What is a dscr loan and how it fuels profitable real estate deals

What is a dscr loan and how it fuels profitable real estate deals

Discover what is a dscr loan and how it unlocks financing for your next real estate deal.

Domingo Valadez

Feb 5, 2026

Blog

A DSCR loan is a type of financing built specifically for income-producing investment properties. The lender's primary concern isn't your personal W-2 income; instead, they focus almost exclusively on the property's potential cash flow.

Think of it as a business loan for a building. If the projected rental income is strong enough to cover the mortgage and other expenses, your personal salary takes a backseat. This makes it an incredibly powerful tool for real estate investors looking to scale their portfolios based on the strength of their deals, not the limitations of their personal finances.

Unlocking Your Next Deal With a DSCR Loan

Let's use an analogy. Say you want to buy a small, popular coffee shop. A traditional bank would pour over your personal tax returns, your salary, and every line item of your financial history.

But what if the lender was more interested in the coffee shop's own track record? If the business itself generates enough profit to easily cover the loan payments, your personal income becomes far less relevant. That’s exactly how a DSCR loan works for real estate investments.

This approach completely flips the script on traditional underwriting. Instead of asking, "Can you personally afford this property?" it asks a much more direct question: "Can the property afford itself?" For real estate syndicators and active investors, this distinction is a total game-changer.

To give you a quick reference, here's a simple breakdown of what a DSCR loan entails.

DSCR Loan At a Glance

This table shows why these loans are so popular: they're designed for the asset, not the individual.

Focusing on Property Performance

The entire loan is built around one simple but powerful metric: the Debt Service Coverage Ratio (DSCR). This ratio is a straightforward calculation that gives lenders a clear snapshot of whether a property generates enough cash to handle its debt obligations.

Lenders look at two main components to figure this out:

- Net Operating Income (NOI): This is all the money the property brings in (gross rents, laundry fees, parking, etc.) after you subtract its operating expenses (like maintenance, property management, insurance, and property taxes).

- Total Debt Service: This is the total annual cost of the mortgage payments, including both principal and interest.

By dividing the NOI by the Total Debt Service, lenders get a clear, unbiased picture of the property's financial viability. If the property's income comfortably "covers" its debt, the deal makes sense.

This no-income-verification approach became popular as lenders looked for more secure, asset-focused ways to underwrite loans for income-producing properties. It's a pragmatic solution that ties the loan's success directly to the performance of the real estate itself. For more background on this financing method, you can explore these insights from J.P. Morgan on DSCR in real estate.

Of course, before you dive deep into financing, it helps to have a solid grasp of the big picture. Understanding how rental income is managed from a tax perspective is crucial. For a great overview, check out this landlord's guide to taxes on rental income. This knowledge helps you build a complete financial strategy for any successful investment.

Calculating the DSCR for Your Next Deal

This is where the rubber meets the road. Calculating the Debt Service Coverage Ratio (DSCR) is how you move from theory to a practical tool that gets deals done. This single number tells a lender almost everything they need to know about whether your property can stand on its own two feet and pay its bills.

The whole thing boils down to a simple division problem: the property's income divided by its total loan payments.

DSCR = Net Operating Income (NOI) / Total Debt Service

Think of this ratio as a quick health check for your property's cash flow. If the result is above 1.0x, you're in the black—the property makes enough money to cover the mortgage. But lenders aren't just looking for "enough"; they want a safety cushion. For most multifamily deals, you'll find they're looking for a DSCR of 1.25x or higher.

Breaking Down Net Operating Income

First things first, you need to nail down the property's income. To do this, you have to get intimate with its Net Operating Income (NOI), which is the top half (the numerator) of the DSCR formula.

NOI isn’t just the sum of all rent checks. It's a more refined number that reflects the property's true earning power before the mortgage is paid. It’s the gross income minus all the unavoidable operating expenses.

- Income to Include: This is every dollar the property generates. Think monthly rents, sure, but also pet fees, laundry income, and parking charges.

- Expenses to Deduct: These are the real-world costs of keeping the lights on. We're talking property taxes, insurance, routine maintenance, utilities, and property management fees.

One critical point: NOI specifically excludes the mortgage payment itself, major capital upgrades (like a new roof), and accounting concepts like depreciation. It’s a pure look at the asset's profitability from its day-to-day operations.

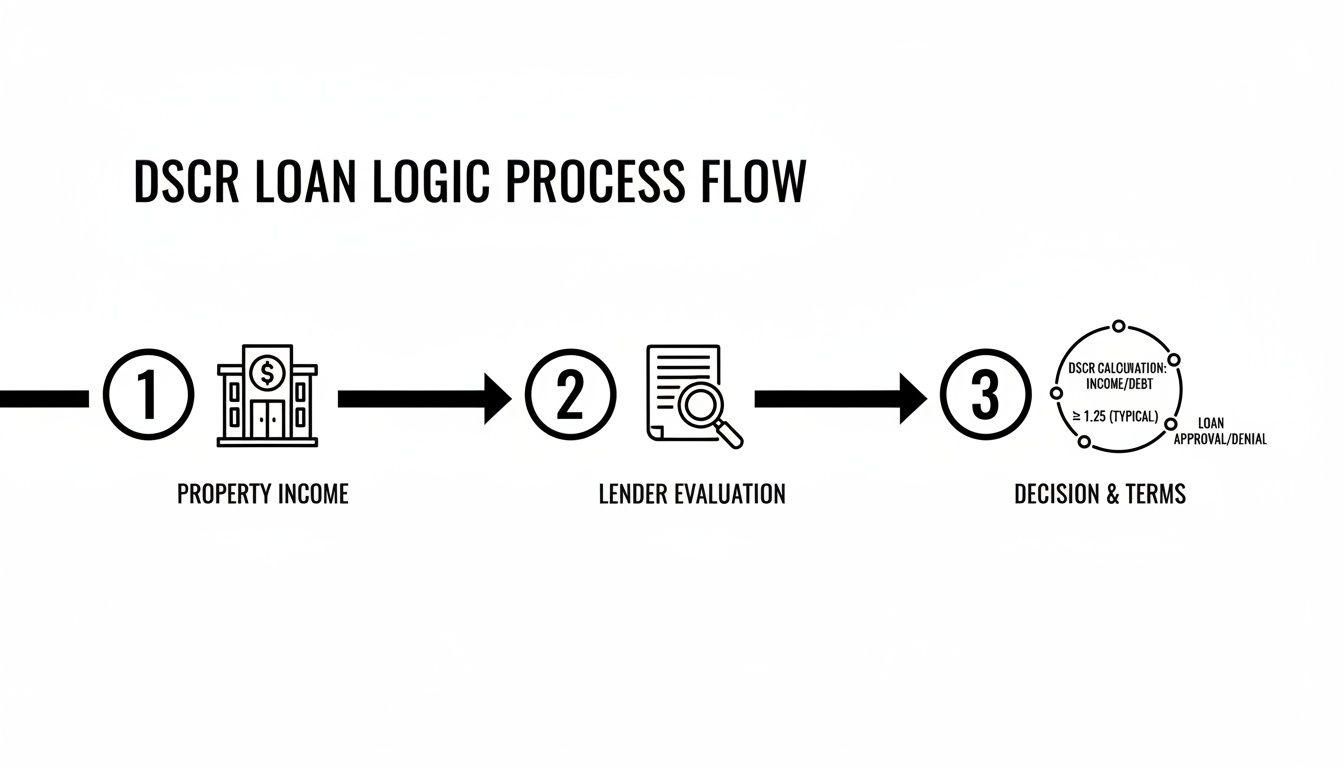

This is the fundamental logic lenders follow. They start with the property's income and work their way to a decision.

As the diagram shows, the whole process is built around the asset’s performance. That’s the entire philosophy behind a DSCR loan.

Defining Total Debt Service

The other half of the equation—Total Debt Service—is much more straightforward.

This is simply the grand total of all loan payments you'll make over a single year. It includes both the principal and the interest (P&I) packed into your monthly mortgage payment.

For instance, if your proposed monthly mortgage payment is $5,000, your annual Total Debt Service is $60,000 ($5,000 x 12). That $60,000 is the number you'll use on the bottom (the denominator) of the DSCR calculation. It’s the hurdle your NOI has to clear, and by how much determines the strength of your deal.

Meeting Lender Requirements and Underwriting Standards

So, you know how to calculate your Debt Service Coverage Ratio. That's the first step. But the real question is: what’s the magic number that gets a lender to say "yes"?

While every bank and private lender has its own rulebook, there’s a clear benchmark in the industry that any serious real estate syndicator needs to hit.

Most lenders are looking for a minimum DSCR of 1.25x. You can think of this as the unofficial gold standard for multifamily and commercial real estate deals. Hitting a 1.0x ratio just means you’re breaking even—the property’s income is just enough to pay the mortgage, and that's it. Lenders hate that. It leaves zero room for error.

That extra 0.25x is the lender's comfort zone. It's the cushion that proves the property can withstand a few unexpected vacancies, a surprise HVAC replacement, or a minor dip in market rents without missing a loan payment. It shows your deal is resilient, not just scraping by.

For syndicators, the DSCR loan's strict 1.25x benchmark is actually a good thing. It’s a powerful signal to everyone involved—lenders and investors alike—that the property itself generates more than enough cash to cover its own debts, without needing a personal guarantee from the sponsor. You can get more perspective on how lenders view this ratio in this guide to DSCR from BDC.ca.

Beyond the DSCR Score

But don't get tunnel vision. A great DSCR is critical, but it’s not the only thing lenders look at. Underwriting is about building a complete risk profile, and your ratio is just one piece of that puzzle. While the property's cash flow is the star of the show, the sponsor's track record and financial health still matter.

Here are a few other items you'll find on any lender's checklist:

- Minimum Credit Score: DSCR loans don't hinge on your personal W-2 income, but lenders still want to see that the key principals are financially responsible. Expect them to pull your credit, and they’ll typically want to see a score of at least 640-680.

- Loan-to-Value (LTV) Ratio: Lenders won’t finance 100% of the deal. For a DSCR loan, they’ll usually cap the LTV at 75-80%. This means you need to bring a down payment of 20-25%, ensuring you have plenty of your own skin in the game.

- Cash Reserves: Lenders need to know you can weather a storm. They'll require you to have enough liquid cash set aside to cover a certain number of months' worth of total mortgage payments (often called PITI—Principal, Interest, Taxes, and Insurance). Six months of reserves is a pretty standard ask.

Structuring a Deal That Lenders Love

For a syndicator, meeting these requirements isn't just about getting the loan; it's about getting the right loan. When you bring a deal to the table with strong fundamentals—a high DSCR, healthy cash reserves, and a conservative LTV—you’re in the driver's seat.

A well-structured deal gives you the leverage to negotiate better terms, like a lower interest rate or more favorable prepayment penalties. Those small wins flow directly to your bottom line, improving your capital stack and helping you deliver the kind of strong, predictable returns your investors are looking for. To see how all these pieces fit together, you can dig deeper into DSCR loan requirements. At the end of the day, a solid deal package proves you’ve done the work and built an investment that’s made to last.

The Pros and Cons of DSCR Loans for Syndicators

Like any tool in a real estate investor's toolkit, a DSCR loan isn't a one-size-fits-all solution. It can be the perfect key to unlocking a deal, but it can also be a poor fit depending on your specific strategy. For syndicators, understanding both sides of the coin is essential before committing.

The biggest draw is pretty clear: speed and scalability. The entire underwriting process revolves around the property's ability to generate income, not the sponsor's personal tax returns. This means less paperwork and a much faster path to the closing table—a huge advantage in a hot market.

And because the loan isn't tethered to your personal debt-to-income ratio, you won't hit the financing wall that conventional mortgages often create. This makes DSCR loans an incredible vehicle for growing a portfolio quickly.

Advantages: Why Syndicators Love DSCR Loans

When you get down to the nitty-gritty, the benefits for syndicators are more than just speed. The structure of these loans solves some of the most common headaches sponsors face when pulling together a deal.

Here’s a quick rundown of the main upsides:

- You Can Use an LLC: DSCR loans are built for business entities. This means you can hold the property in an LLC, which creates a vital liability shield between your personal assets and the investment.

- No Personal Income Verification: This is a game-changer. For full-time sponsors or those whose personal income doesn't tell the whole story, this is a lifesaver. It’s the property that qualifies, not you.

- Faster Closing Timelines: The streamlined documentation lets lenders underwrite and fund these loans much faster than traditional commercial financing, giving you a competitive edge.

Disadvantages: What to Watch Out For

Of course, all that flexibility comes at a price. It’s critical to weigh the trade-offs, as they can have a real impact on your deal's bottom line and your exit plan. Knowing these potential pitfalls ahead of time allows you to structure the deal to minimize the risk.

Here are the most common downsides:

- Higher Interest Rates and Fees: Lenders charge a premium for the convenience. You can expect both the interest rates and origination fees to be a bit higher than what you'd find on a conventional investment property loan.

- Strict Prepayment Penalties: This is a big one. Most DSCR loans come with prepayment penalties, often for the first 3-5 years. This can make an early sale or refinance very expensive, boxing you in and limiting your strategic options.

- Not Ideal for Value-Add Deals: Because the loan is based on the property’s current or immediately projected cash flow, it's a tough fit for a heavy value-add project that will be bleeding cash during renovations.

In the end, a DSCR loan is a strategic choice. It’s fantastic for snapping up stabilized, cash-flowing properties with speed, but it’s often the wrong tool for an opportunistic, heavy-lift project that needs a major turnaround.

DSCR Loans Advantages vs Disadvantages for Syndicators

For syndicators evaluating financing, it's helpful to see the pros and cons side-by-side. The right choice often depends on whether the advantages align with your business plan for a specific asset.

Ultimately, DSCR loans offer a powerful path to acquisition for syndicators focused on stabilized assets. But if your strategy involves a heavy value-add or a quick flip, you'll likely want to explore other financing avenues.

How to Prepare Your Deal for DSCR Financing

Getting the best terms on a DSCR loan is about more than just having a good property. It's about storytelling—presenting a deal that practically screams stability and upside. The most important work you'll do happens before you ever speak to a lender: putting together a bulletproof deal package. This isn't just about paperwork; it's about building confidence and making the underwriter's job a breeze.

Think of it like this: you wouldn't show up to a high-stakes job interview with just a resume. You’d bring a full portfolio showcasing your best work. For a DSCR loan, your deal package is that portfolio. It needs to be organized, accurate, and so compelling that it leaves zero doubt about the property's ability to perform.

Building Your Lender-Ready Checklist

Nothing signals risk to a lender faster than a sloppy, disorganized submission. To put your best foot forward, you need to assemble a complete package that anticipates every question they might have. Your mission is to make their decision an easy "yes."

Here’s a checklist of the absolute must-haves:

- A Pristine Rent Roll: This document needs to be current and detailed. We're talking every unit, tenant name, lease start/end dates, monthly rent, and security deposits. Lenders live in the rent roll, using it to verify occupancy and revenue consistency.

- Trailing 12-Month (T-12) Financials: Hand over a clean T-12 operating statement that lays out all income and expenses over the last year. This historical data is the bedrock for calculating and verifying your Net Operating Income.

- A Confident Pro-Forma: This is your chance to show the property's future potential. Your projections should be optimistic but firmly grounded in reality. If you're forecasting rent bumps or lower expenses, be ready to back it up with market data or a clear capex plan.

- Property & Sponsor Information: This includes high-quality photos of the asset, a personal financial statement for each key principal, and a schedule of real estate owned (your track record).

Stress-Test Your Own Numbers

Long before a lender’s underwriter starts poking holes in your deal, you need to do it yourself. Run the numbers through a few conservative scenarios. What happens if vacancy creeps up by 5%? What if property taxes jump next year?

By running these "what-if" analyses, you can spot potential weaknesses and prepare strong, data-backed answers. This shows the lender you're a sophisticated operator who has thought through the risks, not just the best-case scenario. It builds a tremendous amount of credibility.

Ultimately, a killer deal presentation tells a powerful story. It uses your calculated DSCR as the headline to prove the asset can stand on its own two feet. When you walk in with this level of preparation, you aren't just asking for money—you're demonstrating why your deal is a secure and profitable investment for them. That’s how you get the right DSCR loan, not just any loan.

Common Questions Syndicators Ask About DSCR Loans

Even after you've got the basics down, real-world deals always bring up specific questions. Let's tackle some of the most common things that come up for sponsors when they're deep in the underwriting process.

Can I Still Get a DSCR Loan if My Personal Credit Isn't Perfect?

You'd be surprised. While these loans are all about the property's income, most lenders will still glance at your personal credit. But the bar is usually much lower than for a conventional mortgage.

Typically, you'll see a minimum FICO score somewhere in the 640-680 range. The logic is simple: the property's cash flow is the main event, not your personal balance sheet. If your deal has a killer DSCR, a lender might even get a little more flexible on a borderline credit score.

What’s a “Good” DSCR for a Multifamily Deal?

For most lenders financing a multifamily asset, the magic number is 1.25x. Think of it as the minimum passing grade. This tells them the property generates $1.25 in income for every $1.00 it owes in mortgage payments.

But "good" is different from "great." If you can bring them a deal with a DSCR of 1.40x or higher, you're in the driver's seat. That kind of financial cushion gives lenders confidence, which often translates into better terms for you—think a lower interest rate or a bit more loan proceeds (higher LTV).

Are These Loans Just for Apartments?

Not at all. DSCR loans are the go-to financing tool for all sorts of cash-flowing commercial real estate. You’ll see them used for:

- Mixed-use properties

- Retail strip centers

- Self-storage facilities

- Smaller office buildings

Just be aware that underwriting can get a bit tougher depending on the asset type. A lender might see a single-tenant retail building as riskier than a 50-unit apartment complex and require a higher DSCR to compensate.

Will I Get Hit with a Prepayment Penalty?

Almost certainly, yes. This is a big one to watch out for. The overwhelming majority of DSCR loans include a prepayment penalty, which is a fee for paying off the loan ahead of schedule.

These penalties typically apply for the first 3 to 5 years of the loan term. The structure can vary—some use a simple step-down percentage (e.g., 3% in year one, 2% in year two), while others use more complex calculations like yield maintenance. You absolutely have to understand these terms upfront, as they directly impact your exit strategy and when you can profitably sell or refinance.

Managing investor relations, fundraising, and deal administration can be a heavy lift. Homebase is an all-in-one platform built to take the busywork out of real estate syndication, helping you focus on closing deals and building stronger investor relationships. Streamline your syndication process with Homebase.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

NOI Real Estate Explained A Guide for Syndicators

Blog

Master NOI real estate with our definitive guide. Learn how to calculate net operating income, increase property value, and drive investor returns.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.