Commercial Property Management Fees Explained

Commercial Property Management Fees Explained

Our complete guide to commercial property management fees breaks down costs, structures, and negotiation tips to help you maximize your investment's value.

Domingo Valadez

Aug 17, 2025

Blog

When you hire a firm to look after your commercial real estate, you'll pay them what's known as a commercial property management fee. Think of this as the cost of outsourcing the day-to-day headaches of running an investment property. Typically, this fee falls somewhere between 4% and 12% of the gross rent collected each month.

This payment covers a whole host of services—everything from dealing with tenant phone calls and collecting rent checks to coordinating maintenance and crunching the numbers for financial reports. It's less of an expense and more of an investment in your property's performance and your own peace of mind.

Understanding Commercial Property Management Fees

A good property manager is essentially the COO of your real estate investment. Their fee isn't just a line item on a profit and loss statement; it’s the cost of having a professional ensure your asset runs smoothly, stays profitable, and appreciates in value over the long haul. Handing over the operational reins frees you up to focus on the bigger picture, like scouting your next acquisition.

I like to use the analogy of a ship captain. You own the ship (your property), but you hire a seasoned captain (the manager) to steer it toward profitable routes, navigate around potential problems, and ensure the cargo (your rental income) arrives safely each month. A top-notch manager, just like a great captain, is worth their weight in gold because they protect your asset and maximize your returns.

What Your Fee Actually Covers

So, what are you really paying for? At its core, that management fee covers the essential services that keep a commercial property running like a well-oiled machine. These are the tasks that directly impact your cash flow and the property's overall health.

Here's a quick breakdown of the core responsibilities:

- Leasing and Tenant Management: This is a big one. It includes marketing vacant space, carefully screening potential tenants, and handling all the lease negotiations. Once a tenant is in place, the manager handles all communication, renewal discussions, and any issues that pop up.

- Financial Administration: Your manager is your financial gatekeeper. They're responsible for collecting rent on time, paying all the property's bills, and providing you with detailed monthly financial statements. They also take the lead on creating the annual budget.

- Maintenance and Operations: Keeping the property in prime condition is crucial. This involves scheduling routine upkeep, managing emergency repair calls (so you don't have to), and supervising the various vendors, from landscapers to HVAC technicians.

The demand for these professional services is massive. The property management market in the U.S. is on track to hit USD 98.88 billion by 2029, with over 304,000 different management companies out there. This boom really underscores how vital professional oversight has become for optimizing commercial real estate. You can dig into more of these industry stats over at DoorLoop.com.

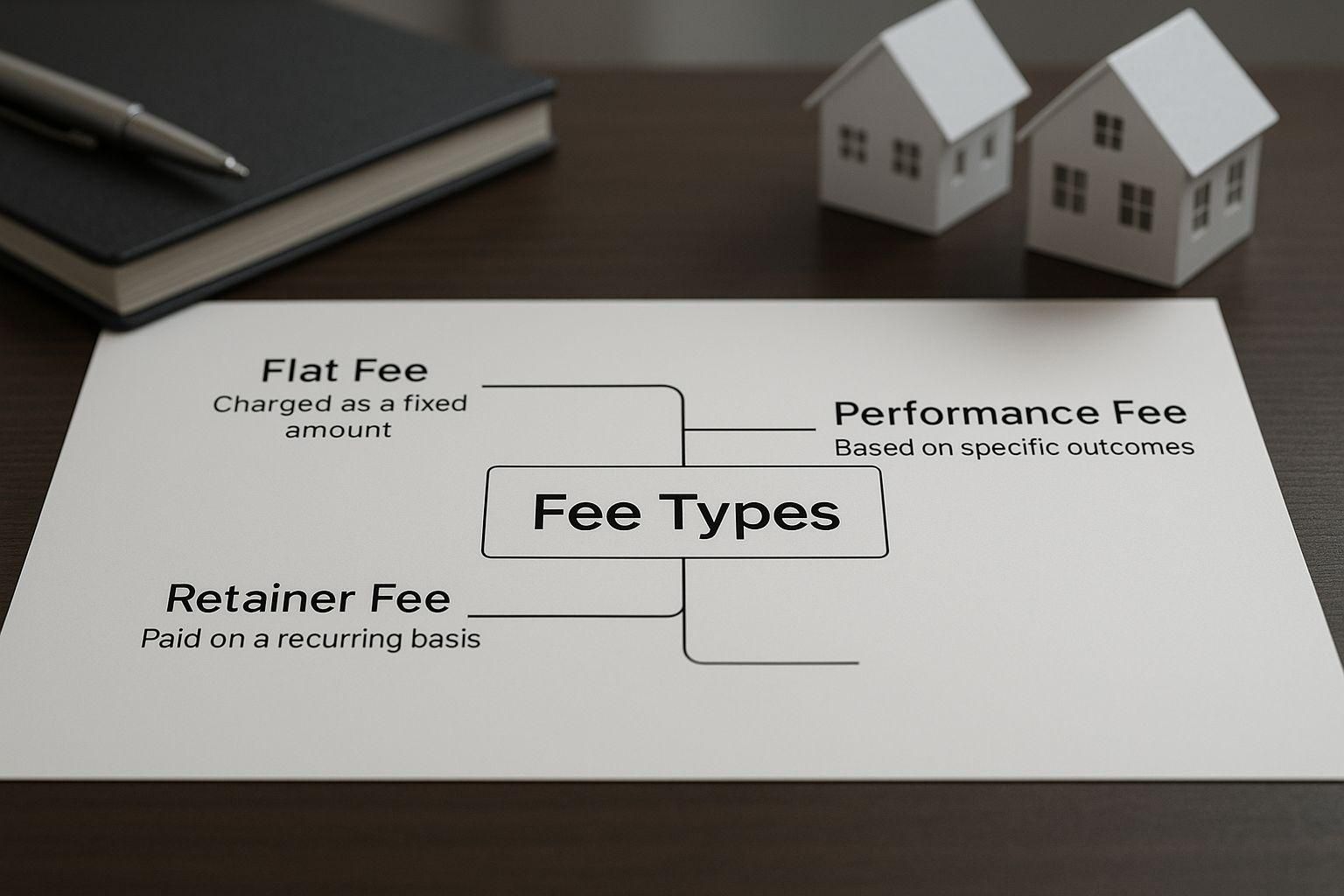

Common Commercial Property Management Fee Structures at a Glance

Before we dive deep into the different ways you can be charged, let's get a quick overview of the most common fee models. The right structure often comes down to the type of property you own and what your specific goals are. It’s also important to remember that these fees are just one part of the financial picture; understanding the full scope of tax advantages of rental property is key for any serious investor.

To make things simple, here’s a table that breaks down the main fee structures you'll encounter.

Each of these models has its place, and we'll explore the pros and cons of each one in more detail later on. For now, this gives you a solid foundation for understanding how you'll pay for professional management.

Breaking Down the Core Fee Structures

When you bring on a commercial property manager, how they get paid is just as important as the services they provide. The fee structure you agree on directly shapes your cash flow, but more importantly, it sets the incentives for how your manager performs. Think of it like a sales commission—the structure determines what actions get rewarded.

Let's walk through the three main ways these fees are structured: the percentage model, the flat-fee model, and a hybrid of the two. Each one has its own logic and works best for different types of properties and owner priorities.

This image gives a great at-a-glance summary of the common fees you'll run into.

As you can see, your choice boils down to a trade-off between performance-based costs and fixed, predictable expenses. Neither is inherently better; it's all about what aligns with your investment strategy.

The Percentage of Gross Rent Model

By far the most common setup in the commercial world is the percentage of gross rent model. It's simple: the management company earns a slice of the total rent collected from your tenants each month, typically somewhere between 4% and 12%.

The beauty of this model is that it automatically aligns everyone's interests. Your manager is directly motivated to keep the property leased up with good, paying tenants. If a unit sits vacant or a tenant falls behind on rent, their paycheck shrinks right alongside yours. This creates a natural partnership where you're both rowing in the same direction—towards full occupancy and steady income.

For example, say your retail plaza brings in $50,000 in gross rent this month. With a 5% management fee, you’d pay $2,500. But if a key tenant moves out next month and your collected rent drops to $40,000, the fee automatically falls to $2,000. The manager feels the pain of that vacancy, too.

Key Insight: The percentage model ties your manager’s success directly to your property’s performance. They only make money when you do, which is a fantastic foundation for a healthy partnership.

This structure is a perfect fit for multi-tenant properties like office buildings, shopping centers, and industrial parks, where rental income can ebb and flow with occupancy.

The Predictable Flat-Fee Model

On the other end of the spectrum is the flat-fee structure, which offers total budget certainty. You agree on a fixed dollar amount to pay your property manager every single month, no matter what the rent roll looks like.

This approach is a lifesaver for owners who need to forecast their cash flow down to the dollar. It smooths out the monthly P&L and removes the guesswork that comes with percentage-based fees. If your property's income is already rock-solid and stable, a flat fee can be a clean, straightforward way to go.

The potential downside, however, is a weaker alignment of incentives. Because the manager’s pay isn't tied to rental income, there isn't that built-in financial push to aggressively market a vacancy or chase down late payments. A professional manager will, of course, do their job, but the fee structure itself doesn't reward them for going the extra mile to boost your top-line revenue.

You'll often see this model used for:

* Single-tenant properties under long-term leases where the income is extremely reliable.

* Smaller properties where a percentage fee might not be enough to properly compensate the management company for their time.

* Owners who handle leasing themselves and just need a manager for day-to-day operations and maintenance.

The Flexible Hybrid Model

What if you want the "skin in the game" of a percentage fee but the predictability of a flat fee? That's where the hybrid model comes in. It blends elements from both structures to create a more customized arrangement that can be tailored to the unique needs of a property or owner.

A popular hybrid setup is a lower base flat fee plus a performance-based kicker. A manager might get a $1,500 monthly flat fee to cover their core administrative costs, plus a 3% commission on all rents collected. This ensures their lights stay on while still motivating them to keep the building full.

Another twist is to use a flat fee with specific bonuses tied to hitting key performance indicators (KPIs), such as:

* Keeping occupancy above 95% for the year.

* Successfully negotiating a certain number of lease renewals.

* Bringing operational expenses in under budget.

The global property management market is expected to reach nearly USD 27.8 billion by 2025, and Europe is a huge piece of that pie, holding over 30% of the market share. This growth shows just how much the industry is evolving, with sophisticated owners increasingly demanding flexible fee structures like the hybrid model. You can learn more about the global property management market trends and what’s driving this demand.

Beyond the Basics: What Are These Extra Service Fees?

The base management fee, whether it's a percentage of rent or a flat monthly rate, is what you pay for the day-to-day running of your property. But that's rarely the whole story. Most management agreements have a separate list of fees for big-ticket services that go way beyond routine oversight.

Think of your base fee as the retainer for your property's general practitioner. They handle the check-ups and common colds. But when you need major surgery or a specialist, that's a separate, more intensive service with its own cost. Getting a handle on these potential commercial property management fees is the key to creating an accurate budget and avoiding any nasty surprises down the road.

These aren't hidden fees, to be clear. They're designed to compensate your manager for taking on significant, time-consuming tasks that directly add value to your asset. Let's dig into the most common ones you'll run into.

Leasing and Renewal Fees

Getting a quality tenant into a vacant space is probably the single most important—and difficult—job a property manager has. It's a full-on sales and marketing effort, so it’s almost always paid for separately through a leasing fee, sometimes called a tenant placement fee. This fee covers the whole process: advertising the space, showing it to dozens of prospects, running background checks, and hammering out the final lease agreement.

You'll almost always see this fee structured as a percentage of the tenant's first-year rent, typically landing somewhere between 3% and 6%.

For instance, say your manager lands a great new tenant on a five-year lease. If the rent for the first year is $100,000, a 4% leasing fee would come out to $4,000. It's a one-time payment made right after the lease is signed.

On the flip side, keeping a great tenant is always cheaper than finding a new one. To encourage managers to keep tenants happy, many agreements also include a lease renewal fee. This is a much smaller fee paid when the manager successfully negotiates an extension with a current tenant. Since the heavy lifting of finding and vetting is already done, it’s usually a small flat fee or a reduced percentage.

Project Management Fees

Small, routine maintenance jobs like fixing a leaky pipe or replacing a burned-out light are part of the daily grind covered by your base fee. But what about major capital projects? Think a full roof replacement, a new HVAC system, or a complete lobby renovation. That’s a whole different ballgame.

Overseeing a major construction project is a massive undertaking that pulls a manager away from their day-to-day duties. They have to:

- Find and vet contractors: This means getting multiple bids and actually checking references.

- Negotiate contracts: They ensure the scope of work is tight and the price is right.

- Supervise the entire project: This is about making sure the work gets done correctly, on schedule, and within budget.

For this intensive oversight, you'll see a project management fee. This is calculated as a percentage of the total project cost, usually falling in the 4% to 10% range.

Let's say you're replacing the roof for $150,000. A 5% project management fee would be $7,500. This fee ensures you have a dedicated professional protecting your investment from start to finish.

Administrative and Technology Fees

You might also spot a few smaller, recurring fees meant to cover the management company's internal operational costs. An administrative fee, for example, is typically a small monthly charge for things like postage, printing, and office supplies used specifically for your property.

Lately, technology fees have become more common. Good property management runs on powerful software for everything from accounting and rent collection to maintenance requests and tenant communication. This fee is a way for the owner to share in the cost of the essential software licenses, usually as a small monthly charge.

While these fees are usually minor, you absolutely need to spot them in the agreement. Make sure they are clearly explained and seem reasonable. It’s always fair to ask exactly what services or platforms these fees are paying for so you know what you’re getting for your money.

What Drives Your Management Fee Rate

Ever get two quotes for managing the same property and wonder why one is 4% while the other is 8%? That gap isn't random. It’s the result of a detailed risk and workload assessment by each management firm, and several key factors are at play.

Think of it like getting a quote for car insurance. Your final premium depends on the type of car you drive, where you park it, and your driving record. In the same way, a property management fee is tailored to the unique profile of your asset and the specific services you need.

Getting a handle on these drivers is essential. It lets you read between the lines of a proposal, compare apples to apples, and make sure you’re paying a fair price for the value you're getting.

Property Type and Size

First and foremost, the complexity of your asset is a massive cost driver. A simple, single-tenant industrial warehouse with a solid triple-net (NNN) lease is pretty hands-off. The manager’s job is often just collecting one rent check and making sure the tenant handles their maintenance obligations.

Now, contrast that with a bustling multi-tenant retail center. That's a different beast entirely. The manager has to juggle multiple leases with staggered end dates, handle complex common area maintenance (CAM) reconciliations, mediate tenant issues, and run marketing campaigns to keep foot traffic high. The workload is exponentially greater, which is why the fee will naturally sit at the higher end of the typical 4% to 12% range.

Size matters, too, but maybe not how you'd think. Bigger properties generate more income, but that doesn't automatically mean a lower percentage fee. A huge office park with a gym, multi-level parking garage, and conference centers needs a larger on-site team and far more complex operational oversight, pushing the fee percentage right back up.

Location and Asset Condition

Where your property is located makes a huge difference in the management effort required. An asset in a prime, high-demand downtown area might be a breeze to lease, but it also comes with higher vendor costs, stricter local regulations, and fierce competition. On the flip side, a building in a quieter, more remote area might take a much more aggressive—and expensive—marketing push to find and keep good tenants.

The building's physical state is another critical piece of the puzzle. A shiny new Class A office tower will have far fewer headaches than a 40-year-old Class C building with a long list of deferred maintenance. Older properties mean more repair calls, intensive vendor management, and proactive planning for capital improvements, all of which add to the manager's workload and risk. When a manager quotes a fee for an older property, they're pricing in the inevitable emergency calls and complex projects. If you're thinking about financing major repairs, our guide to https://www.homebasecre.com/posts/understanding-commercial-equity-line-of-credit offers some great insights.

How Property Characteristics Impact Management Fees

The table below breaks down how specific property attributes can push your management fee up or down. A property with more "Higher Fee" characteristics is simply more labor-intensive to manage effectively.

Ultimately, a higher fee is often a direct reflection of the time and expertise required. The manager is pricing their services based on the real-world effort needed to protect and grow your investment.

Scope of Required Services

At the end of the day, the single biggest driver of your management fee is what you actually ask the company to do. This is where you have the most control. A bare-bones agreement that only covers rent collection and paying the bills will always be cheaper than a full-service partnership.

A comprehensive, all-in management scope could include services like:

- Full-Service Accounting: Detailed financial reporting, budgeting, and thorny CAM reconciliations.

- Proactive Asset Management: High-level strategic planning, market analysis, and suggesting value-add improvements.

- In-House Leasing and Marketing: A dedicated team to market empty spaces, negotiate leases, and manage tenant relations.

- Construction Management: Oversight for tenant build-outs and major capital projects.

Market dynamics also play a part. Consider the 2025 forecast, which predicts new office completions will plummet by 73% in major U.S. cities. In a market with that kind of supply shortage, keeping your existing tenants happy is paramount. This makes intensive asset management and retention efforts incredibly valuable, justifying higher fees for proactive managers who can deliver in a tough market.

To see how these concepts apply elsewhere, this guide to understanding service rates and pricing models offers a great look at how another professional industry structures its fees.

How to Negotiate Your Management Agreement

Once you have a solid grasp of the different fee structures and what drives them, you're in a great position to negotiate an agreement that truly works for you. The goal isn't to squeeze every last penny and find the cheapest manager. It's about building a fair, win-win partnership. A well-crafted agreement makes sure the fee structure actually encourages performance and lines up perfectly with your long-term goals for the property.

Think of negotiating less as a battle and more as a collaboration. You're starting a long-term relationship with a partner who will be critical to your asset's success. A little thoughtful work upfront can prevent a world of misunderstandings and disputes down the road, setting the stage for a profitable venture together.

Do Your Homework Before the Conversation

Walking into a negotiation unprepared is like trying to build a house without a blueprint—it’s not going to end well. Before you even sit down with a potential manager, you need a crystal-clear baseline of what’s fair and competitive for your specific property in your market. This homework is what gives you the confidence and data to back up your position.

First, benchmark everything. Reach out to several management firms and get proposals for your property. This will quickly give you a realistic range for commercial property management fees in your area for your asset type. Don't just fixate on the main percentage; dig into the full scope of services included in each proposal to make sure you're comparing apples to apples.

Also, remember that your portfolio is your leverage. If you have multiple properties, you're a much bigger fish. Use that to your advantage by negotiating a more favorable, blended rate across all your assets. Managers are almost always more flexible on fees when they can secure a larger, more stable book of business.

Key Clauses to Scrutinize

As the old saying goes, the devil is in the details. In a management agreement, those details live in the contract clauses. Paying close attention to these specific terms now will save you from major headaches and surprise costs later. A good contract is clear, fair, and protects everyone involved.

Zoom in on these critical areas during your review:

- Scope of Services: This is the heart of the agreement. It needs to spell out, in painstaking detail, every single responsibility the manager has. Vague phrases like "general maintenance oversight" are a huge red flag. Insist on specifics. This prevents future arguments about what is or isn't covered by the base management fee.

- Fee Approval Process: The contract must clearly state that any expense or project management fee for costs over a certain amount (say, $1,000) needs your written approval beforehand. This simple clause is your best defense against being blindsided by large, unauthorized bills.

- Termination Conditions: Know exactly what it takes to end the relationship. Look for two key things: a "for cause" clause that lets you terminate immediately for major issues like negligence, and a "without cause" clause that allows either party to part ways with reasonable notice, usually 30 to 90 days. Steer clear of long, restrictive lock-in periods.

Crucial Tip: Always have an attorney who specializes in commercial real estate review the final agreement before you sign it. The small cost upfront is nothing compared to the significant financial and legal trouble a bad contract can cause.

Structuring a Performance-Based Agreement

If you want to create a true partnership, you have to structure the agreement to reward the outcomes that matter most to you. Instead of just accepting a standard flat percentage, think about building in performance incentives that tie your manager's compensation directly to your asset's success. This is where you can get creative and make sure everyone is pulling in the same direction.

A great way to do this is by proposing a hybrid fee model. This might look like a slightly lower base management fee paired with bonuses for hitting specific, measurable targets.

Here are a few ideas for performance incentives you can bring to the table:

- Occupancy Bonus: Offer a bonus if the manager keeps the average occupancy rate above a key threshold, like 95%, for the entire year.

- NOI Growth Incentive: Tie a portion of their compensation to year-over-year growth in the property's Net Operating Income (NOI).

- Lease Renewal Bonus: Give them a small bonus for every successful lease renewal. This directly incentivizes tenant retention, which is far cheaper than finding new tenants.

By building incentives like these into the contract, you change the entire dynamic. The focus shifts from simply managing a property to actively enhancing its value. This transforms the relationship from a basic vendor-client transaction into a powerful strategic alliance focused on mutual growth.

Answers to Your Top Fee Questions

Stepping into the world of commercial property management can feel a bit like learning a new language, especially when it comes to the fees. It's only natural to have a lot of questions. Getting straight answers is the only way to make smart decisions and build a solid, transparent relationship with your management team.

This section gets right to the point, tackling the questions we hear most often from property owners. We'll skip the jargon and give you the practical answers you need to feel confident about your management agreement.

What Is a Typical Percentage for Commercial Property Management Fees?

This is almost always the first question out of the gate: "What's this going to cost me?" While there's no magic, one-size-fits-all number, commercial property management fees almost always land within a fairly predictable range.

Generally speaking, you can expect to pay anywhere from 4% to 12% of the property’s gross collected monthly rent. That’s a wide spread, and for good reason. It reflects just how different commercial properties can be and how much work is involved in managing them. The final percentage isn't just a number pulled out of a hat; it's based on real factors like workload, complexity, and risk.

Think about it this way. A massive, stable industrial warehouse with a single, long-term tenant is relatively straightforward to manage. For a property like that, the fee will likely be on the lower end, maybe 4% to 6%. Now, compare that to a bustling multi-tenant retail strip with constant leasing activity and complicated common area maintenance (CAM) reconciliations. That's a much more hands-on job, so a fee in the 8% to 12% range is far more realistic.

Key Takeaway: Don't just hunt for the lowest percentage. A cheap fee might look good on paper, but it often means you're getting fewer services. If crucial tasks are getting ignored or billed as extras, that "deal" can end up costing you a lot more in the long run.

Are Commercial Property Management Fees Tax Deductible?

This is a fantastic question because the financial impact of your management agreement goes beyond just the monthly invoice. So, can you write these costs off?

The short answer is yes. The good news for property owners is that in most places, commercial property management fees are considered a standard operating expense. That means they are typically tax-deductible against your property's rental income. This isn't just for the base management fee, either; it usually applies to other charges like leasing commissions or project oversight fees. These deductions lower your taxable income, which can make a real difference to your property's bottom line.

A word of caution, though. Tax laws are notoriously complex and can change based on your location, how your business is structured, and other specific details.

This is why we always—and I mean always—recommend talking to a qualified tax advisor or CPA. They can give you advice that's actually tailored to your portfolio and make sure you're legally taking advantage of every deduction you're entitled to.

How Do I Know If I Am Getting Good Value?

This might be the most important question of all. Is the fee you're paying actually worth it? Measuring the value of a property manager isn't about finding the rock-bottom price. It’s about understanding your return on that investment.

A top-notch manager doesn't just cost you money; they make you money. They're a profit-driver, not just another line item on an expense report. The real test of their worth shows up in your property's performance and your bank account.

So, how can you tell if you're getting great value? Look for these key signs:

- High Occupancy Rates: A proactive manager keeps your spaces filled with quality tenants, which is the best way to minimize the cash drain from vacancies.

- Low Tenant Turnover: Happy tenants stay put, and keeping them is far cheaper than finding new ones. Strong tenant relationships and quick service are huge value-adds.

- Proactive Maintenance: A manager who catches small problems before they become big, expensive disasters is saving you a fortune over time. This is a big one.

- Growing Net Operating Income (NOI): This is the ultimate scorecard. A great manager is always finding ways to boost revenue and keep expenses in check, pushing your NOI in the right direction.

You should also expect clear, detailed financial reports every month that show you exactly what's happening. Open communication is another non-negotiable. Remember, the cheapest manager often leads to neglected maintenance, unhappy tenants, and a declining asset. True value comes from a partnership that actively protects and grows your investment.

At Homebase, we understand that managing your real estate deals and investors efficiently is the key to scaling your portfolio. Our all-in-one platform simplifies fundraising, investor relations, and deal management, so you can focus on finding your next great investment, not on administrative tasks. Discover how Homebase can support your growth by visiting us at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.