Your Guide to Value Add in Real Estate Investing

Your Guide to Value Add in Real Estate Investing

Discover how value add in real estate works. This guide breaks down proven strategies for finding, funding, and profiting from underperforming properties.

Domingo Valadez

Oct 17, 2025

Blog

At its heart, value-add real estate is about buying a property that's not living up to its potential and then taking deliberate steps to make it more valuable. You’re not just banking on the market to lift all boats; you're actively creating value yourself.

It's a hands-on strategy where investors find underperforming assets and improve them, either through physical upgrades or better management. This process is often called "forcing appreciation."

What Value Add in Real Estate Actually Means

Think of it this way: instead of buying a perfectly polished, move-in-ready trophy property, a value-add investor is looking for a hidden gem. They’re hunting for assets with a great "story"—properties that are fundamentally sound but are held back by fixable problems.

This is a strategy of transformation. It’s not about buying and holding passively. It’s about rolling up your sleeves and creating new value where it didn't exist before.

The Core Principle: Forcing Appreciation

The key concept that drives this whole strategy is forced appreciation. This is completely different from market appreciation, which is the passive increase in value that happens when the entire market rises. Forced appreciation is active; it's the direct result of the investor's work.

Common targets for a value-add approach are properties that are struggling with things like:

- Dated Interiors: Think 1980s kitchens, worn-out flooring, or old, inefficient fixtures that are turning off modern tenants.

- Below-Market Rents: The property might have long-term tenants paying rents that are well below what the neighborhood currently commands.

- Inefficient Management: Poor operational habits can lead to high vacancy rates, unhappy tenants, or bloated expenses.

A savvy value-add investor looks right past the peeling paint and overgrown landscaping. They see the property for what it could be, identify the gap between its current performance and its true potential, and then build a solid plan to close that gap.

Why This Strategy Works

The beauty of this approach is that it puts more control in the investor's hands. A rising market is always a nice tailwind, but a well-executed value-add project can turn a profit even when the market is flat or uncertain. It’s particularly effective in sectors like multifamily and logistics, where tenant demands are always evolving.

The numbers back this up. Globally, the S&P Global Property Index showed a one-year total return of 14.1%, which actually outpaced major stock indices like the S&P 500 (11.7%). This really underscores the power of actively repositioning assets to meet what the market wants. You can dig deeper into this trend in Deloitte's comprehensive commercial real estate outlook.

Ultimately, by making smart improvements, you increase a property's net operating income (NOI), which directly boosts its overall valuation and creates a much more resilient and profitable asset.

Comparing Real Estate Investment Strategies

The value-add strategy is just one of several approaches investors take. To really understand it, it helps to see how it compares to other common strategies in the commercial real estate world. Each one comes with its own risk profile and return expectations.

As you can see, value-add sits right in that sweet spot between the stability of Core properties and the high-risk, high-reward nature of Opportunistic deals. It offers a balanced way to generate strong returns without betting the farm on new construction or market timing.

Finding Your Next Value-Add Opportunity

Spotting a genuine value-add opportunity is part art, part science. It’s like being a detective, looking past the peeling paint and shag carpet to see the property's hidden potential—the diamond in the rough that everyone else overlooked. This is where you put theory into practice and start hunting for properties that are primed for a serious glow-up.

The hunt doesn't start with a walkthrough. It starts with the numbers. A property’s profit and loss statement tells a story, and a seasoned investor knows how to read between the lines to find clues of mismanagement or untapped revenue streams.

Uncovering Operational Inefficiencies

Sometimes, the biggest value add in real estate has nothing to do with swinging a hammer. It's about fixing sloppy management. Your job is to find assets where a few simple operational tweaks can send the net operating income (NOI) through the roof.

Keep an eye out for these red flags in the financials:

- Bloated Utility Bills: Are water or electricity costs unusually high? That could mean leaks or ancient, inefficient systems—an easy win with modern fixtures.

- Inflated Repair Costs: Consistently high maintenance bills often point to a management team that’s always putting out fires instead of preventing them.

- High Vacancy or Turnover: This is a huge one. It often signals problems with tenant screening, marketing, or rent pricing that a sharp operator can solve.

By spotting and fixing these operational drags, you can boost cash flow right away without spending a fortune on renovations. It’s about creating value through smarter management.

Assessing Physical and Market Gaps

Of course, the physical condition of the property is a classic opportunity. A building might have "good bones" but suffer from years of neglect. A little TLC—like fresh paint, new flooring, or updated appliances—can immediately justify higher rents and attract a better quality of tenant.

A savvy value-add investor knows how to tell the difference between cosmetic problems and fatal flaws. An ugly building in a great neighborhood is an opportunity; a beautiful building in a dying market is a trap.

This is why market analysis is non-negotiable. You’re looking for a mismatch: a tired, underperforming property sitting in a neighborhood with strong fundamentals. Things like job growth, a rising population, and new infrastructure projects are all great signs. These are the forces that create the demand you need to fill your newly upgraded units at a premium.

The U.S. housing market has become fragmented, and this shift creates openings for investors who can find underappreciated assets and bring them up to modern standards. It's smart to learn about different buy-to-let investment strategies to see what fits your goals. While national housing inventory is up roughly 20% year-over-year, it's still way below historical averages, which means there's a persistent demand for quality housing.

Crafting Your Value-Add Game Plan

So, you've found a diamond in the rough. That's a great start, but spotting potential is one thing—unlocking it is another. A fantastic opportunity means nothing without a smart, actionable plan to bring it to life. This is where you switch gears from being a property scout to the architect of its future value.

Your game plan becomes the central playbook for the entire project. It needs to be detailed and grounded in reality, yet flexible enough to roll with the punches—because every renovation project has its surprises. The objective here is to turn your high-level vision into a clear, step-by-step roadmap that will transform the property and, ultimately, your returns.

What's the Scope of Work?

Not all value-add projects are cut from the same cloth. The first thing you need to do is clearly define the renovation scope, which usually fits into one of three buckets. Knowing which path you're on is fundamental for setting your budget, timeline, and managing risk.

- Light Cosmetic Lifts: This is often the entry point for many investors. We're talking fresh paint, new light fixtures, swapping out cabinet hardware, and laying down new flooring. These are the quick wins that deliver a big visual punch for a relatively small investment.

- Heavy-Duty Renovations: Now we're getting into more significant capital improvements. This could mean gutting kitchens and bathrooms, knocking down walls to create better layouts, adding a community gym, or replacing big-ticket items like the roof or HVAC systems.

- Complete Operational Overhauls: Sometimes, the most valuable "fix" has nothing to do with hammers and nails. The real opportunity might be in fixing terrible management. This could look like bringing in new property management software, hiring a competent leasing team, or creating new income streams like paid parking or laundry services.

Budgeting for Success

Once you've defined the scope, it’s time to talk money. A sloppy budget is the quickest way to kill a great deal. Your numbers need to account for all the capital expenditures required to make your vision a reality. For a much deeper dive, you can check out our complete guide on what capital expenditures are and how to properly plan for them.

Always, and I mean always, build in a contingency fund of 10-15% of your total renovation budget. This isn't just "extra" cash—it's your planned safety net for the inevitable curveballs, like finding hidden plumbing problems or dealing with supply chain delays.

A solid budget breaks down everything into hard costs (materials, labor) and soft costs (permits, architectural fees). As you map this out, it's also a good time to research proven strategies to increase property value to make sure your planned upgrades will actually give you the best bang for your buck.

Turning Upgrades into Higher Rents

Every single dollar you pour into a property needs a purpose, and that purpose is almost always to increase revenue. It's the specific, modern upgrades that let you justify higher rents and attract higher-quality tenants. Think about it: installing smart thermostats or keyless entry doesn't just add a "cool" factor; it can command a rent premium while also making life easier for your property manager. Updating a dated kitchen with stainless steel appliances and quartz countertops is a tried-and-true method for boosting a unit's appeal and its rental rate.

The expectations of today's renters are higher than ever. Properties that fall behind on energy efficiency and modern tech risk becoming stale and undesirable. On the flip side, buildings that offer sustainable features and a better overall tenant experience are the ones set to win. A well-thought-out game plan ensures your asset meets these evolving demands, securing its value for the long haul.

Measuring The Success Of Your Project

Once the paint dries and the new tenants are settling in, the real work of measuring your success begins. This is where you find out if your vision—and all that capital—translated into tangible returns. It’s about proving that you didn't just create a prettier building, but a significantly more profitable one.

To get a clear picture, savvy investors lean on a handful of key performance indicators (KPIs). These metrics cut straight to the point, telling the real story of the investment's financial health and just how much value you actually created.

Key Metrics For Value-Add Success

You don't need to be a Wall Street quant to understand these, but mastering them is non-negotiable for any serious real estate investor. Think of them as the language of returns.

- Capitalization Rate (Cap Rate): This is your go-to for a quick snapshot of a property’s profitability against its market value. You find it by dividing the Net Operating Income (NOI) by the property's value. A higher cap rate generally points to a better return.

- Cash-on-Cash Return: This one is beautifully simple: it tells you how hard your own money is working. It measures the annual cash flow you receive before taxes against the total amount of cash you put into the deal.

- Internal Rate of Return (IRR): This is the most comprehensive metric of the bunch. IRR calculates the total annualized return over the entire investment holding period, factoring in the time value of money. It gives you the full picture of profitability from day one to the day you sell.

These numbers are all part of the same story. The central goal of any value add in real estate strategy is to drive up the property’s Net Operating Income (NOI). When you successfully increase rents and manage expenses better, the NOI climbs.

This jump in NOI is what ignites forced appreciation. A higher NOI directly forces the property's value upward, which in turn boosts all your other return metrics. It’s a powerful chain reaction that you get to control.

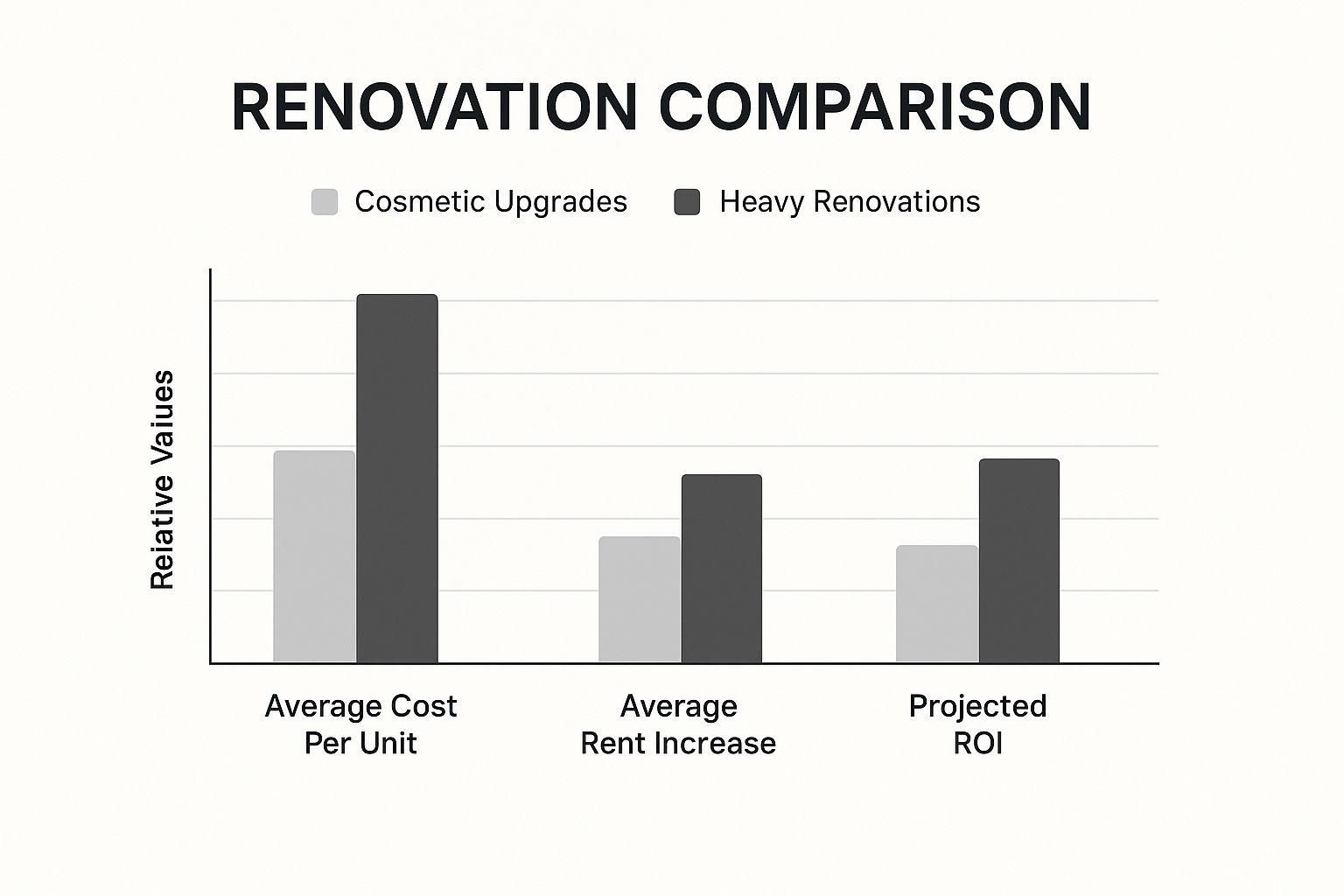

The infographic below breaks down how different levels of renovation can affect your initial costs and ultimate returns.

As you can see, even though heavy renovations demand more cash upfront, they often lead to much larger rent bumps and a more impressive overall ROI.

A Real-World Example

Let's bring this to life with a hypothetical 10-unit apartment building. By renovating the units, you’re able to boost the monthly rent for each by just $200.

That single change adds $24,000 in new annual revenue, which flows directly to your NOI.

Now, if buildings in that area typically sell for a 6% cap rate, that extra $24,000 in NOI just increased your property’s value by a staggering $400,000 ($24,000 / 0.06).

That’s forced appreciation in action. You didn't just wait around for the market to do the work for you—you went in and created that value yourself.

To visualize this impact, let's look at a simplified financial model for that 10-unit building.

Hypothetical Value Add Financial Impact

This table clearly shows the "before and after" effect. By executing a solid renovation plan and increasing the NOI, every key financial metric improves, demonstrating a successful project and delivering substantial value to investors.

Navigating the Inevitable Risks of Value-Add Deals

Let's be honest: while the returns on a great value-add project can be fantastic, the road to get there is almost never a straight line. Every investment has its risks, and this strategy is certainly no exception. The real mark of an experienced investor isn't avoiding problems—it's anticipating and planning for them.

The biggest headaches usually pop up during the renovation phase. You can have the most detailed plan in the world, but the moment you start opening up walls or digging into old plumbing, you're bound to find a few surprises. A quick fix for a leaky pipe might suddenly reveal that the entire line is rusted out. That small electrical update? It could uncover a whole building that's dangerously out of code.

These are the kinds of discoveries that can blow up your timeline and, more importantly, your budget.

How to Protect Your Project from Getting Derailed

Smart investors don't just cross their fingers and hope for the best. They build a financial cushion right into the project from the very beginning to protect their capital and keep the deal on track.

Here are a few non-negotiable tactics:

- Build a Serious Contingency Fund: This is crucial. Always, always set aside 10-15% of your total renovation budget for the unexpected. This isn't "extra" money to play with; it's a dedicated war chest for surprises. It's the single best tool you have for absorbing those curveballs without sacrificing quality or profitability.

- Vet Your Contractors Like a Detective: The success of your renovation rests squarely on the shoulders of your general contractor. Don't just take the lowest bid—that's often a recipe for disaster. You need to check their references, walk their past projects, and make sure they have a solid track record with jobs similar in size and scope to yours.

- Underwrite with a Dose of Pessimism: When you're running the numbers on a potential deal, be realistic. In fact, be a little pessimistic. Assume the renovation will take longer and cost more than you initially think. Building this conservative buffer into your analysis is what protects you when things inevitably go sideways.

A well-run value-add project isn't about eliminating risk—that's impossible. It's about managing it with discipline, foresight, and smart planning.

Real estate markets worldwide are dealing with a bit of uncertainty right now, but that's also what creates opportunity. The sector has proven its resilience time and again, and new openings are appearing for investors who can master the value-add approach. To get a better sense of this outlook, you can explore JLL's global real estate market insights.

By anticipating the common bumps in the road, like renovation delays and cost overruns, you put your project in a powerful position to succeed, turning what could be a liability into just another manageable challenge.

How to Fund Your Value-Add Project

Finding a promising deal is only half the battle. The other half—the part that actually brings your vision to life—is securing the right financing. You can't just walk into a bank and get a standard mortgage for a value-add property. Traditional lenders get skittish when they see a property that needs a ton of work and isn't producing stable income yet.

The problem is that these lenders base their loan amounts on the property's current value and cash flow, not its future potential. This almost always creates a funding gap because you need money for the purchase and all the planned renovations.

Bridge Loans: The Go-To Tool

This is exactly why experienced investors turn to specialized financing, most commonly a bridge loan. Think of it as a short-term loan purpose-built for this kind of project, covering both the acquisition cost and the capital you need for construction.

These loans are typically interest-only, which is a huge advantage. It keeps your monthly payments low while you're in the middle of renovations and the property isn't generating its full income potential. Lenders are more comfortable with this arrangement because the loan is underwritten based on the projected "after-repair value" (ARV) of the asset.

A bridge loan is like the temporary scaffolding for your project. It’s not meant to be permanent, but it provides the essential support you need to do the heavy lifting of renovations and get the property stabilized.

Once the work is done and you've leased up the units at new, higher market rents, the property's value and net operating income (NOI) have shot up. This is your exit.

With a stabilized, cash-flowing asset in hand, you can now go back to a traditional lender to refinance into a permanent loan. This new, long-term financing pays off the bridge loan, usually at a much better interest rate, and locks in the value you've created. This clear path from acquisition to stabilization is the financial engine that drives every successful value-add project.

Got Questions About Value-Add Investing? We’ve Got Answers

Stepping into the world of value-add real estate can feel like learning a new language. Naturally, you've probably got some questions about how it all works in practice. Let's tackle a few of the most common ones we hear from investors.

How Long Does a Value-Add Project Actually Take?

This is one of the most common questions, and the honest answer is: it depends entirely on the game plan. The timeline can swing pretty dramatically based on how much work you're putting in.

For a light value-add deal—think fresh paint, new light fixtures, maybe some updated flooring—you're typically looking at a 6 to 18-month window. That covers everything from closing the deal to finishing the cosmetic upgrades and getting the property fully leased up and stabilized.

But if you're diving into a heavy value-add project, you need to be prepared for a longer haul. These are the deals involving major construction, like reconfiguring floor plans or a complete brand overhaul. These can easily take 2 to 5 years to see through to stabilization.

Isn't This Just a Fancy Term for Flipping Houses?

Not quite. While both strategies involve buying a property and improving it, their core objectives and timelines are worlds apart.

Flipping is a sprint. It’s a short-term play, almost always with single-family homes, where the goal is to get in, renovate quickly, and sell for a lump-sum profit.

Value-add investing is more of a marathon. It’s a longer-term strategy, usually applied to commercial properties or apartment buildings. The real goal isn't just a quick sale; it's to boost the property's net operating income (NOI), creating a stable, cash-flowing asset for years to come. The endgame might be to hold it, refinance to pull cash out, or eventually sell after the property is stabilized and worth much more.

Can a Beginner Really Pull This Off?

It's definitely a bigger leap than buying a turnkey rental, but it's not impossible for a newcomer to succeed. You just have to be smart about it.

If you're just starting out, a "light" value-add project is your best bet. Think about taking on a small multifamily property that just needs some cosmetic love. This keeps the construction risk low and lets you learn the ropes on a project that won't overwhelm you.

Another great way to get your feet wet is by partnering up. Find an experienced operator to work with or consider investing passively in a real estate syndication. This gives you a front-row seat to the entire process, letting you learn from the pros without shouldering all the risk yourself.

Ready to manage your next value-add deal without getting buried in paperwork? Homebase is built to handle everything from fundraising and investor relations to distributions and reporting, all in one place. See how sponsors are closing deals faster and building stronger relationships at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.