NOI Real Estate Explained A Guide for Syndicators

NOI Real Estate Explained A Guide for Syndicators

Master NOI real estate with our definitive guide. Learn how to calculate net operating income, increase property value, and drive investor returns.

Domingo Valadez

Feb 4, 2026

Blog

Let's cut through the jargon. If you want to know if a commercial property is actually profitable, Net Operating Income (NOI) is the single most important number you’ll look at.

Think of it as the property's annual profit from its core business—renting out space—before you even think about mortgage payments or income taxes. It’s the purest measure of how well the asset itself is performing, stripping away all the financing and tax noise.

Why NOI Is The Bedrock Of Real Estate Investing

Imagine you're sizing up two identical apartment buildings side-by-side. One has a massive mortgage, and the other is owned free and clear. If you just looked at the final cash flow in the bank account each month, you'd get a wildly distorted picture of their operational health.

This is exactly the problem NOI solves.

By removing financing and tax details from the equation, NOI focuses strictly on the property’s operational performance. This creates a level playing field, allowing you to make true "apples-to-apples" comparisons between potential investments, no matter how the deals are structured.

The Foundation of Deal Analysis

For any serious real estate investor or syndicator, mastering NOI is non-negotiable. It's the number that drives a property's valuation and dictates the loan terms a bank will offer. Simply put, a strong and growing NOI is the engine that generates investor returns and builds long-term wealth.

Whether you're evaluating a multifamily deal in New York, a retail strip in Los Angeles, or an office building in Atlanta, the process is the same. You need to know if the property makes money from its day-to-day operations.

In simple terms, NOI answers one fundamental question: Does this asset generate a profit on its own? Before you ever worry about debt service, capital improvements, or tax strategy, you need a clear, honest answer.

To help clarify what goes into the calculation, here’s a quick breakdown of the key components.

NOI Formula Components At A Glance

This table shows how NOI deliberately isolates the property's core operational cash flow from financing and accounting decisions.

What You Will Learn

This guide is designed to move you beyond simple definitions. We’ll get into the practical mechanics, showing you:

- How to calculate NOI with step-by-step, real-world examples.

- The direct and powerful link between NOI, property value, and underwriting.

- Actionable strategies you can use to increase your property's NOI.

For a deeper dive into the fundamentals, this guide on What Is Net Operating Income is an excellent resource. By the time we're done, you'll see exactly why this metric is at the heart of every successful deal.

How To Calculate Net Operating Income Step By Step

Calculating Net Operating Income isn't some abstract accounting task; it's how you get under the hood and see what a property is really made of, financially speaking. The formula itself is simple enough, but the real skill lies in understanding each piece of the puzzle. Think of it like a chef's recipe—the ingredients are basic, but the way you combine them determines the final result.

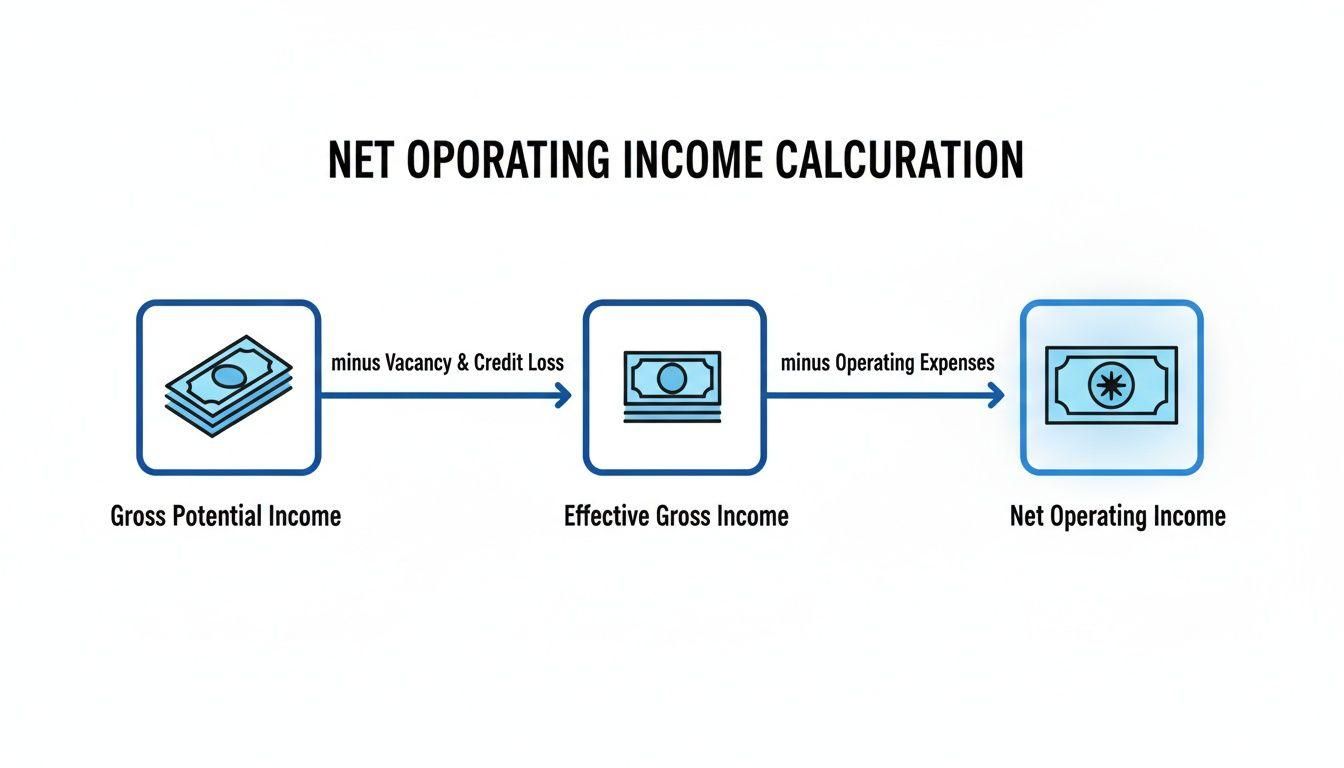

The whole calculation boils down to one simple truth: Income minus Expenses equals Profit. For NOI real estate analysis, we're just getting more specific about what counts as income and what's a true operating expense to get an honest look at the property's performance.

Step 1: Start With Potential Income

First, you need a baseline. We start by calculating the property's absolute maximum earning power, or its Gross Potential Income (GPI). This is the "perfect world" number—the total amount of money the property would bring in if it were 100% occupied for the entire year, with every single tenant paying every dollar they owe, on time.

Of course, GPI isn't just about rent. It includes every possible stream of revenue.

- Gross Potential Rent (GPR): The total rent you'd collect if every unit was leased at its full market rate.

- Ancillary Income: Don't forget the other money-makers, like parking fees, laundry machines, pet rent, or fees for storage units.

This gives you your best-case scenario—the theoretical ceiling before we bring things back down to earth.

Step 2: Adjust For Real-World Conditions

Let's be honest: no property ever hits that perfect-world scenario. You'll always have some empty units, and unfortunately, some tenants won't pay. That's why the next step is to subtract these realities—vacancy and credit losses—from your GPI. What you're left with is the Effective Gross Income (EGI).

EGI = Gross Potential Income - Vacancy and Credit Loss

This is probably the single most important adjustment you'll make. EGI isn't a fantasy number; it's the income you actually have a realistic shot at collecting, making it a far more reliable figure to build your analysis on.

When you're forecasting vacancy, you have to be a realist. Don't just plug in a number you hope for; use actual market data. A 5% vacancy rate might be the norm for one neighborhood, but the submarket right next door could average 8%. Getting this wrong can throw off your entire NOI calculation and lead you straight into a bad deal. Our guide on how to calculate NOI has more examples showing just how much these small percentage differences matter.

Step 3: Identify And Sum All Operating Expenses

Now that you have a realistic income figure, it’s time to subtract what it costs to keep the lights on. Operating Expenses (OpEx) are all the day-to-day costs necessary to maintain the property and keep your tenants happy. They generally fall into two buckets:

- Fixed Expenses: These costs don't change much, whether the building is full or half-empty. Think property taxes and building insurance.

- Variable Expenses: These costs go up and down with occupancy and usage, like utility bills, routine maintenance, and property management fees.

Make sure your list is complete: property management, administrative costs, marketing, utilities, repairs, maintenance contracts, landscaping—it all adds up.

Step 4: Exclude Non-Operating Costs

This is the final, crucial step that makes NOI such a powerful tool for comparing apples to apples. To get a pure measure of the property's performance, you have to strip out any expenses related to the owner's financing or tax situation.

This is non-negotiable. You must exclude:

- Debt Service: Your mortgage payments (both principal and interest). This is a financing cost, not an operating cost.

- Capital Expenditures (CapEx): Big-ticket replacements that extend the property's life, like a new roof or a full HVAC overhaul. These aren't daily expenses.

- Depreciation: This is a "paper" loss for tax purposes, not actual money leaving your bank account.

- Income Taxes: Your personal or corporate income tax is about you, the owner, not the building itself.

By stripping these items away, you're left with a clean, standardized number. It allows you to fairly compare a property in Dallas financed with 80% debt to one in Atlanta that's owned free and clear. The final NOI reveals the raw, unadulterated profitability of the asset itself—the exact insight every smart investor is looking for.

A Practical NOI Calculation In Action

Theory is great, but let's get our hands dirty. To really wrap your head around Net Operating Income, you have to see it work in the real world. Walking through a realistic example takes NOI from an abstract formula to a tangible tool you can use on your next deal.

Let's imagine you're looking at a 150-unit multifamily apartment complex. This isn't some shiny new high-rise; think of it as a solid, Class B property in a decent neighborhood. Our job is to figure out its annual NOI to see what it's really earning.

Step 1: Building The Revenue Picture

First things first, we need to tally up every dollar the property could possibly bring in. This starts with rent, but it doesn’t end there.

- Gross Potential Rent (GPR): If every single one of the 150 units rented for an average of $1,200 a month, we’d be looking at a GPR of $2,160,000 for the year. (That's just 150 units x $1,200/month x 12 months).

- Ancillary Income: But wait, there's more. The property also makes money from other things—parking spots, laundry machines, pet fees, you name it. Let's say that all adds up to another $150,000 a year.

Add those together, and you get a Gross Potential Income (GPI) of $2,310,000. This is our "perfect world" number, where every unit is filled and every tenant pays on time.

Of course, we don't live in a perfect world. We need to adjust for reality. No property runs at 100% occupancy all the time. Based on the local market for similar buildings, a 5% vacancy and credit loss rate is a reasonable assumption. This covers both empty apartments and the unfortunate reality of tenants who don't pay.

Effective Gross Income (EGI) Calculation:

$2,310,000 (GPI) - $115,500 (5% Vacancy) = $2,194,500

This EGI of $2,194,500 is the number that matters. It’s the stabilized, realistic revenue we can actually expect to collect, and it's the real starting line for our NOI calculation.

Step 2: Itemizing The Operating Expenses

Now that we have our income figured out, it's time to look at the other side of the ledger: the costs. What does it actually take to run this place day in and day out? These are the operating expenses, or OpEx, needed to keep the lights on and the tenants happy. Crucially, this list doesn't include the mortgage or big-ticket capital projects.

Here’s a plausible breakdown of the annual OpEx for our 150-unit property:

- Property Management Fees: Often a percentage of collected rent. At 4% of our EGI, that's $87,780.

- Property Taxes: One of the biggest line items, and it's not going anywhere. We’ll pencil in $220,000 for the year.

- Insurance: A must-have for liability and property coverage. The annual premium runs $65,000.

- Repairs & Maintenance: This is the budget for everything from fixing leaky faucets to painting units between tenants. Let's set it at $150,000.

- Utilities: This covers electricity for the hallways, water for the landscaping, etc. We'll budget $95,000.

- General & Administrative: Think marketing, legal fees, and other office overhead. That adds another $35,000.

Add it all up, and our Total Operating Expenses come to $652,780.

Step 3: Arriving At The Final NOI

This is the easy part. We just subtract the total expenses from our realistic income.

$2,194,500 (EGI) - $652,780 (OpEx) = $1,541,720 (NOI)

And there you have it. The annual Net Operating Income for this 150-unit complex is $1,541,720.

This single number is incredibly powerful. It represents the property's pure, unadulterated profitability before debt. It gives us a clean, standardized metric we can use to value the asset, talk to lenders, and stack it up against other investment opportunities. Getting this part right is absolutely fundamental to any serious analysis of NOI real estate deals.

How NOI Dictates Property Value And Financing

Calculating Net Operating Income is far more than an accounting task—it’s the moment you unlock a property's real market value and its ability to attract financing. For any real estate sponsor, NOI isn’t just another line item on a spreadsheet. It's the very engine that powers your deal, influencing everything from what you can pay for the property to the loan terms you’ll get from the bank.

This is where all the theory crashes into market reality. Lenders and buyers aren’t just looking at your gross rent roll; they need to see proven, consistent profitability. And the universal yardstick for that profitability is NOI.

The journey from a property's total potential income down to its core profitability is a process of refinement, as this chart shows.

You can see how the optimistic Gross Potential Income is brought back to earth by real-world deductions like vacancy and operating costs, leaving you with the Net Operating Income—the number that truly matters for valuation.

The Direct Link Between NOI And Property Value

In commercial real estate, the relationship between a property’s income and its value is made incredibly clear by the capitalization rate, or cap rate. A cap rate is simply a market-driven percentage that reflects the expected return on a real estate investment. Think of it as the market’s pulse for a specific asset class in a particular location at a given time.

The formula that ties all this together is simple but profoundly powerful:

Property Value = Net Operating Income / Capitalization Rate

This is the formula that explains why small, strategic boosts to your NOI can create an outsized leap in the property's value. For a sponsor, it's the most important lever you can pull. For example, if the going cap rate for your type of property is 5.5%, every single dollar you add to the annual NOI increases the asset's value by more than $18.

Let's look at how this multiplier effect plays out.

Impact of NOI Increase on Property Value (Assuming 5.5% Cap Rate)

This table shows how incremental increases in Net Operating Income can have a magnified effect on a property's total valuation.

As you can see, a $50,000 bump in annual profit—often achievable through smart operational tweaks—can create nearly $1 million in new equity. This is the heart and soul of value-add real estate investing and exactly why a deep understanding of NOI is non-negotiable.

How Lenders Use NOI To Underwrite Loans

Just as investors use NOI to figure out what a property is worth, lenders use it to figure out how risky a loan would be. When you go to a bank for a commercial loan, their number one concern is whether the property can generate enough cash to make the mortgage payments. They measure this with a metric called the Debt Service Coverage Ratio (DSCR).

The DSCR formula is another one you absolutely need to know:

DSCR = Net Operating Income / Total Debt Service

In this equation, "Total Debt Service" is just the sum of all principal and interest payments for the year. The resulting ratio tells the lender how many times over the property's annual NOI can "cover" the annual mortgage bill.

A DSCR of 1.0x is the break-even point. The property generates just enough cash to pay its mortgage, leaving zero room for error. Lenders hate this.

- Lender's Minimum Threshold: Most commercial lenders won’t even look at a deal with a DSCR below 1.25x.

- What This Means: A 1.25x DSCR shows that the property's NOI is 25% higher than its annual mortgage payment. That surplus is a critical financial buffer for handling surprise vacancies or a jump in expenses.

- Impact on Loan Terms: The higher your DSCR, the safer your deal looks. A strong ratio, like 1.35x or better, signals a lower-risk investment to the bank, which often leads directly to better loan terms like a lower interest rate or a higher loan-to-value (LTV).

At the end of the day, a healthy NOI doesn't just make a property more valuable—it makes it more financeable. It's the proof both your investors and your lenders need to see that the asset is built on a solid operational foundation that can produce reliable cash flow and weather market storms.

Actionable Strategies to Boost Your Property's NOI

Knowing how to calculate Net Operating Income is one thing, but the real magic happens when you actively make it grow. Increasing your property's NOI is the single most powerful way to force appreciation and deliver better returns to your investors. Think about it: every single dollar you add to that bottom line has a multiplier effect on the property's total value. This is why it’s the central focus for any serious value-add real estate sponsor.

The playbook is straightforward and comes down to two things: driving up revenue and trimming down expenses. When you systematically work on both sides of the NOI real estate equation, you can uncover a ton of hidden value. This isn't just wishful thinking; it's about running a deliberate game plan with proven tactics.

Boosting Revenue Beyond Just Raising Rents

Hiking rents to meet the market is the obvious first step, but the best operators know that's just scratching the surface. Real optimization comes from building several different income streams that not only pad your bottom line but also make life better for your tenants.

- Implement Utility Bill-Backs: Using a system like the Ratio Utility Billing System (RUBS), you can pass a fair share of common area utility costs (like water, sewer, and trash) back to tenants. This does more than just cut your operating expenses; it also gives residents a reason to conserve.

- Introduce High-Demand Ancillary Services: Today’s tenants will happily pay for convenience. You can add new revenue by offering things like reserved premium parking spaces, on-site storage units, secure package lockers, or pet-friendly policies that include a monthly pet rent.

- Focus on Keeping Good Tenants: Every time a unit turns over, you’re bleeding money on marketing, repairs, and lost rent during the vacancy. A smart tenant retention program—maybe offering a small upgrade at renewal or building a real sense of community—is a direct investment in a stable and predictable income stream.

A small bump in occupancy can have an outsized impact on your financials. For syndicators, this is where fortunes are made. A 10% increase in NOI, which can often be achieved just by reducing turnover and cutting back on rent concessions, can boost the Internal Rate of Return (IRR) by a whopping 200 basis points. If you want to dive deeper into these numbers, you can explore the full analysis on how NOI drives investor returns.

Controlling Operating Expenses with Precision

The other side of the NOI coin is all about managing your costs. The ability to shave down expenses without letting the property's quality or tenant satisfaction slip is what separates the great operators from the average ones. It takes a proactive and detail-oriented approach to your property’s finances.

This isn’t about just slashing budgets across the board. It’s about finding smart, sustainable efficiencies that create long-term savings.

Proven Cost-Saving Measures

Effective expense management means looking past the obvious line items and really digging into how your property runs day-to-day.

- Conduct Regular Energy Audits: Utilities are often one of your biggest variable costs. A professional energy audit can pinpoint huge savings opportunities, from simple things like installing low-flow toilets to bigger projects like upgrading common area lighting to LEDs, which can cut those specific costs by a third or more.

- Appeal Your Property Tax Assessment: Property taxes are a major fixed expense, but they aren't always set in stone. If you have good reason to believe your property has been over-assessed compared to similar buildings in the area, filing an appeal can result in thousands of dollars in annual savings.

- Renegotiate Vendor Contracts: Never let contracts for services like landscaping, pest control, or trash hauling auto-renew without a fight. Make it a regular practice to get competitive bids from other vendors to make sure you’re getting the best service for the best price.

- Embrace Preventative Maintenance: Fixing a small leak today is exponentially cheaper than dealing with a catastrophic flood and mold remediation down the road. A solid preventative maintenance schedule helps you get ahead of problems and avoid the kind of costly emergency repairs that blow up budgets and can lead to painful capital calls. You're essentially turning unpredictable disasters into manageable, planned expenses.

Streamlining NOI Reporting For Modern Investors

Knowing your Net Operating Income is one thing. Communicating it clearly to your investors is another challenge entirely. For most real estate sponsors, this turns into a frustrating loop of wrestling with clunky spreadsheets, creating inconsistent reports, and drowning in email chains to answer one-off questions.

This administrative headache isn't just a time sink; it can slowly chip away at investor confidence. When performance data is a chore to get or a puzzle to interpret, it creates friction. Investors today expect transparency and clarity, not a quarterly scavenger hunt for information. The old way of doing things just doesn't cut it anymore.

The Shift To Automated Investor Portals

This is exactly why modern investor portals are becoming so essential. They are built to solve these specific pain points by taking sponsors out of the manual data-entry game. By centralizing all your documents and data, you can automate a huge chunk of your NOI tracking and reporting, creating a single, reliable source of truth for both you and your investors.

This is more than just a back-office efficiency play. It's about completely upgrading the investor experience. Imagine giving your partners a secure, professional dashboard where they can check in on key metrics, including NOI, whenever they want.

Here’s a quick look at how a clean, professional investor dashboard can present performance data at a glance.

This kind of open-book approach lets investors see exactly how their capital is working, which goes a long way in building the trust needed for future deals.

From Manual Work To Building Trust

Putting your reporting on autopilot creates a positive ripple effect through your entire operation. It frees up your team from the tedious, low-value work of report creation so you can focus on what really matters: finding and executing great deals.

The benefits are pretty clear:

* Professional Deal Rooms: You can present performance data cleanly right from the start, track actuals against your pro forma, and send out seamless updates across the entire investment lifecycle.

* Radical Transparency: Giving investors 24/7 access to their data cuts down on inbound questions and proves your commitment to open communication.

* Operational Efficiency: For sponsors managing over $100M in equity, optimizing NOI directly impacts distributions and investor loyalty. Automating updates through an integrated portal just makes sense.

At the end of the day, a polished reporting system shows investors you're a sophisticated operator. It signals that you run a tight ship—not just at the property level, but inside your own business—giving them the confidence to reinvest with you again and again.

Many of the best property management apps can also help sponsors get a better handle on their operations and NOI reporting. These tools often connect directly with investor portals, creating a smooth flow of data from the property right to the partner. This integration is the key to delivering accurate, real-time insights without all the manual work that invites errors and delays.

Common Questions About NOI

Once you start digging into real estate deals, you'll find that Net Operating Income isn't always straightforward. Certain situations come up that can trip up even experienced investors. Let's walk through a few of the most common questions that pop up during underwriting.

What's The Difference Between NOI And EBITDA?

Here’s the simplest way to think about it: NOI is for the property, and EBITDA is for the business.

NOI isolates the financial performance of a single real estate asset. It tells you exactly how much cash a specific building generates from its day-to-day operations, before factoring in debt payments or taxes. It’s the go-to metric for evaluating a property on its own merits.

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, looks at the profitability of an entire company. A real estate investment firm that owns dozens of properties would use EBITDA to measure its overall business health, not the performance of just one building in its portfolio.

For a syndicator underwriting a specific apartment complex, NOI is the number that truly matters.

How Do Capital Expenditures Affect NOI?

This is a great question because the answer has two parts. Directly, they don’t. Capital Expenditures (CapEx) are specifically left out of the NOI formula.

Why? Because things like replacing a roof or renovating all the kitchens aren't considered regular, day-to-day operating expenses. They are major investments designed to increase the long-term value of the property, not just keep the lights on.

But here’s the indirect connection that savvy sponsors focus on: You spend CapEx precisely to increase future NOI. Those new kitchen renovations? They justify charging higher rent, which boosts your Gross Potential Rent and, ultimately, your Net Operating Income for years to come.

Separating the two allows you to see a clear picture of the property's current operational health (NOI) while also analyzing the potential upside from future improvements (CapEx).

Can A Property Have A Negative NOI?

Absolutely, and it's a huge red flag. A negative NOI means a property is losing money before you even think about paying the mortgage. The basic costs to run the building—like property taxes, insurance, and utilities—are higher than all the income it brings in.

A property usually ends up in this situation for a few key reasons:

- Massive Vacancy: Not enough rent is coming in to cover the fixed costs.

- Gross Mismanagement: Expenses are out of control, or the manager is failing to collect rent from existing tenants.

- Catastrophic Deferred Maintenance: Years of neglect have led to emergency repairs that are draining all the income.

An asset with a negative NOI is deeply distressed. While some specialized investors might see a high-risk, high-reward turnaround play, it requires a rock-solid business plan and a huge cash infusion to have any hope of becoming profitable again.

Ready to stop wrestling with spreadsheets and start building stronger investor relationships? At Homebase, we provide an all-in-one platform that makes it easy to manage your deals, automate reporting, and deliver the transparency modern investors demand. Learn more and see how we can support your next deal.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Definition rent roll: A Practical Guide for Real Estate Investors

Blog

Definition rent roll explained: discover what the term definition rent roll means and how to use this key document for due diligence and portfolio growth.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.