What Are Capital Expenditures? Your Complete Guide

What Are Capital Expenditures? Your Complete Guide

Learn what are capital expenditures, their impact on business value, and how to manage them effectively with our easy-to-understand guide.

Domingo Valadez

Sep 29, 2025

Blog

At its heart, a capital expenditure (CapEx) is a major investment your business makes in something that will deliver value for years to come. Think of it less like fixing a leaky faucet and more like a full kitchen remodel that significantly boosts your home's long-term value. These are the foundational purchases that power your company’s future growth.

Understanding Capital Expenditures at a Glance

So, what does that mean in the real world? Capital expenditures are the funds a company sinks into buying, upgrading, or maintaining physical assets like buildings, property, technology, or heavy equipment. These aren't your day-to-day running costs; they are big-ticket, strategic investments that show up on your balance sheet and are depreciated over their useful lifespan.

Getting a handle on CapEx is crucial for any business, but it's absolutely essential in real estate. It impacts your financial health in a few key ways:

- Financial Reporting: Classifying these expenses correctly ensures your financial statements are accurate, painting a true picture of what your company is actually worth.

- Tax Implications: CapEx gets special treatment from the IRS. Instead of a one-time deduction, you get tax benefits through depreciation, which can lower your taxable income year after year.

- Strategic Planning: When you track these investments properly, you can budget for future growth, plan for when major assets will need replacing, and make smarter decisions about where to put your money for the best return.

The Scale of Capital Investment

The amount of money flowing into capital expenditures is a huge indicator of economic health and business confidence. When companies are spending on big-ticket items, it shows they’re committed to future growth.

For example, in the United States, total private nonfinancial capital expenditures have consistently been above $2.5 trillion per year in recent quarters. That number represents a massive, sustained investment in the country's core assets. For a deeper dive, you can explore historical trends and more data on FRED's economic database.

The decision to make a capital expenditure is fundamentally a bet on the future. It signals that a company anticipates growth and is willing to invest substantial resources to support it, turning today's cash into tomorrow's revenue-generating assets.

CapEx vs. OpEx: A Quick Comparison

To really get what CapEx is, you have to understand what it isn't: an Operating Expense (OpEx). Differentiating the two can be tricky at first, but it's a critical distinction for any investor or business owner. OpEx covers the day-to-day costs of just keeping the lights on—things like rent, utilities, and payroll.

The table below breaks down the key differences.

Quick Guide: Capital Expenditures vs. Operating Expenses

In short, the main difference comes down to timing and benefit. CapEx is a long-term investment for future gain, while OpEx is an immediate cost for present operations.

Navigating the CapEx vs. OpEx Divide

Drawing the line between a capital expenditure (CapEx) and an operating expense (OpEx) can sometimes feel a bit murky, but getting it right has massive implications for your business's financial health. How you classify an expense directly shapes your company's financial story, impacting everything from short-term profitability to your tax bill for years to come.

Let's break it down with a simple analogy. Imagine you run a local coffee shop. That shiny new commercial espresso machine you just bought? That’s a classic capital expenditure. It's a major purchase that will be the heart of your operation, churning out lattes and driving revenue for the next decade.

On the other hand, the weekly order of coffee beans is a textbook operating expense. You absolutely need them to do business, but they're consumed and gone in a matter of days.

This single decision creates a ripple effect across your financial statements. When you classify that espresso machine as CapEx, it lands on your balance sheet as a valuable asset. You'll then gradually expense its cost over its useful life through depreciation. If you mistakenly called it an OpEx, the entire cost would hammer your income statement in a single month, making it look like you had a terrible, unprofitable period.

The Financial Story Each Choice Tells

Understanding this difference is central to smart financial management. An OpEx immediately reduces your net income, which, in turn, lowers your tax bill for the current period. While a smaller tax bill always sounds good, consistently expensing items that are truly long-term assets can paint a misleading picture of your company's health by understating its real value.

On the flip side, capitalizing an expense makes your assets look stronger and boosts your current profitability. This can be very appealing to potential investors and lenders. The trade-off is that you'll have those ongoing depreciation expenses chipping away at profits for years. The real goal isn't to pick the most convenient option—it's to be accurate and reflect the true nature of the expense.

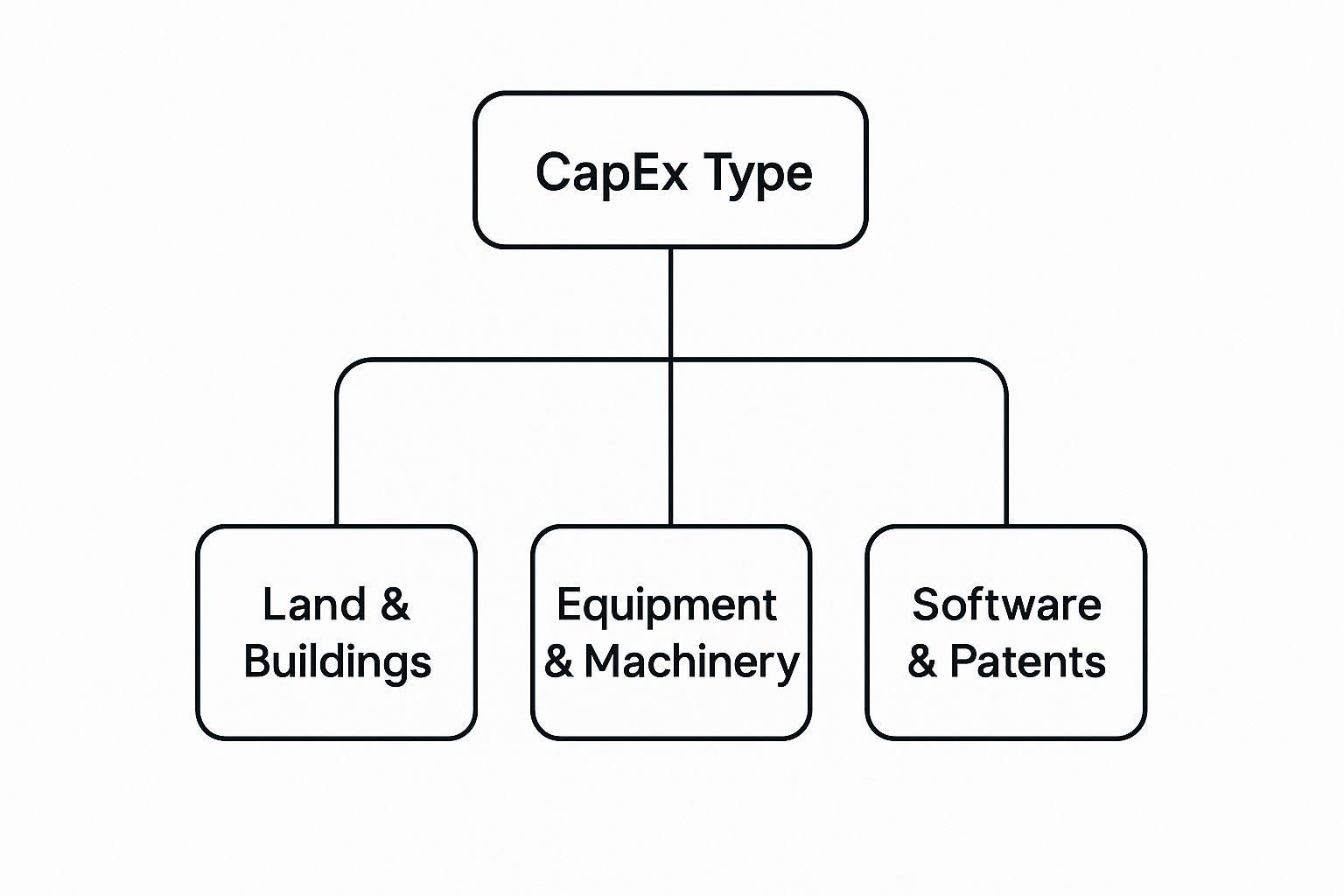

The infographic below offers a great visual breakdown of where capital expenditures typically fall, helping to clarify where these major investments are made.

As you can see, CapEx isn't just one thing. It covers a whole range of long-term investments, from tangible assets like buildings and machinery to intangible ones like patents.

Tackling the Gray Areas

So, what about those tricky situations that aren’t so black and white? A massive software upgrade or a full engine rebuild for a delivery truck can easily blur the lines. When you're stuck, ask yourself these questions:

- Does it extend the asset's useful life? Replacing a flat tire is just maintenance (OpEx). But replacing the entire engine to get another five years out of the truck? That's almost certainly CapEx.

- Does it significantly improve the asset? A fresh coat of paint on a rental property is an operating expense. A full kitchen and bathroom gut-renovation that boosts its value and lets you charge higher rent is a capital expenditure.

- Is it adding a new capability or just a repair? Fixing a leaky faucet is OpEx. Adding a brand-new bathroom to a home is CapEx.

The core question to ask is this: Does the expense provide a significant, lasting benefit that stretches beyond the current year? If the answer is a clear yes, you're looking at a capital expenditure.

For a concrete, real-world example, look at a ski resort that recently made a $20 million investment in new snowmaking equipment and employee housing. Those powerful snow guns and hydrants aren't a one-season fix; they are a multi-year upgrade designed to secure the resort's operations and revenue. By classifying this as CapEx, the resort can spread that massive cost over the equipment's lifespan, neatly matching the expense to the long-term value it generates.

The Two Faces of Capital Investment

Not all capital expenditures are created equal. While they all represent significant, long-term investments, they tell two very different stories about a company’s strategy and its financial health. To really get a handle on what capital expenditures are, you have to look at them through two distinct lenses: maintenance and expansion.

Imagine you own a delivery business. Your fleet of trucks is the lifeblood of your operation. Over time, those vehicles are going to wear down.

Keeping the Engine Running with Maintenance CapEx

Maintenance CapEx is the money you have to spend just to keep your business running as-is. It’s the cost of replacing one of your old delivery trucks with a comparable new one. You aren’t growing your capacity; you’re just swapping out an essential asset to maintain the status quo. Think of it as the "keeping the lights on" category of investment.

For a real estate investor, this looks like:

- Replacing the aging roof on an apartment building.

- Upgrading an old HVAC system that's on its last legs.

- Repaving a cracked and deteriorating parking lot.

These are absolutely necessary expenses to preserve the value and functionality of your property. A pattern of high maintenance CapEx can sometimes be a red flag, signaling aging infrastructure that needs constant, and costly, attention.

Fueling Growth with Expansion CapEx

On the flip side, Expansion CapEx is all about growth. This is the money you invest to increase your company’s capacity, break into new markets, or boost your revenue potential. It’s not about replacing one delivery truck; it’s about buying an entire new fleet to launch service in a new city.

This kind of spending is a forward-looking bet on future success. For a hotel owner, replacing old furniture is maintenance. But building a brand-new wing with 50 additional rooms? That’s pure expansion. It signals ambition and a clear strategy to scale the business.

For investors and analysts, the ratio between maintenance and expansion CapEx is a powerful indicator of a company’s trajectory. A business heavily weighted toward expansion is actively building for the future, while one dominated by maintenance spending may be focused more on preservation than growth.

A Modern Look at Aggressive Expansion

Nowhere is this kind of expansionary spending more visible today than in the tech sector, especially with the boom in artificial intelligence. The top four AI giants—Amazon, Microsoft, Alphabet, and Meta—are projected to pour a combined total exceeding $320 billion into capital expenditures. This is a massive jump from their previous spending of $246 billion and shows an unprecedented investment in AI infrastructure to meet the exploding demand. You can explore the latest market updates on ssga.com to get more details on this trend.

This is a perfect real-world example of expansion CapEx. These companies aren't just maintaining their servers. They are aggressively building the foundational assets required to dominate the next technological frontier. Understanding this distinction is absolutely key to decoding a company’s strategic priorities and its potential for future performance.

How CapEx Shapes the World We Live In

If you really want to get a feel for capital expenditures, forget the accounting ledgers for a moment. Look at the world around you. Industries like real estate and public infrastructure are built—quite literally—on CapEx. It’s where the abstract concept of a balance sheet entry becomes a tangible force that builds our physical environment.

Think about owning a commercial building. Keeping the lights on and the floors clean? Those are just day-to-day operating costs. But when you decide to undertake a major project, you’ve officially waded into CapEx territory.

These aren't small fixes. We're talking about substantial investments meant to boost the property's market value, make it work better, or give it a much longer lifespan.

CapEx in the World of Real Estate

For a property owner, CapEx shows up in a few common, and often costly, scenarios:

- A Full Roof Replacement: This is far more than patching a leak. A brand-new roof is a major investment designed to protect the entire building for decades to come, so it’s capitalized as a huge improvement.

- A Complete HVAC Overhaul: Tearing out an old, clunky heating and cooling system for a modern, energy-efficient one isn't just a repair—it's an upgrade that adds lasting value and makes tenants happier.

- Repaving the Parking Lot: Grinding up cracked, faded asphalt and laying down a fresh surface is a long-term improvement, not just routine upkeep.

- Building an Addition: Constructing a new wing, adding a second story, or even building a new garage are classic examples of expansion CapEx. You're creating brand-new, valuable square footage.

To get a clearer picture, it helps to understand the investment behind a significant upgrade. For example, learning about the true cost of a new garage door provides a concrete example of this kind of project. It’s an investment that goes well beyond a simple fix, adding real value and utility to the property.

A capital expenditure in real estate is any investment that transforms a property from what it is today into something more valuable, more durable, or more capable for the long haul. It’s the difference between maintaining your house and remodeling it for the future.

Infrastructure: CapEx on the Grandest Scale

Now, zoom out from a single building to an entire city or country. This is where you see CapEx driving the development of whole communities and economies. Public and private infrastructure projects are some of the biggest and most powerful examples of capital expenditures you can find.

Imagine a city government pouring funds into a new light rail system or a utility company building a massive solar farm. These projects demand enormous upfront cash but are built to deliver vital services and economic returns for generations. They are capitalized on the books and then depreciated slowly over their very long, useful lives.

This connection between CapEx and infrastructure is a huge deal for global investors. Investment in infrastructure is still a critical engine in private markets, which shows just how foundational these assets are. One recent analysis pointed out that while fundraising dipped, the actual deployment of capital into infrastructure sped up, with deal values climbing 18% over the previous year. This spending brought available investment capital down to $418 billion, but infrastructure remains the #1 asset class investors are looking to pour more money into. You can explore the full Global Private Markets Report on mcksey.com for a deeper dive.

From putting a new roof on a duplex to building a nationwide broadband network, capital expenditures are the financial fuel that builds, maintains, and improves the tangible world. Every project, no matter the size, is a calculated bet on the future—turning today's cash into the durable assets of tomorrow.

How CapEx Shows Up On Your Financials

This is where the rubber meets the road—where your big-ticket purchases get translated into the black-and-white numbers on your financial statements and tax returns. The way you account for CapEx has a huge impact on your company’s reported profitability, how much you owe in taxes, and even how investors see your business. It’s the official process of turning a hefty, one-time cash outlay into a long-term asset that generates value over time.

Instead of swallowing the entire cost of a major purchase in a single year, you capitalize it. This move is crucial. It means the purchase doesn't nuke your income statement right away. Instead, it gets recorded as an asset on your balance sheet, reflecting its ongoing contribution to the business.

From there, the magic of depreciation kicks in.

The Power of Depreciation

At its core, depreciation is just an accounting method for spreading the cost of an asset over its useful life. Think of it like this: you’re systematically turning that asset into a small, manageable expense, piece by piece, year after year. It's the most accurate way to match the cost of the asset with the revenue it helps you earn over time.

Let's make this real with an example. Say your real estate firm buys a new heavy-duty construction vehicle for $100,000. You look at your fleet and know from experience that a truck like this will last about 10 years.

Using the simple straight-line depreciation method, the math looks like this:

- Total Cost: $100,000

- Useful Life: 10 years

- Annual Depreciation Expense: $100,000 / 10 = $10,000 per year

For the next decade, your company will record a $10,000 depreciation expense on its income statement. This simple step smooths out the vehicle's cost, giving you a much truer picture of your annual profitability than if you'd taken a $100,000 hit all at once. If you want to dive deeper into the calculations, our guide on how to calculate capital expenditures breaks it down even further.

Key Takeaway: By capitalizing an asset and then depreciating it, you align the expense with the value it creates over its entire lifespan. This prevents one large purchase from distorting your short-term financials and gives you a more honest look at your operational profitability.

To help clarify how these concepts interact, the table below outlines the financial journey of a capital expenditure from purchase to its long-term impact on your books.

Summary of CapEx Financial Treatment

This table outlines the key steps and implications of accounting for and reporting capital expenditures on financial statements and tax returns.

This systematic approach not only ensures accurate financial reporting but also opens the door to significant tax benefits.

Unlocking Strategic Tax Advantages

Beyond just good bookkeeping, the financial treatment of CapEx offers some powerful strategic levers—especially when it comes to taxes. The government actually wants businesses to invest in themselves, and it provides some fantastic incentives to do so. The two big ones you need to know are Section 179 and bonus depreciation.

These tax codes are absolute game-changers. They let businesses accelerate depreciation, allowing you to write off a much larger chunk—or sometimes the entire cost—of an asset in the very year you buy it.

- Section 179 Deduction: This lets you deduct the full purchase price of qualifying equipment or software in the year it’s placed into service, rather than capitalizing and depreciating it over many years.

- Bonus Depreciation: This incentive allows you to take an additional deduction on the cost of certain new and used assets, often after you've maxed out the Section 179 limit.

Think back to our $100,000 vehicle. Under normal depreciation, you’d get a $10,000 deduction this year. But with these incentives, you could potentially deduct the full $100,000 right away, dramatically lowering your taxable income.

Since most major capital projects require careful planning, a solid grasp of project management and finance is essential. It ensures you’re not just making smart investments but are also set up to squeeze every last dollar of tax benefit out of them. Ultimately, these incentives lower the real cost of your investment and free up cash you can pour right back into the business to fuel more growth.

Creating Your CapEx Management Playbook

Understanding what capital expenditures are is the easy part. The real challenge—and what separates the successful from the rest—is managing them well. Great ideas fall flat without great execution, which is why you need a practical playbook for making sure your big investments actually pay off. Think of it as your framework for shifting from reactive, spur-of-the-moment spending to smart, strategic asset management.

A solid CapEx strategy starts with a formal budgeting and approval process. This isn't just about spreadsheets and numbers; it's about forcing a tough, honest conversation before any major purchase. The whole point is to put up a barrier against impulsive spending and make certain every dollar lines up with your bigger business goals. Getting this right is the foundation for seeing a real return on your investments.

Building Your CapEx Budget and Process

A good CapEx plan follows a few key steps. Working through them in order brings discipline and clarity to your long-term investment decisions, making sure each one is thought-out and justified.

- Identify Critical Needs: First, just make a list. Brainstorm all the potential projects on the horizon, from replacing that ten-year-old HVAC unit to jumping on a growth opportunity, like buying the building next door.

- Prioritize Based on ROI: Let's be honest, you can't do everything. Now you have to rank your list. For each potential investment, figure out its projected return on investment (ROI), how long it'll take to pay for itself, and how well it fits with your company's main goals.

- Forecast Costs Accurately: Don't just look at the price tag. A real forecast goes deeper, including costs for installation, training your team, and any ongoing maintenance. This gives you the total cost of ownership, which is the number that actually matters.

- Establish a Formal Request Process: Create a standard form that anyone has to fill out to request capital. This isn't busywork; it forces people to build a clear business case, run a cost-benefit analysis, and map out a timeline.

- Secure and Document Approvals: Make sure every request goes through a clear chain of command. This ensures senior leaders have a chance to review major investments before any money is spent.

A formal CapEx process changes the central question from "Can we afford this?" to "Is this the absolute best use of our capital right now?" It injects discipline and strategic thinking into every major spending decision.

Using Modern Tools for Better Tracking

You could try to manage all of this with a tangled web of spreadsheets, but that gets messy fast and is a recipe for mistakes. Modern business management tools give you a much clearer, more accurate picture of your investments and what they’re really costing you.

Take Homebase, for example. It can be a huge help in tracking the "hidden" costs of CapEx that often get missed. It lets you accurately log the labor hours your team pours into installations or renovations, set up maintenance schedules for new equipment, and pull reports that show you the complete financial picture of your investment.

This screenshot shows how a dashboard can help you manage schedules and track time—two things you absolutely need to nail down the labor cost of any CapEx project.

When you have a clean, digital record of labor and other operational data, you can finally see beyond the initial purchase price and understand the true financial impact of your capital expenditures.

Got Questions About Capital Expenditures? We’ve Got Answers.

Even after you get the basics down, you’ll find that real-world situations bring up a lot of specific questions about capital expenditures. It's one thing to know the definition, and another to apply it to your own business. Let's dig into some of the most common questions that pop up.

Getting these details right can be the difference between clean, accurate financials and some expensive accounting headaches down the road.

Is There a Minimum Cost for Something to be CapEx?

This is a great question, and the short answer is no—there isn't a single, legally-required dollar amount. Instead, most businesses create what's called a capitalization policy.

This is your own internal rule that sets a threshold. For example, you might decide that any purchase over $2,500 will be treated as CapEx, while anything less is just a regular expense. This policy is all about consistency. It stops you from wasting time debating whether a new office chair is a capital asset and ensures the big-ticket items are always handled the right way.

A well-defined capitalization policy is your company's internal rulebook for CapEx. It removes ambiguity and ensures consistent financial reporting, which is critical for accurate records and audits.

Having a clear threshold just makes life easier. It streamlines your bookkeeping by letting you immediately expense smaller purchases, which saves a ton of administrative work.

Can I Include Labor Costs in CapEx?

Yes, absolutely! This is a detail that a lot of people overlook. If your own employees are directly involved in building or installing a new capital asset, their wages for that specific work should be capitalized.

Think about it this way: if your in-house maintenance team spends 40 hours building a new extension on your property, the cost of their labor for that project is just as much a part of the new asset's value as the lumber and concrete. It all gets bundled into the total cost on your balance sheet.

This can include a range of costs:

* Direct labor for your team that’s building or installing the asset.

* Architectural or engineering fees you paid for the design.

* Site preparation costs needed to get the ground ready before work begins.

Tracking these expenses correctly is crucial for capturing the true cost of your investment. It gives you a more accurate valuation for the asset, which in turn leads to a more precise depreciation schedule over its useful life.

How Does CapEx Impact a Company's Cash Flow?

This is a really important distinction to grasp. Even though a huge capital purchase doesn't hit your income statement all at once (because it gets depreciated over time), it creates a major, immediate drain on your cash.

When you buy that new piece of machinery or renovate a building, the full cost is paid upfront (or financed). This cash outflow shows up in the "cash flow from investing activities" section of your cash flow statement.

This is why a company can look incredibly profitable on paper but still be struggling with its cash balance. If a business is making heavy capital investments, its cash reserves can shrink fast. Investors pay close attention to this because it shows where the company is actually putting its money—is it reinvesting for future growth or just holding onto cash? Understanding this dynamic is key to managing your liquidity and planning for those big projects.

Ready to stop wrestling with spreadsheets and streamline your real estate investments? Homebase offers an all-in-one platform to manage fundraising, investor relations, and deal reporting with ease. Focus on closing deals, not on paperwork. Discover how Homebase can help you scale your business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.