Homebase vs. InvestNext: Which Real Estate Software Wins?

Homebase vs. InvestNext: Which Real Estate Software Wins?

Compare Homebase vs. InvestNext to find out which real estate investment software best fits your needs. Discover features, pricing, and more.

Domingo Valadez

Jun 26, 2025

Blog

When you're comparing Homebase vs. InvestNext, the choice really boils down to your operational scale and complexity. For smaller operators who need a direct, no-fuss way to run syndications, Homebase often hits the sweet spot. But for firms that are scaling up and need more power under the hood for investor relations and deep portfolio analytics, InvestNext offers a more robust set of tools.

Choosing Your Real Estate Investment Software

Picking the right real estate investment software is a critical decision. It’s not just a tool; it's the foundation for how you raise capital and how your investors perceive you. Both Homebase and InvestNext cater to distinct needs within the real estate world, and understanding their philosophies is key.

Homebase is built for the small-to-midsize operator who needs to syndicate deals without getting bogged down by enterprise-level features. It’s all about straightforward fundraising and clean investor relations. InvestNext, on the other hand, is geared toward operators who are growing and need more sophisticated automation, real-time performance metrics, and a single source of truth for communications. It’s also wise to think about how this platform will work alongside your other systems, like those you use for real estate invoice management.

Homebase vs InvestNext At a Glance

To cut to the chase, let's look at a high-level summary. This table gives you a quick snapshot of where each platform shines, who it's built for, and its general approach to pricing and features.

This gives you a solid framework for thinking about which direction to go. Now, let's dive deeper into what these differences mean in practice.

The Homebase user interface is a great example of its core philosophy. It's clean, modern, and designed to make potentially complex tasks feel intuitive.

As you can see, the dashboard gives sponsors immediate access to deals, investors, and key metrics without overwhelming them. The entire layout is built around simplicity, aiming to speed up fundraising and make day-to-day management a breeze.

A Real Syndicator’s Look at Core Features

Let’s move past the marketing checklists and get into what it’s actually like to use these platforms day-to-day. When you’re in the trenches of a deal, the real value of a platform isn't just a list of features, but how those features work together to get a deal funded and managed. This is where you'll see the biggest differences between Homebase and InvestNext.

From setting up a deal room to handling investor communications, every click matters. Let's break down how each platform handles these critical moments.

Setting Up a New Deal

When it’s time to launch a new offering, Homebase is all about speed and simplicity. The workflow is incredibly intuitive. You can get a new deal room live in minutes—upload your documents, set the funding target, and send invites to your investor list. It’s built for sponsors who need to move quickly and present a clean, professional offering without getting bogged down in configuration.

InvestNext, on the other hand, gives you more control right from the start. It's designed with more granular options for structuring the deal, like setting up different investor classes with unique terms. This depth is fantastic if you're juggling multiple, complex offerings, but it does mean there's a bit more of a learning curve compared to Homebase’s plug-and-play feel.

The Investor Subscription Experience

The journey from an investor showing interest to actually signing the subscription documents is where deals can stall. Homebase creates a polished, guided path that makes investors feel confident. The entire process, from KYC/AML checks to e-signatures, is smooth and automated, which is key to reducing friction and getting commitments over the line.

InvestNext offers a similarly solid subscription workflow but integrates it more tightly with its CRM. This allows you to build sophisticated, rules-based journeys. For instance, you can set it up to automatically show different offering documents or investment minimums based on an investor's accreditation status or how much they've invested with you in the past.

Key Takeaway: Homebase is your go-to for a universally clean and fast subscription experience that works great for everyone. If you need the power to create custom-tailored subscription paths for different types of investors, InvestNext has the edge.

Managing Complex Distributions

Distributions are another area where the two platforms reveal their different design philosophies. Both automate the calculations and payments, but how they handle complexity is the real story.

The main difference shows up when you start dealing with complex distribution waterfalls. Homebase is perfectly suited for the most common deal structures you see in real estate syndication—think preferred returns with simple equity splits. For the vast majority of syndicators, this is all you’ll ever need.

However, if your deals involve multi-tiered waterfalls, tricky promote calculations, or clawback provisions, you'll feel the power of InvestNext's financial engine. It was built from the ground up to model these sophisticated scenarios with a high degree of precision. This kind of detailed reporting is essential for maintaining trust with LPs in more complex deals. Your choice here really comes down to how complicated your deal structures are now—and how complicated you expect them to be in the future.

Digging into the Real Cost: Pricing Models and Total Cost of Ownership

When you're comparing Homebase and InvestNext, the sticker price is just the beginning. The real story is in the total cost of ownership. You need to understand how each platform's pricing will scale with your business and what sneaky fees might pop up down the line.

Homebase keeps things simple and predictable. It’s built on a straightforward flat-fee model, giving you unlimited deals, investors, and assets under management. For syndicators who need to forecast their expenses with absolute certainty, this is a huge plus. You won't get hit with a surprise bill just because you had a successful capital raise.

InvestNext takes a different route with a tiered pricing structure that grows with you. This gives you more flexibility, letting you pay only for the features you need right now. It also provides a clear upgrade path as your firm expands its operations.

How the Costs Play Out in the Real World

Let's look at a couple of common scenarios to see how these different pricing philosophies actually impact your bottom line. This should help you picture the financial side of the decision.

- For the First-Time Syndicator: If you're managing your very first deal with maybe 20-30 investors, Homebase's flat fee is incredibly appealing. You get access to all the core tools without having to stress about per-investor or per-deal fees. It's a low-risk way to get started.

- For the Growing Operator: Imagine you have a few deals under your belt and about 100 investors. InvestNext's lower-tier plans might be a better fit. You can start with the essentials and then upgrade when you’re ready for more advanced tools like complex waterfall modeling or deeper CRM integrations.

The Bottom Line: Homebase delivers cost certainty, which is perfect for operators who want predictable overhead. InvestNext offers cost flexibility, making it a great choice for firms that prefer their software expenses to align directly with their feature needs and operational growth.

You can really see this difference in their plans. InvestNext’s pricing can start as low as $99/month for a plan focused purely on fundraising and goes all the way up to a custom-priced Fund Admin tier. This shows how it’s designed to scale. Homebase is all about making core syndication easy, while InvestNext builds in features like white-labeled portals and debt management for users with more complex portfolios. Find out more about investment management software options.

Ultimately, when you analyze the true cost, you have to look past the monthly subscription. Think about potential transaction fees, charges for premium support, or data migration costs. Your choice shouldn't just fit your budget today; it should align with your financial strategy for the next three to five years.

Comparing Platform Usability and Investor Experience

Powerful features don't mean much if your platform is a headache to use or if the investor portal looks amateurish. When weighing Homebase vs. InvestNext, the user experience—both for your own team and for your limited partners—is a huge piece of the puzzle. A smooth, professional interface cuts down on your administrative workload and, just as importantly, builds investor confidence.

Homebase was clearly built with a clean, modern design in mind. It favors simplicity and ease of use, so new team members can get the hang of it quickly without much training. This same approach carries over to its investor portal. Information is laid out clearly and professionally, allowing investors to track their commitments and pull documents without feeling lost in a sea of data.

InvestNext, on the other hand, presents a more feature-dense interface. This is great for power users who want every function just a click away from the main dashboard. The trade-off? It can feel a bit more intimidating and might have a steeper learning curve for sponsors who aren't as comfortable with technology or are new to this kind of software.

The Investor Portal Showdown

Think of the investor portal as your digital handshake. For many of your investors, it’s the main way they'll interact with your firm after wiring their funds. How it looks and feels matters.

- Homebase: Aims for a minimalist, high-end feel. It’s designed to make the investor feel secure and well-informed without any clutter. This is perfect for sponsors who want to project a premium, straightforward brand image.

- InvestNext: Provides a more data-rich portal. Here, investors can dive deep into detailed performance metrics and analytics. This is a huge plus for more sophisticated LPs who crave granular data on how their investments are doing.

The real difference comes down to their core design philosophy. Homebase goes for an "Apple-like" simplicity, working on the idea that a clean, effortless experience builds the most trust. InvestNext is more like a financial terminal, prioritizing immediate access to data for seasoned investors.

Take a look at the InvestNext dashboard. It gives you a pretty comprehensive snapshot of investment activity and overall portfolio performance right away.

This screenshot really drives home the platform's strength in detailed reporting and analytics, making it a solid choice for sponsors managing complex portfolios with data-hungry investors. Ultimately, your decision hinges on the kind of experience you want to create: the elegant simplicity of Homebase or the data-dense environment of InvestNext.

So, Which Platform Is Right for You?

Okay, let's cut through the feature lists and get to the real question: which platform actually makes sense for your business right now? The best choice isn't about finding the software with the most bells and whistles. It's about aligning the tool with your current deals, your budget, and where you plan to be in a few years.

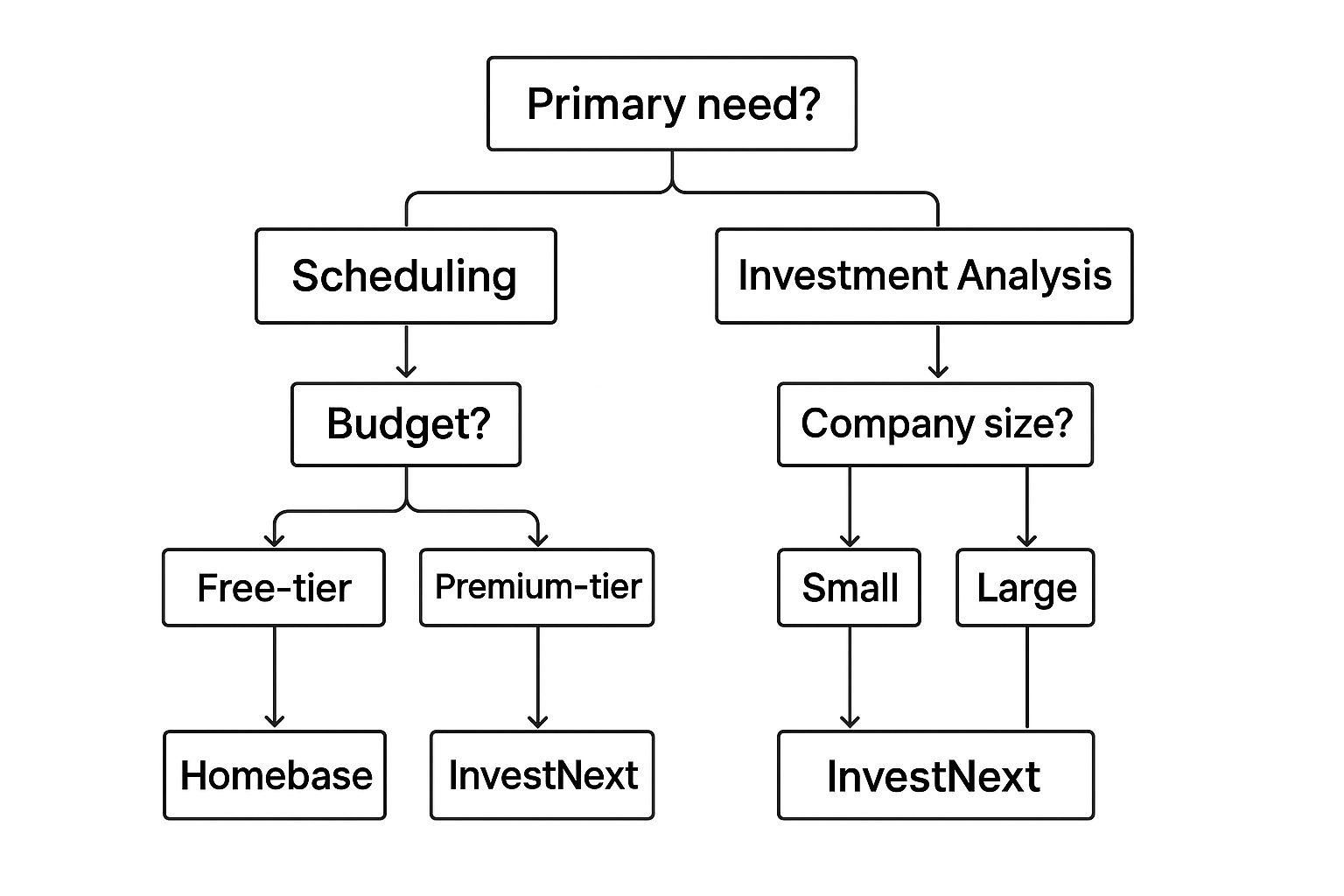

This decision tree breaks it down into the core questions you should be asking yourself.

As you can see, it really boils down to whether you need a straightforward, professional way to close a deal or a more powerful system for complex investment management.

For the First-Time Syndicator

Just getting your first couple of deals off the ground? Your world revolves around speed, simplicity, and looking credible without breaking the bank. You need to get your deal funded, fast, with a professional sheen that gives investors confidence.

This is exactly where Homebase shines. It was designed from the ground up for this exact moment in a syndicator's journey. You can spin up a polished, professional deal room in minutes, and the automated subscription process makes it incredibly easy for investors to commit capital. Plus, the flat-fee pricing gives you cost certainty, which is a huge relief when you're laser-focused on proving your business model.

For the Growing Operator

Once you start juggling multiple deals and a growing list of investors, you hit an inflection point. The simple tools that got you started begin to creak under the pressure. This is when you know you're outgrowing your initial setup.

This is the sweet spot for InvestNext. When you find yourself needing to automate K-1s for 100+ investors, model complex waterfall distributions, or deeply integrate with your accounting software, InvestNext has the horsepower you need. Its tiered pricing is designed to grow with you, allowing your software capabilities to scale alongside your operational needs. If your back office is starting to feel like a bottleneck, it's probably time to look here.

For a deeper dive into making this transition, our complete real estate syndication software guide is a great resource.

Situational Recommendation: If your deals are mostly straightforward syndications and you prioritize ease of use and predictable costs, Homebase is the clear winner. If you see complex fund structures and sophisticated investor management in your future, InvestNext is built for that path.

For the Established Fund Manager

Managing institutional capital or running multi-asset funds is a different ballgame entirely. At this level, sophisticated fund-level accounting, robust compliance features, and granular, auditable reporting are non-negotiable.

While both platforms cater to professional sponsors, InvestNext generally has the edge for established funds. Its capabilities in fund administration and detailed financial modeling are more aligned with institutional demands. The platform is better equipped to handle complicated entity structures and generate the kind of reports that will satisfy discerning LPs and their auditors. Your final decision should come down to a direct comparison of how each platform’s reporting lines up with your specific fund agreements.

Getting Started: Migration, Onboarding, and Support

Switching software is a big commitment, and it's about much more than just features. It’s a partnership. How you get your data moved over and the help you receive afterward can make or break the entire experience. This is a crucial part of the Homebase vs. InvestNext decision, because a clunky migration or a ghost of a support team will erase any benefits the software promises.

Both companies get that moving your deal history and investor data is a headache. Homebase tackles this with a white-glove migration service. Their goal is to make the jump from messy spreadsheets or another platform feel effortless. Their team gets hands-on with your data to ensure everything is transferred accurately, which is a lifesaver for sponsors who can't afford to slow down operations or spook investors.

InvestNext also offers a very structured onboarding process. Because their platform is more complex, they often give you a dedicated person to walk you through the setup. This is less about just moving data and more about configuring the system correctly from day one—especially for tricky things like custom waterfalls or specific integrations. Getting that right from the start is key to actually using the platform's more advanced capabilities.

How You'll Get Help When You Need It

Once you're up and running, the support model is what really matters. When something goes wrong, how you get help directly affects your team's workflow and your sanity.

- Homebase: Their big selling point is 24/7 support. This is a huge deal for anyone who’s ever been stuck on a weekend trying to close a deal or answer an urgent investor question after hours. It’s all about immediate access.

- InvestNext: They use a tiered support system. If you're on a higher-tier plan, you'll likely get a dedicated account manager. This creates a more personal, long-term relationship, which is perfect for firms with complex portfolios who need someone that truly understands their business inside and out.

The Bottom Line: Your choice here really comes down to your work style. If you need quick answers at any hour, Homebase is built for that. If you'd rather have a dedicated expert for more strategic, in-depth help, InvestNext's model is probably a better fit.

Adopting platforms like these is a sign of a bigger shift happening in real estate. While exact user numbers are kept close to the chest, the high retention rates across the prop-tech industry show just how valuable these systems are once you're on them. For instance, prop-tech company Latch saw a 154% net dollar retention and 100% gross dollar retention, which points to incredible customer loyalty. These kinds of numbers show that getting the onboarding and support right—as Homebase clearly prioritizes—is a huge factor in whether you'll stick around for the long haul. You can read more about the strong performance metrics in the prop-tech sector.

Frequently Asked Questions

When you're trying to decide between Homebase vs. InvestNext, a few practical questions always seem to pop up. Here are some straightforward answers to the questions we hear most often from real estate sponsors.

Can I Manage Debt Investments on These Platforms?

This is a major point of difference between the two. InvestNext was built from the ground up to handle both equity and debt investments. It gives you more sophisticated tracking and specialized reporting tools specifically for debt positions. If debt deals are a regular part of your portfolio, InvestNext is the clear winner here.

Homebase, on the other hand, is really tuned for equity syndication. You can make its flexible system work for simpler debt deals, but it's more of a workaround than a core feature. Sponsors who focus heavily on debt will likely find InvestNext's dedicated tools a much better fit.

Which Platform Offers Better Third-Party Integrations?

Both platforms are constantly adding new integrations, but their priorities are different. InvestNext tends to focus on deep connections with accounting software and other financial tools. This is a huge plus if you're looking to scale your back-office operations and need everything to talk to each other seamlessly.

Homebase leans more towards providing a clean, self-contained experience that handles most of your essential tasks right out of the box. So, if your main priority is linking up with a wide variety of existing financial software, InvestNext usually has the advantage. It's always a good idea to check their latest integration libraries to make sure your specific tools are supported.

Key Insight: Don't expect a typical free trial from either platform. Managing real estate investments is too complex for a simple click-around experience. Instead, both offer personalized demos. This is your best opportunity to see the software live and ask questions that apply directly to your business.

How Secure Is Investor Data on These Platforms?

Both Homebase and InvestNext take security extremely seriously, as they should. They use bank-level encryption, store data in secure centers with nightly backups, and have strong access controls to keep sensitive investor information locked down. You can be confident that both platforms are built to meet high financial data security standards.

The bottom line is that using a dedicated portal like Homebase or InvestNext is light-years safer and more professional than juggling confidential investor details in scattered spreadsheets or insecure email chains.

Ready to see how a streamlined platform can transform your real estate operations? At Homebase, we offer a simple flat-fee structure with unlimited deals and investors, backed by white-glove migration and 24/7 support. Schedule your personalized demo today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.