning signs. Unrealistic projections, exorbitant fees, or a lack of transparency from the sponsor should raise immediate concerns. Exercise caution with deals that appear too good to be true. Thorough due diligence and critical thinking are your best defenses against potential pitfalls.

Leveraging a Real Estate Syndication Platform

A robust real estate syndication platform, such as Homebase, can significantly simplify the process of navigating these complex deal structures. These platforms often offer tools and resources to analyze offering memorandums, track investment performance, and communicate directly with sponsors. This streamlined approach allows investors to focus on their investment objectives while benefiting from expert support. By utilizing these platforms and understanding the core concepts discussed, you can confidently participate in real estate syndication and make informed investment decisions.

Selecting the Right Platform For Your Investment Goals

Choosing the right real estate syndication platform is crucial for reaching your investment goals. It's not just about finding deals; it’s about partnering with a platform that truly understands and supports your specific needs. This requires looking beyond the marketing materials and digging deeper into the platform's features, track record, and investor protections.

Evaluating Platform Track Records and Deal Flow

A platform’s past performance can provide valuable insights, but it's important to remember that past results don't guarantee future success. Look for platforms with a consistent history of quality deals and satisfied investors. Analyze the types of deals they typically offer.

Do they focus on specific asset classes like multifamily properties, or do they offer a diverse range of options? Understanding your own investment goals is key here. If you're primarily interested in, say, self-storage facilities, a platform specializing in multifamily might not be the right fit.

For example, if an investor is interested in value-add multifamily properties in a particular geographic area, they should look for platforms with a proven track record in that specific niche. This targeted approach increases the likelihood of finding appropriate investment opportunities.

Due Diligence and Investor Protection Mechanisms

Thorough due diligence is essential for any real estate investment. A reputable platform will have a robust due diligence process for vetting both deals and sponsors. This might involve independent appraisals, thorough market analysis, and background checks on the sponsor team.

Look for platforms that offer strong investor protection mechanisms, such as escrow accounts, insurance policies, and clear communication protocols for unexpected situations. These safeguards protect your investment and provide peace of mind.

Platform Transparency and Reporting Quality

Transparency is paramount when entrusting your capital to a real estate syndication platform. The platform should provide clear and easy-to-access information about their fees, their investment process, and the historical performance of their deals.

The quality and frequency of their reporting is also crucial. Regular updates on property performance, financials, and distribution schedules are essential for making informed decisions. Proactive communication builds trust and fosters stronger investor relationships.

Customer Service and User Experience

Don’t overlook the importance of excellent customer service. A responsive and knowledgeable support team can quickly address your questions and guide you through the investment process.

A user-friendly platform interface can significantly improve your overall experience. Features like streamlined investment dashboards, secure document portals, and direct communication channels with sponsors can simplify your interactions and save you valuable time. Homebase, for example, offers white-glove migration services for a smooth transition from other platforms. This commitment to customer support adds value and enhances the user experience.

To help you evaluate different real estate syndication platforms, consider the following criteria:

Introducing the "Real Estate Syndication Platform Evaluation Criteria" table, this resource details the key metrics and factors investors should consider. This table will guide you through essential questions, highlighting their importance and potential red flags to watch out for.

By carefully considering these evaluation criteria, you can select a real estate syndication platform that aligns with your investment goals and supports your success. Remember to weigh these factors carefully and choose a platform that offers the right balance of features, performance, and security for your individual needs.

Understanding the Legal Landscape of Syndication

Navigating the regulatory environment is crucial for protecting your investments in real estate syndication. This section explains the key legislation and regulations governing the syndication marketplace, empowering you to make informed decisions and safeguard your capital.

The JOBS Act and Its Impact on Real Estate Syndication

The Jumpstart Our Business Startups (JOBS) Act of 2012 significantly altered the real estate syndication landscape. This legislation eased securities regulations, making it easier for companies to raise capital through crowdfunding. Consequently, more investors can participate in real estate syndications, broadening the pool of potential capital for sponsors.

This increased access is particularly beneficial for smaller investors who may not have previously qualified for traditional private placements. The JOBS Act facilitated the emergence of online real estate syndication platforms, creating a more efficient and accessible marketplace.

Navigating Regulation D and Accredited Investor Requirements

Regulation D, a set of rules under the Securities Act of 1933, provides exemptions from registration requirements for certain private placements. This is frequently used in real estate syndication to streamline fundraising. However, Regulation D includes various rules, such as 506(b) and 506(c), each with specific requirements regarding investor solicitation and verification.

A crucial aspect of Regulation D revolves around accredited investors. Accredited investors typically meet specific financial criteria: a net worth exceeding $1 million (excluding their primary residence) or an annual income of $200,000 (or $300,000 jointly with a spouse) for the past two years. These requirements ensure investors possess a certain level of financial sophistication and can withstand potential losses.

Investor Verification, Solicitation, and Reporting

Real estate syndication platforms play a vital role in ensuring compliance with these regulations. They often manage the investor verification process, confirming that investors meet the accreditation requirements. This protects both the sponsor and the investor.

Platforms must also adhere to specific solicitation rules. Under certain Regulation D exemptions, general solicitation (public advertising) of investment opportunities may be restricted. Furthermore, platforms have reporting obligations to ensure transparency and maintain regulatory compliance. This might include providing investors with regular financial statements and property performance updates.

Protecting Your Investment Through Regulatory Knowledge

Understanding the legal aspects of real estate syndication helps you identify platforms committed to high compliance standards. You might be interested in: How to master the syndication calculator. Choosing a compliant platform protects your capital and maximizes investment opportunities. Due diligence empowers informed decisions and confident navigation of the syndication market.

Knowing how platforms handle investor verification, adhere to solicitation rules, and fulfill reporting obligations allows you to assess their commitment to compliance. This knowledge empowers you to choose platforms that prioritize investor protection, minimizing risk, and fostering a secure investment environment. This builds trust and allows you to focus on the potential returns.

The Future of Real Estate Syndication Platforms

The real estate syndication landscape is constantly changing, creating exciting new opportunities for investors. These changes are fueled by new technologies and shifting investor needs, reshaping how deals are accessed and exited. Let's explore some key trends influencing the future of real estate syndication platforms.

Blockchain Technology and Tokenization

One of the most significant developments is the incorporation of blockchain technology and tokenization. Real estate investments have traditionally faced liquidity challenges, making it difficult to sell a property quickly. Tokenization, which represents fractional ownership of a property on a blockchain, offers the potential to change this.

This means investors could buy and sell shares of a property more easily, much like trading stocks. This increased liquidity could attract a wider range of investors and reshape how portfolios are managed. The result could be a more dynamic and accessible real estate investment market.

The Role of Artificial Intelligence

Artificial intelligence (AI) is also playing a growing role in real estate syndication. Platforms are using AI to improve deal analysis, providing more advanced assessments of property value and potential returns. AI also enhances risk assessment by analyzing large datasets to identify potential problems that might be missed. This leads to better informed investment decisions.

Further, AI helps with market prediction. By analyzing market trends and economic indicators, AI algorithms can help forecast future property performance. This provides valuable insights for investors.

Expanding Investment Opportunities

Real estate syndication platforms are branching out into new property sectors and investment structures. This reflects changing investor preferences and the desire for diversified investment options. For example, platforms are increasingly offering investments in specialized areas like self-storage, senior housing, and data centers.

We're also seeing new investment structures, like debt funds and preferred equity investments. This gives investors more choices for tailoring their portfolios to specific risk levels and income goals. This expansion creates exciting opportunities for investors looking beyond traditional property types.

ESG Criteria and Impact Investing

Environmental, Social, and Governance (ESG) criteria are increasingly important for investors. Many seek opportunities that align with their values and have a positive social impact. Real estate syndication platforms are responding by incorporating ESG factors into their deal evaluation process.

This means prioritizing properties that meet environmental standards, promote social equity, and adhere to strong governance practices. This creates new opportunities for impact-focused investors seeking both financial returns and social benefits. This trend toward responsible investing will likely continue to shape the future of real estate syndication.

Ready to experience the future of real estate syndication? Visit Homebase today to learn more about how we can help you achieve your investment goals.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.