Calculating Equity Multiple A Real Estate Investor's Guide

Calculating Equity Multiple A Real Estate Investor's Guide

Master calculating equity multiple for real estate deals. Our guide provides clear examples, compares it to IRR, and offers actionable tips for syndicators.

Domingo Valadez

Feb 2, 2026

Blog

Calculating the equity multiple is actually much simpler than most people think. At its core, the formula is just your Total Distributions divided by your Total Equity Invested.

This single number directly answers the most important question on every investor's mind: "How many times my money am I going to get back from this deal?" It gives you a clean, big-picture look at the total profitability of an investment over its entire life.

What Equity Multiple Reveals About Your Real Estate Deal

Before we start crunching numbers, it’s crucial to understand the story the equity multiple is telling you. Unlike other metrics that get hung up on the speed of returns, the equity multiple gives you a straightforward measure of the total cash you’ll get back on your investment.

For anyone running a real estate syndication, this metric is more than just a calculation. It's a powerful way to build trust with your investors and set clear, realistic expectations right from the start. It cuts through all the noise and shows the cumulative return, including every dollar from cash flow during the hold period and the final payout when the property sells.

The Core Formula Explained

The beauty of the equity multiple is how intuitive it is. The formula just combines the two most fundamental pieces of any real estate investment:

- Total Distributions: This is every single dollar an investor gets back from the deal. Think of it as the sum of all the periodic cash flow distributions from rental income, plus the big lump sum they receive when the property is sold or refinanced.

- Total Equity Invested: This is simply the initial cash an investor puts into the deal to get it off the ground. It’s their "skin in the game."

The simplicity here is what makes it so powerful. Let’s say a syndicator buys a $1 million property using $250,000 of investor equity and $750,000 in debt. If the property throws off $75,000 in cash flow each year for five years and then sells for a $150,000 gain, the math is easy.

Total cash back to investors would be $525,000 ($375,000 from operations + $150,000 from the sale). You divide that by the initial $250,000 in equity, and you get a 2.10x equity multiple. This kind of direct calculation has been a go-to for commercial real estate pros for years because it offers such a clear way to compare different opportunities. You can find more insights into the equity multiple formula and its uses if you want to dig deeper.

A Practical Example

Let's ground this in reality with a common investment amount. Imagine you decide to invest $100,000 into a multifamily syndication that’s projected to run for five years.

The goal is always to see a return that not only gives you your initial investment back but multiplies it. A 2.0x equity multiple means you got your original $100,000 back, plus another $100,000 in pure profit.

To see how the numbers add up, let's break down how a deal like this might play out.

The table below gives a quick look at how the different cash flows come together to produce the final multiple.

Quick Look Calculating Equity Multiple on a $100,000 Investment

As you can see, the final calculation is straightforward: divide the $200,000 in total cash you received by the $100,000 you put in, and you get a 2.0x multiple. You’ve successfully doubled your money.

How to Calculate the Equity Multiple

Alright, let's get down to the brass tacks of calculating the equity multiple. The good news is, it’s not rocket science. It’s a simple, powerful metric that comes down to one thing: tracking every dollar that goes into the deal and every dollar that comes out.

Think of it as a scorecard for your capital. To do the math, you just need to get your hands on a few key numbers from your pro forma or historical records.

Gathering Your Core Inputs

Before you even think about opening a spreadsheet, you need to pin down three specific numbers. These are the building blocks of the entire calculation.

- Total Equity Invested: This is the full boat—all the cash put into the deal by every investor, both limited partners (LPs) and general partners (GPs). This number is your starting point and serves as the denominator in the formula.

- Total Cash Distributions: This is the sum of all the cash flow you plan to pay out (or have already paid out) to investors from the property's operations throughout the entire time you own it.

- Net Proceeds from Sale: This is the big one—the final cash distribution after you sell the asset, pay off the mortgage, and cover all the closing costs. This bucket also includes any capital returned to investors from a cash-out refinance during the hold period.

Once you have these three figures, you’re ready to go. For a deeper dive into financial modeling, a good property investment calculator can really help you nail down these projections accurately.

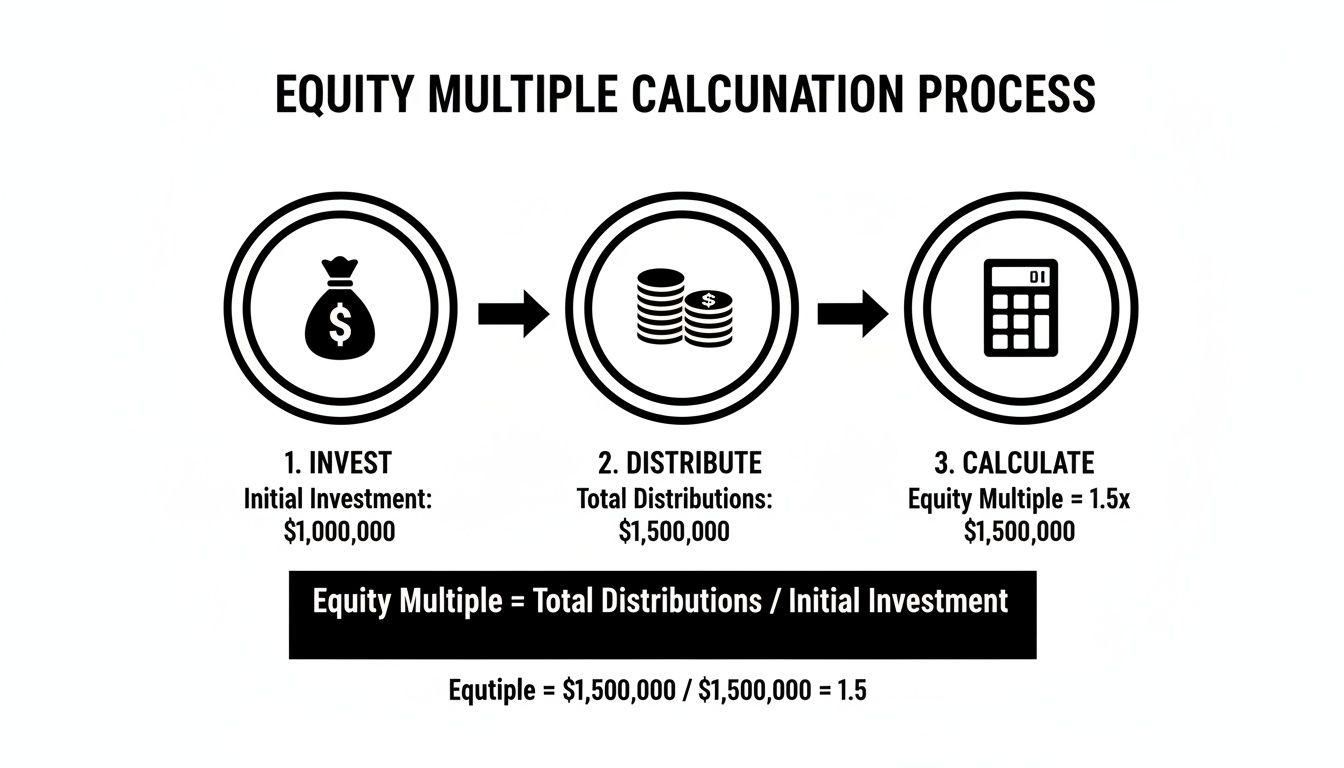

This flowchart lays out the simple path from investment to return.

As you can see, it’s a direct line from the initial cash in to the total cash out, which gives you that final multiple.

A Real-World Syndication Example

Let's look at how this plays out in a real deal. Picture this: It's August 2019, and a syndicator is buying a multifamily property in Houston. This isn't hypothetical; it’s what REEP Equity did with Candleridge Park, a 128-unit Class B apartment complex. They invested equity, operated the property, and eventually sold it, delivering fantastic results for their partners.

Across 11 of their full-cycle deals, investors have seen an average equity multiple of 2.04x. That’s a tangible result from a real-world investment.

Key Takeaway: The equity multiple is a realized metric. You absolutely project it when underwriting a deal, but its true, final value isn't locked in until the property is sold and every last dollar has been returned to investors.

Gross Multiple vs. Net Multiple

Here’s a distinction that really matters for building trust with investors: the difference between gross and net multiples.

The gross multiple is calculated before any of the sponsor's fees, like asset management fees or the carried interest (promote), are taken out. It’s a bigger, flashier number, but it's not what investors actually receive.

The net multiple, on the other hand, is the number that hits your investors' bank accounts. It represents the total cash returned to them after all sponsor fees and promotes have been paid. When you're talking to investors, always lead with the net multiple. It shows transparency and reflects the true return they can expect. It's how you build a reputation for being a straight-shooter.

Equity Multiple Vs. IRR: What Investors Need To Know

When you look at a real estate syndication deal summary, you'll almost always see two metrics sitting side-by-side: the equity multiple and the Internal Rate of Return (IRR). They seem similar, but they tell two very different parts of the investment story.

Getting a handle on how they work together is crucial for making smart investment decisions.

Here's the simplest way to think about it: the equity multiple answers the question, "How much money will I get back?" while IRR answers, "How fast will I get it back?" One measures the total profit on your invested cash, while the other measures the speed and efficiency of that return.

The Classic Tradeoff: Speed vs. Total Profit

You might see a deal with a huge equity multiple but a surprisingly average IRR. This is common for long-term holds, like a ground-up development or a stabilized asset with a 10-year business plan. The total profit might be an impressive 3.0x, but since it took a decade to hit that number, the annualized return (the IRR) gets watered down.

On the other hand, a deal with a killer IRR might have a lower equity multiple. Think of a quick flip that’s done and dusted in 18 months. It could post a 25% IRR, which looks amazing, but the equity multiple might only be 1.4x. You got your capital back fast, which is great, but you didn't multiply it by a huge amount.

Neither metric is inherently "better." A sophisticated investor uses both to get a complete picture. The equity multiple shows the project's overall profitability, while the IRR reveals its efficiency in generating that profit over time.

To help clarify the differences, here's a quick breakdown of how these two key performance indicators stack up.

Equity Multiple vs IRR at a Glance

Ultimately, using both metrics provides a more balanced view of a deal's potential, protecting you from being swayed by a single impressive-looking number.

Why The Hold Period Changes Everything

The "time value of money" is the invisible force that separates these two metrics. It’s the simple idea that a dollar today is worth more than a dollar tomorrow.

Let's walk through a quick example. Imagine you have $100,000 to invest in one of two projects.

- Investment A pays you $20,000 in cash flow every year for five years. At the end of year five, the property sells, and your final distribution is $200,000. You’ve received a total of $300,000 on your $100,000 investment, giving you a strong 3.0x equity multiple.

- Investment B is a long-term land development deal. It provides zero cash flow for 20 years but then sells for a massive payout, returning $500,000 to you. That's a whopping 5.0x equity multiple.

On paper, 5.0x looks way better than 3.0x. But Investment A returned your capital much sooner, giving you the chance to reinvest that money and compound it over the next 15 years. This is a dynamic that the equity multiple, on its own, completely misses. While you're at it, another key metric for evaluating real estate is the capitalization rate, and understanding how calculating cap rate for rental property works will round out your analytical toolkit.

As a syndicator, your job is to explain this dynamic clearly. Helping investors understand when to prioritize a high multiple versus a high IRR builds trust and shows you're focused on their complete financial picture. To go deeper on this, check out our guide on https://www.homebasecre.com/posts/how-to-calculate-irr and master this critical metric.

Common Mistakes When Calculating Equity Multiple

On the surface, the equity multiple formula seems straightforward. But in the real world of deal-making, a few common slip-ups can easily throw off your numbers, damaging your credibility with investors. It's not just about getting the math right; it’s about maintaining trust.

One of the easiest traps to fall into is forgetting to include all capital distributions in the numerator. It's more than just the regular cash flow and the big check from the final sale. Did you do a cash-out refinance halfway through the hold? That’s a capital event, and that money returned to investors absolutely has to be part of the "Total Distributions."

Another classic error is getting gross and net multiples mixed up. If you present a gross multiple without clearly stating it as such, you're setting yourself up for an awkward conversation later. Investors don't care about the project's return before fees and promotes; they care about the net multiple—what actually lands in their bank account. Always be crystal clear.

Overlooking Capital Calls and Additional Investments

It's natural to anchor on the initial investment, but what happens when a deal requires more cash down the road? If you need to make a capital call to cover a surprise renovation or an operating deficit, that new money has to be added to the denominator, the "Total Equity Invested."

Forgetting this step will artificially inflate your equity multiple and paint a misleadingly rosy picture.

Here’s a quick example of how big the impact can be:

* Initial Investment: $100,000

* Total Distributions: $200,000

* Initial Multiple: 2.0x

Now, let's say there was an unexpected capital call.

* Capital Call: $20,000

* Total Equity Invested: $120,000

* Corrected Multiple: $200,000 / $120,000 = 1.67x

That’s a significant difference. Overlooking that capital call would be a major misrepresentation of the deal's actual performance.

Presenting the Multiple in a Vacuum

This might be the biggest strategic blunder of all: presenting the equity multiple without its crucial partners, the IRR and the hold period. A 2.0x multiple sounds fantastic, but what does it really mean? Achieving it in three years is a home run. Achieving it in ten years? Not so much.

An equity multiple without the context of time is only half the story. It tells you 'how much' but not 'how fast,' which is a critical piece of information for any investor evaluating an opportunity.

You should always present these metrics together. A simple, clean table showing the equity multiple, IRR, and hold period gives investors a complete, transparent view of what you're projecting. This professional approach shows you respect their capital and their time, building a foundation for a strong, long-term relationship.

How to Talk About Equity Multiple With Your Investors

Knowing how to run the numbers is table stakes. The real art is telling the story behind those numbers in a way that builds investor confidence and drives decisions. An equity multiple might be a simple metric, but how you present it can make or break an investor's understanding of your deal.

The goal isn't just to spit out a number; it's to provide a clear, digestible narrative. Instead of burying the metric deep within a spreadsheet, pull it out. Use a simple bar chart or a clean timeline in your pitch deck to show how the multiple builds over the life of the investment. A good visual makes the projections feel tangible and much easier to grasp.

Benchmark Your Projections

Investors are always thinking about opportunity cost. A 2.0x multiple sounds pretty good on its own, but they need context to understand how good. Is that standard for this type of deal? Is it ambitious? This is where benchmarking comes in.

You should always frame your target multiple against market norms and, if you have one, your own track record. For a typical value-add multifamily deal with a five-year hold, a target net equity multiple somewhere in the 1.8x to 2.2x range is often seen as a healthy, achievable goal. By saying that upfront, you're showing investors you understand the market and are setting realistic expectations.

You can add a ton of credibility by referencing past performance. For example:

* For experienced sponsors: "Across our last five full-cycle deals, we've delivered an average net multiple of 2.1x to our investors. This project fits a similar profile, and we're confident in our plan."

* For newer sponsors: "Our underwriting aligns with conservative market standards for similar assets in this submarket, which typically target a 1.9x multiple."

This simple act of benchmarking transforms your projection from just a number into a well-reasoned target grounded in reality.

Frame the Complete Performance Puzzle

The most common mistake I see sponsors make is presenting the equity multiple in a vacuum. When you do that, you're just inviting questions and can even create suspicion. The savviest operators present a complete, holistic picture of an investment's potential returns.

The equity multiple should always travel in a pack with the IRR and the hold period. This trifecta tells the full story of "how much," "how fast," and "how long." A clear, concise table in your investor summary is the perfect way to display this. It lets investors immediately see the relationship between total profit and the speed of that return.

The most effective investor communication goes beyond the numbers. Frame the metrics as the financial outcome of your strategic business plan—the renovations you'll make, the rent increases you project, the operational efficiencies you'll create. This connects the 'what' (the multiple) with the 'how' (your strategy).

Ultimately, your job is to educate. Explain that while the equity multiple shows the total return on their invested capital, the IRR measures how efficiently that capital is put to work over time. Modern platforms like Homebase are built to help with exactly this. They let you create professional deal rooms where you can share these key metrics, supporting documents, and investor updates in a single, transparent portal. This ensures every investor has a full, clear picture of the opportunity you're presenting.

Answering Your Top Questions About Equity Multiple

Even when you know the formula by heart, real-world deals throw curveballs. Let's tackle some of the most common questions that pop up for both new and seasoned investors when they're digging into the equity multiple.

Getting these details right is key to truly understanding what this metric is telling you about a deal's potential.

What Is a Good Equity Multiple in Real Estate Syndication?

This is the million-dollar question, and the honest answer is: it depends. A "good" multiple is completely tied to the deal's strategy, its risk level, and how long you plan to be in it.

For a standard value-add multifamily project with a three-to-seven-year hold, most investors are looking for a target net multiple somewhere in the 1.8x to 2.5x range. That's generally considered a solid return for the risk involved.

But context is everything.

- A lower-risk, stabilized property? A more modest 1.5x to 1.8x might be perfectly acceptable.

- A riskier ground-up development or a major repositioning? You'd better be aiming for 2.5x or higher to make the extra risk and brain damage worthwhile.

The real trick is to look at the multiple in tandem with the IRR and the hold period. A 2.0x multiple in three years is a home run. That same 2.0x over ten years? Not nearly as exciting.

Can an Equity Multiple Be Less Than 1.0x?

Absolutely, and it’s a reality every investor needs to be prepared for. An equity multiple below 1.0x means you've lost money. It's as simple as that.

If you see a final multiple of 0.8x, it means for every dollar you invested, you only got 80 cents back. That’s a 20% loss of your original capital. No sponsor ever projects a deal to go this way, of course. But things happen—a market downturn, a major unexpected capital expense, or being forced to sell at the worst possible time can crush returns. This is precisely why your due diligence on the deal and the sponsor is so critical.

How Does a Cash-Out Refinance Affect the Equity Multiple?

A cash-out refinance can give the equity multiple a serious, and very welcome, boost. When a sponsor refinances the property and returns a chunk of the original invested capital back to investors, that distribution counts toward the "Total Capital Returned."

It gets added right into the numerator of the formula, juicing the multiple without having to sell the asset. It’s a fantastic way to return capital to investors early, de-risk the project, and improve one of your key performance metrics all at once.

Does Equity Multiple Account for Taxes?

No, and this is a crucial point to remember. The equity multiple you see in any pitch deck is almost universally a pre-tax figure. It measures the cash flow generated by the asset itself, completely separate from your personal tax situation.

Your actual take-home return will look different after you account for your income tax bracket, any depreciation benefits passed along to you, and the capital gains taxes you'll owe when the property is eventually sold. Any reputable sponsor will be clear that their projections are pre-tax, so investors know exactly what they're looking at.

Communicating these metrics clearly and handling investor questions is the bedrock of a successful syndication. A platform like Homebase gives you a professional, centralized hub to share deal projections, handle subscription documents, and provide transparent updates and distribution reports. When you automate the tedious administrative work, you can focus on building trust and delivering the strong returns your investors expect.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

12 Essential Types of Real Estate Investment to Explore in 2026

Blog

Discover the 12 key types of real estate investment, from syndication to REITs. This guide covers risk, returns, and how to get started.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.