How to Get a Commercial Real Estate Loan: Quick Guide

How to Get a Commercial Real Estate Loan: Quick Guide

how to get a commercial real estate loan: a concise, practical guide with lender requirements, rates, and approval tips.

Domingo Valadez

Nov 15, 2025

Blog

Before you even pick up the phone to call a lender, the fate of your deal is already being decided by the numbers. A strong financial case isn't just a list of figures on a spreadsheet; it's a compelling story about an asset's potential and your ability to unlock it. To get a commercial real estate loan, you have to get fluent in the language lenders speak, and that means mastering three core metrics: Debt Service Coverage Ratio (DSCR), Loan-to-Value (LTV), and Net Operating Income (NOI).

Speaking the Lender’s Language: Key Underwriting Metrics

Forget the sales pitch. Securing a commercial loan is all about demonstrating financial viability. Lenders are fundamentally in the business of managing risk. Their one true goal is to confirm that the property you're buying can spit out enough cash to comfortably cover its mortgage payments, month after month. Your job is to present the numbers in a way that leaves them with zero doubt.

This starts with your pro forma, but a truly great one goes way beyond a simple financial model. A powerful pro forma gets inside an underwriter’s head and answers their questions before they even ask them. It provides solid justification for your rent growth assumptions, clearly outlines your capital improvement plans, and proves the property can perform even if things don't go perfectly.

These three metrics are the pillars of that financial story:

- Net Operating Income (NOI): This is your property's pure profit before you pay the bank. It's the gross income minus all the real-world operating expenses.

- Loan-to-Value (LTV): This simple ratio compares the loan amount to the property's appraised value. It's the lender's shorthand for how much of your own money—or "skin in the game"—you have in the deal.

- Debt Service Coverage Ratio (DSCR): This one is arguably the most important of all. It's the acid test that measures if the property's NOI can actually cover the annual mortgage payments.

An underwriter’s job is to poke holes in your story. They stress-test your assumptions, inflate your expense projections, and hunt for any sign of weakness. Your goal is to build a case so airtight there are no holes left to find.

How an Underwriter Sees Your Deal

Let's say you're buying a 24-unit apartment building. The lender’s underwriter isn’t just glancing at your rent roll. They're essentially rebuilding your pro forma from scratch, using their own conservative assumptions to gauge the real risk.

First, they’ll put your Net Operating Income (NOI) under a microscope. If you’re projecting a big jump in rents, they’ll immediately pull market comps to see if your numbers are grounded in reality. Are your vacancy assumptions too optimistic? They’ll also "normalize" your expenses, often plugging in a higher management fee or a larger replacement reserve figure than what you’ve budgeted. A solid understanding of managing investment property tax effectively is also a must, as it directly impacts your real NOI and shows the underwriter you've done your homework.

Next up is the Loan-to-Value (LTV). While this number ebbs and flows with the market, most lenders want to see an LTV between 65% and 75% for a stabilized asset. If your deal only works with an 80% LTV, that's an immediate sign of higher risk to them. Lenders do get more aggressive in certain cycles. For example, in a recent quarter, the average LTV crept up to 63.3% as lenders loosened their standards to win deals.

DSCR: The Ultimate Go/No-Go Signal

Finally, we get to the big one: the Debt Service Coverage Ratio (DSCR). This single number tells a lender everything they need to know about whether the property’s cash flow can support the debt you’re asking for.

Most lenders won't even look at a deal with a DSCR below 1.25x. What does that mean? For every $1.00 of annual mortgage payments, the property must generate at least $1.25 in Net Operating Income. That 25-cent cushion is their margin of safety.

A DSCR that dips below that threshold is a non-starter. On the other hand, a deal that pencils out to a 1.40x DSCR or higher? That’s what lenders love to see. It signals a low-risk investment with plenty of buffer. Getting this calculation right isn't optional. For a deeper look, check out our complete guide on the real estate debt service coverage ratio.

Once you can confidently calculate and defend your NOI, LTV, and DSCR, you're no longer just asking for money—you're demonstrating precisely why your deal deserves to be funded.

Lenders rely on a handful of core metrics to quickly assess the viability and risk of any commercial real estate loan. Understanding these numbers from their perspective is the key to building a compelling financial case for your deal.

Key Underwriting Metrics at a Glance

These three metrics form the foundation of any loan application. When you can present a deal that hits these targets, you're speaking a language that every underwriter understands and respects.

Finding the Right Lender for Your Deal

Choosing your financing partner is just as critical as finding the perfect property. I've seen too many deals fall apart because the sponsor approached the wrong type of lender. It’s not just about getting a “yes”—it’s about finding a lender whose goals and risk tolerance align with your specific project.

Every lender has their own playbook. Some love the stability of a 95% leased apartment building, while others get excited by the upside of a value-add industrial project. Pitching a fixer-upper to a conservative life insurance company is a surefire way to waste everyone's time and kill your deal's momentum. Understanding the different players in the capital markets is the first step toward securing the right loan on the right terms.

The good news? The lending environment is looking much better for borrowers these days. After a period of serious tightening in 2023, the market has thawed. As of mid-2025, only 9% of banks were still tightening their standards—a massive drop from 67.4% back in April 2023. This shift means lenders are back in the market and ready to deploy capital for solid deals. For more on this, check out Deloitte's commercial real estate outlook.

Commercial Lender Comparison

So, who should you be talking to? It all comes down to your deal's specifics. A local bank might be perfect for your hometown retail strip, but a CMBS lender is better suited for a large, tenanted office portfolio across multiple states. This table breaks down the main players to help you zero in on the best fit.

Ultimately, the goal is to match your deal's story with the lender who wants to hear it. Don't try to fit a square peg in a round hole.

Breaking Down the Players

Traditional Banks and Credit Unions

These are your classic relationship lenders. If you're buying a multifamily or small industrial property in a market they know well, a local or regional bank is often your best bet. They value sponsors with a proven local track record and solid personal finances.

The process feels more personal, but they are generally more conservative. Expect them to cap leverage around 65-75% LTV and almost always require a personal guarantee on the loan.

Life Insurance Companies

Life insurance companies, or "life cos," are the most selective lenders out there. They aren't interested in your value-add plans or development deals. They want pristine, stabilized assets—think a Class A office building with a 15-year lease to a Fortune 500 company.

If your deal fits their narrow criteria, the terms are unbeatable:

* The lowest interest rates in the market.

* Long-term, fixed-rate debt (10, 15, even 20+ years).

* Non-recourse financing, which is the gold standard for protecting your personal assets.

Securing a loan from a life co is a major vote of confidence, but their underwriting standards for both the property and the sponsorship team are incredibly high.

CMBS Lenders

CMBS stands for Commercial Mortgage-Backed Securities. These lenders operate on a totally different model. They don't hold the loan on their own books; instead, they package it with other similar loans and sell it off as a bond to investors.

This "originate-to-distribute" model means they can offer non-recourse loans on a huge range of properties and markets, often with more leverage than a bank would provide. But there's a trade-off. CMBS loans are notoriously rigid. Once the terms are set, they're set in stone. You'll also face stiff prepayment penalties, and the loan servicing is often handled by a third party who has no relationship with you.

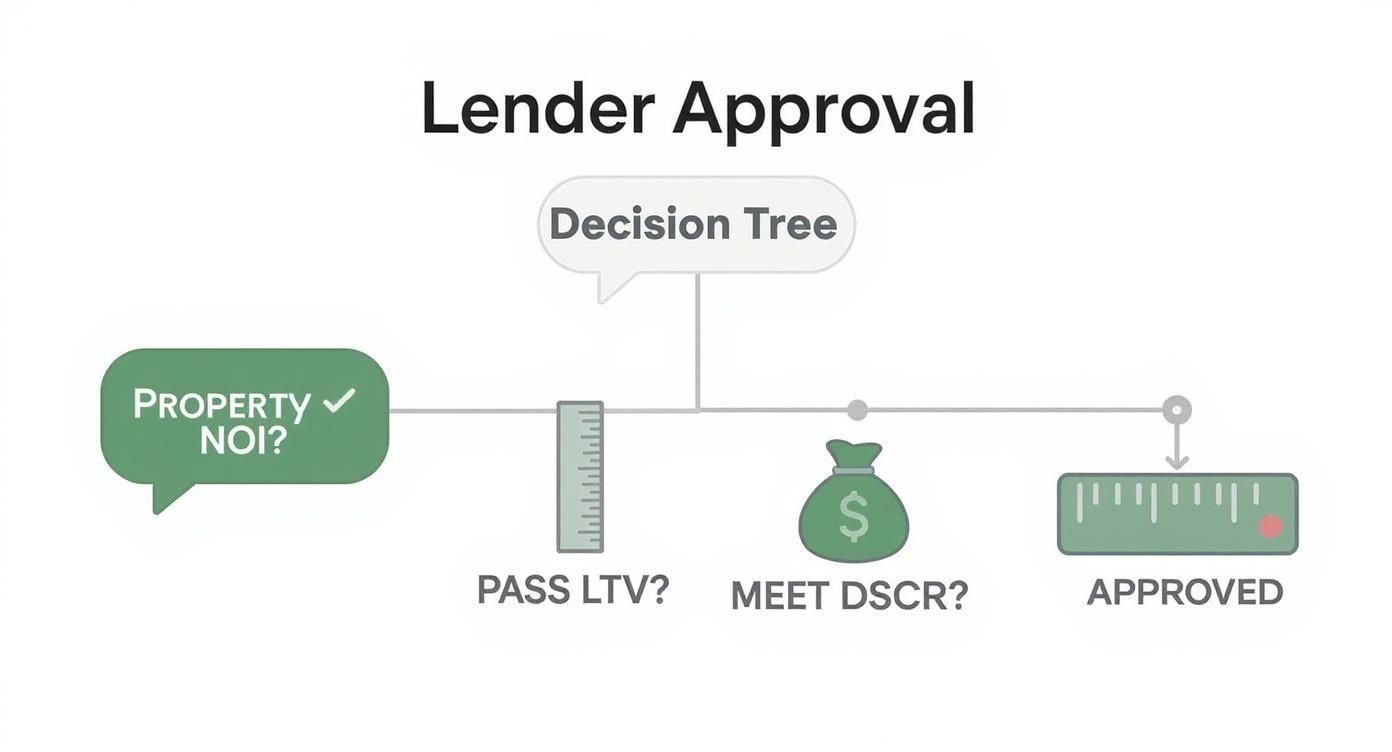

This infographic gives you a quick look at how a lender might view your deal, walking through the key metrics they need to see.

As you can see, it’s a sequential process. If your NOI isn't there, the LTV and DSCR calculations won't matter. You have to pass each gate to get to the finish line.

Private Debt Funds and Hard Money Lenders

What happens when your deal doesn't fit the neat-and-tidy box of a traditional lender? That's where private debt funds and hard money lenders come in. They are the specialists for deals with a bit of hair on them.

They are the perfect financing source for:

* Value-add or opportunistic projects where you're repositioning an asset.

* Bridge financing to acquire a property quickly while you line up permanent debt.

* Unique situations, like a building with high vacancy or a sponsor who is still building their track record.

This flexibility comes at a price—namely, higher interest rates, more upfront fees, and shorter loan terms (usually one to three years). Think of them as a specific tool for a specific job: getting you from Point A to Point B, not a permanent financing solution.

My Two Cents: I’ve learned this the hard way: there's no single "best" lender. The right lender is the one whose program is built for your exact deal. A mismatch between your business plan and their lending mandate is the fastest path to a rejection.

Assembling a Bulletproof Loan Package

Your loan application is your first—and often only—impression on an underwriter. A messy, incomplete package doesn't just slow things down; it screams disorganization and instantly puts your deal in the high-risk pile. To get a commercial real estate loan, you need to present a story that's not just compelling but also impeccably documented. Think of it as your deal's professional resume.

A well-assembled loan package does more than just provide raw data; it anticipates the lender's questions. It proves you're a sophisticated operator who understands their process and respects their time. This simple act of preparation positions you as a low-risk partner and dramatically increases the odds of your request moving to the top of the stack.

The Core Components of Your Submission

Every lender has a slightly different checklist, but a bulletproof package always contains the same core elements. Having these documents prepared before you even start shopping for a term sheet shows you're serious and ready to execute. It’s all about building momentum from day one.

At a minimum, your package needs:

* A Detailed Executive Summary: This is your one-page pitch. It should hit the high points: the loan request, property details, your business plan, and a quick bio of the sponsorship team's experience.

* Comprehensive Property Information: This is the nitty-gritty. Include the current rent roll, trailing 12-month (T-12) operating statements, high-quality property photos, and a copy of the purchase and sale agreement.

* Sponsor Financials: Here's where the lender scrutinizes you and your partners. Be ready with personal financial statements for all key principals, a schedule of real estate owned (SREO), and the last 2-3 years of personal and business tax returns.

Don’t just email a zip file of random PDFs to an underwriter. Organize everything logically in a shared folder (like Dropbox or Google Drive) with clear, numbered labels. A clean submission signals a clean operation, and that’s exactly the kind of borrower lenders want to work with.

Telling Your Story Beyond the Numbers

A great loan package tells a story that the numbers alone can't. This narrative comes to life in your executive summary and the business plan for the property. Don't just state the facts; explain the why behind your strategy.

For example, anyone can say, "we will increase rents by 10%." A professional says, "Based on our analysis of three comparable renovated properties within a one-mile radius, current in-place rents are 12% below market. Our $250,000 capital improvement plan, which focuses on targeted kitchen and bath upgrades, will allow us to achieve market rents within 18 months."

See the difference? That level of detail preempts underwriter skepticism and builds immediate credibility.

Key Documents Explained

Let's quickly break down the purpose of a few critical documents and how to present them effectively. Getting these right is a crucial part of the process and will help get your commercial real estate loan approved much faster.

- Personal Financial Statement (PFS): This is just a snapshot of your personal balance sheet. Be thorough and completely honest. Lenders use this to gauge your liquidity (cash on hand for surprises) and your overall net worth.

- Schedule of Real Estate Owned (SREO): This document lists every property you and your partners currently own. For each asset, you'll detail the purchase price, current debt, NOI, and the lender. A well-managed SREO is proof of a strong track record.

- T-12 Operating Statement: Think of this as the property's financial report card for the last year. Make sure it's clean and easy to read. If there are any unusual spikes in expenses or income, add a footnote to explain them proactively. For instance, a high R&M cost could be explained as a "one-time, non-recurring capital expense for a full boiler replacement."

Ultimately, your loan package is a testament to your professionalism. A complete, well-organized submission tells the lender you are a capable steward of capital and a reliable partner, making their decision to fund your deal an easy one.

Structuring Your Deal and Negotiating Terms

So, a lender slid a term sheet across the table. Pop the champagne? Not yet. Getting a term sheet isn't the finish line; it’s the starting gun for the real race. A preliminary "yes" is just an invitation to negotiate, and this is where experienced sponsors really separate themselves from the pack.

It’s easy to get tunnel vision on the interest rate. But the true art of structuring a commercial real estate loan is in the fine print—the details that dictate your deal's flexibility and profit potential for years to come. Often, a slightly higher rate in exchange for a longer amortization schedule or a less painful prepayment penalty is the much smarter long-term play. Your job is to architect a financing solution that perfectly matches your business plan for the asset.

Beyond the Interest Rate

Seasoned operators know the loan structure is a series of levers you can pull. If you understand these moving parts, you can negotiate a deal that actually fits your project, rather than just accepting a generic, off-the-shelf product.

Here are the key terms you need to master before you even think about signing:

- Amortization Schedule: This is how the loan balance is spread out to calculate your payments. A longer amortization—say, 30 years instead of 25—means smaller monthly payments. That directly boosts your cash flow and makes your DSCR look much healthier.

- Loan Term: This isn't the same as amortization. It's the actual date the loan is due. A very common structure is a "10/30" loan, which means you have a 10-year term, but your payments are calculated as if it were a 30-year loan. The catch? A big balloon payment is due at the end of that 10-year term.

- Prepayment Penalties: Lenders build these in to protect their expected return. If you sell or refi early, they lose out on future interest. The penalties can be structured as yield maintenance, defeasance, or a straightforward step-down penalty (like 5-4-3-2-1%, where the penalty percentage drops each year).

From the Trenches: When you have multiple term sheets, don't just compare the rates. Build a simple spreadsheet to model out the "all-in" cost of each loan over your planned hold period. Factor in fees, the cash flow benefit of a longer amortization, and what it would cost to exit the loan early. You'll quickly see that the lowest rate isn't always the cheapest loan.

Recourse vs. Non-Recourse Debt

This is one of the most critical negotiation points, period. The recourse provision defines what a lender can do in a worst-case scenario, and it has massive implications for both you and your investors.

- Full Recourse: If the deal goes south and you default, the lender can take the property and come after your personal assets—your house, your savings, everything. Banks and credit unions almost always demand this.

- Non-Recourse: The lender's claim is limited only to the property. They can’t touch your personal assets. For syndicators, this is the gold standard. You'll typically find this with CMBS and life company lenders.

One important caveat: even non-recourse loans have "bad boy" carve-outs. These are clauses that flip the loan back to full recourse if the borrower commits fraud, embezzles funds, or does something else shady.

Practical Negotiation Tactics

Effective negotiation comes down to two things: preparation and leverage.

Your biggest piece of leverage is a competing offer. Always try to have at least two competitive term sheets in hand. This lets you tactfully push for better terms without being adversarial.

Instead of making a demand, you can approach your preferred lender and say, "We love this offer and really want to work with you. Our other term sheet has a 30-year amortization, which really helps our cash flow. Is there any flexibility on your end to match that?" It’s a collaborative-sounding request backed by real leverage.

Before you even get on the phone, divide your desired terms into two lists: your 'must-haves' (non-recourse is usually on this list) and your 'nice-to-haves' (like a slightly lower origination fee). Knowing where you can concede gives you the clarity to stand firm on what truly matters for your deal and your investors.

Financing Strategies for Real Estate Syndicators

https://www.youtube.com/embed/Od7kL_d-vnk

When you’re syndicating a deal, you’re playing in a different league. Securing a loan isn't just a transaction between you and a bank anymore. You are now a fiduciary, the guardian of the capital your limited partners (LPs) have entrusted to you. This simple fact adds a whole new dimension to the financing process, especially when it comes to personal guarantees and keeping your investors in the loop.

Remember, lenders aren’t just underwriting the brick-and-mortar asset; they're underwriting your entire sponsorship team. They need to see a group that’s not just financially strong but also cohesive and experienced. One sponsor with a stellar balance sheet often isn't enough if the rest of the general partnership (GP) team looks green.

Navigating Personal Guarantees as a GP Team

The conversation around personal guarantees—also known as recourse—is probably one of the most critical and uncomfortable ones a syndication team will have. When a loan is full-recourse, the lender can come after the personal assets of the guarantors if the deal goes south. With multiple GPs at the table, you need to have a blunt, legally sound discussion about this long before you ever see a term sheet.

So, how do you slice up that liability? It usually comes down to two paths:

- Joint and Several Liability: This is what every lender wants. It means each guarantor is on the hook for 100% of the loan. If one sponsor goes broke, the lender can chase the others for the full amount. It’s simple for them, but risky for you.

- Several Liability: This is what every sponsor team wants. Here, each guarantor is only responsible for their pro-rata share. If four GPs have equal 25% stakes, they are each only liable for 25% of the guaranteed portion of the loan.

You absolutely must hammer this out in your internal GP agreement. Finding out your partner had a different understanding of their exposure when the pressure is on can crater a deal and destroy a partnership.

A lender's final decision often hinges on their gut feeling about the sponsorship team. They want to see that you've worked together, that your roles are crystal clear, and that you're all rowing in the same direction. Presenting a united, experienced front is non-negotiable.

Communicating the Stakes to Your Investors

Being transparent with your LPs isn't just good practice; it's your duty. This is especially true when it comes to recourse. Your investors have to understand that when the GP team puts their personal assets on the line, that "skin in the game" is a powerful feature of the deal, directly protecting their capital.

Don't bury this in the fine print. Articulate the recourse structure clearly in your private placement memorandum (PPM) and talk about it in your investor presentations. Explain why you agreed to recourse—maybe it was the only way to get a killer interest rate from a local bank that crushed the non-recourse agency quotes. This level of detail builds immense trust and signals that you're a sophisticated operator who knows how to manage risk.

For anyone focused on this asset class, getting deep into the nuances of financing for multi-family properties is a must for building a successful syndication.

Keeping Investor Confidence Through the Closing Maze

For an LP, the time between wiring their funds and the deal actually closing can feel like a black hole. It’s your job to light the way with consistent, clear communication. Don't leave them guessing.

Set up a simple, regular update schedule. A weekly email that hits the key milestones—appraisal is in, environmental reports are clean, loan commitment is signed—works wonders. It stops the trickle of one-off "any updates?" emails and phone calls, and it reinforces that you are in complete control of the process.

This steady communication does more than just calm nerves. It turns passive investors into loyal partners who will be eager to join you on the next deal.

Your Top Commercial Loan Questions, Answered

When you're in the thick of a commercial real estate deal, the financing process can feel like a maze. Questions pop up constantly, and getting clear, straightforward answers is crucial for keeping your deal on track.

Let's dive into some of the most common questions and sticking points that syndicators and sponsors face. Think of this as a field guide to navigating the practical, real-world issues that can make or break your timeline and deal structure.

How Long Does It Really Take to Close a Commercial Loan?

This is the million-dollar question, isn't it? The honest answer is, it depends entirely on who you’re borrowing from and how messy the deal is. There’s no magic number.

For a simple acquisition with a local bank where you’re already a known entity, you could be looking at a 45 to 60-day close. They know you, they trust you, and their process is generally more streamlined.

But if you're going for a more complex loan, like a CMBS deal or a government-backed SBA loan, you need to set your expectations accordingly. These can easily stretch out to 90 or even 120 days. The layers of approval and rigid third-party reporting requirements—appraisal, environmental, property condition—just take time.

Need to close lightning fast? A private debt fund is often your best bet. They can sometimes get a deal done in under 30 days because speed is their main selling point. Just know that this velocity usually comes at a premium, meaning higher rates and fees.

My Two Cents: The single biggest thing you can do to speed up a closing is to be ridiculously responsive. Have your entire loan package buttoned up before you even apply, and when an underwriter asks for something, get it back to them in hours, not days. Most delays I see are on the borrower's side of the court.

Recourse vs. Non-Recourse Debt: What’s the Big Deal?

Understanding this difference is non-negotiable, especially if you're a syndicator. It boils down to one simple question: in a worst-case scenario, what can the lender come after?

With a recourse loan, the lender can take the property and come after your personal assets if the sale doesn't cover the outstanding debt. We're talking about your house, your savings, your other investments—everything. This is the standard for most bank loans because it gives the lender maximum protection.

A non-recourse loan, on the other hand, limits the lender's claim to the property itself. If things go south, they take back the asset, but they can't touch your personal finances. This is why it’s the holy grail for syndicators. You’ll typically find non-recourse options from life insurance companies and CMBS lenders, usually on stabilized, cash-flowing properties.

But be warned: even "non-recourse" loans have fangs. They include "bad boy" carve-outs, which are specific triggers that make the loan fully recourse. If a borrower commits a fraudulent act, the non-recourse protection vanishes. These acts include things like:

* Committing fraud or misrepresenting facts.

* Pocketing insurance proceeds instead of using them for repairs.

* Voluntarily filing for bankruptcy.

These clauses are there to protect the lender from a borrower intentionally trying to sink the deal.

Can I Still Get a Commercial Loan with a Bad Credit Score?

It's tough, but not necessarily a deal-breaker. In the world of commercial real estate, the property is the star of the show, not you. Lenders are laser-focused on the asset's Net Operating Income (NOI) and whether it can generate enough cash to comfortably cover the debt payments (the DSCR).

If the deal is a home run—meaning the property's income is strong and stable—some lenders will be willing to overlook a less-than-perfect credit score. Your best shot will be with private or hard money lenders, who are almost entirely focused on the asset's value.

Traditional banks, however, are a different story. For them, a low personal credit score is a major red flag, signaling potential financial distress or poor management habits.

If your credit is a hurdle, you might need to get creative:

* Partner with a co-guarantor who has a stronger financial profile.

* Put more skin in the game with a larger down payment to lower the LTV.

* Be prepared to accept a higher interest rate and more fees to make the lender comfortable with the added risk.

At Homebase, we simplify the entire syndication process, from raising capital to managing investor relations. Our all-in-one platform gives you the tools to create professional deal rooms, handle subscriptions with ease, and keep your investors happy with streamlined updates and distributions. Find out how you can close more capital and build stronger relationships at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.