Commercial Real Estate Development Process: Your Success Guide

Commercial Real Estate Development Process: Your Success Guide

Learn the commercial real estate development process step by step. Discover key strategies to ensure successful projects and maximize returns.

Domingo Valadez

Jun 6, 2025

Blog

Understanding What Makes CRE Development Projects Succeed

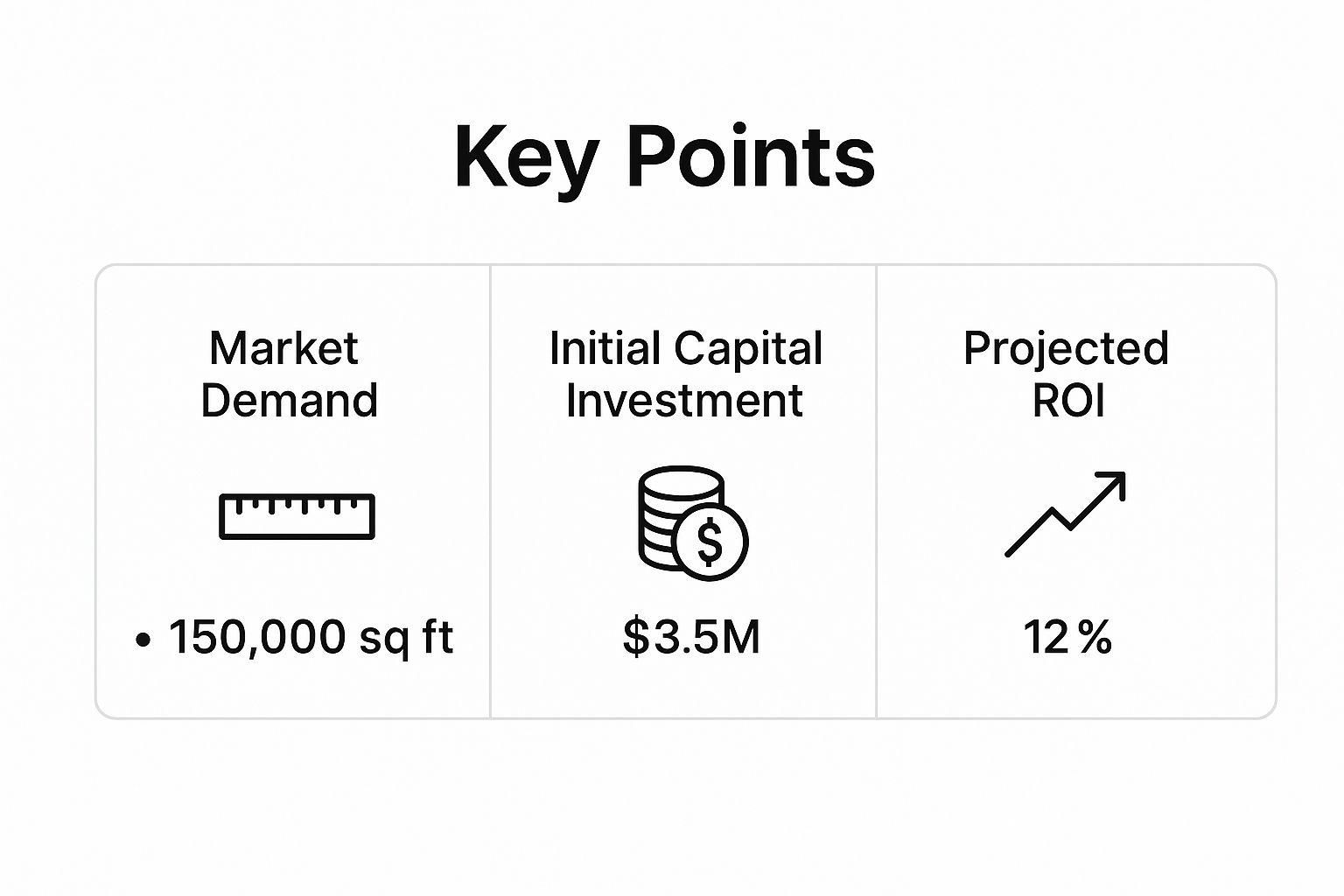

The infographic above illustrates key data points in a commercial real estate (CRE) development project. These include market demand, initial capital investment, and projected ROI. These metrics are essential for assessing the feasibility and potential profitability of a CRE development. As the data suggests, aligning strong market demand with a reasonable initial investment can lead to substantial returns.

This highlights the critical role of thorough due diligence and market analysis in the commercial real estate development process. A well-researched project is much more likely to attract investors and achieve financial success.

Key Factors in Successful CRE Development

Several crucial factors contribute to the success of CRE development projects. When thoughtfully considered and strategically executed, these elements can dramatically improve the probability of a profitable outcome.

- Thorough Market Research: Understanding market demand, demographics, and economic indicators is paramount. This includes analyzing vacancy rates, rental trends, and absorption rates to pinpoint opportunities and potential risks. A burgeoning population with rising disposable income, for instance, could indicate strong demand for retail spaces.

- Strategic Site Selection: The location of a CRE project is a crucial determinant of its success. Accessibility, visibility, proximity to amenities, and local competition all play key roles. This is comparable to selecting the right fishing spot: a location rich with fish (potential customers) naturally yields better results.

- Robust Financial Planning: Securing necessary capital and effectively managing project budgets are essential. Developers should explore diverse financing options, create realistic pro forma projections, and carefully track expenses throughout the development lifecycle. A solid financial plan ensures that the project stays on track and within budget.

- Efficient Project Management: Executing a project on time and within budget demands meticulous planning, coordination, and oversight. This includes efficiently managing multiple teams, proactively mitigating potential risks, and maintaining stringent quality control throughout the construction phase.

- Effective Leasing and Management: Once the project is complete, attracting and retaining high-quality tenants is crucial for generating consistent cash flow and maximizing ROI. Targeted marketing campaigns, negotiating favorable lease terms, and providing top-notch property management services are key.

To better understand the various stages and their associated costs and timelines in a typical CRE development project, let's examine the following table:

Development Phase Comparison

Comparison of time requirements, costs, and key activities across major development phases

This table provides a general overview, and actual durations and costs can vary depending on the specific project. However, it highlights the substantial investment required during the construction phase and the importance of efficient execution to minimize costs and delays. The lease-up phase is also critical for achieving stabilized occupancy and generating returns.

The Impact of Market Dynamics

Commercial real estate market performance is closely tied to broader economic trends and investor confidence. In 2025, a significant majority – 88% – of CRE executives surveyed anticipate revenue growth for their companies. This reflects optimism about market recovery and potential growth. For more insights into current CRE statistics, see Learn more about commercial real estate statistics.

This positive sentiment suggests a favorable environment for CRE development. However, carefully evaluating market dynamics remains essential. This includes understanding the potential effects of fluctuating interest rates, economic cycles, and shifts in tenant demand.

Building a Strong Foundation for Success

Successfully navigating CRE development requires a comprehensive approach. This includes integrating meticulous planning, thorough market analysis, sound financial expertise, and effective project management. By concentrating on these key areas, developers can position their projects for success and maximize their potential returns. Furthermore, remaining adaptable and responsive to evolving market conditions is vital for sustained profitability in the dynamic world of CRE development.

Finding Gold: Market Analysis And Site Selection Mastery

The success of commercial real estate development depends heavily on location. It's not just about finding an available plot; it's about identifying a site with the potential for substantial returns. This requires a systematic approach to market analysis and site selection.

Unveiling Hidden Opportunities: In-Depth Market Analysis

Effective market analysis delves deeper than simply reviewing current data. It requires understanding the underlying dynamics of demand and anticipating future trends. This means examining demographics, economic indicators, and the competitive landscape.

- Demographic Deep Dive: Analyzing age, income, education, and lifestyle trends helps determine the types of commercial properties best suited for an area. For example, a younger, tech-savvy population might create demand for co-working spaces and high-end apartments.

- Economic Indicator Assessment: Evaluating job growth, unemployment rates, and major employers provides insights into the local economy. A robust and diverse economy offers a stronger foundation for long-term success. Understanding industrial sector trends, such as rising average asking rents, is also crucial. Average asking rents reached $10.13 per square foot in Q4 2024, a 61% increase from Q4 2019. This highlights attractive investment opportunities in the industrial sector. More detailed statistics can be found here: Commercial Real Estate 2025: Hurdles and Horizons

- Competitive Landscape Analysis: Identifying existing and planned commercial developments reveals potential market gaps and opportunities for differentiation. This could involve offering unique amenities or targeting an underserved segment.

Mastering Site Selection: From Data to Decisions

After completing the market analysis, the next step is site selection. This involves evaluating specific sites based on various criteria to determine the best fit for the project.

Essential Site Selection Criteria

Several key criteria contribute to the overall feasibility and potential profitability of a development project.

- Accessibility and Visibility: Sites with easy access and high visibility are more desirable for tenants and customers. A retail space on a busy street corner is significantly more attractive than one hidden in a back alley.

- Infrastructure and Utilities: Adequate infrastructure, including water, sewer, and power, is essential. Reliable high-speed internet access is also increasingly important for businesses.

- Zoning and Regulations: Understanding local zoning regulations is critical. A site already zoned for the intended use can streamline the approval process, reducing development time and costs.

- Environmental Considerations: Environmental due diligence is vital to identify any potential issues that could impact the project. These assessments protect both the environment and the developer's investment.

Validating Your Choice: Tools and Techniques

Market validation tools provide additional insights to refine site selection decisions, helping confirm assumptions and mitigate potential risks.

- Traffic Pattern Analysis: Understanding traffic flow is important for retail locations and other businesses that rely on customer accessibility. This analysis helps predict customer volume and optimize site design.

- Local Economic Assessments: Detailed local economic assessments offer a granular understanding of the immediate market. This data complements the broader market analysis to refine site selection strategies.

- Demographic Trend Projections: Projecting demographic shifts provides a long-term perspective, helping ensure the site remains viable over time.

By combining thorough market analysis with rigorous site selection, developers can significantly improve their chances of success. This systematic approach minimizes risks and maximizes the potential for creating valuable and profitable properties.

Securing Capital: Financing Strategies That Actually Work

Financing is essential for any commercial real estate development project. This section explores effective strategies to attract investors and secure the necessary capital to turn your vision into reality. We'll examine deal structuring, key lender metrics, and financing options beyond traditional bank loans.

Structuring Deals to Attract Investors

Attracting investors requires structuring deals that offer appealing returns while aligning with your development goals. This involves creating a compelling investment narrative, structuring beneficial equity splits, and clearly demonstrating the project's profitability potential.

- Develop a Compelling Narrative: Clearly articulate your project's vision, target market, and potential for financial success. This narrative should resonate with potential investors and align with their investment objectives. Think of it as a concise and persuasive pitch that highlights the project's strengths and opportunities.

- Offer Attractive Equity Splits: Structure equity splits that incentivize investors while ensuring a reasonable share for yourself. A balanced approach fosters trust and encourages collaborative, long-term partnerships. This balance is crucial for attracting and retaining investors.

- Demonstrate a Clear Path to Profitability: Provide realistic financial projections backed by thorough market research and due diligence. Clearly show investors how the project will generate revenue, manage expenses, and ultimately deliver strong returns. Detailed financial modeling is essential for demonstrating viability.

You might be interested in: How to master real estate capital raising strategies

Understanding Lender Metrics

Lenders use specific metrics to evaluate projects and determine loan terms. Understanding these metrics is vital for securing favorable financing. These metrics help assess the project's risk and the likelihood of loan repayment.

- Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the property's appraised value. A lower LTV generally indicates lower risk for the lender and can lead to better loan terms.

- Debt Service Coverage Ratio (DSCR): This metric measures the property's ability to generate enough income to cover debt payments. A higher DSCR signals stronger financial performance and a greater ability to repay the loan.

- Credit Score: Both your personal and business credit scores are important factors in loan approval and interest rates. Maintaining a good credit history is crucial for securing financing.

Exploring Financing Options

While traditional bank loans are common, exploring alternative financing options can offer greater flexibility and potentially more favorable terms.

- Private Equity Partnerships: Partnering with private equity firms can provide access to significant capital. However, these partnerships typically involve sharing a larger portion of the profits.

- Joint Ventures: Joint ventures allow you to share the financial burden and risk with another developer or investor. This collaborative approach can be particularly advantageous for large-scale projects.

- Crowdfunding:Crowdfunding platforms can connect you with a broader pool of investors, especially for smaller projects. This method often requires a comprehensive marketing strategy to attract sufficient funding.

The global commercial real estate market remains attractive to investors. In Q1 2025, direct transaction activity reached $185 billion, a 34% year-over-year increase. This indicates a strong and continuing interest in the sector. Find more detailed statistics here: Global Market Perspectives

Building Relationships with Capital Sources

Securing capital involves more than just financial figures; it also requires building strong relationships with lenders and investors. These relationships can be invaluable for future projects and offer access to industry expertise.

- Network Actively: Attend industry events, conferences, and networking opportunities to connect with potential lenders and investors. Building genuine relationships requires consistent effort and engagement.

- Maintain Open Communication: Keep lenders and investors updated on the project's progress, challenges, and achievements. Transparency fosters trust and strengthens these crucial partnerships.

- Seek Mentorship: Learn from seasoned developers who have successfully secured financing. Their guidance can offer valuable insights and help you avoid potential obstacles.

By understanding these financing strategies, fostering strong relationships, and carefully navigating the capital markets, you can secure the funding needed to realize your commercial real estate development projects.

Navigating The Regulatory Maze Without Losing Your Mind

Securing the necessary permits and approvals is crucial for commercial real estate development. While this stage can be intricate, a strategic approach can prevent it from becoming a major obstacle. This section provides guidance on effective strategies for collaborating with municipal officials and optimizing the approvals process.

Building Bridges: Effective Relationships With Local Officials

Developing positive relationships with local officials can significantly influence your project's outcome. Understanding their priorities and fostering trust is key.

Attending community meetings and engaging in open discussions demonstrates your commitment to the local area. Proactively addressing any concerns they might have can also preemptively resolve potential issues.

- Understand Their Perspective: Research the local government's key priorities and areas of concern. This insight will enable you to tailor your proposals to align with their objectives.

- Open Communication: Regularly communicate with officials, providing timely updates and promptly answering their questions. This transparency builds trust and cultivates a collaborative working relationship.

- Be Proactive: Anticipate potential problems and address them before they escalate into significant roadblocks. This proactive approach can save valuable time and resources.

Streamlining Approvals: Preparation and Presentation

A well-structured and compelling presentation to the planning commission can significantly expedite the approval process. This requires presenting a clear, concise, and persuasive argument in favor of your project.

- Clear and Concise Proposals: Present your project in a straightforward and organized manner, emphasizing its benefits to the community. Avoid technical jargon and focus on the project's positive impact.

- Visual Presentations: Utilize visual aids such as maps, renderings, and diagrams to effectively communicate your project's scope and design. Visuals can enhance understanding and engagement.

- Address Potential Concerns: Anticipate questions and concerns the commission might raise, and prepare thoughtful responses. This demonstrates thoroughness and preparedness.

Winning Community Support: Turning Opposition Into Advocacy

Community engagement is a cornerstone of successful commercial real estate development. Engaging the community early on and addressing their concerns can transform potential opposition into valuable support.

Holding public forums and incorporating community feedback into your plans demonstrates that you value their input. This proactive approach can prevent delays and foster a sense of shared ownership in the project.

Research shows that developers who prioritize early community engagement experience significantly fewer project delays. In fact, these developers complete approval processes 34% faster and encounter 67% fewer delays than those using traditional methods. Read the full research here.

- Early and Frequent Engagement: Initiate community outreach from the beginning of the planning process. Early involvement fosters trust and facilitates ongoing dialogue.

- Active Listening: Listen attentively to community concerns and address them with honesty and respect.

- Transparency and Feedback: Openly share project information and integrate community feedback whenever possible. This inclusive approach builds community support and fosters a sense of shared responsibility.

Managing the Timeline: Keeping Your Project on Track

Effective timeline management is essential to avoid costly delays. This involves setting realistic deadlines, diligently tracking progress, and establishing contingency plans.

- Realistic Deadlines: Develop a realistic project timeline that takes into account potential delays.

- Regular Monitoring: Consistently track your progress against the established timeline and make adjustments as necessary.

- Contingency Planning: Prepare backup plans to address unforeseen circumstances. This proactive approach helps maintain project momentum even when challenges arise, ensuring that your project stays on schedule and within budget.

Managing Construction Like A Pro

Turning architectural drawings into profitable commercial properties takes more than skilled labor; it demands expert project management. This section explores the strategies that keep projects on schedule, within budget, and built to the highest standards, protecting your investment.

Coordinating The Symphony Of Construction

Successful commercial real estate development hinges on effective coordination. Think of construction as an orchestra: multiple specialized teams working in concert toward a shared goal. This requires clear communication, well-defined roles, and regular progress meetings. These meetings are vital for proactively addressing potential problems before they escalate into major setbacks. This proactive approach keeps everyone focused and aligned with the project's overall success.

Handling The Unexpected: Adaptability In Action

Construction rarely proceeds exactly as planned. Unexpected issues, from supply chain disruptions to unforeseen site conditions, are practically inevitable. Savvy developers anticipate this, incorporating contingency plans into their projects. This means allocating both time and budget reserves to absorb unexpected costs or delays. This foresight helps maintain project momentum, even when facing challenges. Adaptability, the ability to adjust as needed, is essential for navigating these unavoidable surprises.

Quality Control: Preventing Costly Rework

Quality control isn't an afterthought; it’s an ongoing process integrated into every construction phase. Regular inspections, detailed documentation, and adherence to industry standards prevent expensive rework later. This saves money and protects your reputation for delivering high-quality properties. Consider it an investment in avoiding future problems.

Real-World Construction Scenarios

Let’s examine specific construction challenges and how experienced developers address them:

- Managing Change Orders: Change orders, modifications to the original scope, can significantly impact costs and timelines. Effective management requires clear communication with contractors, thorough documentation, and a pre-approved authorization process.

- Maintaining Safety Standards: Job site safety is paramount. Implementing and enforcing rigorous safety protocols protects workers and minimizes the risk of costly accidents and delays. Investing in safety training and equipment is not only ethically sound but also financially prudent.

- Navigating Supply Chain Challenges: Recent events have exposed vulnerabilities in global supply chains. Experienced developers mitigate this by diversifying suppliers, incorporating lead time buffers, and closely monitoring potential disruptions. This proactive approach helps maintain project schedules and minimizes the impact of unforeseen delays.

Communication And Monitoring: The Pillars Of Success

Effective communication underpins successful project management. Regular progress reports, transparent communication channels, and clear lines of responsibility keep all stakeholders informed and aligned. Real-time monitoring, using tools like project management software, allows for early problem identification and proactive intervention. These systems provide a clear overview of the project's status, facilitating swift adjustments when necessary.

Building Strong Contractor Relationships

Cultivating strong contractor relationships is essential. Open communication, mutual respect, and fair payment practices foster a collaborative environment where everyone is invested in the project's success. This enhances the quality of work and reduces the likelihood of disputes. View contractors as partners, not just vendors, in the development process.

Construction Phase Risk Mitigation

The following table summarizes common construction risks and effective mitigation strategies.

By implementing these project management strategies, you can turn architectural plans into profitable realities. Ensure your commercial real estate developments are completed on time, within budget, and to the high standards that attract tenants and maximize your investment.

Maximizing Returns Through Smart Leasing and Management

Completing construction is a significant achievement in commercial real estate development. But the real test comes next: securing profitable leases and implementing effective long-term management. This is where your project transforms from a building site into a revenue-generating asset.

Attracting and Retaining Quality Tenants

Attracting the right tenants is key to maximizing your returns. This requires a strategic marketing approach and a deep understanding of your ideal tenant profile.

- Targeted Marketing Campaigns: Craft marketing materials that showcase your property's unique selling points. Use online listings, social media, and targeted advertising to reach the right audience. If your property is in a business district, for example, highlight its proximity to transport links and amenities.

- Understanding Tenant Needs: Thoroughly research the specific needs of your target demographic. A tech company might prioritize high-speed internet and flexible layouts, while a retailer will be more focused on foot traffic and storefront visibility.

Negotiating Lease Terms for Maximum ROI

Lease negotiations have a substantial impact on your long-term profitability. It's important to strike a balance between attracting tenants and securing favorable terms.

- Lease Structure: Explore different lease structures, such as net leases, gross leases, and modified gross leases. Net leases, for instance, often shift more responsibility for operating expenses to the tenant, providing more predictable income for the landlord.

- Rent Escalation Clauses: Consider incorporating rent escalation clauses to account for inflation and market fluctuations. This ensures your rental income keeps up with rising costs and market values.

Leveraging Technology for Efficient Property Management

Technology plays a crucial role in optimizing property management, increasing efficiency, reducing costs, and improving tenant satisfaction.

- Property Management Software: Consider implementing property management software solutions to manage leases, track payments, handle maintenance requests, and generate reports. These tools can automate tasks, minimizing administrative overhead and potential errors.

- Tenant Portals: Online portals allow tenants to easily access important information, submit maintenance requests, and communicate directly with property management. This improves tenant convenience and facilitates clear communication.

Building Lasting Tenant Relationships

Positive tenant relationships can lead to lease renewals and valuable referrals. Cultivating these relationships creates a harmonious environment and encourages long-term tenancy.

- Proactive Communication: Regular communication with tenants, addressing their concerns promptly and proactively, builds a strong landlord-tenant relationship and prevents minor issues from becoming major problems.

- Tenant Appreciation Programs: Show your appreciation through tenant appreciation programs. These can include events, special offers, or small gestures that demonstrate you value their business.

Managing Tenant Mix for Optimal Performance

In multi-tenant properties, a balanced tenant mix is essential for creating a dynamic environment.

- Complementary Businesses: Consider attracting businesses that complement one another. For example, a coffee shop within an office building can be mutually beneficial for both the coffee shop and the building's other tenants.

- Diverse Tenant Base: A diverse range of tenants mitigates risk. If one tenant vacates, the impact on your overall income is minimized.

Property Maintenance and Value Preservation

Consistent property maintenance protects your investment and attracts high-quality tenants. Regular inspections, timely repairs, and proactive maintenance can prevent small issues from escalating into expensive problems.

- Preventative Maintenance: A regular preventative maintenance schedule addresses potential problems before they occur, minimizing the likelihood of expensive repairs and disruptions to tenants.

- Capital Improvements: Planned capital improvements, such as upgrades and modernizations, maintain the property's value and enhance its appeal to both current and prospective tenants.

Exit Planning: Maximizing Your Investment

Exit planning should be an integral part of your overall strategy from the outset. This allows you to capitalize on market opportunities and achieve your investment goals.

- Market Timing: Understanding market cycles is vital for planning your exit strategy. Selling during peak market conditions can significantly maximize your return.

- Property Positioning: Prepare your property for sale by highlighting its strengths and addressing any potential weaknesses. This enhances its marketability and appeal to potential buyers.

Effective leasing and management are fundamental to maximizing returns in commercial real estate development. By employing these strategies, you can attract and retain quality tenants, maintain property value, and achieve your investment objectives. This careful approach ensures long-term profitability and positions your property for lasting success.

Ready to streamline your real estate syndication? Homebase offers an all-in-one platform to simplify fundraising, investor relations, and deal management.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Financial Modelling Real Estate: Win Deals with financial modelling real estate

Blog

Explore financial modelling real estate techniques to structure deals, forecast returns, and secure financing with confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.