What is Investor Relations? Key Strategies for Business Success

What is Investor Relations? Key Strategies for Business Success

Learn what is investor relations and how it builds trust, drives growth, and ensures financial stability. Discover essential strategies now.

Domingo Valadez

Jul 15, 2025

Blog

At its most basic level, investor relations (IR) is the strategic role responsible for the conversation between a company and its financial backers. Think of it as the critical bridge connecting a company’s leadership with its investors, analysts, and the broader financial community. Its job is to make sure the company's story gets told clearly, accurately, and consistently.

Understanding Investor Relations Beyond the Buzzwords

Simply put, investor relations is the art and science of managing your company's financial story. It's so much more than just pushing out press releases or filing the necessary paperwork. A really effective IR program is always on the front foot, building trust and confidence by taking complex financial data and corporate strategy and turning it into a compelling, easy-to-understand narrative.

This isn't just a communications task; it's a strategic management responsibility that blends finance, marketing, and a deep understanding of securities law. The whole point is to create a solid two-way street for communication between the company, its investors, and the financial world. The field's growing significance is undeniable; the global market for investor relations tools was valued at around $2.5 billion in 2023 and is expected to hit roughly $5.8 billion by 2032. You can dig into the specifics of this growth in recent market reports.

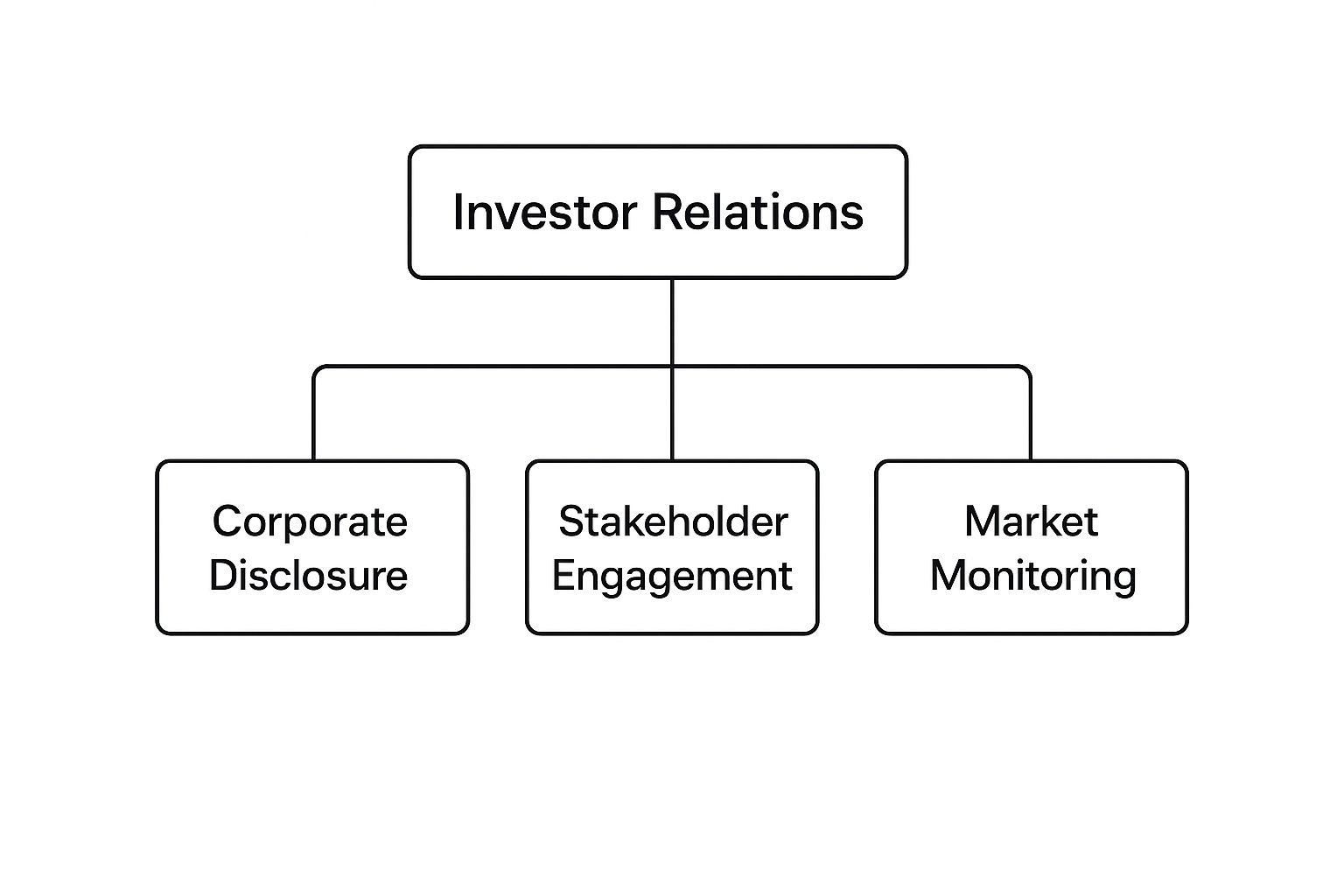

To truly grasp how IR works in the real world, it helps to break it down into its core functions. These elements all work together to build a credible and influential presence in the financial markets.

To provide a clearer picture, here’s a breakdown of the primary duties and strategic goals that fall under the investor relations umbrella.

Core Functions of an Investor Relations Program

These functions show that a modern IR strategy is about much more than just one-way communication; it's a dynamic discipline.

As you can see, IR is a multifaceted practice where transparent disclosure, direct engagement, and market awareness are completely intertwined. Great IR isn’t just about broadcasting information—it’s about listening to the market and using that feedback to help shape the company's direction.

How Strong IR Shapes Company Success

A proactive investor relations strategy is so much more than just a box-ticking exercise for regulators. When you consistently and clearly communicate your company's financial story, you’re giving the market the tools it needs to fairly assess your value. The result? A more stable stock price and, in the long run, a higher valuation.

Think about it like this: a great company with a weak IR strategy is like an incredible product with zero marketing. The value is there, but no one knows about it. Strong IR ensures your performance, vision, and potential are front and center for the people who matter most—your investors.

Driving Financial Strength and Resilience

There's a direct line between effective IR and a company's financial health. Building trust and clearing up uncertainty through a solid IR program can actually lower your cost of capital, making it cheaper to fund growth initiatives. It also helps improve stock liquidity by attracting a wider, more diverse pool of investors.

This becomes absolutely critical when things get choppy. During a market downturn or a company-specific crisis, having a track record of transparent communication is priceless. It helps you manage investor anxiety, provide essential context, and maintain trust when you need it the most. You can explore our guide on https://www.homebasecre.com/posts/building-and-maintaining-strong-investor-relationships to see these principles in action.

Recent events have only hammered this point home.

Market uncertainty from geopolitical and economic disruptions has elevated IR to a critical survival function. Companies are doubling down on trust-building measures, recognizing that strong shareholder relationships are essential for navigating turbulence and sustaining capital access.

This shift shows just how far investor relations has come—from a simple reporting task to a core strategic advantage. To not just survive but thrive, businesses now understand they have to actively manage their relationship with the financial community. You can find more insights on this trend in the 2025 State of Investor Relations Report.

The Core Responsibilities of an IR Professional

So, what does an investor relations professional actually do all day? It's a role that wears many hats, blending financial wizardry, strategic planning, and good old-fashioned relationship management. It’s far from a simple desk job. Think of them as the bridge, ensuring critical information flows smoothly between your firm and the people who fund it.

An IR professional is your company's chief storyteller to the investment community. Their job is to craft a clear, consistent, and compelling narrative about your performance, your strategy, and where you're headed. This isn't just about PR; it’s about giving investors the complete picture they need to make smart, confident decisions.

Financial Reporting and Disclosure

A huge piece of the puzzle is structured, formal communication. The IR team architects the financial disclosures that investors and analysts pore over. This isn't just about plugging numbers into a template—it's about crafting a message that gives those numbers meaning and builds trust.

Key responsibilities here include:

* Quarterly Earnings Releases: They’re the ones preparing the detailed reports that announce financial results, complete with management’s analysis and commentary.

* Annual Reports: This is the big one—a comprehensive yearly document that paints the full picture of the company’s financial health and strategic direction.

* Earnings Calls: IR pros script and orchestrate the live calls where executives discuss results and field tough questions from analysts.

This regular cycle of reporting becomes the heartbeat of your relationship with investors, creating a reliable rhythm of transparent communication.

Above all, an IR professional must ensure every communication is accurate, timely, and compliant with strict regulatory standards from bodies like the Securities and Exchange Commission (SEC). This blend of financial skill and legal diligence is the essence of investor relations.

Strategic Communication and Relationship Building

But it's not all reports and filings. At its core, IR is about people. The IR team is the go-to contact for analysts, institutional investors, and individual shareholders. They're the ones organizing investor days, setting up one-on-one meetings with key stakeholders, and hitting the road for industry conferences to keep conversations flowing.

Ultimately, their goal is to manage expectations and provide a faithful, accurate representation of the company’s value. They take complex financial data and turn it into a story that is both clear and trustworthy.

Building a World-Class Investor Communications Strategy

A top-tier investor relations program really comes down to three core principles: transparency, consistency, and accessibility. This isn't just about pushing out an email update now and then. It’s about building a communications plan that gets ahead of investor needs, answering their questions before they even think to ask.

I like to think of a communications strategy like building a house. Transparency is the solid foundation—everything is out in the open. Consistency is the structural frame, giving investors a reliable rhythm they can count on. And accessibility? That’s the doors and windows, making it easy for investors to connect with you.

This means you need a plan for delivering timely, accurate information across different channels. Some of your investors will pour over every detail in an email, while others just want a quick summary on their phone. Many will appreciate having a dedicated investor portal to log into.

Crafting a Proactive IR Plan

A proactive plan puts you in the driver's seat of the narrative instead of just reacting to it. The first step is simple: set a regular communication schedule. This could be a mix of in-depth quarterly reports, monthly newsletters, and immediate alerts for major news like a new acquisition or a successful refinancing.

Beyond the regular updates, your plan must also map out how you’ll handle both good and bad news. Having a clear, pre-defined process for talking about challenges builds incredible trust. It stops speculation in its tracks and shows your investors you’re a steady hand at the wheel.

A truly effective investor relations strategy is dynamic. It involves actively listening to the market's perception of your company and using that feedback to sharpen your messaging and overall corporate strategy.

A key part of a great communication strategy is applying email segmentation best practices. This ensures you’re sending the right message to the right people, based on their specific interests and investments.

Using Technology for Better Engagement

Modern technology is your best friend when it comes to investor relations. A centralized investor portal, for instance, gives your partners 24/7 access to crucial documents, performance dashboards, and all past communications. This not only makes you look more professional and transparent, but it also frees up your team from handling constant one-off requests.

Here’s how the right tech can elevate your IR strategy:

* Centralized Document Hub: A single, secure place for offering memorandums, K-1s, and property reports. No more hunting through old emails.

* Automated Distributions: Makes paying out returns a breeze, with crystal-clear records for both your team and your investors.

* Secure Messaging: Provides a direct, secure line for investors to ask questions and get prompt, private responses from you.

By embracing these tools, you build a more efficient and scalable IR function that helps you maintain that personal touch, even as your portfolio grows.

The Global Power of Investor Relations

Investor relations isn't just a corporate buzzword; its principles are at work on the global economic stage. Think of it this way: just as a real estate syndicator communicates with their partners, entire nations use IR strategies to manage their financial reputation and attract critical foreign investment.

It's essentially diplomacy for capital. When a country needs to fund massive projects—new highways, power grids, or public transit—it often looks to the global markets for the necessary cash.

How well that country tells its economic story directly influences its ability to secure that funding. Nations that practice transparency and keep open lines of communication with international investors are viewed as more stable and reliable. This isn't just about looking good; it has real, tangible financial consequences.

From Corporate Strategy to National Policy

A country with a strong IR game can earn better credit ratings, which in turn lowers its borrowing costs. Cheaper financing for critical infrastructure creates a virtuous cycle of growth and development. It’s the exact same logic a syndicator applies, just scaled up to a macroeconomic level. Trust and clarity are universal currencies.

A recent report from the Institute of International Finance (IIF) drove this point home. It found that countries with solid investor relations and debt transparency programs tend to secure higher credit ratings and are more resilient during economic shocks. Nations like Indonesia, the Philippines, and Brazil, which scored well in the IIF’s assessment, now benefit from better access to affordable capital.

When a country manages its sovereign debt with the same transparency and diligence as a well-run public company, it builds a foundation of trust that can weather global financial storms and fuel long-term progress.

Seeing investor relations operate at a national level really highlights its fundamental power. It proves that clear, consistent, and honest communication is the bedrock of financial stability and growth—whether you're funding a single real estate deal or an entire economy.

Answering Your Top Investor Relations Questions

If you're starting to work with outside investors, you probably have a lot of questions about how to manage those relationships. That's completely normal. Getting these early communications right is the key to building a foundation of trust that will pay dividends for years.

Let's walk through some of the most common questions we hear from real estate syndicators and entrepreneurs.

When Should I Start Thinking About IR?

This is easily the most frequent question. For a private real estate syndication, the answer is simple: from your very first deal. You might not need a full-time IR officer, but you absolutely need to establish professional, consistent communication from day one. For public companies, IR is a must-have the second an IPO is on the table.

What's the Difference Between Investor Relations and Public Relations (PR)?

It's a great question, and the distinction is crucial. Think of it like this: PR broadcasts to the general public to build your brand’s reputation. IR, on the other hand, speaks directly to the financial community—your investors, lenders, and analysts—to build their confidence in your financial stewardship. Different audiences, different messages.

How Should We Handle Bad News?

Sooner or later, every business faces a setback. The most important question is, how do you communicate it? The golden rule here is to be transparent, timely, and truthful. Trying to hide or downplay bad news almost always backfires, causing far more damage to investor trust than the news itself.

A solid IR strategy always has a plan for communicating challenges. It's about getting ahead of the story, explaining the situation clearly, and outlining the exact steps you’re taking to fix it.

How Often Should We Communicate with Investors?

Finding the right balance is key. You want to keep investors in the loop, but you don't want to drown them in information. It’s all about creating a predictable rhythm.

- Quarterly Reports: These are the bedrock. They provide the detailed performance data your investors expect.

- Monthly Summaries: A quick email update or newsletter is a great way to maintain engagement between the big quarterly reports.

- Immediate Alerts: For major news—a new acquisition, a refinance, or a change in leadership—you need to communicate instantly.

The goal is to create a rhythm of communication that investors can rely on. This consistency builds confidence and demonstrates professionalism, showing that you are in control of the narrative, regardless of market conditions.

Can't Technology Just Handle All of This?

Technology is an incredible tool, but it’s an amplifier, not a replacement for the human touch. An investor portal can automate your reporting, manage distributions, and securely store documents, which is a massive time-saver.

However, technology can't replicate a phone call to one of your key partners or a face-to-face meeting to walk through a complex issue. The human element is what turns a financial transaction into a genuine, long-term relationship. It's still the heart of effective investor relations.

Ready to build a professional, scalable investor relations function for your real estate business? Homebase provides an all-in-one platform to manage fundraising, automate communications, and give your investors the transparent experience they deserve. Discover how Homebase can help you focus on closing deals, not managing spreadsheets.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.