What Is eSign A Guide for Real Estate Syndicators

What Is eSign A Guide for Real Estate Syndicators

Wondering what is eSign? This guide explains electronic signatures, how they work, and why they're essential for modern real estate syndication.

Domingo Valadez

Sep 27, 2025

Blog

Ever signed for a package on a digital screen or clicked "I Agree" on a new app's terms? If so, you've used an electronic signature. In simple terms, an eSign is just a legally recognized way to get consent or approval on a digital document.

Think of it as the 21st-century version of a wet ink signature. It carries the same legal weight but ditches the pen, paper, and postage in favor of speed and security.

Your Direct Answer to What Is eSign

At its heart, an e-signature is a process. It’s a series of actions that proves a person intended to sign a document and agree to its terms. It’s much more than just a picture of your signature or a typed name at the bottom of an email.

This technology has quickly become a cornerstone of modern business, particularly in document-heavy fields like real estate syndication. It takes the old, clunky process of printing, signing, scanning, and mailing documents and turns it into a few simple clicks.

The Core Components of an eSign

To really get what makes an e-signature legitimate, you have to look at what's happening behind the scenes. It’s a combination of a few key elements that work together to create a secure, legally sound agreement.

- Intent to Sign: The person signing has to take a clear, deliberate action. This could be checking a box, clicking an "Agree" button, or drawing their signature with a mouse or finger. It shows they meant to sign.

- Consent to Business: Everyone involved has to agree to do business electronically. This is usually part of the initial sign-up or agreement process.

- A Clear Record: This is the most critical part. A secure, tamper-proof record—often called an audit trail—is generated. It captures everything: who signed, when they signed, their IP address, and every other step they took in the process.

A Rapidly Growing Industry

The move away from paper isn't just a small shift; it's a massive economic wave. The global market for e-signature solutions jumped from around $512.5 million just a few years ago to an estimated value of over $2 billion by 2020. That kind of growth shows just how quickly businesses are embracing digital agreements. If you're curious, you can find a lot of information online about the history and growth of eSignatures.

An electronic signature is more than just a digital mark; it's an authenticated, secure process that validates a person's identity and their agreement to the terms within a document, creating a comprehensive audit trail for every transaction.

To make these concepts even clearer, here’s a quick breakdown of the fundamentals.

eSign at a Glance: Key Concepts Explained

This table shows how an e-signature is far more than a simple image—it's a robust system built on layers of security and verification.

How eSignatures Work Behind the Scenes

Ever wondered what's really going on when you click "sign" on a digital document? For you, the experience is simple enough: you open an email, look over the agreement, and add your signature. Easy.

But under the hood, a complex and highly secure process kicks into gear to make sure everything is legitimate and locked down. This is what separates a legally binding e-signature from just a picture of your name on a screen.

It helps to think of an e-signature platform as a digital notary. It’s an impartial third party that watches and records every single step of the signing process, creating a detailed, tamper-proof log called an audit trail.

Verifying the Signer

First things first: the system has to confirm you are who you say you are. This is called user authentication, and it’s the crucial first line of defense against unauthorized signing.

Most of the time, this is done by sending a unique link to your specific email address. Since only you should have access to your inbox, clicking that link ties the action directly to you. Some systems add another layer of security, like sending a one-time code to your phone.

Once your identity is confirmed, you can add your signature by:

- Typing out your name.

- Drawing it with a mouse or your finger.

- Selecting a pre-designed signature font.

No matter which method you choose, the act itself shows your clear intent to sign and accept the terms—a key requirement for the signature to hold up legally.

Securing the Document

This is where the real magic happens. The moment you sign, the document and all the signature data are cryptographically "sealed" together. The core technology that keeps e-signatures safe involves sophisticated techniques to encrypt and share files securely, locking in their authenticity.

This seal, often created using something called public key infrastructure (PKI), generates a unique digital fingerprint for the signed document. If anyone tries to change even a single comma after it's been signed, that digital seal breaks. This instantly flags the document as tampered with and invalidates the signature.

Every single action—from the moment the document is first viewed to the exact second it's signed—is logged with a timestamp. This creates an unchangeable audit trail that captures the signer's IP address, their general location, and the full sequence of events, providing strong, court-admissible evidence.

It's this powerful combination of authentication, encryption, and a meticulous audit trail that gives electronic signatures their legal weight. It isn't just about speed and convenience; it’s about creating a verifiable record of an agreement that's often far more secure than a wet-ink signature on paper. The entire system is built to prove exactly who signed what, and when they signed it.

Understanding the Legal Power of an Electronic Signature

So, is an electronic signature just as legally sound as one signed with a pen? The short answer is a resounding yes. This isn't just a matter of convenience; it’s a legally recognized method for executing contracts, giving you the confidence to know your agreements are fully enforceable.

The legal foundation for all of this was set back in 2000 with a landmark piece of legislation: the Electronic Signatures in Global and National Commerce Act. You’ll usually hear it called the E-SIGN Act. This federal law officially gives electronic signatures the same legal weight as their handwritten counterparts across the United States.

Once that law was on the books, adoption skyrocketed. A great example is DocuSign, which popped up in 2003 and now supports over 300,000 companies and 200 million users worldwide. It’s a testament to the global trust in this technology.

The Three Pillars of a Legal eSign

For an e-signature to hold up legally, it has to satisfy three core requirements laid out by the E-SIGN Act. Think of it like a three-legged stool—if one leg is missing, the whole thing topples over.

Let's walk through a real-world scenario for a real estate syndicator. You’ve just sent a subscription agreement to a new investor, and they're about to sign it on their phone.

Here’s a breakdown of how that simple tap-and-sign action checks all the legal boxes:

- Intent to Sign: The investor has to do something that clearly shows they mean to sign. This could be clicking a button that says "Agree & Sign" or using their finger to draw their signature. It’s an active step, proving they weren’t just scrolling through the document.

- Consent to Do Business Electronically: Before they even get to the signature line, the investor must agree to handle the transaction electronically. This is usually a simple checkbox or a consent clause you see right at the beginning of the process.

- A Clear Transaction Record: The platform you use has to capture the entire signing event in a secure, unchangeable record. This is the audit trail. It logs everything—who signed, their IP address, the exact time they signed, and every other interaction with the document. It's solid proof.

So, when your investor signs that subscription agreement on their phone, it becomes a legally binding commitment because all three of these standards are met. In many ways, this digital proof is even stronger and more detailed than what you get with an old-school paper contract.

Why This Matters for Your Deals

Grasping these legal basics is more than just trivia; it’s about peace of mind. It means every document your investors sign, from the first NDA to the final closing paperwork, is secure, valid, and will hold up if ever questioned.

The process ensures that your agreements aren't just signed faster but are also wrapped in a strong legal framework. If you want to dive deeper, we have a complete guide covering all the details on electronic signature legal requirements and how they apply to syndication. This knowledge lets you run your deals more efficiently and with total legal confidence.

eSign vs. Digital Signature: Clearing Up the Confusion

It’s easy to get the terms "electronic signature" and "digital signature" mixed up—they’re often thrown around as if they mean the exact same thing. But for anyone managing important legal documents, especially in the high-stakes world of real estate syndication, knowing the difference is critical.

Let's break it down with a simple analogy. Think of an electronic signature (eSign) as the broad, umbrella category. It's any electronic process that shows you agree to something. This could be as simple as typing your name at the bottom of an email, checking an "I Agree" box on a website, or even drawing your signature on a tablet. It's all about demonstrating intent.

A digital signature, however, is a very specific type of eSign, and it’s built for serious security. If an eSign is like initialing a document, a digital signature is like getting it notarized with a tamper-proof seal. It uses advanced encryption to lock down the document and verify the signer's identity in a way that’s much harder to dispute.

The Technology Behind the Trust

The real difference comes down to the technology running in the background. A basic eSign is great at capturing the intent to sign, but a digital signature goes a step further by cryptographically binding your identity to that specific document.

This isn't some brand-new concept. The groundwork for this was actually laid back in the late 1970s through cryptography research. The development of the RSA algorithm in 1988 was a major breakthrough, creating the secure framework that underpins the digital signatures we use today. You can learn more about the fascinating history of digital signature technology to see just how far we've come.

Essentially, a digital signature uses a certificate-based digital ID to prove who you are.

A digital signature creates a unique digital "fingerprint" for the document. If even a single character is altered after signing, the signature is visibly invalidated, making tampering immediately obvious. This provides an unmatched level of security for high-value agreements.

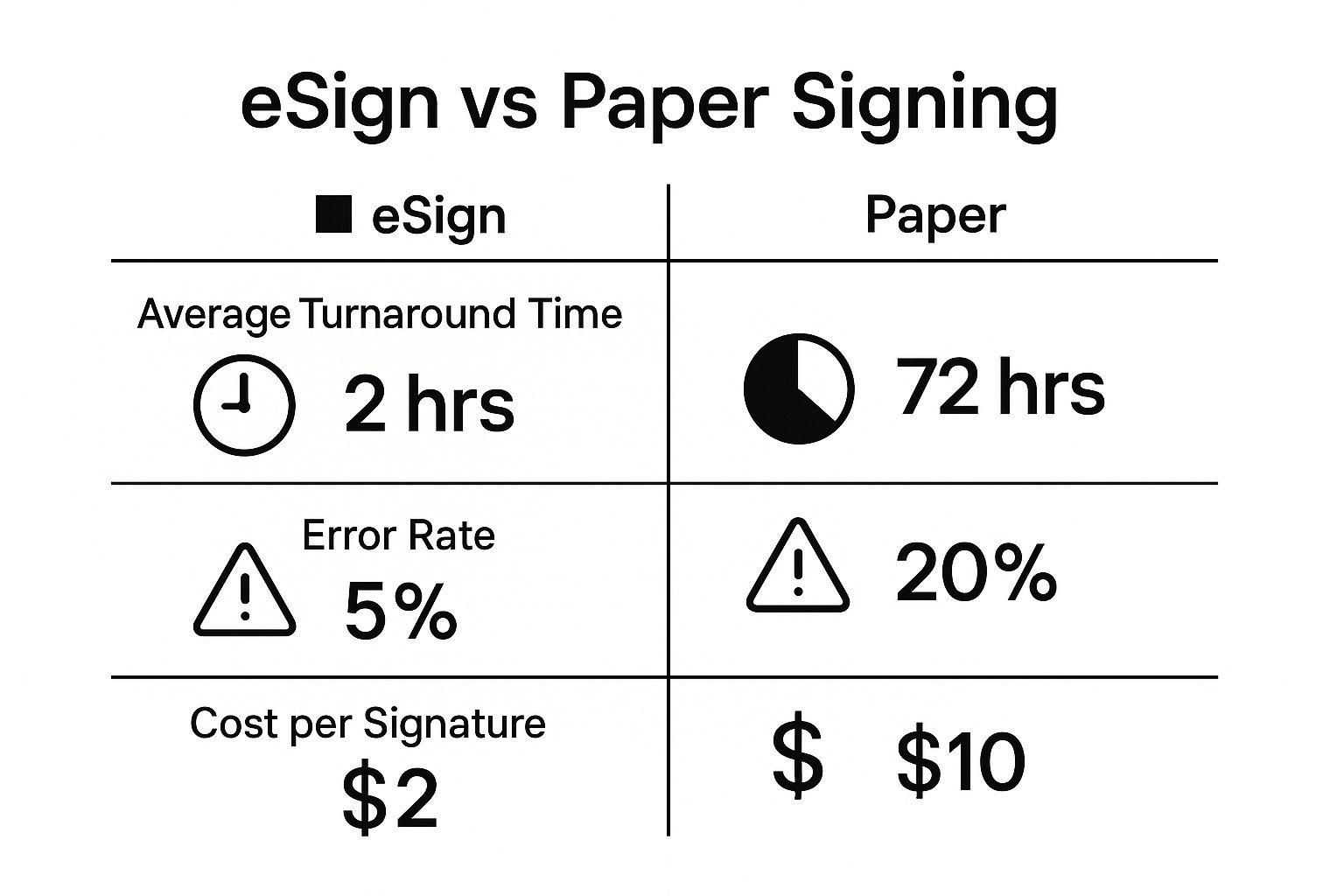

This visual below really drives home just how much more efficient a modern eSign process is compared to the old-school paper-and-pen method.

As you can see, this isn't just about saving a few minutes. It's about drastically cutting down on errors and operational costs.

To make the distinction crystal clear, here’s a quick side-by-side comparison.

Electronic Signature vs Digital Signature Compared

This table highlights that while both are useful, they serve very different purposes depending on the level of security and legal assurance you need.

When to Use Each Type

So, how do you decide which one you need? It all comes down to the stakes of the document in question.

- eSignatures are perfect for: Routine paperwork where speed is the priority. Think acknowledging receipt of an updated policy or signing off on an internal memo. They're quick, easy, and get the job done.

- Digital signatures are essential for: High-value transactions where there's no room for error or dispute. This is the gold standard for real estate closing packages, investor subscription agreements, and any other legally binding contract where integrity is non-negotiable.

For real estate syndicators using a platform like Homebase, you get the best of both worlds. The eSign features are built on a foundation of digital signature-level security, ensuring that your most critical investor documents are always protected with the highest level of verification.

Why eSignatures Are a Game Changer for Syndicators

Okay, let's bring this down from the clouds and talk about what really matters: how this technology actually helps your syndication business. The concept of an eSignature is interesting, but it becomes a serious tool when you see how it can directly speed up your success.

To really get it, let's paint a picture of two different scenarios.

First, think about the old-school way of doing things. You’ve got an office overflowing with printers, scanners, and filing cabinets bulging with folders. Closing a deal means printing out stacks of thick subscription agreements, stuffing them into FedEx envelopes, and shelling out for overnight shipping. Then the real fun begins: weeks of chasing down investors, praying the documents didn’t get lost in a mailroom or buried under a pile of papers on someone’s desk.

And you know what happens next. An initial is missed, a date is wrong. Every little mistake sends you right back to the beginning, reprinting and reshipping everything. It's not just a headache; it’s a massive drag on your timeline and makes you look behind the times to savvy investors.

The Modern Syndicator's Advantage

Now, imagine a different way. You’re ready to close a new deal. You simply upload your subscription agreement to a platform like Homebase. In a matter of minutes, you can send out a signing request to every single investor at once, whether they're across town or on the other side of the globe.

Investors get an email alert right away. They can open, review, and sign the documents on their laptop or even their phone while waiting for a coffee. The system walks them through every field that needs a signature or initial, which means no more chasing down missed spots. The whole ordeal can be wrapped up in a few hours instead of a few weeks.

This isn't just about convenience—it's a massive competitive edge. When you shrink your closing timeline from weeks to days, you secure capital faster. You can close on that property sooner and be well on your way to the next deal while your competition is still checking their tracking numbers.

It's More Than Just Speed

The ripple effect of using eSignatures goes way beyond just getting documents signed quickly. A solid digital process can reshape how your entire syndication operates.

- Slash Your Admin Work: Think of all the time your team spends printing, mailing, and keeping track of paper. Now imagine all that time back. They can focus on what actually grows the business, like talking to investors and finding great deals.

- Look Like a Pro: A smooth, secure digital signing experience sends a powerful message. It tells investors that you run a modern, efficient, and professional operation, building trust right from the start.

- Tighter Security and Compliance: Digital documents create a complete audit trail, making them incredibly secure and easy to track. This isn't just good for your peace of mind; it simplifies compliance and gives you a rock-solid, legally defensible record for every single transaction.

At the end of the day, understanding what an eSign is is the first step. The real goal is to use it as a strategic weapon. For a syndicator, this isn't just about signing paperwork. It’s about closing deals faster, running a leaner operation, and building better investor relationships from the get-go.

Choosing the Right eSign Solution for Your Deals

Let's be honest, not all e-signature platforms are built the same. When you're dealing with complex subscription agreements and millions in investor capital, picking the right tool is a make-or-break decision. It’s less about just getting a signature and more about finding a partner that gets the high-stakes nature of real estate syndication.

The absolute first thing on your checklist? Security. Your investors are handing over incredibly sensitive financial information, so the platform you use must have bank-grade security and top-notch encryption. This isn't just a "nice to have"—it's the bedrock of investor trust.

Key Features for Syndicators

Beyond locking things down, an e-signature platform needs to fit the unique rhythm of a real estate deal. If it doesn't, you'll find yourself bogged down in administrative headaches instead of focusing on closing.

Here’s what to look for:

- Comprehensive Audit Trails: Every single signature needs a digital paper trail that can stand up in court. This log should meticulously record every touchpoint—who viewed the document, when they signed, and even their IP address. This is non-negotiable for compliance.

- Intuitive Investor Experience: Your investors shouldn't have to call you for tech support. A clean, simple, and mobile-friendly interface makes the signing process smooth and fast, which reflects positively on your entire operation.

- Multi-Signer Routing: Syndication documents almost always need signatures in a specific sequence. A good platform lets you automate this workflow, automatically sending the document to the next person in line as soon as the previous one signs.

A crucial element is seamless integration with your core systems. An eSign tool that works directly with your investor portal or CRM eliminates the need for manual data entry, reduces errors, and creates a single source of truth for all your deal documents.

When you're shopping around, providers like SignRequest offer user-friendly services that are a great benchmark for comparison.

Ultimately, you need a platform that can grow with you. Look for features like automated reminders that can gently nudge investors who haven't signed yet and customizable templates that will save you a ton of time on your next deal. Making the right choice here isn’t just about securing agreements; it’s about putting your entire fundraising process on the fast track.

Got Questions About eSign? We’ve Got Answers.

Even after you get the basic concept, a few practical questions always pop up. It's totally normal. Let's tackle some of the most common ones I hear from syndicators so you can feel completely confident about making the switch.

What Can I Actually Sign Electronically?

The short answer? Almost everything you use to run your business. Electronic signatures are legally binding for the vast majority of documents you handle every day.

Think about your core workflow:

* Investor subscription agreements

* Non-disclosure agreements (NDAs)

* Operating agreements

* Closing documents for real estate deals

* Vendor contracts and invoices

All of these are perfect candidates for eSignatures. There are a few rare exceptions, usually things that need a notary or are tied to old-school legal requirements like wills or court orders. But for a real estate syndicator, you can expect that 99% of your operational documents are good to go.

Is This eSign Stuff Really Secure?

Yes, and honestly, it’s often much more secure than passing around a piece of paper. The real game-changer here is the audit trail that’s automatically created. A pen-and-ink signature can be faked, but a digital signature comes with a rock-solid electronic footprint.

Every single action is tracked and time-stamped in a digital log that can't be altered. It records who opened the document, their IP address, and the precise moment they signed. This creates a powerful, court-admissible record that a physical document just can't compete with.

Can My Investors Sign From Their Phones?

Absolutely. Any modern eSign platform worth its salt is built for mobile. We all know business doesn't stop just because you're not at a computer. You and your investors can review and sign critical agreements straight from a smartphone or tablet in a matter of seconds.

This is a huge win for everyone involved. It smooths out the entire process, letting deals move forward without delay, no matter where people are. An investor can finalize their commitment from an airport lounge just as easily as they could from their office. No more "I'll sign it when I get back to my desk" excuses.

Ready to stop chasing paperwork and start closing deals faster? Homebase provides a secure, intuitive eSign solution built directly into an all-in-one platform for real estate syndicators. Learn how Homebase can streamline your fundraising and investor management.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.