7 Best Practices for Document Management in Real Estate 2025

7 Best Practices for Document Management in Real Estate 2025

Discover the top best practices for document management in real estate syndication to enhance security, organization, and efficiency. Learn more!

Domingo Valadez

Jun 21, 2025

Blog

Streamline Your Syndication: Why Smart Document Management is Non-Negotiable

In the high-stakes world of real estate syndication, efficiency and security are paramount. Every deal involves a mountain of paperwork, from investor subscription agreements and PPMs to financial statements and compliance forms. Mismanaging this flow of information doesn't just create administrative headaches; it introduces significant risks, including compliance breaches, investor disputes, and deal delays. Effective systems are the bedrock of a scalable and defensible operation.

This article unpacks the essential best practices for document management that every real estate syndicator needs to implement. We will move beyond generic advice to provide actionable, pragmatic strategies tailored for the unique complexities of syndication, ensuring your operations are organized, secure, and scalable. For those seeking interactive learning, consider attending specialized efficient document management webinars to gain live insights.

Adopting these frameworks will not only protect your firm but also enhance investor confidence and free up your team to focus on what matters most: closing deals and growing your portfolio. Let's dive into the strategies that will transform your document chaos into a competitive advantage.

1. Implement a Standardized File Naming Convention

The foundation of any organized digital workspace is a systematic, enforced approach to naming files. For real estate syndicators managing countless documents across multiple deals, a standardized file naming convention is not just helpful; it is essential. This practice involves establishing clear, logical rules for every file name, ensuring any document can be instantly identified and located by any team member, investor, or auditor. Without a standard, you inevitably face a digital mess of duplicated, misplaced, and cryptically named files, which leads to compliance risks and operational slowdowns.

This approach is one of the most fundamental best practices for document management because it imposes order directly at the point of creation. A well-designed convention acts as a metadata tag embedded directly in the file name, providing crucial context at a glance. Think of it as the Dewey Decimal System for your entire real estate portfolio, critical for scaling your operations efficiently. Platforms like Homebase can further streamline this by providing a centralized repository where consistent naming can be applied across all deal rooms, creating a single source of truth.

How to Create Your Naming Convention

A successful naming convention for real estate syndication should be simple, scalable, and intuitive. It should contain key identifiers that allow for quick sorting and searching. A highly effective format for a syndication firm might be: PropertyName_DocumentType_InvestorLastName_YYYY-MM-DD.

- Example 1 (Investor Document):MapleCreekApts_SubDoc_Smith_2023-10-26.pdf

- Example 2 (Property-Level Report):MapleCreekApts_Q4-Financials_2023-12-31.xlsx

- Example 3 (Legal Document):MapleCreekApts_PPM_v2.1_2023-09-15.pdf

Actionable Implementation Tips

- Create a Naming Guide: Document your chosen convention in a clear, one-page guide with specific examples. Make this guide easily accessible to your entire team and include it in onboarding materials for new hires.

- Start with a Pilot: Test your new naming convention on a single project or with a small group of team members. This allows you to identify any flaws or confusion before a firm-wide rollout.

- Use Automation: Leverage tools within your document management system or folder templates to pre-populate parts of the file name, reducing the chance of human error.

- Keep It Simple: Avoid overly complex structures with too many elements. The goal is clarity and speed, not to capture every possible piece of data in the file name itself.

2. Establish Version Control Systems

In the fast-paced world of real estate syndication, documents like Private Placement Memorandums (PPMs), operating agreements, and financial models are constantly evolving. A version control system is a systematic method for tracking and managing these changes, ensuring every team member works from the most current file. This practice is critical for preventing costly mistakes that arise from using outdated information, such as circulating a draft term sheet to investors or relying on old financial projections. It creates a historical record of all revisions, providing a clear audit trail and the ability to revert to a previous state if needed.

Implementing robust version control is one of the essential best practices for document management because it brings order to the collaborative chaos of deal-making. Without it, you risk creating multiple conflicting "final" versions of the same document, saved in different locations with confusing names. This leads to confusion, undermines compliance, and can damage credibility with investors and partners. Modern document management platforms like Microsoft SharePoint or Google Workspace have this functionality built-in, automatically saving new versions every time a file is edited.

How to Implement Version Control

A successful version control strategy should be automatic where possible and intuitive for your team. The system should clearly distinguish between major milestones and minor edits. For critical legal and financial documents, this level of precision is non-negotiable.

- Example 1 (Minor Revision): A team member corrects a typo in the PPM. The system automatically saves it as PPM_v2.1. The core content is unchanged.

- Example 2 (Major Revision): Legal counsel updates the risk factors in the PPM. This is a significant change, so the file is manually saved as PPM_v3.0.

- Example 3 (Superseded Document): The final executed operating agreement is uploaded, rendering all previous drafts obsolete and archived.

Actionable Implementation Tips

- Use Major/Minor Numbering: Adopt a formal numbering system like v1.0, v1.1, v2.0. Major numbers (1.0, 2.0) indicate significant changes or milestones, while minor numbers (1.1, 1.2) denote small edits or corrections.

- Train Your Team: Educate users on the importance of versioning and how to use the check-in/check-out feature if your system has one. This prevents multiple people from editing a document simultaneously and creating conflicting copies.

- Automate Where Possible: Choose a document management system that creates new versions automatically upon saving. This removes the burden from team members and ensures no change is lost.

- Set Clear Finalization Protocols: Establish a clear process for marking a document as "Final" or "Executed." This final version should be locked from further edits and moved to a secure, permanent record folder.

3. Create Logical Folder Hierarchies

A standardized file name is powerful, but it's only half the battle. The other half is ensuring those files are stored in an equally logical place. Creating clear, intuitive folder hierarchies is the practice of organizing documents into a structure that mirrors your business operations, making it easy for anyone to navigate. For real estate syndicators, this means structuring folders by property, deal stage, or department, ensuring every document from a K-1 to a property inspection report has a predictable home. Without this, even perfectly named files get lost in a chaotic digital landscape, slowing down workflows and making audits a nightmare.

This systematic approach is one of the most crucial best practices for document management because it creates a predictable map for your entire portfolio. A well-designed folder hierarchy means less time spent searching and more time spent on value-add activities. Instead of relying on one person’s memory, the structure itself guides users to the correct location. Centralized platforms like Homebase amplify this benefit by allowing syndicators to create and deploy templated folder structures for every new deal, guaranteeing consistency from the very beginning.

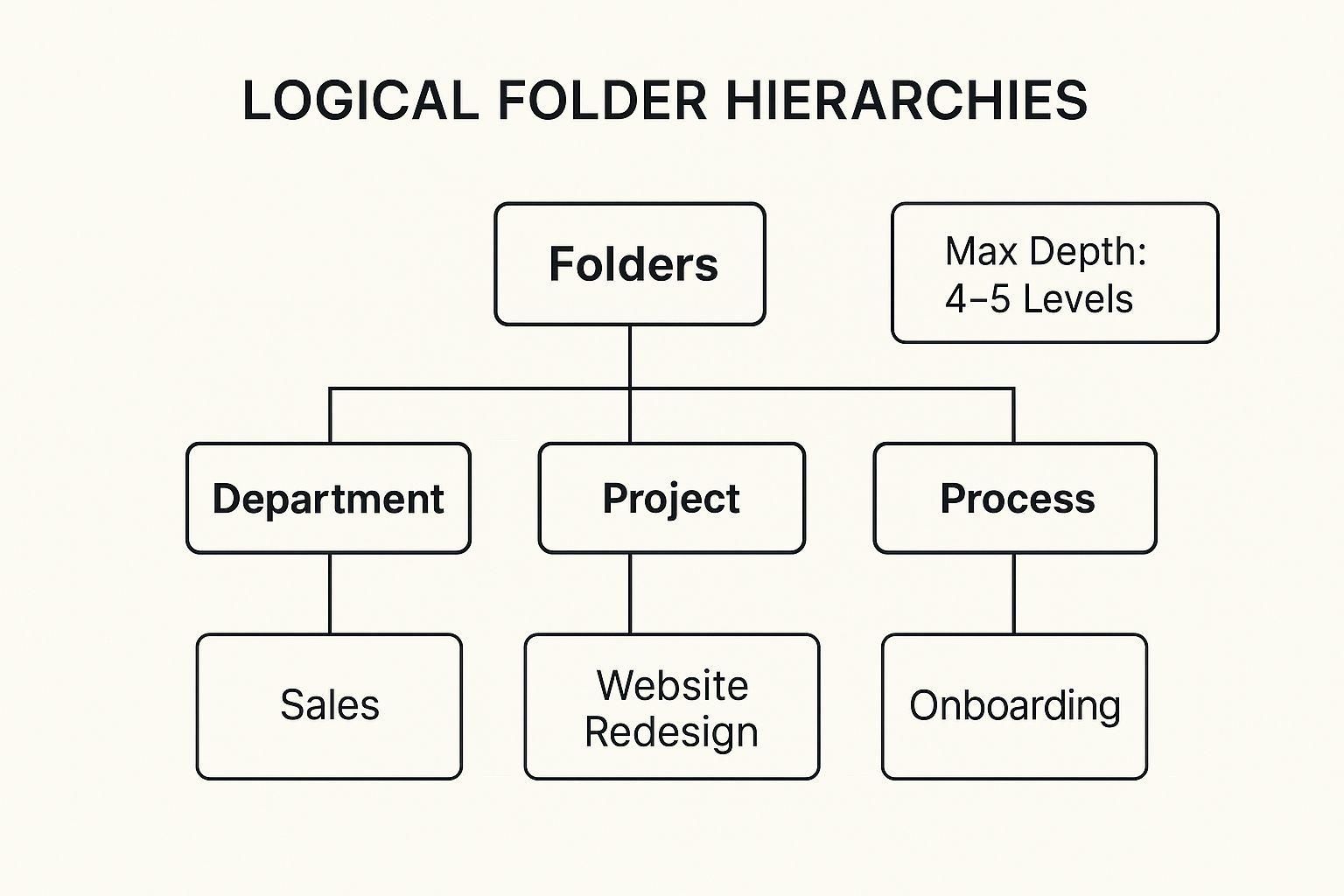

The following diagram illustrates three common and effective models for organizing a firm's top-level folders.

This visualization highlights how you can build a scalable structure based on your firm’s primary operational focus, whether it's departmental, project-based, or process-driven.

How to Create Your Folder Hierarchy

An effective folder structure for real estate syndication should be shallow, intuitive, and consistent. The top levels should be broad, with subfolders becoming progressively more specific. The goal is for a team member to locate any document within a few clicks.

- Project-based Example:/Properties/MapleCreekApts/03_DueDiligence/Financials/

- Department-based Example:/InvestorRelations/Communications/Q4_2023_Update/

- Process-based Example:/CapitalRaising/Syndication_Alpha/InvestorDocs/Signed_SubDocs/

Actionable Implementation Tips

- Limit Folder Depth: Keep your hierarchy to a maximum of four or five levels deep. Overly nested folders become cumbersome and difficult to navigate.

- Create Folder Templates: For recurring processes like new property acquisitions, create a pre-defined folder template. This ensures every deal is organized identically from day one.

- Use Broad Top-Level Categories: Start with simple, high-level folders like "Properties," "Corporate," and "Investor Relations" to create a clear starting point for all users.

- Conduct Regular Audits: Schedule periodic reviews of your folder structure to identify and clean up orphaned files, empty folders, and areas where the structure has become confusing or inconsistent.

4. Implement Robust Access Controls and Permissions

In real estate syndication, not every document is meant for every eye. Robust access controls are the digital equivalent of a secure vault, ensuring that sensitive information is only accessible to authorized individuals. This practice involves setting up granular permissions that define who can view, edit, download, share, or delete specific documents and folders. For a syndicator handling everything from investor PII to confidential property financials, controlling access isn't just a good idea; it's a critical security and compliance mandate.

This system is one of the most vital best practices for document management because it directly mitigates risk. Unauthorized access can lead to data breaches, compliance violations (like those under SEC regulations), and a catastrophic loss of investor trust. By implementing role-based permissions, you ensure that a limited partner can only see their own subscription documents, while your asset management team can access operational reports, and your legal counsel can review offering memorandums. This segmentation is fundamental to maintaining confidentiality and operational integrity.

How to Structure Access Permissions

A successful permissions structure is built on the principle of least privilege, meaning each user is granted only the minimum level of access necessary to perform their job duties. This minimizes the potential for both accidental and malicious data exposure. Platforms like SharePoint and specialized syndication portals excel at this. To fully leverage advanced features for security and access, robust Microsoft 365 support can be invaluable in configuring and maintaining precise permissions.

- Example 1 (Investor Access): An investor in "Maple Creek Apts" is granted view-only access exclusively to the MapleCreekApts/InvestorDocs/Smith folder.

- Example 2 (Asset Manager Access): An asset manager is given edit access to all property-level folders (e.g., MapleCreekApts/Operations, OakRidgePlaza/Financials) but has no access to corporate-level HR files.

- Example 3 (Acquisitions Team Access): The acquisitions team has full access to DueDiligence/NewDeal_123 but cannot view folders related to post-acquisition asset management.

Actionable Implementation Tips

- Follow the Principle of Least Privilege: Always start with the most restrictive permissions and grant additional access only as needed. Deny access by default.

- Use Role-Based Groups: Instead of assigning permissions to individuals, create groups like "Investors-MapleCreek," "Asset Managers," or "Legal Team." This simplifies administration, as you can add or remove users from a group rather than changing permissions on countless files.

- Conduct Regular Access Audits: At least quarterly, review who has access to what. This helps identify and revoke outdated permissions for former employees, partners, or investors who have exited a deal.

- Document Your Permission Structure: Create a clear policy that outlines the different access levels and roles. This ensures consistency and makes it easier to train staff and troubleshoot issues.

5. Establish Document Retention and Archival Policies

Not all documents should be kept forever. A systematic approach to managing the lifecycle of documents, from creation to disposal, is a critical component of effective governance. Establishing clear retention and archival policies defines how long different document types must be kept, when they should be moved to secure long-term storage, and when they can be legally and safely destroyed. This practice ensures compliance with federal and state regulations, mitigates legal risk, and simultaneously optimizes storage costs and system performance by removing outdated, irrelevant files.

This strategy is one of the most vital best practices for document management because it moves beyond simple organization and into strategic, compliant information governance. For real estate syndicators, who handle sensitive financial, legal, and investor documents, a documented policy protects the firm from litigation and regulatory penalties. It provides a defensible framework for why certain documents were destroyed, preventing accusations of evidence spoliation. Firms like Iron Mountain have built their entire business model around helping enterprises manage this lifecycle securely.

How to Create Your Retention Policy

A robust retention policy for a real estate syndication firm must be based on legal requirements and operational needs. It should categorize documents and assign specific timeframes for each. For example, documents related to a specific deal should be retained for a period extending beyond the deal’s lifecycle, often dictated by statutes of limitations for potential lawsuits.

- Example 1 (Financial Records): Tax-related documents, such as K-1s and annual financial statements, must be retained for at least 7 years to comply with IRS regulations.

- Example 2 (Legal & Offering Docs): Key legal documents like the Private Placement Memorandum (PPM) and subscription agreements should be kept for the life of the investment plus a number of years, as defined by legal counsel, to address any potential investor disputes.

- Example 3 (Operational Documents): Transient operational files like internal meeting notes or draft communications may only need to be retained for 1-2 years before being securely purged.

Actionable Implementation Tips

- Consult with Legal Counsel: Work directly with your attorney to define legally-sound retention periods for all document categories, from corporate filings to investor communications. This is not an area for guesswork.

- Automate Where Possible: Modern document management systems can automate retention policies. Configure your system to flag documents for archival or deletion once they reach the end of their retention period, reducing manual effort and risk.

- Train Staff on Legal Holds: If litigation is anticipated, you must issue a "legal hold," which suspends the normal destruction of relevant documents. Ensure your team understands what a legal hold is and the procedure for implementing one.

- Document All Disposals: Maintain a secure, unalterable log of every document that is destroyed. This certificate of destruction serves as crucial evidence that you followed your established policy in good faith.

6. Deploy Comprehensive Search and Metadata Capabilities

Storing documents is only half the battle; finding them quickly when needed is what separates an adequate system from a high-performance one. Deploying comprehensive search with rich metadata tagging transforms your document repository from a passive digital filing cabinet into an intelligent information hub. For real estate syndicators who need to pull up a specific K-1 from three years ago or find all environmental reports for a portfolio, this capability is a game-changer. It allows users to locate files not just by their name, but by their content, properties, and business context.

This approach is one of the most powerful best practices for document management because it creates multiple pathways to the same information. While a rigid folder structure and naming convention are foundational, metadata and search provide a flexible, intuitive layer on top. Think of it as adding a powerful search engine, like Google, specifically for your firm’s documents. Systems like SharePoint and other modern document management platforms excel at this by indexing not only file names but the full text of documents and their associated tags, ensuring critical data is always just a few keystrokes away.

How to Leverage Search and Metadata

An effective metadata strategy for real estate syndication involves tagging documents with key business-specific data points. These tags act as filters, allowing you to narrow down thousands of files to the exact one you need instantly.

- Example 1 (Finding Investor Information): Search for Tag:Accreditation and Property:MapleCreekApts to instantly pull up all accredited investor verification documents for that specific deal.

- Example 2 (Due Diligence): A search for DocumentType:Phase-I-ESA and DateRange:2022 could retrieve all initial environmental site assessments from that year across your entire portfolio.

- Example 3 (Financial Analysis): Use a query like "pro forma" AND Tag:Underwriting to find all underwriting models containing the term "pro forma," even if it’s not in the file name.

Actionable Implementation Tips

- Define a Metadata Schema: Create a standardized list of metadata tags for your organization. Common tags for syndicators include PropertyName, DocumentType (e.g., PPM, Subscription Agreement, K-1), DealStatus (e.g., Underwriting, Active, Exited), and InvestorName.

- Implement Auto-Tagging: Configure your document management system to automatically apply certain tags based on the folder a document is uploaded to or keywords within the document, reducing manual effort and ensuring consistency.

- Train Your Team: Show users how to use advanced search operators (like AND, OR, NOT, and quotation marks for exact phrases). A powerful tool is useless if no one knows how to operate it effectively.

- Balance Indexing and Performance: Work with your IT provider to ensure that full-text indexing is enabled without slowing down the overall system performance. A slight delay in indexing is better than a system that lags during daily use.

7. Enable Regular Backup and Disaster Recovery

A robust document management system is incomplete without a plan for the unexpected. Regular backup and disaster recovery protocols are your firm's ultimate insurance policy against data loss, ensuring business continuity in the face of hardware failure, cyberattacks, or natural disasters. For a real estate syndicator, losing access to critical documents like signed subscription agreements, financial models, or legal contracts could be catastrophic, halting operations and eroding investor trust. This practice involves systematically creating redundant copies of your data and having a clear, tested plan to restore it quickly.

This strategy is one of the most crucial best practices for document management because it protects the integrity and availability of your entire digital asset portfolio. While a good system organizes your data, a backup and recovery plan ensures it survives any potential threat. It guarantees that a server crash or a ransomware attack is a temporary inconvenience rather than a permanent business-ending event. For an in-depth look at how modern platforms handle this, you can explore the ultimate guide to real estate document management systems.

How to Create Your Backup and Recovery Plan

A successful backup and recovery strategy for real estate syndication should be automated, multi-layered, and regularly tested. The goal is not just to have backups but to be confident in your ability to restore them efficiently. The industry-standard "3-2-1 rule" provides an excellent framework: maintain at least three copies of your data on two different types of media, with one copy stored offsite.

- Example 1 (Financial Services): A firm uses real-time data replication to a secondary data center, ensuring no transactional data is lost in a system failure.

- Example 2 (Healthcare): A hospital system performs daily automated backups to a HIPAA-compliant cloud service and keeps encrypted physical backups in a secure, fireproof offsite location.

- Example 3 (Real Estate Syndicator): Using a cloud-based DMS that automatically backs up data across multiple geographic regions, supplemented by a quarterly manual backup to a separate cloud storage provider.

Actionable Implementation Tips

- Define RTO and RPO: Establish your Recovery Time Objective (RTO), the maximum acceptable time to restore operations, and your Recovery Point Objective (RPO), the maximum acceptable amount of data loss measured in time. This will guide your backup frequency and technology choices.

- Automate Everything: Manual backups are prone to human error and inconsistency. Use automated tools from providers like AWS Backup, Azure Backup, or built-in features of your DMS to run backups on a consistent schedule.

- Test Your Recovery Process: A backup plan is useless if it doesn't work. At least twice a year, perform a full recovery test to ensure your data can be restored within your defined RTO and that the restored data is intact.

- Document the Plan: Create a detailed disaster recovery document that outlines roles, responsibilities, contact information, and step-by-step procedures for restoration. Ensure all key personnel have access to this plan.

7 Best Practices Comparison Matrix

From Best Practices to Business Advantage: Centralize Your Success

The journey from administrative friction to operational excellence in real estate syndication is paved with systematic processes. We've explored a comprehensive suite of best practices for document management, moving far beyond generic advice to provide a clear, actionable blueprint. From establishing a standardized file naming convention like ProjectName_DocumentType_YYYY-MM-DD to implementing robust version control, each practice serves as a critical pillar supporting the integrity and efficiency of your operations.

Adopting these strategies is not merely about tidying up your digital files; it's about fundamentally transforming how you manage risk, build investor confidence, and scale your business. A logical folder hierarchy, strict access controls, and a well-defined retention policy are not just administrative tasks. They are strategic imperatives that safeguard sensitive information, ensure regulatory compliance, and create a seamless, professional experience for your partners and investors. Without them, you risk data breaches, costly errors, and a reputation for disorganization that can deter potential capital.

The Power of Integration Over Fragmentation

The most critical takeaway is the inherent limitation of a fragmented, piecemeal approach. Juggling documents across email, a basic cloud storage drive, and separate e-signature tools creates information silos and introduces unnecessary friction. The true competitive advantage lies not just in adopting these best practices individually, but in integrating them into a single, cohesive ecosystem. When your document management system is unified, the benefits multiply.

Consider the cumulative impact:

- Accelerated Deal Flow: A centralized system means offering memorandums, subscription agreements, and K-1s are all in one secure, easily accessible location. This eliminates the frantic search for documents and streamlines the entire fundraising and reporting process.

- Enhanced Investor Trust: Providing investors with a secure, professional portal where they can access all relevant deal documents and execute agreements builds immense confidence. It demonstrates a commitment to transparency and security that sets you apart.

- Reduced Operational Risk: Integrating version control, access permissions, and automated backups into one platform drastically reduces the likelihood of human error. It ensures the right people access the right version of the right document, every single time.

Your Actionable Next Steps

To translate these principles into tangible results, start by auditing your current processes against the best practices outlined in this article. Identify the biggest points of friction. Are you spending too much time searching for files? Is your version control process manual and prone to error? Do investors frequently ask for documents they can't find? Answering these questions will illuminate where a unified system can deliver the greatest impact.

Ultimately, mastering these best practices for document management is about creating a scalable foundation for growth. It’s about building a business that runs on efficiency, security, and professionalism, allowing you to focus your energy on what you do best: finding great deals and creating value for your investors.

This is precisely why we built Homebase. It’s an all-in-one platform designed to embed these best practices directly into your workflow, providing structured deal rooms, secure document sharing with e-signatures, and robust investor relations tools. Ready to trade spreadsheets for a scalable, secure, and professional system? Explore how Homebase can centralize your operations and provide an unparalleled experience for you and your investors.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.