What Are Blue Sky Laws Explained Simply

What Are Blue Sky Laws Explained Simply

Our simple guide answers what are blue sky laws, explaining the state-level rules that protect investors and what issuers must know to stay compliant.

Domingo Valadez

Oct 4, 2025

Blog

Before you dive into the world of real estate syndication, it's crucial to understand a key piece of the regulatory puzzle: blue sky laws. These are state-level rules designed to protect investors like you from fraudulent investment schemes.

Think of them as the local sheriff in the Wild West of investing. While the federal SEC sets the national laws of the land, blue sky laws are on the ground, making sure every offering that comes through town is legitimate and not just a slick sales pitch with no real substance.

The name itself comes from a judge who, way back in the day, described a sketchy investment as having no more value than "so many feet of blue sky." The name stuck, and it perfectly captures their purpose: to ensure every investment is backed by something solid.

Understanding the Role of Blue Sky Laws

Long before the SEC was established in the 1930s, individual states were already working to protect their residents from financial scams. This grassroots movement began in Kansas in 1911 and quickly spread. By 1933, almost every state had its own version of these investor protection laws.

You can get a deeper look into the legal foundations on law.cornell.edu to see just how foundational these regulations are.

A great way to think about it is like this: the SEC provides the national building code for investments, but it’s the state regulators—enforcing blue sky laws—who act as the local building inspectors. They show up on-site to make sure every investment offering is built to code and safe for the public.

The Three Pillars of State Securities Regulation

At their heart, blue sky laws are pretty straightforward. They stand on three core principles, each designed to cover a different angle of an investment deal to keep investors safe.

- Registration of Securities: This requires the people offering the investment (the issuers) to file detailed information about it with the state. It's all about transparency.

- Licensing of Sellers: This ensures that the brokers and advisors selling the investment are properly licensed and meet professional and ethical standards.

- Enforcement of Anti-Fraud Provisions: This gives state regulators the teeth to go after bad actors, investigate fraud, and get justice for investors who have been wronged.

This three-pronged approach means that both the investment itself and the people selling it are held to a high standard.

To make this crystal clear, here’s a quick breakdown of these core components.

Core Pillars of Blue Sky Laws

This table shows how each part works to create a secure environment for your capital.

Together, these pillars form the bedrock of investor protection at the state level, working hand-in-hand with federal regulations to make the investment landscape safer for everyone involved.

Why Blue Sky Laws Were Created

To really get a handle on blue sky laws, you have to picture the investment world of the early 1900s. It was the Wild West. Before any real federal laws were in place to protect investors, the market was crawling with swindlers and fast-talking promoters. They'd sell shares in companies that had no assets, no operations—sometimes not even a real product.

These schemes were famously described as being backed by nothing more than "so many feet of blue sky." A promoter would spin a tale of massive profits just over the horizon, maybe from a newly discovered gold mine or a revolutionary new gadget. They were convincing enough to get everyday folks—farmers, factory workers, small business owners—to part with their life savings.

Of course, when these sham companies went belly-up, investors were left holding worthless stock certificates with no way to get their money back. This wasn't a small-time problem; the fraud was so widespread it sparked public outrage and a loud call for the government to step in.

A Grassroots Movement for Investor Protection

What’s fascinating is that blue sky laws didn't start at the federal level and trickle down. They grew from the ground up. Individual states saw what was happening to their citizens and decided to take action long before the U.S. Securities and Exchange Commission (SEC) even existed.

Kansas led the charge, passing the very first comprehensive securities law in the country back in 1911. This was a landmark piece of legislation that kicked off a chain reaction.

This state-by-state effort wasn't just a minor legal trend; it was a full-blown movement. The idea was simple but powerful: states have a duty to stop fraudulent investments from being sold to their residents in the first place.

It was a total reversal of the old "buyer beware" mindset. Now, the government was stepping in to screen investment deals before they could do any harm.

The Foundation of Modern Regulation

The momentum was unstoppable. Between 1911 and 1931, nearly every state jumped on board. In an incredible legislative push, 47 out of 48 states passed their own blue sky laws to fight the rampant fraud of the pre-Great Depression era. If you're curious about this period, you can explore the history of this rapid legislative adoption and see how it shaped the American economy.

This patchwork of state regulations laid the groundwork for the core principles we still rely on today:

* Full Disclosure: Companies must be upfront and honest about their business.

* Seller Accountability: Brokers and agents have to be licensed and meet certain standards.

* Anti-Fraud Powers: State regulators gained the authority to go after bad actors.

At the end of the day, blue sky laws were born out of pure necessity. They were a direct response to predatory schemes that were ruining the financial lives of countless Americans. They built the foundation for investor protection that helps maintain trust and integrity in our markets even now.

How States Enforce Blue Sky Laws

So, we know why blue sky laws exist, but how do states actually put them into practice? This is where the rubber meets the road for anyone raising capital. States don't have a single, universal playbook. Instead, they generally rely on one of three methods to review and register securities offerings, each with its own level of scrutiny.

You can think of it like getting a driver's license. The process isn't the same for everyone; it depends on your driving history and what kind of vehicle you want to drive. For investment deals, the path to approval depends on the company's track record and the type of security being offered.

Registration by Coordination

The most common route, by far, is registration by coordination. This method is designed for companies that are simultaneously registering their securities with the federal Securities and Exchange Commission (SEC).

It’s a lot like moving to a new state and transferring your driver's license. You don't have to start from square one and take the full driving test all over again. The new DMV trusts that your old state did its job, so they simply coordinate with them and process your paperwork.

This works the same way. The company files the exact same documents with the state that it submitted to the SEC. The state's review happens in tandem with the federal one, and once the SEC gives the green light, the state registration automatically becomes effective. It's a sensible approach that harmonizes the state and federal systems, making life much easier for larger, public offerings.

Registration by Notification

Next up is registration by notification. This is the easiest path available, but it’s an exclusive club reserved for well-established, blue-chip companies. Think of this as the express lane—like a simple online renewal for a driver with a decades-long, spotless record. The state already trusts you, so the process is minimal.

To qualify for this streamlined filing, a company has to meet some pretty high standards. They usually need to have:

* Been in business for at least a few years (often three or more).

* A solid history of profitability.

* A clean record with no defaults on any debt.

Because these companies have proven themselves to be financially sound, the state’s review is more of a formality than a deep-dive investigation. It’s a privilege earned through years of stability and success.

Registration by Qualification

The most intensive method is registration by qualification. This is the catch-all for any offering that doesn't fit the other two categories. You can think of this as applying for a commercial pilot's license for the first time—the scrutiny is off the charts because the stakes are so high.

Here, the state securities administrator conducts a full "merit review." They'll meticulously examine every detail of the offering—the business plan, the financials, the backgrounds of the promoters, and the terms of the deal itself.

They aren’t just checking boxes to make sure everything was disclosed. They’re making a fundamental judgment on whether the investment is “fair, just, and equitable” for potential investors. This hands-on, deep-dive approach is how states provide the highest level of protection, especially for offerings that are more complex, speculative, or new to the market.

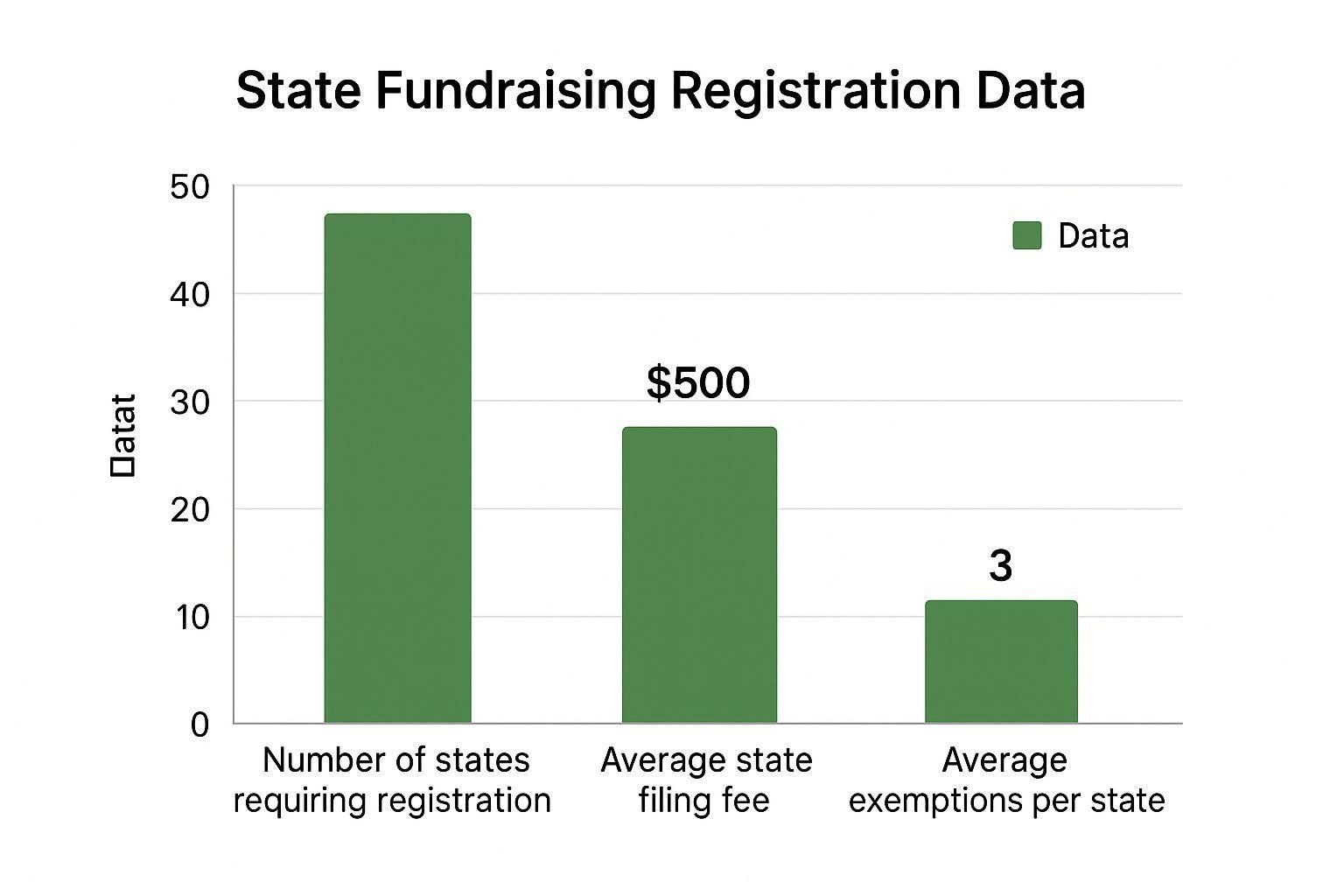

Navigating State-by-State Differences

If there’s one thing to understand about blue sky laws, it’s this: there is no “one-size-fits-all” approach to compliance. Trying to navigate these rules is like looking at a patchwork quilt of regulations. From a distance, they all seem to serve the same purpose, but up close, every single state has stitched its own unique patterns, rules, and requirements into its legal fabric. This makes raising capital across state lines a genuinely complex puzzle.

In an effort to create some consistency, the Uniform Securities Act was developed as a model law—a template meant to bring some order to the chaos. While it has been widely adopted in some form by about 40 U.S. states, most states couldn't resist adding their own modifications. So, while the foundation of requiring securities registration and proper licensing is common, the exact rules you have to follow can still be wildly different from one state to the next. You can get a deeper perspective on these state-level regulations from Yieldstreet.

Why State Variations Matter

Let’s put this into a real-world context. Imagine you’re a real estate syndicator with a great new apartment building deal, and you have potential investors lined up in California, Texas, and Florida.

This single investment offering suddenly requires three completely different compliance game plans.

- In Texas, you might get by with a straightforward notice filing and a standard fee. Simple enough.

- But then Florida might require you to add specific disclosures about the risks of real estate investments, tailored just for their residents.

- And then there’s California. Known for its tough investor protection laws, California might put your offering through a full-blown “merit review,” where regulators decide if the deal is fundamentally fair to investors.

Failing to get it right in just one of these states can derail your entire capital raise and land you in serious legal trouble.

This is the reality on the ground for syndicators. The requirements are universal, but the details are what trip people up.

While every state requires a filing, the financial and legal hurdles you have to clear are unique to each one.

Comparing Key Differences

To really hammer this home, let's look at a simplified comparison showing how different states might treat the exact same securities offering.

State-by-State Blue Sky Law Variations Example

The core takeaway here is that federal compliance is only half the battle. State-level requirements are mandatory and non-negotiable, making expert legal counsel an absolute must for any multi-state offering.

This patchwork of rules is precisely why a surface-level understanding just won't cut it. To truly grasp what blue sky laws are, you have to appreciate the unique legal landscape of every single state where you intend to raise money.

Blue Sky Laws in Real Astate Investing

When you hear the term "blue sky laws," it's easy to picture Wall Street stockbrokers, not real estate deals. But for anyone involved in real estate syndication, these state-level rules are anything but abstract. They're a fundamental part of the business, shaping how capital is raised and deals are structured.

So, how does a real estate deal get tangled up in securities law? It all comes down to the syndication model. A sponsor (the General Partner or GP) pulls together funds from a group of passive investors to buy a large asset, like an apartment building or a shopping center. Legally speaking, that's not just a group investment—it's the sale of a security. And the moment you sell a security, blue sky laws kick in.

How Syndication Triggers State Oversight

Once a deal is defined as a security, a whole new layer of state and federal compliance comes into play. A common mistake is thinking the rules only apply in the state where the property is located. That's a dangerous assumption.

The reality is, a sponsor must comply with the blue sky laws for every single state where their investors live.

Let's say you're a syndicator based in Texas, and you're buying a property there. If you raise money from investors in California, Florida, and New York, you have to satisfy the securities regulations in all three of those states, plus Texas. This state-by-state puzzle is one of the trickiest parts of raising capital. To dig deeper into what this looks like, you can learn more about the specifics of blue sky filings for real estate syndication and see how the process actually works.

Federal Exemptions Do Not Eliminate State Rules

Most real estate syndications operate under federal exemptions, like Regulation D, to avoid the massive cost and paperwork of a full-blown SEC registration. This is a standard and smart practice.

However—and this is a big one—being exempt from federal registration does not make you exempt from state blue sky laws.

This is a crucial point that trips up so many new sponsors. A federal exemption doesn't give you a free pass at the state level. You still have to do what’s called a “notice filing,” which basically means telling the state about your offering and paying a fee. And no matter what, the anti-fraud provisions of blue sky laws always apply.

Ignoring these rules can have catastrophic consequences. If a sponsor botches the filing in an investor's state, that investor could gain a "right of rescission." This is a powerful legal right that allows them to demand a full refund of their investment, plus interest, at any time. A single rescission request can put the entire deal—and the sponsor's own capital—in serious jeopardy. Simply put, getting blue sky laws right isn't just a good idea; it's a non-negotiable part of the business.

When Federal Rules Override State Laws

So, you've got this complex web of state-specific blue sky laws. It seems like a lot to handle, right? But here's the thing: these state laws don't apply to every single investment out there. Sometimes, federal law steps in and basically tells the state laws to take a backseat. This concept is known as federal preemption.

Think about it like this: you're driving through a small town that has a local speed limit of 30 mph. But you're on a major interstate highway that cuts right through it, and the federally mandated speed limit is 70 mph. On that highway, the federal rule wins. The same idea applies to certain types of securities offerings.

The Game-Changer: NSMIA

This whole federal vs. state hierarchy was really cemented in 1996 with the National Securities Markets Improvement Act (NSMIA). This was a major piece of legislation designed to cut through the regulatory red tape for certain investments by creating a category called “covered securities.”

The goal was simple: stop forcing companies to deal with 50 different registration processes for the same offering. By exempting these "covered securities" from state-level registration, the feds made the capital markets a lot more efficient.

So, what qualifies as a covered security? Generally, it's things like:

* Big Board Stocks: Any security listed on a national exchange like the NYSE or Nasdaq.

* Mutual Funds: Shares offered by well-known registered investment companies.

* Certain Private Deals: This is the big one for our world. It specifically includes offerings made under Rule 506 of Regulation D, which is the go-to exemption for most real estate syndications.

Don't Get Too Comfortable, States Still Have a Say

Now, just because your offering is a "covered security" doesn't mean you can completely ignore the states. This is a crucial point that trips people up all the time. Getting this wrong can land you in serious trouble.

Even when an offering is federally covered and exempt from state registration, the states can still require notice filings, collect their fees, and—most importantly—bring the hammer down on any fraud they uncover.

This means that while the feds streamline the paperwork, they don't take away a state’s power to protect its residents. State securities regulators are still very much the local cops on the beat, ready to investigate bad actors and protect investors within their borders. Think of it as a courtesy notice—you're telling them you're doing business in their state, even if you don't need their permission slip to do it.

Common Questions About Blue Sky Laws

Even after getting the basics down, a few common questions always seem to pop up when you're trying to apply blue sky laws to a real-world deal. Let's tackle some of the most frequent ones we hear from both investors and syndicators to clear up any lingering confusion.

Think of this as your quick-reference guide.

Are Blue Sky Laws the Same in Every State?

Not even close, and that’s the single most important thing to grasp. While many states have adopted a version of the Uniform Securities Act to create some level of consistency, each one puts its own spin on the rules.

One state might have a simple notice filing, while the one next door conducts a deep "merit review" to decide if your deal is fair to its residents. This patchwork of regulations is exactly why compliance has to be a state-by-state effort, tailored specifically to where each of your investors lives.

Do SEC Rules Replace Blue Sky Laws?

Absolutely not. This is a common and dangerous misconception. Federal SEC compliance and state-level compliance are two separate mountains you have to climb. Unless your deal is structured as a "federally covered security"—like a popular Rule 506 of Regulation D offering—you typically have to register at both levels.

And here's the kicker: even for those federally covered deals, states don't just disappear. They can still demand notice filings, charge fees, and—most importantly—bring the hammer down with fraud investigations if something smells fishy. Federal preemption isn't a get-out-of-jail-free card.

What Happens If You Violate a Blue Sky Law?

The fallout can be swift, severe, and financially catastrophic for a syndicator. State regulators don't mess around. They can slap you with heavy fines and issue cease-and-desist orders that can stop your capital raise dead in its tracks.

But the real killer is the "right of rescission." This powerful legal right gives your investors the ability to demand their entire investment back, plus interest, if you didn't follow the rules when selling them the security. Imagine having to refund a huge chunk of your capital mid-project—it’s a risk you simply can’t afford to take.

Ready to stop worrying about compliance and focus on what you do best? Homebase is the all-in-one platform built to take the busywork out of real estate syndication. From professional deal rooms and secure e-signatures to investor updates and distributions, we help you manage the entire process effortlessly. Learn more and streamline your next deal at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.