How to Evaluate Investment Opportunities

How to Evaluate Investment Opportunities

Learn how to evaluate investment opportunities with a proven framework. Get actionable advice on financial analysis, market cycles, and risk assessment.

Domingo Valadez

Sep 7, 2025

Blog

If you want to evaluate real estate deals like a pro, you need a system. A repeatable, consistent framework is the only thing that separates disciplined investing from pure guesswork. It's about digging into an asset's financial health, understanding its place in the market, and getting real about the risks before you ever write a check.

Build Your Investment Evaluation Framework

Jumping into a deal without a process is a surefire way to get inconsistent results and take on risks you never saw coming. Think of your evaluation framework as a pre-flight checklist; it ensures you never skip a critical step, no matter how exciting a deal might seem on the surface.

This is the core of mastering the investment decision-making process. You’re not looking for a magic formula. Instead, you're building a system that forces you to look at every single deal through the same critical, unbiased lens. It’s your best defense against emotional decisions driven by hype or the fear of missing out.

When you have a solid framework, you gain the confidence to spot a genuine opportunity and—just as importantly—the discipline to walk away from a bad one.

The Three Pillars of Your Framework

A strong framework doesn't have to be overly complex. In my experience, it really boils down to three fundamental pillars. Get these right, and you're ahead of 90% of investors out there.

Before you get bogged down in the details of a specific property, you need a quick way to vet the opportunity. This table summarizes the three essential components I look at first.

The Three Pillars of Investment Evaluation

Each pillar forces you to answer a critical question about the deal, ensuring you have a holistic view before moving forward.

Let's quickly break down what each of these pillars really means in practice.

- Financial Dissection: This is where you get your hands dirty with the numbers. You’re tearing apart the pro-forma to analyze key metrics that determine profitability, cash flow, and overall financial stability. The numbers have to tell a compelling story.

- Market Context: No property exists in a vacuum. This pillar is all about understanding the bigger picture—local economic trends, the competitive landscape, and any regulatory shifts on the horizon. A great property in a dying market is still a bad investment.

- Risk Assessment: Finally, you have to play devil's advocate. This means looking past the glossy marketing materials to uncover what could realistically go wrong. What happens if interest rates spike? Or a major employer leaves town? You need to know how these scenarios would impact your capital.

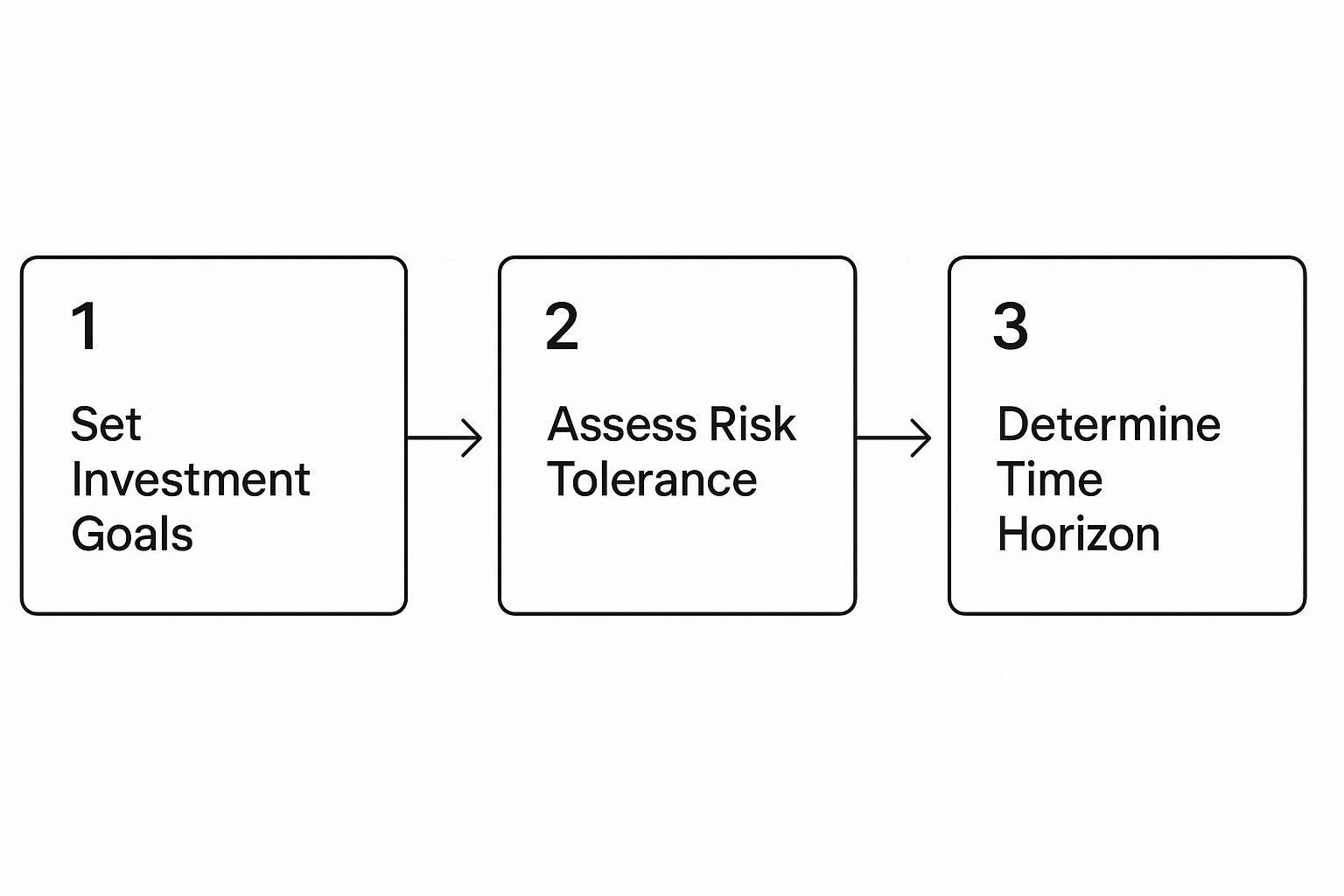

The visual below illustrates how you can start defining your personal investment criteria, which is the very first step before you even begin analyzing specific deals.

Starting with this self-assessment ensures your evaluation framework is perfectly aligned with your own financial goals and risk tolerance from day one.

Look Under the Hood with Financial Analysis

Before you even think about putting money into a deal, you need to get comfortable with the numbers. A slick pitch deck can promise the moon, but the real story is always buried in the financial statements. This is where you roll up your sleeves and see if the investment's engine is actually running smoothly.

Digging into the financials helps you answer one simple, crucial question: Does this deal actually make sense on paper? It's about more than just a potential profit. You need to understand the cash flow, the property's efficiency, and what your money is really doing over the long haul.

For any real estate investment, a handful of core metrics will tell you almost everything you need to know. Don't let yourself get lost in a sea of data points. Just focus on the big ones that truly impact your wallet.

Key Metrics Every Real Estate Investor Should Know

When you're sizing up a rental property, your entire analysis really boils down to cash flow and profitability compared to what you put in. There are three metrics I always come back to for this.

- Return on Investment (ROI): This is the classic profitability yardstick. It simply measures your total profit (or loss) against the investment's initial cost. Think of it as the 30,000-foot view of how an asset performed.

- Cash-on-Cash Return: For income-focused investors, this is the holy grail. It measures the annual cash you get back (before taxes) against the actual cash you pulled out of your pocket to buy the place. It answers the most important question: "For every dollar I put in, how many cents do I get back each year?"

- Internal Rate of Return (IRR): This one is a bit more advanced, but it’s a powerhouse. IRR calculates the annualized return over the entire life of the investment. Crucially, it accounts for the time value of money—the simple fact that a dollar today is worth more than a dollar a year from now.

A high Cash-on-Cash Return is great, but if the IRR is low, it could be a red flag that long-term growth is weak. You need to look at these metrics together to get the full story.

A Real-World Example: Analyzing a Rental Property

Let's walk through a common scenario. You're eyeing a small multifamily property, and the seller hands you a pro-forma that looks almost too good to be true. It probably is. Your job is to pick it apart.

First, check the income. Are the rents they're projecting realistic for that neighborhood, or are they wishful thinking? A quick look at comparable listings will give you the real answer. Then, attack the expenses. Are they conveniently forgetting to budget enough for maintenance, property management, or vacancies? A classic move is to project 100% occupancy—something that almost never happens in the real world.

Let's say the property costs $500,000, and you're planning to put down $100,000 in cash. After you've done your own homework and adjusted their numbers to reflect reality, you figure the annual pre-tax cash flow will be about $8,000.

Now, you can calculate your Cash-on-Cash Return:

($8,000 / $100,000) = 8%

Suddenly, you have a clear 8% figure you can use to compare this deal to any other opportunity that comes your way. To really get good at this, it's worth learning how to Master Ratio Analysis, which gives you a much deeper understanding of a deal's financial health.

This kind of systematic approach turns your evaluation from a gut feeling into a data-driven decision. You start to spot the red flags—like inflated rents or skimpy expense budgets—that can turn a "sure thing" into a money pit. Building this financial confidence is the bedrock of learning how to evaluate investment opportunities like a pro.

Read the Market and Economic Indicators

A fantastic property with stellar financials can still turn into a money pit if the economic tide turns against you. It's like a sailor checking the weather before a long voyage; a savvy investor always reads the broader market and economic indicators before putting capital at risk. This big-picture view helps you ground your strategy in reality, not just the glossy projections in a sponsor's pitch deck.

This macro-level analysis is a non-negotiable part of evaluating any investment opportunity. It keeps you from buying at the absolute peak of a market cycle or getting blindsided when a shift in the economy changes the entire game. For example, a multifamily property might cash flow beautifully today, but if local job growth is grinding to a halt, you could be looking at a future vacancy problem.

Tune Into Key Economic Signals

You don't need a doctorate in economics to get a solid read on the market. By focusing on a handful of key indicators, you can get a surprisingly clear picture and anticipate potential headwinds or tailwinds for your investment.

Think of these as the vital signs of an economy's health.

- Gross Domestic Product (GDP): This is the broadest measure of economic health. When GDP is consistently growing, it signals an expanding economy—which usually translates to more jobs, higher wages, and stronger demand for all types of real estate. A shrinking GDP, on the other hand, is a major red flag.

- Employment Data: Always dig into job growth reports and unemployment rates, especially at the local MSA (Metropolitan Statistical Area) level. A city with a diverse and booming job market is a much safer bet for a rental property than a town where the single largest employer is starting layoffs.

- Inflation Rates: Inflation is a silent killer of returns. It erodes purchasing power and can dramatically increase a property's operating costs, from maintenance supplies to utility bills. High inflation also tends to get the attention of central banks, which brings us to the next critical point.

The Power of Interest Rates

Of all the economic factors out there, interest rates have one of the most direct and potent effects on real estate performance. When central banks hike rates to fight inflation, borrowing gets more expensive. This immediately cools the real estate market by pricing out homebuyers and making it tougher for investors like us to finance new acquisitions.

The impact is real and well-documented. Long-term global investment data reveals that the annualized return on U.S. stocks was 9.4% during easing cycles—when central banks were cutting rates. But during hiking cycles, when rates were rising, those returns plummeted to just 3.6%. This powerful dynamic shows why you have to assess the macro backdrop; you can find more insights about these global investment returns and how they affect different asset classes.

Understanding the current interest rate environment isn't just a "nice to have"—it's a must. A deal that pencils out perfectly with 4% financing can quickly become a loser if rates jump to 7% before you can lock in your loan.

Identify the Current Market Cycle

Economies don't move in a straight line. They flow in cycles, and knowing where we are in that cycle—expansion, peak, contraction, or trough—gives you a huge strategic advantage.

- Expansion: This is the good-times phase, with strong GDP growth and low unemployment. It's generally a fantastic time for real estate as demand, occupancy, and rents all trend upward.

- Peak: The economy hits its maximum output, but growth starts to slow. Valuations are often stretched, and it’s a time to be extra cautious and not overpay.

- Contraction: Economic activity declines, and unemployment starts to tick up. This phase can present incredible buying opportunities for patient, well-capitalized investors.

- Trough: The cycle finally bottoms out before a new expansion begins. This is often the point of maximum financial opportunity—if you have the courage to buy when everyone else is selling.

When you layer this market cycle awareness over your property-level financial analysis, you create a much more resilient and complete evaluation framework. This macro perspective ensures you’re not just buying a good asset, but buying it at the right time.

Ground Your Projections in Reality with Historical Data

Let's talk about one of the biggest traps new investors fall into: chasing unbelievable returns. A deal memo lands in your inbox promising a 25% annual return. It sounds incredible, right? But without any context, that number is just a number. It's pure marketing.

This is where a dose of reality comes in handy. Before you get swept up in the hype, you need to ground your evaluation in historical performance. What has the market actually delivered over the last few decades? Knowing this gives you a powerful defense against making emotional, FOMO-driven decisions on a deal that just seems too good to be true.

When you have a solid grasp of what a "good" long-term return looks like, you can start to seriously question whether a deal's projections are aggressive, conservative, or flat-out fantasy. It's all about building a baseline so your expectations are guided by data, not just excitement.

What's a "Normal" Return, Anyway?

For most of us, the S&P 500 is the go-to benchmark for the stock market. It's a solid yardstick for what a diversified portfolio of big U.S. companies has historically paid out. Seeing these numbers helps you frame the potential returns of any other investment you're looking at, including real estate.

For instance, if you look at the S&P 500 since its inception way back in 1928, the average annual return works out to be about 8.55%. Now, that's a long-term number that smooths out a ton of volatility—we're talking wars, recessions, and massive bull runs. If you want to dig a bit deeper into these figures, you can learn about average stock market returns and see the full picture.

Here's a question I always ask myself: When a deal projects returns that blow long-term market averages out of the water, where is that extra return really coming from? And more importantly, what extra risk am I taking on to get it?

Why The Timeframe You Choose Matters

Looking at data across different time horizons is critical because it tells different stories. A 10-year average can look wildly different from a 30-year average, mostly because shorter periods can be heavily skewed by a recent bull or bear market.

Let's stick with the S&P 500 to see what I mean:

- The Last 10 Years (2014–2024): The market crushed it, averaging 11.01% a year. This was a fantastic bull run.

- The Last 20 Years (2004–2024): The average drops to 8.87%. That period includes the brutal 2008 financial crisis.

- The Last 30 Years (1994–2024): Here, the average is 9.33%, a timeframe that captures the dot-com bubble, the bust that followed, the 2008 crash, and all the recovery since.

See the difference? The market generally trends up, but returns can swing wildly depending on what's happening in the world.

This isn't about trying to predict the future with past data—that's a fool's errand. It's about establishing a realistic range of outcomes. This data-first approach lets you walk into any investment evaluation with a healthy dose of skepticism and a clear-eyed view of what’s actually achievable.

Master Risk Assessment and Due Diligence

Let’s be honest. Successful investing isn't about chasing the highest possible return; it’s about protecting your capital first. The most exciting projections in the world don't mean a thing if you haven't done the deep, often tedious, work of risk assessment and due diligence.

This is where you move past the flashy marketing brochure and really start pressure-testing the deal for weaknesses. Think of it as your primary defense against a bad investment. You're deliberately shifting your mindset from "How much can I make?" to "How much could I lose, and can I live with that?"

This isn’t just a box to check. It’s a systematic, repeatable process you need to tailor for every single deal. In real estate, that means a multi-faceted investigation.

A Practical Due Diligence Checklist

You have to look at the property from every possible angle—physical, financial, and legal. One overlooked issue can completely derail your investment.

Here's where to start digging:

- Physical Inspection: Don't just do a quick walkthrough. Hire a professional inspector to get into the guts of the building—the foundation, roof, HVAC, and electrical systems. For an apartment building, that means inspecting a solid sample of the units, not just the renovated model.

- Financial Audit: Never, ever take a seller's pro-forma at face value. Demand at least two to three years of actual operating statements and tax returns. You need to cross-reference every number with the current rent roll to make sure the income claims are real.

- Legal and Title Review: A title search is absolutely non-negotiable. This simple step confirms the seller has the legal right to sell and, more importantly, uncovers any liens, easements, or other nasty surprises that could become your problem later.

A classic mistake I see all the time is "deal fatigue." Investors get so far down the road they just want to close, so they start cutting corners on due diligence. This is exactly when a hidden lien or a huge deferred maintenance problem pops up right after you get the keys.

Understanding the Different Flavors of Risk

Risk isn't some big, scary monolith. It comes in several different forms, and a savvy investor knows how to spot each one. In real estate, you're primarily dealing with four types:

- Market Risk: This is the big-picture stuff you can't control—a local recession hits, interest rates spike, and suddenly property values and rental demand take a hit.

- Credit Risk: This one's simple: the risk that your tenants stop paying rent. A rock-solid tenant screening process is your best defense.

- Liquidity Risk: Real estate is not a stock you can sell in seconds. This is the risk that if you need your cash back now, you won't be able to sell the property quickly without taking a major financial hit.

- Operational Risk: This covers everything that can go wrong in the day-to-day management of the property. Think burst pipes, a bad property manager, or unexpected repairs.

Thinking about risk in the context of time is helpful. Look at the U.S. stock market: the probability of a positive return on any single day is just 56%. But stretch that out to a ten-year period, and it jumps to 95%. Over twenty years, it's 100%. This shows how a longer time horizon can smooth out volatility, a principle that applies just as well to real estate.

If you want to go deeper on capital protection, check out these essential strategies for risk management in trading. While it's written for traders, the core principles are universal. In any real estate deal, all your findings should be meticulously documented in your formal evaluation, which is often summarized in what’s known as an investment memorandum for real estate.

Common Questions I Hear About Evaluating Investments

As you start digging into how to size up investment deals, the same questions tend to surface time and again. These are the practical, gut-check concerns that hit every investor right before they're about to write a check. Let's tackle a few of the most common ones head-on.

Is There One "Magic" Metric I Should Focus On?

I get this one a lot, and the honest answer is no. There's no single "best" metric because what matters most is completely tied to your personal investment goals. Your strategy is what tells you which numbers to obsess over.

For example, a real estate investor laser-focused on generating monthly cash flow is going to live and die by the Cash-on-Cash Return. That metric tells them, in plain English, how much cash they're getting back each year for every dollar they put in. It's the North Star for an income property.

On the other hand, someone buying stocks for long-term growth might care far more about the Price-to-Earnings (P/E) ratio and revenue growth. They're playing a different game—capital appreciation over many years, not immediate income.

The smartest move is to use a handful of metrics that all point toward your specific investment thesis. A value investor will hunt for a low P/E, while a dividend investor will zero in on the dividend yield and payout ratio to make sure that income stream is solid.

How Do I Know When a Deal Is "Too Risky"?

This is a deeply personal question. The answer really depends on your age, your financial situation, and frankly, how well you sleep at night when the market gets choppy. An investor in their 20s can, and probably should, take on significantly more risk than someone who's five years from retirement.

Here’s a practical rule I follow: never put more money into a single high-risk asset than I can afford to lose completely. It's a simple gut-check that prevents you from making a catastrophic mistake that could wreck your financial future.

Ultimately, the best tool for managing risk isn't a single metric, but a strategy: diversification. By spreading your capital across different asset classes (like stocks, bonds, and real estate) and within different sectors, you build a buffer so that one bad bet doesn't sink the whole ship.

How Can I Spot a Scam?

Learning to spot a scam often just comes down to pattern recognition. Fraudulent deals almost always wave the same red flags. Your healthy skepticism is your best defense.

Be immediately suspicious of any investment that promises "guaranteed" high returns with little to no risk. That's the oldest trick in the book.

Here are a few other massive warning signs I always watch for:

* High-pressure sales tactics pushing you to "act now before it's too late!"

* A total lack of professional, clear documentation, like a prospectus or a private placement memorandum.

* An investment strategy so complex that the person selling it can't explain it in simple terms.

Always do your own homework and independently verify the credentials of the person or company you're dealing with. And never, ever forget the golden rule: if it sounds way too good to be true, it is.

Ready to manage your real estate deals and investors with a professional, all-in-one platform? Homebase simplifies everything from fundraising to distributions, so you can focus on finding your next great opportunity. See how it works at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.