Your Guide to a Private Placement Memorandum

Your Guide to a Private Placement Memorandum

Our expert guide demystifies the private placement memorandum. Learn to craft a PPM that secures capital, ensures legal compliance, and builds investor trust.

Domingo Valadez

Jul 12, 2025

Blog

Think of a private placement memorandum (PPM) less like a brochure and more like the master blueprint for a serious investment. It's the comprehensive legal document that gives private investors all the nitty-gritty details on an investment opportunity, from the business model and financials to all the potential risks involved.

Understanding the Core Purpose of a PPM

At its heart, a PPM serves two critical functions. On one hand, it’s a powerful tool to attract capital from serious, accredited investors. On the other hand, it's a legal shield. By providing full and transparent disclosure, it protects you and your company from potential liability down the road.

This isn't some new-fangled document. The concept goes all the way back to the U.S. securities laws put in place after the 1929 stock market crash. The Securities Act of 1933 was a landmark piece of legislation that required most securities to be registered, but it also carved out exemptions for private offerings. These exemptions, like Regulation D, paved the way for the PPM, which became the required disclosure document to ensure investors were still protected.

A Quick Glance at PPM Characteristics

To really get a feel for what a PPM is, it helps to see its fundamental characteristics laid out simply. This table breaks down the essentials at a glance.

In short, a PPM is your single source of truth for the investment. It's the document that underpins the entire private capital-raising process, ensuring everyone is on the same page.

What a PPM Is Not

Just as important as knowing what a PPM is, is understanding what it isn't. It's easy to confuse it with other business documents, but the distinctions are critical.

A PPM is not:

- A Business Plan: While it shares some DNA with a business plan, a PPM is a formal legal document. Its focus is squarely on the investment offering itself and the associated securities laws and risks.

- A Simple Pitch Deck: A pitch deck is the highlight reel. The PPM is the full-length feature film with all the director's commentary. It's the deep-dive document that provides the legal and financial substance to back up the claims you made in your initial pitch.

- An Informal Agreement: This is a legally significant document. When combined with the subscription agreement that an investor signs, it forms the core of the contract between your company and the investor.

Grasping these differences clarifies the PPM's unique and indispensable role in raising capital. When you're ready to start building your own, using a structured guide can be a huge help. You can get a head start with our guide on a private placement memorandum template to set yourself up for a successful fundraise.

Why the PPM Is So Important in Today's Capital Markets

The private placement memorandum has grown into something much more than a stuffy legal document. In the fast-paced world of modern capital raising, it's become a strategic necessity for any serious venture. With the explosion of private equity, venture capital, and complex startups, the PPM has shifted from a mere compliance checkbox to a powerful tool for building trust and making a compelling case.

Just think about the investment scene today. It’s full of seasoned investors who have seen thousands of pitches. They're sizing up everything from software-as-a-service companies with recurring revenue to biotech ventures that might not pay off for a decade. In an environment like this, a slick pitch deck just doesn't cut it. Investors need real substance.

A solid private placement memorandum is the best way to deliver that substance. It proves you've done more than just come up with a great idea—you've stress-tested it. It shows you know your market inside and out, have a realistic grasp of the risks, and have a clear strategy to handle them. This is the kind of homework that separates a wishful thought from a real investment opportunity.

A Direct Answer to Intense Investor Due Diligence

This demand for deep, honest disclosure didn't just appear out of nowhere. It was forged in the fire of major market shifts. The 2008 global financial crisis, for example, completely changed how investors think. That crisis was a painful lesson in what happens when risks are hidden or misunderstood, creating a generation of far more careful and diligent investors.

In the years that followed, as private markets boomed, the PPM's role only grew. Companies raising capital now rely on the private placement memorandum to lay out every potential risk and provide the kind of transparency that cautious investors require. It brings a clear, regulated process to private fundraising, where thorough due diligence is the name of the game. You can explore more about the PPM's evolving role in the wake of major financial events.

The PPM is more than a disclosure document; it's a narrative. It tells the complete story of your venture—the opportunity, the team behind it, the market you operate in, and the challenges you are prepared to overcome.

A well-written PPM anticipates and answers the tough questions every investor is thinking, building the kind of confidence that's absolutely critical for getting a deal funded.

Proving Your Credibility and Strategic Vision

When you're competing for capital, your private placement memorandum can be what sets you apart. It's a direct reflection of your professionalism and strategic depth. When an investor gets a thorough, well-organized PPM, it speaks volumes about your operation.

Here’s what a great PPM quietly tells an investor:

- You're Prepared: It shows you’ve put in the hard work to build a solid business on a sound legal footing.

- You Have Integrity: Being upfront about the risks builds far more trust than a perfect-sounding pitch that ignores reality.

- You Have a Clear Vision: The document shows you've thought not just about how to spend the money, but how you'll manage growth and navigate roadblocks.

- You're Legally Responsible: It confirms you're serious about compliance and protecting both the company and its investors.

In short, the PPM is your chance to prove your venture is a professionally vetted, institutional-quality opportunity. It elevates the conversation from a high-level idea to a detailed, tangible investment proposal, making it absolutely essential in the sophisticated world of private capital.

The Anatomy of a Winning PPM

A great private placement memorandum does more than just tick legal boxes and lay out financial projections. It’s a compelling story, carefully crafted to build trust and give investors the confidence to join your deal. Think of it as a guided tour of your entire investment opportunity, where each section has a specific job—to walk an investor from initial curiosity all the way to a firm commitment.

Let’s pull back the curtain on the key components that make up a persuasive and legally solid PPM. Once you understand the role each part plays, you'll see how they all work together to create a powerful narrative for your venture.

The Opening Act: The Executive Summary

This is your first—and arguably most important—shot at grabbing an investor’s attention. The Executive Summary isn't just an introduction; it’s the high-impact highlight reel of your entire deal. You need to be concise but thorough, delivering a powerful snapshot of the opportunity.

A strong executive summary gets right to the point, answering the critical questions every investor has:

* What’s the core asset or business?

* How much are you raising?

* What are the key terms of the deal?

* What are the projected returns?

This section really sets the tone for everything that follows. A clear, confident summary backed by solid numbers will make an investor eager to learn more. A vague or confusing one? It might just land your PPM in the "pass" pile.

Setting the Stage: The Offering Terms

Once you've piqued their interest with the summary, investors will want to dig into the mechanics of the deal. The Terms of the Offering section is where you lay out the nitty-gritty details of the security they’re buying. It's the "how" of the investment.

This part of the PPM gets specific, covering details like:

* The type of security being sold (e.g., limited partnership interests, LLC membership units).

* The price per unit and the total number of units available.

* The minimum investment required from each investor.

* The target closing date for the offering.

Clarity is everything here. Investors need to know exactly what they're buying and on what terms. This section cuts through any ambiguity and establishes the ground rules for the investment.

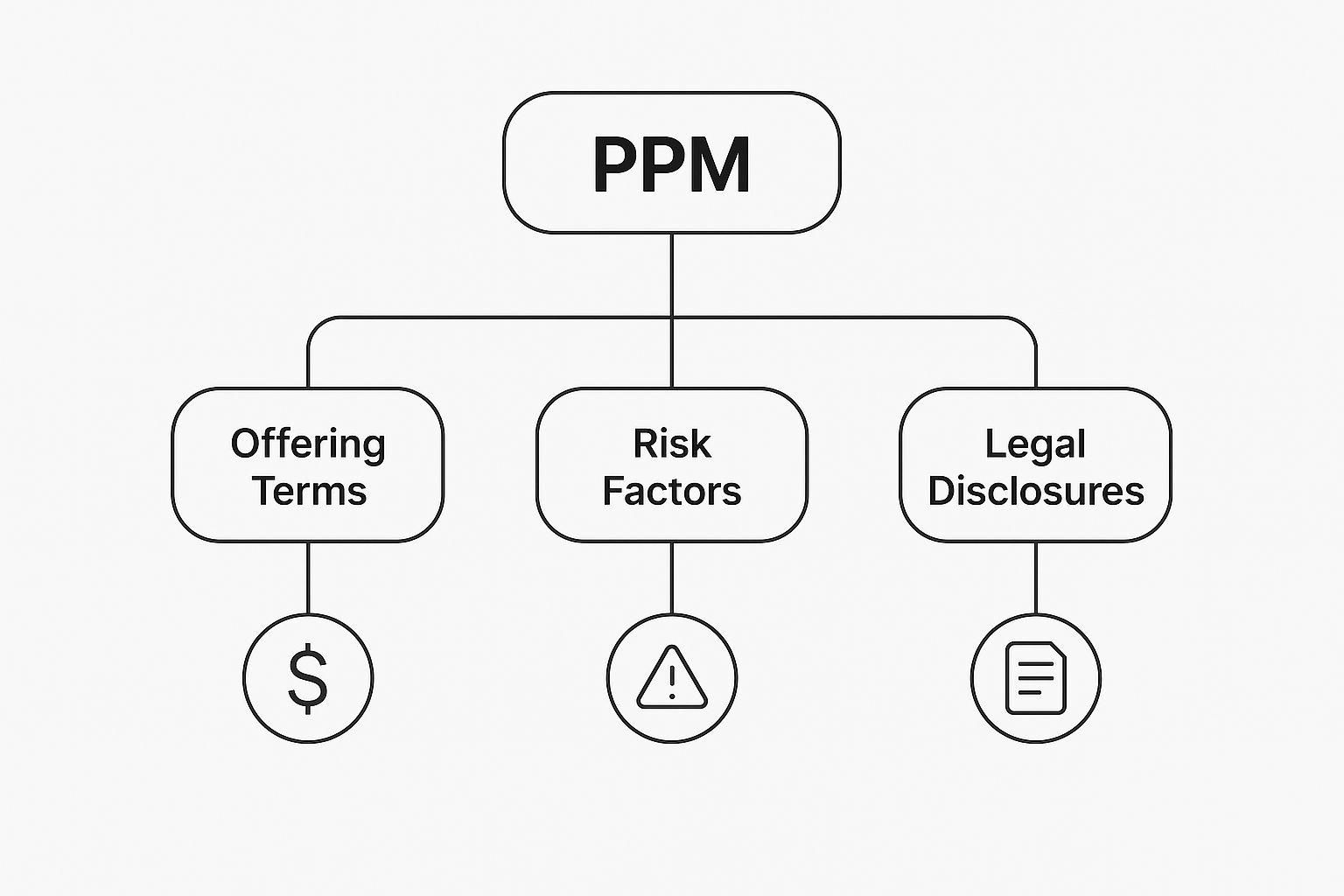

The visual below shows how these offering terms are a core pillar of the entire PPM structure.

As you can see, the Offering Terms, along with Risk Factors and Legal Disclosures, form the foundational support for the whole document.

Building Credibility Through Transparency: Risk Factors

The Risk Factors section is probably the most misunderstood part of a PPM. Its real purpose isn't to scare investors off—it's to build massive credibility. By being upfront and honest about the potential challenges, you show investors that you're a seasoned professional with foresight.

Every single investment has risks. Sophisticated investors know this. What they’re looking for is proof that you know it too and have already thought through the potential hurdles.

A candid and detailed Risk Factors section is one of the strongest signals of a trustworthy sponsor. It shows you respect the investor's capital and are committed to full, transparent disclosure.

These risks might be market-wide, like an economic downturn, or they could be project-specific, like construction delays or tenant vacancies in a real estate deal. A comprehensive list proves you’re a prudent operator, not just an optimistic promoter.

Showcasing the Leadership: Management Team

At the end of the day, investors are betting on people just as much as they're betting on the deal itself. The Management Team section is your chance to show off the experience and expertise of the people steering the ship. This is where you build a personal connection and prove you have the right team to execute the business plan.

Your bios should be more than a simple resume. They need to highlight relevant wins and explain why each person's unique background is essential for this specific venture.

The Roadmap for Capital: Use of Proceeds

Investors have a right to know exactly where their money is going. The Use of Proceeds section provides a clear, itemized breakdown of how every dollar raised will be spent.

This is no place for vague estimates. A strong section will list specific line items, such as:

* Property acquisition cost

* Renovation and capital improvement budget

* Legal and closing fees

* Operating reserves

This transparency acts as a roadmap for the investor's capital, giving them confidence that you have a deliberate and responsible plan. It directly answers their fundamental question: "Where is my money going?"

The Final Handshake: The Subscription Agreement

Finally, we have the Subscription Agreement. This is the legally binding contract that makes the investment official. It’s the document an investor signs to formally "subscribe" to your offering and is often included as an exhibit to the PPM.

The agreement reiterates the deal's terms and includes important statements from the investor, like confirming their status as an accredited investor. It’s the last critical step that turns an interested prospect into a true partner in your deal.

Navigating the Legal Rules of Private Placements

When you're raising private capital, you're not operating in the Wild West. There’s a specific set of rules, mainly from the Securities and Exchange Commission (SEC), designed to protect everyone involved—especially your investors. Your private placement memorandum is your single most important tool for proving you're playing by those rules.

Think of the PPM as your official game plan, showing you're on the right side of the law.

Most private offerings lean on a set of exemptions found in Regulation D of the Securities Act. This is what allows you to raise money without the massive headache and expense of a full-blown public IPO. For real estate syndicators, it all comes down to two specific "safe harbor" rules: Rule 506(b) and Rule 506(c).

Understanding Rule 506 Offerings

Choosing between a 506(b) and a 506(c) offering is a critical decision. It’s not just paperwork; it dictates who you can raise money from and how you can talk about your deal.

- Rule 506(b): The Quiet Approach

This is the old-school, relationship-based method. You are strictly forbidden from general solicitation or advertising. That means no blasting your deal on social media, no public website banners, and no mass emails to strangers. You can only raise funds from people you already have a real, pre-existing relationship with. The trade-off? You can bring in up to 35 non-accredited (but financially savvy) investors alongside an unlimited number of accredited ones. - Rule 506(c): The Public Approach

Thanks to the JOBS Act, this rule lets you advertise your offering to the world. You can post on LinkedIn, run an email campaign, and openly discuss the deal's merits. But there’s a big catch. You can only accept money from verified accredited investors, and the burden is on you to take "reasonable steps" to prove their status. This is far more involved than just having them check a box on a form.

Your choice here really defines your capital-raising strategy. A 506(b) is all about your personal network. A 506(c) lets you cast a much wider net, but the investor requirements are far more stringent.

Key Takeaway: A well-drafted PPM is your best defense. By disclosing every material fact and risk, you satisfy the anti-fraud provisions of securities law. This applies to all offerings and protects both you and your investors from potential disputes down the road.

Defining the Accredited Investor

So, what exactly is an "accredited investor"? It's not just someone with money; it’s a specific definition from the SEC for individuals who have the financial knowledge and ability to handle a potential loss.

The government sets clear, non-negotiable thresholds. An individual is considered accredited if they meet one of the following criteria:

* An annual income over $200,000 (or $300,000 combined with a spouse) for the last two years, with a reasonable expectation for that to continue.

* A net worth of more than $1 million, not including the value of their primary home.

If you’re running a 506(c) deal, you must verify this by reviewing sensitive documents like tax returns, W-2s, or brokerage statements. This process highlights just how crucial it is to handle investor information securely. When discussing these details, following strict online meeting compliance guidelines is non-negotiable to protect everyone involved.

The specific terms you find in a PPM aren't set in stone; they often shift with the market. For instance, after the market downturn in the early 2000s, investors had more leverage. This led to PPMs with more investor-friendly terms and extra protections. The balance of power between a deal sponsor and investors is always reflected in this document.

Of course. Here is the rewritten section, designed to sound like it was written by an experienced human expert.

How to Draft a PPM That Actually Gets Your Deal Funded

Knowing the definition of a PPM is one thing. Crafting one that truly inspires an investor to write a check is a different beast entirely. Think of it as part sales brochure, part ironclad legal contract, and part brutally honest business plan. Nail the balance, and you're golden. Miss it, and you’ll struggle to raise a single dollar.

Your goal isn't just to list facts and figures. It’s to build a compelling story—a narrative of opportunity that is both exciting and, crucially, legally sound. This means every claim you make, from your ambitious return projections to your market analysis, must be anchored in solid data and realistic assumptions. You're building a case, not just telling a story.

Clarity Is Your Most Powerful Tool

The best PPMs I’ve ever seen are models of clarity. Jargon, vague promises, and overly technical language are massive red flags for any investor who’s been around the block. They want to see that you can explain your business, your strategy, and the inherent risks in a way that is direct and easy to follow. If they have to struggle to understand your core concept, they're not going to invest. It's that simple.

Put yourself in their shoes: your PPM is a window into how you'll manage their money. A messy, confusing, or hype-filled document signals that your management style might be just as chaotic. On the other hand, a clear, well-organized, and transparent PPM communicates professionalism and competence before you ever have a single conversation.

This dedication to clarity is absolutely critical in two specific areas:

- Risk Disclosures: Don’t just copy and paste generic risks. Get specific. Are there local zoning hurdles for your real estate project? A dominant competitor you need to outperform? Detail those real-world challenges.

- Use of Proceeds: Simply stating "working capital" is a non-starter. You need a detailed, line-item budget showing exactly where every investor dollar is going. For sophisticated investors, this transparency isn't a "nice-to-have"; it's a requirement.

An effective private placement memorandum doesn’t sell a dream; it presents a well-researched opportunity. The difference lies in substituting baseless hype with defensible data and swapping vague promises for a clear, actionable plan.

You Can’t Do This Alone: The Role of Professional Review

Let me be blunt: no matter how smart or experienced you are, you should not draft a PPM in a vacuum. Bringing in legal and financial experts isn't just a good idea—it's an essential step to protect yourself and your future investors. These pros do more than just proofread; they provide a critical layer of scrutiny that can save you from massive headaches later.

First, a securities attorney is non-negotiable. They ensure your PPM complies with all the intricate SEC rules, like those under Regulation D. They are your guide through the maze of investor accreditation, advertising restrictions, and proper risk disclosure. Trying to navigate this alone is a recipe for legal and financial disaster. In fact, getting legal counsel involved early can dramatically speed up the entire capital-raising process, which can often take 3 to 12 months from start to finish.

Next, have a CPA or another financial professional audit your projections. They will pressure-test your assumptions, making sure your financial models are logical and defensible. This third-party stamp of approval shows investors that your numbers are grounded in reality, not just wishful thinking.

Common PPM Drafting Mistakes to Avoid

Even the most well-intentioned syndicators can make critical mistakes that sink an otherwise great deal. Knowing what these common blunders are is the first step to making sure you don't fall into the same traps.

The table below breaks down some of the most frequent errors I see and, more importantly, how to steer clear of them.

By committing to absolute clarity, bringing in the right experts, and sidestepping these common pitfalls, you can create a PPM that does more than just tick a legal box. You can build a document that actively inspires the confidence you need to get your deal across the finish line.

Common Questions About Private Placement Memorandums

As you start diving into the world of private capital, the Private Placement Memorandum, or PPM, is one of those documents that can feel a bit intimidating. It's complex, dense, and full of legalese, so it’s completely normal to have questions. Let's clear the air and tackle some of the most common ones.

This isn't about getting lost in abstract legal theory. It’s about giving you the practical clarity you need to make smart, confident decisions for your next capital raise. We’ll cover the legal must-haves, compare the PPM to other documents you're probably more familiar with, and get real about the costs involved.

Is a PPM Always Legally Required to Raise Capital?

This is easily the most common question, and the answer isn't a simple yes or no. Technically speaking, the SEC doesn't have a rule that explicitly says, "You must create a document called a Private Placement Memorandum for every private offering." But relying on that technicality is like walking a tightrope without a net.

The real answer is rooted in the anti-fraud provisions of securities law. These rules are crystal clear: you must provide all "material information" to your investors. That means disclosing everything a reasonable person would need to know to make an informed investment decision—especially all the potential risks.

So, while the law doesn't name the document, it demands comprehensive disclosure. The PPM just happens to be the established, legally-vetted, and most reliable way to meet that obligation.

Crucial Insight: Deciding to skip a PPM is like building a house without blueprints or insurance. You might save a little money upfront, but you're exposing yourself to catastrophic financial and legal risk if something goes wrong. A well-drafted PPM is your single best defense against future claims that you misled investors.

For most offerings, particularly those under Rule 506(b) that might include non-accredited investors, a PPM is an absolute necessity. For offerings limited to accredited investors, it’s a powerful best practice that builds immense credibility and shields you from liability. So, while it may not be technically mandatory in every single case, it's always the prudent choice.

Differentiating a PPM From a Business Plan

It's easy to see why these two get mixed up. Both documents talk about your business, your market, and your financial goals. But they are built for fundamentally different purposes and speak to very different audiences.

Think of it this way: a business plan is your internal roadmap. It’s a strategic guide focused on operations—how you’ll find the property, manage it, and execute your value-add strategy. It's optimistic and forward-looking, designed to guide your team's decisions.

A PPM, on the other hand, is an external, legally-driven disclosure document. Its job isn't just to sell the dream; its primary goal is to disclose risk and ensure you're complying with securities law.

Here’s a quick breakdown of the key differences:

You’ll absolutely pull information from your business plan when creating your PPM. But they aren't interchangeable. The PPM is a highly specialized tool built for the specific, high-stakes job of raising capital legally and responsibly.

What Does It Cost to Create a Professional PPM?

Alright, let's get down to brass tacks. The cost of a professionally prepared PPM can vary quite a bit, but it's an investment you can't afford to skip. Skimping here is the classic definition of being "penny wise and pound foolish."

The final price tag really depends on a few key things:

- Complexity of the Deal: A straightforward single-asset real estate syndication will naturally cost less to document than a complex, multi-state fund or a startup with complicated intellectual property.

- Attorney's Experience: A top-tier securities attorney will charge more than a generalist lawyer, but their deep expertise in navigating SEC rules is almost always worth the premium. You're paying for their experience, not just their time.

- Scope of Work: The cost is also influenced by whether your attorney is drafting everything from scratch or reviewing documents you've already started. It also includes the other necessary offering documents, like the operating agreement and subscription agreement.

As a general rule, you can expect a complete package of offering documents, with a robust PPM at its core, to be a significant investment. For simpler deals, you might be on the lower end, but it's not uncommon for a well-prepared PPM package from an experienced law firm to cost between $10,000 and $20,000. Highly complex offerings can easily climb to $25,000 or more.

While that number might make you pause, it's crucial to frame it correctly. This isn't just an administrative expense; it's your primary risk management tool. A professional PPM can protect you from litigation that could cost hundreds of thousands of dollars down the road. It also provides the institutional-grade credibility needed to attract serious investors and ensures your fundraising journey starts on a solid legal foundation.

Managing investor documents, ensuring compliance, and keeping your deals organized is a full-time job. With Homebase, you can automate the busywork and focus on what you do best—finding great deals and growing your portfolio. Our all-in-one platform handles everything from fundraising and accreditation to reporting and distributions, all for one simple flat fee. See how you can streamline your syndication business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.