How to Value a Commercial Building Accurately

How to Value a Commercial Building Accurately

Learn how to value a commercial building with expert insights. This guide covers the Income, Sales, and Cost approaches for smarter real estate investments.

Domingo Valadez

Nov 13, 2025

Blog

When you're trying to figure out what a commercial building is worth, you're not just looking for a single number. You're building a story—a defensible argument for its value based on hard data. For a real estate syndicator, nailing this valuation is everything. It’s the foundation of investor trust and the linchpin of a profitable deal.

It all starts with getting your hands dirty with the data and truly understanding the three core pillars of commercial real estate valuation.

Laying the Groundwork for an Accurate Valuation

So, how much is this building really worth? Before you can even begin to answer that, you need to build a rock-solid foundation. A number pulled out of thin air is just a guess, but a valuation backed by meticulous research and sound logic becomes a powerful strategic asset.

This isn't some abstract financial exercise. As a sponsor, every assumption you make—from projecting rent growth to picking the right cap rate—directly shapes the returns you promise your investors. Getting this first part right is crucial. It helps you avoid costly mistakes in your underwriting, builds massive credibility, and ensures your deal can withstand tough questions from lenders, partners, and savvy investors.

The Three Pillars of Commercial Valuation

Think of commercial property valuation as a three-legged stool. Each leg represents a different way to look at the property's value, and you need all three for a stable, reliable result. By looking at an asset from these different angles, you create a holistic picture that's far more defensible than relying on a single method.

Here's a quick look at the core valuation methods you'll be working with.

Core Valuation Methods at a Glance

Each method provides a unique perspective. The Income Approach tells you what the property is worth as a cash-flowing machine. The Sales Comparison Approach grounds your number in market reality. And the Cost Approach gives you a baseline based on physical replacement cost.

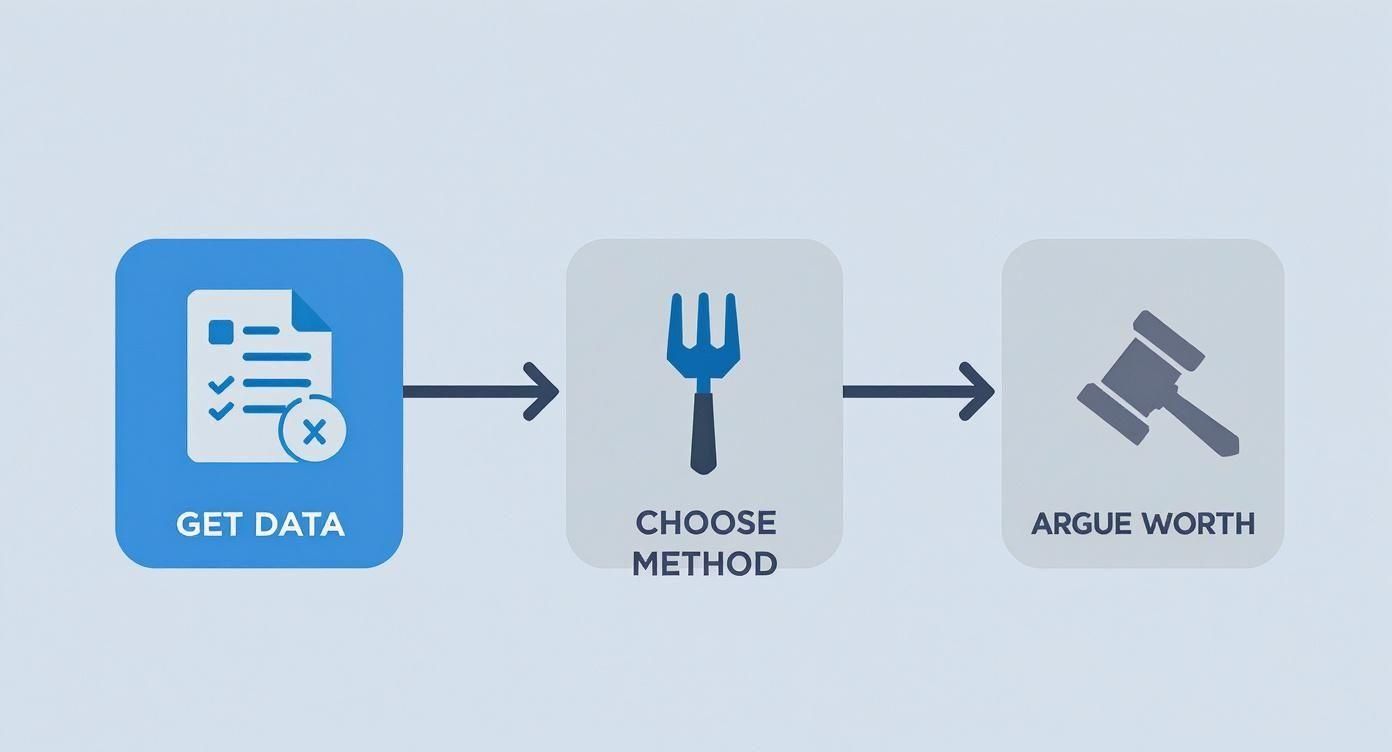

This chart lays out the entire valuation journey, from the initial data deep-dive to crafting a final, convincing argument of value.

As you can see, a bulletproof valuation isn't a straight line. It’s a process of gathering evidence, choosing the right tools for the job, and then putting it all together to build a compelling case. No single method ever tells the whole story. A smart syndicator triangulates the results from all relevant approaches to land on a final value they can confidently stand behind.

Driving Value with the Income Approach

When you're valuing a commercial building, the Income Approach is where the rubber meets the road. For any serious investor, especially in a syndication, the core question is always the same: "How much money does this asset actually make?" This method gets right to the point, directly linking the building's value to the cash flow it can produce.

It's a world away from just comparing sale prices or estimating what it would cost to rebuild. The Income Approach treats the property as a living, breathing business. Its value is a direct reflection of its profitability. For sponsors, getting this right isn't just important—it's everything. This is the language that both your investors and your lenders speak fluently.

Nailing Your Net Operating Income

The engine driving the entire income approach is the Net Operating Income (NOI). It’s a straightforward concept on the surface, but it's astonishingly easy to fumble. Your NOI is simply the total income the property brings in after you've paid all the necessary operating expenses to keep the lights on and the doors open.

Getting to a credible NOI means following a precise sequence:

- Start with Gross Potential Rent (GPR): This is your best-case scenario—the total annual rent you'd collect if the property was 100% occupied and every single tenant paid their full market rent on time.

- Account for Reality (Vacancy & Credit Loss): No property is full forever. You have to subtract a realistic amount for vacancy and tenants who don't pay. A 5-10% vacancy rate is a common industry benchmark, but you need to ground this in local market data and the property's actual history.

- Add in Other Income: Don't forget the extra revenue streams. This could be anything from parking fees and laundry machines to renting out billboard space. This gets you to your Effective Gross Income (EGI).

- Subtract Operating Expenses: Finally, you deduct all the costs associated with running the property day-to-day.

Key Takeaway: Your NOI calculation is the single most critical number in your valuation. If you inflate it, you overvalue the property. That's a deal-killing mistake that can shatter investor confidence. Always be conservative and check your work.

What Stays In, What Comes Out: Defining Operating Expenses

One of the most common rookie mistakes is misclassifying expenses. Getting this right is fundamental to a defensible NOI. Operating expenses are the routine costs required to maintain the property and serve its tenants.

These expenses always belong in your calculation:

* Property Taxes

* Insurance

* Utilities (that you, the owner, pay)

* Property Management Fees

* Repairs and Maintenance

* Landscaping and Janitorial

Just as important are the major expenses that you must exclude. These are often called "below-the-line" items because they relate to the investment structure, not the property's operational health.

Be sure to leave these out of your NOI calculation:

* Debt Service: Mortgage payments (both principal and interest) are a financing cost, not an operating cost.

* Capital Expenditures (CapEx): A new roof or an HVAC overhaul is a major capital investment, not a routine expense. These are accounted for separately in your underwriting.

* Tenant Improvements & Leasing Commissions (TIs/LCs): The costs to get a space ready for a new tenant are also capital costs.

* Depreciation: This is an accountant's tool—a non-cash expense for tax purposes. It has no place in an NOI calculation.

Turning NOI into Value with the Cap Rate

Once you have a rock-solid NOI, the final piece of the puzzle is the capitalization rate, or cap rate. Think of the cap rate as a market-driven benchmark that reflects the expected return an investor would get if they bought the property with all cash. It’s a snapshot of the risk and return for that type of property in that specific market at that moment in time.

The formula itself is beautifully simple:

Property Value = Net Operating Income (NOI) / Capitalization Rate (Cap Rate)

Now, finding the right cap rate is part science and part art. You can't just pull a number out of thin air; you have to be able to defend it. Your justification will come from a few key sources:

- Broker Reports: Major firms like CBRE and JLL publish regular market reports with cap rate data by asset class and location.

- Comparable Sales: Dig into recent sales of similar properties in the area. Take their reported NOI and divide it by the sale price to see what cap rate they actually traded at.

- Market Sentiment: What's happening with interest rates? Is investor demand for this asset class hot or cold? These macro factors absolutely influence cap rates.

For a more detailed breakdown, our guide on the income capitalization approach is a great resource. This method became a cornerstone of commercial real estate because it so clearly connects a building's value to its earning power.

Let's put it into practice. Say a property generates a yearly NOI of $320,000. If the going cap rate for similar assets in that market is 7%, your valuation would be right around $4.57 million.

Here's another quick example. Imagine you're underwriting a small retail strip center. You've scrubbed the numbers and calculated a reliable annual NOI of $150,000. After researching the submarket, you find that similar, well-located retail properties have been trading at a 6.5% cap rate.

Plugging it into the formula:

* Value = $150,000 / 0.065

* Estimated Value = $2,307,692

This gives you a powerful, data-driven valuation that's grounded not in guesswork, but in the property’s proven performance and current market expectations.

Finding Market Proof with Sales and Cost Analysis

Your income-based valuation gives you a fantastic look at the property’s economic engine, but relying on it alone is a rookie mistake. I’ve seen syndicators get burned by projections that looked great on a spreadsheet but didn't hold up in the real world. That’s why you have to pressure-test your numbers.

This is where you bring in other methods to act as a crucial reality check. The goal is to make sure your valuation isn't just a theoretical exercise but is firmly grounded in tangible market proof. The Sales Comparison and Cost approaches are your best tools for this. Think of them as the guardrails that keep your deal thesis from veering off a cliff.

The Sales Comparison Approach: Your Market Reality Check

At its heart, this approach is beautifully simple: a property is worth what other, similar properties have recently sold for. It’s the go-to method in residential real estate, and it’s just as vital for us in the commercial space. It anchors your analysis in actual, closed transactions, which is the best defense against overpaying based on rosy income forecasts.

The real trick, however, is finding genuinely "comparable" properties—what we call "comps." It’s not about just pulling up buildings down the street. A true comp has to mirror your property across several critical dimensions.

- Property Class: You can't compare a gleaming Class A office tower to a Class C industrial box that needs a ton of work. It’s a classic apples-to-oranges mistake.

- Tenant Mix and Lease Terms: A strip center anchored by a national credit tenant on a long-term lease is a completely different beast than one filled with local mom-and-pop shops on month-to-month agreements.

- Age and Condition: A 10-year-old building will trade very differently from a 50-year-old one, even if they're the same size and in the same submarket.

- Location: This is more granular than just the city. Think about visibility, daily traffic counts, and access to major highways. These factors create massive value differences.

Expert Tip: Never just take the comps a broker hands you at face value. Do your own digging. Get access to tools like CoStar or Reonomy and pull your own list of recent sales. Public records can be a goldmine, too. The more data points you gather yourself, the more bulletproof your valuation becomes.

Once you’ve got a solid list of three to five comps, the real analysis starts. No two buildings are ever identical, so you have to make adjustments to the sale prices of your comps to account for how they differ from your target property.

If a comp is better than yours in some way—maybe it has a brand new roof or a prime corner location—you adjust its sale price downward. If it’s inferior—say, it has higher vacancy or ancient HVAC units—you adjust its price upward. This process normalizes the data, allowing you to land on a credible value per square foot (or per unit) that you can then apply to your own deal.

Building Value from the Ground Up with the Cost Approach

The Cost Approach flips the script and asks a totally different question: "What would it cost to build this exact property from scratch today?" This method isn't our primary tool for stable, income-generating assets, but it becomes absolutely essential in certain situations. It’s the default for new construction, unique properties like a church or a specialized medical facility, or any building where you lack good income data or comparable sales.

The formula is straightforward: calculate the current cost to replace the building, subtract all forms of depreciation, and then add the value of the land. For example, if a building’s replacement cost is $8 million, its total accumulated depreciation is $1.5 million, and the land is worth $2 million, your value using the cost approach is $8.5 million. For a deeper dive, the experts at LoopNet have some great insights on this valuation tool.

The process breaks down into a few key steps:

1. Estimate Land Value: Figure out what the raw, vacant land would sell for today.

2. Calculate Replacement Cost: Determine the current, all-in cost to construct a similar building using modern materials and methods.

3. Account for Depreciation: This is where it gets subjective. You have to identify and subtract value for every form of functional, physical, and economic wear and tear.

Getting this right means understanding that depreciation is more than just a leaky roof.

The Three Faces of Depreciation

In the Cost Approach, "depreciation" is a catch-all term for anything that makes the existing building less valuable than a brand-new one.

- Physical Depreciation: This is the obvious stuff—the physical decay of the property. We're talking about worn-out roofing, cracked parking lots, or an HVAC system on its last legs. Some of it is "curable" (you can fix it economically), and some is "incurable" (the fix costs more than the value it adds).

- Functional Obsolescence: This happens when the building's design is simply outdated for its modern use. Think of a warehouse with ceilings too low for today’s logistics, or an office with a bizarre layout that no company wants.

- External Obsolescence: This is the killer because it's completely out of your control. It's depreciation caused by factors outside the property lines. A new highway bypass that kills traffic to your retail center, a major local employer closing its doors, or unfavorable zoning changes are all forms of external obsolescence. It's almost always considered incurable.

By carefully tallying these costs and losses, you can build a credible valuation from the ground up. While it's rarely the lead valuation method for a syndicator, the Cost Approach provides an invaluable ceiling on your value. After all, why would any sane investor pay more for your used building than it would cost to build a brand new one next door?

Projecting Future Value with a DCF Model

The income approach gives you a fantastic snapshot of a building's value today, but for a value-add deal, that's only half the story. If your game plan is to bump up rents, slash costs, or fill vacancies over the next few years, you need a way to measure that future growth.

This is where the Discounted Cash Flow (DCF) model becomes one of the most powerful tools in your arsenal.

A DCF analysis goes way beyond a single year's NOI. It projects the property's cash flows over your entire planned holding period—usually five or ten years—and then pulls all that future money back to what it’s worth in today's dollars. It’s a dynamic valuation that respects a fundamental truth: a dollar in your pocket now is worth more than a dollar you expect to get five years from now.

Building Your Multi-Year Cash Flow Projection

The engine of any DCF model is the proforma, which is just a fancy term for your multi-year financial forecast. This isn’t about pulling numbers out of thin air. It’s about making a series of smart, defensible assumptions that align with your business plan and what the market is telling you.

You'll need to project how the key numbers will evolve year-over-year.

- Rental Income Growth: What’s a realistic bump in rent each year? You might pencil in a 3% annual growth based on market comps and the upgrades you plan to make.

- Expense Inflation: Costs never stand still. It’s critical to project an annual increase for things like property taxes, insurance, and utilities. A conservative assumption is usually around 2-2.5% for expense inflation.

- Occupancy Changes: If you're buying a building that’s only 85% occupied, your model needs to show a clear path to getting it stabilized at 95%, mapping out when you expect to sign those new leases.

This detailed projection gives you a clear line of sight into the property's unlevered free cash flow for every single year you plan to own it. It’s a financial map showing how your strategy will directly hit the bottom line.

The Two Inputs That Make or Break Your DCF

A DCF model is only as good as its assumptions, and two of them carry almost all the weight: the terminal value and the discount rate. Get these wrong, and your entire valuation is suspect.

Calculating the Terminal Value

The terminal value, or exit value, is what you think you can sell the property for at the end of your hold period. This number is a huge deal—it can easily account for over 70% of the total value in a DCF model, so you have to get it right.

The most common way to nail this down is by applying a future cap rate (the “exit cap rate”) to your final year’s projected income.

The formula is simple:

Terminal Value = Year 5 NOI / Exit Cap Rate

Let's say you project the NOI in your final year will be $250,000. You then have to apply a defensible exit cap rate. A good rule of thumb is to assume your exit cap rate will be a bit higher than the cap rate you’re buying at today—maybe by 50 to 75 basis points (0.50% - 0.75%). This builds a conservative cushion into your numbers, accounting for the fact that the market could cool off or that your building will simply be older when you sell.

Syndicator's Insight: Whatever you do, never assume you'll sell at a lower (more aggressive) cap rate than you bought at. Sophisticated investors will spot that a mile away and see it as a major red flag. Projecting a slightly higher exit cap rate shows you’re underwriting with discipline and not just banking on the market to bail you out.

Choosing the Right Discount Rate

The discount rate is the other critical lever in your model. This is the annual return you use to translate all those future cash flows—including that massive terminal value—back into today's dollars. It essentially answers the question, "What return do I need to earn to make the risk of this investment worthwhile?"

The discount rate you pick should be a direct reflection of the deal’s risk profile.

- A stable, fully-leased Class A office building with a blue-chip tenant might warrant a lower discount rate, maybe in the 7-8% range. The cash flow is predictable and safe.

- On the other hand, a riskier Class C value-add apartment deal needing a gut renovation and a full lease-up demands a much higher discount rate, perhaps 10-12% or even more, to compensate for all that uncertainty.

Choosing the rate is more art than science, but it has to be logical. It’s often linked to the expected returns on similar real estate deals or a company’s cost of capital. Just know that this single percentage has a massive impact on your valuation; a higher discount rate means a lower present value, and vice-versa. It’s how you bake risk into your numbers.

Turning Your Valuation into a Compelling Investment Story

An airtight valuation spreadsheet is critical, but it’s only half the battle. If you can't translate those numbers into a clear, credible, and compelling narrative for your investors, the deal will never get off the ground. This is where you move beyond raw analysis and craft a professional underwriting package that inspires confidence and gets you funded.

Your valuation is ultimately built on a series of well-researched assumptions—about rent growth, market trends, and capital improvements. But smart investors always want to know, "What if you're wrong?" This is where sensitivity analysis becomes your most powerful tool. It’s how you pressure-test your model to see how the deal holds up when things don’t go exactly as planned.

Building a Bulletproof Case with Sensitivity Analysis

Instead of just presenting a single, static value, you should show investors a range of potential outcomes. This demonstrates that you’ve thought through the risks and aren’t just pitching a best-case scenario.

Your analysis needs to tackle the tough questions head-on:

- Interest Rate Risk: What happens to our returns if interest rates jump by 1% before we close or need to refinance?

- Vacancy Risk: How does our cash flow and overall value change if our largest tenant leaves and the space sits empty for six months?

- Cap Rate Risk: What's the impact on our exit value if the market softens and our exit cap rate increases by 75 basis points (0.75%)?

By modeling these scenarios, you're not just stating a value—you're defending it. This level of diligence shows discipline and builds a deep layer of trust with your capital partners.

Assembling the Investor-Ready Report

Your final report isn’t a data dump; it's a persuasive document. It should walk the reader logically from the property's current state to its future potential, justifying every major assumption with hard market data and a clear business plan. For those looking to quickly create a polished pitch deck from their analysis, understanding how to create a presentation with AI can be a huge time-saver.

Key Takeaway: The goal of your presentation is not just to show your conclusion, but to show your work. Investors are betting on you, the sponsor, as much as they are on the asset. A transparent, well-documented valuation proves you're a sophisticated operator they can trust with their capital.

Avoiding Common Underwriting Pitfalls

In this business, credibility is everything. Even small mistakes in your underwriting can shatter investor confidence and kill a deal. Be vigilant and watch out for these all-too-common errors:

- Overly Aggressive Rent Growth: Projecting 10% annual rent growth without rock-solid market comps to back it up is an immediate red flag.

- Underfunded Reserves: Forgetting to budget enough for capital expenditures is a classic rookie mistake. A baseline of $250-$300 per unit annually is common for multifamily, but you must tailor this to the property's actual age and condition.

- Skipping a Rent Roll Audit: Never just trust the seller's rent roll. You have to verify it against the actual lease agreements. You might discover that the "pro-forma" numbers include tenants who are actually months behind on rent.

Presenting a well-supported valuation, complete with a robust sensitivity analysis and a clear narrative, is how you transform a good deal on paper into a funded deal in reality.

Answering Your Top Valuation Questions

When you're getting into commercial real estate valuation, you'll find the same questions pop up time and again. It's totally normal. Getting a firm grip on these core concepts is what separates a sharp underwriter from someone who makes costly mistakes.

Let’s dive into some of the most common sticking points I see with syndicators and investors.

Which Valuation Method Is Most Important?

For any property that generates cash flow, the Income Approach is king. It’s that simple. At the end of the day, investors are buying the property's ability to produce income, and this method gets right to the heart of that.

But here’s the thing: you can't live in a vacuum. A savvy valuation always cross-references with the Sales Comparison Approach. This is your reality check. It tells you what people are actually paying for similar buildings down the street. The Cost Approach? We usually only break that out for new construction or really unique, special-purpose properties.

How to Find a Reliable Cap Rate

Pinning down a solid, defensible cap rate means doing a bit of detective work. If you just grab the first number you see, you’re setting yourself up for a skewed valuation.

I always recommend triangulating your data from a few different places:

- Recent Sales Comps: This is where the rubber meets the road. Dig into recent sales of comparable properties. Take their Net Operating Income (NOI), divide it by the sale price, and you’ll see the cap rates the market is truly paying.

- Subscription Services: If you have the budget, platforms like CoStar are the gold standard for granular sales and cap rate data.

When you pull from all three, you can land on a cap rate that you can confidently stand behind when talking to investors or your lender.

The biggest mistake I see people make when calculating NOI is mixing in "below-the-line" expenses. Remember, items like your mortgage payment (debt service), major capital projects, tenant improvements, and leasing commissions do not belong in the NOI calculation. Including them will crush your NOI and throw your whole valuation off.

For many operators, a proper valuation is a key piece of their larger financial picture. Understanding this is central to effective financial planning strategies for business owners. A rock-solid valuation isn't just a number—it's a cornerstone of managing any commercial asset well.

At Homebase, we build the tools that let you focus on what you do best: finding great deals. From professional deal rooms to streamlined investor relations, we handle the backend administrative work. Learn more about how Homebase can help you close more capital.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.