Definition of Repositioning: definition of repositioning in investing

Definition of Repositioning: definition of repositioning in investing

Learn the definition of repositioning in multifamily real estate with practical strategies, models, and risk insights to boost profits.

Domingo Valadez

Feb 12, 2026

Blog

In the world of real estate investing, repositioning is all about transformation. It’s the art of taking an underperforming, often overlooked property and turning it into a sought-after asset that commands higher rents and, ultimately, a much higher valuation.

Think of it less like a simple facelift and more like a complete business turnaround for a building.

What Is Repositioning in Real Estate Investing

At its core, repositioning is a classic value-add strategy. Syndicators and investors who use this approach aren't just buying a property and hoping the market goes up; they are actively forcing appreciation through smart, targeted improvements. The entire goal is to change the property's story and its place in the market.

This often means taking a dated Class C apartment complex and, through a series of upgrades, elevating it to a solid Class B property that attracts a more stable tenant base willing to pay higher rents. It's a hands-on strategy that requires vision, capital, and execution.

The Core Components of Repositioning

A successful repositioning project isn’t just about slapping on a new coat of paint. It's a calculated effort to make changes that directly justify increased rental income and a higher overall property value. Let's break down what's usually involved.

To give you a clearer picture, here’s a quick summary of the key elements that make up a typical repositioning plan.

Core Components of a Repositioning Strategy

By getting these pieces right, an investor can fundamentally shift a property's identity.

By changing a property's physical condition, amenities, and management, syndicators can effectively create a new identity for the asset, allowing it to compete at a higher level in the local market.

This strategy is especially powerful in markets with older building stock. In a city like New York, for example, the average building age is around 82 years, which means countless properties are prime candidates for this kind of revitalization. You can learn more about how repositioning unlocks hidden potential in our guide to value-add real estate.

The principles are similar to other active investment strategies, where the value is created through direct action. For instance, the process of buying homes to flip for profit also hinges on transforming a property to unlock its hidden value.

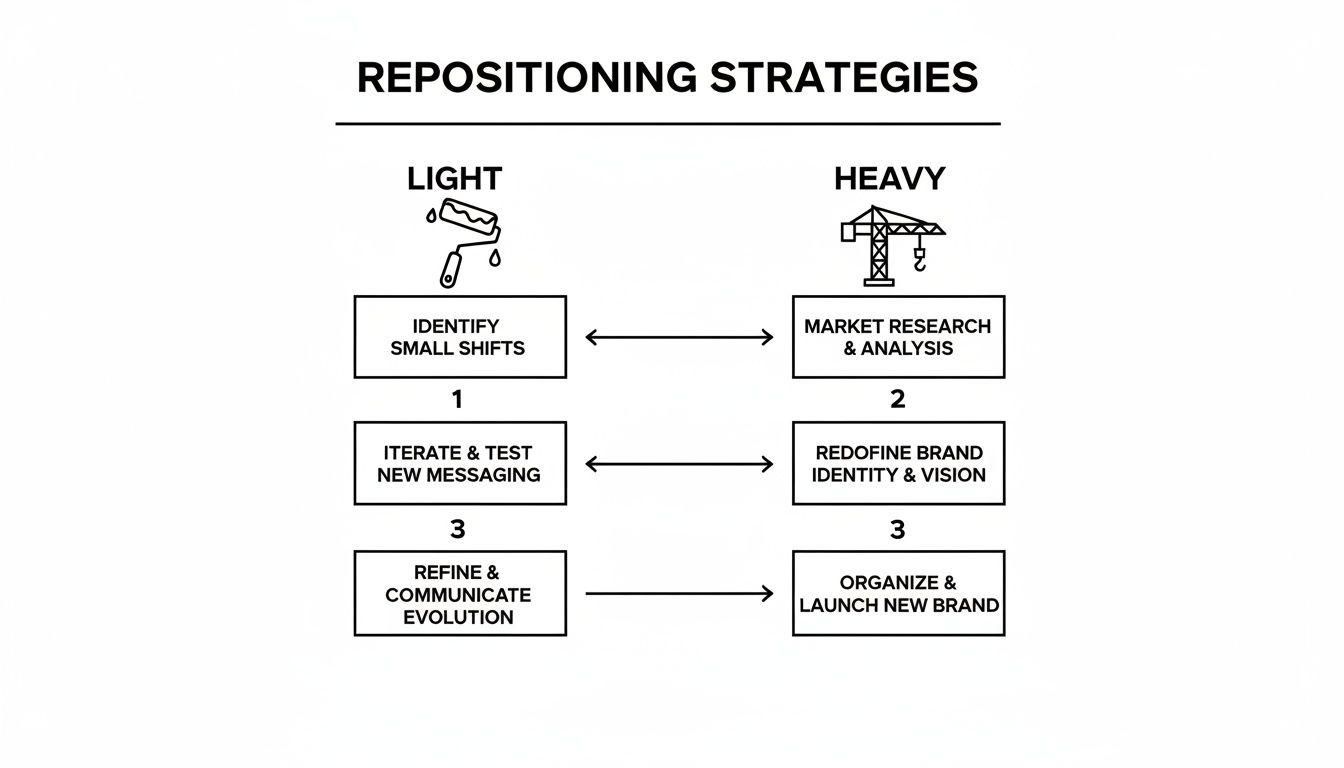

Light vs. Heavy Repositioning Strategies

Not all repositioning projects are created equal. Think of it like renovating a car: sometimes, all you need is a good detailing and some new tires. Other times, you're talking about a full engine rebuild and a brand-new paint job. In real estate, these transformations fall into two main camps: light and heavy.

Knowing which path to take is one of the most critical decisions in your business plan. It dictates everything from your budget and timeline to the kind of returns you can realistically expect.

The Light Repositioning Makeover

A light repositioning is essentially a cosmetic facelift for a property. The strategy here is all about making high-impact, visually appealing upgrades that don't break the bank. You're aiming for quick wins that boost the property's curb appeal and justify a bump in rent without taking the building offline.

Here are some classic examples of a light touch-up:

* Interior Upgrades: A fresh coat of paint, swapping out old carpet for durable luxury vinyl plank (LVP) flooring, and replacing dated light fixtures or cabinet pulls.

* Exterior Enhancements: Sprucing up the landscaping, painting the facade, or restriping the parking lot can make a huge first impression.

* Minor Amenity Refresh: Think adding a simple dog park, putting new furniture in the leasing office, or installing a community BBQ and picnic area.

This approach is faster, cheaper, and carries less risk. It’s the perfect play for a property with good bones that’s just a bit tired and suffering from some deferred maintenance.

The Heavy Repositioning Overhaul

A heavy repositioning, on the other hand, is a complete gut renovation. This isn't just about aesthetics; it's a deep, structural transformation that involves serious capital. You’re fundamentally changing the property to solve major functional issues or bring it up to a completely different standard in the market.

Heavy repositioning goes beyond the surface to tackle the core infrastructure of the asset. It’s about creating an entirely new product, which in turn allows for a significant leap in rent and a major boost to the property's overall value.

This is where the big-ticket items come into play:

* Replacing major building systems like the HVAC, plumbing, or electrical.

* Tackling major structural work, like a full roof replacement or foundation repairs.

* Reconfiguring floor plans, maybe converting outdated three-bedroom units into more desirable two-bedroom apartments.

* Adding brand-new, high-value amenities like a swimming pool, a modern fitness center, or a resident clubhouse.

A heavy repositioning is a marathon, not a sprint. These projects can easily take a year or more, demand a much larger budget, and come with a higher degree of risk. But for the right property and an experienced team, the payoff can be massive, often elevating the asset into a completely different class.

To make the differences crystal clear, let's break them down side-by-side.

Comparing Light and Heavy Repositioning

Ultimately, choosing between a light and heavy repositioning depends entirely on the property's condition, the market dynamics, and your specific investment goals.

The Syndicator's Playbook for Repositioning a Property

Pulling off a successful repositioning is about more than just having a renovation budget; it's a disciplined, step-by-step process. For syndicators, this is a well-honed playbook designed to turn a lazy, underperforming asset into a cash-flowing winner. The real work begins long before the first sledgehammer swings and doesn't stop until the property is fully leased up and stable.

Every phase presents its own unique hurdles and critical decisions. Knowing how to navigate this sequence is what separates a speculative gamble from a calculated, profitable investment.

Phase 1: Identifying the Opportunity

It all starts with finding a property with hidden potential. Smart syndicators are constantly hunting for assets in growing markets that are showing classic signs of neglect or sloppy management. Telltale signs include rents lagging far behind the market, high vacancy, or tired, dated units that just don't cut it for today's renters.

The objective here is to spot a building where the problems are fixable—something that a smart infusion of capital and a clear vision can solve. This initial hunt is all about measuring the gap between what the property is and what it could be.

Phase 2: Due Diligence and Capital Planning

Once a promising property is under contract, the real deep-dive begins. This is the due diligence phase, where the business plan gets built from the ground up. Syndicators commission exhaustive physical inspections to craft a detailed Capital Expenditure (CapEx) budget, itemizing every single planned upgrade, whether it's new vinyl plank flooring or a complete overhaul of the HVAC systems.

This is also when the deal gets underwritten. We're projecting realistic post-renovation rents and running the numbers on all the key investor metrics. A rock-solid financial model, plus a healthy contingency fund—usually 10-15% of the total reno budget—is non-negotiable before a single dollar is raised from investors.

A bulletproof CapEx budget is the foundation of a successful repositioning. Underestimating renovation costs is one of the fastest ways to derail a project and erode investor returns.

This diagram breaks down the two main strategies, from simple cosmetic lifts to a full-blown transformation.

As you can see, there's a clear difference between the lighter, quicker approach and the more intensive, capital-heavy strategy.

Phase 3: Execution and Management

With the deal closed and funds in the bank, it's go-time. The execution phase is all about managing contractors, hitting deadlines, and sticking to the budget. This is where skilled project management really shines; it's a constant battle to minimize unit downtime and keep costs from spiraling.

At the same time, the marketing and leasing teams are gearing up for the relaunch. They're creating fresh marketing materials, overhauling the online listings, and dialing in a leasing strategy to attract the right tenants at the new, higher price point.

Phase 4: Stabilization and Exit

The final leg of the journey is stabilization. As units are turned and renovations wrap up, the singular focus becomes leasing the property to a steady occupancy rate—the industry benchmark is typically 90% or higher—at our target rents. Once the property is consistently generating the projected Net Operating Income (NOI), we can officially call it stabilized.

From this point, the syndicator can finally execute the exit plan. This might mean refinancing the property to pull out the initial capital and return it to investors while continuing to hold for long-term cash flow. Or, it could mean selling the newly polished asset to another buyer, locking in the forced appreciation and delivering a big win for everyone involved.

Mastering the Financials of a Repositioning Deal

A great repositioning strategy is only as good as the numbers behind it. While having a compelling vision for a property is essential, the real work is in the financial modeling. This isn't your standard, run-of-the-mill property analysis; it's a detailed, forward-looking forecast that justifies every dollar of investment and proves the strategy to your partners.

It all starts with a ridiculously detailed renovation budget. I’m not talking about a ballpark guess. I mean a line-item breakdown of every single anticipated cost—from the new countertops and LVP flooring in 150 units to the new roof, landscaping, and that fancy new dog park you’re planning. This budget is the bedrock of your entire financial pro forma.

Projecting Future Value and Income

Once you have a firm grip on the costs, the next step is to figure out what the property can earn after the work is done. This means diving deep into a rental comparable analysis to see what the market will realistically bear for your newly upgraded units.

The whole point of this exercise is to calculate the future stabilized Net Operating Income (NOI). Think of the NOI as the engine that drives the property’s new, higher valuation. From there, you can determine the After Repair Value (ARV), which is simply what the property will be worth once all the dust settles and it’s fully leased up at the new rents. This answers the single most important question investors have: "What's the payoff?"

The true power of repositioning lies in this financial alchemy. You're strategically investing a calculated amount of capital to generate a much larger, disproportionate increase in NOI. That boost in income directly translates to a significant pop in the property's overall value.

To get this right, you have to know your metrics cold. A crucial first step is to learn how to calculate cap rate, as this is what directly links your projected NOI to the property's market value.

Key Metrics Investors Need to See

Your financial model needs to do more than just make sense to you; it has to speak directly to your investors. This means translating all your property-level assumptions into the key metrics that matter most to them. These are the numbers that will sell the deal.

- Internal Rate of Return (IRR): This shows the total annualized return, factoring in when cash is returned to investors.

- Equity Multiple: A simple, powerful metric. It shows how many times investors will get their initial capital back. A 2.0x multiple means they've doubled their money.

- Cash-on-Cash Return: This calculates the annual pre-tax cash flow investors receive based on the total cash they put in.

The financial impact of a well-executed repositioning can be massive. We've seen deals where targeted investments of just $100 to $250 per square foot lead to annual rental rate increases of $10 to $20 per square foot. That flows right to the bottom line.

Even better, adding energy-efficient upgrades like new windows or smart thermostats can slash operating expenses by over 15%, helping you recoup those capital costs even faster.

A solid pro forma weaves all these elements into a clear, data-driven story. It shows you’ve done your homework and gives both you and your investors the confidence to pull the trigger.

Real-World Examples of Successful Property Transformations

It’s one thing to talk about repositioning in theory, but seeing it happen in the real world is where the strategy really clicks. Case studies bring the numbers and business plans to life, showing exactly how smart capital and a clear vision can rescue an underperforming asset and turn it into a powerhouse investment.

These stories give us a practical blueprint for what a successful transformation actually looks like, from the first walkthrough to the final rent check. Let's walk through a classic scenario: a tired, 1980s-era apartment complex that’s seen better days, suffering from years of neglect and rents that are lagging far behind the market.

Case Study: The Overlooked Garden-Style Apartment

Picture a 150-unit, Class C garden-style community. Before we got our hands on it, the property was weighed down by problems that crushed its value and kept good tenants away.

The "Before" Picture:

* High Vacancy: Occupancy was stuck at just 82%, while the rest of the market was humming along at a healthy 95%.

* Dated Units: Think original shag carpets, peeling laminate countertops, and ancient, energy-guzzling appliances.

* Low Rents: The apartments were leasing for $250 less per month than updated, comparable properties just down the street.

* Poor Curb Appeal: The paint was faded, the landscaping was a mess, and the amenity package was non-existent.

This place was worn out and poorly managed. In other words, it was the perfect candidate for a value-add repositioning play. The goal wasn't just to patch things up; it was to completely reinvent the property's identity and attract a whole new caliber of resident.

The Repositioning Strategy and Execution

Our syndication team mapped out a heavy repositioning strategy, locking in a total renovation budget of $2.25 million—or $15,000 per unit. We projected an 18-month timeline to get all the work done and stabilize the asset.

The game plan was simple: invest in upgrades that people could see, feel, and would happily pay more for. This meant we had to hit both the in-unit finishes and the community amenities that would make the property feel like a totally new place to live.

Here’s what we did:

1. Full Interior Renovations: Every single unit was gutted and refreshed with new LVP flooring, granite countertops, stainless steel appliances, and modern lighting.

2. Exterior and Amenity Overhaul: We gave the entire property a fresh coat of paint, brought in professional landscapers, and converted an old, forgotten laundry room into a state-of-the-art fitness center.

3. Branding and Management: The complex got a new name, a sleek website, and—most importantly—a top-notch property management team focused on great service.

This isn't just for small apartment buildings. The same comprehensive thinking drives massive commercial projects, like the transformation of 1095 Avenue of the Americas in Manhattan. That project involved huge infrastructure overhauls that slashed operating costs and commanded higher rents. Smart investors also look for incentives like the EPAct 2005 tax write-downs for energy-efficient upgrades to squeeze even more return out of a deal. You can find more insights on these kinds of smart repositioning strategies on Markets Media.

The "After" Results and Financial Impact

Fast forward 18 months, and the property was unrecognizable. The transformation was complete, and we had stabilized occupancy at an incredible 96%.

Thanks to the modern units and desirable new amenities, we were able to raise average rents by $300 per unit. That huge jump in rental income sent the Net Operating Income (NOI) soaring, which in turn gave the property's valuation a massive lift. It was a textbook example of forcing appreciation through a well-executed repositioning.

How to Mitigate Risk in Repositioning Projects

Let's be honest: the financial upside of repositioning a property is what gets everyone excited. But that potential comes hand-in-hand with a unique set of risks. This isn't like buying a stabilized, cash-flowing asset; you're stepping into the world of construction, leasing, and market timing. If you don't manage these variables, they can chew through your returns.

Success here isn't about avoiding risk entirely—that’s impossible. It’s about anticipating the pitfalls before they happen and building a business plan that’s resilient enough to handle a few punches. This is what separates a calculated, professional investment from a speculative gamble.

The Due Diligence Checklist for Value-Add Deals

For a repositioning project, due diligence has to be dialed up to eleven. It goes way beyond a standard property inspection because you have to pressure-test every single assumption baked into your plan.

Here's where you need to focus:

- Zoning and Permitting Verification: Before you even think about closing, you absolutely must confirm that the city will let you do what you want to do. A surprise "no" from the zoning board can stop a project dead in its tracks.

- Contractor Bidding and Vetting: Never, ever go with the first quote you get. You need multiple, competing bids from general contractors who have a proven track record of completing projects just like yours, on time and on budget. Check their references.

- Market Absorption Analysis: How fast are similar renovated units actually leasing up in the area? This is your reality check. If other landlords are struggling to fill their new units, you need to know why before you add more to the supply.

A non-negotiable part of any repositioning budget is the contingency fund. Seasoned operators will build in 10-15% of the total renovation cost just for the unexpected—because something always comes up, whether it's hidden rot behind a wall or a sudden spike in lumber prices.

Protecting Investor Capital with Foresight

Navigating a repositioning deal means you're constantly looking around corners, trying to see what’s coming next. This is more critical than ever, especially as older buildings become outdated. We’re seeing a massive shift in real estate, where office and retail assets now account for just 34% of transactions—a huge drop from their 54% average between 2013 and 2019. You can read more about how asset managers approach strategic repositioning on Datagrid.

Ultimately, protecting your investors' capital comes down to stress-testing your financial model against the worst-case scenarios. Ask the tough questions upfront. What happens if the renovation timeline gets pushed back by three months? What if you can’t achieve the target rents you projected? Running these fire drills early on is what forges a truly durable investment.

Answering Your Top Questions About Property Repositioning

Even with a solid strategy in hand, turning a plan into a successful project brings up a lot of practical questions. Let's tackle some of the most common things syndicators and investors ask when they're getting into the weeds of a repositioning deal.

How Do You Finance These Kinds of Projects?

Financing a value-add deal isn't like buying a stabilized, turnkey property. Lenders can't just look at the current, lackluster numbers; they have to buy into your vision for the property's future. This requires a different kind of financing.

- Bridge Loans: Think of these as a short-term financial "bridge" to get you from the property's current state to its future, stabilized value. Lasting one to three years, they are perfect for heavy repositioning because they often cover both the purchase price and the renovation budget in one package.

- Value-Add Financing: Many commercial lenders have loan products specifically for this kind of work. They often come with interest-only periods during the renovation, which is a huge help for cash flow while units are offline and not bringing in their full income potential.

The real key is finding a lender who gets it. You need someone who understands the definition of repositioning and has a track record of backing these projects. They'll be looking just as closely at your business plan and the projected After Repair Value (ARV) as they are at the current rent roll.

A great financing package for a repositioning isn't just about the money. It's about structuring the loan to match your project's timeline, giving you the breathing room you need to renovate, lease up, and stabilize the asset.

What’s a Realistic Timeline for a Repositioning?

This is a big one, and the answer completely depends on the scope of the project. Setting realistic expectations from the start is critical for both you and your investors.

A light repositioning—think cosmetic upgrades and modernizing finishes—can often be wrapped up within 6 to 12 months. This timeframe usually allows you to renovate units as they naturally turn over and get the property stabilized with new tenants at higher market rents.

On the other hand, a heavy repositioning is a marathon, not a sprint. When you're talking about major construction or overhauling core building systems, you should plan for a timeline of 18 to 24 months, and sometimes even longer, to get the job done and the building fully leased.

How Should You Keep Investors in the Loop?

During a long renovation, keeping investor confidence high is everything. The property might not be cash-flowing yet, and progress isn't always obvious from the outside. This is where transparent, consistent communication becomes your most powerful asset.

Great syndicators set up a communication schedule right from the beginning. This usually looks something like this:

* Monthly or Quarterly Updates: Send out detailed reports with plenty of high-quality photos and videos that actually show the work getting done.

* Budget vs. Actuals: Be transparent with the numbers. Show investors a clear breakdown of how you're tracking against the original capital expenditure budget.

* Leasing Velocity Updates: Share the good news as it happens. Report on how quickly the newly renovated units are leasing and, most importantly, the new rents you're achieving.

When you're proactive, detailed, and honest with your updates, you build a foundation of trust that keeps your investors confident and excited about the project's future.

At Homebase, we built an all-in-one platform to take the headache out of investor relations and deal management for real estate syndicators. From creating professional deal rooms and streamlining fundraising to managing investor updates and distributions, our software frees you up to focus on executing your business plan, not administrative tasks. Learn how Homebase can support your next repositioning project.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Founder's Guide to Real Estate Partnership Agreements

Blog

Build airtight real estate partnership agreements. Our guide covers key clauses, LLC vs. LP structures, and negotiation tactics for successful syndications.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.