Regulation D Rule 506: Your Guide to Legal Real Estate Syndication

Regulation D Rule 506: Your Guide to Legal Real Estate Syndication

Learn how Regulation D Rule 506 helps you raise capital legally and stay compliant. Discover the right path for successful real estate investments.

Domingo Valadez

Jul 13, 2025

Blog

When you're looking to raise private money for a real estate deal, you're essentially selling a "security"—a piece of the investment. Normally, this would trigger a massive, expensive, and time-consuming registration process with the SEC, much like a huge corporation going public with an IPO. For most syndicators, that's a non-starter.

This is where Regulation D Rule 506 comes in. It's a set of rules from the Securities and Exchange Commission (SEC) that creates a "safe harbor," allowing you to raise capital from private investors without that full-blown public registration. Think of it as the private, high-speed lane for funding your deals. It's the single most popular pathway for private placements in the U.S. and forms the legal backbone for almost every real estate syndication you'll encounter.

What Is Regulation D Rule 506 and Why It Matters

This rule isn't some obscure bit of legal jargon; it's the engine that powers the private real estate market. The numbers don't lie. Historical data shows that Rule 506 offerings accounted for a staggering 94% of all Regulation D capital raises between 2008 and 2010. This statistic alone shows just how critical it is compared to other exemptions. It’s not just an option; it’s the option for serious syndicators.

The Two Paths of Rule 506

At its core, Regulation D Rule 506 provides a predictable legal framework to raise unlimited capital from private investors. The rule is split into two distinct paths, and choosing the right one is one of the first major decisions you'll make as a sponsor.

- Rule 506(b): This is the traditional, relationship-based approach. Think of it as raising money from your trusted, pre-existing network.

- Rule 506(c): This is the modern route that allows for public advertising. You can cast a much wider net, but it comes with stricter compliance hurdles.

Understanding the nuances between these two is absolutely fundamental. One path is about who you know, while the other is about who you can reach—and proving they’re qualified.

The real magic of Rule 506 is that it preempts state "blue sky" laws. This means that while you still have to file a simple notice in the states where your investors live, those states can't block you from selling your securities as long as you're following the federal rules.

This federal preemption is a game-changer. It simplifies fundraising enormously, letting you source capital from investors across the country without getting bogged down in 50 different sets of state-specific registration laws.

Why It's the Go-To for Syndicators

For real estate syndicators, the benefits of using Rule 506 are huge. Most importantly, it completely removes the cap on how much money you can raise, which is a major limitation in other exemptions. This is absolutely vital for large-scale projects like multifamily complexes or new commercial developments where your capital needs can easily soar into the millions.

Let's break down the key aspects of Rule 506 in a simple table to see why it's so foundational for syndicators.

Rule 506 at a Glance for Syndicators

This structure gives both you and your investors confidence. You have a clear, legal path to follow, and they know the offering is structured within a well-established federal framework.

For those looking to go even deeper into the regulatory world, this comprehensive guide on Registered Investment Advisor (RIA) regulations offers valuable context on the broader compliance landscape. By sticking to the rules of the road, you build credibility and ensure your syndication business starts on solid legal ground.

The Private Network Approach With Rule 506(b)

Rule 506(b) is the classic, time-tested path for raising private money. I like to think of it as the "friends and family" model scaled up for your entire professional network. The whole idea is built on a simple, foundational principle: you raise capital from people you already know, without advertising your deal to the general public.

Under this rule, you can raise an unlimited amount of capital. The catch? The defining feature of a Regulation D Rule 506(b) offering is the strict ban on general solicitation or advertising. That means no posts on social media, no mass email blasts, and definitely no ads. The fundraising process has to rely on direct, one-on-one conversations with potential investors you have a real connection with.

This approach is, by far, the most popular method for private offerings. In fact, Rule 506(b) is the go-to exemption under the Securities Act of 1933, responsible for an eye-watering $1.4 trillion in capital raised between July 2019 and June 2020 alone. That number really shows you its central role in private markets. You can dig into a deeper analysis of these private securities offering trends to see just how dominant it is.

The Cornerstone of Rule 506(b): Your Pre-Existing Relationship

The entire compliance framework for Rule 506(b) really boils down to one critical concept: the “pre-existing, substantive relationship.” This isn't just about being casual acquaintances. The SEC needs to see that a genuine, meaningful connection was in place between you (the sponsor) and the investor before you ever brought up the investment opportunity.

Let’s unpack what that actually means on the ground:

- Pre-existing: The relationship has to be established before the offering officially begins. You can't just meet someone at a conference, find out they're an accredited investor, and immediately pitch them your deal. That’s a clear violation.

- Substantive: This is the important part. It means you know enough about the person’s financial standing and level of sophistication to reasonably believe they are a suitable fit for your specific deal. This kind of understanding doesn't happen overnight; it develops over time through real conversations and interactions.

A quick handshake or a single LinkedIn connection simply won't cut it. You have to be able to document the history of your relationship, showing how you know the person and what gives you the confidence that they can understand the risks involved.

Accommodating Sophisticated Investors

One of the unique perks of using Rule 506(b) is its flexibility with investor types. While you can bring in an unlimited number of accredited investors, you also get a special allowance that many syndicators find valuable.

Under Rule 506(b), you can include up to 35 non-accredited "sophisticated" investors in your deal. A sophisticated investor is someone who, through their own experience in business and finance, has enough knowledge to properly evaluate the pros and cons of your investment.

This is a major difference from its counterpart, Rule 506(c), which is strictly for accredited investors only. But be warned: bringing non-accredited investors on board triggers some extra, non-negotiable compliance hurdles.

Heightened Disclosure for Non-Accredited Investors

If you decide to accept funds from even one non-accredited investor, you’re on the hook to provide them with a comprehensive disclosure document. This is almost always a Private Placement Memorandum (PPM), and it needs to contain the same level of detailed information you'd find in a fully registered public offering.

Think of it as a master document that combines a detailed business plan, a thorough risk disclosure, and financial projections. And here’s the key part: this document must be given to all investors—both accredited and non-accredited—if even one non-accredited investor participates. This requirement adds significant complexity and cost, which is why many syndicators using 506(b) still choose to work only with accredited investors to keep things simple.

Public Fundraising and Verification Under Rule 506(c)

If Rule 506(b) is the quiet, relationship-driven path, then Rule 506(c) is its modern, public-facing cousin. Rolled out with the JOBS Act in 2013, this rule completely changed the game by allowing syndicators to use general solicitation and advertising to market their offerings. Think of it as putting up a digital billboard for your real estate deal for the whole world to see.

Suddenly, you could promote your investment opportunity on websites, through social media, via email marketing campaigns, and even at industry events. This blows the doors wide open, letting you connect with potential investors well beyond your immediate circle. It's an incredibly powerful tool, especially if you're just starting out or want to scale your capital-raising efforts in a big way.

But all that marketing freedom comes with a major trade-off. Unlike the more flexible 506(b), a Regulation D Rule 506(c) offering has one absolute, non-negotiable rule: you can only accept funds from accredited investors. There’s no room for sophisticated investors here. None.

The Higher Burden of Proof

Here’s the biggest operational shift you need to grasp with Rule 506(c): active investor verification. It’s no longer enough for an investor to simply check a box and tell you they're accredited. The SEC puts the responsibility squarely on your shoulders, the sponsor, to take "reasonable steps to verify" that every single person investing in your deal truly meets the accredited investor criteria.

This is a much higher bar than the self-certification that often flies in a 506(b) offering. If you fail to properly verify your investors, you could jeopardize your entire exemption, putting the deal and your business in serious jeopardy. The SEC does not mess around with this requirement.

Key Takeaway: The power to advertise your deal (Rule 506(c)) is directly linked to a much stricter, mandatory process for verifying every single investor is accredited. You're basically trading a wider marketing funnel for a heavier compliance workload.

Interestingly, even with its potential, not everyone has jumped on the 506(c) bandwagon. For instance, research shows that since it was introduced, only about 8.4% of venture capital funds have used it, suggesting a strong preference for old-school fundraising in that world. You can dig into the specifics by reading this detailed SEC report on Rule 506(c) usage trends.

Practical Steps for Investor Verification

So, what do "reasonable steps" actually mean in the real world? The SEC gives a few non-exclusive methods that act as a "safe harbor." If you follow one of these, you're generally considered to have met your verification duty.

Here are the most common ways to verify an individual's accredited status:

- Income Verification: This involves reviewing an investor’s IRS forms (like a W-2, Form 1099, or K-1) for the last two years. You'll also need a written statement from them confirming they reasonably expect to hit the income threshold in the current year.

- Net Worth Verification: You'll need to look at recent bank statements, brokerage statements, or other financial records. This is paired with a credit report from a national agency to confirm their net worth is above the required threshold.

- Third-Party Confirmation: You can get a written confirmation from a licensed attorney, a Certified Public Accountant (CPA), a registered broker-dealer, or a registered investment adviser. This letter must state that they have taken reasonable steps to verify the investor's status within the last three months.

This can feel like a lot to manage, which is why many syndicators turn to platforms like Homebase. These tools can help streamline the process by providing a secure portal to collect, manage, and store all of these sensitive verification documents.

Ultimately, Rule 506(c) offers incredible reach, but that power is balanced by the heavy responsibility of rigorous, documented compliance.

Choosing Your Path: A Practical Comparison of Rule 506(b) and 506(c)

Picking the right exemption under Regulation D Rule 506 is one of the biggest calls a real estate syndicator has to make. This isn't just about checking a legal box—it dictates your entire fundraising strategy, how you market your deal, and the kind of relationships you build with your investors.

Think of it like choosing your route for a cross-country road trip.

One route, Rule 506(b), is a private, unmarked road. You're traveling with a small group of people you already know and trust. The other route, Rule 506(c), is a major highway with billboards everywhere. You can invite anyone to join your convoy, but you have to personally check everyone's credentials before they can hit the gas. Both routes get you to your destination, but the journey—and the rules of the road—couldn't be more different.

To make the right call, you need to look past the legal jargon and think about what fits your business, your network, and your goals.

Key Factors in Your Decision

The choice between 506(b) and 506(c) really boils down to three things: who your investors are, how you plan to reach them, and how much paperwork you're willing to handle. Let's look at how this works in the real world with two different syndicators.

Scenario 1: Sarah, the Relationship-Builder, Chooses Rule 506(b)

Sarah has spent a decade as a commercial real estate broker. Over the years, she’s built a solid network of high-net-worth individuals, other brokers, and financial advisors who know her, like her, and trust her judgment. For Sarah, a 506(b) offering is a no-brainer.

- Her Investor Base: She can tap directly into her deep list of pre-existing, substantive relationships.

- Her Marketing Plan: She doesn't need to advertise. Her fundraising is all about personal phone calls, one-on-one emails, and private meetings with people who already know her track record.

- Her Compliance: The burden is lighter. Since she's only accepting accredited investors, they can simply self-certify their status. This saves her the hassle of requesting and reviewing sensitive financial documents.

Scenario 2: Mike, the New Operator, Chooses Rule 506(c)

Mike is a sharp operator who knows how to find undervalued multifamily properties, but he’s new to the syndication game and has a small personal network. To get his first deal funded, he needs to cast a much wider net. Rule 506(c) is the perfect tool for the job.

- His Investor Base: He can build his investor list from scratch by putting his offering out there for the public to see.

- His Marketing Plan: He’s free to use social media ads, a professional website, email marketing campaigns, and even public webinars to attract accredited investors from all over.

- His Compliance: The workload is significantly heavier. He is legally required to take "reasonable steps" to verify that every single investor is accredited. This means he has to collect and review tax returns, bank statements, or get verification letters from their CPA or attorney.

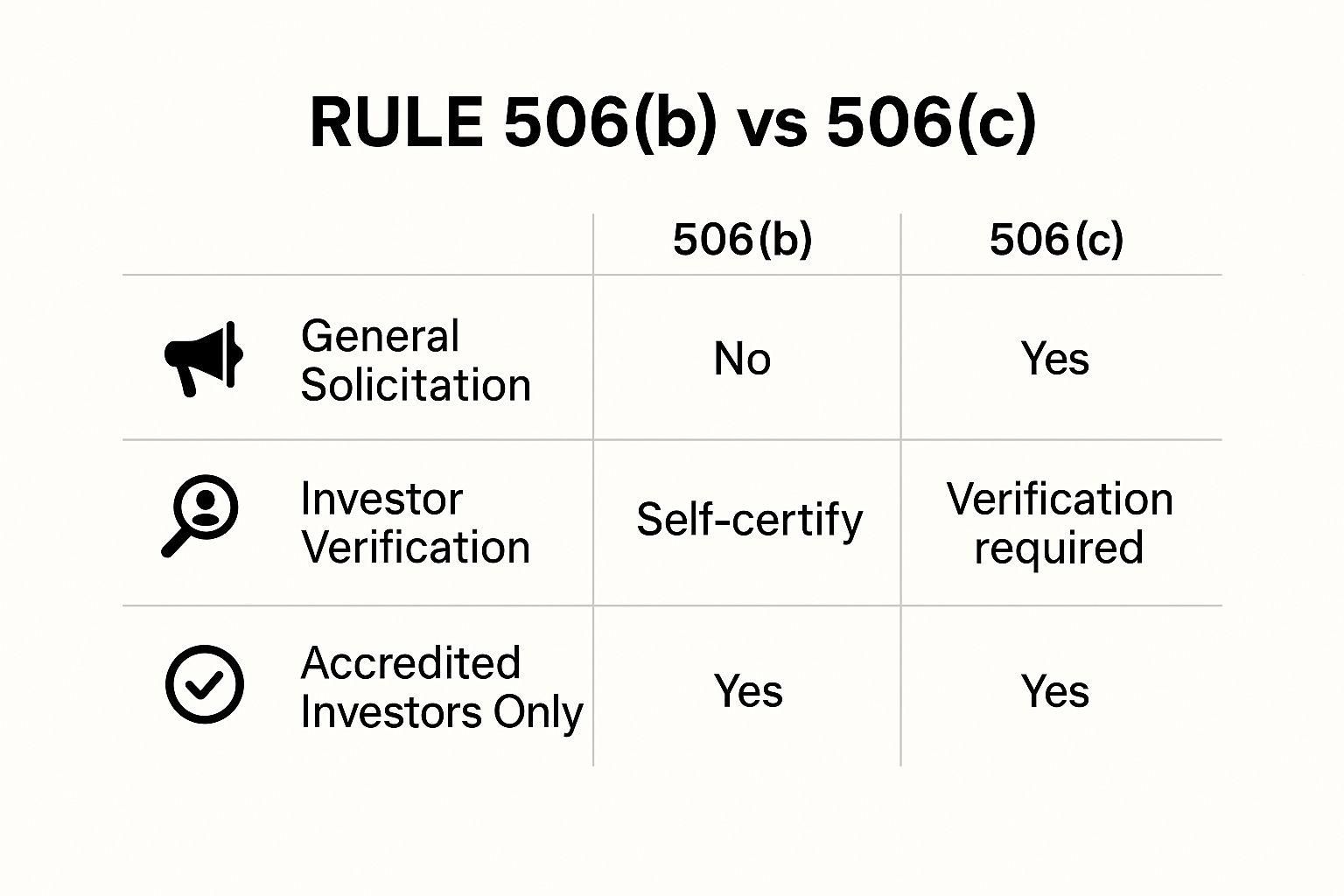

This infographic breaks down the core differences in a simple, visual way.

The image makes the trade-off crystal clear: Rule 506(c) gives you the power to advertise, but it comes with a strict, non-negotiable verification process. Rule 506(b) keeps your fundraising private and relies on the trust you've already built.

Strategic Comparison: Rule 506(b) vs. Rule 506(c)

Making the right choice means honestly weighing these trade-offs. The path you choose will define how you connect with capital and the exact systems you’ll need to have in place from day one.

Your decision needs to be proactive, not reactive. Trying to switch from a 506(b) to a 506(c) in the middle of a raise is a legal minefield. Once you go down the private path of 506(b), any form of public advertising can taint the entire offering, putting you in hot water with the SEC.

This table breaks down the operational differences to help you choose the right exemption for your syndication.

At the end of the day, there is no "best" option. The right Regulation D Rule 506 exemption is the one that fits your specific strategy, your available resources, and your comfort level with the rules.

Alright, you've picked your path—Rule 506(b) or 506(c). That’s a huge step, but now the real legal legwork begins. Staying compliant isn't a one-time task; it's an ongoing commitment to meticulous detail and, yes, a fair bit of paperwork. This is the administrative engine of your capital raise, and you absolutely have to get it right.

Think of it this way: your choice of 506(b) or 506(c) is the destination you've plugged into your GPS. Now, you have to actually drive the car, follow the rules of the road, and make sure your vehicle is legally registered.

Your Legal Document Trifecta

Before you can accept a single dollar, you need a trio of foundational legal documents. These aren't just formalities. They are the blueprints, the contract, and the official rulebook for your entire real estate syndication.

- Private Placement Memorandum (PPM): This is your deal's encyclopedia. It lays out everything an investor could possibly want to know—the business plan, property specifics, financial models, and, crucially, all the potential risks. A thorough, well-drafted PPM is your first and best line of defense if a dispute ever arises down the road.

- Subscription Agreement: This is the official "I'm in!" document. It's the binding contract an investor signs to formally subscribe to your offering. In it, they'll confirm how much they're investing and legally attest to their investor status, whether accredited or sophisticated.

- Operating Agreement: This document is the charter for the new LLC you've formed to hold the property. It spells out how the company will be managed, detailing the rights and responsibilities of both the managers (that's you) and the members (your investors). It covers everything from voting rights and profit splits to how major decisions get made.

Together, these three documents create the transparent, legally sound framework that protects everyone involved.

The All-Important Form D Filing

Once your documents are drafted and you land your very first investor commitment, a new clock starts ticking. This brings us to a make-or-break compliance step for any Regulation D Rule 506 offering: filing Form D.

Form D is a straightforward, five-page notice filed electronically with the SEC. Filing it doesn't mean the SEC has "approved" or blessed your deal. It's simply you, the syndicator, raising your hand and officially telling the federal government, "Hey, I'm selling securities and I'm using this specific exemption to do it." The form asks for basic info about your company, its leadership, the size of the offering, and which exemption you're claiming.

The most critical detail here is the timing. You must file your Form D with the SEC no later than 15 calendar days after the date of the first sale of securities. Mark it on your calendar. Set a reminder. Missing this deadline can lead to serious trouble, including the SEC potentially blocking you from using Regulation D for future deals.

Don't Overlook State "Blue Sky" Laws

Rule 506 is powerful because it's a federal exemption that largely overrides, or "preempts," state-level registration laws. But it doesn't give you a complete hall pass from the states. You still have to pay attention to what are commonly called "blue sky" laws.

For a Rule 506 offering, this usually just means making a "notice filing." In simple terms, you have to give a heads-up to each state where you have an investor. This typically involves sending them a copy of the Form D you filed with the SEC and paying a small state filing fee. It’s a mandatory step that shows state regulators you're operating by the book.

Keeping all this paperwork straight is essential. Effective document management is your best friend for ensuring you meet all your Regulation D compliance deadlines, especially for Form D. If you find yourself juggling multiple deals, you might want to see how Cloud-Based Legal Case Management Software for Document Management can help keep everything organized. Handling these filings correctly from day one protects your deal, your investors, and your ability to keep raising capital for years to come.

Common Questions About Regulation D Rule 506

Even when you feel like you've got a handle on the rules, applying Regulation D Rule 506 to a live deal always brings up tricky questions. The difference between a smooth, compliant offering and a very expensive mistake often comes down to getting these small details right.

Let's walk through some of the most common questions we hear from real estate syndicators out in the field. Think of this as your go-to guide for those "what if" moments that are bound to pop up when you're raising capital.

What Counts as a Pre-Existing Substantive Relationship for Rule 506(b)?

This is the absolute heart of a Rule 506(b) offering, so you have to nail it. The "pre-existing" part is straightforward: you knew the potential investor before your offering went live. You can't just meet someone at a networking event and immediately pitch them your deal.

The "substantive" piece is where it gets more nuanced. It means you have a relationship strong enough that you genuinely understand their financial situation and sophistication. You need to have a reasonable basis for believing they are a suitable fit for this kind of investment.

A quick email exchange or a brief phone call won't cut it. This requires a real, established connection where you've learned about their investment experience or financial standing over time. A best practice? Document these interactions—notes on when you met and what you discussed can be a lifesaver.

Can I Switch from a Rule 506(b) to a Rule 506(c) Offering Mid-Raise?

This question comes up a lot, and the answer is a hard no. Trying to flip from a 506(b) to a 506(c) in the middle of a raise is a legal disaster waiting to happen.

Once you start raising money privately under the 506(b) "no general solicitation" rules, you can't suddenly start advertising to the public like you would in a 506(c). The SEC could easily see any later advertising as "tainting" the entire raise, potentially viewing it as an illegal public offering from the start.

You absolutely must decide on your path—506(b) or 506(c)—before you begin fundraising. Stick to that choice. The two exemptions are legally separate lanes, and you can't switch between them.

What Are the Biggest Mistakes with Rule 506(c) Investor Verification?

By far, the biggest mistake syndicators make with a 506(c) offering is simply taking an investor’s word for it that they're accredited. Having them check a box on a form is not enough. It completely misses the point of the rule.

The regulation demands that you take "reasonable steps to verify" their status. This is an active duty, not a passive one. Here are the most common ways people get this wrong:

* Relying on self-certification: This is the most frequent and dangerous mistake. You have to do more.

* Using old documents: An investor's finances can change. Make sure any verification documents, like bank statements or income verification letters, are recent—usually within the last three months.

* Not documenting your steps: You must keep a clear record of how you verified each and every investor. If regulators ever ask, the burden is on you to prove you did your job.

Getting verification right is your single most important compliance task in a 506(c) raise. For a clear look at how this plays out in a deal, check out this real estate syndication example that shows how all the pieces fit together.

What Happens If I Fail to File Form D on Time?

Forgetting to file your Form D within that 15-day window won't automatically invalidate your Rule 506 exemption for the current offering. But don't breathe a sigh of relief just yet—the consequences can be serious and affect your future deals.

If you miss the deadline, the SEC can hit you with an injunction that disqualifies you from using Regulation D Rule 506 for all future offerings, typically for one year. This is what's known as landing on the SEC's "bad actor" list, and it can stop your business in its tracks.

On top of that, individual states can levy their own fines and penalties for late filings. Filing Form D is cheap and easy. It's a simple, crucial signal to regulators that you're playing by the rules. Missing the deadline is an unforced error you should never make.

Ready to manage your real estate deals without getting lost in spreadsheets and compliance headaches? Homebase provides an all-in-one platform to manage your fundraising, investor relations, and deal administration seamlessly. Learn how Homebase can help you scale your syndication business today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.