Waterfall Real Estate Model: Investors' Essential Guide

Waterfall Real Estate Model: Investors' Essential Guide

Unlock predictable returns with the waterfall real estate model. Discover key components and tactics for successful investments.

Domingo Valadez

Mar 30, 2025

Blog

The Waterfall Real Estate Model: Foundation for Success

The waterfall real estate model is a vital framework used by investors to structure real estate investments, especially in syndications. It dictates how profits are distributed among investors and sponsors, creating a transparent and equitable system. Imagine a series of cascading pools, each representing a different return level.

Each pool must fill before overflowing into the next, ensuring a predictable distribution process. This structure provides clarity and builds trust between all parties.

Transparency and Fairness: The Cornerstones of the Waterfall Model

A significant advantage of the waterfall real estate model is its inherent transparency and fairness. Crucial in commercial real estate, the model ensures trust between investors and developers. This structured approach functions much like a series of buckets.

Each tier, or "bucket," must fill before the next receives cash flow. This structure ensures investors' capital is secure and returns are distributed as agreed. For example, if an investor contributes 40% of the equity, they might receive a preferred return of 8% before the sponsor's share increases.

This system helps maintain investor confidence, crucial for large-scale projects. Learn more about the benefits of the waterfall model: Commercial Real Estate Waterfall Model.

Aligning Incentives for Optimal Performance

The waterfall model fosters alignment between sponsors and passive investors. By setting clear expectations from the start, it motivates sponsors to maximize returns. The sponsor's profit share increases as the project performs better, creating a powerful incentive for efficient management.

This structured approach allows both parties to share in the investment's successes while mitigating risk.

Adaptability Across Market Cycles

The waterfall real estate model isn't static; it adapts. It can be customized to fit various investment strategies, from conservative, capital preservation approaches to more aggressive, value-add opportunities. This flexibility is essential for navigating changing market conditions.

You might be interested in: Understanding the Real Estate Waterfall Guide for Investors. Understanding these structures has become indispensable for serious real estate investors, ensuring investor capital remains protected while still incentivizing strong performance.

Why the Waterfall Model Matters

The waterfall real estate model provides a robust framework for successful real estate investing. Its transparent structure, ability to align incentives, and adaptability make it a critical tool for managing risk and maximizing returns.

Whether you're a seasoned investor or just starting, understanding this model is paramount for informed decision-making and achieving your investment goals.

Decoding the Essential Components of Waterfall Structures

Understanding the waterfall real estate model requires a closer look at its core components. These elements work in concert to create a structure that carefully balances risk and reward for everyone involved. This involves examining how different parts of the waterfall interact and affect the overall performance of the investment.

Preferred Returns: Prioritizing Investor Payouts

Preferred returns act as a crucial safeguard for investors. They establish a minimum rate of return that must be met before sponsors begin to share in the profits. This helps ensure that investors recoup a specific percentage of their initial investment before profit-sharing arrangements change.

For instance, an 8% preferred return guarantees investors an 8% annual return on their investment before the sponsor's profit share increases. It's also important to note that these returns can be cumulative. This means any unpaid preferred returns are accrued and distributed in later periods.

Catch-Up Provisions: Recouping Initial Investments

Once preferred returns are satisfied, catch-up provisions enable sponsors to quickly recover their initial investment and development costs. This mechanism helps sponsors reach parity with investors more rapidly. The precise workings of the catch-up provision can differ depending on the specifics of the investment agreement. This element incentivizes sponsors to strive for early project success.

Promote Structures: Rewarding Performance

Promote structures reward sponsors for strong performance that surpasses established benchmarks. They define how profits are divided after investors receive their preferred returns and sponsors have caught up. These structures are often tiered, meaning the sponsor's profit share increases as return levels rise. This encourages sponsors to maximize the overall investment performance.

Waterfall models in real estate are quite diverse, but they often incorporate similar elements, such as various tiers for distributing cash flows. For example, a sponsor might implement a waterfall structure where initial cash flows are directed to investors until they achieve a 10% IRR (Internal Rate of Return). After this hurdle rate is met, the sponsor's share could increase significantly, motivating them to manage the property efficiently.

Consider a case study involving a $10 million multifamily property. The sponsor contributes $1 million in equity, while other investors provide $3 million. Initially, the sponsor might receive only 25% of the cash flows. However, as property performance improves, this percentage could rise to 50%. This tiered system aligns incentives with the property's overall performance, benefiting both sponsors and investors by setting clear expectations for potential returns. Learn more about waterfall structures: Equity Waterfall in Commercial Real Estate Explained.

Lookback Provisions: Balancing Long-Term Returns

Finally, lookback provisions add a layer of protection for investors. These provisions stipulate that if investors don't reach a specified return by the end of the investment term, sponsors may have to relinquish a portion of their profits. This balances the potential for high sponsor returns with a mechanism to ensure investors achieve their minimum return targets.

Understanding the interplay of these components is essential for evaluating the effectiveness of any waterfall real estate model. They create a framework for profit distribution, balancing risk and reward, and aligning the interests of both sponsors and investors. This knowledge enables investors to make well-informed decisions and negotiate terms that best suit their individual investment strategies.

Preferred Returns: Your First Line of Investment Defense

Preferred returns are essential in the waterfall real estate model. They act as a crucial safeguard for investors by establishing a minimum return threshold. This threshold must be met before sponsors participate in profit distributions, creating a financial buffer for investors and offering a degree of certainty in their returns.

But how are these returns calculated, and what factors influence their effectiveness?

Calculating Preferred Returns: Understanding the Mechanics

Calculating preferred returns is a straightforward process. It’s typically a percentage of the initial investment, often accruing annually. For instance, an 8% preferred return on a $100,000 investment would generate $8,000 annually before the sponsor receives any profit. However, it's crucial to understand whether the preferred returns are cumulative or non-cumulative.

- Cumulative Preferred Returns: Unpaid preferred returns accrue and are added to the outstanding balance, essentially earning interest on the unpaid amount. This ensures investors receive their full preferred return eventually, even if cash flow is temporarily limited.

- Non-Cumulative Preferred Returns: Unpaid preferred returns are forfeited. While this structure may offer potentially higher overall returns for sponsors, it presents a greater risk for investors.

Evaluating Preferred Return Rates: Matching Risk and Reward

The preferred return percentage is a critical factor in the waterfall real estate model. It often reflects the investment’s perceived risk level. A lower preferred return, such as 8%, might be tied to a lower-risk project. Conversely, higher returns, like 10% or 12%, could signify higher risk.

It’s estimated that approximately 40% of projects use an 8% preferred return as a baseline. However, this can vary depending on individual risk tolerance and investment objectives. This preference for a secure initial yield provides investors with downside protection, but it also limits their upside potential. Learn more about preferred returns here.

Investors should carefully consider whether the offered preferred return aligns with the investment’s overall risk profile. Experienced investors frequently evaluate the internal rate of return (IRR) alongside the preferred return. Analyzing both metrics helps determine if the combined structure provides a suitable balance between risk and potential reward.

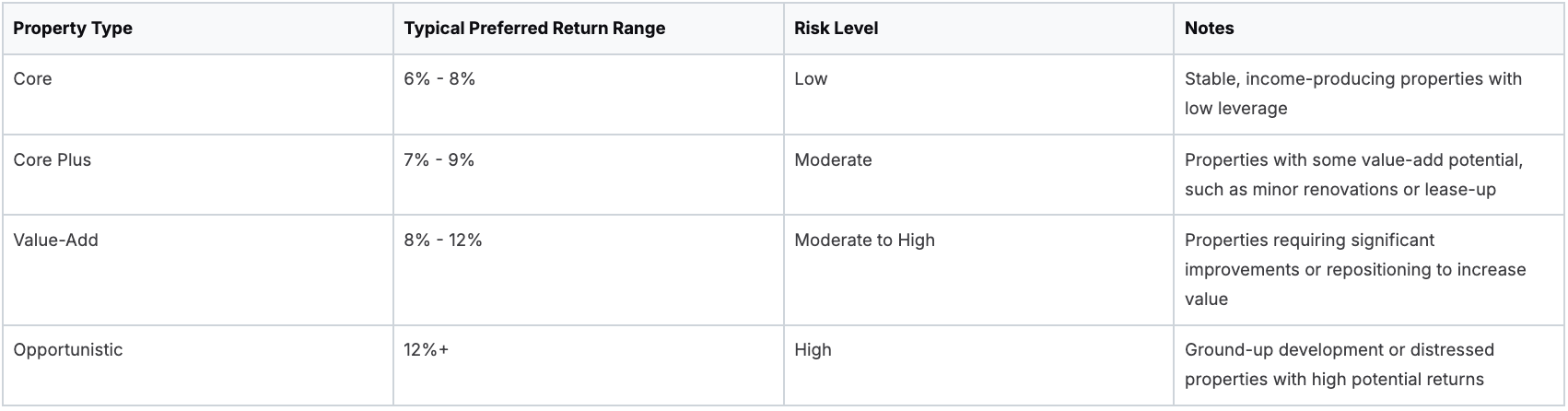

To help investors understand the relationship between property type, preferred return rates, and risk, the following table provides a general overview. Keep in mind these are typical ranges and specific rates can vary based on individual deal terms and market conditions.

Common Preferred Return Rates by Property Type

This table illustrates how the expected preferred return generally increases with the perceived risk level of the investment. Core properties, being the least risky, offer lower preferred returns, while opportunistic investments, with their higher risk, offer potentially higher returns.

Uncovering Hidden Traps: Critical Questions for Investors

While preferred returns offer valuable protection, they can sometimes include hidden provisions that diminish investor benefits. Here are some vital questions to consider:

- Is the preferred return truly preferential? Some structures may prioritize other debt payments before distributing preferred returns, potentially delaying or lessening payouts.

- How is the preferred return calculated? Different calculation methods can significantly affect actual returns. Be sure the calculation is clear and easy to verify.

- What triggers the next tier in the waterfall? Understanding the specific conditions for moving beyond the preferred return phase is vital for projecting overall returns.

By understanding the complexities of preferred returns, investors can approach the waterfall real estate model with more clarity and confidence. Thorough due diligence and careful consideration are crucial for maximizing potential returns while mitigating inherent risks.

IRR Hurdles: The Performance Metrics That Matter

Beyond preferred returns, understanding IRR hurdles is paramount for evaluating the waterfall real estate model. These hurdles act as performance benchmarks, dictating how profits are shared between investors and sponsors. Think of them as signposts indicating how profits are distributed as the investment performs.

Defining IRR Hurdles and Their Significance

An IRR hurdle is a pre-determined target for the Internal Rate of Return (IRR). When this target is met, the profit split within the waterfall structure changes. For instance, a typical structure might allocate the bulk of profits to investors until a 10% IRR is achieved.

After hitting this benchmark, the sponsor's profit share often increases significantly. This structure incentivizes the sponsor to drive returns, benefiting both the sponsor and the investor. This shift in distribution creates alignment between both parties involved.

How IRR Hurdles Influence Sponsor Economics

IRR hurdles are fundamental to sponsor economics. They directly influence how much profit, and when, sponsors receive their promote – the share of profits they are entitled to after meeting certain investment return targets. One example might be a tiered promote structure:

- Tier 1: The sponsor receives 10% of profits after achieving a 10% IRR.

- Tier 2: The sponsor receives 20% of profits after achieving a 15% IRR.

- Tier 3: The sponsor receives 30% of profits after achieving a 20% IRR.

This tiered system demonstrates how exceeding performance expectations can lead to substantially higher returns for sponsors. IRR hurdles are powerful motivators for sponsors to strive for strong investment outcomes.

IRR Hurdles vs. Other Metrics

While metrics like equity multiples and cash-on-cash returns offer valuable insights, sophisticated investors frequently prioritize IRR hurdles. This is because IRR hurdles incorporate the time value of money, a critical element in investment analysis.

They also offer a comprehensive view of overall investment profitability throughout the investment lifecycle. However, IRR hurdles are not without their limitations. A high IRR achieved rapidly might appear attractive, but it may not indicate the overall long-term return potential compared to a lower IRR sustained over a longer period.

Market Conditions and Target Hurdles

Prevailing market conditions play a substantial role in setting suitable IRR hurdles. In robust markets, higher hurdles may be reasonable, reflecting increased competition and potentially higher achievable returns. Conversely, in weaker markets, lower hurdles may be more realistic.

Target hurdles also vary by investment strategy. A core strategy, which emphasizes stable income generation, might have lower IRR hurdles, possibly in the 8-10% range. In contrast, a value-add strategy, targeting more significant capital appreciation, might set hurdles at 12-15% or higher.

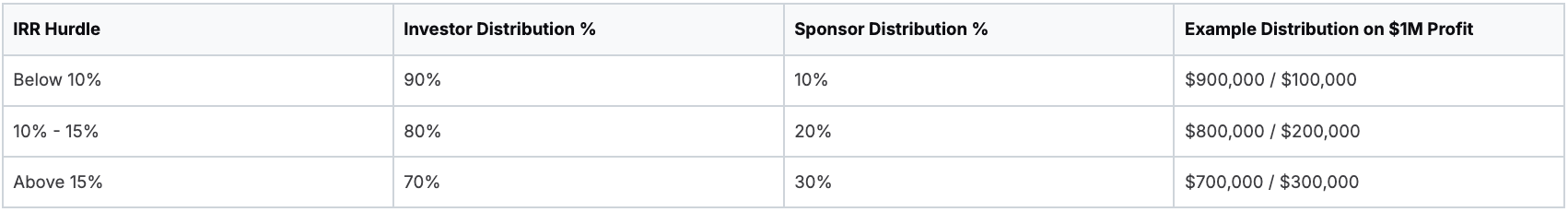

To illustrate how distributions shift based on various IRR hurdles, consider the following table:

Waterfall Distribution Examples at Different IRR Hurdles

This table will illustrate how cash distributions change as projects hit different IRR hurdle rates, showing the shifting economics between investors and sponsors

This table demonstrates how profit distributions change as various IRR milestones are achieved, highlighting the dynamic relationship inherent in the waterfall real estate model. Understanding these nuances empowers investors to evaluate deals more effectively and ultimately make more informed investment decisions.

Real-World Waterfall Models That Drive Results

Understanding the waterfall real estate model in theory is essential. However, seeing these models applied to successful real estate investments provides invaluable practical insights. Analyzing performance under real-world market conditions bridges the gap between theory and practice.

Case Studies Across Diverse Property Types

Examining case studies across various property types, including multifamily, office, retail, and industrial, demonstrates the waterfall model’s adaptability. Each sector has unique characteristics and risk profiles, influencing how the waterfall structure is customized. This comparative analysis reveals how components like preferred returns and IRR hurdles are adjusted to each property type.

Examining Core, Value-Add, and Opportunistic Investments

The waterfall model isn't universal. Its application varies based on the investment strategy. Analyzing structures across the risk spectrum—from core to value-add and opportunistic—reveals how terms are adapted to the investment timeline and risk level. For example, a core investment, with its lower risk, typically has a lower preferred return (often between 6-8%). Opportunistic investments, with higher risk, might have a preferred return of 12% or higher, reflecting the potential for greater rewards.

Real-World Examples and Pattern Recognition

Studying practical applications fosters pattern recognition. This skill allows you to identify advantageous structures and potential red flags. For example, understanding how different promote structures affect sponsor incentives reveals whether a structure is balanced or favors the sponsor. Recognizing these patterns empowers confident investment decisions.

Insights From Both Sides of the Table

Gaining perspective from both investors and sponsors is crucial. Analyzing how specific terms influenced investor returns and sponsor behavior offers valuable insights. You might discover how a particular catch-up provision influenced a sponsor’s decisions regarding property management or refinancing. These real-world narratives provide invaluable lessons and contribute to a more nuanced understanding of the waterfall model’s dynamics.

By examining real-world examples and outcomes, you can move beyond theoretical knowledge and develop practical skills for evaluating and negotiating waterfall structures. This expertise helps identify advantageous opportunities and protect your interests as a real estate investor. Learn more about structuring your deals with Homebase CRE.

Negotiating Winning Waterfall Terms: The Investor's Edge

Negotiating the terms of a waterfall real estate model is where preparation meets opportunity. Understanding which terms are truly flexible, recognizing industry standards, and knowing where to focus your efforts can significantly impact your returns. This section equips you with the insights and strategies to navigate these crucial negotiations.

Identifying Negotiable and Standard Terms

Not all terms within a waterfall structure are created equal. Some, like the preferred return, are often standard within a particular market and property type. For example, an 8% preferred return is frequently seen in stable multifamily investments, while higher returns might be expected in value-add opportunities.

Other elements, like promote structures and catch-up provisions, offer more room for negotiation. Recognizing this distinction is crucial for directing your efforts where they can yield the greatest impact. Knowing industry standards provides a foundation for evaluating the fairness of proposed terms and identifying areas where adjustments are warranted.

Recognizing Warning Signs and Misaligned Incentives

Experienced investors develop a keen eye for subtle warning signs. Unrealistic projections, overly complex structures, or excessively sponsor-favorable terms can indicate misaligned incentives. For example, a promote structure that heavily rewards the sponsor early on, while offering limited upside for investors, warrants careful scrutiny.

Additionally, overly optimistic revenue projections or underestimated expenses could be red flags. These might suggest the sponsor is prioritizing their interests over the project’s realistic potential. Due diligence is key to uncovering these potential issues.

Practical Negotiation Strategies for Building Strong Relationships

Negotiation isn't about confrontation; it’s about building a collaborative relationship. Approaching discussions constructively, focusing on mutual benefit, and maintaining open communication with sponsors are essential for long-term success.

For instance, instead of simply demanding a lower promote, demonstrate how a more balanced structure could further incentivize the sponsor. Show how aligning their success more closely with investor returns benefits everyone. This collaborative approach not only increases the likelihood of a mutually beneficial agreement but also fosters a more productive long-term relationship with the sponsor.

Focusing on Promotes, Hurdle Rates, and Catch-Up Provisions

While every term in a waterfall model deserves attention, promotes, hurdle rates, and catch-up provisions significantly influence your final returns. Negotiating a reasonable promote structure ensures the sponsor is adequately incentivized while protecting investor interests.

Similarly, carefully evaluating hurdle rates and catch-up provisions ensures a fair distribution of profits as the investment progresses. For example, negotiating a lower IRR hurdle before the sponsor's promote begins can significantly increase investor returns, especially in shorter-term investments. Conversely, a more aggressive catch-up provision might be suitable for higher-risk investments with significant potential upside.

By understanding the nuances of waterfall negotiations, you can confidently advocate for terms that protect your capital and maximize your investment returns. This knowledge empowers you to make informed decisions, build strong sponsor relationships, and ultimately achieve your investment goals.

Homebase CRE offers a platform to simplify real estate syndication processes, from fundraising and investor relations to deal management.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

General Partners And Limited Partners Explained

Blog

A clear guide to general partners and limited partners. Understand the key roles, responsibilities, and financial structures in real estate syndication.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.