How to Locate Real Estate Investors

How to Locate Real Estate Investors

Discover how to locate real estate investors with proven strategies. Learn to find, vet, and connect with capital partners using online and offline tactics.

Domingo Valadez

Aug 14, 2025

Blog

Finding the right real estate investor isn’t about dumb luck. It's about having a proven system that blends online detective work with good old-fashioned, in-person networking.

If you want to find investors fast, you need to be in two places at once. Spend time prospecting digitally on platforms like LinkedIn, but also make sure you're shaking hands at local Real Estate Investment Association (REIA) events. This dual-channel approach is your ticket to connecting where today's investors are most active.

Your Playbook for Finding Real Estate Investors

Before you even think about starting your search, let’s get your mindset right. Finding a capital partner is far less about a single transaction and much more about building a real, long-term professional relationship. You're not just looking for a check. You're searching for a partner whose goals, risk tolerance, and communication style actually match yours.

Success comes from a systematic strategy that puts you in the right places, both online and off. To get there, you first need to understand what makes an investor tick. Learning the different strategies for building wealth through investment homes gives you a massive advantage. It helps you speak their language and frame your opportunities in a way that aligns directly with their financial goals.

Understanding Investor Profiles

Let's be clear: not all investors are cut from the same cloth. Knowing the different types helps you sharpen your search and tailor your pitch. Generally, they fall into a few key categories:

- The Individual Investor: This is often a high-net-worth individual—think doctors, lawyers, or successful business owners—looking to diversify their portfolio with a hard asset. You’ll usually find them through your personal network, local business groups, and community events.

- The Professional Syndicator: These are the pros. They're seasoned operators who pool capital from multiple passive investors to go after much larger assets. They live on forums like BiggerPockets and are regulars at national real estate conferences.

- The Institutional Buyer: We're talking about the big players here—private equity firms, family offices, and REITs. They operate on an entirely different scale. Getting in front of them typically requires a formal introduction through commercial brokers or investment bankers.

Key Takeaway: The single most important shift you can make is from "pitching a deal" to "building a relationship." Investors fund people they know, like, and trust. Your initial outreach should focus on seeking advice and establishing credibility long before you ask for capital.

Where to Start Your Search

So, where do you actually begin looking? To give you a clear starting point, I've put together a quick-reference table outlining the most effective channels. Think of this as your map to the investor landscape.

Top Channels to Locate Real Estate Investors

A summary of the most effective online and offline methods to begin your search for potential investment partners.

This table isn't just a list; it's the foundation of your search strategy. A successful search combines broad outreach with targeted, meaningful engagement. It's a funneling process. You start by casting a wide net to generate as many leads as possible, then systematically narrow your focus to vet and connect with the most promising partners.

This guide is designed to move you beyond theory and into action. We’ll break down the exact online and offline strategies that successful dealmakers use every day—from pinpointing investor hotspots with digital tools to building genuine connections at local meetups. Consider this your roadmap to securing the capital you need.

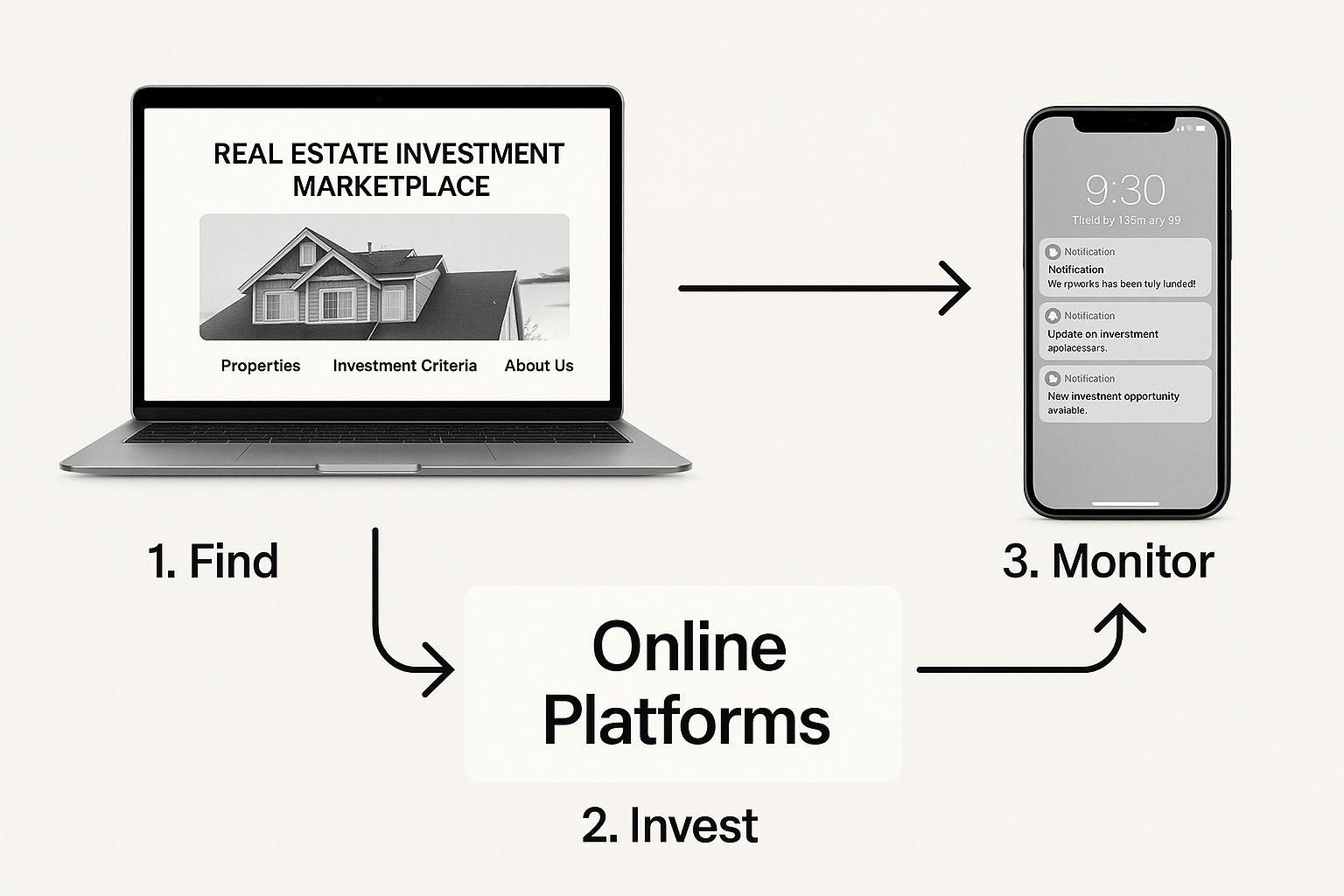

Mastering Digital Prospecting to Find Investors

The internet is swimming with potential real estate investors, but you can't just scroll your way to a funded deal. Finding the right capital partners online requires a real strategy. It’s less about stumbling upon them and more about actively hunting for the digital breadcrumbs they leave behind.

You need to shift your mindset from passive searching to active prospecting. Forget generic searches for "investor." Instead, focus on specific signals that show someone has the capital and the intent to deploy it.

This process involves a multi-channel approach, blending professional networks, niche communities, and public data to build a solid pipeline of qualified investors.

Pinpoint Investors on Professional Networks

LinkedIn is your best friend here, especially with a Sales Navigator subscription. It lets you get incredibly granular with your searches, moving way beyond simple keywords to find your ideal investor profile.

Start by thinking like a detective. Who really controls the capital? Instead of just "real estate investor," broaden your search to include precise job titles that signal access to money and decision-making authority.

- Targeted Titles: Think "Managing Partner," "Principal" at private equity firms, or "Family Office Manager." Even high-net-worth professionals like an "Anesthesiologist" or "Surgeon" can be great targets.

- Company Filters: Zero in on people working at real estate investment firms, private equity groups, or family offices. This puts you directly in the right circles.

- Geographic Focus: Always narrow your search to your target investment markets. Local investors are often easier to connect with and more motivated to invest in their own backyard.

Once you find someone promising, don't just hit "connect." That's a rookie mistake. Look at their profile. Do you have any shared connections who could make a warm introduction? Check their recent activity. If they're commenting on real estate news, you have the perfect, organic opening to start a conversation.

Engage in Niche Real Estate Communities

Serious investors don't just hang out on LinkedIn; they gather in specialized online forums to talk shop. This is where you'll find the truly active players. Platforms like BiggerPockets are ground zero for this because they're built for exactly this crowd.

Jump into the forums and observe. Who is asking smart questions? Who is sharing detailed deal analyses? These are the people you want to know. By participating in discussions and offering valuable insights, you build a reputation as a savvy operator. It's an indirect approach, but establishing credibility often makes investors come to you.

Pro Tip: Keep an eye out for users who consistently post about deals in your specific asset class or city. Thoughtfully engaging with their posts is a fantastic way to open the door for a private message about a potential opportunity.

To really get good at this, it's worth understanding the mechanics of running lead generation campaigns on social media. This knowledge can help you turn your online activity into a systematic lead-generating machine.

Uncover Hidden Opportunities in Public Records

Here's one of the most powerful—and most overlooked—digital strategies: mining online public records. County recorder or assessor websites are gold mines. They tell you exactly who is buying property in your market, right now.

What you're hunting for are recent cash buyers. An all-cash deal is the ultimate proof that an individual or company has serious liquid capital and is putting it to work in real estate.

Here’s a simple process to follow:

1. Isolate Recent Sales: Start by filtering property records for sales within the last 6 to 12 months.

2. Identify Cash Transactions: Look for sales where no mortgage was recorded. The deed will show an individual's name or an LLC, not a bank.

3. Research the Buyer: The buyer is often an LLC. A quick search of state business records will usually reveal the managing member's name—giving you a direct person to reach out to.

This isn't theoretical. This is how you find the people making real moves. They have proven liquidity and an active interest in your market, making them the most qualified prospects you can find for your next deal.

Following the Money to Global and Regional Hotspots

Here's a core principle I've learned over the years: capital never sleeps. It's always on the move, chasing the best returns. Instead of casting a wide, random net for investors, you can dramatically improve your odds by learning to follow this flow of money.

Think of it as a powerful river current. If you position yourself in its path, you’ll naturally encounter far more active players. Understanding where capital is heading on a macro level helps you spot emerging hotspots before they’re all over the news. This high-level view lets you focus your energy on markets where investors are already writing checks, which is a massive strategic advantage.

Where the Big Money is Going

Major commercial real estate firms like JLL, CBRE, and Cushman & Wakefield publish quarterly reports that are essentially roadmaps to investor activity. These aren't just dry academic papers; they're treasure troves of actionable intelligence. They show you exactly which regions and property types are getting the most attention from serious capital.

For instance, a recent analysis of global real estate markets revealed that direct transaction volumes hit an incredible US$179 billion in just the second quarter of the year. That's a 14% jump from the year before. The Americas led this charge with US$99 billion in transactions. This data isn't just a statistic; it's a huge neon sign pointing you toward the action.

To get a feel for these trends yourself, you can explore detailed insights on global market perspectives.

This kind of information helps you see the bigger picture. When you read that cross-border investments surged by 21%, it tells you that international money is actively looking for a home. Your job is to make your deal the most attractive destination for it.

My Two Cents: Don't just skim the headlines of these reports. The real gold is in the details. Is a specific city within a hot region seeing outsized growth? Is institutional money flooding into industrial properties while private capital targets multifamily? This is the nuance that sharpens your focus and separates you from the crowd.

From Global Trends to Your Local Market

This global data is powerful, but it's useless until you connect it to your own backyard. A boom in logistics investment across Asia-Pacific doesn't help you much if you're working on a multifamily deal in the American Southeast. The trick is to use these macro trends as a compass to guide your local research.

Here’s a practical way to bridge that gap:

- Spot the Big Wave: Start with a global or national trend, like the explosion in demand for industrial and logistics space.

- Find the Regional Ripple: Look for how that trend is showing up closer to home. Are major logistics companies like Amazon or Prologis expanding their footprint in nearby states?

- Drill Down to Local Clues: Finally, search for evidence on the ground. This could be new construction permits for warehouses, city council meetings about zoning changes for industrial development, or local business journals reporting on job growth in the logistics sector.

Following this path aligns your search with powerful market forces, making your efforts much more effective.

Homing in on Hot Property Sectors

Capital flows aren't just geographic; they're also sector-specific. Most serious investors specialize, so knowing which sectors are currently in favor helps you find the right audience immediately. If private equity is pouring billions into build-to-rent communities, that’s a signal you can't ignore.

Pay close attention to which asset classes are getting the most press and, more importantly, attracting the most capital. Right now, some of the hottest sectors include:

- Multifamily: Always in demand, thanks to housing shortages and predictable cash flows.

- Industrial & Logistics: Still riding the massive wave of e-commerce growth.

- Data Centers: A niche but rapidly expanding sector fueled by our insatiable need for data.

- Life Sciences: Specialized lab and R&D space for biotech and pharmaceutical companies is a booming market.

When you can approach an investor whose known focus aligns with a hot sector and your specific deal, the conversation starts from a place of mutual interest. You’re no longer just pitching a property; you’re presenting a solution that fits perfectly into their established investment strategy. That kind of strategic alignment is how you stand out and get deals funded.

Building Connections Through In-Person Networking

Digital prospecting is powerful, but it often misses the one thing every great partnership is built on: trust. A firm handshake, a real conversation over coffee, the simple act of looking someone in the eye—these things can build more rapport in five minutes than a dozen emails ever could. This is where old-school, in-person networking gives you a serious advantage in finding real estate investors. It’s how you go from being just another name on a screen to a real person they actually want to work with.

These face-to-face moments are where you build the social capital that truly gets deals done. When an investor has met you in person, heard about your focus, and gets a good read on your character, they’re far more likely to pick up the phone when you call with an opportunity.

Go Where the Deals Are Actually Happening

The smartest way to meet active investors is to go where they already are. Don't try to reinvent the wheel. Instead, plug yourself into the existing ecosystems where real estate is the main topic of conversation. You’ll find a much higher concentration of qualified, serious people this way.

Your first stop should be your local Real Estate Investment Association (REIA). Think of these monthly or weekly meetups as the heartbeat of your local investment scene. I've seen everyone from seasoned flippers and landlords to hard money lenders and big-time syndicators in one room. The secret? Be consistent. Showing up once makes you a visitor; showing up regularly makes you part of the community.

Beyond the usual REIA meetings, here are a few other high-value spots to scout for partners:

- Property Auctions: Head down to a foreclosure or tax deed auction, even if you just plan to watch. It’s a masterclass in identifying cash-heavy investors. The people with paddles in the air are there to put capital to work, making them your ideal contacts.

- City Planning Meetings: This is a pro-level strategy. Big-time developers and serious investors often attend these meetings to get their new projects green-lit. It’s an incredible way to see who’s making major moves in your market long before anyone else knows about it.

- Events Hosted by Lenders: Private and hard money lenders frequently host smaller, invite-only events for their top clients. If you can get on their radar and earn an invitation, you’ll get access to a pre-vetted group of proven investors.

The goal isn't just to swap business cards. Focus on building genuine rapport. Ask them about their recent projects or what part of the market they're focused on right now.

Platforms like Meetup.com are fantastic for finding these groups. A quick search will show you just how many local options you likely have.

As you can see, no matter where you live, there are probably several active groups dedicated to real estate investing, giving you a ready-made pool of potential partners.

How to Approach People and Make Real Connections

Walking into a room full of strangers can be nerve-wracking, I get it. But a little preparation makes all the difference. Before you walk through the door, get crystal clear on your own value proposition. What kinds of deals are your specialty? What’s your unique expertise?

Pro Tip: Don't lead with what you need. Lead with what you know. Instead of saying, "Hi, I'm looking for an investor," try something like, "I specialize in finding undervalued multifamily properties in the North County area." This immediately positions you as a specialist with deal flow, not just another person asking for money.

This simple shift changes everything. Your pitch transforms from a request into a statement of capability. Investors are naturally drawn to people who have a clear, focused strategy because it signals professionalism and a potential source of quality opportunities.

You can even weave in broader market knowledge to spark more sophisticated conversations. For instance, you could mention how the European real estate market has seen annualized returns hit 4.8%, fueled by a 46% quarterly surge in investment. Then, you can pivot to how you're tracking similar trends in your local industrial or residential sectors. You can find more details in this real estate market outlook and use it to frame your local insights.

Ultimately, your objective with networking is to cement your reputation as a knowledgeable, trustworthy professional. When you consistently show up, provide value, and prove you have a deep understanding of your market, you'll find you stop searching for investors. They'll start seeking you out.

How to Vet and Engage Potential Partners

Alright, you've built a solid list of potential investors. Now the real work begins. Moving from just a name in your CRM to a signed partnership agreement is a delicate dance of vetting and relationship-building. The goal here is to qualify people efficiently, making sure you're a good fit before sinking too much time into the wrong partnership.

Let's be clear: finding someone with money is the easy part. The make-or-break phase is discovering if their investment philosophy, risk tolerance, and even their communication style mesh with yours. A mismatch in these areas is a recipe for disaster down the road, no matter how much capital they bring to the table.

Your Due Diligence Checklist

Before you even think about picking up the phone, it’s time to do some digging. Think of yourself as an intelligence agent gathering critical data to shape your approach. A little homework goes a long way. It helps you tailor the conversation and, frankly, shows the investor you’re a professional who respects their time.

Here's what I always look for:

- Past Projects and Portfolio: A quick search of their company or personal name can tell you a lot. Look for press releases, portfolio pages on their website, or news articles mentioning past deals. This will reveal the asset classes they prefer (e.g., multifamily, industrial) and the typical scale of their projects.

- Typical Investment Size: Are they known for writing $50,000 checks or $5 million checks? There’s a huge difference. Knowing their sweet spot helps you determine if your deal is a fit. Pitching a small private investor on a massive institutional-grade deal is almost always a waste of everyone's time.

- Online Presence and Reputation: What are people saying about them? Check forums like BiggerPockets or listen for chatter in local real estate circles. A lack of an online footprint isn't necessarily a red flag, but a history of negative comments or public disputes certainly is.

The best partnerships are built on a foundation of shared goals. An investor laser-focused on stable, cash-flowing assets has a completely different mindset from someone chasing high-risk, value-add opportunities. Knowing this upfront prevents you from pitching the wrong deal to the right person.

The Initial Conversation and Key Questions

Your first call should feel more like an interview than a pitch. Remember, you're interviewing them just as much as they're evaluating you. You want to gauge their expectations and see if their investment criteria actually line up with what you can deliver.

Let them do most of the talking. People love to talk about their own experiences and strategies. By asking smart, open-ended questions, you not only get the intel you need but also start building genuine rapport.

Questions to Gauge Their Mindset:

1. "What does your ideal investment opportunity look like right now?" This question is gold. It reveals their current focus on asset class, market, and desired returns.

2. "What's your preferred level of involvement in a deal post-closing?" This tells you if they want to be a completely hands-off partner or if they expect regular updates and a say in big decisions.

3. "What are the most important metrics you look at when evaluating a deal?" Are they driven by cash-on-cash return, IRR, the equity multiple, or something else? Their answer tells you how to frame your numbers.

4. "How has your investment strategy shifted over the past year?" This is a great way to understand their current market sentiment and how risk-averse (or aggressive) they're feeling.

Understanding these preferences is everything. As you get more experienced, you'll see how important it is to align your pitch with what an investor is actually looking for, a point we also cover in our guide on how to find private investors.

Understanding the Bigger Economic Picture

No investor makes decisions in a vacuum. Their appetite for risk and their geographic focus are heavily influenced by broader economic trends. Factors like interest rates, inflation, and market stability are always on their mind. For example, after recent inflation spikes and higher debt costs, global real estate prices have largely stabilized, and the prospect of future rate cuts is renewing some confidence. You can explore a deeper dive into the 2025 global real estate outlook to see how this cautious optimism varies.

Bringing this kind of awareness into your conversations shows you’re more than just a deal-finder—you're a strategic partner. It demonstrates that you understand the forces shaping their world, allowing you to frame your opportunity in a way that directly addresses their current concerns and goals. That makes your proposal far more compelling.

Common Questions About Finding Investors

Jumping into real estate investing always stirs up some tough, practical questions. Getting solid answers is the only way to move forward with real confidence. Let's tackle some of the most common things I hear from people trying to find capital.

What’s the Fastest Way to Find My First Investor?

If you want speed, you need a two-pronged attack. First, get yourself to your local Real Estate Investment Association (REIA) meetings regularly. Second, start working your existing professional network—hard. This combination gives you the best shot at a quick connection.

REIA events are where you’ll find the people actively writing checks and closing deals in your specific market right now. At the same time, you should be telling your trusted contacts—your accountant, your lawyer, even old colleagues you respect—that you're looking for partners for a real estate venture.

A warm introduction from someone who already knows and trusts you is gold. It’s the single most effective way to cut through the noise and get an investor’s serious attention.

How Should I Approach an Investor When I Don't Have a Deal Yet?

Think relationship, not transaction. Your goal is to ask for advice, not money. This approach completely changes the dynamic and puts you on more of an equal footing.

Instead of a generic pitch, try something specific that shows you've done your homework. For example, you could say, "I've been really impressed with the multifamily properties you've acquired in the downtown core. I'm analyzing that market myself and would love to get your take on where you see it heading."

This does a couple of brilliant things for you:

* It shows respect for their experience and proves you’re not just spamming a list.

* It opens the door to a real conversation. When you do find that perfect deal, you're no longer a stranger—you're a familiar face who valued their insight.

What Are the Biggest Red Flags in a Potential Investor?

You have to be on high alert for warning signs. A bad partnership can be far worse than no deal at all. The most glaring red flags almost always come down to a lack of transparency and professionalism.

Watch out for anyone who balks at providing proof of funds. That's a huge one. Also, do your homework—a track record of messy lawsuits or failed projects is a clear signal to proceed with caution, or not at all. Another major red flag is anyone trying to rush you into a decision before you can do your own due diligence.

Pay close attention to their communication style. Are they evasive? Unprofessional? A solid partner will be direct, professional, and will expect you to vet them just as thoroughly as they vet you.

Tired of juggling spreadsheets to manage your deals and investors? Homebase offers an all-in-one platform designed to handle fundraising, reporting, and investor relations seamlessly. This lets you focus on what you do best: finding great deals. Find out how it works and get started with Homebase.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

The Ultimate Rent Roll Sample Guide for Real Estate Investors

Blog

Unlock property performance with our rent roll sample. Learn to analyze deals, verify income, and master real estate syndication with our expert guide.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.