Investment Memorandum Real Estate: Create Deals That Win

Investment Memorandum Real Estate: Create Deals That Win

Master investment memorandum real estate documents that secure funding. Real-world insights from successful developers who've closed deals.

Domingo Valadez

Jun 14, 2025

Blog

What Actually Makes Investors Say Yes

Let's be honest, a poorly written investment memorandum is like trying to sell a Ferrari with a rusty Yugo brochure. It's just not going to happen. I've seen amazing properties get overlooked because of a dull memorandum, and I've seen less-than-stellar properties generate serious buzz thanks to a compelling narrative. The secret? It's not just about the numbers; it's about connecting with investors on an emotional level. You're not selling bricks and mortar; you're selling a vision.

The Power of the Narrative

Investors are drowning in opportunities. What makes one stand out from the rest? Often, it's the story behind it. Dry facts and figures won't grab their attention. You need to create a narrative that resonates, one that makes them feel the potential of your project. This means highlighting what makes your property unique. Is it perfectly positioned for future growth? Does it tap into an emerging trend? Does it solve a problem?

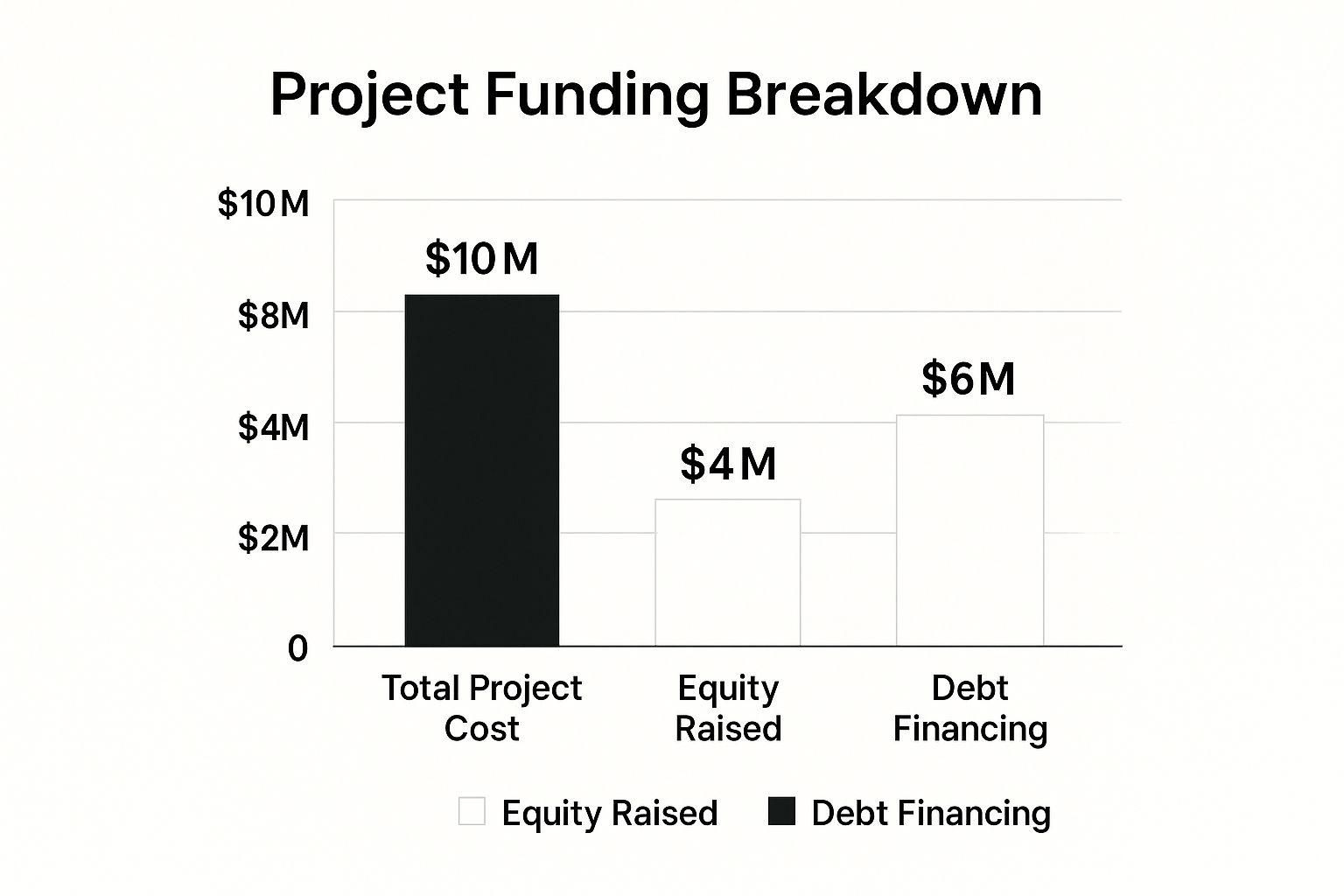

Take a look at the infographic above. It breaks down the capital structure of a sample project, clearly showing how the $10M total cost is split between $4M in equity and $6M in debt financing. This visual representation makes the deal easy to understand at a glance. The significant equity contribution also signals lower risk to potential investors.

Understanding Investor Psychology

Successful memorandums also understand investor psychology. Instead of focusing on risks, emphasize the inevitable upside. Highlight trends – demographic shifts, infrastructure developments, economic indicators – that support your projections. For example, the growing demand for data centers is a significant trend in the real estate market. PwC's Emerging Trends in Real Estate report offers valuable insights into these market forces. By tying your project to these bigger trends, you demonstrate a deep understanding of the market and reinforce the idea that this is a solid investment.

Showing, Not Just Telling

Don’t just say your property is well-managed; prove it with detailed financials. Your projections should be meticulous, transparent, and realistic. Clearly outline your assumptions, and include a sensitivity analysis to show you've considered different scenarios. Investors appreciate a conservative approach that acknowledges potential challenges. Overpromising rarely wins in the long run.

To help illustrate the differences between successful and unsuccessful memorandums, let's take a look at this comparison table:

Investment Memorandum Success Factors Comparison

This table summarizes some key distinctions that can significantly influence the success of your memorandum. A well-crafted document not only informs but inspires, transforming it from a static report into a dynamic tool for achieving your real estate goals. By blending a compelling story with solid financials and a keen understanding of market dynamics, you can create a memorandum that truly resonates with investors and helps you secure the funding you need.

Building Your Property's Irresistible Investment Story

This screenshot from Wikipedia gives you a glimpse into the sheer variety in real estate investments. Everything from family homes to massive commercial projects and raw land is in the mix. Seeing this really underscores why a powerful investment memorandum is so essential for making your opportunity stand out.

Every real estate investment memorandum (memorandum) needs to tell a story that investors can't put down. Now, this isn’t about making things up. It’s about strategically presenting your property in a way that clicks with potential investors. It's about going beyond the basic facts and figures and creating a real connection. You’re not just selling bricks and mortar; you're selling a slice of the future.

Crafting Your Narrative Hook

Think of your memorandum like a best-selling novel. It needs a gripping opening. This means showcasing what makes your property a star right from the get-go. Skip the generic market overview at the beginning; lead with your unique value proposition. Are you offering a multifamily property primed to take advantage of a hot rental market? Perhaps a strategically located warehouse ready to ride the wave of e-commerce growth? Grab their attention immediately.

I remember working on a memorandum for a historic downtown office building that was being converted into luxury apartments. We could have started with the typical square footage and cap rates, but instead, we opened with a story about the building’s fascinating history and its one-of-a-kind architecture. That instantly sparked investor interest and created a sense of exclusivity – exactly the tone we wanted to set.

Weaving in Market Trends

When you're putting together your investment story, taking a look at winning presentations can be incredibly helpful. These pitch deck examples can give you some great ideas. A well-crafted narrative seamlessly integrates key market trends into your property’s story. Don't just throw dry statistics at investors; show them how those trends directly affect their potential returns. Is the local population booming? Are there infrastructure projects on the horizon that will boost property values?

Showing investors that you've got a deep understanding of the local market adds so much weight to your projections. For example, if there's a rising demand for eco-friendly buildings and your property fits the bill, highlight it! This proves you've done your homework and understand the market forces at play.

Addressing Potential Concerns

Let's be real, every investment has risks. Acknowledging potential downsides head-on builds trust and shows you're prepared. Instead of brushing challenges under the rug, present them as manageable hurdles with clear solutions. If your property needs renovations, for instance, lay out a detailed plan with a realistic budget. This demonstrates a proactive approach.

This transparency shows potential investors you’ve thought things through, which boosts their confidence in your ability to handle whatever comes up. It also shows you're a reliable partner, which is just as crucial as the property itself. Something else you might find useful is our guide on crafting a powerful real estate offering memorandum. By crafting a compelling story, backing it up with solid market research, and addressing potential concerns upfront, you can transform your memorandum from a simple document into a persuasive tool that attracts and secures the investment you need. You’re not just presenting a property; you're presenting an opportunity they won't want to miss.

Financial Models That Inspire Confidence, Not Skepticism

Your real estate investment memorandum lives and dies by its financial model. It's the core piece investors use to assess potential returns and risks. But a solid, well-built model does more than just show numbers; it builds trust and demonstrates your expertise. This means crafting financial projections that inspire confidence, not skepticism.

Key Metrics That Matter

Every real estate deal has its quirks, but certain metrics consistently drive investment decisions. These key indicators give a snapshot of the property’s financial health and potential. Net Operating Income (NOI), for instance, tells you how profitable the property is before debt service. A healthy NOI suggests strong cash flow, music to any investor's ears.

The Internal Rate of Return (IRR) calculates the projected annualized return over the investment's lifetime. A strong IRR, in line with the investor's risk tolerance, is a major selling point. And finally, the capitalization rate (cap rate)—calculated by dividing NOI by the property value—quickly shows the property's income potential compared to its cost.

Building a Believable Model

Creating a believable financial model starts with realistic assumptions. Overly optimistic projections are a huge red flag. A conservative approach is much better. For example, when projecting rental income, consider potential vacancies and market fluctuations. Don’t assume 100% occupancy; factor in realistic downtime.

When estimating expenses, account for both predictable and unpredictable costs. Building in a contingency buffer for unforeseen issues shows foresight and tells investors you’re thinking ahead. Transparency is key here. Clearly outlining your assumptions lets investors understand your logic and assess the model's validity.

Presenting Multiple Scenarios

Showing a range of scenarios demonstrates that you understand the market's potential ups and downs. Include a base case, a best-case, and a worst-case scenario. This gives investors a clear picture of the potential outcomes. Avoid presenting too many scenarios, though. This can muddy the waters and make you seem indecisive.

Let's look at some key financial metrics you'll want to consider:

To help visualize these metrics across various investment types, check out this table:

Key Financial Metrics by Investment Type

Essential financial metrics and benchmarks for different real estate investment categories

This table gives you a general idea of the metrics and returns you might expect, but remember, every deal is unique. Use this as a starting point for your own research and due diligence.

The Power of Sensitivity Analysis

Sensitivity analysis is a powerful tool that boosts your model's credibility. It shows how changes in key assumptions—like vacancy rates or operating expenses—affect your projected returns. This demonstrates that you’ve thought through different outcomes and aren’t relying on a single, potentially fragile, projection.

Addressing Investor Questions

Be ready to answer tough questions about your model. Investors will scrutinize your assumptions and challenge your projections. Anticipate their concerns and have clear, concise answers ready. If your projected rental income seems high, for example, be ready to explain your market research and rationale. Handling these questions with confidence reinforces your expertise and builds trust. Remember, a well-crafted financial model isn't just about numbers; it's about showing your understanding of the market and your ability to execute. It’s the cornerstone of a compelling investment memorandum that attracts and secures the capital you need.

Market Research That Actually Moves The Needle

Generic market studies just won't cut it in your real estate investment memorandum. Investors want to see real depth of understanding, not just a surface-level glance. They need to feel confident you've done your homework. Think of it this way: you’re building a case, not just reciting facts.

Identifying Key Market Drivers

Ditch the generic market overviews. Instead, laser-focus on the specific drivers impacting your target property and its submarket. For example, don't just mention population growth. Dig deeper. Analyze how those new residents’ income levels and lifestyles align with your property type. Are young professionals moving in, driving up demand for high-end apartments? Or are families looking for larger homes in the suburbs? These nuances matter.

Here’s a real-world example: I was working on a memorandum for a self-storage facility. Instead of simply stating the overall market size for self-storage, we drilled down into the specific demographics. We highlighted the high percentage of renters and downsizing baby boomers – two groups that often drive self-storage demand. That targeted approach showed real market understanding.

Sourcing and Presenting Data Effectively

Data is crucial, but too much can overwhelm investors. Focus on the data points that directly support your investment thesis. And don't just dump a table of numbers on them! Present data visually. Use clear charts and graphs that highlight key takeaways. Think infographic, not spreadsheet. It's about making the information digestible and persuasive.

Your data sources matter, too. Using reputable sources like local government reports, industry publications (like the Urban Land Institute), and established research firms like CBRE adds serious credibility. It shows you’re relying on solid information, not just guesswork. Also, consider the increasing importance of sustainability. Investors are paying attention to energy efficiency and green building practices. This outlook report from Columbia Threadneedle Investments offers more insights into current real estate trends.

Making Macro Trends Personal

Macroeconomic trends can feel abstract. The key is to connect them to your specific opportunity. For instance, if interest rates are rising, explain how your property’s fixed-rate financing provides a buffer against future increases. If there’s a housing shortage, show how that translates into higher rental income and increased property value. Make it tangible for the investor.

Positioning Your Property

Where your property sits within the broader market is key. Is it in a booming submarket, or a stable, established area? Highlight the location’s strengths and how they boost the investment's potential. Don't be afraid to compare your property to the competition. Show how yours offers better features, a superior location, or stronger financials. Position it as the smarter choice.

Remember, effective market research in your investment memorandum isn’t just about gathering data; it’s about crafting a compelling narrative that convinces investors your property is the right opportunity, at the right time.

Handling Risk Without Scaring Away Capital

Smart investors get it: risk is part of the real estate game. Trying to pretend there isn't any makes you look naive, not optimistic. So how do you address the potential pitfalls in your real estate investment memorandum without sending investors running for the hills? It’s a balancing act: transparency and reassurance. You want to present risks as manageable hurdles, not deal-breakers.

Let’s explore how to do just that.

Categorizing and Quantifying Risks

One approach I’ve found helpful is categorizing risks based on likelihood and potential impact. Visualize a matrix. Low likelihood, low impact risks might just need a quick mention. But high likelihood, high impact risks? Those demand a more detailed discussion, along with clear mitigation strategies. A small delay in permitting is a lot less scary than a major shift in local zoning laws, right? This structured approach shows you've done your homework and considered the what-ifs.

This Wikipedia screenshot illustrates a standard risk assessment process. Notice how it emphasizes the cyclical nature of risk management. It's not a one-and-done deal. You start by identifying potential hazards and finish with communicating those risks and constantly monitoring them. This iterative approach keeps your risk assessment relevant and adaptable to changing circumstances.

Demonstrating Mitigation Plans

Don't just point out the risks; show how you plan to handle them. This is where you build real investor confidence. If your project hinges on securing specific permits, lay out your application strategy and any backup plans. What if market conditions shift and impact your projections? Explain your strategies for adapting to those scenarios. Thinking ahead reassures investors that you’re not just hoping for the best.

Here's a real-world example: I worked on a memorandum for a development project located in a flood zone. Big risk, right? Instead of ignoring it, we addressed it head-on. We detailed our flood mitigation measures, including elevated construction and better drainage systems. We were transparent, and we presented a comprehensive insurance plan. Surprisingly, this actually strengthened investor confidence. It showed we were prepared.

Using Risk Discussion to Differentiate

This might sound counterintuitive, but discussing risks effectively can set you apart from the competition. Many developers shy away from highlighting potential downsides. By being upfront, you show a level of honesty and savvy that builds trust and positions you as a reliable partner.

Contingency Plans: Showing Sophistication Without Negativity

Contingency plans are tricky. They show you’re prepared for different outcomes, but they can also suggest that you anticipate problems. The key? Present them strategically. Focus on demonstrating flexibility and adaptability, not pessimism. For example, if pre-leasing is critical, explain your alternative leasing strategies if initial targets aren't met. This shows you’re prepared for anything without implying a lack of confidence in the primary plan.

The bottom line? Handling risk in your real estate investment memorandum isn't about eliminating all uncertainty. It's about showing you can manage it. Transparency and preparedness are key to building trust and getting investors on board.

Design That Commands Respect And Gets Read

Your real estate investment memorandum could be the golden ticket to millions in funding, but even the most brilliant insights will fall flat if the presentation isn't up to par. Think of it like this: would a Michelin-star chef serve a masterpiece on paper plates? Your memorandum deserves better – it deserves a presentation that reflects the quality of the opportunity.

First Impressions Matter: Setting The Tone

The visual impact is the first thing potential investors see. A clean, modern font like Helvetica or Arial goes a long way. Skip the overly stylized fonts – they can come across as unprofessional. I generally stick to a consistent font size of 11 or 12 points for body text, using larger sizes for headings to create a clear visual hierarchy.

Color also plays a role. Black text on a white background is a classic for a reason. You can also incorporate subtle accent colors, maybe something from your company branding, for headings or dividers. Just avoid anything too bright or clashing that could distract from the content.

Structure For Success: Guiding The Reader’s Eye

A well-structured layout makes complex information digestible. Use clear headings and subheadings to break up the text and guide the reader. Bullet points and numbered lists are invaluable for presenting key features, investment highlights, or risk assessments. This makes the information scannable so busy investors can quickly grasp the key takeaways.

Whitespace is also important. Don’t cram the pages with text. Generous margins and spacing between paragraphs drastically improve readability and create a more professional feel. Imagine trying to read a dense wall of text—exhausting, right? Whitespace gives the reader's eyes a break. Effectively handling risk is crucial; for a deeper dive, explore strategies for drone risk management.

Visuals That Enhance, Not Overwhelm

Charts, graphs, and images can be incredibly powerful tools. A well-placed chart can often communicate financial projections far more effectively than a paragraph of numbers. However, don't go overboard. Too many visuals can clutter the document and distract from the core message.

My advice? Choose visuals strategically. Use them to highlight key trends, illustrate financial performance, or showcase the property's unique features. Make sure they are high-quality, professionally designed, and, importantly, relevant to the text. A blurry image can really undermine your credibility.

Consistency Is Key: Maintaining Professionalism

Consistency in formatting throughout the document is crucial. This includes everything from font sizes and headings to the use of bullet points and page numbering. Consistent formatting creates a polished, professional impression and shows attention to detail. Imagine a book where the font randomly changes – jarring, right? The same applies to your investment memorandum.

Creating Reusable Templates: Efficiency Without Sacrificing Quality

Once you've developed a design that works, create a template. This saves time and effort on future memorandums. You can adapt the template for different properties and investment opportunities, maintaining a professional look every time. Think of it as your secret weapon for impactful communication. A well-designed memorandum not only presents information but also conveys professionalism, credibility, and commitment. By mastering these design principles, you'll create a document that stands out and captures investors' attention.

Your Roadmap To Memorandum Success

Crafting a compelling real estate investment memorandum isn't about a rigid, step-by-step process. It's about weaving a story. Think of your memorandum as a tapestry of information, where the narrative, financials, market analysis, and risk assessment all come together to create a vibrant picture for potential investors. It’s like conducting an orchestra – each section plays a critical role in the overall harmony.

Managing the Creation Process

Let's be real, creating a winning investment memorandum is a marathon, not a sprint. A realistic timeline is essential. From the initial idea to the final presentation, it can take weeks or even months, depending on the deal's complexity. Allocate enough time for each stage – gathering data, crunching numbers, writing, designing, and reviewing. Trust me, rushing the process almost guarantees mistakes and a weaker final product.

Collaboration is your secret weapon. Bring your team and advisors in from the get-go. Tap into the expertise of your financial analysts, legal counsel, and marketing team throughout the process. This ensures everyone is on the same page and the final document reflects a unified vision. Just like a successful building project needs a variety of skilled tradespeople, a successful memorandum needs input from diverse perspectives.

Testing Your Memorandum

Before you unveil your memorandum to potential investors, try it out on a friendly audience. Share it with colleagues, mentors, or trusted advisors who will give you honest feedback. Don't be afraid to ask the tough questions. Are the financials clear? Is the story compelling? Does the design make it easy to read? This pre-launch review can reveal any weak spots and help you polish your message.

Handling Investor Presentations and Follow-Up

Presenting your memorandum is just as important as the document itself. Be ready to walk investors through the key points, answer their questions, and address their concerns. Rehearse your presentation and anticipate the questions they might ask. Confidence and clarity make all the difference.

After the presentation, a prompt thank-you note and any additional materials they requested are essential. Keep the lines of communication open throughout the due diligence process. Being responsive demonstrates professionalism and reinforces your commitment.

Common Pitfalls and How to Avoid Them

Even the best-laid plans can go sideways. Typos, grammatical errors, or inconsistencies in the financials can damage your credibility. Meticulous proofreading, accuracy checks, and double-checking data sources are your best defense. A polished document reflects your attention to detail and builds trust. A well-designed investment memorandum is crucial for projecting professionalism and inspiring confidence. Think about how important your investment presentation is, and consider the impact of professional website design.

Another common mistake is a one-size-fits-all approach. Investors have different priorities and risk tolerances. Understand their needs and tailor your presentation accordingly. A seasoned institutional investor might zero in on the IRR and cap rate, while a high-net-worth individual might be drawn to the property’s unique characteristics and potential for appreciation.

Continuously Improving Your Approach

After each deal, take time to reflect. What worked? What didn't? Get feedback from investors, even those who chose not to invest. What were their hesitations? What could have been presented more effectively? This feedback is gold. Use it to refine your approach and improve your future memorandums. Like any successful portfolio, your memorandum strategy should adapt to the changing market.

Seeking Professional Help

While you can handle some aspects of memorandum creation in-house, bringing in professional expertise can be invaluable. A professional writer or editor can ensure your document is clear, concise, and persuasive. A graphic designer can create a visually engaging and professional layout. And legal counsel is essential for navigating the legal and regulatory landscape. Knowing when to seek professional help can be a game-changer.

By following these tips, you can create a real estate investment memorandum that doesn't just inform – it inspires. Remember, you're not just showcasing a property; you're presenting a vision.

Ready to simplify your real estate syndication and create winning investment memorandums? Check out Homebase, the all-in-one platform designed to streamline fundraising, investor relations, and deal management.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.