How to pick the fund manager real estate partner

How to pick the fund manager real estate partner

Discover how to choose the fund manager real estate for your portfolio: criteria, fees, due diligence, and key questions to ask before you invest.

Domingo Valadez

Nov 10, 2025

Blog

At its core, a real estate fund manager is the person or firm you trust to invest your money in property. They're the ones in the driver's seat, responsible for raising capital from a group of investors and then using that money to buy, manage, and eventually sell a portfolio of real estate assets.

Their entire job is to generate a return for those investors. Think of them as the captain of an investment ship, charting the course through shifting market tides and making the critical decisions that keep the voyage profitable.

What a Real-Estate Fund Manager Actually Does

Let's say you want to own a piece of a large-scale real estate deal—maybe a 200-unit apartment building or a new industrial park—but you don't have the millions in capital or the deep industry expertise to pull it off yourself. This is the exact problem a fund manager solves.

They pool capital from many different investors into a single fund. This gives them the collective financial muscle to chase bigger, more lucrative deals that are typically out of reach for any single individual.

But their job isn't just about buying buildings. A great fund manager is a strategist, a deal-sourcer, a financial analyst, and a relationship manager all rolled into one. They orchestrate the entire investment from start to finish with a single mission: to grow their investors' capital.

Charting the Investment Course

It all starts with a clear investment strategy, or what we in the industry call an "investment thesis." This is the fund's playbook. It dictates exactly what kind of properties they'll target. Are they going after high-growth multifamily apartments in the Sun Belt? Or are they focused on stable, cash-flowing industrial warehouses in the Midwest?

This strategic blueprint is everything. It sets clear expectations for investors and creates a benchmark for success. A well-defined strategy ensures every potential deal is measured against the same core criteria, preventing emotional decisions and keeping the fund on track.

At the heart of it all, a fund manager is a fiduciary. That’s a legal and ethical term with real teeth—it means they have a duty to act in the absolute best financial interests of their investors. This obligation is the bedrock of their entire business.

Executing the Plan From Start to Finish

With a solid strategy in place, the real work begins. The fund manager and their team hit the market to find deals that fit their thesis. They perform exhaustive due diligence on every potential property—poring over financials, walking the grounds, and building complex models to project future performance.

Once a property is acquired, the job shifts to asset management. This is the hands-on work of overseeing day-to-day operations, managing the on-site property managers, and executing any "value-add" plans, like renovating units or improving management to boost the property's income.

Throughout the entire lifecycle of an investment, the fund manager is juggling a few key responsibilities:

- Raising Capital: Constantly networking to attract and secure commitments from investors.

- Investor Relations: Keeping investors in the loop with transparent, regular updates on how the portfolio is performing.

- Strategic Dispositions: Knowing the right time to sell a property to lock in profits and maximize returns for everyone.

Ultimately, the fund manager is the critical link between investment capital and real estate opportunity. They handle every last detail to turn a property investment strategy into a profitable reality.

Comparing Different Types of Fund Managers

Not every real estate fund manager plays the same game. The field is surprisingly diverse, with different models built to suit specific investor needs, risk tolerances, and capital commitments. Figuring out these distinctions is the essential first step to finding a partner who's truly aligned with your financial goals.

We can generally group fund managers into three main categories, each with its own way of structuring deals, raising money, and handling assets. Let's break them down with some simple analogies to make their roles crystal clear.

The Private Fund Manager

Think of a Private Fund Manager as a private wealth advisor, but exclusively for real estate. They put together exclusive, high-stakes investment funds—often called private equity real estate funds—for a small, select circle of sophisticated, high-net-worth individuals and institutional players. These aren't advertised on a billboard; they're open only to accredited investors who meet strict income or net worth criteria.

Their strategy is typically broad and long-term. Instead of zeroing in on a single property, a private fund manager raises a "blind pool" of capital to build a whole portfolio of assets over several years. This gives them the agility to jump on opportunities that fit their fund's strategy, like snapping up undervalued apartment buildings across the Sun Belt as they come to market.

- Investor Profile: Accredited investors, family offices, and institutions.

- Deal Structure: A portfolio of multiple properties acquired over time.

- Liquidity: Low, with capital typically locked up for 5-10 years.

The REIT Manager

A REIT (Real Estate Investment Trust) Manager is basically the CEO of a publicly-traded company that owns and runs income-producing real estate. Their main job is to make property investing available to everyday people through the stock market. If you have a brokerage account, you can buy shares in a REIT just as easily as you can buy stock in Apple or Google.

This model is all about liquidity—investors can trade shares any day the market is open. The REIT manager is at the helm of a massive, often highly specialized portfolio, which could include hundreds of shopping centers, office towers, or data centers. They also have to follow strict SEC rules, including the big one: distributing at least 90% of their taxable income to shareholders as dividends. This makes REITs a huge draw for anyone looking for steady income.

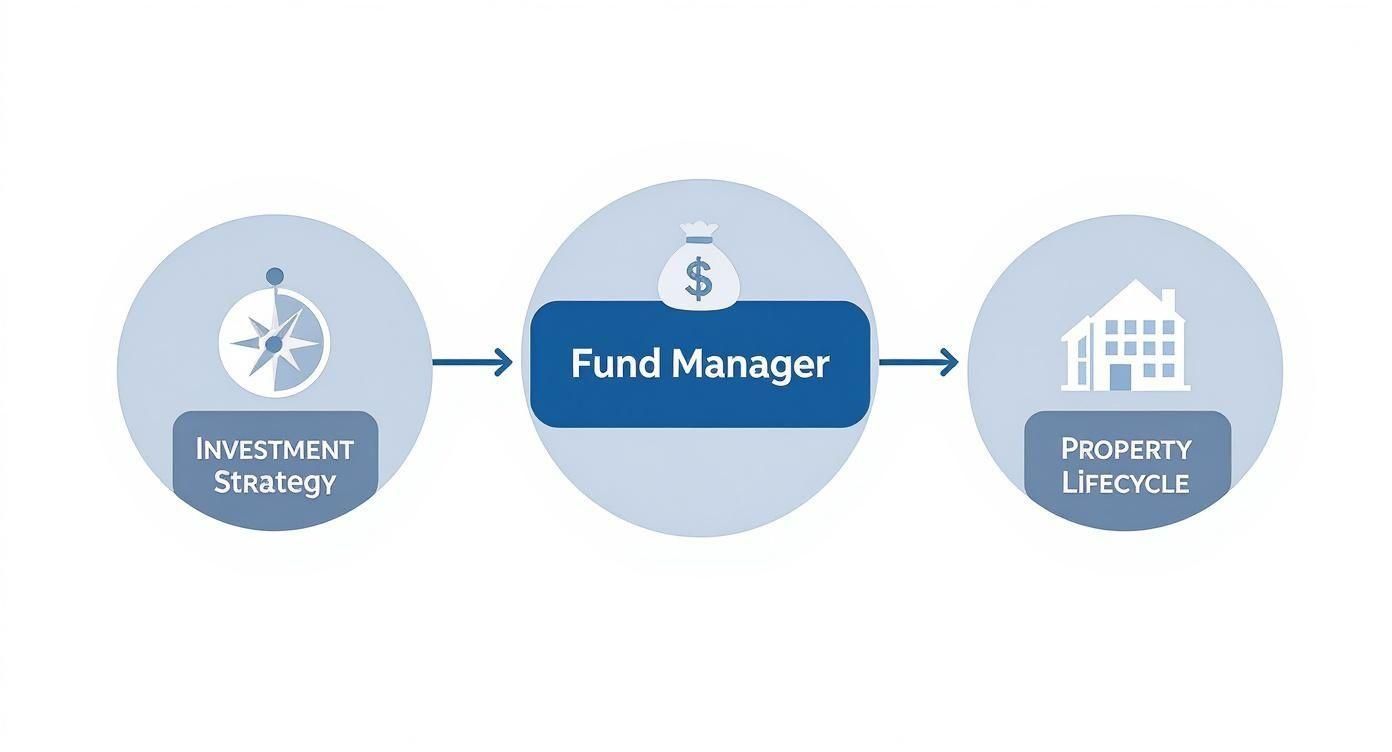

The infographic below shows the core skills every fund manager needs to succeed, no matter which model they follow.

As you can see, success boils down to mastering investment strategy, raising capital, and managing the entire property lifecycle from start to finish.

The Real Estate Syndicator

Finally, there's the Real Estate Syndicator (also called a Sponsor), who acts more like a project manager for one specific deal. Picture a movie producer who finds an amazing script (the property), brings together the right investors (the cast and crew), and oversees the whole production to make sure it’s a blockbuster.

Unlike a private fund manager raising a blind pool of cash, a syndicator brings a fully identified asset to the table. They might find a 150-unit apartment building with a solid value-add plan, then go out and raise the precise amount of money needed from investors to buy and renovate that one property.

A key difference is focus. A syndicator pitches a deal-by-deal opportunity, giving investors total control over which specific assets they want to invest in. This provides more transparency and control compared to a blind pool fund.

This hands-on approach is very popular with investors who want more say and prefer to do their own homework on each deal before writing a check. Every syndication is its own standalone venture, creating a direct and clear link between your investment and the physical property. It’s no surprise that many professionals get their start in the fund manager real estate world as a syndicator.

Comparing Real Estate Fund Manager Models

To help you see the differences side-by-side, we've put together a simple comparison. Each model has its pros and cons, and the right fit really depends on what you, as an investor, are looking for.

Ultimately, choosing between these fund managers comes down to your personal investment style. Do you want the hands-off, portfolio approach of a private fund, the liquidity of a REIT, or the deal-specific control offered by a syndicator? Understanding these core models is the first step toward making an informed decision.

The Five Core Responsibilities of a Fund Manager

A great real estate fund manager wears a lot of hats. They’re much more than just a property buyer; they're the strategist, the number-cruncher, the communicator, and the hands-on operator, all rolled into one. Their job covers the entire life of an investment, from the initial idea to the final sale.

For anyone looking to invest their money with a fund manager real estate pro, it’s crucial to understand what they actually do day-to-day. Their duties really boil down to five key areas. Excelling at one or two isn't enough—the best managers are masters of all five, and that's what drives a fund's success.

1. Deal Sourcing and Underwriting

First things first, you can't have a fund without deals. A manager's primary job is to be a professional scout, constantly hunting for properties that fit the fund's unique investment strategy. This means they're not just scrolling through public listings; they're cultivating a deep network of brokers, owners, and insiders to get a look at off-market deals before anyone else.

Once they find a promising asset, the real work begins: underwriting. This is where they put the deal under a microscope. It’s an intense financial deep-dive where they stress-test every assumption to see if the numbers hold up.

- Financial Modeling: They'll build complex spreadsheets to project everything from future rent growth to operating costs over the next five to ten years.

- Market Analysis: This involves digging into local market trends, checking out what similar properties have sold for, and understanding the economic drivers of the area.

- Physical Due Diligence: They’ll walk the property, bring in inspectors, and check the condition of the big-ticket items—the roof, HVAC, and foundation—to uncover any hidden problems.

Underwriting is the moment of truth. A single miscalculation here can sink an investment, which is why disciplined, conservative analysis is the signature of a top-tier manager.

2. Capital Raising

A brilliant investment strategy is just a theory without the money to back it up. That brings us to the second core job: raising capital. A fund manager real estate expert has to be a compelling storyteller, able to clearly explain the vision and persuade investors to come aboard. This involves putting together professional pitch decks, hosting webinars, and sitting down for countless one-on-one meetings.

They have to be upfront about both the risks and the potential rewards, making sure every investor is comfortable and confident in their ability to execute the plan. It’s a constant process—even after a fund is closed, they’re already building relationships for the next one.

A fund manager’s ability to raise capital is a direct reflection of the market’s trust in their track record and strategy. It is a constant process of building and maintaining credibility within the investment community.

3. Investor Relations and Reporting

Once the money is in and the properties are bought, a manager's role shifts to keeping their partners in the loop. This is all about transparent, consistent communication, which is the foundation of any good long-term relationship. Investors have a right to know how their money is performing and how the business plan is progressing.

This responsibility includes:

- Delivering regular, easy-to-understand financial reports, usually on a quarterly basis.

- Making sure cash flow distributions are sent out on time, as promised in the legal documents.

- Hosting update calls or webinars to walk investors through portfolio performance.

- Being available to answer questions and address concerns quickly and professionally.

Great investor relations builds the trust needed to keep investors coming back for future deals.

4. Active Asset Management

With the deal done and investors onboard, the manager’s attention turns to the nitty-gritty of asset management. This isn't a passive role. It’s the hands-on work of bringing the business plan to life to boost the property's value. It’s where managers roll up their sleeves and make things happen.

This means overseeing the property management team, managing renovation projects, and finding creative ways to improve the bottom line. For an apartment complex, this could mean upgrading kitchens to justify higher rents, renegotiating a waste removal contract to cut costs, or launching a new marketing campaign to fill vacant units. The mission is simple: maximize the net operating income (NOI) and, by extension, the property's overall value.

5. Strategic Dispositions

The final chapter in the investment lifecycle is the disposition—the sale. A skilled manager has a sharp sense of market timing, knowing the right moment to sell and lock in profits. This decision is all about knowing when the business plan is complete and whether market conditions are ripe for an exit.

The manager steers the entire sale, from hiring the right broker and marketing the asset to negotiating with buyers and navigating the closing process. The ultimate prize is to sell for the highest possible price, delivering a strong total return to investors and proving that the initial strategy was a success. A profitable exit is what solidifies a manager’s reputation and sets them up for their next fund.

Understanding How Fund Managers Get Paid

When you're vetting a fund manager real estate professional, understanding how they get paid is non-negotiable. It’s more than just a line item on a report; their compensation structure tells you exactly how aligned their interests are with yours.

Think of it this way: you want a manager who only wins big when you win big. The most common structure in private real estate, often called the “2 and 20” model, is designed to do just that. It's a simple shorthand for a two-part system: a modest fee to keep the lights on and a much larger, performance-based reward for hitting a home run. This model ensures the manager has serious skin in the game.

Core Fee Components

A real estate fund manager's compensation is typically built from a few key pieces. Each fee serves a specific purpose, from covering the upfront legwork of finding and buying a great property to the day-to-day oversight and, ultimately, the big payday after a successful sale.

Here are the usual suspects:

- Acquisition Fee: This is a one-time fee for all the hard work that goes into finding, analyzing, and closing on a new property. It’s typically 1-2% of the purchase price and compensates the manager for getting the deal across the finish line.

- Asset Management Fee: Think of this as the ongoing fee for managing the portfolio and executing the business plan. It’s usually an annual fee of 1-2% of the equity invested or total assets under management. We cover this in-depth in our guide to the asset management fee.

- Carried Interest (The "Promote"): This is where the real alignment happens. Carried interest, or the “promote,” is the manager’s share of the profits. It's often 20% (or more), but here's the crucial part: they only collect it after investors get their initial capital back, plus a preferred return.

How the Promote Aligns Interests

The "promote" is what truly motivates a manager to outperform. It creates a powerful incentive structure where their largest financial reward is directly tied to generating exceptional returns for you, the investor. This is managed through a distribution system called a "waterfall."

A waterfall structure is designed to make sure investors get paid first. The fund manager only gets a share of the profits after the investors' capital has been returned and a minimum return threshold has been met.

Let’s walk through a simple example of how this plays out:

- Return of Capital: First, 100% of all cash flow—from both rental income and the final sale—goes straight to the investors until every dollar of their original investment is paid back.

- Preferred Return: Next, investors continue to receive all cash flow until they’ve hit a "preferred return" on their investment. This hurdle is often set around 6-8% annually. It’s the minimum performance bar the manager has to clear.

- The Promote Kicks In: Only after both of those hurdles are cleared does the manager start to share in the remaining profits. From this point on, the cash is split, often 80% to the investors and 20% to the fund manager.

This tiered system ensures the fund manager real estate team is focused on one thing: exceeding the minimum targets. Their biggest payday only comes after they’ve delivered solid returns for you first.

How to Vet and Choose the Right Fund Manager

Picking the right fund manager real estate partner is the single most critical decision you'll make as an investor. A great manager can be a powerful engine for wealth creation, but the wrong one can lead to stalled returns or, in the worst cases, significant losses. Your job is to look past the glossy pitch deck and dig deep.

Think of it like hiring a CEO to run your capital. You wouldn't hire them off a resume alone, right? You'd check their references, grill them on their past decisions, and make sure their vision aligns with yours. This requires a methodical, fact-based approach.

Assess the Track Record

A manager’s past performance is the best crystal ball you have. Don’t just accept the highlight reel; ask for a detailed track record of every single deal they’ve ever done—the home runs and the strikeouts.

Anyone can look like a genius in a hot market. The real test is how their portfolio held up during the last recession. That's where you see their true risk management chops shine through.

When you get their deal history, focus on these key performance indicators (KPIs):

- Internal Rate of Return (IRR): This isn't just a simple percentage. It’s an annualized return that factors in when you get your money back, which is incredibly important.

- Equity Multiple (EM): This is the straightforward "cash-on-cash" metric. An EM of 2.0x means for every dollar you invested, you got two dollars back.

- Hold Period: How long did it take to generate those returns? A high multiple achieved in three years is far more impressive than the same multiple achieved in ten.

Scrutinize the Investment Strategy

A well-defined strategy is a sign of a disciplined manager. Do they have a laser focus—say, value-add multifamily in the Sun Belt—or are they chasing deals all over the map? There’s no single "right" strategy, but it needs to be clear, consistent, and logical.

Ask them to walk you through a recent deal from start to finish. How did they find it? What assumptions did they make in their underwriting? What unexpected problems popped up, and how did they solve them? This kind of storytelling reveals more about their hands-on expertise than any marketing brochure ever could.

A fund manager's track record tells you what they've done, but their strategy tells you what they will do. Ensure both align with your financial goals and risk tolerance before committing capital.

The scale of this industry is massive, with the top 100 global managers now overseeing more than $3.83 trillion in assets. In such a crowded space, a manager with a proven, repeatable strategy is who you want on your side.

Verify Transparency and Communication

Finally, gauge their commitment to keeping you in the loop. How often, and how well, do they communicate with their investors? Ask to see sample quarterly reports. Are they detailed and easy to understand, or vague and confusing? When you're researching potential managers, also look at their online presence. A professional website and an understanding of marketing concepts like SEO for real estate can signal a modern, forward-thinking operation.

The ultimate acid test? Ask for references. And don't back down on this one. Speaking with a few of their current and past investors is non-negotiable. Hearing directly from people who have already trusted them with their money will give you the unfiltered truth you need to know if the manager really walks the walk.

Key Questions for Your Potential Fund Manager

A fund manager’s track record tells you what happened, but it doesn’t tell you why or how. The numbers look great on paper, but they won’t reveal a manager's character, how they communicate under pressure, or their game plan when things go sideways.

Before you write that check, you need to dig deeper than the glossy pitch deck. Think of it like hiring a critical business partner for a multi-year journey. You’re not just investing in a property; you’re investing in the person and their team. The right questions peel back the layers and show you who you’re really getting into business with.

It's wise to approach this with the same level of scrutiny you'd apply to any major partnership, asking critical questions to ask any professional in real estate ventures.

Questions About Strategy and Risk Management

First, let's get into their head. You want to understand how they think about both making money and, more importantly, not losing it. A manager's plan for a crisis is often a better indicator of their skill than their plan for a boom.

Here are some questions to test their discipline and foresight:

- How did your portfolio hold up during the last major downturn? What were the biggest lessons you walked away with?

- What’s your playbook for dealing with a sudden, massive capital expense or if your anchor tenant goes dark?

- Tell me about a deal that went south. What happened, how did you pivot, and what was the end result for your investors?

- How do you stress-test your underwriting? What happens to the deal if interest rates jump 2% or rent growth stalls?

You’re listening for proactive, battle-tested answers, not just optimistic projections. A seasoned fund manager real estate pro has already run through the fire drills and knows where the emergency exits are.

A manager who is willing to talk about their failures is far more credible than one with a spotless story. Honesty about past stumbles shows they’ve learned from experience and value transparency.

Questions About Communication and Operations

Next, you need to get a feel for the day-to-day reality of being their partner. Clear and consistent communication is everything. It’s the foundation of trust, especially when the market gets choppy.

These questions will help you understand what life is like after you’ve signed the subscription agreement:

- Reporting Frequency: How often will I hear from you, and what’s included in those updates? Can I see an example of a past investor report?

- Access and Availability: If I have a question, who’s my go-to person? What’s a realistic timeframe for a response?

- Investor References: Would you be open to connecting me with a couple of your current long-term investors so I can hear about their experience?

A manager who runs a tight ship will have no problem with these questions. If you get vague answers or hesitation, that’s a major red flag. And a flat-out refusal to provide investor references? That’s almost always a deal-breaker. You need complete confidence to move forward, and asking the tough questions is how you build it.

Got Questions? We’ve Got Answers.

Diving into the world of real estate investing always brings up a few questions, especially when you’re thinking about putting your capital in the hands of a professional. Let's tackle some of the most common things investors ask about working with a real estate fund manager.

Fund Manager vs. Property Manager: What's the Difference?

It’s an easy mistake to mix these two up, but they operate on completely different levels. Think of a property manager as the boots-on-the-ground captain of a single ship. They’re dealing with the day-to-day nuts and bolts: screening tenants, collecting rent, and fixing leaky faucets.

A real estate fund manager, on the other hand, is the admiral of the entire fleet. They’re the high-level strategist managing a whole portfolio of properties. Their job is to make the big financial calls—which assets to buy, when to sell, and how to steer the overall strategy to deliver the best possible returns to investors. In short, the fund manager hires the property manager to execute the plan at the property level.

What’s a Typical Minimum Investment for a Fund?

There’s no one-size-fits-all answer here. The minimum check size can swing wildly based on the fund’s strategy and who they’re trying to attract as investors.

But to give you a ballpark idea:

- Syndications & Small Private Funds: These are often more accessible, with minimums typically falling in the $25,000 to $100,000 range.

- Larger Private Equity Funds: These are built for institutional players and high-net-worth individuals, so you'll often see minimums starting at $250,000 and going up from there.

The minimum investment isn’t just an arbitrary number; it’s a reflection of the fund’s scale and game plan. Before you get too far down the road, always confirm the capital requirement to make sure an opportunity actually aligns with your financial capacity.

What Are the Main Risks of Investing in a Real Estate Fund?

Real estate has a reputation for being a stable investment, but no investment is completely risk-free. Getting familiar with the potential downsides is a non-negotiable part of your homework.

Here are the big three to watch out for:

- Market Risk: A broad economic downturn can hit property values and rental income hard, making it tough for a manager to sell assets for a profit.

- Liquidity Risk: This is a big one. Unlike stocks, you can't just sell your stake in a private real estate deal on a whim. Your money is typically tied up for the life of the fund, which could be anywhere from 5 to 10 years.

- Execution Risk: At the end of the day, you're betting on the manager. If they fail to execute their business plan—whether it's a renovation or a lease-up strategy—the returns won't live up to the projections. This is precisely why digging into a manager’s track record is so critical.

Ready to stop juggling spreadsheets and start closing deals? Homebase is the all-in-one platform built for real estate sponsors to manage their pipeline, raise capital, and give investors a seamless, professional experience. Find out how to get back to focusing on what you do best at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.