What Is a Promote in Private Equity Explained

What Is a Promote in Private Equity Explained

Understand what is a promote in private equity, how it aligns investor and manager goals, and see how the profit waterfall works with clear, practical examples.

Domingo Valadez

Oct 3, 2025

Blog

Let's cut right to the chase. In the world of private equity, the promote is essentially a performance bonus. It’s the way a fund manager, known as the General Partner (GP), gets rewarded for hitting it out of the park and delivering great returns.

Think of it as a disproportionate slice of the profits that goes to the GP, but only after the investors have gotten their initial investment back, plus a predetermined minimum return.

Understanding the Promote and Key Players

Imagine hiring a top-tier home builder. You agree to pay them a fee for their work, but you also offer a hefty bonus if they finish the project ahead of schedule and significantly increase the property's value. The promote works in a similar way.

It’s not a simple 50/50 profit split based on who put in what cash. Instead, the promote structure is designed to light a fire under the GP. It perfectly aligns their financial goals with those of the investors, who are called Limited Partners (LPs).

This kind of performance-based incentive is a cornerstone of many alternative investments. While the term is most common in private equity, you’ll see similar structures elsewhere. For a different perspective, you can see how this concept works by learning about the promote in real estate, where it serves the same fundamental purpose.

The promote is the central mechanism that transforms a fund manager into a true partner. It ensures that the GP's biggest payday is directly tied to delivering exceptional returns for their investors.

To really grasp how the money flows in these deals, you need to know who the main players are.

Key Players in a Private Equity Deal Structure

At its simplest, a private equity fund involves two key groups: the hands-on managers and the passive investors. This table breaks down their distinct roles.

As you can see, the GP puts up a small fraction of the capital but does all the heavy lifting, while the LPs provide the vast majority of the funds. This dynamic is what makes the promote structure so crucial for keeping everyone's interests aligned.

How a Private Equity Promote Actually Works

So, how does the money actually change hands? It all comes down to a mechanism called the distribution waterfall. Think of it as the rulebook that dictates the exact order in which profits from a deal are paid out to everyone involved.

It's a lot like filling a series of buckets, one after another. Capital flows into the first bucket, and only when it’s completely full does anything spill over into the next. This tiered system is intentionally designed to protect investors first, while giving the fund manager a huge incentive to knock it out of the park.

The Waterfall Tiers Explained

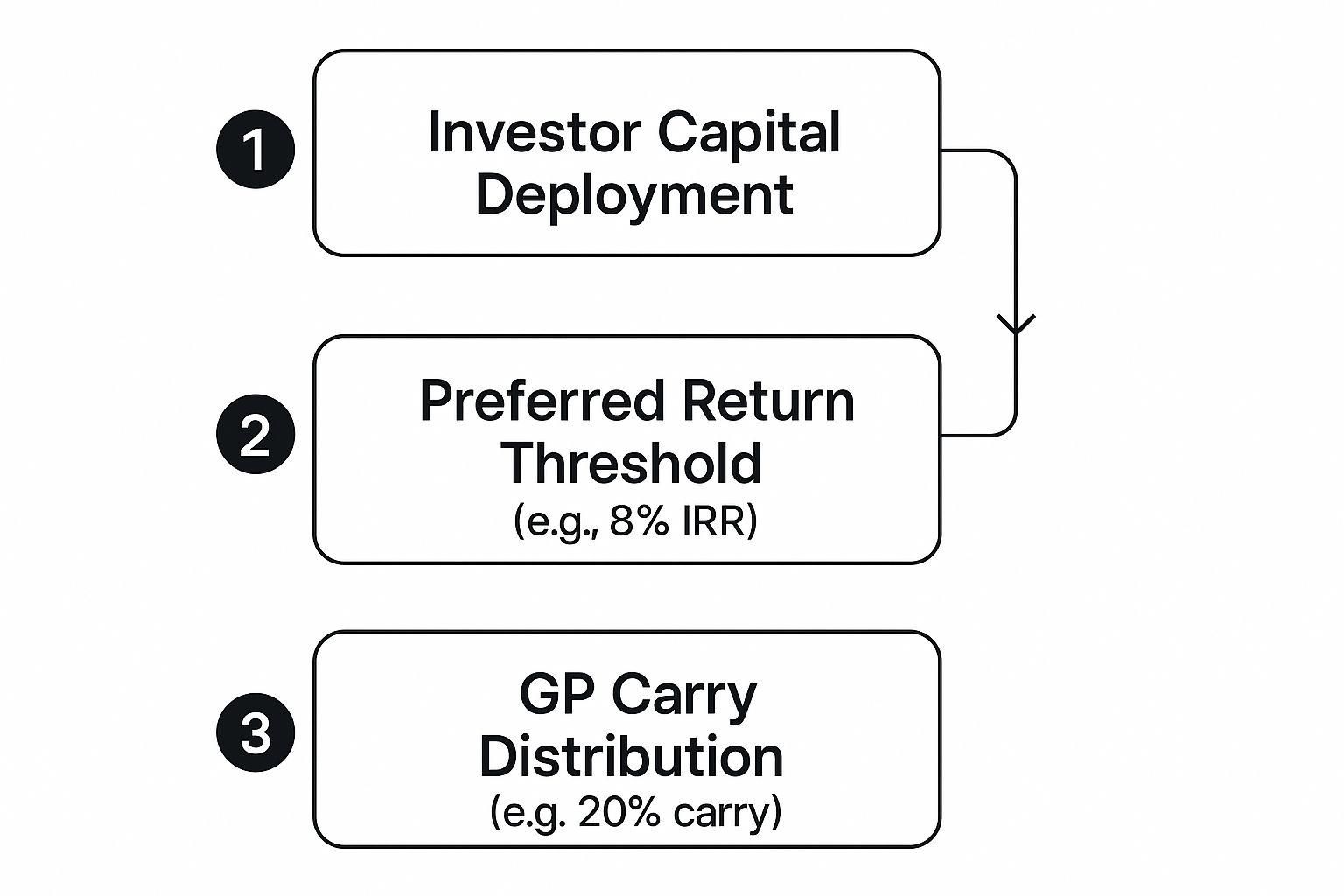

The process follows a logical, step-by-step sequence. To really get what a promote is, you have to see how these steps stack on top of each other to make sure everyone's interests are aligned.

- Step 1: Return of Capital: First things first. Before anyone sees a penny of profit, the Limited Partners (LPs) get all of their initial investment back. Every single dollar.

- Step 2: The Preferred Return: Once the LPs are made whole, the next bucket to fill is their preferred return (often called the "pref"). This is a minimum annual return, typically around 8%, that investors must earn before the General Partner (GP) gets any of the promote.

- Step 3: The Promote Distribution: Only after those first two buckets are overflowing does the real profit-sharing begin. The remaining profits are finally split according to the promote structure, like the classic 80/20 split.

This infographic breaks down that sequential flow of cash.

As you can see, the promote only kicks in after the investors’ capital is returned and their minimum return threshold is met. This structure directly ties the GP's compensation to the investors' success. Understanding the foundational Private Equity Investment Strategies that generate these returns is key to seeing how this all fits together in the real world.

The distribution waterfall is the financial blueprint for a private equity deal. It protects LPs by paying them first and motivates GPs by offering a massive reward for outstanding performance.

This performance fee—also known as carried interest—is the GP's outsized share of the profits. It’s disproportionate because they typically only contribute 5-10% of the total capital, yet they can earn 20% or more of the profits. This is their reward for finding the deal, managing the investment, and making it a success. This system ensures managers are highly motivated to deliver.

How a Promote Gets Calculated: A Real-World Walkthrough

Theory only gets you so far. The best way to really understand how a private equity promote works is to see it in action. Let’s break down a simplified deal to see how the money actually flows through the distribution waterfall and creates the GP’s payout.

Picture this: a private equity firm (the GP) and its investors (the LPs) team up to buy a company for $10 million.

Here’s the deal structure:

- General Partner (GP) Contribution:$1 million (that's 10% of the capital)

- Limited Partner (LP) Contribution:$9 million (the other 90%)

- Preferred Return: LPs get an 8% annual return on their money first.

- Promote Structure: After the LPs get their "pref," there’s a 100% catch-up for the GP, followed by an 80/20 split of all remaining profit.

Fast forward five years. The GP does its job, grows the business, and sells it for $20 million. That's a $10 million gross profit. Now, it's time to pay everyone, and this is where the distribution waterfall begins.

The Four Tiers of the Distribution Waterfall

That $20 million from the sale gets paid out in a very specific order. Think of it like a series of buckets—each one has to be filled to the brim before a single drop spills over into the next.

1. Return of Capital

First things first: everyone gets their initial investment back. The goal here is to make both the LPs and the GP whole.

- LPs get their $9 million back.

- The GP gets its $1 million back.

That’s $10 million of the sale price accounted for. We have $10 million in pure profit left to distribute.

2. The Preferred Return

Next up are the LPs. They were promised an 8% preferred return on their $9 million investment. Since the deal lasted five years, that comes out to $3.6 million ($9M x 8% x 5 years). This payment comes directly out of the profit pool.

The preferred return is crucial. It compensates LPs for the risk they took and the time their money was tied up before the GP gets to share in the upside.

3. GP Catch-Up

Now it’s the GP's turn to start catching up. The catch-up clause is designed to re-balance the profit split so the GP can get its proportional share. In an 80/20 deal, the $3.6 million paid to the LPs is considered their 80% share of the profits distributed so far.

To calculate the GP’s 20% catch-up portion, the math is: $3.6M / 0.80 * 0.20, which equals $900,000. This amount is paid to the GP.

4. The Final 80/20 Profit Split

With all the initial obligations met, whatever is left is split according to the final promote structure.

Let's do a quick tally. We started with $20 million. We returned $10M in capital, paid $3.6M in preferred return, and another $900K for the GP catch-up. That leaves us with $5.5 million in profit.

This remaining cash is split 80/20:

- LPs receive $4.4 million (80% of $5.5M).

- The GP receives $1.1 million (20% of $5.5M).

Understanding Different Promote Tiers

Not all private equity promotes are created equal. While a single, flat profit split is easy to understand, many modern deals use multi-tiered structures. Why? Because they's a powerful way to incentivize the General Partner (GP) to deliver truly exceptional performance. It adds layers to the compensation, creating bigger rewards for bigger wins.

Think of it like a video game with bonus levels. Once the GP clears the first objective—hitting the preferred return for investors—their reward level increases. For instance, after an 8% return is achieved, the profit split might be a standard 80/20. But if the fund knocks it out of the park and hits a 16% return, the promote structure can shift again, but only for the profits above that new threshold.

Single Tier vs. Multi-Tier Promote

A tiered promote creates a powerful win-win. It pushes GPs to aim for home-run deals instead of just settling for baseline targets, which ultimately means much better returns for the Limited Partners (LPs). The better the fund performs, the larger the GP's slice of the pie becomes. This structure directly aligns everyone's interests toward one goal: maximizing value.

These structures often have several tiers tied to specific return hurdles. A common multi-tier waterfall might start with LPs getting 100% of the distributions until their capital and preferred return are paid back. After that, returns up to a 16% IRR might be split 70/30. For any profits generated beyond that 16% hurdle, the split could jump again to 65/35. This model is especially prevalent in real estate private equity, where these tiers are used to structure complex deals.

A multi-tiered promote essentially tells the GP, "Good performance gets you a good reward, but exceptional performance gets you an exceptional reward." It's the engine that drives truly outstanding results.

To really see the difference, let's compare how profits get carved up in a simple single-tier deal versus a multi-tier one, based on the fund's Internal Rate of Return (IRR).

Single-Tier vs. Multi-Tier Promote Structures

The table below breaks down how the profit split changes as the investment's performance improves under both models. Notice how the GP's share accelerates in the multi-tier structure once they clear the higher hurdles.

As you can see, the multi-tier structure gives the GP a much larger stake in the upside as they clear each performance hurdle. This creates a powerful incentive to not just meet expectations, but to blow past them.

Why the Promote Is the Engine of Private Equity

Think of the promote as more than just a bonus—it's the core engine that drives the entire private equity model. For General Partners (GPs), this is the ultimate prize for their expertise, the long hours, and the massive risks they take on when managing hundreds of millions or even billions of dollars.

This performance fee is what motivates a GP to hunt for overlooked companies, roll up their sleeves to make real operational improvements, and engineer a profitable sale. Take away the promise of that upside, and the drive to deliver exceptional, market-beating returns just wouldn't be the same.

The Power of Aligned Interests

For Limited Partners (LPs), the promote is their ace in the hole for managing risk. It ensures their fund manager is completely focused on the same outcome they are.

How? By making the GP’s biggest payday conditional on clearing a specific performance hurdle, known as the preferred return. This simple mechanic transforms the GP from a mere manager collecting a salary into a genuine partner in the venture. Their financial success is tied directly to the success of their investors.

The promote ensures that GPs eat what they kill. Their compensation is directly tied to the value they create for investors, making it the central mechanism that powers the industry’s success and high returns.

To really get why this is so motivating, it helps to understand the core private equity investment strategies they use to create that value in the first place. The promote is what gives GPs the incentive to swing for the fences with ambitious value-creation plans that, if successful, enrich everyone involved.

This relationship creates a high-stakes, high-reward environment where performance is everything. It’s the secret sauce that has made private equity such a powerful asset class, consistently attracting capital from the world's biggest investors. Simply put, this powerful incentive is what makes the whole model work.

Common Questions About Private Equity Promotes

As we've worked through the mechanics of the promote, a few common questions always seem to pop up. Let's tackle them head-on to make sure you have a solid grasp of this core private equity concept.

Is a Promote the Same as Carried Interest?

Yes, for all practical purposes, "promote" and "carried interest" are two sides of the same coin. Both terms refer to the General Partner's slice of the profits—the bonus they get only after the fund hits specific performance goals.

So why the two names? It's mostly just industry jargon. You'll hear "promote" used constantly in real estate private equity circles. Venture capital and buyout funds, on the other hand, tend to use the term "carried interest." The name might change, but the idea is identical: it’s a performance fee.

What Is a Typical Preferred Return Rate?

The preferred return is the first hurdle. It’s the minimum annual return that investors, the Limited Partners, must earn before the General Partner can even think about collecting their promote.

While the exact number is always up for negotiation, the industry standard for a preferred return typically lands somewhere between 6% and 9%. This "pref" is a critical safeguard for investors. It ensures they get paid first for taking the risk and locking up their capital, long before the GP gets rewarded for outperformance.

"The vast majority of private equity funds use a promote or carried interest structure, as it is the industry standard for aligning the interests of the GP and the LPs. While specific terms can be negotiated, the underlying model is a foundational component of modern private equity."

Do All Private Equity Funds Have a Promote?

Just about. The promote structure is so fundamental to private equity that it's nearly universal. It's the engine that aligns the interests of the fund manager (the GP) with the investors (the LPs).

Of course, the fine print can vary. You'll see differences in the preferred return rate, the catch-up provisions, or the final profit split. But the basic framework remains constant because it works. This model is what incentivizes GPs to hunt for the best deals and maximize returns, making it the bedrock of private equity compensation.

Juggling investor relations, subscription documents, and distributions can quickly become a headache. Homebase is an all-in-one platform designed to handle the tedious side of real estate syndication. It helps you streamline your fundraising and lets you focus on what really matters: closing deals and building stronger investor relationships. Learn how Homebase can simplify your operations.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.