How to Value an Apartment Building: Your Complete Guide

How to Value an Apartment Building: Your Complete Guide

Master how to value an apartment building with proven methods from real estate pros. Get cap rates, comparables, and insider strategies.

Domingo Valadez

Jun 4, 2025

Blog

Understanding What Makes Apartments Worth What They're Worth

Valuing an apartment building differs significantly from valuing a single-family home. Location is still essential, but the key difference lies in recognizing apartment buildings as income-generating assets. This perspective shift alters the valuation approach. Instead of solely comparing sales, investors prioritize factors impacting profitability. This includes analyzing potential rental income, operating expenses, and market dynamics.

For example, a well-maintained building in a growing rental market with low vacancy rates will likely have a higher value than a similar building in a stagnant market.

Key Factors Driving Apartment Building Values

Several factors influence an apartment building’s value. Location plays a crucial role, impacting both rental rates and occupancy levels. Properties in desirable areas with convenient access to transportation and strong amenities tend to attract higher rents and lower vacancy. The building's physical condition and age also significantly impact its value. Newer buildings with modern amenities generally command higher prices than older buildings needing renovations.

The local market’s economic health is another critical aspect. Factors like job growth, population trends, and interest rates all affect demand and rent levels. A thriving economy with rising incomes and a growing population typically increases housing demand, driving up rents and property values. Conversely, economic downturns can decrease demand, leading to declining property values.

Valuing an apartment building involves several methods. One common method is the capitalization rate (cap rate) approach. This method divides the net operating income (NOI) by the cap rate to determine the property's value. For example, a building with a $250,000 NOI and a 6% cap rate is valued at approximately $4.17 million.

The cap rate indicates the expected return on investment and varies by location and property type. In major markets like New York City or London, cap rates can be as low as 4% due to high demand and limited supply. In smaller cities, cap rates might be around 8% or higher. Understanding these dynamics is crucial for sound investment decisions. Learn more about commercial real estate valuation methods from Altus Group.

Understanding Market Cycles and Their Impact

Real estate markets are cyclical, with periods of growth and decline. Recognizing the current market cycle phase is crucial for accurate valuations. During expansion periods, high demand and rising rents lead to value appreciation. Conversely, during downturns, demand weakens, rents stagnate or decline, and property values can decrease.

Therefore, investment timing significantly impacts returns. Buying at a market peak can result in lower returns, while buying during a downturn may present opportunities for greater appreciation.

To make informed investment decisions, understanding the interplay of factors influencing apartment building values is essential. This analysis forms the foundation for more advanced valuation methods discussed later.

Let's take a look at typical cap rate ranges across different market types. The following table provides a comparison of typical cap rates, example cities, and investment characteristics.

Cap Rate Variations By Market Type

This table highlights the inverse relationship between market size and cap rates. Larger, more established markets tend to have lower cap rates, reflecting lower risk and strong demand. Smaller, emerging markets often offer higher cap rates, but with potentially increased risk. Carefully analyzing market conditions and investment goals is vital when evaluating potential investment opportunities.

Mastering The Cap Rate Method That Pros Actually Use

Let's explore the income capitalization approach, focusing on the cap rate method. This is a vital tool used to assess the value of apartment buildings. It helps investors understand a property's potential return on investment based on its net operating income (NOI).

Calculating Net Operating Income (NOI) Accurately

The first step is calculating the NOI. This involves subtracting operating expenses from the property's potential gross income. Gross income includes all revenue generated by the property, primarily from rent.

Operating expenses include costs such as property taxes, insurance, maintenance, and utilities. However, it's crucial to be mindful of potential inaccuracies in these figures.

For example, a seller might overstate projected revenue or underreport expenses to make the property seem more attractive. Thorough due diligence is essential to uncover any discrepancies and determine a realistic NOI. This often involves verifying rent rolls, carefully examining expense reports, and obtaining independent assessments of necessary repairs or upgrades.

Selecting the Right Cap Rate

With a reliable NOI calculated, the next step is choosing the right cap rate. The cap rate is a percentage reflecting the market's expected return on investment for similar properties.

This percentage is not fixed and varies depending on several factors, including location, property type, and current market conditions. A property in a desirable location with high demand and low vacancy may justify a lower cap rate compared to a similar property in a less desirable area.

Accurate market analysis is essential for selecting a cap rate that leads to a reliable valuation. For further insights into this topic, you can explore this helpful resource: How to master apartment building cap rates.

Handling Complexities and Refining Your Analysis

Real-world valuations often involve complexities requiring careful thought. For instance, if a property has below-market rents, this might indicate an opportunity for future income growth. However, these increases must be projected accurately.

Similarly, any planned major repairs could significantly affect future expenses and should be considered in the valuation. Properties with inconsistent occupancy histories need a thorough analysis to determine the underlying causes and project future performance realistically.

You can refine your analysis by projecting realistic income growth, comparing your numbers to market data, and consulting with real estate experts when necessary.

Using Cap Rate Analysis to Your Advantage

Mastering the cap rate method empowers you to make informed investment decisions. It helps you identify undervalued properties and spot potential opportunities that others might overlook, leading to better negotiation outcomes.

By understanding how cap rates change with market conditions, you can better anticipate future trends and position your investments strategically. This proactive approach is essential for maximizing returns and minimizing risk in the ever-changing real estate market.

This knowledge equips you to effectively analyze potential investment opportunities and make data-driven decisions about how to value an apartment building.

Getting Real Numbers From Comparable Sales

Forget simply comparing price per unit. This section dives into how seasoned investors use comparable sales, or "comps," to accurately assess the value of apartment buildings. Finding truly comparable properties involves more than just superficial similarities. It requires careful examination of key factors like tenant quality, building systems, neighborhood trends, and the unique details of each sale.

Looking Beyond the Surface: Identifying True Comparables

Consider two seemingly similar apartment buildings in the same neighborhood. One might boast newly upgraded HVAC systems, while the other struggles with outdated, inefficient units. This single difference can significantly impact operating expenses and, therefore, the property’s overall value. Similarly, the quality of tenants—whether they are long-term or short-term, and their payment history—can dramatically influence future income projections.

Furthermore, understanding the neighborhood’s trajectory is crucial. Is it experiencing growth and revitalization, or showing signs of decline? This can significantly affect future rent growth and property appreciation. The sales comparison approach involves analyzing recent sales of similar properties to determine a fair market value. For example, if comparable apartment buildings have recently sold for an average of $180,000 per unit, this provides a valuable benchmark. Factors such as age, size, amenities, condition, and location are all carefully considered. Learn more about apartment building valuation here.

Adjusting for Differences: Refining Your Valuation

Once you've identified potential comps, it's essential to adjust for any discrepancies that could skew the valuation. These adjustments might account for variations in the timing of sales, property condition, or recent renovations. For example, a property sold a year ago during a market peak might not accurately reflect current market value.

Timing adjustments help investors normalize sales data for accurate comparisons. This involves researching market trends and applying appropriate adjustments based on factors like inflation and recent sales data. For example, if a market has seen a 5% increase in property values since a comparable property sold, the comparable sale price should be adjusted upward accordingly.

Sourcing Reliable Data and Interpreting Market Trends

Finding accurate sales data can be a challenge. Public records don't always provide a complete picture. Experienced investors often leverage their networks, relationships with brokers, and access to specialized real estate databases for a more comprehensive understanding of market activity. This granular data is vital for understanding the nuances of comparable sales, such as seller motivations or unique financing arrangements.

Furthermore, interpreting market trends requires more than just looking at the headlines. It's about understanding local market dynamics, such as population growth, job market trends, and new development projects. These factors can have a considerable impact on the value of an apartment building, even within a seemingly stable overall market.

Navigating Thin Markets: When Comparables Are Scarce

In some markets, finding truly comparable properties can be difficult. In these so-called thin markets, investors must be resourceful and think outside the box. They may need to broaden their geographic search or consider properties with slightly different characteristics.

This often requires a deeper understanding of the fundamental factors that drive value. For instance, an investor might compare a smaller, well-maintained building in a prime location to a larger, older building in a slightly less desirable area, weighing the potential return based on location and operating expenses. Even when direct comparisons are limited, such considerations can provide valuable insights, helping investors estimate a property's potential value.

Using Gross Rent Multipliers For Quick Deal Screening

The Gross Rent Multiplier (GRM) offers a fast way to gauge a property's potential value compared to its rental income. It's an especially useful screening tool for quickly evaluating potential deals.

Understanding GRM and Its Applications

The GRM is calculated by dividing the property's sale price by its gross annual rent. As an example, a building selling for $2 million with $200,000 in annual rent has a GRM of 10. This indicates the property sold for ten times its annual rental income. The GRM is practical for quick valuations, particularly during initial assessments or for properties with consistent and predictable cash flow. While simpler, the GRM method is less precise than the cap rate approach because it doesn't consider operating expenses. It's frequently used in initial evaluations or for properties with stable, predictable income streams. Historically, GRMs have differed significantly by location, with lower GRMs common in urban areas due to higher property values compared to rents. Conversely, rural areas may have higher GRMs reflecting lower property values but similar rent levels. While useful for rapid estimations, the GRM should be combined with more detailed analysis for serious investment considerations. Learn more about valuing apartment buildings here.

Interpreting GRM Across Different Markets

It's crucial to recognize that GRMs can vary significantly across different property types and markets. A luxury high-rise in a major city will likely have a different GRM than a garden-style apartment complex in the suburbs. Market conditions also impact GRMs; they tend to rise during periods of high demand and fall during market downturns.

Benchmarking GRM for Effective Screening

Seasoned investors often use GRM benchmarks to quickly filter potential investments. For instance, if the average GRM for comparable properties in a particular market is 8, a property with a GRM of 12 may warrant closer examination. This could indicate the property is overpriced, or it might suggest potential for improvements and increased future rents. Conversely, a considerably lower GRM might appear attractive, but could also point to hidden problems requiring further investigation.

Combining GRM with Other Quick Metrics

While valuable, the GRM has limitations. It doesn't factor in operating expenses, which significantly impact profitability. Therefore, it's advisable to use the GRM in conjunction with other quick metrics like price-per-unit and vacancy rates for a more thorough initial assessment. This combined approach helps investors quickly spot potential opportunities while avoiding properties that appear promising superficially but have underlying issues. This combination leads to more informed decisions and a better understanding of property valuation.

Advanced Strategies That Separate Smart Money From Everyone Else

Beyond standard valuation methods, savvy investors gain an advantage by understanding subtle factors that significantly influence property values. These factors often go unnoticed in basic analyses. This involves looking beyond just the numbers and diving into qualitative aspects that can make or break an investment.

Evaluating Emerging Neighborhood Trends

One key strategy is evaluating emerging neighborhood trends. Planned infrastructure improvements, such as new public transportation, schools, or parks, can significantly boost property values. Demographic shifts, like an influx of young professionals or families, can signal increased rental demand and appreciation potential.

However, negative trends, like rising crime rates or declining school quality, can pose significant risks. Analyzing these factors requires thorough local market research. It also demands an understanding of how broader economic and social trends influence specific neighborhoods.

Assessing Property Classes With Nuance

Smart investors also understand the nuances of different property classes (A, B, and C). Each class caters to a different tenant demographic and requires a tailored valuation approach. A Class C building in a gentrifying area might offer higher returns than a Class A property in a declining market.

This is because Class C properties often present value-add opportunities. Examples include renovations and amenity upgrades. These improvements can attract higher-paying tenants and increase rents. Accurately assessing these opportunities requires a realistic understanding of renovation costs and potential rental increases.

Quantifying Value-Add Opportunities Realistically

While value-add opportunities are enticing, it's crucial to avoid overly optimistic projections. Rental increases are not guaranteed, and operational improvements can be more costly and time-consuming than anticipated.

Experienced investors use conservative estimates and conduct thorough due diligence. This helps them avoid overpaying for a property based on unrealistic expectations. Due diligence includes carefully analyzing operating expenses, such as property taxes, maintenance, and insurance. This determines the true potential for increased net operating income.

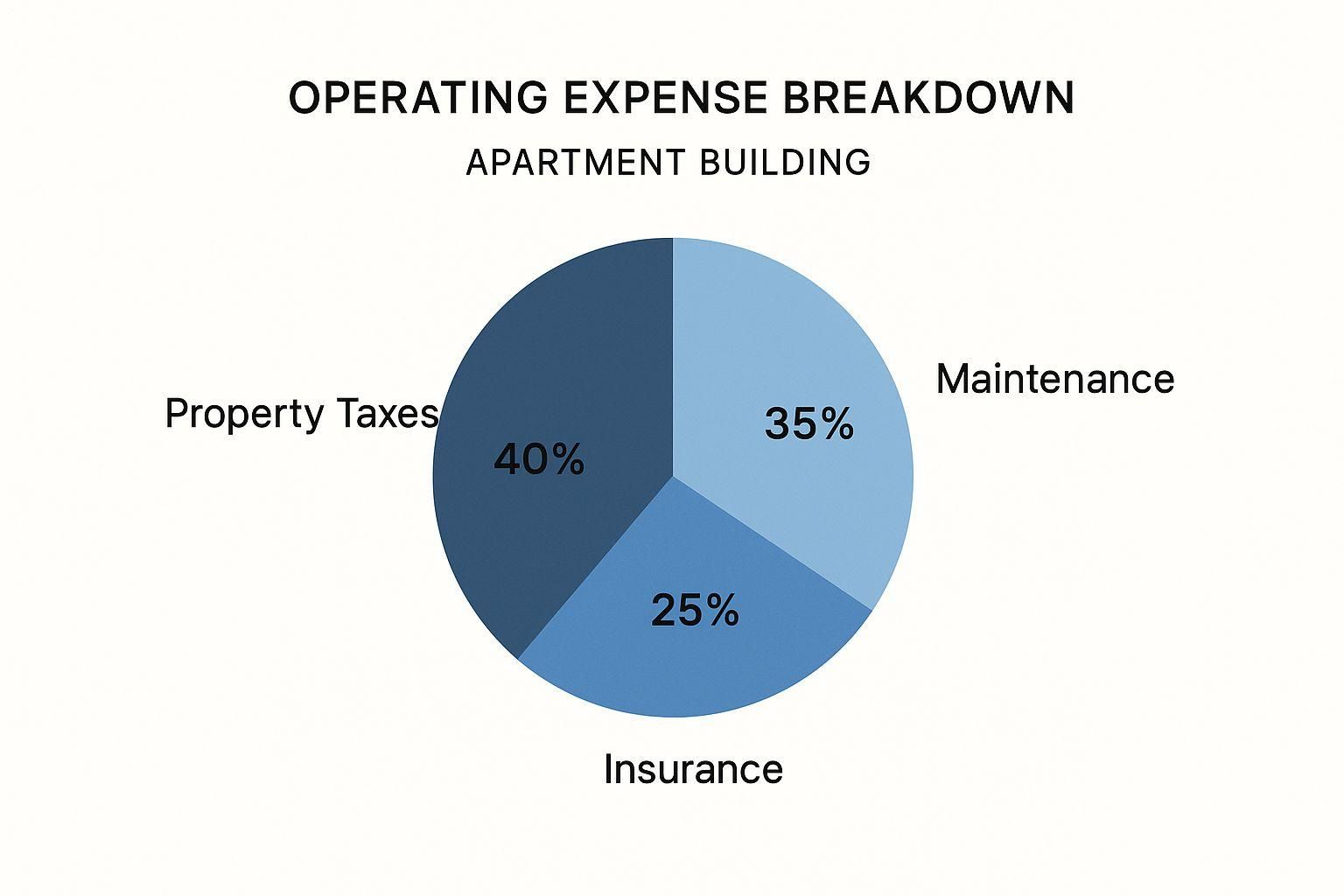

This infographic visualizes the operating expense breakdown for a typical apartment building. Property taxes represent the largest portion of operating expenses at 40%. Maintenance follows at 35%, and then insurance at 25%. This breakdown underscores the importance of accurately forecasting these expenses when valuing an apartment building. Even small variations can significantly impact the net operating income and, consequently, the property's value.

To further illustrate the different valuation approaches and their suitability, let's examine the following comparison:

Valuation Method Comparison Matrix: Comprehensive comparison of different valuation methods showing their strengths, weaknesses, and best use cases.

This table summarizes the key characteristics of the primary valuation methods. As shown, each method has its own strengths and weaknesses. Selecting the appropriate method depends on the specific property being evaluated and the available data.

Analyzing Market Cycles and Positioning Investments

Finally, experienced investors understand that real estate markets are cyclical. They develop frameworks for analyzing market cycles and positioning their investments accordingly. This means buying at opportune times and avoiding overpaying during market peaks.

It also involves understanding how different property classes perform during various phases of the market cycle. For example, Class B and C properties may be more resilient during economic downturns. This is often due to their lower price point and appeal to a broader tenant base. By considering these factors, investors can make more informed decisions and maximize their chances of long-term success. This approach allows them to not only accurately value an apartment building today but also project its potential future value based on market dynamics.

Avoiding The Expensive Mistakes Most Investors Make

Valuing an apartment building requires careful analysis and a keen understanding of potential pitfalls. Let's discuss common valuation traps that can cost investors significant money—and how to avoid them. These mistakes can range from over-reliance on seller-provided information to letting emotions cloud judgment.

The Danger of Seller-Provided Financials

One of the most common mistakes is accepting seller-provided financials without independent verification. Sellers naturally want to present their property in the best possible light. This can lead to inflated rent rolls, understated expenses, or overlooked maintenance issues. Always conduct your own due diligence. This includes scrutinizing rent rolls, examining expense reports, and obtaining independent inspections to accurately assess the building's true condition.

For example, a seller might claim a 95% occupancy rate, but a closer look at the rent roll could reveal several long-term vacancies or units rented to family members at below-market rates. This discrepancy can significantly impact the property's actual income potential and lead to an overvaluation.

Underestimating Capital Expenditures

Another costly mistake is underestimating capital expenditures (CapEx). These are major expenses for repairs or replacements, such as roof repairs, HVAC system upgrades, or plumbing overhauls. Failing to account for these can lead to inaccurate net operating income (NOI) calculations and, ultimately, an inflated valuation. A thorough inspection and a realistic assessment of upcoming CapEx needs are crucial.

Consider a building with an aging roof. While it might not need immediate replacement, ignoring its eventual replacement cost will lead to an unpleasant financial surprise later. Accurately estimating the remaining lifespan of major building components and factoring their replacement cost into your valuation is essential for a realistic investment analysis.

The Emotional Trap

Emotional attachment to a deal can also lead to costly errors. Falling in love with a property's aesthetics or its perceived potential can cloud judgment and lead to overpaying. It's essential to maintain objectivity and base your decisions on data-driven analysis rather than gut feelings.

Imagine a beautifully renovated building in a prime location. While aesthetically pleasing, the property might be significantly overpriced based on its actual income potential and operating expenses. Letting emotions override your financial analysis can result in a poor investment and diminished returns.

Recognizing Red Flags and Maintaining Objectivity

Learning to recognize red flags, like unusually high rent rolls or deferred maintenance, is vital for successful investing. These often indicate underlying problems that can substantially impact a property’s value. Developing a systematic approach to due diligence and valuation helps maintain objectivity, especially in competitive markets.

Additionally, understanding how cognitive biases influence investment decisions is critical. Confirmation bias, for example, can lead investors to seek out information that confirms their initial impressions while disregarding contradictory evidence. Being aware of these biases and actively working to mitigate their influence can dramatically improve investment decision-making.

Real case studies of deals gone wrong provide invaluable lessons. By examining the warning signs that were missed or ignored, investors can develop a sharper eye for potential problems and avoid repeating past mistakes. This learning process is ongoing and requires continuous market analysis and deal experience to hone your valuation skills. Ultimately, informed investment decisions require combining sound analysis with a healthy dose of skepticism and a commitment to objective evaluation. This disciplined approach will allow you to avoid costly mistakes and make successful investments in the apartment building market.

Your Step-By-Step Valuation Action Plan

Let's create a reliable process for valuing apartment buildings. This action plan will guide you from initial property screening to your final investment decision. We'll also explore how using multiple valuation methods together provides a more well-rounded perspective, increasing your confidence in the numbers.

Initial Screening: Quick Evaluation and Filtering

Start with quick screening tools like the Gross Rent Multiplier (GRM) and price-per-unit. These metrics offer a quick look at a property's potential and help you quickly filter out unsuitable deals.

For example, if a property's GRM is substantially higher than the market average, it might warrant further investigation, but it could also be a sign of an overpriced asset. This initial screening saves you valuable time and lets you focus on properties meeting your investment criteria.

In-Depth Analysis: Combining Valuation Methods

After the initial screening, conduct a deeper analysis on promising properties using the cap rate and sales comparison approaches. The cap rate method analyzes the property's potential income. The sales comparison approach uses recent sales of similar properties as benchmarks.

These methods give a more accurate valuation than GRM, offering a clearer picture of a property's true worth. By comparing a property's projected cap rate to the cap rates of similar, recently sold buildings in the area, you can assess if the asking price is justified by its income potential.

Verification and Refinement: Due Diligence and Market Research

Thorough due diligence is essential. Verify all financial information from the seller. Don't rely solely on the seller's provided data. Independently confirm rent rolls, operating expenses, and any projected income growth.

For instance, if the seller reports low vacancy rates, confirm this by examining lease agreements and contacting current tenants. This step verifies accuracy and reveals any potential discrepancies. Also, conduct thorough market research to understand local trends, future developments, and the competitive landscape. This information contextualizes your valuation and supports informed decision-making.

Cross-Verification: Building Confidence in Your Numbers

Using multiple valuation methods and comparing results builds confidence in your final valuation. Alignment between different methods reinforces your assessment.

However, significant discrepancies signal the need for further investigation to identify the cause and refine your analysis. This process ensures a more accurate valuation.

Documenting and Presenting Your Analysis

Documenting your analysis is critical for lenders, partners, or your own future reference. Create a concise report outlining your valuation process, key assumptions, and supporting data. This documentation promotes transparency, allowing others to understand your investment rationale. This organized record becomes invaluable for monitoring performance and making future decisions.

Professional Appraisal: When to Bring in the Experts

While developing your valuation skills is important, it's equally crucial to recognize when to engage a professional appraiser. Complex properties, unique market situations, or large financing needs often require a professional appraisal. Their expertise provides an objective, independent valuation, often required by lenders and investors.

Ongoing Learning: Sharpening Your Valuation Skills

Valuing apartment buildings is a continuous learning experience. Staying informed about market trends, studying successful deals, and refining your analytical skills are essential for smart investing.

Attend industry events, network with seasoned investors, and join online communities to broaden your knowledge. This continual learning builds your expertise and prepares you for future opportunities. This comprehensive action plan equips you with a structured approach to accurately value apartment buildings, avoid costly errors, and make confident investment decisions. Each step builds upon the last, providing a solid framework for navigating the complexities of multifamily real estate investment.

Ready to improve your real estate syndication process? Homebase offers a comprehensive platform for managing deals, investors, and fundraising. From automated workflows to integrated reporting, Homebase streamlines complex processes and empowers growth. Learn more about Homebase and how we can help your business thrive.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Unlocking debt coverage ratio real estate in syndication

Blog

Explore debt coverage ratio real estate essentials, learn the DCR formula, benchmarks, and syndication strategies to secure better financing.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.