Top Financial Reporting Best Practices for 2025

Top Financial Reporting Best Practices for 2025

Learn essential financial reporting best practices for real estate syndicators to boost transparency and compliance in 2025.

Domingo Valadez

Sep 11, 2025

Blog

In the competitive world of real estate syndication, success hinges not just on sourcing profitable deals, but on managing them with unwavering precision and transparency. For sponsors and general partners, financial reporting serves as the bedrock of investor trust and operational integrity. Moving beyond disorganized spreadsheets and cumbersome manual processes is no longer an option; it's a critical necessity for scaling a successful business. Subpar reporting not only introduces a high risk of costly errors but also fails to provide the sophisticated clarity that today's investors rightfully demand.

This guide moves past generic advice to deliver a detailed roundup of essential financial reporting best practices specifically tailored for the complexities of real estate syndication. We will break down eight actionable strategies designed to fortify your operations, enhance investor confidence, and streamline compliance. You will learn how to implement robust internal controls, maintain meticulous audit trails, and leverage technology to automate tedious tasks, reducing manual errors and freeing up valuable time.

Each point is structured to provide practical implementation steps and real-world context relevant to multifamily and commercial real estate investments. By adopting these proven methods, you can transform your financial reporting from a burdensome administrative chore into a powerful strategic asset. Let's dive into the practices that will help you build a more scalable, compliant, and trustworthy syndication enterprise, allowing you to focus more on finding the next great opportunity and less on wrestling with data reconciliation.

1. Implement Robust Internal Controls and Segregation of Duties

The foundation of trustworthy financial reporting best practices lies not in the final statements themselves, but in the systems that produce them. Implementing robust internal controls and a clear segregation of duties is the single most effective measure a real estate syndicator can take to prevent fraud, minimize errors, and ensure the integrity of financial data. This practice involves creating a framework of checks and balances where no single individual has control over all aspects of a financial transaction.

At its core, segregation of duties means separating the authorization of a transaction, the recording of that transaction, and the custody of the related asset. For a syndicator, this prevents one person from, for example, approving a fraudulent vendor invoice, paying it, and then concealing the transaction in the books.

Why This Is a Foundational Practice

For real estate syndicators managing millions in investor capital and complex property operations, the risk of both intentional fraud and unintentional error is significant. Strong internal controls provide a critical safeguard, building investor confidence and ensuring that financial statements are an accurate reflection of the asset's performance.

Think of Apple's treasury functions, where initiating a wire transfer, approving it, and reconciling the bank statement are handled by three separate teams. This multi-layered verification process makes unauthorized transactions nearly impossible. Similarly, Johnson & Johnson maintains consistency and reliability by standardizing key financial controls across its 250+ global companies, ensuring every entity adheres to the same high standards.

Actionable Implementation Steps

Implementing these controls doesn't have to be an overwhelming overhaul. A strategic, phased approach is most effective.

- Map Key Financial Processes: Identify and document the steps involved in high-risk areas first. This includes rent collection, vendor payments, capital calls, and distributions.

- Assign Distinct Roles: Separate key duties. The person who collects rent checks should not be the same person who records the revenue and reconciles the bank account. Likewise, the property manager who approves a maintenance invoice should not be the person who processes the payment.

- Leverage Technology: Use property management or accounting software to automate controls. Set up user permissions to restrict access to certain functions. Implement automated three-way matching, which ensures that purchase orders, invoices, and receiving reports all align before a payment is issued.

- Document and Train: Create a clear, written manual of all control procedures. Regularly train your team on their specific roles and the importance of following these protocols to the letter. This documentation is crucial for consistency and for satisfying audit requirements. For insights into the rigorous requirements of regulatory adherence, reviewing the expectations outlined in a relevant SOX Compliance Analyst Job Application Form can be highly informative.

- Conduct Regular Reviews: Controls are not a "set it and forget it" system. Review and test your controls at least quarterly to identify weaknesses and adapt to changes in your business, such as acquiring a new property or changing software systems.

2. Maintain Accurate and Timely Account Reconciliations

Where internal controls provide the preventative framework, regular account reconciliations serve as the crucial detective mechanism. This practice is the systematic process of comparing your internal financial records against external statements from banks, lenders, and vendors to verify that the figures align. For real estate syndicators, this means diligently matching your books to reality, ensuring every dollar is accounted for and that financial reporting is built on a foundation of verified data.

At its core, this involves a monthly reconciliation of all balance sheet accounts, including bank accounts, loan balances, escrow accounts, and investor capital accounts. The goal is to promptly investigate and resolve any discrepancies, preventing small errors from compounding into significant financial misstatements that could erode investor trust and trigger compliance issues.

Why This Is a Foundational Practice

For a real estate syndication, where cash flow is king and multiple stakeholders rely on the numbers, untimely or inaccurate records can be disastrous. Timely reconciliations provide an accurate cash position, catch unauthorized transactions or bank errors early, and validate the integrity of your financial statements. It is a non-negotiable component of sound financial reporting best practices.

Consider Walmart's massive operational scale; they rely on real-time inventory reconciliation across more than 10,500 retail units to manage stock and prevent loss. Similarly, JPMorgan Chase performs daily reconciliations of its vast trading positions to manage risk and ensure regulatory compliance. While a syndication's scale is different, the underlying principle of verifying internal records against external data is identical and equally critical.

Actionable Implementation Steps

Implementing a rigorous reconciliation process creates a rhythm of financial discipline that pays dividends in accuracy and confidence.

- Establish a Strict Schedule: Mandate that all key accounts, especially bank accounts, be reconciled within five business days of the statement date. This creates urgency and prevents backlogs.

- Leverage Automation: For high-volume accounts like operating bank accounts that see numerous rent payments and vendor expenses, use automated reconciliation tools within your accounting software. These tools can automatically match the majority of transactions, freeing your team to focus on exceptions.

- Standardize Formats and Procedures: Create standardized reconciliation templates for every balance sheet account. Document the specific steps and supporting documentation required for each, ensuring consistency no matter who performs the task.

- Implement a Review and Approval Process: The person who prepares the reconciliation should not be the one who approves it. A manager or second team member must review the reconciliation, verify its accuracy, and sign off, creating a clear audit trail.

- Focus on Discrepancies: Develop a formal process for investigating and resolving reconciling items. Any discrepancy older than 30 days should be escalated for immediate resolution. This prevents unresolved issues from lingering and distorting financial reports.

3. Follow Consistent Revenue Recognition Principles

Accurate revenue reporting is the lifeblood of credible financial statements. For real estate syndicators, adhering to established accounting standards like ASC 606 (for GAAP) ensures revenue is recognized consistently and transparently. This practice dictates that revenue is recorded only when performance obligations are satisfied, reflecting the true economic transfer of services to tenants or buyers. It moves beyond simple cash collection to a more accurate depiction of earned income.

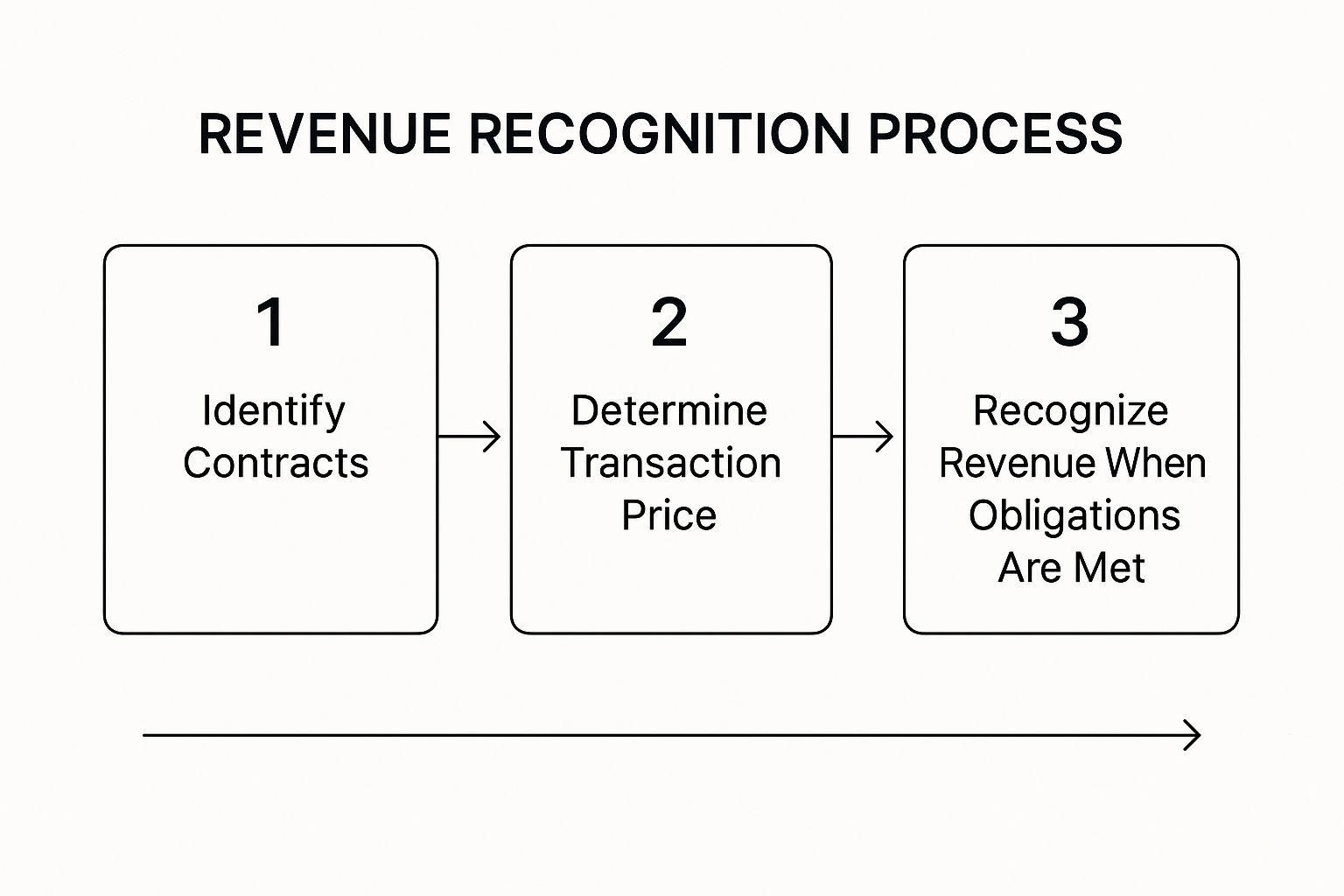

This process flow infographic outlines the core, simplified steps for applying the revenue recognition principle in a real estate context.

Following this sequence ensures that income from sources like rental agreements is recognized systematically over the lease term, not just when a payment is received.

Why This Is a Foundational Practice

For syndicators, this standard governs everything from monthly rental income and late fees to more complex transactions like lease termination fees or utility bill-backs. Inconsistent application can lead to volatile, misleading financial reports that obscure an asset's true performance, eroding investor trust and complicating decision-making. Proper adherence is a cornerstone of reliable financial reporting best practices.

Consider how major corporations navigate this. Microsoft's transition to ASC 606 required a massive overhaul, fundamentally changing how it recognized revenue from its multi-year software and cloud service contracts to better align with service delivery over time. Similarly, Salesforce applies these principles across its diverse subscription models, providing investors with a clear, consistent view of its performance regardless of billing cycles.

Actionable Implementation Steps

Implementing a consistent revenue recognition policy requires a structured approach that aligns accounting with operational realities.

- Establish a Cross-Functional Team: Involve accounting, property management, and legal teams to review lease agreements and other contracts. This ensures all revenue-generating performance obligations are identified and understood from all perspectives.

- Create Detailed Policies: Document a formal revenue recognition policy that outlines how different income streams (e.g., base rent, CAM charges, ancillary fees) are to be treated. This document should serve as the single source of truth for your accounting team.

- Leverage Your Software: Configure your property management or accounting software to automate revenue recognition. For example, set up straight-line rent schedules for leases with built-in escalations or free-rent periods to ensure revenue is recognized evenly over the lease term.

- Document Significant Judgments: Keep detailed records of any significant judgments made, such as determining the transaction price or identifying distinct performance obligations within a single contract. This documentation is critical for auditors and ensures consistency year over year.

- Provide Regular Training: Accounting standards evolve. Train your team regularly on the latest guidance from bodies like the FASB to ensure your policies remain compliant and reflect current best practices.

4. Establish Clear Documentation and Audit Trail Procedures

Beyond internal controls, one of the most critical financial reporting best practices is the creation of a comprehensive and unbroken audit trail. This means establishing rigorous documentation standards where every single financial entry can be traced back to a supporting source document. This practice ensures that every number on your financial statements is verifiable, defensible, and can withstand the deepest levels of investor or regulatory scrutiny.

An audit trail provides a step-by-step record of a transaction, from its inception to its final reporting. For a real estate syndicator, this could be the path from a signed lease agreement to the recorded rental income on the profit and loss statement, supported by bank deposit slips and tenant ledger entries along the way.

Why This Is a Foundational Practice

For syndicators, who act as fiduciaries for investor capital, a transparent and complete audit trail is non-negotiable. It provides irrefutable proof of financial activity, builds trust, simplifies audits, and protects the firm from potential disputes or allegations. It moves financial reporting from a matter of trust to a matter of fact.

Consider Amazon's e-commerce platform, which logs every detail of a transaction, from the initial click to final delivery confirmation, creating a bulletproof record. Similarly, Procter & Gamble's global ERP system maintains consistent, verifiable audit trails across hundreds of entities, ensuring uniformity and reliability in its consolidated financial reports.

Actionable Implementation Steps

Building a robust audit trail is about systematic process design, not just saving receipts. A clear, methodical approach ensures nothing falls through the cracks.

- Standardize Documentation Requirements: Create a policy that explicitly defines what documentation is required for every transaction type, such as requiring a signed contract, an approved invoice, and proof of payment for all vendor expenses over a certain threshold.

- Implement a Digital-First Workflow: Leverage technology to create an electronic paper trail. Use accounting or property management software that automatically links uploaded source documents (like invoices or receipts) directly to the corresponding journal entries.

- Establish Naming Conventions and Filing Structures: A chaotic digital filing system is as useless as a box of unsorted papers. Create a logical, consistent naming convention and folder structure for all financial documents. For guidance on creating effective documentation policies, it's helpful to review standard operating procedure examples to see how clear instructions enhance control.

- Use Cloud-Based Solutions: Employ secure, cloud-based storage to ensure documents are accessible, backed up, and protected from physical loss. This also facilitates remote access for team members, investors, and auditors. To dive deeper into organizing your digital assets, explore these best practices for document management.

- Conduct Periodic Internal Audits: Regularly test your audit trail. Select a sample of transactions from the financial statements and trace them back to their source documents. This self-testing process helps identify and correct any gaps in your procedures before they become significant problems.

5. Conduct Regular Management Review and Analysis

Financial statements are not merely historical records; they are dynamic tools for strategic decision-making. The practice of conducting regular management review and analysis transforms passive data into forward-looking insights. This involves systematically reviewing financial results, dissecting variances from the budget, and discussing operational trends to ensure accountability and proactively identify opportunities or issues.

For a real estate syndicator, this means going beyond a simple P&L review. It's about questioning the numbers: Why was maintenance spending 15% over budget? What is the trend in utility reimbursements, and how does it impact Net Operating Income (NOI)? This rigorous, scheduled analysis is a cornerstone of effective financial reporting best practices, turning data into a strategic asset.

Why This Is a Foundational Practice

In real estate syndication, where operational efficiency directly impacts investor returns, a passive approach to financial oversight is a significant risk. Regular, in-depth reviews ensure that management is held accountable, problems are caught before they escalate, and strategic decisions are based on a comprehensive understanding of the asset’s performance. It’s the difference between reacting to a bad quarter and actively steering the property toward its pro-forma targets.

Think of how Intel, under Andy Grove, pioneered its detailed quarterly business review process. Each business segment was required to present a deep analysis of its performance, forcing accountability and strategic alignment. Similarly, Jeff Bezos's famous "six-page narrative" meetings at Amazon forced teams to think through issues deeply and present a coherent analysis, rather than relying on superficial data points. This level of rigor is what separates top-tier operators from the rest.

Actionable Implementation Steps

Implementing a formal review process creates a cadence of accountability and strategic thinking. It ensures the financial reports serve their ultimate purpose: to guide better business decisions.

- Establish a Consistent Cadence: Schedule monthly or quarterly review meetings with key stakeholders, including asset managers, property managers, and accounting staff. Make these meetings mandatory and non-negotiable.

- Focus on Key Drivers and Variances: Structure the review around key performance indicators (KPIs) like Gross Potential Rent, Economic Occupancy, and NOI. Demand clear, concise explanations for any significant variance between actual results and the budget.

- Use Visual Dashboards: Leverage software to create visual dashboards that highlight trends and exceptions. This allows the team to quickly identify areas needing attention without getting bogged down in raw data. The goal is exception reporting, not data recitation.

- Integrate Operational Metrics: Combine financial data with operational metrics. Discuss rent growth alongside marketing lead conversions or repair costs alongside maintenance ticket completion times. This provides a holistic view of asset performance.

- Document Decisions and Actions: End every meeting with a clear summary of key decisions made and assign specific action items with deadlines and responsible parties. This documented follow-up ensures that insights from the review translate into tangible improvements.

6. Implement Comprehensive Disclosure Controls and Procedures

Beyond accurate numbers, trustworthy financial reporting best practices demand transparency. Implementing comprehensive disclosure controls and procedures establishes a formal system to ensure all material information is identified, evaluated, and correctly disclosed in external reports. This goes beyond the balance sheet to include narrative disclosures that provide crucial context for investors.

This practice involves creating a systematic, cross-functional workflow to capture all relevant operational, financial, and legal information that could impact an investor's decisions. For a syndicator, this means having a process to disclose a major tenant default, significant unexpected capital expenditure, or pending litigation related to a property.

Why This Is a Foundational Practice

For real estate syndicators, who act as fiduciaries for investor capital, complete and timely disclosure is a matter of both legal compliance and investor trust. Failing to disclose material information can lead to regulatory scrutiny, investor lawsuits, and irreparable damage to your reputation. A structured disclosure process ensures that nothing falls through the cracks.

Consider public companies like ExxonMobil, which have rigorous procedures for disclosing environmental risks and liabilities in their financial reports, especially as regulations change. Similarly, after its IPO, Facebook (now Meta) enhanced its disclosure controls to ensure investors were fully aware of risks related to user data and privacy. These examples highlight the importance of a formal system for identifying and communicating risk.

Actionable Implementation Steps

Building a disclosure framework ensures you communicate critical information consistently and effectively.

- Establish Clear Materiality Thresholds: Work with legal and accounting advisors to define what constitutes "material" information for your assets and investors. This could be a specific dollar amount for a financial event or a qualitative trigger, like the loss of an anchor tenant.

- Create Disclosure Checklists and Templates: For recurring reports like quarterly updates, develop a standardized checklist. This ensures all key areas, such as property performance, occupancy changes, capital project updates, and any new risks, are consistently addressed.

- Conduct Regular Training: Key personnel, including asset managers and property managers, must be trained on what information needs to be escalated for potential disclosure. They are on the front lines and are often the first to know about events that investors need to be aware of.

- Implement Early Warning Systems: Develop triggers within your operations to flag potential disclosure events. For example, a tenant being more than 60 days delinquent on rent should automatically trigger a review by the asset manager and accounting team to assess the financial impact and need for disclosure.

- Mandate Legal and Executive Review: Before any external report containing material disclosures is published, it must be reviewed and signed off on by senior management and legal counsel. This final check ensures accuracy, completeness, and compliance with all relevant securities regulations.

7. Utilize Technology for Automation and Error Reduction

In today's fast-paced real estate market, manual data entry and spreadsheet-based reporting are not just inefficient; they are significant sources of risk. Leveraging financial technology to automate routine processes is a critical financial reporting best practice that reduces human error, enhances data accuracy, and frees up your team to focus on high-value analysis rather than repetitive tasks. This involves implementing integrated software solutions that streamline everything from rent collection to investor distributions.

At its core, automation in financial reporting means using technology to handle tasks that were previously done by hand. For a real estate syndicator, this could mean using a property management platform that automatically syncs rent payments with your general ledger, eliminating the need for manual reconciliation and drastically reducing the chance of transposition errors or missed entries.

Why This Is a Foundational Practice

For syndicators managing multiple properties and hundreds of investors, the volume of financial transactions can be immense. Manual processes simply cannot scale effectively and are prone to costly mistakes. Automation creates a single source of truth, ensuring that all stakeholders, from property managers to investors, are working with consistent and up-to-date information. This builds trust and allows for more agile, data-driven decision-making.

Consider how Netflix's automated revenue recognition system processes millions of unique subscriber transactions daily, ensuring GAAP compliance without manual intervention. Similarly, Coca-Cola's global implementation of SAP created a unified financial system across over 200 countries, standardizing reporting and enabling real-time global financial oversight. These principles of scalability and consistency are directly applicable to a growing real estate portfolio.

Actionable Implementation Steps

Adopting technology is a strategic investment in the accuracy and efficiency of your operations. A thoughtful rollout is key to success.

- Start with a Pilot Program: Instead of a full-scale overhaul, identify one key pain point, such as accounts payable or bank reconciliation. Implement an automation tool for that specific area to test its effectiveness and gain team buy-in before expanding.

- Invest in Change Management: Technology is only as good as the people using it. Dedicate significant resources to training your team on the new systems. Clearly communicate the benefits of the change, focusing on how it will make their roles more strategic and less tedious.

- Establish Robust Testing: Before going live, conduct thorough testing with real-world data to ensure the system functions as expected. Run the new automated process in parallel with your manual process for one reporting cycle to validate the results and identify any discrepancies.

- Prioritize System Maintenance: Once implemented, schedule regular system updates and security checks. One of the most impactful best practices is to embrace financial reporting automation not as a one-time project, but as an ongoing commitment to operational excellence and data security.

8. Maintain Strong Communication with Stakeholders

Financial reports are not just collections of numbers; they are a primary communication tool. Establishing a strategy for clear, timely, and transparent communication with all stakeholders, including investors, lenders, and property management teams, is a critical financial reporting best practice. This practice transforms reporting from a mere obligation into a powerful tool for building trust, managing expectations, and fostering long-term relationships.

At its core, strong stakeholder communication ensures that the narrative behind the numbers is as clear as the figures themselves. For a syndicator, this means providing context for performance, explaining variances from the pro forma, and outlining future strategies, ensuring that investors feel informed and confident in their investment and the management team.

Why This Is a Foundational Practice

For real estate syndicators, who are stewards of investor capital, proactive communication is non-negotiable. It preempts confusion, mitigates panic during market downturns, and reinforces the sponsor's credibility. When stakeholders understand the "why" behind financial results, they are more likely to remain supportive partners through the entire investment lifecycle.

Consider Warren Buffett's annual shareholder letters for Berkshire Hathaway. They are legendary not just for their financial transparency but for their candid, educational, and forward-looking commentary. Buffett explains both successes and failures, providing a masterclass in how to build unparalleled investor trust. Similarly, JPMorgan Chase under Jamie Dimon is known for its detailed quarterly reports and investor calls that provide deep insights into the firm’s performance and economic outlook.

Actionable Implementation Steps

Building a robust communication strategy involves creating a reliable and predictable cadence of information flow. A systematic approach ensures no stakeholder is left in the dark.

- Develop a Communication Calendar: Schedule regular updates in advance. This should include quarterly financial reports, monthly operational summaries, and ad-hoc alerts for significant events like a major capital expenditure or a refinancing opportunity.

- Segment Your Audience: Tailor your communication to different stakeholders. Lenders may require specific covenant calculations and formal reports, while investors will benefit more from a narrative summary of performance, key metrics like cash-on-cash return, and updates on the business plan.

- Provide Both Data and Context: Don’t just send a profit and loss statement. Include a cover letter or executive summary that explains the results. Highlight key wins, address challenges head-on, and explain any significant variances from the budget or pro forma. This qualitative context is invaluable.

- Use Multiple Channels: Distribute information through a secure investor portal, email newsletters, and even webinars for major updates or annual reviews. This ensures your message reaches everyone through their preferred medium.

- Solicit and Act on Feedback: Create a formal process for stakeholders to ask questions and provide feedback. Answering questions promptly and transparently demonstrates that you value their partnership and are committed to open dialogue.

Financial Reporting Best Practices Comparison

Building a Foundation for Scalable Growth

Navigating the complexities of real estate syndication requires more than just identifying lucrative deals; it demands a steadfast commitment to operational excellence. The financial reporting best practices we've explored-from implementing robust internal controls to leveraging technology for automation-are not merely isolated tasks on a compliance checklist. Instead, they represent the interconnected pillars of a durable, scalable, and trustworthy syndication business. Mastering these disciplines is a strategic imperative that directly impacts your ability to attract and retain investor capital, mitigate risk, and build a lasting legacy in a competitive market.

Think of these practices as the architectural blueprint for your company's financial integrity. Strong internal controls and segregated duties are the foundation, preventing the structural weaknesses that can lead to costly errors or fraud. Consistent revenue recognition and timely account reconciliations act as the support beams, ensuring that every financial statement is accurate, reliable, and a true reflection of your portfolio's performance. Without this solid structure, even the most promising assets can become liabilities under the weight of poor financial management.

From Compliance to Competitive Advantage

Adopting these financial reporting best practices moves your operation from a reactive, compliance-focused mindset to a proactive, strategic one. When your financial data is meticulously documented, consistently reviewed, and transparently communicated, it becomes a powerful tool for decision-making.

Consider the ripple effect of these improvements:

* Enhanced Investor Confidence: When stakeholders receive clear, accurate, and timely reports, their trust deepens. This confidence is the bedrock of long-term relationships and is crucial for future capital raises.

* Improved Operational Efficiency: Automating routine tasks and establishing clear workflows frees up valuable time. This allows you and your team to focus on high-impact activities like deal sourcing, asset management, and investor relations, rather than getting bogged down in manual data entry.

* Superior Risk Management: A disciplined approach to financial reporting, including regular management reviews and comprehensive disclosures, allows you to identify potential issues early. This proactive stance helps you navigate economic shifts and operational challenges with greater agility and foresight.

Ultimately, the goal is to create a financial reporting ecosystem that works for you, not against you. It should be a source of clarity and insight, enabling you to steer your business with confidence and precision. By weaving these principles into the fabric of your daily operations, you are not just meeting industry standards; you are setting a new benchmark for excellence.

Your Path Forward: Actionable Next Steps

The journey toward impeccable financial reporting is an ongoing process of refinement and commitment. It begins with an honest assessment of your current procedures and a dedication to incremental improvement. Start by identifying one or two areas from this guide that present the biggest opportunity for enhancement within your organization. Perhaps it's formalizing your documentation procedures or exploring new software to automate reconciliations.

Each step you take to strengthen your financial framework is a direct investment in the future of your business. As your portfolio grows and your deals become more complex, this solid foundation will be what separates you from the competition. It will empower you to scale efficiently, manage complexity with ease, and build a reputation for integrity and transparency that becomes your most valuable asset. The effort you invest today will pay dividends for years to come, creating a resilient and thriving syndication enterprise.

Ready to implement these financial reporting best practices with unparalleled efficiency? Homebase provides an all-in-one platform designed for real estate syndicators, automating everything from fundraising and investor communications to deal management and reporting. Streamline your operations and build investor trust by visiting Homebase to see how our tools can transform your workflow.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.