A Guide to Syndication in Real Estate Investing

A Guide to Syndication in Real Estate Investing

Discover how syndication in real estate works. Our guide explains the key players, deal structures, and benefits of pooling capital for larger investments.

Domingo Valadez

Aug 25, 2025

Blog

So, what exactly is real estate syndication? At its core, it's a way for a group of investors to pool their money and buy a property that would be too expensive for any single person to purchase on their own.

Think of it as crowdfunding for commercial real estate. It allows everyday investors to get a piece of the action on major assets like apartment buildings, shopping centers, or office complexes—all managed by a seasoned professional.

Unlocking Larger Deals Through Group Investment

Let's be realistic: most of us can't write a check to buy a 200-unit apartment building or a downtown skyscraper. That's the exact problem that syndication in real estate was created to solve. It builds a bridge, connecting individual investors with institutional-quality properties by setting up a partnership for a specific deal.

It’s a bit like a team sport. One person can't win the championship alone, but a whole team combining their strengths and resources can. In this world, the team captain is the "Sponsor," and the investors are the other key players on the team.

The Two Key Roles in Every Syndication

Every real estate syndication boils down to two essential roles, each with a very different job to do:

- The Sponsor (General Partner): This is the person or company actively running the show. They're the ones who find the deal, do the due diligence, and get the property under contract. They handle all the heavy lifting—from arranging the loan and managing daily operations to carrying out the business plan to boost the property's value. The Sponsor brings the expertise and the opportunity.

- The Investors (Limited Partners): These are the people who provide most of the cash needed to buy the property. In exchange for their capital, they get an equity stake in the real estate, but their role is completely passive. They aren't involved in management decisions, making it a perfect fit for anyone who wants real estate returns without the hassle of being a landlord.

How the Partnership Works

It all starts when the Sponsor finds a promising deal and puts together an investment package for potential investors. This package lays out everything: property details, the financial model, and the strategy for making money.

Investors review the opportunity, and if it looks good, they commit their capital. Once enough money is raised, the group buys the asset. From there, the Sponsor takes over, managing the property and distributing cash flow back to the investors. The end game is usually to sell the property down the road for a healthy profit.

A well-run syndication is a classic win-win. Investors supply the capital needed to close a big deal, and the Sponsor provides the expertise to make it a success. This structure opens the door to bigger and better real estate opportunities for everyone at the table.

Understanding the Key Players in a Syndication

At its core, every real estate syndication is a powerful partnership. It's built around two very distinct but equally important roles, designed to bring specialized expertise and investment capital together.

This structure creates a symbiotic relationship where both sides can achieve something they simply couldn't on their own. To really get how this investment model works, you first have to understand who's doing what.

The Sponsor: The Active Expert

Leading every deal is the Sponsor, who you'll also hear called the General Partner (GP). Think of the Sponsor as the quarterback of the entire operation—the one calling the plays and making things happen on the field.

The Sponsor is the active professional who puts in the real sweat equity. Their job is massive. They’re the ones hunting for the right properties, digging through the financials during due diligence, securing the loans, and overseeing the day-to-day management of the asset. They're also tasked with carrying out the business plan, whether that means renovating units to command higher rents or bringing in better management to cut costs and boost the property’s value.

A Sponsor's reputation and track record are everything. A good one will have a portfolio of successful projects that prove they know how to navigate market shifts and, most importantly, deliver returns. Clear, consistent communication is just as vital; they need to keep their investors in the loop with transparent updates on how the property is performing.

Because they're the ones doing all the heavy lifting, Sponsors are compensated for their work and the risk they take on. This compensation typically includes fees for acquiring and managing the asset, plus a share of the profits. This setup is crucial because it aligns their interests directly with the investors'—when the deal does well, everybody wins.

A Sponsor’s role is far more than just finding a property. They are the strategic mind, the operational manager, and the fiduciary responsible for stewarding investor capital from acquisition to a profitable exit.

The Investors: The Passive Capital Partners

On the other side of the table, you have the Investors, also known as Limited Partners (LPs). Their role is fundamentally different but no less critical to the deal's success. Investors are the ones who provide the bulk of the equity capital needed to actually buy the property.

In return for their capital, Limited Partners get an ownership stake in the real estate. Their main job is to put up the funds and then, for the most part, take a step back and let the Sponsor do what they do best. This hands-off approach is one of the biggest draws of syndication in real estate, as it frees investors from the headaches that come with being a landlord.

This structure opens the door for people to build a serious real estate portfolio without needing to be an expert or dedicating all their free time to managing properties. Instead, they rely on the Sponsor’s experience to generate returns on their behalf.

To make the distinction crystal clear, here’s a breakdown of how the roles and responsibilities typically shake out.

Sponsor vs. Investor Roles and Responsibilities

This partnership is the engine that drives a real estate syndication forward. The Sponsor brings the opportunity and the operational know-how, while the Investors provide the financial fuel to make it happen.

When it works, it’s a true win-win. Together, they can acquire and operate large-scale, income-producing assets that would be completely out of reach for either party alone.

How a Real Estate Syndication Deal Works

So, how does one of these deals actually come together? It’s not just a matter of finding a building and asking for money. Every syndication follows a predictable lifecycle, a step-by-step journey from a promising opportunity to a real, cash-flowing asset. Think of it as a well-choreographed dance designed to protect everyone involved and maximize the potential for a great return.

It all starts with the sponsor. This individual or company is the quarterback of the entire play. Their first, and arguably most important, job is to hunt down a promising property. This isn't about scrolling through Zillow; it’s about deep-dive market analysis, leveraging broker relationships, and often uncovering off-market deals that the public never even sees.

Once they've zeroed in on a property, the real heavy lifting begins: due diligence. This is a forensic-level investigation into every nook and cranny of the deal. The sponsor pores over financial records, gets the building physically inspected, digs into local zoning laws, and triple-checks the market data to make sure the whole plan is built on a solid foundation.

Structuring the Financials

With the property vetted and the numbers confirmed, the sponsor then has to build the financial structure of the deal. This is where the partnership between the sponsor and the investors gets put down in black and white. The goal is to create a win-win scenario where everyone's interests are aligned.

Here are the key pieces you'll almost always see:

- Equity Splits: This is how the profits get divided after every investor has gotten their initial investment back. A very common structure is a 70/30 split, meaning investors get 70% of the profits, and the sponsor gets the remaining 30% for orchestrating and managing the deal.

- Preferred Return: This is a fantastic feature for investors. It’s a minimum return you're promised before the sponsor sees a dime of the profits. An 8% preferred return, for instance, means you get the first 8% of returns each year. Only after that threshold is met does the profit-sharing split kick in.

- Sponsor Fees: Let's be real—sponsors do a ton of work. They're typically compensated through a couple of standard fees, like an acquisition fee for finding and closing the deal and an asset management fee for the day-to-day oversight of the property.

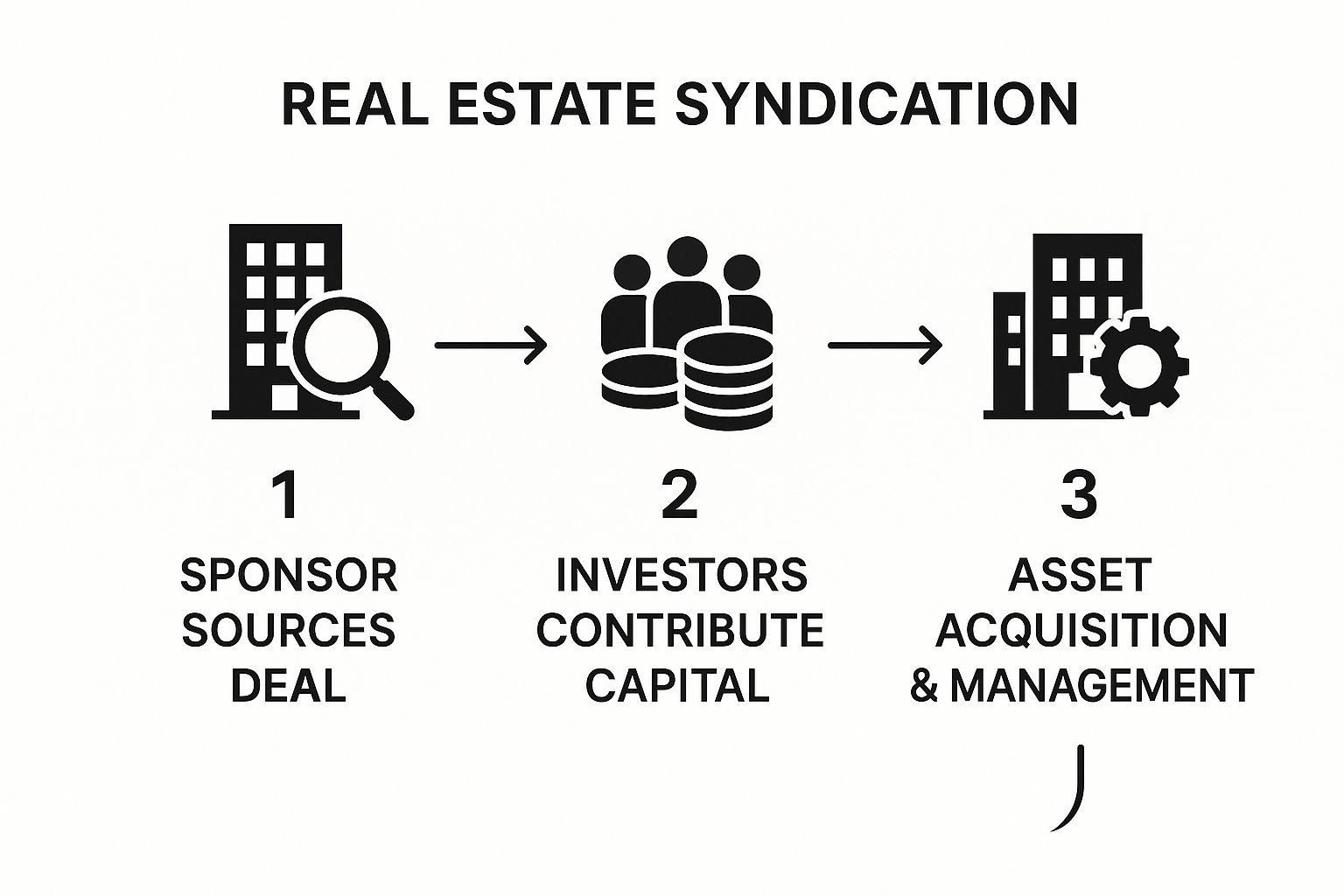

This simple graphic helps visualize the flow from start to finish.

As you can see, the process flows logically from finding the deal to managing the asset, all with the sponsor leading the charge.

A Concrete Example of Syndication

Let's walk through a real-world scenario to make this crystal clear.

Imagine a sponsor finds a great apartment building for $10 million. They work with a bank to secure a $7 million loan, which means they need to raise the remaining $3 million in equity from a group of passive investors.

Let's say ten investors come in, each putting up $300,000. The deal is structured with that 8% preferred return and a 70/30 profit split we talked about. For the next five years, the building performs well, generating enough cash to pay every investor their 8% "pref" each year. Then, the sponsor decides it's the right time to sell and gets an offer for $15 million.

Here's how the money flows:

1. The $7 million bank loan is paid off, leaving $8 million.

2. The investors get their original $3 million back, leaving a $5 million profit.

3. The profits are then split 70/30. The investors collectively receive $3.5 million, and the sponsor gets $1.5 million. It’s a huge win for everyone.

The Role of Legal Documentation

Of course, a deal like this isn't done on a handshake. A fortress of legal documentation is built around the entire syndication to ensure everything is transparent, fair, and legally sound.

The legal framework is what transforms a handshake agreement into a secure, enforceable investment. It clearly defines the rights, responsibilities, and expectations for both the sponsor and the investors.

The cornerstone document is the Private Placement Memorandum (PPM). Think of it as the ultimate owner's manual for the investment. It lays out every single detail: the business plan, all potential risks, financial projections, and the full terms of the deal. Alongside the PPM, you'll have an Operating Agreement that governs the LLC, and a Subscription Agreement, which is the document you sign to officially become an investor in the project.

This clear, methodical process of sourcing, structuring, and executing the deal is what makes syndication work. To learn more about what this journey looks like from the investor's perspective, you can read more about the accredited investor's journey into syndication.

Common Legal and Financial Structures

No two syndications are built exactly alike. The legal and financial framework is the real blueprint for any deal, and it determines everything from how risk is handled to how profits are split. If you want to find opportunities that truly match your financial goals, you have to understand how these deals are put together.

At its core, the legal entity created for a syndication has one critical job: to protect everyone involved. By setting up a dedicated company just for the property, the sponsor and investors create a legal firewall. This barrier separates their personal assets from the investment itself, meaning if the deal goes south, your personal finances are safe.

The Go-To Legal Entities

You'll find that two structures dominate the world of syndication in real estate. They're popular for a reason—they offer the best combination of liability protection and operational flexibility.

- Limited Liability Company (LLC): This is the crowd favorite, and for good reason. An LLC gives you the rock-solid liability protection of a corporation but with the tax benefits and simpler operations of a partnership. In this setup, the sponsor is the "managing member," and the investors are simply "members."

- Limited Partnership (LP): This is the more traditional route. An LP has a General Partner (the sponsor) with total control and unlimited liability, and Limited Partners (the investors) whose liability is capped at whatever they invested. LPs still get the job done, but LLCs have largely taken over because they're just easier to manage.

Both entities accomplish the most important goal: shielding your personal assets from any liability beyond the capital you put in.

Equity vs. Debt: Two Paths to Returns

Once you get past the legal paperwork, the financial structure is what dictates how you actually make money. Syndications generally follow one of two paths: equity or debt. Each comes with its own risk-reward profile, designed to suit different types of investors.

An equity syndication is what most people think of. When you invest in an equity deal, you're buying a piece of the property. You become a part-owner.

In an equity deal, your success is tied directly to the property's performance. You share in the ongoing cash flow from rental income and, most importantly, the profits from the property's appreciation when it's eventually sold.

This is where you find the highest potential returns because you get a piece of both the income and the growth. The flip side, of course, is that it also comes with more risk. If the property doesn't perform as planned, your returns could be lower than you hoped, and in a worst-case scenario, you could lose your investment.

A debt syndication, on the other hand, makes you the bank. Instead of owning the property, you're lending money to the project, and your investment is secured by the real estate itself.

You won't get a share of the profits. Instead, you receive fixed interest payments over a specific term, much like a loan. Your return is predictable and isn't tied to how well the property operates or what it sells for. This makes debt deals a lower-risk, more conservative play for steady income. The trade-off? Your upside is capped. Even if the property's value goes through the roof, your return is limited to that pre-agreed interest rate.

Why Bother With Group Investing? The Big Payoffs

So, why would you pool your money in a real estate syndication instead of just buying a duplex down the street? It's a fair question. The answer comes down to a handful of powerful advantages that completely change the game for building real wealth through property. We're not just talking about buying bigger buildings; it's a fundamentally different, and frankly, smarter way to invest for the long haul.

The most obvious perk is getting a seat at the big table. Syndication gives you access to what we call "institutional-quality" assets. Think about a 250-unit apartment complex or a sprawling industrial warehouse—the kinds of properties that are usually way out of reach for a single investor. By pooling funds, you get to own a slice of a much larger, more stable pie.

Finally, Truly Passive Income

Let's be honest, one of the biggest draws to syndication in real estate is the promise of income that’s actually passive. When you own a small rental property yourself, you're the landlord. You're the property manager. You're the one getting a call at 10 PM about a leaky faucet. It's a job.

Syndication cuts you out of that loop entirely. The sponsor and their professional management team are on the ground, handling every single detail—from finding and vetting tenants to overseeing renovations and paying the bills.

As a Limited Partner, your job is refreshingly simple: you put up the capital, and you collect your share of the profits. This is how you can build a serious real estate portfolio that generates cash flow without becoming a second career, freeing you up to focus on what you do best.

For busy professionals, this hands-off model is a total game-changer. It delivers the financial upside of real estate without the operational headaches.

Tap Into Professional Asset Management

When you invest with a seasoned sponsor, you’re not just buying a piece of a building; you're buying their expertise and their entire operational machine. A good sponsor has a full-time team singularly focused on one thing: making that property perform at its absolute best to maximize your returns.

These teams bring a level of sophistication to the table that an individual investor just can't match. They know how to:

* Get Better Deals: They can negotiate more favorable financing and insurance rates because of their track record and scale.

* Execute a Real Strategy: They have a clear business plan from day one, whether it's upgrading units to raise rents or streamlining operations to cut costs.

* Navigate the Unknown: They are constantly watching the market and managing risks, protecting the investment from unexpected bumps in the road.

This professional oversight isn't just a nice-to-have; it's a core advantage that dramatically stacks the odds of success in your favor.

Diversify Your Portfolio the Right Way

We've all heard that diversification is key to smart investing. Syndication makes it incredibly simple to put that principle into practice. Instead of tying up all your capital in one property in one market, you can spread smaller investments across multiple deals.

This is where you can build a truly resilient portfolio by diversifying across:

* Geography: Own pieces of properties in different cities or even states, shielding you from a downturn in a single local economy.

* Asset Class: Put your capital to work in different property types, like multifamily apartments, self-storage facilities, or industrial warehouses.

* Sponsors: Partner with different expert teams, each with their own unique market focus and strategy.

This ability to spread your risk is more important than ever. For example, right now, supply chain issues and financing trends are creating huge opportunities in sectors like data centers across North America and Europe. Through syndication, investors can get a piece of massive projects like Blackstone’s £10 billion data center campus in England or a $1.2 billion hyperscale project in Northern Virginia—assets with incredible scale. You can discover more insights about the global real estate market and how it’s shaping these opportunities.

Unlock Serious Tax Advantages

Last but certainly not least, real estate syndication comes with some fantastic tax benefits that help you keep more of what you earn. The star of the show here is depreciation. It’s essentially a "paper loss" that lets you deduct a portion of the property's value from your taxable income each year, even while the property is appreciating.

Because you are a direct partner in the LLC that owns the asset, you get to share in these depreciation losses. Very often, these paper losses can offset the actual cash distributions you receive. This means you could be collecting regular checks from the property while paying little to no tax on that income in the current year. It's a powerful way to shelter your passive income and accelerate your wealth-building journey.

Why Multifamily Is the Go-To for Syndication

You'll notice that while you can syndicate almost any type of real estate, apartment buildings—what we call multifamily—are a perennial favorite. There's a very good reason for this, and it has nothing to do with trends. It all comes down to a fundamental human need: shelter.

Office buildings, retail centers, and industrial parks are all tied to the ups and downs of the economy. But people always need a place to live. This simple truth creates a built-in, predictable demand for rental housing that just doesn't exist in other commercial real estate sectors. It’s this stability that makes it such an attractive asset for a group of investors to own together.

Riding the Wave of a Market Imbalance

The appeal of multifamily syndication in real estate gets even stronger when you look at the bigger economic picture. For years, the U.S. has been grappling with a serious housing shortage. This isn't a headline-of-the-day issue; it's a deep, structural imbalance between supply and demand that directly benefits apartment owners.

So, what's causing this gap? It’s a perfect storm of factors. Land is scarce, local zoning laws are often incredibly restrictive, and finding skilled labor is a constant struggle. All of this makes building new housing, especially affordable housing, incredibly difficult and expensive. In fact, the construction of smaller, more affordable starter homes has cratered by 80% since the 1970s.

This supply crunch means more people are renting, and for longer periods. For investors, this isn’t just a momentary blip—it's a long-term strategic advantage. Understanding how to play in this market is crucial. For a closer look, you can explore a deeper dive into navigating the real estate syndication landscape in our recent article.

When you invest in a multifamily syndication, you are essentially stepping in to meet a critical need. You become a provider of an essential product—housing—in a market that simply doesn't have enough of it.

The Power of Scale and Steady Income

Multifamily properties bring some unique advantages to the table that make them perfectly suited for the syndication model. Think about it: a 100-unit apartment building is a world away from a single-family rental.

- Built-In Risk Management: If a couple of tenants move out of a 100-unit building, it’s a minor hiccup. The other 98 tenants are still paying rent, easily covering the mortgage and operating costs. That's stable cash flow.

- Smarter Operations: Managing one large apartment community is far more efficient than juggling dozens of individual houses spread across town. You get economies of scale on everything from marketing and maintenance to property management.

- Manufacturing Value: This is a big one. Sponsors can strategically "force appreciation" by renovating units, adding amenities, or improving management. This directly increases the property's value in a way that's much harder to pull off with a single home.

These built-in benefits are why multifamily remains a dominant force. In 2023, syndicated multifamily deals saw rental growth hit around 7.1%, a direct result of a national housing shortage estimated at 3.8 million homes. This climate creates clear, actionable opportunities for syndicators, especially those targeting growing suburban markets and properties across the Sun Belt.

Common Questions About Real Estate Syndication

As you start looking into group real estate investing, you’re bound to have questions. It’s a world with its own lingo and rules, but the core ideas are actually pretty simple once you pull them apart. Here are some clear, straight-up answers to the questions we hear most often from new investors.

The goal here is to give you the confidence that comes from really understanding the details. By tackling these common questions head-on, you'll be in a much better position to size up an opportunity and figure out if this investment path is a good fit for you.

Do I Need to Be an Accredited Investor to Participate?

This is usually the first thing on everyone's mind. The short answer is: most of the time, yes, but not always. The vast majority of syndication deals are set up under SEC regulations that require investors to be accredited.

So, what does that mean? An accredited investor is someone who meets certain financial thresholds. Think a net worth over $1 million (not counting your primary home) or a steady annual income of over $200,000 (or $300,000 if you're filing jointly with a spouse). Sponsors do this because it dramatically simplifies the legal and regulatory paperwork on their end.

That said, there's a slight exception. Some deals, known as 506(b) offerings, can legally include a limited number of "sophisticated" investors who aren't accredited. These are people who, despite not hitting the income or net worth numbers, have enough financial knowledge to understand the risks involved. You'll always want to check the specific offering documents to see who is eligible for any deal you're considering.

What Kind of Returns Can I Expect?

This is the big question, and the honest answer is that returns can be all over the map. They really depend on the type of property, the sponsor's game plan for improving it, and what the market is doing at the time. There's no single "typical" return.

Instead, the sponsor will lay out detailed financial projections. These forecasts usually have two main parts:

- Ongoing Cash Flow: This is your share of the rental income, paid out periodically—usually every quarter or sometimes monthly.

- Profit from Sale: This is the big payout at the end. When the property is eventually sold or refinanced, you get your slice of the profit from its increased value.

Sponsors often aim for a total Internal Rate of Return (IRR) somewhere in the 12% to 20% range, typically over a three to seven-year holding period. But it's absolutely crucial that you dig into the assumptions behind those numbers to really grasp the potential risks and rewards.

Remember, projected returns are not guarantees. They represent the sponsor's educated forecast for the property's performance. Diligence means understanding the "how" and "why" behind those numbers.

How Liquid Is a Real Estate Syndication Investment?

This is a critical point every investor needs to get: an investment in a real estate syndication is highly illiquid. You can't just log into an app and sell your shares like you would with a stock.

When you invest, you're locking up your capital for the entire ride, which is almost always a multi-year commitment (think 3 to 7 years). The sponsor has a business plan, and that plan dictates the timeline.

Your money is essentially tied up until the sponsor executes their exit plan, which is usually selling or refinancing the property. For this reason, you should only invest money you’re certain you won't need for the foreseeable future. Treat it as a long-term strategic play, not a quick flip.

Juggling investor questions, handling documents, and sending out distributions can get complicated fast. Homebase is an all-in-one platform built to make life easier for real estate sponsors. From fundraising and compliance to investor relations, we handle the administrative headache so you can focus on what you do best: finding great deals. Discover how Homebase can help you scale your syndication business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Capital Raising Meaning A Sponsor’s Guide to Real Estate Investing

Blog

This guide demystifies the capital raising meaning for real estate sponsors. Learn to navigate syndication, structure deals, and attract investors.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.