How Do You Value Commercial Property A Syndicator's Playbook

How Do You Value Commercial Property A Syndicator's Playbook

Learn how do you value commercial property using proven methods. Our guide covers the income, sales, and cost approaches for smarter syndication deals.

Domingo Valadez

Jan 1, 2026

Blog

Valuing a commercial property isn't about pulling a single, magic number out of thin air. It’s about building a rock-solid, defensible case for what an asset is truly worth. For syndicators like us, this valuation is everything—it's the foundation of our entire deal and the bedrock of investor trust.

Getting it right means blending three distinct methodologies: analyzing cash flow, digging into market comparisons, and understanding the replacement cost. Mastering these isn't just a good idea; it's a requirement for putting a credible, compelling deal in front of your investors.

The Three Lenses of Commercial Property Valuation

The best way to think about valuation is as a process of triangulation. Imagine a three-legged stool—each leg is a different valuation method. You need all three for a stable, balanced conclusion. If you lean too heavily on just one, you risk getting a lopsided view that could lead to a disastrous investment.

Each of these "lenses" gives you a unique perspective on the property's value. When you combine their insights, you get a complete picture that considers the property's financial engine, its position in the current market, and its fundamental physical worth.

To give you a quick overview, here's how these three methods stack up.

Overview of Commercial Valuation Methods

By using all three, you can reconcile the different values to arrive at a well-supported final figure.

The Income Approach

For syndicators and anyone focused on cash flow, this is the main event. The Income Approach directly ties a property’s value to the money it puts in your pocket. The central idea is incredibly intuitive: what would a savvy investor pay today for the right to collect this property’s future stream of income?

This is the method that tackles the critical questions:

* How much net income is this property really producing each year?

* What kind of return are investors demanding in this specific market for this type of asset?

* Based on its performance, what is the property's true economic value?

We'll spend a lot of time on this one, especially on how to calculate the Net Operating Income (NOI) and apply cap rates—the lifeblood of commercial real estate analysis.

The Sales Comparison Approach

Often just called the "market approach," this method is your anchor to reality. It answers the most fundamental question in real estate: What are similar properties actually selling for right now? It provides an indispensable reality check against the numbers you generate with your financial models.

The process involves hunting down "comps"—comparable properties in the same area that have recently sold. You then make adjustments for any meaningful differences, like age, condition, or amenities, between the comps and your target property. It’s less about spreadsheets and more about what the real-world market is willing to pay.

A valuation without solid sales comps is just a hypothesis. The market provides the proof. This is what keeps you from overpaying based on optimistic income projections that just aren't supported by actual transaction data.

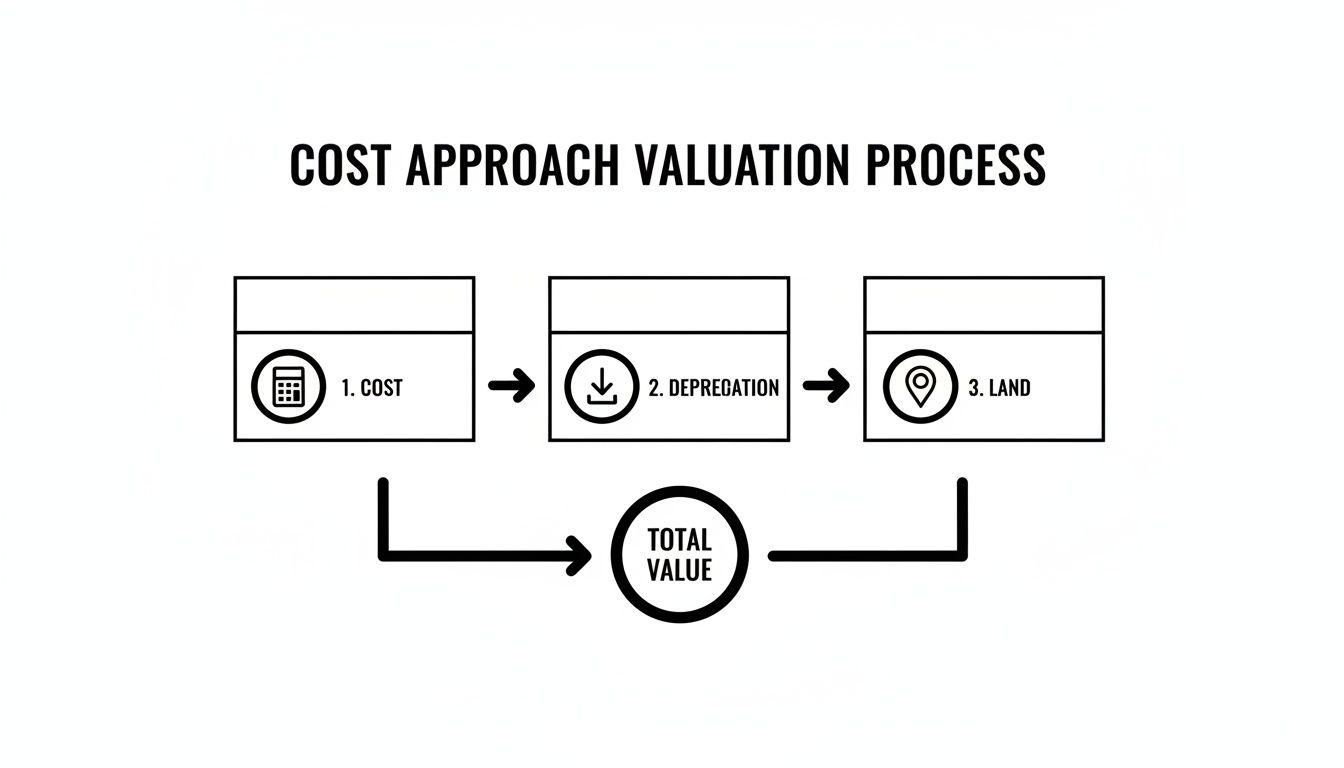

The Cost Approach

The third and final lens is the Cost Approach. The logic here is that no prudent buyer would pay more for an existing building than the cost to build a similar one from the ground up. The formula is straightforward: estimate the cost to build a replacement, subtract all forms of depreciation (physical, functional, and economic), and then add the value of the land.

While you won't use this as your primary method for a stable, older apartment complex, it becomes absolutely vital for:

* New construction projects where there’s no income history to analyze.

* Special-use properties like a school or a fire station where finding comps is nearly impossible.

* Insurance purposes and establishing a baseline value for an asset.

When you can confidently navigate all three approaches, you're able to synthesize the data into a single, highly defensible valuation. This is what builds investor confidence and positions your syndication for long-term success.

Mastering the Income Approach for Maximum Returns

For a real estate syndicator, cash flow isn't just a metric; it's the entire game. That's why the Income Approach is the most powerful tool in your valuation arsenal. It gets right to the heart of the matter by directly connecting a property's financial performance to its market value.

This method cuts through the noise and answers the one question every investor asks: "What is this stream of income actually worth?" It's the language we all understand because it mirrors how we evaluate the deal itself—based on the returns. If you want to build credible financial models that can withstand tough questions, mastering this approach is non-negotiable.

The Foundation: Net Operating Income

Before you can even think about value, you have to nail down the property's Net Operating Income (NOI). In simple terms, NOI is the property's annual income after you've paid all the operating expenses but before touching debt service (your mortgage) or income taxes.

Think of it as the pure, unlevered profit the asset generates on its own.

The formula looks simple enough:

Effective Gross Income (EGI) - Operating Expenses (OpEx) = Net Operating Income (NOI)

But don't be fooled. The devil is in the details here. A single sloppy calculation can throw off your entire valuation and lead you to overpay for a property.

Calculating Effective Gross Income

First things first, you need a realistic top-line number. Your starting point is the Potential Gross Income (PGI), which is what the property would earn if it were 100% occupied all year long. You'll pull this straight from the rent roll.

Now for a dose of reality. No property stays full forever. You have to subtract an allowance for vacancy and credit loss. Sellers love to show you financials with 0% vacancy, but that’s not the real world. A standard vacancy rate is usually between 5-10%, depending on the market and property type. This adjustment gives you the Effective Gross Income (EGI), a much more honest picture of your revenue.

Let's say you're looking at a 50-unit apartment building where the average rent is $1,500 a month. That gives you a PGI of $900,000 for the year. If you apply a conservative 7% vacancy rate ($63,000), your EGI drops to $837,000. That's the number you build your analysis on.

Scrutinizing Operating Expenses

Next up, you have to subtract all the costs of running the place. This is where your due diligence really pays off. You need to comb through the seller’s T-12 (trailing 12 months) operating statement and hunt for red flags or, just as importantly, things they left out.

Be sure to account for all the key operating expenses:

* Property Taxes: Often the biggest line item. Don't assume they won't be reassessed after the sale.

* Insurance: This includes both property and liability coverage.

* Utilities: Even if tenants pay their own, you still have common area costs.

* Repairs & Maintenance: For the day-to-day upkeep.

* Property Management Fees: A professional firm will typically charge 3-5% of EGI.

* Administrative & Marketing: The costs of doing business and finding new tenants.

When dealing with commercial leases, properly understanding tenant improvement costs is crucial for an accurate NOI. It’s also critical to separate true operating expenses from capital expenditures (CapEx). A new roof is a capital improvement, not a routine repair. CapEx gets budgeted for separately and doesn't belong in your NOI calculation.

From NOI to Value: Direct Capitalization

With a solid, defensible NOI in hand, you can now use the Direct Capitalization method. This is one of the quickest and most common ways to get a handle on a commercial property's value, turning its income stream into a price tag with a simple formula.

You can learn more about the specifics in our guide on the https://www.homebasecre.com/posts/income-capitalization-approach.

The formula is: Market Value = Net Operating Income / Capitalization Rate

The capitalization rate, or cap rate, is simply the rate of return an investor would expect on an all-cash purchase. It’s a direct reflection of the market’s feeling about the risk and potential of that asset, in that location.

A lower cap rate implies lower risk and commands a higher value, while a higher cap rate suggests more risk and a lower value.

For example, if a retail property generates an NOI of $500,500 per year in a market where similar properties are trading at a 6.54% cap rate, the math points to a value of $7,652,905.

The real skill here isn't the math; it's choosing the right cap rate. This isn’t a number you just pull out of thin air. It has to be derived from real market data. You find it by looking at recent, comparable sales (your comps), taking their NOI, and dividing it by their sale price.

If three similar apartment buildings down the street recently sold at cap rates of 5.0%, 5.2%, and 5.1%, then using a 5.1% cap rate for your target property is a very defensible assumption to make in your underwriting.

Key Takeaway: A tiny change in your cap rate assumption can have a massive impact on the final valuation. A 0.25% shift on a property with a $1,000,000 NOI changes the value by over $500,000. This is why accurately sourcing and justifying your cap rate is one of the most critical steps in the entire process.

Using Sales Coms as Your Market Reality Check

While the Income Approach tells you what a property could be worth based on its numbers, the Sales Comparison Approach grounds your analysis in what the market is actually paying. It’s an essential reality check.

This method answers the most fundamental question in any deal: what have similar properties nearby sold for recently? It stops you from falling in love with your own pro forma projections. Think of it as the voice of reason, ensuring the value you’ve calculated on paper aligns with the real-world decisions of other savvy investors.

Without this step, your valuation is just a well-argued theory. With it, it becomes a defensible market position.

Sourcing and Selecting True Comparables

The first job is to hunt down the right "comps." This is more art than science, demanding you look beyond simple metrics like asset class and zip code. A genuinely comparable property needs to mirror your subject property across several key dimensions.

Your search for high-quality comps should be focused on these factors:

- Property Type and Class: You can't compare an office building to a warehouse. Likewise, a shiny new Class A multifamily complex isn't a good comp for a Class C property, even if they're right next door.

- Location and Submarket: All real estate is local. Your comps must be in the same submarket, dealing with the same traffic patterns, demographic shifts, and economic drivers.

- Size and Unit Mix: You have to compare apples to apples. A 200-unit apartment building operates on different economies of scale than a 20-unit building. For multifamily, the mix of one-bedroom versus two-bedroom units is also a huge factor.

- Age and Condition: A recently renovated property will always command a higher price than a 30-year-old building that's been neglected.

Finding this data usually means digging through public records, using subscription services like CoStar, and—most importantly—talking to local commercial brokers. They live and breathe this information every single day.

The Critical Art of Making Adjustments

Finding a perfect one-to-one comp is like finding a unicorn. It just doesn't happen. This is where the real skill comes in: making logical, data-backed adjustments to account for the differences between your property and the comps.

The goal is to adjust the comp’s sale price to reflect what it would have sold for if it were identical to your property. If your building has a brand-new roof but the comp has an old one, you’d make a positive adjustment to the comp’s price. On the flip side, if the comp sits in a superior location, you’d make a negative adjustment to its price to normalize the value.

A common mistake is to make adjustments based on gut feelings. Every adjustment must be quantifiable and defensible. Instead of just saying "better location," you might determine that properties on that specific block trade at a 5% premium based on other market data.

The Sales Comparison Approach systematically values commercial properties by benchmarking against recent sales of similar assets. You adjust for variances in size, location, condition, and lease terms to derive a price per square foot (PSF) or per unit. If comparable office buildings in a major market sold for an average of $350 PSF, a 50,000 sq ft subject property might be valued around $17.5 million after you make tweaks for things like superior tenant credit or a newer build year. To keep your analysis sharp, it's vital to stay updated on all market activity, including things like the current trends in modular building sales.

The table below shows a simplified version of how this adjustment process looks on a grid.

Sample Sales Comparison Adjustment Grid

This grid helps you systematically apply your adjustments to each comparable, ultimately leading to a much tighter and more defensible value range for your subject property.

A Practical Example of Adjustments

Let's walk through a quick example. Imagine you're valuing a 100-unit apartment building. You find a comp that recently sold for $15 million, which breaks down to $150,000 per unit.

Here’s how you might adjust that price:

- Condition: Your property has renovated kitchens in every unit, but the comp doesn't. You estimate this adds about $8,000 in value per unit. So, you adjust the comp’s price up by $800,000.

- Occupancy: The comp sold at a stellar 98% occupancy, while your property is stabilized at a more typical 94%. This suggests slightly higher risk, so you adjust the comp’s price down by $300,000 to reflect that difference.

- Amenities: The comp has a swimming pool and your property doesn't. Based on other sales, you figure a pool adds roughly $5,000 per unit in value. You need to adjust the comp’s price down by another $500,000.

After running the numbers, the comp's adjusted sale price becomes $15,000,000 + $800,000 - $300,000 - $500,000 = $15,000,000.

In this specific case, the pluses and minuses happened to cancel each other out, leaving the adjusted value at $150,000 per unit. By repeating this process with several different comps, you’ll arrive at a narrow range of values, giving you a powerful, market-driven conclusion for your final valuation.

When Does the Cost Approach Actually Make Sense?

While the Income and Sales Comparison approaches are the workhorses for valuing most properties you'll come across, the Cost Approach is a specialized tool that's absolutely critical in certain situations. Don't dismiss it.

The logic behind it is simple and powerful: a smart buyer isn't going to pay more for a property than it would cost them to build a brand-new, comparable one from scratch.

This method gives you a solid baseline rooted in physical reality, not just market buzz or pro forma spreadsheets. When other valuation methods get fuzzy or fall flat, the Cost Approach can provide a much-needed anchor for your analysis. Knowing when to pull it out is a sign of a seasoned investor.

Ideal Scenarios for Using the Cost Approach

You won't run a Cost Approach analysis on every deal. But for some, it's not just helpful—it's the only game in town.

Here’s when this method really shines:

- Brand-New Buildings: If a property was just built or is still under construction, you have no rent roll to analyze (so no NOI) and no direct sales comps. The Cost Approach is often the primary valuation method here.

- Unique, Special-Use Properties: Think about valuing a church, a public school, a government building, or a highly customized industrial plant. These assets rarely sell, making comps nonexistent. They also don't generate income in a traditional sense, so the Income Approach is a non-starter.

- Getting an Insurance Quote: This is the go-to method for figuring out "replacement cost" for insurance. It answers the question: If this building burned to the ground, what would it cost to rebuild it today?

- When Other Data is Sketchy: In thinly traded markets with few recent sales or when you’re looking at a property with messy, unreliable financials, the Cost Approach gives you a stable data point when the others feel like guesswork.

Breaking Down the Formula

The calculation itself is straightforward. It’s a three-part equation that pieces together the cost to build, the impact of aging, and the raw value of the land itself.

The formula is: Value = Replacement Cost - Accumulated Depreciation + Land Value

Let's unpack what each of these really means.

Estimating Replacement Cost

This is your starting point. You need to figure out the all-in cost to construct a building with the same utility as the one you're analyzing, but using today's materials, labor rates, and building codes. This isn't just lumber and concrete; it includes architect fees, permits, contractor profit—the works.

Appraisers subscribe to services that provide hyper-local, per-square-foot construction cost data. As a syndicator, you can get a solid estimate by talking to a few local general contractors or by using industry-standard cost manuals like the Marshall & Swift Valuation Service.

Accounting for Accumulated Depreciation

Depreciation is the subtle, and sometimes not-so-subtle, loss in value a property suffers over time. It's not just the accounting term you see on a tax return. In the Cost Approach, you have to subtract this loss from your brand-new replacement cost. There are three kinds to look for.

Real-World Insight: Depreciation is more than just a leaky roof. A building can be perfectly maintained but have a terrible floor plan that no tenant wants (functional obsolescence) or be located next to a newly opened waste treatment plant (external obsolescence). A sharp analysis considers all three.

- Physical Deterioration: This is the one everyone thinks of—basic wear and tear. It’s the faded paint, the aging HVAC system, the cracked parking lot. It’s the physical decay from use and the elements.

- Functional Obsolescence: This is about outdated design. Imagine an office building with 8-foot ceilings and a maze of tiny offices when today's market demands open, collaborative spaces with high ceilings. The building "functions" poorly for modern needs.

- External (or Economic) Obsolescence: This is a loss in value caused by something outside the property lines. A new highway rerouting traffic away from your retail strip, a major local employer shutting down, or a change in zoning laws are all classic examples.

Determining Land Value

Finally, you have to add back the value of the land itself, as if it were a vacant lot ready for its "highest and best use."

The most common way to nail this down is to look for recent sales of similar empty lots in the area. This isolates the value of the location, a massive driver of any property's overall worth. By putting these three pieces together, you get a valuation grounded in the cold, hard facts of construction and location.

Synthesizing the Data into a Defensible Valuation

So, you've run the numbers using the Income, Sales Comparison, and Cost approaches. Now you're staring at three different values. Don't worry, that’s not a mistake—it's exactly what should happen in a thorough analysis.

The real art and science of valuation come together in this final step: reconciliation. This is where you thoughtfully weigh each approach to land on a single, defensible market value.

This isn't about simply averaging the three numbers. Anyone can do that. It’s about building a logical argument for why one method might be more reliable than another for your specific property. You need to assign weight to each approach based on its relevance and, just as importantly, the quality of the data you could find.

For a syndicator, this final synthesis is where you really earn your acquisition fee. It's the story you'll tell your investors, a story backed by a clear methodology that builds incredible trust and makes them feel confident in your deal.

Weighing the Three Valuation Approaches

How much weight you give each method really depends on the property itself. The asset’s characteristics and the strength of your data are your guiding lights here.

Think of it this way: if you're valuing a brand-new, fully-leased office tower in a thriving downtown core, the Income Approach is king. But if you’re looking at a quirky, vacant property like an old school or a shuttered church, the Cost Approach suddenly becomes much more relevant.

Let's walk through a classic scenario for a syndicator.

Scenario: You're underwriting a 10-year-old, 150-unit Class B apartment building. The property is 95% occupied with a great rental history, and you've found five nearly identical apartment comps that sold in the submarket within the last six months.

Here’s how I would probably weight the approaches:

* Income Approach (50% Weight): This is the star of the show. Investors are buying this deal for its cash flow. The stable occupancy and reliable financials make your NOI calculation rock-solid. This is the primary driver of value, period.

* Sales Comparison Approach (40% Weight): With a handful of recent, highly relevant comps, this approach provides an essential reality check. It tells you exactly what other sophisticated buyers are paying for similar income streams in this market, right now.

* Cost Approach (10% Weight): Since the building isn't brand new and it's not a unique "special-use" asset, what it would cost to build today is less important than what it earns. It’s still useful as a sanity check—it gives you a theoretical ceiling on value—but it's not the main consideration.

Explaining this weighting shows investors you know what actually drives the property's worth.

Key Takeaway: Reconciliation isn't just a math problem; it's the narrative that justifies your final number. A well-reasoned weighting proves you’ve looked at the asset from every angle and made an informed, professional judgment—not just plugged numbers into a spreadsheet.

The Cost Approach, while less weighted in our scenario, has its own process. It’s built on estimating replacement cost, subtracting all forms of depreciation, and then adding in the value of the land.

This method essentially builds the property's value from the ground up, providing a fundamental baseline that is especially critical for new construction or unique assets.

The Final Report and Building Investor Trust

The last piece of the puzzle is putting it all down on paper. Your final valuation report becomes the backbone of your investment summary or Private Placement Memorandum (PPM). Simply stating your final value isn't enough—you have to show your work.

Your detailed report should clearly lay out:

* Key inputs for the Income Approach, including your rent roll analysis, operating expense assumptions, and the cap rate you chose (and why).

* A list of the comparable sales you used, complete with the adjustment grid showing how you accounted for differences in size, age, location, and condition.

* The Cost Approach calculation, detailing your sources for replacement cost data and your depreciation breakdown.

* Your final reconciliation, explicitly stating the weighting applied to each method and the logic that got you there.

This level of transparency does far more than just justify your purchase price. It’s a powerful tool for building trust. When your limited partners can see every assumption and follow your logic from start to finish, they feel like they're part of the underwriting process. This clarity demystifies the deal and gives them the confidence they need to write that check.

In the end, a detailed and defensible valuation is your best fundraising tool. It proves your expertise, showcases your diligence, and turns a subjective opinion into a data-driven conclusion that sets the stage for a successful syndication.

Got Questions About Commercial Property Valuation? We've Got Answers.

Even after you've mastered the three main valuation methods, you'll find that the real world throws curveballs. Every property has its quirks, and navigating these nuances is what separates the seasoned pros from the newcomers. Let’s tackle some of the most common questions that come up during the underwriting grind.

Getting these right isn't just about crunching numbers; it's about building the kind of deep expertise that gives investors confidence.

What's the Real Difference Between a Cap Rate and a Discount Rate?

This one trips up a lot of people, but the distinction is fundamental.

Think of a cap rate as a snapshot—a single picture taken on day one. It tells you the unlevered return you'd get on a property in its first year of operation. It’s used in the Direct Capitalization method and is perfect for a quick, back-of-the-napkin assessment. In the commercial real estate world, it's the universal language for "Is this deal priced right?"

A discount rate, however, is like a movie. It's used in a multi-year Discounted Cash Flow (DCF) analysis and accounts for the entire story of your investment over the holding period. It's a more complex figure that reflects your required rate of return, factoring in the crucial concept of the time value of money. You use it to pull all those future cash flows, plus the final sale, back to what they're worth today.

The Bottom Line: A cap rate values a single year's income. A discount rate values a whole stream of future income over time. A DCF is more dynamic, but the cap rate is how you’ll talk about deals every single day.

Where Do I Find Cap Rates and Sales Comps I Can Actually Trust?

Your valuation is only as good as the data you plug into it. Garbage in, garbage out—it's a cliché for a reason.

Your first call should always be to commercial brokers who live and breathe your specific market and property type. They're on the front lines and have the most up-to-date intel.

For your own digging, here's where to look:

* Data Services: You'll want access to the industry heavyweights. Subscription platforms like CoStar and LoopNet are the gold standard for verified sales comps and market-level cap rate data.

* Public Records: County assessor websites can be a good starting point for recent sales prices, but they rarely have the detailed financial data you need to make accurate adjustments.

* Your Network: This is an underrated goldmine. Build genuine relationships with local appraisers, lenders, and other investors. They often have the inside scoop on deals and transaction details that never make it to the big platforms.

How Much Does a Property's Condition Really Affect its Value?

Property condition isn't just about curb appeal; it has a massive, direct impact on the numbers across all three valuation methods.

Here's how it shakes out:

1. Income Approach: A building in rough shape means you're spending more on repairs and maintenance. You might also struggle with higher vacancy or have to offer lower rents. Every one of those things eats away at your NOI, which directly torpedoes the property's value.

2. Sales Comparison Approach: Let's say you're comparing your target property to a similar building that sold recently but is in much better condition. You can't just use that price as-is. You have to make a negative adjustment, essentially subtracting the cost of all the deferred maintenance from the comp’s price to make it a true apples-to-apples comparison.

3. Cost Approach: With this method, poor condition shows up as "accrued depreciation." The more beat-up the property, the larger the depreciation you have to subtract from the replacement cost, leading to a lower value.

What Are the Biggest Valuation Mistakes Syndicators Make?

It's painfully easy to get this wrong, but a few mistakes pop up again and again.

The single most dangerous error is falling in love with your own pro forma. Overly optimistic projections are the number one killer of deals and investor capital. This usually looks like assuming aggressive rent growth that the market can't possibly support or plugging in an unrealistically low "exit" cap rate five years down the road.

Another classic blunder is underestimating Capital Expenditures (CapEx). Forgetting to budget for the new roof you'll need in year three, the HVAC units on their last legs, or a parking lot that needs repaving can instantly turn a promising deal into a cash-draining nightmare.

Finally, relying on just one valuation method is just asking for trouble. You absolutely must triangulate your value using at least the Income and Sales Comparison approaches. If the two numbers are wildly different, it’s a massive red flag. It means you need to stop and dig much deeper into your assumptions before you even think about making an offer.

At Homebase, we help sponsors like you put the focus back where it belongs: on finding great deals and building incredible investor relationships. Our platform takes the tedious work of fundraising, investor management, and communications off your plate. You get to spend less time lost in spreadsheets and more time executing your business plan.

See how Homebase can streamline your next syndication

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.