How to Value Commercial Property: Expert Investor Tips

How to Value Commercial Property: Expert Investor Tips

Learn how to value commercial property effectively. Discover expert strategies to maximize your real estate investments today.

Domingo Valadez

Jun 7, 2025

Blog

Understanding What Actually Drives Commercial Property Value

Commercial property valuation is a multifaceted process, going beyond simply plugging numbers into a formula. It requires a deep understanding of the various forces influencing buyer behavior and willingness to pay. This involves looking beyond the surface and delving into the core drivers of value. These drivers typically fall into three main categories: market dynamics, property specifics, and financial performance.

Market Dynamics: The Big Picture

The overall market environment plays a significant role in determining a property's value. It acts like a rising or falling tide, affecting all properties within its reach. A thriving local economy with robust job growth, for example, often fuels demand for commercial spaces, pushing property values upwards. Conversely, an economic downturn can have a significant negative impact.

Understanding local market trends, demographics, and economic forecasts becomes crucial for accurate valuations. National economic factors, like interest rates and inflation, also come into play. These can sway investor sentiment and borrowing costs, further influencing property values. Keeping abreast of these broader economic forces is crucial for anyone involved in commercial real estate.

Property Specifics: Location, Location, Location (and More)

Beyond the general market, a property's unique characteristics significantly contribute to its value. Location is paramount. A property situated in a prime area with high visibility and easy access tends to command a premium price. This parallels the residential market, where houses on desirable streets often fetch higher prices than comparable houses in less sought-after areas.

However, location isn't the only factor. The physical condition, age, size, and amenities also play a role. A modern, well-maintained building with attractive features naturally draws more interest and higher bids. A Class A office building with state-of-the-art amenities, for example, will likely be valued considerably higher than a Class C building in the same locale. These property-specific features, when combined with market conditions, provide a more comprehensive picture of a property’s inherent worth.

Financial Performance: The Bottom Line

A commercial property's financial performance is a critical driver of its value. This is where the practical aspect of valuation comes into focus. Investors rely on metrics like net operating income (NOI), cap rates, and potential cash flow to assess a property's investment potential.

A property generating a strong, consistent cash flow is typically viewed as more valuable than one with fluctuating or uncertain income. This is comparable to evaluating two businesses: one with stable profits, the other with unpredictable earnings. The steady performer is generally considered a safer and more valuable investment. Lease terms, tenant quality, and operating expenses all contribute to the financial health of a property and, ultimately, its value. Understanding these financial aspects is essential for accurate property valuations and making informed investment decisions.

Mastering Cap Rates Without The Common Pitfalls

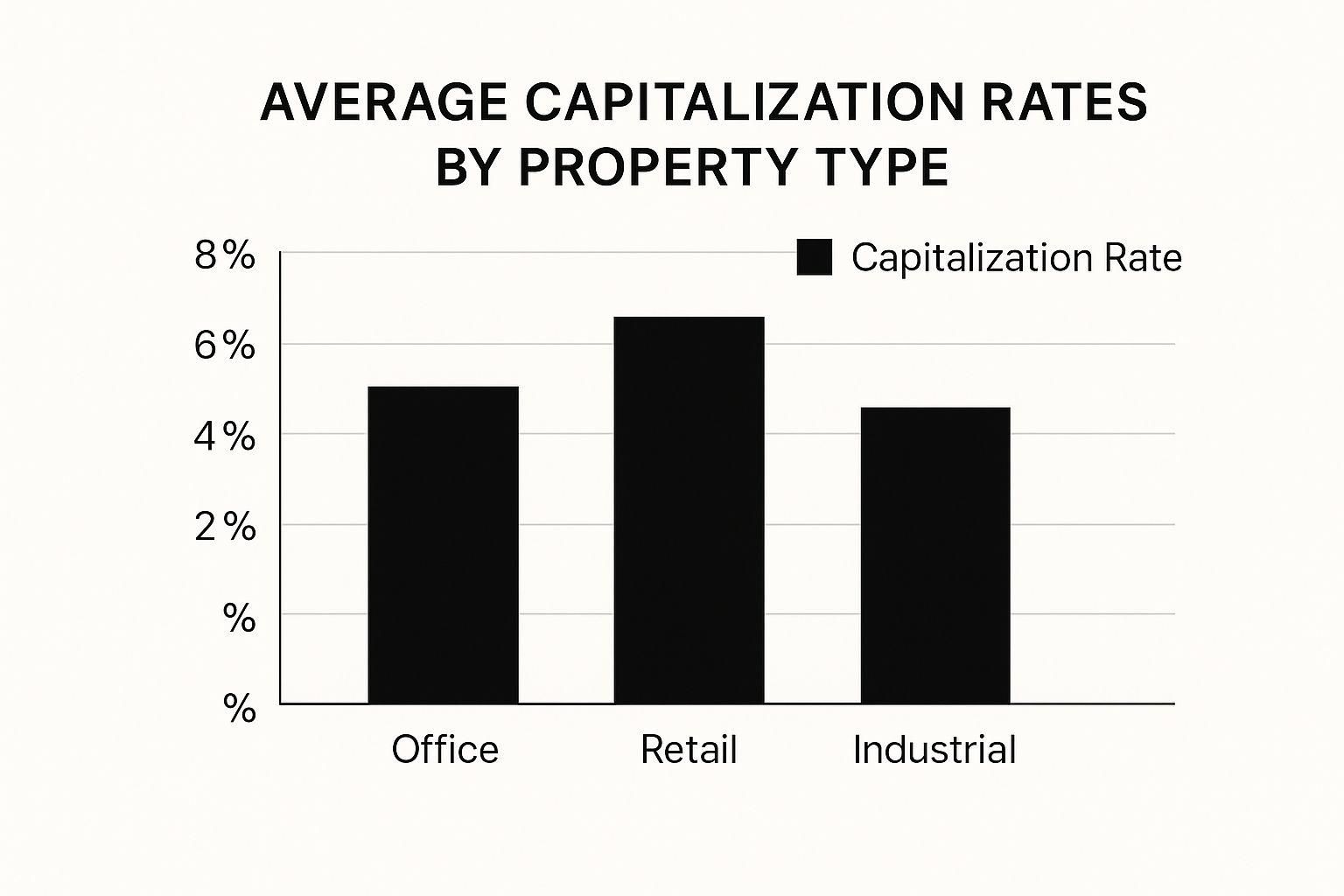

This infographic provides a visual representation of average capitalization rates across different commercial property types, including office, retail, and industrial. Retail properties typically command the highest cap rates at 7%, followed by office properties at 6%, and finally, industrial properties at 5%. These differences highlight the varied levels of risk and potential return associated with each property type. Understanding these benchmarks offers a valuable foundation for property valuation.

One common method for valuing commercial real estate is the capitalization rate (cap rate) approach. This is particularly relevant for properties with consistent income streams. The method relies heavily on the net operating income (NOI). Calculating NOI accurately is vital because even minor inaccuracies can significantly impact the valuation. This is a frequent area where investors make mistakes, often misclassifying expenses, which then distorts their analysis.

The cap rate approach is frequently used by investors and lenders, especially in markets with stable income streams. It involves dividing the NOI by the cap rate to arrive at the property's estimated value. For example, a property with a $100,000 NOI and a 5% cap rate would be valued at $2,000,000. This method is preferred when cash flow is predictable and reliable. Historically, cap rates have fluctuated considerably across different market conditions, typically falling within a range of 4% to 10%. These rates are influenced by the property type and local market dynamics. In stable economic periods, cap rates tend to be lower, while in downturns, they can rise to reflect increased risk. Learn more about commercial property valuation methods.

Selecting The Right Cap Rate: A Critical Step

Selecting the appropriate cap rate is as critical as accurately calculating NOI. It involves analyzing comparable properties within the same market and considering the unique attributes of the specific property being evaluated. For instance, a Class A office building in a prime location would likely justify a lower cap rate compared to a similar-sized Class B property in a less desirable area. This is because investors are typically willing to accept lower returns for lower-risk investments.

Sourcing Reliable Data: Insider Techniques

Locating trustworthy cap rate data is another key component of precise valuations. While some data is readily available, experienced investors often utilize insider networks and specialized databases. This might involve connecting with local appraisers, brokers, or other investors with in-depth market knowledge. You might also be interested in: How to Value an Apartment Building.

The Impact Of Small Differences: A Real-World Example

A small variance in the cap rate can drastically influence the final valuation. For a property with a $200,000 NOI, a 5% cap rate results in a $4 million valuation. However, a 5.5% cap rate yields a valuation of approximately $3.64 million. This $360,000 difference underscores the importance of accuracy when working with cap rates.

Red Flags And Reality Checks: Avoiding Costly Errors

Even with meticulous analysis, market cap rates may not always accurately reflect the specific circumstances of a particular property. This can be attributed to unique features, unfavorable lease agreements, or other property-specific elements. Avoid relying solely on market averages without accounting for these nuances. Be cautious of unusually high or low cap rates compared to similar properties, as these discrepancies could indicate underlying issues. Thorough due diligence and careful evaluation are crucial for avoiding overpaying or undervaluing a property.

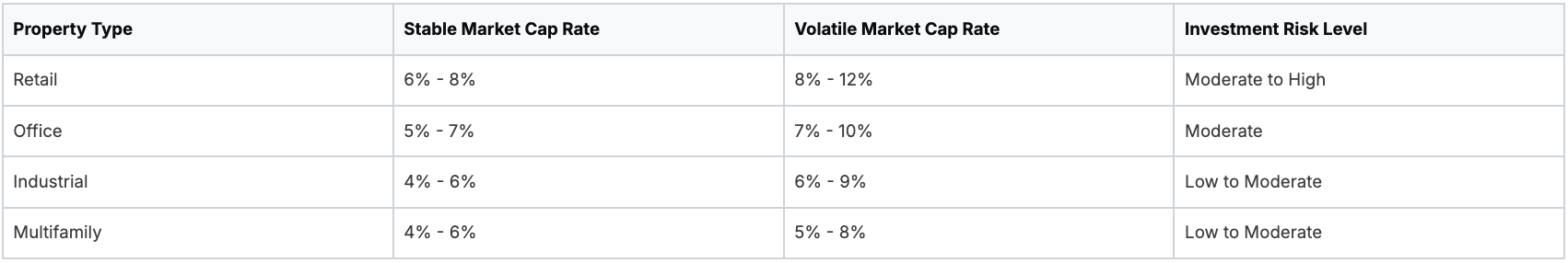

To illustrate the typical cap rate ranges across different property types and market conditions, let's look at the following table:

Cap Rate Ranges By Property Type And Market Conditions

Comparison of typical cap rate ranges across different commercial property types and economic conditions

This table demonstrates how cap rates respond to market volatility. In a stable market, cap rates are generally lower reflecting lower perceived risk. However, as market conditions become more volatile, cap rates increase, reflecting the heightened risk. Retail properties, being more susceptible to economic fluctuations, show the largest increase in cap rates during volatile periods. Conversely, industrial properties, often considered more resilient, exhibit less dramatic changes. Understanding these dynamics is crucial for informed investment decisions.

Finding True Comparables In A Noisy Market

Accessing recent sales data is easy. However, identifying truly comparable properties for valuing commercial real estate requires a deeper level of expertise. This section explores how experienced investors sift through the noise of the market to pinpoint properties that offer a genuine comparison to their target investment. Just as a skilled chef understands the nuances of their ingredients, seasoned investors must carefully evaluate the components of a comparable sale. This meticulous approach is fundamental to accurate valuation.

Adjustment Techniques: Separating Amateurs From Professionals

A key differentiator between amateur and professional valuations lies in the adjustment techniques applied. These adjustments account for the inevitable variations between the subject property and potential comparables. Consider, for example, two retail spaces: one prominently situated on a busy street, the other tucked away in a less visible location. The more visible property will undoubtedly command a higher value. Adjustments help quantify these differences, aligning the comparables more closely with the subject property's true market value.

Key areas requiring adjustments typically include location quality, building condition, lease structures, and market timing. Location adjustments consider factors like accessibility, visibility, and proximity to amenities. Building condition adjustments take into account the property's age, any recent renovations, and the overall quality of construction. Lease structures also significantly influence value. Adjustments are necessary to reconcile differences in lease terms, rent escalations, and the creditworthiness of tenants. Finally, market timing adjustments acknowledge the dynamic nature of the market, recognizing that recent transactions hold greater relevance than older ones.

Sourcing Reliable Data: Insider Resources

Identifying reliable comparable data is another crucial aspect of accurate valuations. The sales comparison approach plays a vital role in this process. This method involves analyzing recent sales of similar properties to estimate the subject property's value, considering factors like location, size, age, and condition. It’s particularly effective in markets with high transaction volumes, providing a realistic, market-based valuation. Historically, this approach has proven successful in data-rich markets such as the United States and the United Kingdom. For instance, between 2010 and 2020, commercial property sales in New York City consistently surpassed $100 billion annually, offering a wealth of data for comparative analysis. Learn more about this approach here.

While publicly available data offers a starting point, experienced investors often tap into insider resources. These include connections with commercial real estate brokers, appraisers, and access to specialized databases. Such resources offer deeper insights into transaction details, nuanced market trends, and off-market deals, leading to a more comprehensive and informed valuation.

Warning Signs and Weighting Comparables: Real-World Applications

Not all transactions offer equal insight. Some sales may appear comparable at first glance, but conceal underlying factors that skew their true value. These can include distressed sales, related-party transactions, and unique financing arrangements. Such situations often result in prices that don't accurately reflect the prevailing market value.

In scenarios where perfect matches are rare, investors weight different comparables according to their relevance to the subject property. A recent sale of a nearly identical property in a similar location carries more weight than an older sale of a less comparable property. This nuanced approach recognizes the inherent complexities and variations within real estate markets.

Furthermore, a hallmark of a skilled investor is the ability to navigate situations where perfect comparables simply don't exist. This may involve placing greater emphasis on alternative valuation methods, such as the income approach or the cost approach. It may also necessitate seeking expert opinions from experienced appraisers to ensure a well-informed and accurate valuation.

When To Use The Cost Approach (And When To Avoid It)

The cost approach is a valuable tool for valuing commercial property, especially when the income approach and sales comparison approach are less effective. It focuses on the current cost of replacing a property, making it useful for specific property types and market situations. However, understanding its limitations is key to avoiding potential mistakes.

Understanding The Cost Approach Basics

The cost approach determines the current market value of the land, adds the replacement cost of the building, and subtracts any accrued depreciation. It considers the cost to rebuild at current prices. This is especially important for properties with unique features or specialized construction. For example, this approach offers a more reliable valuation for a new, state-of-the-art medical facility than trying to find comparable sales. This method is particularly useful for new or unique properties where comparable sales data is limited. For example, in 2020, the average construction cost for a commercial building in the United States was approximately $150 per square foot. Total costs vary significantly based on location and building type. This approach is effective for properties with specialized features that significantly impact value. Historically, the cost approach has been used extensively in areas with limited sales data, such as emerging markets or for properties with unique architectural features. Find more detailed statistics here.

Ideal Scenarios for The Cost Approach

Several instances make the cost approach the most reliable method. New construction projects are a prime example. With no existing operating history or comparable sales, this approach provides a solid basis for estimating value. This also applies to unique or specialized properties with few comparables, such as hospitals, data centers, or manufacturing facilities. In these cases, the cost to replicate the property offers a more realistic value indicator. Additionally, the cost approach is often used for insurance valuations. Insurers use it to determine replacement cost in case of damage or destruction, ensuring adequate coverage for rebuilding.

When The Cost Approach Falls Short

While powerful in specific situations, the cost approach has its limitations. For older properties, accurately estimating depreciation becomes increasingly difficult. The three types of depreciation—physical deterioration, functional obsolescence, and external obsolescence—can significantly impact value. This is where experience is essential. Properly identifying functional obsolescence, such as outdated building systems or inefficient layouts, requires understanding how these factors affect property value. Determining land value can also be complex, especially in fluctuating markets.

Practical Applications And Case Studies

Smart investors use the cost approach in various ways. For development feasibility analysis, it helps determine the potential profitability of new construction. By comparing estimated development costs with the projected market value upon completion, investors can assess financial viability. The cost approach also provides valuable leverage in negotiations with sellers who have invested heavily in property improvements.

Through practical techniques for estimating replacement costs, investors can gain a deeper understanding of a property's intrinsic value. These techniques, combined with accurate depreciation estimates and land valuations, empower investors to make informed decisions in new construction, specialized properties, or negotiations.

Advanced Techniques That Give You An Edge

While essential valuation methods provide a solid foundation, sophisticated investors often employ advanced techniques to gain a competitive edge in the commercial property market. These techniques offer a more nuanced and forward-looking perspective, allowing investors to identify potentially lucrative opportunities often overlooked by others. Think of it as strategic foresight, similar to a chess player anticipating several moves ahead.

Discounted Cash Flow (DCF) Analysis: Projecting Future Income

The discounted cash flow (DCF) method is a powerful tool for valuing properties with fluctuating income streams. Unlike the cap rate approach, which assumes stable income, DCF analysis projects future cash flows and discounts them back to their present value. This allows investors to factor in anticipated rent increases, lease expirations, and planned capital expenditures.

For example, a property undergoing renovations may initially experience lower income. However, after the improvements are completed, income potential could significantly increase. DCF analysis captures this dynamic income stream, providing a more comprehensive valuation than a simple cap rate calculation.

Sensitivity Testing: Preparing For Different Scenarios

Sensitivity testing, sometimes called "what-if" analysis, helps investors understand how changes in various market conditions might affect a property's value. By adjusting key variables – such as vacancy rates, rent growth, and interest rates – investors can assess the potential impact on their investment.

This process is similar to running simulations, evaluating the property’s resilience to various market fluctuations. For instance, an investor might model how a 10% increase in vacancy rates or a 5% decline in rent growth could influence the property's overall value. Such insights provide valuable perspectives on potential risks and rewards.

Market Cycle Analysis: Predicting Future Performance

A key component of successful real estate investing is understanding market cycles. By analyzing historical trends, demographic shifts, and leading economic indicators, investors can better anticipate future market performance. This involves evaluating factors like population growth and migration patterns, employment rates, levels of new construction activity, and planned local infrastructure developments.

For example, an area experiencing rapid population growth coupled with substantial new infrastructure projects might see increased property values in the coming years. This proactive, forward-looking perspective can allow investors to position themselves for optimal returns. Consider San Francisco's office market, which is significantly impacted by the cyclical nature of the tech sector. Understanding these broader economic forces is crucial for accurate valuations.

Leveraging Technology and Data: Enhancing Accuracy

Professional appraisers are increasingly utilizing advanced technology and data sources like Argus to enhance valuation accuracy. Specialized software programs can perform complex calculations, analyze vast amounts of market data, and generate detailed reports. Access to comprehensive databases offers granular information on comparable sales, current lease rates, and typical operating expenses, ultimately empowering investors to make more informed decisions. This data-driven approach complements traditional valuation methods, adding a crucial layer of precision.

Reconciling Conflicting Results: A Systematic Approach

It's common for different valuation methods to produce varying results. For instance, the cap rate approach might suggest a higher value than the sales comparison approach. Reconciling these discrepancies requires a systematic approach that weighs the strengths and weaknesses of each method. This involves considering the specific property type, current market liquidity, and the underlying purpose of the valuation itself.

The sales comparison approach might be more reliable in a market with frequent transactions of similar properties, while the income approach is often more suitable for a property with stable, long-term leases. The investor’s goals – whether acquiring, selling, or refinancing – further influence how the various valuations are interpreted.

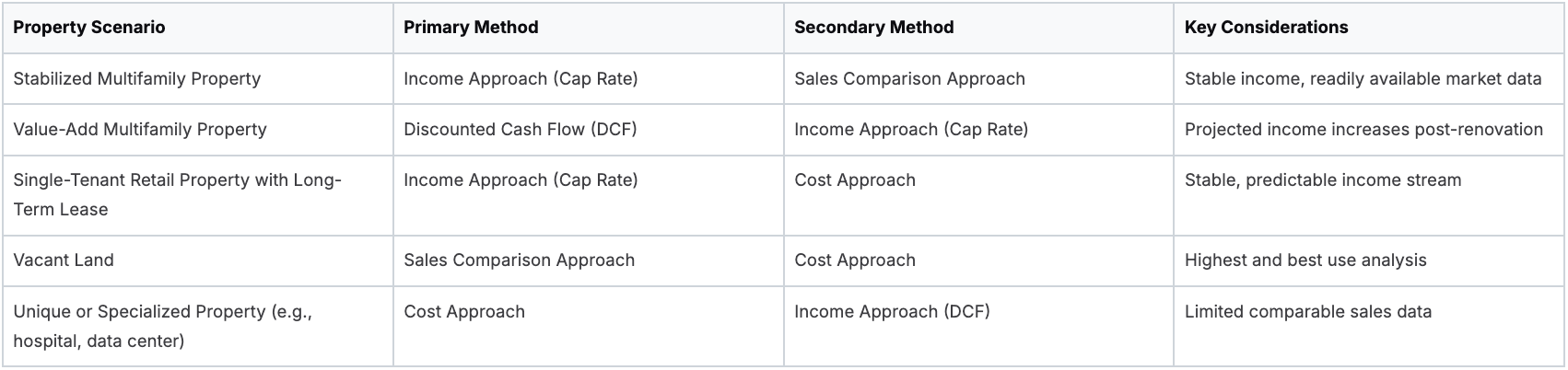

To help guide the selection of the most appropriate valuation method, consider the following table:

Valuation Method Selection Guide

Guidelines for choosing the most appropriate valuation method based on property characteristics and market conditions

This table summarizes the primary and secondary valuation methods for different property scenarios, along with key considerations for making the most informed decision. Choosing the right valuation approach is crucial for sound investment decisions.

Avoiding The Costly Mistakes Most Investors Make

Even seasoned investors can sometimes stumble into valuation pitfalls, leading to significant financial setbacks. This section explores some of the most frequent and costly errors, using real-world examples to illustrate the potential consequences. We’ll also provide strategies to help you navigate these challenges, empowering you to approach valuations with greater confidence and make smarter investment decisions.

Overreliance on Broker Opinions of Value

While brokers can provide valuable market insights, their opinions of value should be considered carefully and not taken as definitive truth. Brokers are incentivized to close deals, which can sometimes influence their valuations. For example, a broker might overstate a property's worth to attract buyers, potentially leading an investor to overpay. It's crucial to conduct your own independent analysis and verify any claims with objective data. Think of the broker's opinion as just one piece of the puzzle, not the complete picture.

Ignoring Property-Specific Realities

Market data provides a helpful benchmark, but it doesn't always capture the unique characteristics of a specific property. Failing to account for these property-specific factors can lead to inaccurate valuations. A property with unfavorable lease terms or significant deferred maintenance, for instance, might be worth considerably less than a seemingly comparable property with strong leases and recent upgrades. Always carefully examine the details and adjust your valuation accordingly.

Failing to Validate Assumptions

Every valuation relies on certain assumptions about future performance. Failing to rigorously validate these assumptions can result in costly errors. For example, projecting unrealistic rent growth or overlooking potential operating expense increases can significantly skew the valuation. A useful technique is to stress-test your assumptions by considering different scenarios and sensitivity analysis, asking "what if" questions to evaluate potential downside risks.

Neglecting Systematic Verification Processes

Catching errors before they become expensive problems requires a systematic approach to verification. Cross-checking your calculations, carefully reviewing comparable sales data for inconsistencies, and seeking expert opinions when needed can contribute to greater accuracy. This meticulous approach minimizes the risk of overlooking crucial details that could significantly impact the valuation.

Underestimating the Value of Professional Consultation

While conducting your own research is essential, don't hesitate to seek guidance from experienced professionals. Consulting with qualified appraisers, commercial real estate attorneys, and seasoned investors can offer invaluable insights and help you avoid costly mistakes. Consider it as building a team of experts to guide you through the complexities of commercial real estate valuation.

Neglecting Ongoing Market Research

The real estate market is constantly changing. Relying on outdated information can lead to flawed valuations. Stay informed about market trends, economic conditions, and regulatory changes that could affect property values. Ongoing market research ensures your analysis remains current and your investment decisions are based on the most relevant information.

Relying Solely on One Valuation Method

Each valuation method has its own strengths and weaknesses, and relying on just one can lead to a skewed perspective. Using multiple approaches, such as the income approach, the sales comparison approach, and the cost approach, provides a more comprehensive and balanced view of a property's value. Reconciling any discrepancies between the methods helps refine your valuation and increases confidence in your conclusions.

By understanding these common pitfalls and implementing a disciplined valuation approach, investors can significantly reduce their risk and make more informed investment decisions. This systematic process, combined with ongoing market research and professional consultation, empowers investors to navigate the complexities of commercial real estate with greater confidence and achieve greater success.

Ready to optimize your real estate syndication and avoid these costly valuation mistakes? Homebase provides the tools and resources you need to effectively manage your deals, from fundraising to investor relations. Visit Homebase today to learn more.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Unlocking debt coverage ratio real estate in syndication

Blog

Explore debt coverage ratio real estate essentials, learn the DCR formula, benchmarks, and syndication strategies to secure better financing.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.