Define Capital Call: Master Guide for Strategic Investors

Define Capital Call: Master Guide for Strategic Investors

Master how to define capital call and leverage this knowledge for smarter investments. Discover expert insights on mechanics, strategies, and future trends.

Domingo Valadez

Mar 27, 2025

Blog

Demystifying Capital Calls: What Every Investor Must Know

A capital call is a key aspect of investing in private markets, such as private equity and real estate funds. It's a legal right that allows fund managers to request additional funds from investors who have already committed to an investment. This means investors don't provide all their committed capital at the outset. Instead, they deploy it over time as the fund manager identifies and pursues opportunities. This staged approach offers flexibility for both fund managers and investors.

This concept is particularly common in private equity and real estate. For example, if an investor commits $100,000 to a fund, they might initially pay only a portion, such as $30,000. The remaining $70,000 is subject to future capital calls as needed. This allows investors to keep their committed funds working in other investments until the fund manager requires them, potentially maximizing returns. Learn more about capital calls here: Capital Call

Understanding the Mechanics of a Capital Call

The process typically begins with the investor making a capital commitment to the fund. This commitment represents the total amount the investor is prepared to invest over the fund's lifetime. However, this commitment isn't an immediate transfer of the full amount. Instead, the fund manager issues capital calls based on the fund's investment strategy and the particular needs of the underlying investments.

For instance, a real estate fund manager might issue a capital call to cover the down payment on a new property acquisition, subsequent renovations, or unforeseen operating expenses. A private equity fund manager, on the other hand, might issue a capital call to finance a portfolio company's expansion or an acquisition. For a more in-depth look at capital calls, check out this resource: Understanding Capital Calls: A Comprehensive Guide

Timing and Implications of Capital Calls

The timing of capital calls can vary significantly depending on the fund's strategy and the overall investment environment. Some funds might issue capital calls regularly, while others do so more sporadically. This unpredictability highlights the importance of liquidity management for investors. Investors need to ensure they have sufficient liquid assets on hand to meet capital calls when they arise. Failure to do so can lead to penalties or even the loss of their investment.

Capital calls are a fundamental mechanism for funding investments in private markets. Understanding their function and potential implications is crucial for any investor considering these markets. By grasping the mechanics, timing, and implications of capital calls, investors can make well-informed decisions and effectively manage their portfolios.

Inside the Private Equity Capital Call Machine

Understanding the mechanics of a capital call is just the first step. This section explores the operational aspects of how private equity firms manage the capital call process. It's a complex system with many moving parts, impacting both the firm and its investors.

The Capital Call Process: A Behind-the-Scenes Look

Private equity firms don't issue capital calls randomly. The process involves careful planning, strategic timing, and transparent communication. Fund managers must consider a multitude of factors, including market conditions, investment opportunities, and investor liquidity.

Private equity firms rely on capital calls to efficiently manage their investments. When a promising investment opportunity arises, the firm can quickly access the necessary capital through a capital call. This flexibility is a defining characteristic of private equity investing.

Between 2010 and 2020, private equity investments grew significantly. Firms frequently used capital calls to quickly capitalize on emerging opportunities and manage cash flow efficiently. However, this advantage also presents risks. For example, poorly timed capital calls could lead to potential investor defaults. For more information about capital calls and associated risks, see Private Equity: What Is a Capital Call?.

Documentation and Communication: Keys to a Smooth Process

Clear documentation and open communication are crucial for a successful capital call process. This includes precisely outlining the terms and conditions of the call, providing ample notice to investors, and ensuring all parties understand their obligations.

Maintaining investor confidence is also paramount. Regular updates, transparent reporting, and accessible points of contact contribute significantly to a positive investor experience. Proactive communication helps mitigate potential concerns and fosters trust between the firm and its investors.

Preparing for the Call: Investor Best Practices

Investors also have an important role in the capital call process. Understanding the potential for future capital calls and maintaining sufficient liquidity is vital for meeting these obligations.

Investors should carefully review the fund's historical capital call patterns before committing. This due diligence helps align investment strategies with individual liquidity profiles and avoids potential financial strain. A proactive approach allows investors to be prepared and contribute capital when called upon. This ensures a smooth and mutually beneficial process.

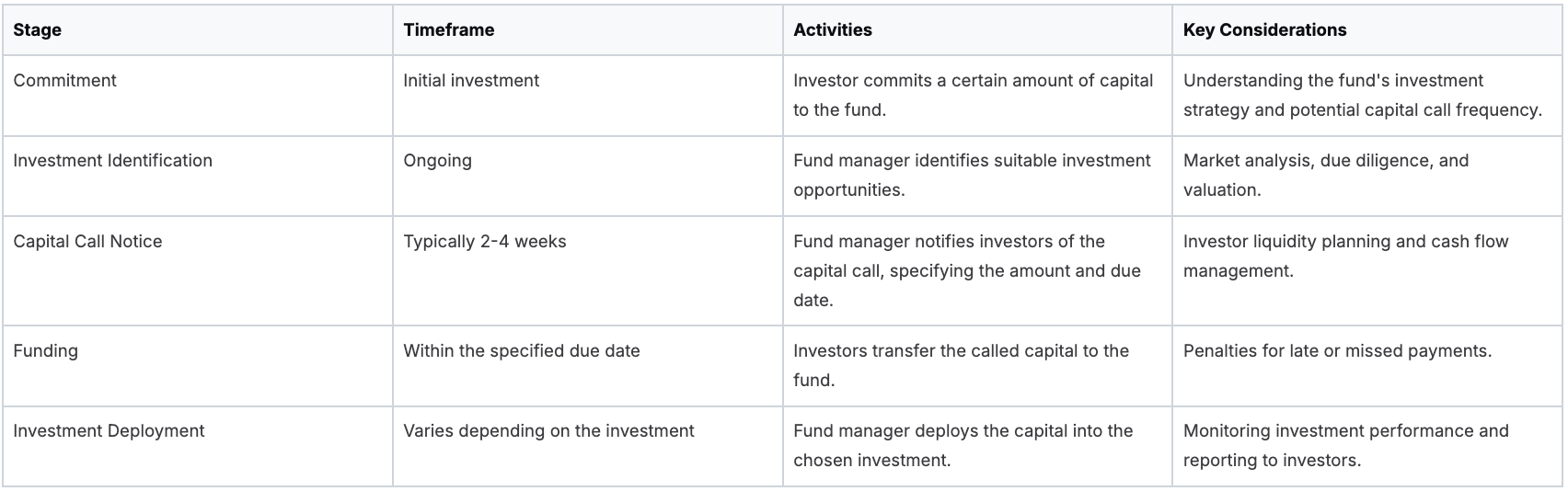

To illustrate the typical timeline of a capital call, the following table provides a detailed overview of the process.

Capital Call Process Timeline

This table outlines the typical sequence of events in a capital call process, from initial commitment to investment deployment.

This table highlights the various stages involved in a capital call and emphasizes the importance of preparation and communication for both the fund manager and the investors. By understanding this process, investors can effectively manage their liquidity and contribute to the success of the fund's investments.

Capital Call Credit Lines: The Strategic Funding Alternative

Sophisticated fund managers are increasingly using capital call credit lines. These lines of credit act as short-term financing, allowing fund managers to borrow funds from a financial institution instead of immediately issuing a capital call to their investors (Limited Partners, or LPs). This offers significant advantages in operational flexibility and financial management.

Advantages of Capital Call Credit Lines

Using a credit line offers several key benefits. For example, it provides a cushion against unexpected costs or funding delays from investors. This ensures deals can progress smoothly, eliminating the risk of missing crucial investment windows due to funding gaps. It can also make the entire investment process more efficient.

This method also lessens the administrative work associated with frequent capital calls. Instead of many smaller capital calls to LPs, a fund manager can draw on the credit line as needed and make a single, larger capital call later. This saves time and resources for both the fund manager (the General Partner, or GP) and the LPs.

Moreover, using credit lines can potentially boost a fund’s reported performance. By delaying capital calls, the fund manager can improve the internal rate of return (IRR), a vital performance indicator in private equity. This is because invested capital is deployed faster, generating returns sooner. The use of these lines of credit has become more common among fund managers, allowing general partners to access funds from financial institutions rather than calling capital directly from limited partners. This helps mitigate the risk of investor defaults and provides more predictable cash flow, enhancing the fund's IRR by ensuring funds are available when needed. Explore this topic further: Cash Flow Management: Lines of Credit.

Potential Risks and Considerations

While offering many pluses, capital call credit lines also present some risks. One significant concern is the potential for higher debt levels for the fund. If not managed effectively, interest payments on the credit line can reduce overall returns. Limited partners should inquire about the planned use and oversight of these credit lines before investing.

Another factor is the impact on the relationship between GPs and LPs. Using credit lines grants GPs greater autonomy and potentially lessens LP oversight. This could reduce LP insight into the fund's short-term financial activities.

Evaluating the Impact on Investment Returns

Ultimately, the decision of whether to use a capital call credit line depends on a careful evaluation of the pros and cons. Fund managers and LPs must determine if the advantages of increased flexibility and potentially higher IRR outweigh the risks of increased debt and reduced LP control. This assessment demands a solid understanding of the fund's investment strategy, the overall investment environment, and the credit facility's specific terms.

By carefully weighing these factors, fund managers and LPs can make informed decisions about using capital call credit lines and determine if they offer a true strategic advantage. Understanding this funding mechanism is essential for those involved in private equity and real estate.

Mastering Capital Call Strategy: The Fund Manager's Playbook

Effective capital call management is a defining characteristic of successful fund managers. It requires a careful balance between securing necessary funds and nurturing positive relationships with investors. This section explores the strategies top-performing managers use to optimize their capital call process.

Forecasting Capital Needs: A Balancing Act

Top-tier fund managers don't just budget. They build sophisticated forecasting models to accurately predict capital needs. This proactive approach minimizes the frequency of unexpected capital calls and maintains a consistent investment rhythm. It also helps manage cash drag, the low returns from holding excessive uninvested capital. This precision is key for deploying capital efficiently and maximizing potential returns.

Even with the best forecasts, flexibility is essential. Market dynamics can change rapidly, impacting investment timelines and funding requirements. This is where strategic reserves and contingency planning become vital. A suitable buffer allows the fund to adapt to market shifts without disrupting investment strategies.

Transparent Communication: Building Trust With Investors

Open and timely communication is paramount for maintaining investor confidence. Fund managers must clearly explain the reasoning behind each capital call, detailing how the funds will be used and the anticipated returns. This transparency builds trust and reinforces the fund manager's expertise.

Regular updates on investment performance and market conditions further strengthen the investor-manager relationship. Keeping investors informed mitigates potential anxieties about their commitments. When developing capital call strategies, fund managers need to strike a balance between necessary flexibility and adequate notice for limited partners.

Capital call notices typically include detailed investment information and are sent at least ten days in advance. Institutional investors generally expect a more structured and predictable capital call schedule. This predictability maintains transparency and trust, crucial for a strong relationship between general partners and limited partners. Learn more about capital calls: Capital Calls.

Optimizing Capital Call Schedules: Enhancing Performance

Capital call schedules are more than just administrative tasks; they are powerful tools for improving fund performance. Skilled fund managers strategically time calls to minimize investor disruption and optimize capital deployment. This involves understanding each investor's liquidity profile and anticipating market fluctuations.

Strategic timing reduces the chances of investors needing to liquidate assets at inopportune times to meet capital calls. For instance, distributing calls strategically avoids undue pressure on investors during market downturns. By considering these factors, fund managers can minimize disruptions to investor portfolios and improve overall returns.

Leveraging Technology: Streamlining the Process

Technology is transforming capital call management. Automated platforms streamline communication, track investor commitments, and produce detailed reports. This increased efficiency reduces administrative burdens, allowing fund managers to focus on investment strategy.

These tools also empower investors by providing real-time access to information on capital calls, investment performance, and fund activity. This increased transparency strengthens the investor-manager relationship and promotes trust.

The Limited Partner's Survival Guide to Capital Calls

A capital call is a request from a fund manager to an investor for a portion of their committed capital. Managing these calls effectively is crucial for limited partners (LPs) to maintain healthy portfolio liquidity and strong returns. This section explores how savvy investors prepare for and manage this aspect of private market investing.

Strategies for Managing Capital Commitments

Different investor types employ unique strategies. Institutional investors often utilize complex portfolio models within tools like FactSet to forecast and allocate funds for anticipated calls. Family offices, with their more concentrated investments, may opt for direct communication with fund managers to gauge timing. High-net-worth individuals frequently work with wealth advisors to structure their portfolios for liquidity events, including capital calls. These varied approaches highlight the personalized nature of liquidity management in private investments.

Some institutional investors, for example, establish dedicated “sidecar” accounts specifically designed to fund anticipated capital calls. This tactic ensures readily available liquidity without disrupting their core investment portfolio. Many family offices leverage established relationships with fund managers to get advance notice of upcoming calls, allowing them to proactively position their liquid assets.

Early Warning Systems and Default Consequences

Experienced LPs develop early warning systems to anticipate capital calls. These systems can involve tracking a fund's investment pace, monitoring market conditions relevant to the fund's strategy, and staying in close contact with the fund manager. This proactive stance minimizes surprises and enables strategic liquidity planning.

Failing to meet a capital call, however, carries serious consequences. Penalties can include forfeiting a portion of the investment, being compelled to sell the stake at a discount, or even legal ramifications. These potential outcomes underscore the critical importance of diligent liquidity management for LPs. Careful planning and preparation are paramount.

Evaluating a Fund's Capital Call Patterns

Before committing to a fund, LPs should meticulously analyze its historical capital call patterns. This analysis should consider the frequency, size, and timing of past calls. Comparing this data to the LP’s own liquidity profile helps ensure alignment and avoids commitments to funds with incompatible capital call practices. For instance, an investor with lower liquidity might avoid funds known for frequent, large, or unpredictable calls.

By carefully assessing these historical patterns, LPs can select funds that fit their liquidity preferences. This due diligence is essential for informed decision-making in private markets, minimizing the risk of unexpected financial strain, and ultimately maximizing the potential for strong investment returns. This careful approach helps investors navigate the complexities of private equity and venture capital.

Capital Calls vs. Alternative Funding Approaches: The Complete Comparison

Beyond traditional capital calls, several alternative funding mechanisms are impacting private markets. This section analyzes how capital calls compare to these emerging alternatives, examining the implications for both fund managers and investors. We'll explore which approaches offer genuine advantages, compare administrative costs, and identify structures gaining traction with institutional allocators.

Subscription Lines of Credit: Bridging the Funding Gap

One common alternative is the subscription line of credit, similar to a capital call credit line. These credit facilities allow fund managers to draw down funds quickly to secure investments, delaying the need to call capital from limited partners.

This provides flexibility and can improve a fund's IRR by deploying capital more quickly. However, it also introduces debt and potential interest expenses, affecting overall returns.

Preferred Equity: Balancing Risk and Reward

Another approach involves using preferred equity. This structure offers a hybrid approach, providing investors with a preferred return and potentially some downside protection.

This can be attractive to certain investors seeking a less volatile return profile. However, it can also dilute the returns for other investors in the fund, and the specific terms of the preferred equity can be complex to negotiate.

Co-Investment Opportunities: Aligning Interests

Co-investment opportunities are becoming increasingly popular, allowing investors to invest directly alongside the fund in specific deals. This offers greater transparency and control over investment selection.

However, it also requires more active involvement from investors and may not be suitable for all.

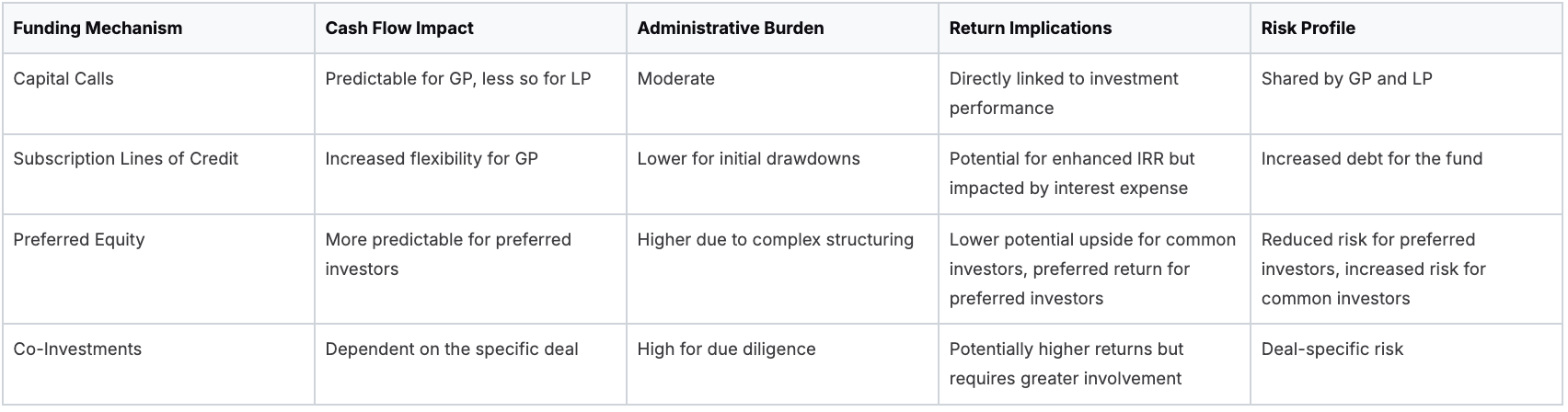

To help illustrate the differences between these funding mechanisms and traditional capital calls, let's examine a comparison table.

Comparing Investment Funding Mechanisms

This table compares capital calls with other funding approaches across key characteristics and considerations

As the table highlights, each funding mechanism has its own set of advantages and disadvantages regarding cash flow, administrative burden, return implications, and risk profile.

Choosing the right funding approach depends on several factors, including investment strategy, time horizon, and risk tolerance. By carefully considering these aspects, fund managers and investors can select the mechanism best aligned with their specific needs and goals. Platforms like Homebase , with its focus on simplifying real estate syndication, are well-positioned to assist in managing various funding models, from traditional capital calls to more innovative structures. This allows for a more efficient and professional approach to capital management.

The Future of Capital Calls: Innovation on the Horizon

The private capital landscape is in constant flux, and the capital call process is no exception. This section explores emerging trends and technologies set to reshape how capital calls are managed in the coming years. These developments offer the potential to improve operational efficiency, enhance transparency, and create new opportunities for fund managers and investors alike.

Blockchain Verification and Enhanced Security

Blockchain technology, already disrupting numerous industries, offers significant potential benefits for capital calls. Its inherent security and transparency could revolutionize how commitments and transactions are verified, mitigating the risk of fraud and boosting efficiency. Smart contracts, for instance, could automate the execution of capital calls, removing manual processes and accelerating funding timelines. This increased efficiency could then lead to quicker capital deployment and potentially higher returns.

Automated Liquidity Management: Empowering Investors

Automated liquidity management platforms are growing in sophistication. These platforms allow investors to better track their commitments, anticipate upcoming capital calls, and manage their liquid assets more effectively. This empowers investors to make informed decisions and fulfill capital call obligations without impacting their overall investment strategy. This move toward automation is likely to become an industry standard, benefiting both investors and fund managers.

Regulatory Changes and Increased Transparency

Increased regulatory scrutiny of private markets is impacting how capital calls are managed. Investor demand for greater transparency is driving the adoption of more robust reporting and communication practices. This increased transparency builds trust between fund managers and investors, fostering stronger relationships. New regulations could also standardize certain aspects of the capital call process, further promoting efficiency and investor protection.

Adapting to the Evolving Landscape: Essential Skills

As the capital call process evolves, both fund managers and investors must adapt. Fund managers need to adopt new technologies and cultivate expertise in areas like data analytics and automated reporting. Investors, meanwhile, will need to become more adept at using online platforms and interpreting complex data. This evolving environment demands new skills and a proactive approach to staying abreast of best practices.

Preparing for these changes is vital for anyone involved in the private capital ecosystem. By understanding the emerging trends and technologies, both fund managers and investors can position themselves for success in the future of capital calls. For a platform designed to navigate this changing landscape, Homebase offers a solution. Learn more about Homebase's comprehensive suite of tools for real estate syndication and capital management at their website.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.