How to Find Private Investors: Top Strategies

How to Find Private Investors: Top Strategies

Learn how to find private investors with expert tips to secure funding and boost your business growth.

Domingo Valadez

Mar 26, 2025

Blog

Navigating Today's Private Investment Landscape

Understanding the private investment landscape is essential for securing funding. This involves recognizing the different motivations and priorities of various investor groups. For example, angel investors often prioritize early-stage companies with high-growth potential.

On the other hand, private equity firms typically focus on established businesses with stable cash flow. Therefore, tailoring your approach to each specific investor type is crucial for a successful fundraising process.

Understanding Investor Psychology

Finding the right private investors requires more than just a strong business plan. It also requires understanding the psychology behind investment decisions. All investors, regardless of their profile, seek a return on their investment.

However, their desired type of return and risk tolerance can differ significantly. Some may prioritize long-term, steady growth, while others may seek quicker, higher-risk returns. Market trends, economic conditions, and the competitive landscape also play a role in influencing investor sentiment.

The Impact of Economic Shifts

The overall economic climate significantly impacts the availability of private investment. One key metric to consider is fixed private investment. As of October 2024, fixed private investment in the United States reached a record $5,280.871 billion.

This figure suggests a healthy spending environment in the private sector, which can attract investors seeking growth opportunities. Historically, this investment has fluctuated, ranging from a low of $35.359 billion in January 1947 to the current high. These shifts reflect changes in economic policies and investor confidence. Analysts often use macroeconomic indicators like these to gauge investor interest in new ventures. You can find more detailed information on Trading Economics.

Aligning Your Approach With Investor Priorities

Given the varied nature of the private investment landscape, aligning your fundraising strategy with investor priorities is paramount. This involves clearly demonstrating how your business aligns with their specific investment objectives and risk tolerance.

For instance, when targeting angel investors, emphasizing your innovative product or disruptive technology is crucial. However, when approaching a private equity firm, highlighting a proven track record of profitability and a strong management team is more effective. Ultimately, understanding the nuances of the private investment landscape allows you to target the right investors and significantly improves your chances of securing funding.

Transforming Your Business Into an Investment Magnet

Attracting private investors requires a multifaceted approach. It's not just about having a great idea; it's about presenting your business as a compelling and secure investment opportunity. This involves crafting a narrative that showcases your vision, planning, and preparedness. Just like building a house requires a solid foundation, attracting investors demands robust financials and a strong team.

Building a Solid Foundation: Financials and Team

Financial projections are essential for any investment decision. They provide insight into the potential profitability of your venture and must be able to withstand scrutiny. Investors look for realistic, data-driven projections, not inflated numbers. These projections should align with industry benchmarks and demonstrate a clear path to profitability.

A strong management team is also crucial for inspiring investor confidence. Investors invest in people as much as they invest in ideas. A capable and experienced team assures investors that the business can navigate challenges and execute the plan effectively.

For instance, a real estate syndication needs to show realistic returns based on market analysis and comparable properties. The presence of experienced developers on the team adds credibility, demonstrating both profit potential and the team’s ability to achieve it.

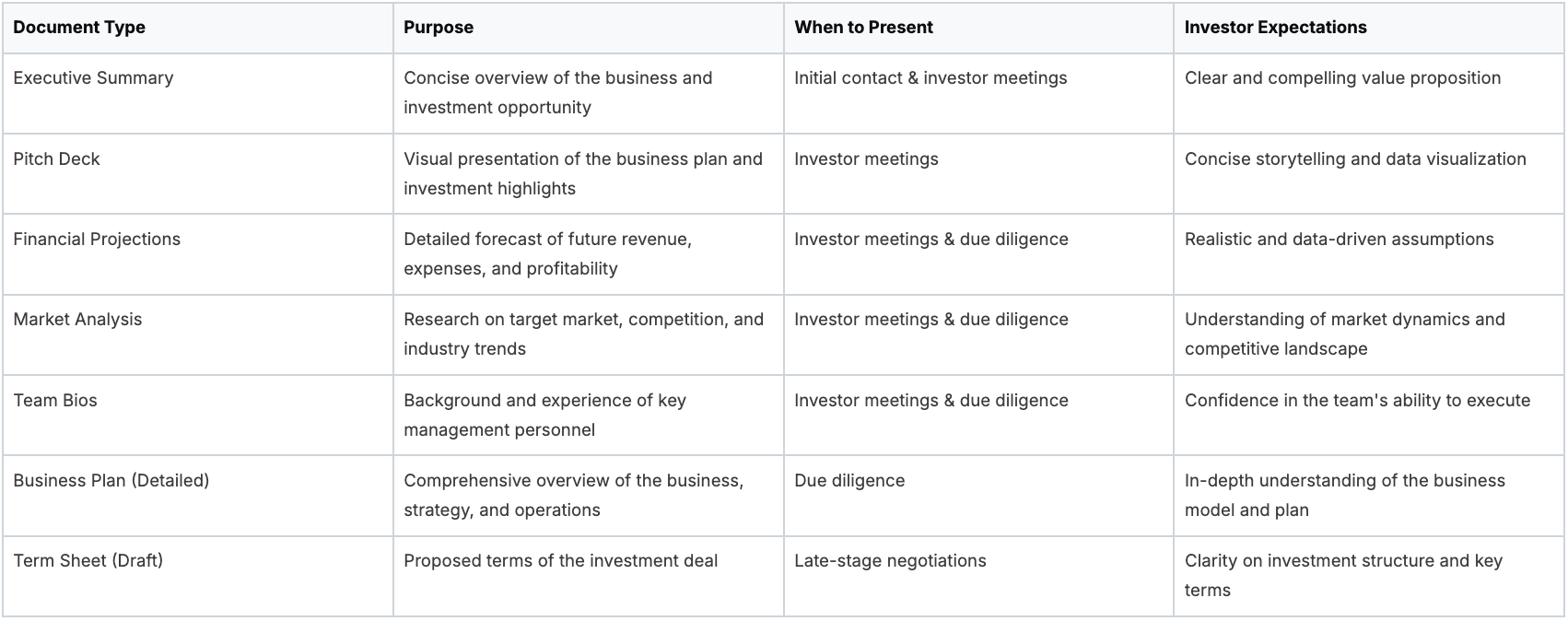

To present this information clearly in investor meetings, consider the following table of essential documents:

Introducing "Essential Documents for Investor Meetings," a comparison of must-have documents and nice-to-have materials when approaching private investors. This table outlines the purpose and optimal timing for presenting each document, along with investor expectations.

This table summarizes the key documents needed to effectively communicate your business proposition and build investor confidence. While the Executive Summary and Pitch Deck are crucial for initial engagement, detailed financial projections and market analysis are essential for due diligence.

Governance and Documentation: The Small Details That Matter

While the big picture matters, small details in governance and documentation can significantly impact investor decisions. Clear, well-organized documents demonstrate professionalism and attention to detail. They provide investors with the necessary information to make informed decisions, showcasing transparency and integrity. Conversely, poorly prepared documents can raise red flags, signaling a lack of preparedness.

Crafting Your Narrative: Vision Meets Execution

Finally, how you present your business is crucial. Crafting a compelling narrative is key to attracting private investors. This narrative should balance ambitious vision with a credible execution plan. It should clearly articulate your value proposition, address potential risks, and outline a realistic path to achieving your goals. A well-crafted narrative not only informs but also inspires investors to share your vision.

Understanding the current investment landscape can strengthen your narrative. For example, net domestic investment by private businesses in the U.S. reached $811.650 billion in October 2024. While below the April 2024 high of $943.344 billion, this still indicates substantial investment activity. You can find more detailed statistics from Trading Economics. Highlighting relevant statistics demonstrates your understanding of market trends and positions your business within a broader context. Ultimately, preparing for investment is a process that starts long before the first meeting.

Where Serious Investors Actually Look for Opportunities

Attracting private investment requires a strategic approach. Instead of sending countless pitches into the void, focus on positioning your business where investors are actively searching. This targeted approach significantly increases your chances of connecting with the right investors. It's about being proactive and strategic, not just hopeful.

Leveraging Digital Platforms and Industry Networks

Digital platforms offer a powerful way to connect with potential investors. However, it's crucial to choose wisely. Curated deal-sharing platforms, for example, provide access to a focused group of accredited investors. In contrast, general networking sites or online forums might yield less qualified leads. Identifying platforms frequented by your ideal investor profile is key.

Industry-specific networks are another often-overlooked avenue for investor connections. These networks can facilitate warm introductions and access to investors specializing in your sector. A real estate developer, for instance, would likely find more success through real estate-focused associations and platforms. For more specialized information, explore our ultimate guide to real estate capital raising strategies.

The Power of In-Person Events

While online networking is valuable, the impact of in-person events shouldn't be underestimated. Industry conferences, investor summits, and even smaller networking gatherings offer opportunities for face-to-face interactions. These personal connections allow you to build rapport and leave a lasting impression, far more effectively than digital exchanges.

When choosing events, prioritize those known to attract serious investors and offer opportunities for genuine engagement. Attending the right event can be a game-changer.

Building Your Reputation Before the Meeting

The investor evaluation process often begins long before any formal pitch. Investors may research your company online, review publicly available information, and speak with mutual contacts. This pre-meeting due diligence is crucial.

A strong online presence, positive testimonials, and endorsements from reputable sources can significantly boost your credibility. Building this positive reputation is like creating a strong foundation for your investor interactions. This pre-framing can significantly influence an investor's interest in your opportunity. Ensure your company's online presence, including website and social media, projects the professionalism and credibility investors look for.

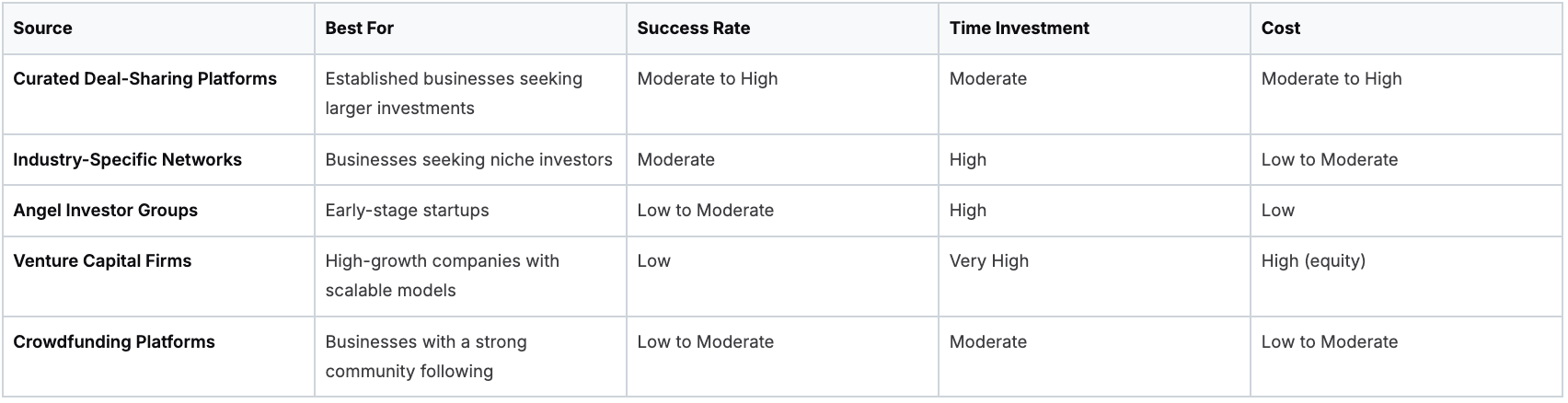

To help you navigate the world of private investors, here's a comparison of various sources:

Top Sources for Finding Private Investors

Comparison of different platforms and networks for connecting with private investors

This table highlights the diverse options available to businesses seeking private investment. Each source has its own advantages and disadvantages, making it crucial to choose the right fit for your specific needs.

Private fund statistics illustrate the substantial capital available in the private investment ecosystem. Over 50,086 private funds reported on Form PF manage over $22.8 trillion in gross assets. This signifies a year-over-year growth of 5.1% and 6.7%, respectively. Learn more about these statistics on the SEC website. These funds utilize various investment strategies across different asset classes, providing numerous opportunities for businesses to find a suitable investor match. Understanding these strategies and asset classes is vital for effectively targeting potential investors.

Crafting a Pitch That Makes Investors Take Notice

Securing private investment relies heavily on a compelling pitch. It's not simply about presenting the facts; it's about resonating with investors on a deeper level. You must connect with their motivations and address their unspoken concerns. This requires understanding the factors that drive investor decisions, from financial projections to the psychology behind their commitment.

Understanding the Psychology of Investor Commitment

Investors are motivated by more than just numbers. While financial returns are crucial, a winning pitch also considers the psychological aspects of decision-making. Trust in the management team, for instance, is just as vital as strong financial projections. Investors are essentially backing the people behind the venture as much as the venture itself.

A clear and concise value proposition is also essential. Clearly articulating how your business solves a problem or addresses a market need is paramount. This clarity reduces perceived risk and makes the investment opportunity more attractive. These non-financial factors often play a decisive role in an investor's commitment.

Structuring Financial Projections for Credibility

Financial projections are the bedrock of any investment pitch. However, presenting these projections in a way that builds trust is key. Overly optimistic forecasts can be detrimental, raising red flags about the validity of your analysis. Instead, focus on realistic projections supported by market research and concrete data.

Investors look for a clear path to profitability, not just aspirational figures. This requires a deep understanding of your target market, competitive landscape, and revenue model. Showcasing this knowledge strengthens your pitch and builds investor confidence. A meticulous approach distinguishes serious opportunities from speculative ventures.

Answering the Unasked Questions

An effective pitch anticipates and addresses questions that investors might not explicitly voice. This means going beyond surface-level details and demonstrating a profound understanding of your business. For example, address potential challenges and outline your strategies for overcoming them.

Acknowledging these "unasked questions" shows foresight and instills confidence in your ability to handle unforeseen obstacles. Also, be prepared to discuss your exit strategy, a crucial aspect for many investors. Proactively addressing these concerns positions you as a prepared and thoughtful entrepreneur. This proactive approach cultivates trust and improves your chances of securing funding.

Customizing Your Approach for Maximum Impact

There’s no universal approach to investor pitches. The type of investor, the meeting context, and your funding round stage all necessitate a tailored strategy. For instance, pitching to an angel investor differs significantly from presenting to a venture capital firm.

Angel investors often focus on the long-term vision, while venture capitalists prioritize rapid growth and scalability. A seed-stage pitch requires a different emphasis than a Series A round. Recognizing these nuances allows you to customize your pitch and maximize its impact. This demonstrates your understanding of the investment landscape and enhances the effectiveness of your message. By carefully considering these factors, you can craft a pitch that turns investor hesitation into enthusiasm. A strong pitch isn't just about asking for money; it's about forging a partnership built on shared vision and mutual benefit.

Building Investor Relationships That Transcend Transactions

Finding private investors isn't just about securing a single funding round; it's about building enduring relationships. This means shifting your perspective and viewing investors not merely as a source of capital, but as potential long-term partners and advocates who can champion your business. This long-term vision is crucial for sustained growth and successful future fundraising.

Providing Value Before Asking for Capital

One effective strategy for fostering genuine connections is to offer value before requesting anything in return. This could involve sharing relevant market insights, connecting investors with valuable contacts in your network, or offering your expertise in areas that align with their interests. This proactive approach demonstrates genuine interest that goes beyond a purely transactional mindset. For example, if an investor is focused on renewable energy, sharing a recent analysis of emerging solar technologies could build goodwill and position you as a knowledgeable resource.

Transforming Rejections into Future Opportunities

Not every investor meeting will lead to an investment, but even rejections can be valuable learning experiences. Consider these as opportunities to gather feedback, refine your pitch, and expand your network. Maintaining a positive relationship after a rejection can leave the door open for future possibilities. Following up with a rejected investor and sincerely asking for feedback on your presentation demonstrates maturity and a willingness to learn, potentially turning a "no" into a "not now" and paving the way for future conversations.

The Art of Effective Follow-Up

Consistent and thoughtful follow-up is crucial for nurturing investor relationships. However, it's important to go beyond standard check-ins. Share relevant updates on your company's progress, key milestones achieved, or newly secured partnerships. This demonstrates forward momentum and reinforces your commitment to success. For instance, instead of simply asking if they've reviewed your pitch deck, provide a concise update like, "We've recently achieved a significant milestone by reaching X number of users, which positively impacts our growth projections. I thought this would be relevant to your investment thesis."

Navigating the Waiting Game

The time between meetings can be stressful. Use this time strategically to address any concerns raised by investors, gather additional data to support your projections, or further refine your business plan. This proactive approach demonstrates your dedication and responsiveness, qualities investors value highly. This preparation can transform downtime into productive time.

Managing Investor Expectations During Due Diligence

Due diligence is a critical stage in the investment process. Transparency and open communication are paramount. Provide investors with all requested information promptly and accurately. Be prepared to answer their questions thoroughly and honestly, even if they are challenging. This builds trust and reinforces your integrity. Having well-organized financial records, for example, streamlines the due diligence process and demonstrates your preparedness.

Building Advocates, Even Without Direct Investment

Not every investor who finds your pitch compelling will invest in the current round. However, they can still become valuable advocates for your business. Maintaining relationships with these individuals by keeping them informed of your progress can lead to introductions to other potential investors or strategic partnerships. These indirect connections can often be just as valuable as direct investments. By focusing on building genuine relationships, you create a network of support that extends beyond individual transactions, positioning your business for long-term success.

Industry-Specific Strategies That Actually Convert

Finding private investors requires a targeted approach. Just like a fisherman uses different lures for different fish, your strategy must be tailored to your specific industry. Understanding the nuances of each sector, including the key metrics, benchmarks, and active investor groups, is crucial for turning interest into investment.

Identifying Key Metrics and Milestones

Different industries prioritize different metrics. In the technology sector, investors often focus on user growth, market share, and technological innovation. However, in real estate, key metrics include capitalization rates, net operating income, and location. Knowing which metrics matter most allows you to highlight the most relevant data in your pitch, resonating more effectively with industry-savvy investors.

Industry-specific milestones also signal investment readiness. For a tech startup, achieving a certain number of daily active users might be key. For a manufacturing business, securing a major distribution contract could be more significant. Demonstrating progress against these benchmarks builds credibility and attracts relevant investor interest.

Positioning Against Sector-Specific Benchmarks

Investors use sector-specific benchmarks to evaluate opportunities. Understanding these benchmarks helps position your business effectively. For example, in the restaurant industry, investors might compare your average revenue per customer against industry averages. By highlighting how your business outperforms these benchmarks, you showcase your competitive advantage and reinforce your value proposition.

Targeting Relevant Investor Groups

Some investor groups specialize in certain industries. Venture capital firms might focus exclusively on biotech or solely on real estate. Identifying and targeting these specialized investors increases your chances of securing funding. It's about focusing your efforts on the most promising prospects.

Understanding specific sectors like real estate or technology, in addition to macroeconomic indicators and regulatory frameworks, can also attract private investors. For example, private residential fixed investment, influenced by factors like interest rates and housing market conditions, has seen fluctuations. Recent data indicates this sector remains significant within gross private domestic investment. Private investors seek opportunities in sectors with growth potential and stability. Focusing on high-demand areas can enhance your business's appeal. Explore this topic further at FRED.

Tailoring Your Pitch to Investor Preferences

Once you've identified relevant investor groups, tailoring your pitch to their preferences is essential. This means understanding their investment criteria, risk tolerance, and preferred exit strategies. Investors in high-growth sectors like technology might accept higher risks for higher returns, while those in more established industries may prioritize stability and steady income. This tailored approach deepens your connection with potential investors.

By considering these industry-specific factors, you position your business as an exceptional opportunity. Securing private investment isn't just about having a strong business; it's about showcasing its relevance and potential to the right investors.

Ready to streamline your real estate syndication and attract more investors? Homebase offers an all-in-one platform to simplify fundraising, investor relations, and deal management. Visit Homebase today to learn more and improve your real estate investment process.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

The Ultimate Rent Roll Sample Guide for Real Estate Investors

Blog

Unlock property performance with our rent roll sample. Learn to analyze deals, verify income, and master real estate syndication with our expert guide.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.