What Is Syndication Cost? Understand the Fees Explained

What Is Syndication Cost? Understand the Fees Explained

Curious about what is syndication cost? Learn what it includes, how to evaluate it, and what to expect when investing in real estate syndications.

Domingo Valadez

Jul 21, 2025

Blog

When you invest in a real estate syndication, you're essentially partnering with an expert—the sponsor—who does all the heavy lifting. Syndication costs are simply the fees you pay that sponsor for finding the deal, managing the property, and eventually selling it on behalf of you and the other passive investors.

Think of the sponsor as the captain of the ship. They're responsible for navigating the entire investment journey, from scouting the perfect property and performing rigorous due diligence to overseeing daily operations and executing the final sale. These fees are their compensation for that expertise, the long hours, and the risk they take on.

What Are Syndication Costs in Real Estate?

It’s easy to look at fees as a drag on your returns, but it’s more helpful to see them as an enabling cost. They are what make passive real estate investing a reality. Without a skilled sponsor handling the complex, full-time job of managing a commercial asset, you’d be stuck doing it all yourself.

These costs are a fundamental part of how the real estate industry facilitates large-scale investments. By pooling resources, investors gain access to deals they couldn't find or afford on their own, all while benefiting from professional management.

A Snapshot of Common Syndication Fees

The syndicated deal structure is more popular than ever. Consider this: the syndicated loans market was valued at a staggering $1018.7 billion in 2021 and is on track to hit an estimated $3798.4 billion by 2031. This explosive growth underscores just how common these fee-based financial partnerships have become.

To give you a clear lay of the land, let's break down the most common fees you'll see in a syndication deal. Think of this as your cheat sheet for understanding where your money goes.

Understanding this fee structure is the first step to confidently evaluating any syndication opportunity. While the numbers can vary, the types of fees are fairly standard across the industry. We'll dive deeper into what each of these means for you as an investor in the sections ahead.

Decoding Upfront Acquisition and Setup Fees

Before a single rent check comes in, a mountain of work has to happen behind the scenes to get a real estate deal off the ground. The first costs you’ll encounter are the upfront fees, which cover this critical setup phase and get the project started on the right foot. Think of these as the initial hurdle to clear before we can even own the property.

At the heart of these initial costs is the acquisition fee. This is what you pay the sponsor—the General Partner—for the exhaustive, often grueling, process of finding, vetting, and locking down a good deal. It’s their reward for a very specialized treasure hunt that can easily burn hundreds of hours of their time.

This isn't just about making a few calls. This fee covers the entire journey before the "for sale" sign comes down. It pays for sifting through dozens of duds to find one winner, running complex financial models, and coordinating all the on-the-ground inspections.

The acquisition fee compensates the sponsor for the immense "at-risk" time and resources they pour into the hunt. They might analyze ten, twenty, or even fifty deals they don't win before landing one for the group. This fee ensures they get paid for the expertise it takes to finally get a promising asset under contract for their investors.

Breaking Down the Upfront Costs

Beyond the sponsor's direct legwork, other essential setup costs get bundled into that initial capital raise. These are the nuts and bolts required to structure the deal legally and financially.

Here are a few key upfront costs you’ll typically see:

- Loan Guarantee Fees: Lenders for big commercial properties don't just hand over millions without some assurance. They usually require the sponsor to personally guarantee the loan. This fee is fair compensation for putting their own personal net worth on the line.

- Legal and Closing Costs: This bucket pays for the specialized attorneys who set up the legal entity (usually an LLC), draft the crucial Private Placement Memorandum (PPM), and manage all the paperwork to get the deal officially closed.

- Due Diligence Expenses: These are the costs for third-party experts to kick the tires on the property. It includes things like the official property appraisal, environmental site assessments, and detailed building inspections.

Let’s put it into perspective. On a $10 million apartment building deal, a fairly standard 1.5% acquisition fee comes out to $150,000. That amount, along with the other setup costs, is paid out of the total capital raised from investors, making sure every part of the purchase is handled professionally right from the start.

Understanding Ongoing Management Costs

Once the deal closes and the property is officially yours (along with your fellow investors), the real work begins. The initial flurry of acquisition and setup is over. Now, the focus shifts to running the property like a well-oiled machine to protect your investment and, hopefully, make it grow. This is where the syndication truly comes alive, transforming from a one-time transaction into a living, breathing business.

The primary fee you’ll see during this phase is the Asset Management Fee. Think of the syndication sponsor as the CEO of the investment. This fee is their salary for providing high-level strategic oversight and actively steering the ship. Their job isn’t just to collect checks; they are constantly working to execute the business plan you invested in.

This hands-on leadership includes a wide range of critical tasks:

* Managing the property management company to make sure they're hitting performance targets.

* Overseeing major capital improvement projects, like unit renovations or amenity upgrades.

* Handling all investor communications, from quarterly reports to distributing cash flow.

* Making the tough financial decisions to boost revenue and cut expenses.

For investors, getting a handle on these ongoing costs is crucial. In fact, understanding the sponsor's strategies to reduce operational costs can give you a much clearer picture of how they plan to maximize the property's profitability.

Asset Management vs Property Management

One of the most common points of confusion for new investors is the difference between asset management and property management. It’s a simple but vital distinction: they are two separate jobs, paid for by two separate fees. The asset management fee goes to the sponsor for their strategic work. The property management fee is paid to an entirely different company—a third-party firm that handles the day-to-day, on-the-ground tasks.

It's the classic difference between working on the business versus working in the business. The asset manager (the sponsor) works on the investment from a 30,000-foot view. The property manager works in the trenches, dealing with tenants, toilets, and trash.

To clarify this further, here’s a breakdown of who does what:

Understanding this division of labor is key. You're paying the sponsor for their expertise in making the investment successful, while a separate fee covers the essential, boots-on-the-ground work required to run a property.

The sheer scale of these management activities is immense across the financial world. For instance, the syndicated loans market in North America was valued at a staggering $682.44 billion in 2024. A significant portion of that value comes from the ongoing management and structuring fees, which just goes to show how central these fees are to any large-scale investment vehicle.

Alright, we've talked about the upfront costs to buy and run a property. But what about when the deal is done and everyone cashes out? This is where the sponsor’s back-end fees come in, and they're set up to reward a successful home run for everyone involved.

The simplest back-end fee is the Disposition Fee. Think of this as the sponsor's commission for selling the property. It’s typically a 1-2% fee based on the final sale price. This covers the massive effort of marketing the asset, fielding offers, and navigating the complex closing process to get the highest possible price for investors.

But the real meat of the sponsor's compensation—and the part you should pay close attention to—is the promote. It's also known as carried interest. This is the sponsor’s slice of the profits, but it’s designed so that investors get paid first. It's the grand prize the sponsor only gets to claim after you've received your initial investment back, plus a preferred return.

The promote is a powerful tool. It ensures the sponsor is laser-focused on maximizing your returns because their biggest payday is directly tied to your success. When interests are aligned like this, good things happen.

The Profit Waterfall Explained

So how does this all work in practice? Syndicators use a distribution model called a "profit waterfall." It’s just a fancy term for a system that dictates who gets paid what, and in what order, once the property sells and all the original investment money is returned.

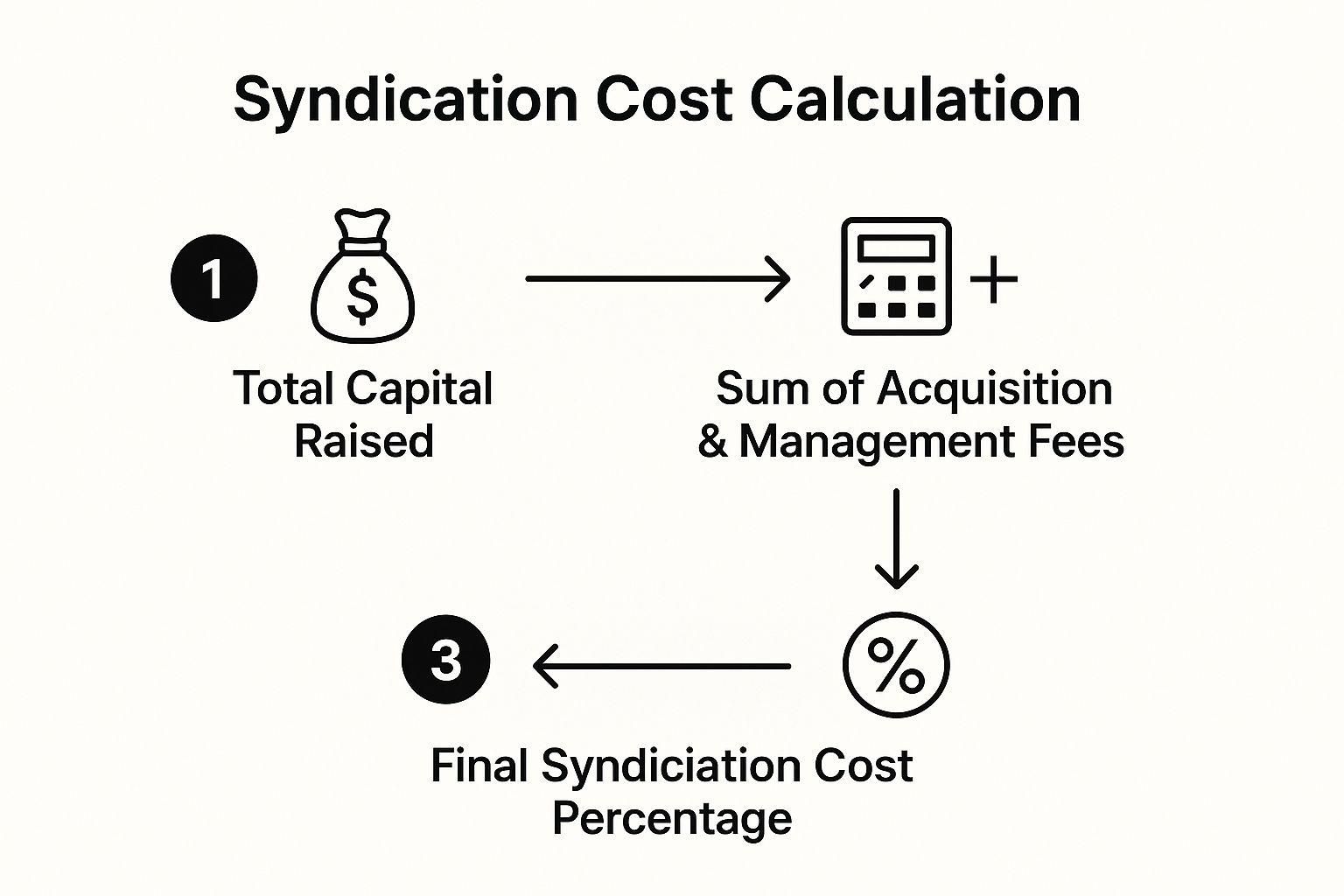

This flowchart breaks down how fees and profits are calculated from the initial capital raise all the way to the final splits.

As you can see, it’s a step-by-step process that shows how the final fee percentages are determined from the total pool of money.

Here’s a typical flow for a profit waterfall:

- Return of Capital: Before anyone sees a dime of profit, 100% of the initial investment capital is returned to you and the other passive investors. The sponsor gets nothing until every investor has their original money back in their pocket.

- The Preferred Return: Next up is the preferred return (often called the "pref"). This is a hurdle that must be cleared, usually a 6-9% annual return on your investment. If the deal promised an 8% pref, investors get paid that amount before the sponsor can share in any of the remaining profits.

- The Promote Split: Only after the first two tiers are completely full does the sponsor get their promote. The remaining profits are split according to a pre-arranged agreement. A common split is 70/30, meaning 70% of the leftover profits go to the investors, and 30% goes to the sponsor.

Just like a lender prices a loan based on risk and overhead, a sponsor's back-end structure is shaped by their own operational realities. As you can learn more from this FDIC analysis on syndicated loans, a sponsor's business costs influence the fees investors see. Ultimately, this tiered profit-sharing model is the best answer to "what is syndication cost" on the back end, because it's built to make sure the sponsor only wins when you win big.

How to Analyze a Syndication Fee Structure

Knowing what the fees are is one thing. Knowing how to judge them is another entirely. This is where you separate the savvy investor from the novice. You need to look at the entire fee structure and ask yourself a simple question: "Is this fair, and does it align the sponsor's success with my own?"

Think of it this way: a good fee structure acts like a powerful incentive, motivating the sponsor to hit home runs for everyone involved. A bad one? It can let them get paid even if the investment barely gets off the ground. The real skill is learning to read between the lines of the fee schedule to understand the sponsor’s confidence in their own plan.

Benchmarking Against Industry Norms

First things first, there’s no one-size-fits-all fee structure. The costs should make sense for the type of deal you're looking at. A simple, stable, cash-flowing apartment complex is a very different beast from a run-down property that needs a complete overhaul.

You should expect the fees to reflect that reality:

- Value-Add Deals: These are the heavy-lifting projects. They require a ton of work from the sponsor to renovate, re-lease, and reposition the property in the market. Because of that, you'll often see slightly higher acquisition and asset management fees. A bigger performance fee (promote) is also common, as it’s the reward for successfully manufacturing new value.

- Stabilized Deals: These are more of a "set it and forget it" type of investment. With less risk and less hands-on work required, the fees should be lower. Look for more modest asset management fees and a performance split that leans more in the investor's favor.

The single most important thing to look for is alignment of interests. A sponsor shouldn't get their big payday until you, the investor, have gotten yours. This is where the preferred return proves its worth.

Does the deal offer a solid preferred return—usually in the 6-9% range—before the sponsor can touch their share of the profits? That’s the true test. It’s a mechanism that ensures investors get paid first, which is the cornerstone of any fair, investor-centric deal. For a deeper dive into how all these costs stack up, this complete real estate syndication fees guide is a great resource. Getting this part right gives you the confidence to jump on great opportunities and walk away from deals with lopsided or excessive fees.

Common Questions About Syndication Costs

Once you start getting serious about real estate syndication, you’ll find yourself with a lot of questions. That’s perfectly normal. Getting comfortable with the costs and fees is a huge step toward becoming a smart, confident passive investor.

Let’s tackle some of the most common questions we get from investors just like you.

Are Syndication Fees Negotiable for Investors?

The short answer is no, not really. For passive investors coming into a deal, the fees are set in stone.

Everything from the acquisition fee to the profit split is legally defined in a document called the Private Placement Memorandum (PPM). This document is the legal backbone of the entire offering, and it ensures that every single investor is treated the same way under the exact same rules. The sponsor can't just cut a special deal for one person without creating a legal and logistical nightmare.

Instead of trying to negotiate, a much better use of your time is to dig into the fee structure itself. Analyze the sponsor's track record and the deal's potential, and decide if it all aligns with your financial goals.

Where Can I Find the Fee Details for a Deal?

Any reputable sponsor will be an open book when it comes to fees. They are legally required to disclose every single cost associated with the syndication.

Your go-to document is always the Private Placement Memorandum (PPM). I know, it's a long, dense legal document, but it's where the real details are. You'll find specific sections breaking down every fee, sponsor compensation, and how the profits are distributed.

Sponsors will often provide a slick investment summary or host a webinar with the highlights, but the PPM is the final word.

Always use the PPM to verify the numbers you see in marketing materials. The investment summary is a great starting point, but the PPM is the legally binding agreement that truly matters.

Do Higher Fees Automatically Mean a Bad Deal?

Absolutely not. It’s easy to think "lower fees are better," but that's a dangerous oversimplification. The sponsor's experience and ability to execute the business plan are far more important.

Think of it this way: would you rather have a world-class surgeon performing a complex operation for a premium fee, or a first-year resident for a discount? An experienced sponsor might charge higher fees because they have the team and expertise to pull off a complicated value-add strategy that generates fantastic returns.

On the flip side, an inexperienced sponsor offering rock-bottom fees could mismanage the project and lose your capital. The real metric to focus on is the projected net return to investors—the money you actually receive after all fees are paid. A great deal with fair fees will always beat a bad deal with low fees.

What Is a Fair Preferred Return for Investors?

The preferred return, or "pref," is a critical number for any passive investor. This is the rate of return you get before the sponsor starts sharing in the profits. A fair pref typically falls somewhere between a 6% to 9% annual return.

The exact number usually depends on the deal's risk profile:

* Lower-Risk Deals: For a stable, cash-flowing property, a 6-7% pref is common.

* Higher-Risk Deals: For a value-add or development project with more moving parts, you should expect a higher pref of 8-9% to compensate you for taking on that extra risk.

This pref acts as a hurdle. The sponsor doesn’t get their share of the profits (the promote) until your preferred return has been paid. It’s a powerful feature that aligns their interests with yours and ensures you get paid first.

Keeping track of investors, managing capital calls, and sending out updates can quickly become a full-time job for deal sponsors. Homebase is an all-in-one platform built by syndicators to make that entire process easier. If you're looking to streamline your fundraising and investor relations, check out Homebase.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.