How to Crowdfund Real Estate: Proven Strategies for Success

How to Crowdfund Real Estate: Proven Strategies for Success

Learn how to crowdfund real estate with expert tips on building investor networks and running successful campaigns that raise funds effectively.

Domingo Valadez

Jun 10, 2025

Blog

Understanding Why Real Estate Crowdfunding Actually Works Now

Let's face it, securing financing for real estate projects isn't what it used to be. Traditional bank loans? They're getting harder and harder to come by, with rising interest rates and ever-stricter lending requirements. It's a tough landscape for developers to navigate. That's why understanding real estate crowdfunding is so vital right now. It's a powerful alternative, opening up access to capital that might have been completely unavailable before. Think of it as having a readily available network of private investors, eager to support your ventures.

The Shift From Traditional Financing

I've personally spoken with many developers who've completely abandoned the traditional bank loan route, choosing crowdfunding instead. I remember one developer in particular, let's call him Mark, who was struggling to fund a small multifamily project. Months of frustrating negotiations with the bank, piles of paperwork, and still no loan. He decided to try crowdfunding, and within just a few weeks, he'd secured the entire $750,000 he needed. That kind of speed and efficiency can completely transform a project's trajectory.

Crowdfunding also frequently offers much more flexible terms than a typical bank loan. Developers often find they have greater control over the deal structure, tailoring it to the specific needs of each project. It's not just about raising money; it's about taking back control of the financing process. And that's where understanding what makes investors tick becomes really important.

The Investor's Perspective

So, why are investors so drawn to real estate crowdfunding? Diversification is a major factor. They can spread their investments across numerous projects, reducing their overall risk. Even relatively small investments provide access to potentially very profitable real estate opportunities they wouldn't normally encounter.

Furthermore, the real estate crowdfunding market has seen some serious growth, thanks to wider adoption and increasingly favorable regulations. By 2025, the global market is predicted to reach USD 22.1 billion, up from over USD 16.24 billion in 2024. This growth is fueled by things like global industrialization, which boosts commercial real estate activity, and the growing influence of cryptocurrencies. Looking even further ahead, the market is projected to continue expanding at a CAGR of over 45.1% between 2025 and 2037, potentially exceeding USD 2.05 trillion by 2037. Discover more insights here.

Riding the Wave of Regulatory Changes

The JOBS Act of 2012 was a pivotal moment for crowdfunding. It opened up participation to a broader range of investors, which further accelerated market growth. Now, more people than ever, from seasoned investors to everyday individuals, can participate in real estate investment opportunities.

But keep in mind, not all crowdfunding deals are the same. Residential flips, for instance, will attract a different kind of investor than, say, a large commercial development project. Understanding these nuances is key to structuring a successful crowdfunding campaign. It's all about finding the right fit between your project and the investor pool. And that brings us to another crucial aspect: selecting the right crowdfunding platform.

Finding The Right Platform Without Getting Burned

Choosing the right crowdfunding platform for your real estate project is a big deal. Think of it like laying the foundation for a building: a shaky one spells disaster, while a solid foundation sets you up for success. I’ve spoken with developers who’ve had both amazing wins and absolute horror stories, and the difference usually comes down to hidden fees, investor support, and the platform's investor base.

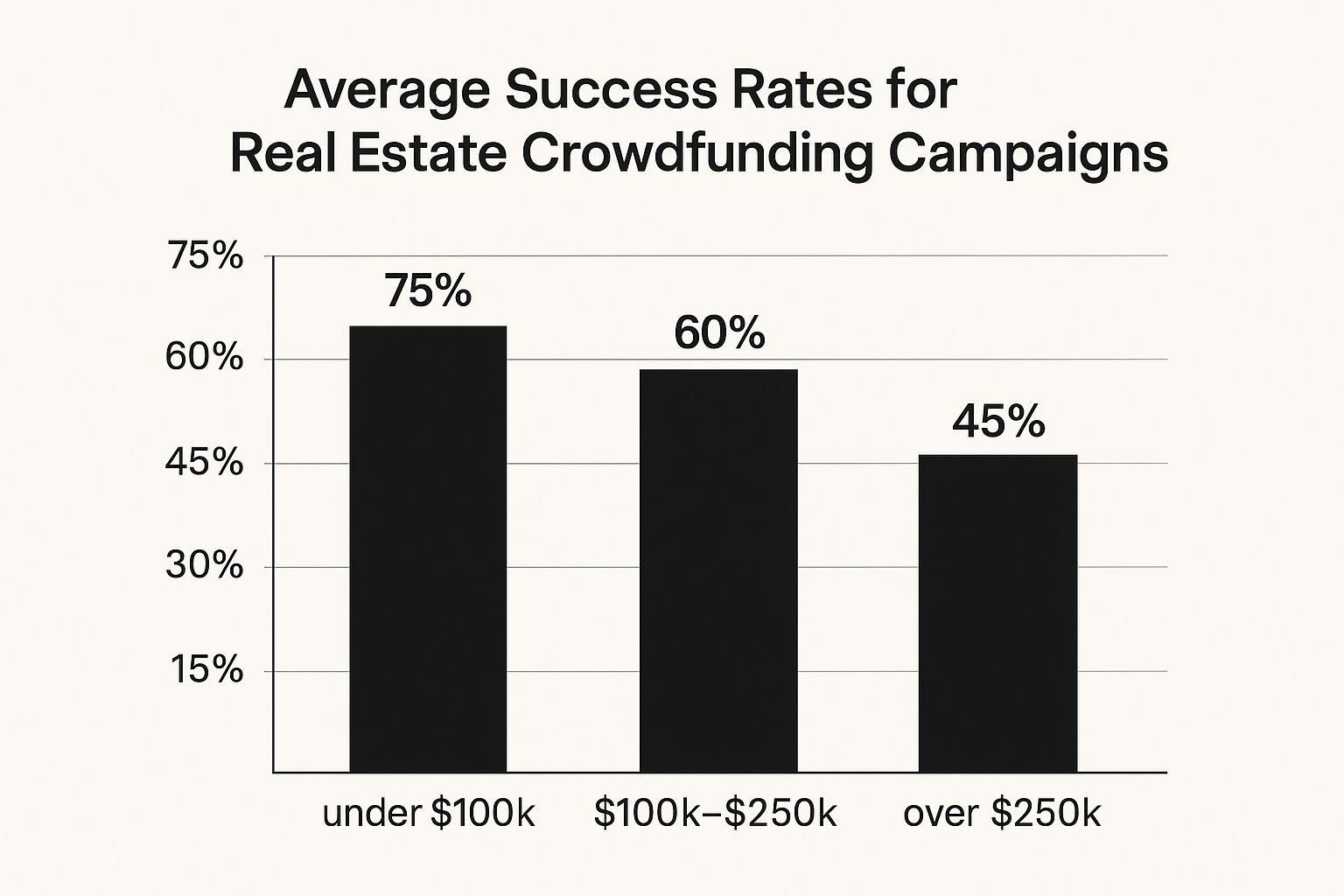

The infographic above shows average success rates for real estate crowdfunding campaigns based on funding goals. Projects under $100k have a 75% success rate, those between $100k and $250k drop to 60%, and campaigns over $250k sit at 45%. Smaller projects tend to do better, probably because investors see them as less risky with quicker returns.

Decoding the Fee Structures

Some platforms lure you in with low upfront fees, only to slam you with hidden charges later. I've seen these hidden fees gobble up 15-20% of the total raised capital. That’s painful! Before you sign anything, dissect the fee structure. Understand every single charge: listing fees, due diligence costs, closing costs, ongoing administrative fees—everything. Ask questions and don’t hesitate to negotiate.

Evaluating Investor Support and Quality

Marketing support matters. Some platforms actively promote your project, while others just list it and cross their fingers. Look for active investor communities, proven marketing strategies, and dedicated support teams to guide you. You might even consider broadening your horizons beyond dedicated real estate platforms and looking into general fundraising platforms for individuals.

Equally crucial is the quality of investors. Some platforms attract seasoned real estate investors actively hunting for deals, while others have a more casual crowd. Knowing the typical investor profile helps you tailor your campaign for maximum impact.

Vetting and Approval Processes

The approval process can be a real headache. Some are streamlined, taking just a few weeks, while others can drag on for months. Ask about their due diligence, average approval time, and project evaluation criteria. A slow, unclear approval process can kill your momentum.

Finding the Hidden Gems

Don’t ignore smaller, lesser-known platforms. They can be hidden gems! They often have highly engaged communities focused on specific real estate niches. Big names might work for some projects, but niche platforms can be goldmines for connecting with the right investors for specialized deals. Explore all your options.

Matching Platforms to Projects

The perfect platform depends on your project. A platform that's great for a $500,000 residential flip won’t be right for a multi-million dollar commercial development. Think about your target investor, project scale, and your own risk tolerance before deciding.

To help you compare, I've put together a quick overview of some major players:

(This table contains example data and needs to be populated with real information for specific platforms you choose to compare.)

Looking at the table above, you can quickly see how fee structures, minimum investments, and project types vary. It's all about finding the best fit for your individual needs.

Creating Deal Packages That Make Investors Reach For Their Wallets

This screenshot from the SEC website on crowdfunding highlights something crucial: regulation. It's there to protect investors and adds legitimacy to the world of real estate crowdfunding. This makes it more attractive to everyone, from seasoned pros to those just starting out. But let's talk about what really matters: building a deal package that shines. Having a great property is just the first step. It's how you present it that gets investors excited. I've seen it all – the good, the bad, and the ugly – and the campaigns that truly connect go beyond the numbers; they tell a story.

The Art of Compelling Financial Projections

Financial projections are essential, but let's be real – nobody believes pie-in-the-sky numbers. Overpromising will only backfire. Instead, aim for a clear, data-backed picture of potential returns. Think solid market analysis, not wishful thinking.

For example, if you're projecting a 12% annual return, show me the market data that supports it. What are similar properties earning? What's the growth looking like in the area? Don't just throw a number out there – back it up. Investors appreciate a realistic, well-researched forecast way more than an inflated one.

Storytelling: Connecting With Your Investors

Remember, you're not just selling bricks and mortar; you're selling a vision. Craft a narrative around your project. What's unique about this property? What problem are you solving? Who benefits?

I once saw a campaign for a mixed-use development that focused on revitalizing a neglected neighborhood. It wasn't just about buildings; it was about community impact. That story resonated with investors who wanted to be part of something bigger.

Visuals That Convert: Showing, Not Just Telling

High-quality visuals – photos, videos, even 3D renderings – can be game-changers. In real estate, a picture is worth a thousand words. Don't just tell investors what's special; show them. Highlight the key features and benefits visually.

Structuring Your Offering: Appealing to Diverse Investors

Not all investors are the same. Some prefer slow and steady returns, while others are comfortable with higher risk and potentially higher rewards. Structure your offering to cater to different risk appetites. Offering different investment tiers with varying levels of risk and reward broadens your reach and maximizes your funding potential.

The Legal Framework: Protecting Everyone Involved

Solid legal documentation is non-negotiable. It protects both you and your investors. Ensure you have all the necessary agreements in place, including operating agreements, subscription agreements, and private placement memorandums.

Setting Realistic Timeline Expectations

Things happen. Construction delays, permit holdups – it's all part of the process. Be realistic with your timelines and build in some buffer. Transparency and honesty build trust, even when things don't go exactly according to plan.

Addressing Investor Concerns Proactively

Investors often have questions about crowdfunded real estate. Address these concerns upfront. What are the exit strategies? What are the potential risks, and how will you manage them? Answering these questions builds confidence and shows that you've thought things through.

Creating a compelling deal package is about combining solid financials with engaging storytelling, high-quality visuals, a strong legal framework, and open communication. It’s about making investors excited about your project. Remember, successful real estate crowdfunding isn't just about finding the right property; it's about presenting it in a way that resonates with potential investors. It's about building trust and showing them that you're not just a developer, but a partner.

Building Your Investor Army Before You Need Them

The biggest mistake I see in real estate crowdfunding? Launching a campaign to crickets. It’s disheartening, and frankly, avoidable. Every successful crowdfunder I know prioritized relationships long before their project even existed. Think of it like this: you wouldn’t want to play a concert to an empty room, would you? You want a buzzing, excited crowd. That’s what we’re aiming for with your investor network.

Identifying Potential Investors in Your Existing Network

I bet you have more potential investors around you than you realize. Seriously! Friends, family, past colleagues, even your dentist – they might be interested in real estate crowdfunding. Think about who you know who’s ever mentioned investments, real estate, or looking for passive income. Start conversations. You’d be surprised at the hidden gems in your existing network.

Creating Content That Positions You as an Expert

Content is key to building trust. Share what you know about real estate. Offer insights on market trends, or talk about successful projects you've worked on. This shows you’re a knowledgeable developer, someone worth investing in. Build that credibility before you ask for a dime.

This isn't about spamming LinkedIn with pitches, though. Instead, focus on providing genuine value. Share insightful articles, host a webinar, or write a blog post on something relevant. Check out our guide on real estate syndication for more ideas. The goal? Establish yourself as an expert and build that all-important trust over time.

Nurturing Relationships That Convert

Building an investor network isn't about stacking business cards. It's about forging real connections. Engage with people on social media, show up at industry events, and follow up with anyone who shows interest. This demonstrates you're not just in it for the money; you genuinely care about building relationships. Think farming, not hunting. Cultivate the soil before you expect a harvest.

Leveraging Social Media Authentically

Social media is a powerful tool, but it's easy to overdo it. Don't be that person constantly pitching. Share useful content, jump into conversations, and foster a sense of community. Authenticity is crucial. Share your experiences, the hurdles you’ve faced, even your failures. People connect with realness.

Finding Value in Investor Meetups

Let’s be real, not all meetups are created equal. Some are fantastic networking opportunities, while others are thinly veiled sales pitches. Do your research. Look for events run by reputable organizations or ones focused on your specific niche in real estate. Remember, the point is connection, not just collecting contact info.

Building an Engaged Email List

A targeted email list is like gold. Offer something valuable in exchange for an email address – a market report, an ebook, access to a webinar. This lets you stay in touch, share valuable insights, and nurture those relationships over time. You’re building a community of potential investors genuinely interested in what you’re doing.

Connecting with High-Net-Worth Individuals

High-net-worth individuals (HNWI) can be a fantastic asset to your network. Think about attending exclusive events, joining relevant industry groups, or even working with a wealth advisor who can connect you with their clients. It's about strategically building relationships in the right circles.

The broader crowdfunding market, including real estate, is booming. Forecasts predict a USD 20.46 billion market globally by 2025, up from USD 17.72 billion in 2024. Projections even suggest a 17.3% CAGR from 2024 to 2029, reaching USD 38.71 billion! You can find more details here. This just underscores why building your network now is so vital – competition for those investment dollars will only get tougher.

Building your investor army before you need them is about cultivating relationships, showing your expertise, and getting people excited about your projects. It's like being a conductor, ready to lead a passionate group of investors when the music starts. It takes time and effort, but when your campaign goes live? You’ll be glad you put in the work.

Running Campaigns That Actually Hit Their Funding Goals

Launch day is exciting, sure, but it’s really just the beginning. Think of a successful real estate crowdfunding campaign like a marathon, not a sprint. It takes consistent effort, thoughtful responses to investors, and providing updates that keep the energy up without feeling pushy. I've learned this firsthand – these seemingly small things are absolutely critical to hitting those funding goals.

Engaging With Investors: Building Trust and Momentum

Answering investor questions isn't just about giving information; it’s about building real confidence. Each interaction is a chance to show your expertise and build trust in you and the project. A detailed, well-researched answer to even a simple question can show how prepared and professional you are. And once you've identified potential investors, consider borrowing a few pages from the digital marketing for startups playbook to really reach and engage them.

Regular updates are key, but don't overwhelm investors with unimportant details. Focus on significant progress and milestones. An update showing completed site prep, for example, is way more effective than daily reports on small tasks.

Navigating the Slowdowns and Creating Urgency

Every campaign has its slow periods. Times when funding plateaus and self-doubt starts to creep in. This is totally normal. The important thing is to stay proactive. Maybe you reach out to potential investors individually, host exclusive webinars, or highlight early successes to build some momentum.

It's also good to create a sense of urgency, but don't come across as desperate. Focus on the perks of investing early, like limited-time incentives or preferred equity positions. This encourages action without that artificial pressure.

Leveraging Social Proof: Turning Early Investors into Advocates

Your early investors can be your biggest cheerleaders. Feature their commitment and testimonials – this kind of social proof is incredibly powerful for attracting more funding. It taps into that “if they’re in, I want to be in too” mindset.

Handling the Unexpected: Pivoting and Maintaining Confidence

In real estate, things rarely go exactly according to plan. Construction delays, unexpected costs, market shifts – these are all part of the game. How you handle these challenges impacts not just your current campaign, but your reputation for future projects.

Be transparent with your investors. If there’s a delay, explain why, what you’re doing to address it, and reaffirm your commitment to the project. Open communication, even when delivering tough news, is essential for maintaining investor confidence. I know one developer who ran into significant permitting delays. Instead of hiding it, he proactively communicated with investors, explaining the situation and giving regular updates. While initially concerning, this transparency actually strengthened investor trust and built his reputation for honesty.

Communication Strategies and Professionalism

Building trust with skeptical investors takes more than just optimistic projections. It requires clear, consistent communication, professional responses to concerns, and a willingness to address valid objections directly. This shows you’re not just trying to raise money; you’re a reliable partner.

Maintaining Visibility: Staying Top-of-Mind

In a crowded marketplace, keeping your campaign visible is essential. Think targeted advertising, engaging on social media, or partnering with relevant influencers. The goal is to stay top-of-mind with potential investors throughout your campaign.

Tracking Your Progress: Data-Driven Decisions

Closely monitor your key performance indicators (KPIs). Track daily and weekly progress against your targets. This helps you identify potential problems early and adjust your strategy as needed.

To help you stay on top of things, I've put together a table of essential metrics to monitor:

(Remember, this table has example data – plug in realistic targets for your specific campaign.)

Running a successful crowdfunding campaign is all about consistent effort. It takes constant engagement, strategic communication, and a willingness to adapt. Use these strategies, and you’ll significantly increase your chances of reaching your funding goals and setting yourself up for future wins.

Keeping Investors Happy And Coming Back For More

Congratulations! You successfully crowdfunded your real estate project. But now the real work begins. Managing investors and delivering on your promises is the difference between crowdfunding pros and those who never raise another dollar. Many developers stumble here, thinking the hard part is over. It's not. Think of it like a restaurant – getting people in the door is one thing, but the food and service determine whether they'll ever come back.

Communication: The Key to Happy Investors

Regular communication builds trust. Create a clear communication schedule. I personally recommend monthly updates during the active project phases, then quarterly reports once things settle down. Focus on key milestones and tangible progress. Did the foundation get poured? Share pictures! Did you secure a key tenant? Let your investors know! This shows you’re actively managing the project and keeps them in the loop.

However, don't overwhelm investors with minor details. No one needs daily updates on paint colors. Focus on the big picture and important developments. It’s a balancing act. Keep them informed without overwhelming them. I know one developer who sends short video updates – they're personal, engaging, and way more effective than dry, text-heavy emails.

Financial Reporting: Transparency Builds Confidence

Clear, concise financial reporting is essential. Provide regular updates on the project's financial performance. Don’t hide key numbers in complicated spreadsheets. Present the information clearly and honestly, highlighting both successes and challenges. This transparency builds confidence in your management skills and reinforces your trustworthiness.

Handling Challenges: Honesty Is the Best Policy

Problems are inevitable in real estate development. A pipe bursts, a permit is delayed, material costs explode. How you handle these situations is crucial. Be upfront and honest with your investors. Explain the problem, your solution, and the potential impact. Even bad news, delivered honestly and promptly, strengthens trust in the long run.

Providing Value Beyond Financial Returns

Think beyond just the money. How else can you add value for your investors? Perhaps you organize exclusive site tours, offer early access to future deals, or connect them with other helpful resources. These small gestures can turn one-time investors into loyal supporters for your next crowdfunded project.

Legal Obligations: Know Your Responsibilities

Understand your legal obligations to investors. Make sure all necessary documentation is in place and meticulously maintained. This not only protects you, but also shows your professionalism and commitment to compliance.

Speaking of growth, the real estate crowdfunding market has massive potential. Estimated at USD 10.8 billion recently, it’s projected to hit USD 250 billion by 2030. This shows the growing interest in this accessible investment space. Find out more here.

Setting Up for Future Success: Streamlining Your Process

Use each campaign as a learning opportunity. What worked? What could be better? Implement systems that make future campaigns smoother and more efficient. This might involve using a dedicated platform like Homebase to manage investor relations, automate reporting, and streamline communication.

Turning Investors Into Advocates: Exceeding Expectations

Strive to exceed investor expectations. Respond to inquiries promptly, provide regular updates, and go the extra mile to show your commitment. Happy investors are more likely to reinvest in your future projects and become valuable advocates. They’ll tell others, attracting new investors and making future fundraising much easier. It's about building long-term relationships, not just closing a single deal. Remember, successful real estate crowdfunding is about more than just raising money; it’s about building a community of investors who trust you and believe in your vision.

Key Takeaways For Real Estate Crowdfunding Success

Your journey to successful real estate crowdfunding takes careful planning, the right platform, a compelling deal, and solid investor relationships. This isn't just theory – it's wisdom gleaned from developers who've raised millions and learned a lot along the way.

Platform Selection and Due Diligence

Picking the wrong platform can torpedo your project. Hidden fees can devour 15-20% of your funding, so really dig into each platform's fee structure. Don't fall for flashy marketing; go with platforms that have a proven track record and solid investor backing. You might be surprised how effective smaller, niche platforms can be, especially for specialized projects. For example, if your project is all about sustainable development, look at platforms that attract environmentally conscious investors.

Crafting Irresistible Deal Packages

Investors want realistic projections, not pie-in-the-sky promises. Back up your projected returns with hard market data and show how similar properties have performed. Tell a story that connects with your target audience. If your project has a positive community impact, highlight it! High-quality visuals are crucial. Don't just tell investors your property is beautiful; show them with professional photos and videos.

Building and Nurturing Your Investor Network

Start connecting with potential investors before you launch your campaign. Your existing network is a goldmine. Creating valuable content positions you as an expert and builds trust. Authentically engaging on social media and running targeted email campaigns nurtures those relationships. Remember, successful crowdfunding is about building genuine relationships, not just adding names to a list.

Managing a Successful Campaign and Investor Relations

Launch day is just the start. Keep investors happy and engaged with regular, transparent communication. Monthly updates during active phases and quarterly reports afterward are a good baseline. Don't shy away from addressing challenges – transparency builds confidence. And exceeding investor expectations will turn one-time backers into loyal supporters for your future projects.

Ready to streamline your real estate syndication and simplify investor management? Homebase gives you the tools and support you need, from automated fundraising workflows to dedicated investor portals. Ditch the spreadsheets and start scaling your business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.