Mastering Blue Sky Filings for Real Estate

Mastering Blue Sky Filings for Real Estate

A definitive guide to blue sky filings for real estate syndication. Learn state rules, avoid common mistakes, and ensure your offering is compliant.

Domingo Valadez

Jul 19, 2025

Blog

At its heart, a blue sky filing is simply a state-level requirement to register a securities offering. It's the state's way of protecting its residents from fraudulent investment schemes. While federal regulations like Regulation D set the nationwide rules for your real estate syndication, these state-specific laws add a critical layer of local oversight.

Think of it this way: the SEC gives you the green light on a national level, but each state where you raise capital wants to know you're coming.

Why Blue Sky Filings Matter in Real Estate

It’s easy to get tunnel vision on federal exemptions. Many syndicators pour all their energy into perfecting their Rule 506(b) or 506(c) offering under Regulation D. And while that's absolutely vital, it's only half the compliance journey.

Securing a federal exemption doesn't give you a free pass at the state level. This is precisely where blue sky laws come into the picture. They bridge the gap between your federal paperwork and your on-the-ground fundraising efforts.

Even when you've done everything right with the SEC, states still have the authority to enforce their own rules, which usually boil down to three things:

- Notice Filings: States want a heads-up that you're raising money from their residents. This is often as simple as sending them a copy of the Form D you filed with the SEC.

- Filing Fees: Of course, there's a cost. Almost every state charges a fee to process your notice, ranging from a couple of hundred dollars to a few thousand.

- Anti-Fraud Powers: This is the big one. States always retain the right to investigate and prosecute fraud. Your blue sky filing creates a paper trail and proves you're operating above board.

Where Did the Name "Blue Sky" Come From?

The term itself paints a vivid picture of why these laws were created. It originated in the early 20th century, a wild west era for investments before the SEC even existed. Scammers were selling securities in companies that had no actual assets or business operations.

In a landmark 1917 Supreme Court case, a justice famously described these shady ventures as having no more substance than "so many feet of blue sky." The name stuck. By 1933, nearly every state had enacted its own "blue sky" laws to shield its citizens from these empty promises. If you're a history buff, you can get a deeper dive into this legal backstory and its modern-day implications from the legal experts at Thomson Reuters.

Understanding this history is key. Blue sky laws aren't just red tape; they're the legacy of a century-long fight to keep private markets honest.

For a real estate syndicator, mastering these rules is not just a legal necessity—it’s a competitive advantage. It signals to investors that you are a professional, thorough operator committed to doing things the right way, building a foundation of trust that is critical for long-term success.

Federal Rules vs. State Rules: A Balancing Act

So, how do federal and state regulations work together? The key piece of legislation is the National Securities Markets Improvement Act of 1996 (NSMIA). This act streamlined things by creating "covered securities," which includes offerings under Rule 506—the most common path for real estate syndicators.

NSMIA preempts (or overrides) a state's ability to perform its own deep-dive, merit-based review of a Rule 506 offering. In short, if the SEC's rules are met, a state can't block your deal just because they don't like it. However, Congress deliberately left a few powers in the states' hands: the right to require notice filings and collect fees.

This creates the two-part compliance system we have today. You file Form D with the SEC to claim your federal exemption, and then you complete a blue sky filing in every state where you have an investor.

Let's break down the key differences between these two layers of regulation.

Federal vs State Securities Regulation At a Glance

The table below clarifies the distinct roles that the federal government and individual states play in overseeing a real estate syndication. While they work in tandem, their focus and authority differ significantly.

Understanding this dual system is non-negotiable. Ignoring the state component is one of the most common—and costly—mistakes a syndicator can make. The consequences can range from hefty fines to the dreaded right of rescission, which gives an investor the power to demand their entire investment back. And that's a call no one wants to get.

What Goes Into Your Filing Package?

Before you can even think about filing in individual states, you've got to get your house in order. I tell every new syndicator to think of this as prepping for a big campaign. You wouldn't launch without having all your materials ready, right? Getting your core documents assembled and organized from the start is the key to making the state-by-state process run smoothly. It’s the best way to avoid those painful, last-minute scrambles and costly mistakes.

Each of these documents plays a specific role, but they all work together to paint a clear, compliant picture of your offering. Let's walk through the essential building blocks you’ll need.

The Federal Form D

First up is the Form D. This is the absolute cornerstone of your entire compliance strategy. It’s the official notice you file with the Securities and Exchange Commission (SEC) to declare you're using a federal exemption from registration, which for most of us in real estate is Rule 506 of Regulation D.

The form itself isn't terribly complicated, but it demands perfect accuracy. You'll disclose the basics of your deal:

* Who the issuer is (your syndication LLC)

* The total amount you're raising

* How many investors are in the deal

* The exact exemption you're claiming

Think of your Form D as your syndication's passport. You get it stamped by the SEC first, and then you show copies to every state where you take money. At its heart, a state blue sky filing is often just this Form D, a consent form, and a check.

My Two Cents: Get your Form D filed with the SEC before you start the state-level paperwork. While you technically have 15 days after the first sale, having the filed form in hand makes everything else easier. It shows state regulators you’re on top of your game.

The Private Placement Memorandum (PPM)

If the Form D is your passport, the Private Placement Memorandum (PPM) is the detailed, all-inclusive travel guide for your investors. I can't stress this enough: this is your most critical disclosure document. It’s the comprehensive story of the investment, the property, the sponsorship team, and—most importantly—all the potential risks.

A well-written PPM is your best line of defense if things ever go sideways. Its job is to give investors every material fact they need to make an informed decision. That means you lay it all out there—the good, the bad, and the ugly.

This level of transparency is exactly what blue sky laws are designed to enforce. The whole point is to protect investors by forcing issuers to be upfront about risks, financials, and the securities themselves. You can find a great breakdown of these state-level investor protections on ContractsCounsel.com.

The Subscription Agreement and Investor Questionnaire

Next, you have the Subscription Agreement. This is the actual contract between an investor and your company. It’s where they formally agree to buy a certain number of shares or units in the deal for a specific price, and it spells out the exact terms of that purchase.

Paired with this is the Investor Questionnaire. This is how you verify an investor’s status, especially whether they are accredited. You'll ask for financial information and investing experience to confirm they meet the legal standard for your exemption (like Rule 506(b) or 506(c)). This isn't just bureaucratic busywork; it's your tangible proof that you sold securities only to people who were legally qualified to buy them.

The Consent to Service of Process

Finally, there's the Consent to Service of Process, which is usually a standard document called a Form U-2. Pretty much every state is going to ask for this.

So what is it? It’s a simple legal form where you appoint the state's securities administrator as your agent. In plain English, it just means that if there's ever a legal dispute, the state can formally serve you legal papers without having to track you down across state lines. It’s a standard, non-negotiable part of the deal when you submit to a state's jurisdiction.

A Practical Walkthrough of the Filing Process

Alright, you've got your core legal documents in order. Now comes the part where the rubber meets the road: the blue sky filings. This is where we move from theory to action. I know the process can seem like a legal maze, but once you break it down into a repeatable workflow, it becomes a manageable part of your capital raise instead of a dreaded chore. The whole game is about methodical preparation and knowing the steps.

Let's dive into the actual logistics, from figuring out which states you even need to file in, to hitting "submit," and handling what comes after.

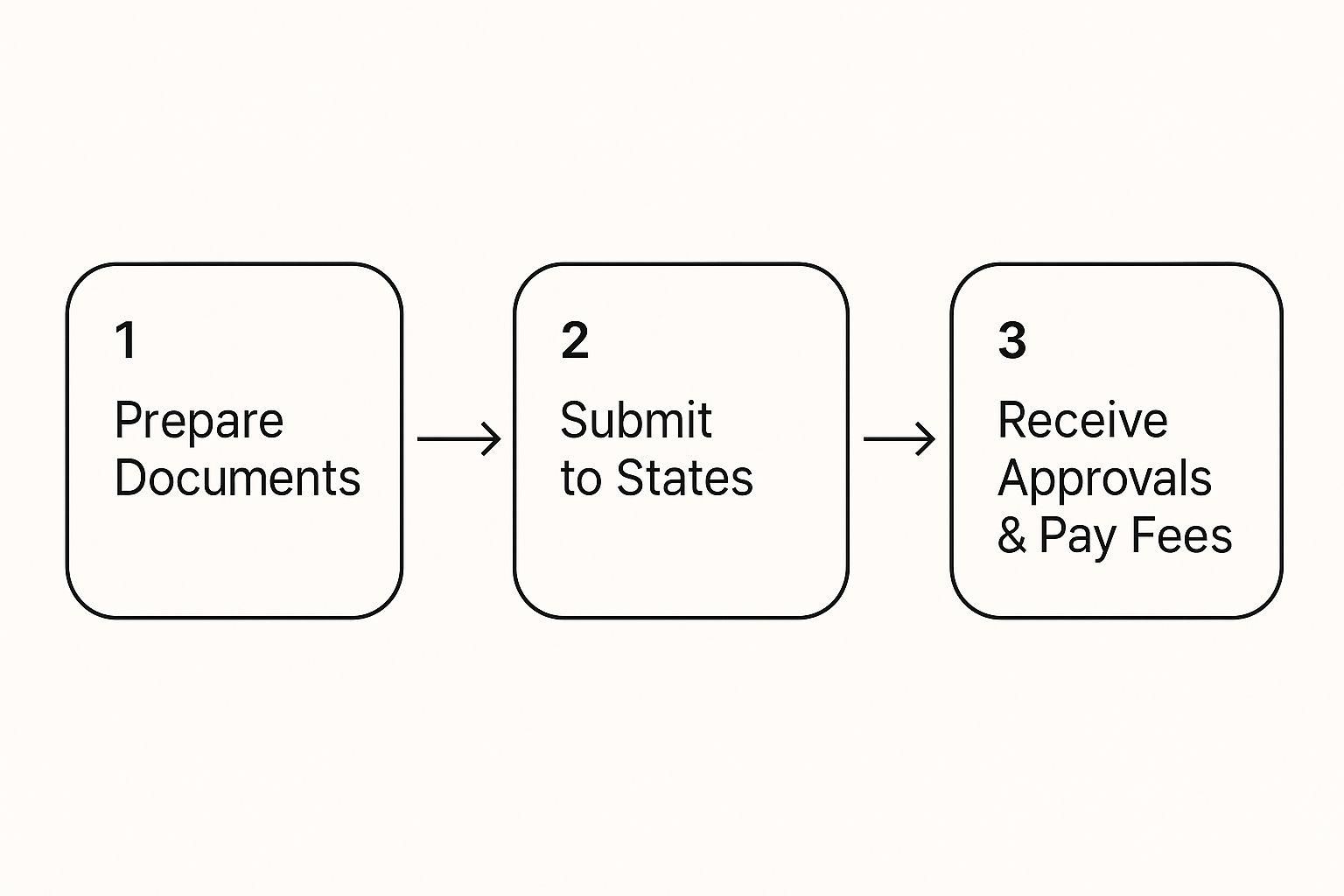

This image really simplifies the core workflow into three key stages.

As you can see, success really boils down to doing your homework before you ever get in front of a state regulator. After that, it's all about systematic submission and paying the fees.

Create Your Pre-Filing Checklist

Before you even dream of logging into a state portal, get a master checklist going. This isn't just a "nice-to-have"; it's your best defense against mistakes. I can tell you from experience, seasoned syndicators live and die by their checklists. They prevent those small, overlooked details that can cause costly delays or even an outright rejection.

Think of this checklist as the central command for your filing. Here’s what it absolutely must include:

- Entity Details: The exact legal name of your LLC (e.g., "123 Elm Street Holdings, LLC"), its formation date, and its principal address. No typos allowed!

- Offering Information: The total offering amount, the date you took your first investor's check, and the federal exemption you're using (most commonly, Rule 506(b)).

- Investor Roster: This is your map. It's a running list of every single investor, their state of residence, and how much they invested. This tells you exactly where you need to file.

- Document Links: Keep links to the final, filed version of your Form D, your Private Placement Memorandum (PPM), and the standard Form U-2 all in one place.

Doing this pre-flight check ensures all your data is consistent and ready to go. It turns what could be a frantic scavenger hunt for information into a straightforward copy-and-paste task.

Navigating the Electronic Filing Depository

Most states have thankfully moved their process online through the Electronic Filing Depository (EFD), a system run by the North American Securities Administrators Association (NASAA). The easiest way to think of it is as the Common App for blue sky filings.

It's a huge time-saver. Instead of mailing paper forms to a dozen different state offices, you can upload your documents and pay fees for multiple states through this one portal. For any modern syndicator, getting comfortable with the EFD is non-negotiable.

Here's a pro-tip I learned the hard way: set up your EFD account well before your filing deadline. The account creation and verification can take a few business days. You do not want that delay to be the reason you blow past your 15-day filing window.

The EFD system is pretty intuitive. It walks you through selecting the states where you have investors, uploading your Form D and other required documents, and processing the fees. But be careful—while the EFD covers most states, a handful still have their own unique online portals or, in rare cases, still demand paper filings. New York, for example, is notorious for its distinct process that operates completely outside the EFD. Always double-check the specific rules for every state on your investor roster.

Post-Filing Management and Diligence

Hitting "submit" and paying the fee doesn't mean you're done. Once the state accepts your notice, you’ll get a confirmation or an approval letter. This is a critical document. Download it immediately and save it in your deal folder as your proof of compliance.

Your job isn't over yet, either. Your responsibilities continue for as long as the offering is open. If any material information changes—say, you decide to increase the total size of your capital raise—you are required to file an amendment. This means filing an amended Form D with the SEC first, then submitting that updated form to each state via the EFD.

Staying organized is everything. A simple spreadsheet or a specialized compliance platform like Homebase can be a lifesaver for tracking filing dates, approval statuses, and renewal deadlines for each state. This level of diligence protects you from penalties and shows both regulators and your investors that you run a professional, buttoned-up operation.

A State-by-State Look at Filing Requirements

When it comes to blue sky filings, thinking you can use a one-size-fits-all approach is a recipe for disaster. I've seen it happen. Once you get past the federal SEC filing, you’re suddenly facing a patchwork of 50+ different rulebooks, deadlines, and fee schedules.

This is exactly where many first-time syndicators get tripped up. They make the mistake of assuming that what works in Texas will be perfectly fine in California. It won’t be.

The secret to not falling into this trap is knowing that states generally fall into a few buckets based on how they treat Rule 506 offerings. If you can identify which bucket a state belongs to, you can anticipate the scrutiny, costs, and paperwork long before a deadline is breathing down your neck.

The Main Categories of State Filings

From a practical standpoint, I like to group states into three main categories. This isn't just a textbook definition; it's a mental model that helps you build a solid strategy for your capital raise instead of just reacting to each state's demands.

- Notice Filing States: These are the most common and, thankfully, the most straightforward. They fully accept the federal preemption for Rule 506 deals, meaning they don't do their own deep-dive review. All they want is a "heads up" that you're raising money from their residents. The filing is typically simple: a copy of your Form D, a Form U-2, and the filing fee. Done.

- Fee-Only States: An even smaller group of states makes the process even easier. Places like Georgia and Colorado might only ask for your Form D and a check. There’s almost no extra paperwork, making them some of the simplest jurisdictions to work in.

- Strict Review States: This is where things get serious. These states, while still bound by federal rules for Rule 506, have piled on their own unique and often complex requirements. They are known for having robust state securities departments that will scrutinize every detail of your filing for completeness and accuracy.

Just knowing which states fall into which bucket is the first step toward building an efficient compliance workflow.

The Unique Headaches of Strict Review States

States like New York and California are in a league of their own. They are the poster children for "strict review," and they demand a much higher level of diligence from syndicators. Ignoring their specific rules is one of the most common and expensive mistakes you can make.

The compliance burden and costs here are significantly higher. We're talking fees that can range from a few hundred to several thousand dollars per state, not to mention the administrative grind of keeping everything in order. Understanding these rules is absolutely essential for avoiding state enforcement actions.

Here's a real-world scenario I've seen play out: A syndicator is raising capital for a great multifamily deal and has investors lined up in Florida, Texas, and New York. They correctly file their Form D with the SEC and then use the EFD system to notify Florida and Texas within the 15-day window. Thinking the process is the same everywhere, they don't do anything for New York until after they’ve already accepted the investor's funds. This is a critical error.

New York is a "pre-filing" state. You must submit your paperwork and get approval before you can legally offer the security to a New York resident. By taking the money first, the syndicator violated New York's Martin Act—one of the most powerful anti-fraud statutes in the country. Now they're on the hook for potential fines and giving the investor rescission rights.

This is a perfect example of why you absolutely need a state-by-state strategy from day one.

Comparison of Blue Sky Filing Requirements in Key States

To really drive this home, let’s look at a side-by-side comparison of a few key states. The table below isn’t exhaustive legal advice, but it clearly illustrates the dramatic differences you'll encounter.

As you can see, the operational difference between filing in Florida and filing in New York is massive. One is a simple post-sale notice; the other is a pre-offering gatekeeper you must pass through first.

For syndicators looking to understand the other side of the table, check out our guide on how to invest in real estate syndication. This knowledge will ultimately make you a more well-rounded and successful sponsor. In the end, building a compliance calendar that tracks each state's specific deadline and requirement isn't just a best practice—it's essential for survival.

Costly Mistakes Syndicators Make (And How You Can Avoid Them)

We all learn from experience, but in the world of securities law, it’s a whole lot cheaper to learn from someone else's mistakes. The Blue Sky filing process has its share of pitfalls, and a simple oversight can easily snowball into serious penalties, deal-killing delays, or even legal trouble.

These aren't just textbook warnings. They're real-world lessons from syndicators who found out the hard way. By understanding these common blunders, you can build a smarter compliance strategy that protects your deal, your investors, and your hard-earned reputation.

Missing the Filing Deadline

This is probably the most frequent—and frustrating—mistake because it's so easy to avoid. Most states give you 15 calendar days from the date you receive funds from an investor (the "first sale") to get your notice filed. Simple enough, right? The problem is, many syndicators assume this is a universal rule. It’s not.

A few key states, with New York being the most prominent, are "pre-filing" states. This means your paperwork must be filed and approved before you can even start talking to a potential investor there. The difference is critical.

Here's a scenario I've seen play out: A GP is raising capital for a great multifamily deal. They accept a $100,000 check from a New York investor and, being diligent, file the notice with New York's online portal just a week later. They think they're well within the 15-day window. But they've just violated New York's powerful Martin Act. The filing had to come before the offer. Now, the syndicator faces potential fines and, even worse, the investor may have the right to demand their entire investment back.

The fix here is organizational. You need a compliance calendar that doesn't just track when checks come in, but also the specific filing rules for every state you're targeting. Treat pre-filing states like New York with extreme care. Their process must be the very first step you take.

Botching the State Filing Fees

It sounds like a minor detail, but messing up the filing fee can get your entire submission kicked back. State fee schedules are notoriously inconsistent. Some are simple flat fees, while others are calculated based on the total size of your offering or just the amount you plan to raise in that state.

For example, a state might charge 0.1% of the offering amount, but with a $250 minimum and a $1,000 maximum. If you just send in the minimum without doing the math, you’ll get a deficiency notice. That grinds everything to a halt until you can correct it and refile.

Getting this right is all about diligence:

- Always Triple-Check the Source: Pull the current fee schedule directly from the state securities administrator's official website. These amounts can and do change without much fanfare.

- Do the Math: For any variable fees, run the numbers and keep a record of your calculation.

- Ask Your Attorney: If you're ever in doubt, a quick confirmation from your securities attorney is well worth the peace of mind.

Submitting an Incomplete Form D

Your Form D is the master document. Every single error or omission on it gets copied and pasted into every state filing you make. I’ve seen it all—incorrect legal entity names, wrong offering amounts, or forgetting to list all the key principals.

State regulators don't see these as typos; they see them as potential misrepresentations. An inaccurate Form D is a red flag that can trigger a deeper review, delaying your entire capital raise while you scramble to file amendments. Get the foundation right, and everything else flows smoothly.

Forgetting to File Amendments

Your job isn't done after the initial filing gets a thumbs-up. If anything material changes about your offering, you have to update your filings. The classic example is increasing the size of your raise.

Let's say you originally filed to raise $3 million but find more demand and decide to bump it to $4 million. First, you have to file an amended Form D with the SEC. Then, you have to turn around and submit that amended Form D to every single state where you previously filed. If you skip that second step, your state filings are no longer accurate, and you're officially out of compliance.

Frequently Asked Questions on Blue Sky Filings

Even the most seasoned syndicators run into specific questions about blue sky filings, usually right in the middle of a hectic capital raise. I’ve put this section together to tackle the most common—and often most urgent—issues that pop up. Think of it as your quick-reference guide when you're in the trenches.

Getting these details right isn't just about checking a box; it's about navigating strict deadlines and avoiding some pretty serious legal heat. Let’s get you some clear, direct answers so you can handle these situations with confidence.

When Exactly Do I Need to Make a Blue Sky Filing?

This is where so many people get tripped up, because the timing is absolutely critical and, frustratingly, it changes from state to state.

The most common deadline you'll hear about is 15 calendar daysafter you take the first dollar from an investor in a particular state. A lot of syndicators treat this as the universal rule, but that’s a dangerous assumption.

A few states, with New York being the most famous example, are "pre-filing" states. This means you have to get your notice filed and approved before you can even formally offer the investment to anyone there.

My Two Cents: Don't ever just assume the 15-day rule applies. Your best friend here is a meticulously kept compliance calendar. Track every investor's state, their commitment date, and the specific filing deadline for that state. It’s the single best way to stay out of trouble.

What Happens If I Forget to File in a State?

Forgetting a blue sky filing isn’t a small slip-up; it's a serious compliance breach that can bring a world of hurt. State regulators can hit you with hefty fines, slap you with a cease-and-desist order to shut down your fundraising in that state, and—worst of all—give the investor a right of rescission.

A right of rescission is a syndicator’s nightmare. It’s a legal do-over button for the investor, allowing them to demand their entire investment back, plus interest. It doesn't matter if your deal is knocking it out of the park. This not only puts a huge financial strain on the project but can also torch your reputation.

If you realize you’ve missed a filing, call your securities attorney immediately. Don't wait. They can help you explore options like voluntary late filing programs to hopefully mitigate the damage.

Do I Need to File an Amendment If My Offering Amount Changes?

Yes, almost always. The Form D you file with the SEC is the bedrock of your state blue sky filings, and it includes key details like the total amount you plan to raise.

If that number changes—especially if you're increasing the raise—you have to update everyone. First, file an amended Form D with the SEC. Then, you have to turn around and send that updated form to every single state where you originally filed a notice.

Let’s walk through a real-world example:

* You file a Form D with the SEC for a $5 million raise.

* You make notice filings in Texas, Florida, and California based on that amount.

* Investor demand is stronger than expected, so you decide to increase the offering to $6 million.

* Your next move: File an amended Form D with the SEC showing the new $6 million total. Then, you must submit that amended form to the regulators in Texas, Florida, and California.

Skipping this step looks like a material misrepresentation to regulators, and that can trigger penalties. It's always better to be proactive and file amendments promptly.

Can I Handle Blue Sky Filings Myself or Do I Need a Lawyer?

Look, is it technically possible for you to handle your own filings? Sure, if you have a dead-simple offering with maybe one or two investors in states with easy rules. But for the vast majority of real estate syndicators, I would say it’s highly inadvisable.

Securities law is a tangled web of complex, nuanced rules that vary wildly from state to state. The odds of making a mistake—misreading a deadline, sending the wrong fee, using an outdated form—are just too high. And the penalties for getting it wrong are severe.

A good securities attorney lives and breathes these regulations. They are your shield. The fee you pay them is a critical business expense that protects you from potentially catastrophic legal and financial headaches down the line.

Are you tired of managing your real estate syndication with scattered spreadsheets and endless email threads? Homebase is the all-in-one platform built by syndicators, for syndicators. We automate fundraising, streamline investor relations, and simplify compliance so you can focus on what you do best: finding great deals. See how you can manage unlimited deals and investors for one flat fee.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.