9 Key Types of Real Estate Investing to Know in 2025

9 Key Types of Real Estate Investing to Know in 2025

Explore the 9 best types of real estate investing for 2025. Discover pros, cons, and expert tips for syndications, rentals, flips, and more.

Domingo Valadez

Jun 19, 2025

Blog

Unlocking Wealth: Which Real Estate Investing Path is Right for You?

The world of real estate investing is vast and varied, offering a multitude of paths to building wealth. Yet, this abundance of choice can be overwhelming for both new and experienced investors. Do you prefer the steady cash flow of long-term rental properties or the rapid returns of a fix-and-flip? Are you a hands-on operator who thrives on managing projects, or a passive investor looking to leverage the expertise of seasoned professionals? The key to success is not just about picking a strategy; it's about picking the right strategy that aligns with your available capital, timeline, risk tolerance, and personal goals.

This comprehensive guide is designed to cut through the noise. We will provide an in-depth exploration of the primary types of real estate investing, moving beyond surface-level definitions to offer actionable insights and practical frameworks. Before committing to a specific real estate investing path, it's crucial to understand the financial landscape, including recent changes in property transfer tax that can significantly impact your initial investment and overall profitability.

For each strategy discussed, we will dissect its core mechanics, weigh the distinct pros and cons, and provide specific examples and scenarios relevant to today's market. Whether you're a real estate syndicator evaluating different asset classes for your next deal, a multifamily investor seeking to diversify, or a sponsor looking for fresh perspectives, this guide will provide the clarity you need. Our structured approach will empower you to confidently identify the investment models that best suit your financial objectives, equipping you with the knowledge to build a robust and successful real estate portfolio. We will cover the following key strategies:

- Buy and Hold Rental Properties

- Fix and Flip

- Real Estate Investment Trusts (REITs)

- Wholesaling

- Commercial Real Estate Investing

- Short-Term Rentals/Airbnb

- Real Estate Syndications

- Real Estate Crowdfunding

- Tax Lien and Tax Deed Investing

1. Buy and Hold Rental Properties

The buy and hold strategy is a foundational approach and one of the most classic types of real estate investing. It involves purchasing a property to rent out to tenants for an extended period, generating a consistent stream of income while the asset appreciates in value over time. This method is the bedrock of building long-term wealth through real estate, focusing on two primary financial benefits: monthly cash flow and long-term equity growth.

How It Works and Ideal Scenarios

Investors purchase residential or commercial properties, from single-family homes in growing suburbs to multi-family apartment buildings, and lease them to tenants. The rental income should ideally cover the mortgage payment, insurance, taxes, and maintenance, with the remainder being positive cash flow. This strategy thrives in markets with strong, stable rental demand and a positive economic outlook, such as areas near universities, corporate headquarters, or transportation hubs.

For syndicators, buy and hold is an excellent model for creating diversified portfolios of stabilized assets. It offers predictable returns and lower risk compared to more speculative strategies. A syndication might acquire a 100-unit apartment complex, using investor capital for the down payment and then distributing the monthly cash flow to partners after all expenses are paid.

Actionable Insights for Implementation

Success in buy and hold hinges on meticulous due diligence and management. Always calculate cash flow before purchasing, accounting for all potential expenses including vacancies and capital expenditures. Thorough tenant screening is non-negotiable to minimize turnover and potential damages. Beyond tenant management and ongoing maintenance, safeguarding your investment from potential damages is crucial. Consider implementing effective resources like these property loss prevention tips to protect your rental properties.

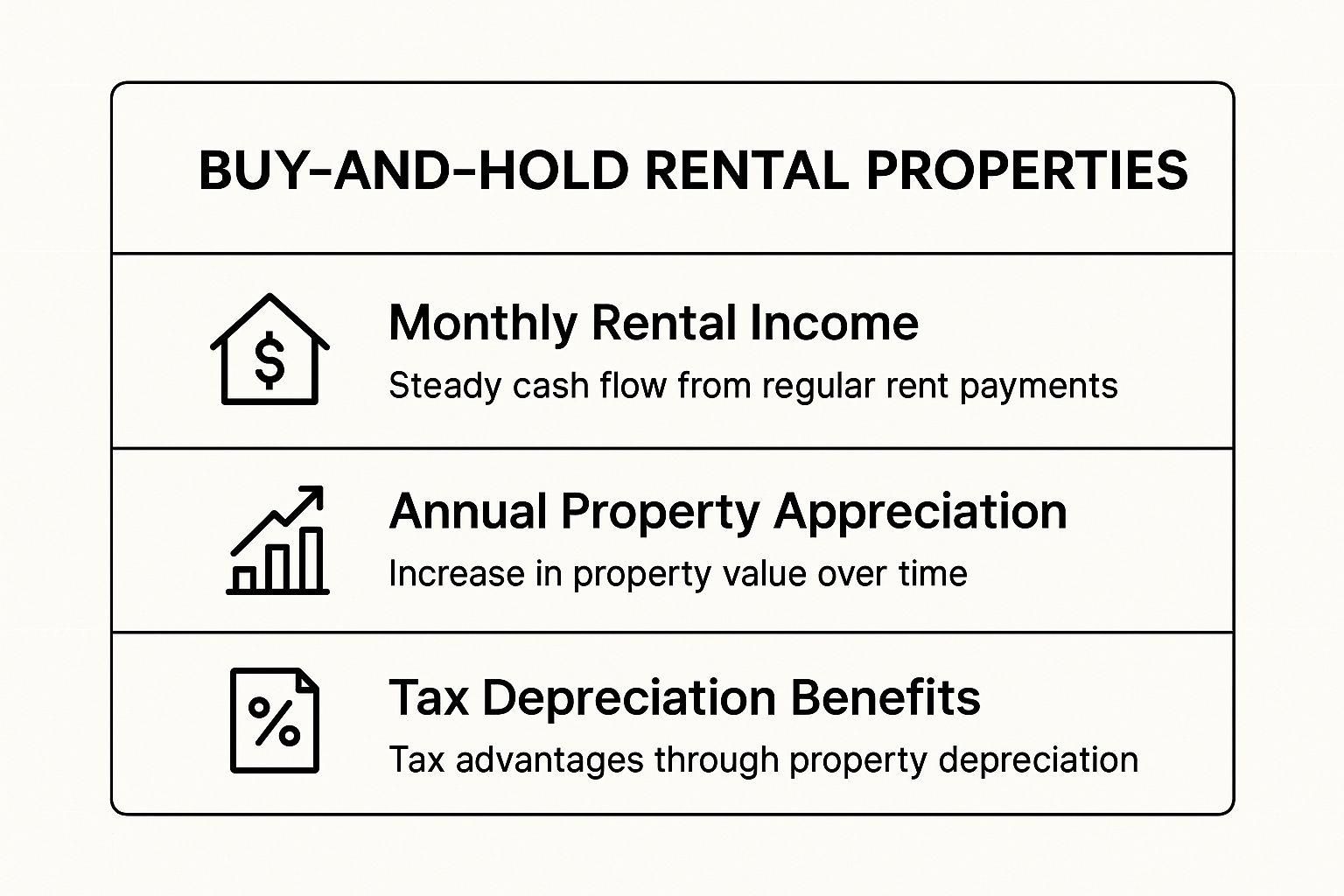

The following infographic highlights the three core financial pillars of a successful buy and hold investment.

These combined benefits illustrate how buy and hold strategies create wealth through both immediate income and long-term asset growth, making it a powerful and reliable method for real estate investors.

2. Fix and Flip

The fix and flip strategy is one of the more active and popular types of real estate investing, focusing on short-term gains rather than long-term holds. This method involves acquiring an undervalued or distressed property, renovating it to increase its market value, and then selling it quickly for a profit. Popularized by TV shows and real estate gurus, this strategy's success hinges on speed, accuracy in budgeting, and a keen understanding of local market dynamics.

How It Works and Ideal Scenarios

Investors identify properties sold below market value, such as foreclosures, estate sales, or homes with significant cosmetic issues but solid structural integrity. The goal is to purchase, complete renovations, and sell the property within a short timeframe, typically 3 to 12 months, to maximize profit and minimize holding costs like taxes, insurance, and loan interest. This strategy works best in a seller's market where home prices are appreciating and inventory is low, ensuring a quick sale at the target price.

For syndicators, fix and flip can be structured as a debt or equity fund that provides capital to multiple projects simultaneously. Instead of a single deal, a syndication might fund a portfolio of five to ten flips, diversifying risk and allowing passive investors to benefit from the high-return potential without getting involved in the day-to-day project management.

Actionable Insights for Implementation

Mastering fix and flip requires disciplined financial analysis and strong project management. Adhere strictly to the 70% Rule, where you pay no more than 70% of the property's After Repair Value (ARV) minus the estimated renovation costs. This creates a built-in profit margin. Building a reliable network of contractors, electricians, and plumbers is essential for keeping projects on time and on budget. Always have a contingency fund, typically 10-15% of the total renovation budget, to cover unforeseen expenses that inevitably arise.

3. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) offer a completely different pathway into the world of real estate investing, allowing individuals to own a piece of a large, diversified portfolio of income-producing assets without ever owning a physical property directly. These entities function much like mutual funds for real estate, trading on major stock exchanges and enabling investors to buy and sell shares with ease. By law, REITs are required to distribute at least 90% of their taxable income to shareholders as dividends, making them a popular choice for income-focused investors.

How It Works and Ideal Scenarios

Investing in a REIT means you are buying shares in a company that owns, operates, or finances a portfolio of real estate assets. These can range from massive industrial warehouses managed by companies like Prologis (PLD) to apartment communities owned by Equity Residential (EQR) or even cell towers from American Tower (AMT). This model provides instant diversification across numerous properties and geographic locations, a feat that would require immense capital for a direct investor.

For syndicators and fund managers, REITs can serve as a liquid component within a broader real estate strategy. While private syndications lock up capital for several years, holding a portion of a fund's assets in public REITs can provide liquidity to manage cash flows or capitalize on market movements. They also serve as a valuable benchmark for comparing the performance of private real estate deals against the public market.

Actionable Insights for Implementation

Success with REITs involves looking beyond the attractive dividend yield. Thoroughly research the underlying assets and management team of any REIT before investing. Understand its sector focus, such as retail, industrial, or residential, as each performs differently based on economic conditions. It's also crucial to analyze the REIT's funds from operations (FFO), a key metric for profitability, and its debt levels.

Before committing capital, consider the impact of interest rates; rising rates can sometimes negatively affect REIT values. Diversifying across different types of REITs, including both equity and mortgage REITs, can help mitigate sector-specific risks. This approach allows you to build a resilient, passive income stream that complements other types of real estate investing, providing liquidity and broad market exposure.

4. Wholesaling

Wholesaling is one of the most dynamic and fastest-paced types of real estate investing, often serving as an entry point for new investors. This strategy involves finding a distressed or undervalued property, getting it under contract with the seller, and then assigning that contract to an end buyer, typically another investor, for a higher price. The wholesaler’s profit is the difference between their contracted price and the price the end buyer pays, known as the assignment fee. This method allows an investor to profit from a real estate deal without ever taking title to the property, minimizing capital requirements and risk.

How It Works and Ideal Scenarios

A wholesaler acts as a middleman, connecting motivated sellers with cash buyers. They excel at marketing to find off-market deals, such as properties in foreclosure, probate, or those owned by landlords tired of managing tenants. Once a property is under contract at a deep discount, the wholesaler markets the deal to their network of investors, who are often house flippers or buy-and-hold landlords looking for their next project. The key is speed and a deep understanding of what constitutes a good deal for the end buyer.

For syndicators, wholesaling can be a powerful deal-sourcing engine. A syndication firm might build an in-house wholesaling arm to secure a consistent flow of off-market properties for their portfolio or for flipping projects. This provides a competitive advantage by bypassing the competitive, on-market Multiple Listing Service (MLS) and acquiring assets at a lower basis, which directly enhances returns for their investment partners.

Actionable Insights for Implementation

Success in wholesaling is built on relationships and systems. Your first and most critical step is to build a robust cash buyers list before you even start looking for deals; there's no point in contracting a property if you have no one to sell it to. Develop a multi-channel marketing system using direct mail, online ads, and networking to generate a consistent stream of leads from motivated sellers. Learning to accurately calculate the After Repair Value (ARV) and estimate repair costs is non-negotiable for presenting credible deals to your buyers.

Finally, you must operate ethically and legally. Ensure your contracts include an assignment clause and be transparent with all parties. Building a reputation for sourcing genuinely good deals will create a loyal network of buyers who come to you first, making your business more sustainable and profitable over the long term.

5. Commercial Real Estate Investing

Commercial real estate (CRE) investing involves acquiring properties intended for business purposes rather than residential use. This category includes a diverse range of assets like office buildings, retail centers, industrial warehouses, and large apartment complexes. Unlike single-family rentals, CRE investing focuses on properties where tenants are businesses, leading to longer lease terms, higher income potential, and different valuation metrics. It is one of the most scalable types of real estate investing, offering opportunities for significant wealth generation through both cash flow and appreciation.

How It Works and Ideal Scenarios

Investors purchase commercial properties to lease to one or multiple business tenants. Income is generated from these leases, which are often structured as triple net (NNN) leases where the tenant pays for property taxes, insurance, and maintenance in addition to rent. This arrangement can create a more passive income stream for the owner. CRE thrives in economically robust areas with strong job growth, business-friendly policies, and high consumer traffic, making it ideal for investors with substantial capital and a long-term outlook.

For syndicators, commercial real estate is a primary focus. The high acquisition costs of assets like a multi-tenant office building or a shopping plaza make them perfect for pooling investor capital. A syndication can acquire a large-scale property that an individual investor could not afford, manage the asset to increase its value, and provide returns to partners from both rental income and the eventual sale. This model allows investors to participate in high-value deals with professional management.

Actionable Insights for Implementation

Success in commercial real estate demands a deep understanding of financial metrics and market dynamics. Master the calculation of Net Operating Income (NOI) and capitalization (cap) rates, as these are the cornerstones of CRE valuation. A property's value is directly tied to the income it produces. Building strong relationships with commercial brokers is essential, as they provide access to off-market deals and critical market intelligence. Before investing, conduct in-depth analysis of local economic fundamentals, including employment trends, population growth, and new construction pipelines to ensure long-term demand. Given the management intensity, always factor in the cost of professional property management to ensure the asset is run efficiently.

6. Short-Term Rental/Airbnb

The Short-Term Rental (STR) strategy has surged in popularity, becoming one of the more dynamic types of real estate investing. This approach involves purchasing properties to lease out on a short-term basis, typically nightly or weekly, through platforms like Airbnb and VRBO. Unlike traditional long-term rentals, this method can generate significantly higher revenue streams by capitalizing on travel, tourism, and business demand, but it requires a much more hands-on, hospitality-focused management style.

How It Works and Ideal Scenarios

Investors acquire properties in locations with high visitor traffic, such as vacation destinations, urban centers near convention halls, or areas with unique attractions. The goal is to maximize occupancy and nightly rates to produce income that far exceeds what a long-term tenant would pay. This model is ideal for properties that offer a unique guest experience, whether it's a cabin in the mountains, a chic city apartment, or a house near a major event venue.

For syndicators, the STR model can be applied to acquire a portfolio of vacation homes or even entire boutique hotels or "aparthotels." This allows for diversification across multiple high-demand micro-markets. A syndication might purchase a block of condos in a tourist hotspot, using professional management and marketing to operate them as a cohesive, branded collection of vacation rentals, distributing the amplified cash flow to investors.

Actionable Insights for Implementation

Success in the STR market is heavily dependent on location, marketing, and guest experience. Thoroughly research local regulations and zoning laws before purchasing, as many municipalities have strict rules governing short-term rentals. Professional photography is non-negotiable, as it is the single most important factor in attracting bookings online. To make informed decisions in this segment, it's beneficial to consult an in-depth market analysis for vacation rentals.

Automating your operations with smart locks, guest messaging software, and dynamic pricing tools can dramatically reduce the management burden. Prioritizing a five-star guest experience through cleanliness, clear communication, and thoughtful amenities is crucial for generating positive reviews, which directly drives future bookings and revenue.

7. Real Estate Syndications

Real estate syndication is a powerful collaborative approach, making it one of the most scalable types of real estate investing. This method allows multiple investors to pool their capital together to acquire large, institutional-grade commercial properties that would be financially out of reach for an individual. A sponsor, or syndicator, orchestrates the entire process from deal sourcing and acquisition to management and eventual sale, while passive investors provide the necessary capital in exchange for equity ownership.

How It Works and Ideal Scenarios

In a typical syndication, a sponsor (General Partner or GP) identifies a promising asset, such as a large apartment complex or a commercial shopping center, and creates a detailed business plan. They then raise capital from passive investors (Limited Partners or LPs) to fund the down payment and any planned renovations. In return for managing the asset, the GP earns fees and a share of the profits, while the LPs receive regular distributions from cash flow and a share of the profits upon sale, all without any active management responsibilities.

This model is ideal for acquiring high-value assets like 200-unit apartment buildings, medical office parks, or industrial warehouses. For sponsors, it’s a way to leverage other people's money to control massive portfolios. For passive investors, it offers access to premier real estate deals, diversification, and potentially higher returns than they could achieve on their own.

Actionable Insights for Implementation

For passive investors, the most critical step is thoroughly vetting the sponsor and their track record. Don't just look at their past returns; analyze their experience with the specific asset class and market in the proposed deal. Always meticulously review all legal documents, including the Private Placement Memorandum (PPM) and the operating agreement, to understand the fee structure, distribution waterfall, and your rights as a Limited Partner.

For aspiring syndicators, building credibility is paramount. Start by partnering on smaller deals or working with an experienced mentor to learn the ropes. As demonstrated by industry leaders like Joe Fairless and Michael Blank, creating a strong brand and transparent communication with investors is non-negotiable for long-term success. Focus on developing a robust business plan for each deal that clearly outlines the path to achieving projected returns.

8. Real Estate Crowdfunding

Real estate crowdfunding has revolutionized how individuals access and participate in large-scale property investments. This modern approach to real estate investing allows numerous investors to pool their capital together through an online platform to fund a specific real estate project. By leveraging technology, crowdfunding democratizes access to deals, such as commercial developments or large apartment complexes, that were once reserved for institutional investors or high-net-worth individuals.

How It Works and Ideal Scenarios

Investors browse a curated marketplace of real estate opportunities on platforms like Fundrise or CrowdStreet. They can choose to participate in either debt investments, where they act as lenders and receive interest payments, or equity investments, where they become partial owners of the property and share in the potential profits and appreciation. This model is ideal for investors seeking diversification with lower capital requirements, often starting from just a few hundred or thousand dollars.

For syndicators, crowdfunding platforms can serve as a powerful capital-raising tool, providing access to a broad, pre-vetted network of accredited investors. Instead of relying solely on a personal network, a sponsor can present a deal on a platform to efficiently fund a project, whether it's a ground-up development or a value-add acquisition. This significantly streamlines the fundraising process and expands the potential investor pool.

Actionable Insights for Implementation

Success with crowdfunding requires careful platform selection and project-level due diligence. Thoroughly investigate the platform’s track record, examining its deal flow, historical returns, and the experience of its leadership team. It is equally important to understand the fee structure, as management, acquisition, and administrative fees can impact your net returns.

Before committing capital, meticulously review all offering documents for each specific deal. Pay close attention to the business plan, financial projections, and identified risks. Diversifying your investments across multiple projects, property types, and geographic locations is a key strategy to mitigate risk. Also, be mindful that most crowdfunding investments are illiquid, so ensure the capital you invest is not needed for short-term financial goals.

9. Tax Lien and Tax Deed Investing

Tax lien and tax deed investing is a specialized niche within the broader landscape of real estate investing. This strategy involves the government's process of collecting delinquent property taxes. Investors can purchase a tax lien certificate from a municipality, which gives them the right to collect the owed taxes plus interest from the property owner. If the owner fails to pay, the investor can foreclose on the property. Alternatively, in a tax deed state, investors purchase the property itself at an auction, often for just the amount of the back taxes and associated fees.

How It Works and Ideal Scenarios

In tax lien states like Florida and Arizona, investors bid on the interest rate they are willing to accept on the debt, sometimes driving it down to a fraction of a percent. The winning bidder pays the delinquent taxes and receives a certificate. The property owner has a redemption period to repay the investor with the agreed-upon interest. If they don't, the investor can initiate foreclosure. In tax deed states like Georgia and Texas, the property is sold directly at a public auction. This strategy is ideal for investors seeking high-yield, secured returns (from lien interest) or the potential to acquire property far below market value.

For syndicators, this strategy presents a unique, albeit complex, opportunity. A fund could be raised to purchase a large portfolio of tax lien certificates across multiple counties or states, diversifying risk and creating a stream of income from interest payments. This approach requires deep legal and procedural expertise but can offer returns uncorrelated with traditional real estate market cycles.

Actionable Insights for Implementation

Success in this arena is entirely dependent on rigorous due diligence and a comprehensive understanding of state and local laws, as they vary dramatically. Never bid on a property or lien without thoroughly researching it first, including checking for title issues, environmental concerns, or other liens that could take priority. Attending a few county auctions as an observer is an invaluable first step to understand the process. Also, it’s vital to factor in all potential costs, such as legal fees for foreclosure or potential clean-up costs if you acquire the property. Exploring the various real estate investment tax benefits on HomebaseCRE can provide additional context on how such strategies fit into a larger tax-optimized portfolio.

9 Types of Real Estate Investing Compared

Choosing Your Strategy and Scaling for Success

We have explored the diverse landscape of real estate investing, journeying through nine distinct strategies. From the hands-on intensity of fix-and-flips and the long-term wealth creation of buy-and-hold rentals to the passive accessibility of REITs and the collaborative power of syndications, it is clear there is no single "best" path. The ideal strategy is not a universal formula; it is a personalized equation that balances your unique resources, risk tolerance, and long-term aspirations.

The various types of real estate investing we've covered represent a spectrum of involvement. On one end, you have highly active roles like wholesaling or managing short-term rentals, which demand significant time, market knowledge, and operational hustle. On the other end, investing in a REIT or a crowdfunding platform offers a more passive approach, allowing you to participate in real estate growth without direct property management. The key takeaway is to conduct a frank self-assessment. What do you have more of: time or capital? Are you driven by quick profits or generational wealth? Answering these questions honestly is the foundational first step.

From Strategy Selection to Scalable Systems

Choosing your initial strategy is just the beginning. The true challenge, and where substantial wealth is built, lies in scaling your operations. A single rental property is manageable. Ten properties require systems. A fix-and-flip project is a transaction. A dozen simultaneous flips require a finely tuned business machine. This transition from investor to operator is where many aspiring professionals falter, becoming bogged down by administrative complexities instead of focusing on high-value activities.

For investors aiming for significant growth, particularly through group investments like syndications, this operational challenge is even more pronounced. Scaling a syndication business means managing a growing number of limited partners (LPs), handling complex legal documentation for each deal, ensuring compliance, and delivering timely, professional investor communications and distributions. This is the critical juncture where manual processes, spreadsheets, and disjointed software solutions break down, creating bottlenecks that stifle growth and damage investor confidence.

Leveraging Technology for Unparalleled Growth

The most successful real estate sponsors and syndicators understand a vital secret: your ability to scale is directly proportional to the strength of your back-office systems. You cannot scale a multimillion-dollar portfolio on spreadsheets and email alone. Modern real estate investing, especially in the syndication space, demands a purpose-built technological infrastructure.

This is where you must leverage technology to create a competitive advantage. Imagine a centralized platform where you can:

- Launch a new offering with a professional, branded deal room in minutes.

- Manage investor pipelines, track interest, and streamline the capital commitment process.

- Automate subscription documents and K-1 distribution, saving hundreds of hours of manual work.

- Provide a secure investor portal where LPs can access deal updates, performance metrics, and important documents 24/7.

This level of operational efficiency is no longer a luxury; it is a necessity for anyone serious about building a scalable real estate enterprise. By automating the administrative burden, you free yourself to focus on your core mission: finding exceptional investment opportunities, executing your business plan, and delivering outstanding returns for your partners. This is how you build a reputation, attract more capital, and create a truly scalable business that transcends your individual efforts. The right platform transforms your administrative tasks from a growth inhibitor into a professional asset that builds investor trust and accelerates your success.

Are you ready to stop managing spreadsheets and start scaling your real estate portfolio? Homebase provides an all-in-one platform designed specifically for real estate syndicators to streamline fundraising, automate investor relations, and manage their portfolio with institutional-grade efficiency. Discover how Homebase can provide the operational backbone you need to grow your business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.