Call for Capital: Proven Strategies to Attract Investors

Call for Capital: Proven Strategies to Attract Investors

Learn actionable call for capital techniques from industry experts to attract investors and avoid common pitfalls.

Domingo Valadez

May 2, 2025

Blog

Demystifying the Call for Capital Process

Raising capital can feel daunting. Whether you're a startup seeking venture capital or a real estate syndicator looking for investors, understanding the call for capital process is crucial. This process involves formally requesting funds from potential investors, outlining the investment opportunity, and defining the terms of the agreement. This includes clearly presenting your business plan, projected returns, and the total capital required.

A successful call for capital requires diligent planning and execution. A critical component is understanding the different investment contexts. For instance, a venture capital round may prioritize growth potential, while a private equity commitment may emphasize stable cash flows. Identifying your target investors and customizing your pitch is essential.

Timing Considerations

The timing of your call for capital can significantly influence its outcome. Launching a call during economic downturns can make investors wary. Conversely, delaying your capital raise can hinder growth and limit your ability to capitalize on opportunities. Finding the right balance between market conditions and your company's needs is paramount.

Regional economic development often directs capital toward high-return areas, bolstering key industries and their subsidiaries. This targeted investment in regions poised for growth stimulates economic activity. For areas undergoing economic transition, capital influx can revitalize industries and create jobs. However, strategic planning is necessary to ensure sustainable investments aligned with local needs. Learn more about regional economic development

Structuring Your Call for Capital

The structure of your call for capital heavily influences investor interest. A well-structured call clearly outlines the investment terms, including the capital sought, the expected return on investment (ROI), and the investor's rights and obligations. This transparency fosters trust and encourages investment.

For real estate syndicators, platforms like Homebase can streamline this process. They offer automated workflows, Know Your Customer (KYC)/Anti-Money Laundering (AML) checks, and secure document sharing. This enables sponsors to manage their call for capital efficiently and maintain regulatory compliance. This simplifies complex processes within real estate syndication, including vital components like investor relations and deal management. A strategic call for capital sets the stage for successful fundraising.

Understanding the history of capital calls offers valuable context for modern fundraising. Examining key moments where these calls reshaped industries reveals patterns and provides insights to inform current strategies. These historical lessons offer guidance for navigating the intricacies of raising capital.

The Industrial Revolution: A Capital Mobilization Case Study

The Industrial Revolution serves as a prime example of how capital calls fueled transformative growth. New technologies, such as the steam engine and the power loom, required substantial investment. This need spurred innovative financing mechanisms, including joint-stock companies and early forms of venture capital. These calls funded the factories, infrastructure, and resources that drove industrialization forward.

The expansion of railroads across continents, for example, required massive capital infusions. Investors who recognized this opportunity and answered the call for capital saw significant returns. This era demonstrates how identifying burgeoning sectors and strategically aligning capital can generate substantial gains.

The Tech Boom: Similarities and Differences

The late 20th and early 21st-century tech boom presents another important lesson regarding capital calls. The rise of the internet and personal computing created a surge in capital demand. This fueled the growth of venture capital firms and initial public offerings (IPOs), providing resources for companies like Microsoft, Apple, and Google.

This period also highlights the crucial role of timing. The dot-com bubble of the late 1990s demonstrated that not all capital calls are equal. Overvaluation and speculative investments resulted in a market crash, negatively impacting many who had answered the call.

Economic Cycles and Investor Confidence

Economic cycles significantly impact the success of a call for capital. During periods of economic growth, investor confidence tends to be high, making successful fundraising more likely. Conversely, during downturns, investors become more cautious. In the early 1950s, the U.S. saw a significant rise in capital expenditures driven by government defense spending and private investment. By Q4 1950, planned investment in plant and equipment reached a seasonally adjusted annual rate of $20 billion, a 10% increase from the previous quarter. This growth occurred across major industries, including manufacturing, mining, railroads, and utilities. Manufacturing investments were projected to rise by 44% in 1951 compared to 1950, while railroads and mining each saw a 19% projected increase. Find more detailed statistics here. This underscores how macroeconomic conditions directly affect capital investment decisions.

Learning from the Past, Building the Future

Understanding these historical trends provides valuable insights for today's capital calls. Recognizing the cyclical nature of markets and how investor sentiment fluctuates within these cycles is crucial. By learning from past successes and failures, fundraisers can make more informed decisions and develop more effective strategies. This historical perspective helps avoid repeating past mistakes and allows fundraisers to capitalize on emerging opportunities. Real estate syndicators, for instance, can leverage these lessons to better structure their call for capital and attract investors. They can use platforms like Homebase to effectively manage these complexities. This historical context is particularly important in the ever-changing real estate market.

Mastering Global Capital Calls Without the Headaches

Expanding your call for capital internationally offers significant opportunities for growth. However, it also presents distinct challenges. Successfully navigating international fundraising requires careful planning and a thorough understanding of the global investment landscape.

Navigating Regulatory and Cultural Landscapes

One of the most significant hurdles in international capital calls is the diverse regulatory environment. Each country has its own specific rules governing investments. This complexity requires diligent research. Often, it's necessary to engage local legal experts to ensure full compliance.

Cultural differences can also significantly affect communication and negotiation strategies. Building strong relationships with local partners can be invaluable in bridging these cultural gaps. These partnerships can smooth the process and lead to greater success.

For example, a call for capital targeting investors in Asia may require a different approach compared to one aimed at European investors. Understanding these nuances is vital for developing a compelling message that resonates with your target audience.

Between 1967 and 1975, Indonesia experienced considerable growth in foreign investment, with authorized capitalization reaching $4.488 billion. Japan led with $2 billion, followed by the U.S. with $520.6 million, primarily in the manufacturing sector. Interestingly, only 40% of approved investments were implemented. This historical data underscores the complexities of international capital calls, even when substantial economic interest exists.

Managing Currency Fluctuations and Exchange Rate Risk

Currency volatility adds another layer of complexity. Fluctuations in exchange rates can significantly impact the value of investments. This creates uncertainty for both investors and those seeking capital. Active management of this risk is crucial.

Hedging strategies and forward contracts are common tools to mitigate potential losses. Solid financial planning is also essential for effectively navigating these uncertainties. This ensures stability and protects against unforeseen market shifts.

Building Credibility in New Markets

Establishing trust and credibility in unfamiliar markets takes time and dedicated effort. A strong track record of successful past projects can build confidence among potential investors. This demonstrates your capabilities and builds a solid foundation for future partnerships.

Partnering with respected local organizations can further enhance your credibility. This can provide access to valuable networks. Such collaborations can significantly streamline your entry into new markets and strengthen the appeal of your call for capital.

Structuring Documentation and Communications

Documentation requirements can vary significantly across jurisdictions. Preparing compliant documentation that meets these diverse legal standards is essential. This ensures a smooth and legally sound investment process.

Clear and concise communication materials are equally important. These materials need to effectively convey the investment opportunity while adhering to local regulations. Platforms like Homebase offer tools to streamline these processes. These tools can simplify document management and investor communications, which is particularly valuable in a global context.

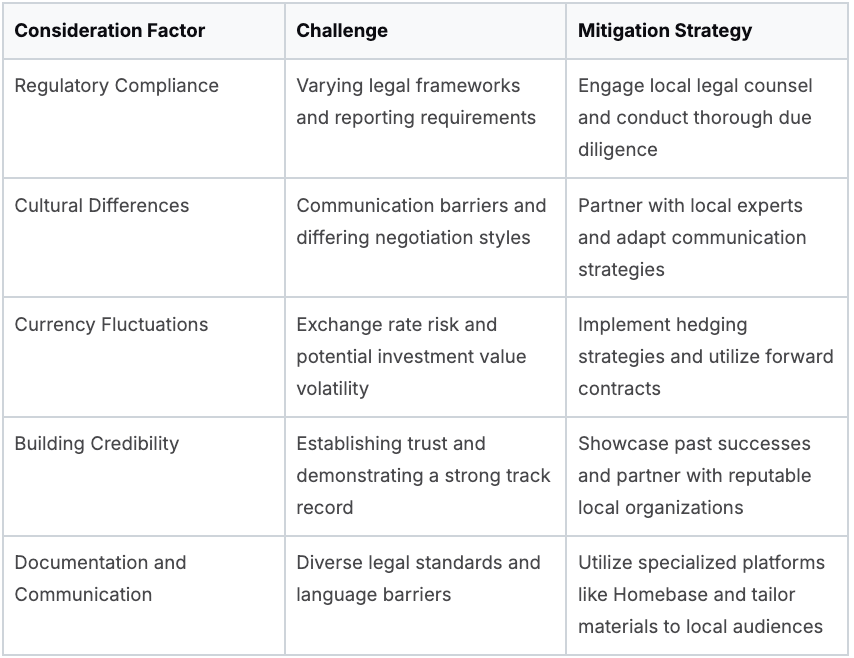

Before diving into cross-border capital calls, it's essential to carefully consider several key factors. The following table outlines some of these critical considerations, potential challenges, and effective mitigation strategies.

Cross-Border Capital Call Considerations

This table summarizes the key challenges and solutions organizations face when expanding their capital calls internationally. Addressing these factors proactively is crucial for success.

These strategic considerations, combined with a thorough understanding of the target market, are essential for mastering global capital calls and achieving fundraising success. Building trust and transparency are paramount for attracting international investors and effectively navigating the complexities of cross-border transactions. This foundation will ensure a successful call for capital in the global arena.

Risk-Proofing Your Call for Capital Strategy

A successful call for capital requires careful planning. However, even with the best laid plans, unforeseen challenges can arise. Understanding these potential roadblocks is essential to developing strong contingency plans. This proactive approach helps protect your fundraising efforts and maintain investor confidence.

Identifying Potential Problems

Market volatility is a significant risk to any call for capital. Sudden economic downturns can make investors hesitant, potentially jeopardizing even well-structured projects. Global events can also disrupt markets and affect investor sentiment.

Investor defaults present another substantial challenge. While not always predictable, certain indicators can suggest potential problems. These might include changes in an investor’s financial situation or a shift in their investment strategy. Recognizing these early warning signs can help you prepare for possible funding shortfalls.

During the 2008-2009 financial crisis, many investors faced liquidity issues due to unfunded commitments in private equity. For example, Harvard Management Company (HMC) had to sell $1.5 billion in fund investments at 50-60% of net asset value to meet its obligations. This case highlights the risks of raising capital during economic downturns. Learn more about this.

Implementing Effective Contingency Plans

Developing comprehensive contingency plans is crucial for mitigating risk. These plans should address a range of scenarios, including market downturns and investor defaults. Having a clear action plan enables quick and efficient responses to unexpected issues.

Diversifying your investor base can lessen the impact of individual investor defaults. By spreading your call for capital across a broader pool of investors, you reduce your reliance on any single funding source.

Stress-Testing Your Strategy

Stress testing your call for capital strategy is another vital risk management tool. This involves assessing your plan against different adverse scenarios. Modeling the impact of a 20% decline in investor commitments, for instance, can highlight vulnerabilities and inform adjustments.

This process helps pinpoint potential weaknesses and allows for refinements to your approach. By anticipating potential issues, you can strengthen your call for capital and enhance its resilience.

Building Financial Buffers

Establishing a financial buffer creates a safety net if your call for capital encounters unexpected hurdles. This reserve can cover unforeseen expenses or bridge funding gaps, providing flexibility and helping to navigate market fluctuations.

This buffer is especially important for real estate syndicators. Unexpected delays in closing deals or unforeseen construction costs can impact the timing of capital calls. Reserves ensure the project can progress smoothly. Syndicators can use platforms like Homebase to manage these financial aspects and maintain transparency with investors.

Maintaining Investor Confidence

Open communication with investors is paramount, especially during challenging times. Keeping investors informed about potential risks and your mitigation strategies fosters trust. This transparency strengthens relationships and builds long-term confidence.

Even when commitments waver, open communication can help preserve valuable relationships. Honest and proactive communication demonstrates your commitment to investors and reinforces your credibility. This is especially important for real estate syndicators, who rely on strong investor relationships. Platforms like Homebase can streamline this communication and manage investor relations effectively. This proactive approach safeguards your call for capital and builds stronger relationships with investors, even in difficult economic times.

Optimizing Capital Calls with Technology

Managing capital calls effectively is crucial for any fund manager. While traditional methods like spreadsheets and emails have served their purpose, they often lack the efficiency and transparency needed in today's fast-paced financial world. Modern technology offers solutions that significantly improve the capital call process, leading to better investor relationships and more streamlined operations.

Technology Solutions Streamlining the Process

Financial technology (Fintech) platforms are at the forefront of this modernization, offering a range of tools to automate and enhance various aspects of capital calls. These platforms introduce automated workflows, secure document sharing, and integrated payment processing. These features reduce manual tasks, accelerate transactions, and contribute to a more positive investor experience.

By automating these processes, fund managers can redirect their focus from administrative burdens to more strategic activities such as building stronger investor relationships and analyzing investment opportunities.

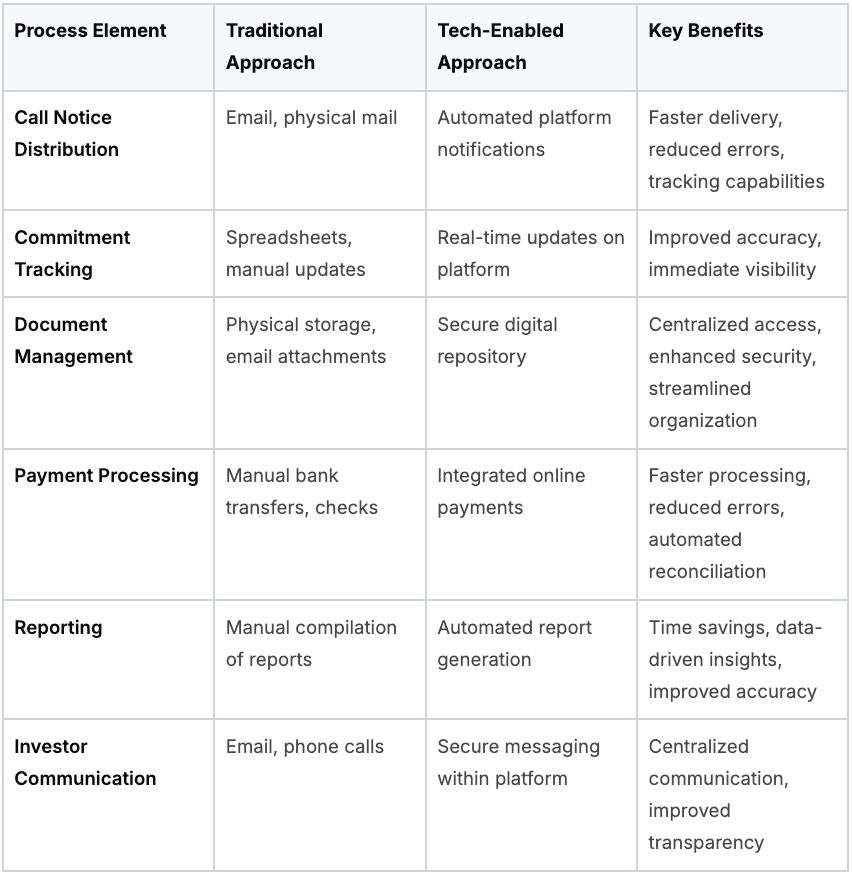

To illustrate the advantages of a tech-enabled approach, let's examine a comparison of traditional versus technology-driven methods.

To better understand the advantages of utilizing technology in capital call management, let's look at a comparison table outlining the key differences between traditional and technology-enabled approaches.

Technology Solutions for Capital Call Management: This table compares traditional vs. technology-enabled approaches to managing different aspects of the capital call process.

The transition to technology-driven solutions provides several key benefits, including reduced administrative burden, increased accuracy, improved transparency, and a more seamless experience for both fund managers and investors.

Blockchain and Smart Contracts for Enhanced Security

Beyond Fintech platforms, blockchain technology and smart contracts offer further innovation in capital call management. Blockchain enhances security and transparency by creating a permanent, tamper-proof record of transactions. Smart contracts, self-executing contracts with terms embedded in code, can automate processes like commitment enforcement and fund distributions.

For instance, a smart contract can automatically release funds when predetermined milestones are achieved, ensuring that capital is deployed efficiently and as agreed. This automation reduces delays and strengthens trust between fund managers and investors.

AI-Powered Analytics for Predictive Insights

Artificial intelligence (AI) and machine learning are also transforming capital calls. By analyzing historical data and market patterns, AI algorithms can predict future capital needs with greater accuracy. This predictive capability allows fund managers to anticipate requirements and proactively engage with potential investors, optimizing the timing and effectiveness of capital calls.

For example, AI can analyze investor behavior to identify patterns and predict the likelihood of commitment to specific opportunities. This targeted approach maximizes conversion rates and reduces wasted effort, enabling fund managers to tailor their outreach effectively. For those interested in real estate investment strategies, this article provides valuable insights: How to master real estate capital raising strategies.

Improving Transparency and Automation for Investors

Digital platforms create a centralized hub for all deal-related information, enhancing transparency for investors. This allows them to readily access documents, track progress, and communicate with fund managers in a secure and efficient environment. Increased transparency fosters trust and encourages greater investor participation.

These platforms also automate administrative tasks, such as KYC/AML checks and subscription document management. This automation frees up fund managers to concentrate on core investment activities and nurture stronger investor relationships.

Implementing Technology Solutions

While adopting these technologies might seem complex, solutions are available for organizations of all sizes. Some platforms offer modular options, allowing for incremental implementation, starting with the areas of greatest impact. This phased approach minimizes disruption and maximizes return on investment.

Furthermore, many providers offer implementation support and training, ensuring a smooth transition. This guidance helps organizations fully utilize the technology and achieve their fundraising objectives.

By embracing these advancements, organizations can optimize their capital call strategies and build stronger, more enduring relationships with investors.

Executing Capital Calls That Get Results

The difference between a successful capital call and one that falls short often lies in the execution. Organizations with a strong track record of raising capital understand this critical difference. They employ carefully planned strategies, refined through experience, ensuring their calls resonate with investors and deliver the desired outcomes.

Communication Frameworks That Drive Investor Action

Effective communication is the foundation of any successful capital call. Simply presenting information isn't enough; the message needs to inspire investors to take action. This means crafting a clear, concise, and compelling narrative that showcases the investment opportunity’s strengths and addresses any potential concerns.

This involves developing a communication framework that guides investors through the investment rationale, clearly outlining projected returns and the overall value proposition. Starting with a compelling story about the market opportunity can grab attention, while using data-driven projections builds confidence and motivates investment.

Streamlined Documentation Builds Trust

The documentation supporting your capital call should be thorough yet easy to understand. Cluttered or confusing documents create obstacles and can discourage potential investors. Well-organized materials, conversely, streamline the process and project professionalism.

Utilize templates that clearly present essential information, including the terms of the investment, projected returns, and potential risks. Accessibility is paramount. Providing summaries of key documents allows investors to quickly grasp important points, while complete versions are available for deeper review.

Strategic Timing Maximizes Investor Interest

Timing is crucial for a successful capital call. Understanding investor psychology and market dynamics is essential. A well-timed call can leverage favorable market conditions and generate maximum investor interest.

Develop a realistic capital call schedule that aligns with investors’ liquidity needs while also fulfilling your funding requirements. Staggering capital calls over a period of time can make larger investments more digestible for investors, while ensuring you have sufficient funds for each project phase.

Effectively Managing Capital Call Defaults

The possibility of investor defaults is an unavoidable aspect of capital calls. While defaults can disrupt funding plans, handling them professionally can minimize the impact and preserve valuable relationships.

Establish clear procedures for managing defaults, including communication protocols and possible solutions. Maintaining open communication with the investor, exploring alternative arrangements, and clearly outlining the consequences of default can often help resolve the situation amicably.

Continuous Improvement Refines Your Strategy

A capital call strategy should not be static; it needs to evolve based on performance data and feedback from investors. Regularly reviewing the outcomes of past calls can identify opportunities for improvement. This data-driven approach ensures your strategies remain effective.

Track key metrics such as response rates, conversion rates, and the reasons behind investor decisions. This data provides valuable insights that can inform future calls, enabling you to continuously refine your communication, documentation, and timing strategies.

Ready to simplify and enhance your real estate syndication process, including calls for capital? Homebase offers a comprehensive platform to manage your deals, investor relations, and fundraising efforts efficiently and effectively. Learn more about how Homebase can transform your real estate syndication business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Syndicator's Guide to Commercial Real Estate Valuation

Blog

Master commercial real estate valuation with our syndicator's guide. Learn the income, sales, and cost approaches to build investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.