Mastering Real Estate Financial Models for Syndicators

Mastering Real Estate Financial Models for Syndicators

Unlock the secrets to building and analyzing real estate financial models. This guide helps syndicators master the data to close more deals and raise capital.

Domingo Valadez

Jan 9, 2026

Blog

At its most basic, a real estate financial model is a spreadsheet. But that's like saying a blueprint is just a piece of paper. In reality, it’s a dynamic tool that translates a property's potential—its bricks, mortar, and location—into a clear story of financial risk and reward.

Think of it as the strategic map for an entire investment journey, guiding you from the initial offer all the way to the final sale. It's how you make smart, data-backed decisions on buying, developing, or selling a property.

Your Blueprint for Profitable Real estate Deals

Staring at a wall of numbers in a complex spreadsheet can feel intimidating. I get it. But the best real estate syndicators I know don't see a calculator; they see a flight plan. Just like a pilot wouldn't dream of taking off without one, you shouldn't enter a deal without a solid financial model.

This blueprint is your guide through every single phase of the investment. It helps you navigate the choppy waters of acquisition analysis, steer through the day-to-day operations during the holding period, and finally, land a profitable exit. A well-built model is your best defense for checking your assumptions, spotting hidden risks, and making the right call when the pressure is on.

From Numbers to Narrative

A truly great financial model does more than just spit out numbers. It weaves them into a compelling, data-backed story. And this story is what you'll use to convince the two most important groups of people in any deal: your potential investors and your lenders.

When you can clearly show how a property is likely to perform—and what might happen if things change—you build instant credibility and trust.

Your model is what provides the answers to the make-or-break questions:

- How will our assumptions on rent growth and vacancy affect our bottom line (the net operating income)?

- What kind of return can our limited partners realistically expect to see?

- Will the property generate enough cash to comfortably cover the mortgage payments every month?

Answering these with a detailed forecast shows you've done your homework. It proves you’re a professional, and that alone can set you miles apart from the competition.

A great real estate financial model is the bridge between a property's physical potential and its financial reality. It’s where vision meets validation, allowing you to prove an investment thesis with concrete data before committing millions of dollars.

The Industry Standard for Success

The days of scribbling numbers on the back of a napkin are long gone. Today, sophisticated financial modeling is the standard, not the exception. It has completely changed how sponsors underwrite deals and present them to investors.

In fact, industry research shows that about 90% of real estate developers now lean on these complex models to project everything from construction costs to final returns before breaking ground. You can dig into more financial modeling statistics to see just how widespread their use has become.

This shift highlights a simple truth for anyone in the syndication business today. Lenders won't even talk to you without seeing detailed projections, and sharp investors will demand a clear breakdown of both the risks and the potential rewards.

Mastering real estate financial modeling isn't just a "nice-to-have" skill anymore—it's a fundamental requirement for closing deals, raising capital, and building a lasting portfolio. This guide is designed to get you there, so you can build, analyze, and present your deals with total confidence.

Understanding the Anatomy of a Winning Model

Think of a professional real estate financial model as a well-organized blueprint, not a jumbled mess of numbers. Each section has a specific job, and understanding how they connect is the key to turning a simple spreadsheet into a powerful tool for making smart investment decisions.

Let's walk through the core components, one by one.

The Assumptions Tab: Your Central Control Panel

Every great model starts with a clean, organized assumptions tab. This is your command center—the single place where you input and control all the variables that drive the entire financial forecast. It’s where you tell the story of the deal.

Why is this so important? It makes your model dynamic. Instead of burying a 3% rent growth figure deep inside a complex formula on some other worksheet, you place it right here. This simple practice makes it incredibly easy to test different scenarios and helps prevent costly errors. Plus, when an investor or lender reviews your work, they can see exactly what beliefs are shaping your projections.

Key inputs you’ll always find here include:

* Property Details: Purchase price, closing costs, square footage, unit mix.

* Income Assumptions: Market rent, annual rent growth, and vacancy loss.

* Operating Expenses: Property taxes, insurance, management fees, and repair budgets—often entered as a percentage of revenue or a dollar amount per unit.

* Financing Terms: Loan-to-value (LTV), interest rate, and amortization period.

* Exit Assumptions: Your projected sale price, which is typically calculated using an exit capitalization (cap) rate.

The Pro Forma: The Heart of the Model

Once your assumptions are set, the data flows directly into the pro forma. This is the true heart of your model. It’s a detailed, year-by-year (or sometimes month-by-month) forecast of the property's financial journey over the entire time you plan to own it.

The pro forma is where your assumptions come to life. It starts at the top with potential rental income, subtracts vacancy and operating expenses, and works its way down to the Net Operating Income (NOI). This projection is the engine that determines profitability and is foundational to any sound investment analysis. For a deeper dive, consider mastering cash flow projection to ensure your model is as reliable as possible.

The Pro Forma isn't just a forecast; it's a narrative. It tells the story of how a property is expected to perform over time, showing the journey from gross revenue to the actual cash available for distribution to investors.

Supporting Schedules and Summaries

While the pro forma provides the big picture, a few other components add critical detail and keep things organized. These supporting "schedules" handle specific, complex calculations, which keeps the main pro forma clean and easy to read.

Think of them as specialized departments that report back to the main office.

To pull it all together, here’s a quick overview of the essential tabs you'll find in nearly every institutional-quality model.

Key Components of a Real Estate Financial Model

These components work together to provide a comprehensive view of the investment. The Returns Summary, in particular, acts as the final report card. It pulls the most important metrics—like IRR, Equity Multiple, and Cash-on-Cash Return—into one clear summary. This is often the first and last place an investor looks to quickly gauge a deal's potential.

Translating Model Metrics Into Investor Confidence

Numbers on a spreadsheet are just that—numbers. They don't mean a thing until you can tell the story behind them. A well-built real estate financial model will spit out dozens of metrics, but a handful of Key Performance Indicators (KPIs) do all the heavy lifting. If you can master these, you can speak an investor's language and clearly articulate why a deal is worth their time and money.

Think of these KPIs as the vital signs for your investment. A doctor checks heart rate and blood pressure to get a quick read on a patient's health; an investor uses these metrics to diagnose the financial health and potential of a property. They aren't just calculations; they're the tools you use to build trust and get a deal across the finish line.

Gauging Profitability and Returns

When an investor looks at your deal, they’re really asking two fundamental questions: "How much money will I make?" and "How fast will I get it back?" A few core metrics cut right to the chase.

- Internal Rate of Return (IRR): This is the time-weighted annual return. Let's say you're looking at two deals. One doubles your money in three years, and another doubles it in five. The IRR is what tells you the first deal is more powerful because it gets cash back in your pocket faster, freeing you up to reinvest it elsewhere.

- Equity Multiple (EM): This is probably the most intuitive return metric out there. If an investor puts in $100,000 and gets $250,000 back over the entire life of the deal, the Equity Multiple is 2.5x. It’s the simple "how many times my money did I get back?" score.

- Cash-on-Cash Return (CoC): This one measures the annual cash flow you receive against the initial cash you put in. If that same $100,000 investment kicks off $8,000 in cash distributions in year one, your Cash-on-Cash Return for that year is 8%. It’s your go-to metric for measuring a property's yearly income performance.

This trio gives you a complete picture. IRR speaks to the speed and efficiency of the returns, the Equity Multiple shows the total profit potential, and Cash-on-Cash measures the ongoing health of your cash flow.

Measuring Operational Health and Stability

Before you can even think about investor returns, you have to be sure the property itself is financially sound. Two operational metrics are non-negotiable here: Net Operating Income and the Debt Service Coverage Ratio. These tell you if the property can stand on its own two feet.

A property's operational metrics are the foundation upon which all investor returns are built. Without strong, stable Net Operating Income and a healthy ability to cover debt, impressive-looking IRR and Equity Multiple projections are just wishful thinking.

First up is Net Operating Income (NOI). This is simply the property's total income (rent, fees, etc.) minus all its operating expenses. NOI is king because it shows you the pure profit the asset generates before you account for any mortgage payments. A steady, growing NOI is the sign of a healthy, well-run property.

Next, you have the Debt Service Coverage Ratio (DSCR). This metric takes your NOI and divides it by your total annual mortgage payments (the debt service). Lenders live and die by this number. A DSCR of 1.0x means you have exactly enough income to pay the mortgage, which leaves zero room for error. That’s why most lenders look for a DSCR of 1.25x or higher—it shows you have a 25% cash flow cushion after paying the bank.

A healthy DSCR is your margin of safety. It reassures investors and lenders that the property can handle a few unexpected vacancies or a jump in expenses without risking a default on the loan. Nail down these core metrics, and you'll be able to turn a complex spreadsheet into a clear, compelling story that gets deals funded.

Building Your First Financial Model From Scratch

Jumping into your first real estate financial model might feel a bit intimidating, but it's really just a step-by-step process. I like to think of it like building a piece of furniture: you start with a box of raw materials (your data and assumptions) and follow a clear set of instructions to create something sturdy and reliable. The trick is to be methodical from the get-go.

Start with the Raw Materials: Data Gathering

Before you even think about opening Excel, you need to get your hands on the documents that tell the property's real story. This isn't optional; these are the essential building blocks for any credible analysis.

You’ll need to round up a few key items:

- The Rent Roll: This is your ground truth for income. It’s a detailed list of every tenant, what unit they're in, their lease terms, and exactly what they pay.

- Historical Operating Statements: You'll want the Trailing 12-Month (T12) statement. This shows you the property’s actual income and expenses over the last year—no guesswork involved.

- Property Tax Bills & Insurance Policies: These give you the exact numbers for two of the biggest line-item expenses. Don't estimate what you can know for sure.

- Capital Expenditures History: A list of recent big-ticket repairs (like a new roof or HVAC system) is gold. It helps you anticipate what big checks you'll have to write in the future.

Once you have these documents, you have everything you need to build a financial forecast that can actually stand up to scrutiny.

Set Up Your Workshop: Structuring the Model

With your data in hand, it’s time to structure your spreadsheet. One of the classic rookie mistakes is just throwing all your inputs, calculations, and outputs onto a single tab. It seems easy at first, but it quickly turns into an unreadable mess. Pros know that a disciplined structure is non-negotiable.

A simple but powerful habit is color-coding your cells. A common convention is to use a blue font for input cells—these are your hard-coded assumptions like the purchase price or an interest rate. Then, use a black font for all your formula cells, which are the calculations that pull from those blue inputs. This tiny bit of organization makes your model incredibly easy for you (and others) to follow and debug later.

The way we build models has come a long way. While a quick "back of the napkin" calculation using a direct capitalization rate (4.9% was the average for U.S. multifamily in early 2023) is still a great way to gut-check a deal's value, any serious underwriting today is built on a multi-year cash flow forecast.

From Pro Forma to Investor Returns

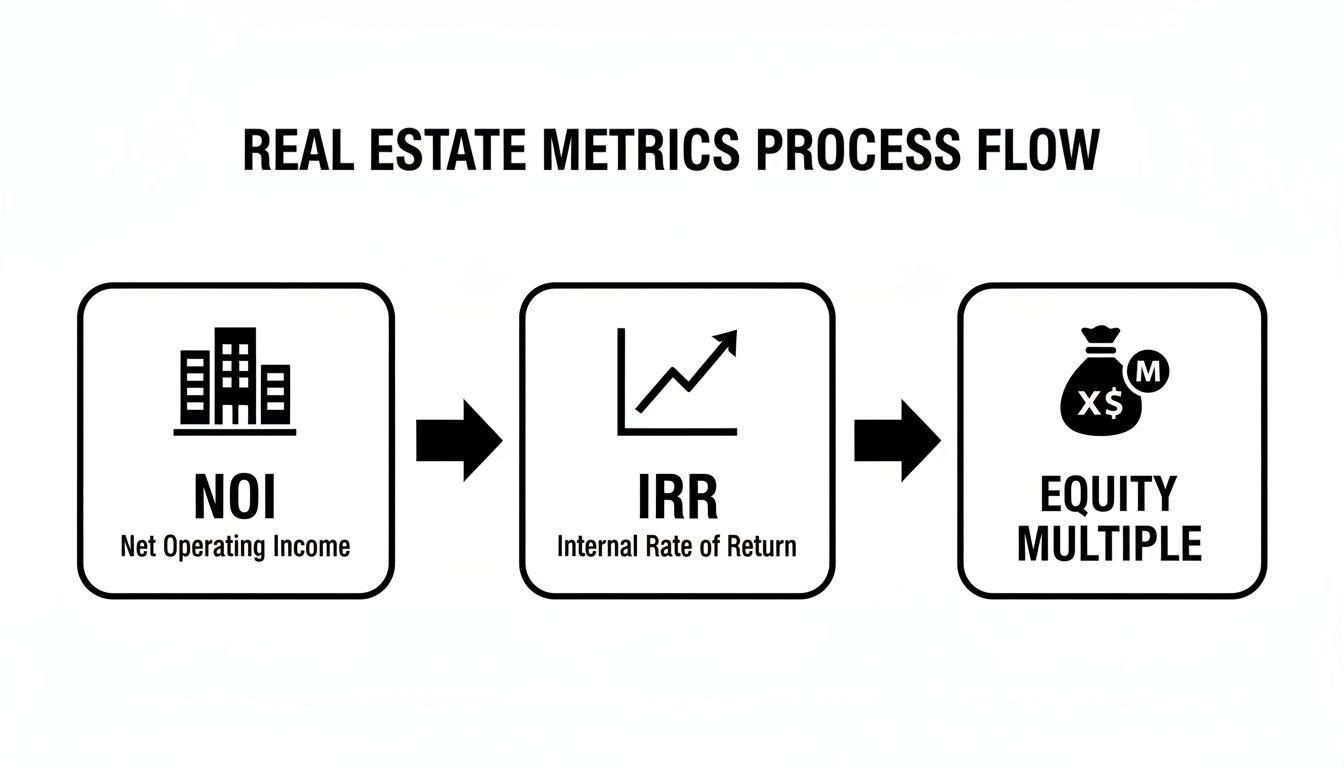

Now for the fun part: building out the pro forma. You'll start by projecting the Gross Potential Rent, then subtract an allowance for vacancy to find your Effective Gross Income. Next, you’ll line-item out all the operating expenses, using the T12 as your guide and inflating them by a reasonable growth rate each year. This gets you to the most important metric in property operations: Net Operating Income (NOI).

This flowchart shows how everything connects, from property performance all the way to investor returns.

As you can see, a healthy NOI is the engine that drives the whole train. It's what ultimately delivers a strong IRR and Equity Multiple to your investors.

Once you've calculated the NOI for your entire hold period, you'll factor in your debt service to find your pre-tax cash flow. The final piece is modeling the sale of the property. You do this by applying an "exit cap rate" to your final year's NOI to estimate the sale price.

By combining the annual cash flows with the net proceeds from the sale, you can finally calculate the key return metrics that every investor wants to see. If you're ready to get your hands dirty, a fantastic exercise is learning how to build a Discounted Cash Flow (DCF) model in Excel.

Building a model isn't just about getting the right answer; it's about building a tool that's flexible, transparent, and auditable. A clean, well-organized model builds confidence with lenders and investors just as much as strong projected returns do.

If you want to save some time and make sure you're starting with a professionally vetted structure, using a template can be a smart move. Check out our guide on using a https://www.homebasecre.com/posts/real-estate-pro-forma-template-excel to get a running start. It lets you focus more on the analysis and less on the setup.

Stress-Testing Your Deal with Advanced Analysis

A basic real estate model is great for painting the perfect picture—the one where everything goes exactly as planned. But seasoned investors know the real world is rarely that cooperative. What happens when it isn't? An institutional-grade model doesn't just map out the sunny-day scenario; it prepares you for the storm.

This is where advanced analysis comes in. Think of these techniques as financial stress tests. They let you quantify risk, see just how fragile your returns are to market shifts, and build unshakable confidence with investors by proving you’ve already thought through what could go wrong. It’s about replacing "I think" with "I've tested."

How Sensitive Are Your Returns?

The first and most fundamental stress test is sensitivity analysis. It’s like a financial simulator where you can nudge key assumptions up or down to see how the deal's returns react. What if occupancy dips by 5%? What if interest rates jump right before you refinance? A sensitivity table shows you the financial fallout instantly.

This is far from an academic exercise; it's a vital risk management tool. The macroeconomic volatility of the past few years has hammered this point home. A 100–150 basis-point shift in your exit cap rate, or a 200–300 basis-point spike in borrowing costs, can completely evaporate double-digit IRRs on a highly leveraged deal. That's a vulnerability you'd only spot by running these sensitivities. To dig deeper into this, you can explore data analytics in real estate cash flow insights.

By building these tables, you pinpoint your deal’s weakest links and can start planning for them proactively.

Sensitivity analysis is like checking the structural integrity of a building before a hurricane. You apply pressure to key points to see where the weaknesses are, ensuring it can withstand the unexpected forces of a turbulent market.

Diving Deeper with Scenario Planning

While sensitivity analysis tweaks one variable at a time, scenario planning takes things a step further. Here, you're building out complete, alternative versions of the future. It’s less about tweaking a single dial and more about telling a few different stories with your numbers.

For instance, you'll almost always want to model three core scenarios:

- Base Case: This is your most likely, well-researched projection. It's the story you believe in and the one you present to investors.

- Upside Case: The optimistic outcome. What happens if rent growth beats expectations and you sell into a hot market with a lower-than-projected cap rate? This shows the deal’s home-run potential.

- Downside Case: The pessimistic "recession" scenario. You might model higher vacancy, flat rent growth, and rising interest rates to see if the deal can still cover its debt and, most importantly, protect investor capital.

Walking into a pitch with these scenarios proves you’ve done your homework. It tells investors you have a clear-eyed view of the risks and a plan to navigate them, which builds far more trust than a single, overly rosy projection ever could.

Structuring Payouts with an Equity Waterfall

One of the most complex—and most critical—parts of any syndication model is the equity distribution waterfall. This is the engine that dictates exactly how and when cash gets distributed to your limited partners (LPs) and you, the general partner (GP). It’s called a waterfall because cash flows from one tier to the next, filling each bucket completely before spilling over into the next one.

A typical waterfall has a few key hurdles or tiers:

- Tier 1: Preferred Return: All available cash flow first goes to investors until they've hit a specific annual return on their capital (e.g., an 8% "pref").

- Tier 2: Return of Capital: After the pref is paid, investors continue to receive all distributable cash until their initial investment is fully paid back.

- Tier 3: The "Promote": This is where it gets interesting. Once investors have received both their preferred return and all their capital back, the profit-sharing split changes. The GP begins earning a disproportionate share of the profits, known as the "promote" or "carried interest." The split might flip from 100/0 (LP/GP) to something like 70/30.

Modeling this correctly is absolutely crucial for transparency and aligning everyone's interests. It's the financial roadmap that shows every partner exactly how the profits will be carved up when the deal succeeds.

From Complex Models to Seamless Capital Raising

So, your real estate financial model is finally done. You've built it, stress-tested it, and polished every last detail. The numbers are solid and tell a compelling story. Now it’s time to get investors on board. This is where the real work often begins, moving from the clean logic of a spreadsheet to the messy, people-driven reality of raising capital.

Suddenly, the game isn't just about IRR or DSCR anymore; it's about execution. You're now wearing a different hat, facing a whole new set of tasks: presenting the deal, managing investor subscriptions, wrangling legal documents, and keeping everyone in the loop—all while trying to avoid getting buried in administrative chaos.

For many, this jump from analyst to capital raiser is a jarring one. Syndicators often find themselves juggling a patchwork of disconnected tools. They’re running email campaigns out of one system, hosting documents in another, and tracking commitments in a completely separate spreadsheet. This isn't just inefficient—it's risky.

The Problem with a Disconnected Workflow

When you rely on a cobbled-together system of spreadsheets, email threads, and generic file-sharing sites, you create a ton of friction for both yourself and your potential investors. It's like trying to run an assembly line where every station uses different tools and speaks a different language.

This disjointed process inevitably leads to some classic headaches:

- Manual Subscription Tracking: Using an Excel sheet to keep track of who committed what, and whether they've signed their docs, is an open invitation for human error. One misplaced decimal or a copy-paste mistake can create a major headache down the road.

- Version Control Nightmares: Emailing out updated offering memorandums or subscription agreements is a recipe for confusion. Before you know it, investors are reviewing outdated information, which can seriously erode their confidence.

- A Clunky Investor Experience: Let's be honest, asking investors to download a bunch of PDFs, print them, sign them, scan them, and email them back feels like a process from a bygone era. Every extra step you force them to take increases the odds they’ll just give up.

These little inefficiencies add up quickly. They kill your fundraising momentum and make you look less than professional. In a market this competitive, a smooth, seamless investor experience isn't just a nice-to-have; it's a real advantage.

Your financial model proves you can find and underwrite a great deal. Your capital-raising process proves you can execute it professionally. Don't let administrative friction undermine the credibility your analysis has built.

Bridging the Gap with an Integrated Platform

The answer is to connect your powerful analysis directly to a smooth, professional capital-raising workflow. This is exactly where an all-in-one syndication platform like Homebase comes in. Think of it as the bridge that takes you from a finished model to a fully funded deal.

Instead of a scattered, manual process, you get a single source of truth. You can spin up a professional deal room in minutes, loading it with your executive summary, financial projections, and all the necessary documents. From there, you invite investors to a secure, online portal where they can review everything, make a commitment, and even e-sign their subscription documents.

This centralized approach does more than just save you a ton of time. It completely changes the investor experience, turning what used to be a series of tedious chores into a simple, frictionless journey. By getting the administrative burden off your plate, you can focus your energy on what actually matters: building relationships, answering tough questions about your real estate financial models, and closing your deal that much faster.

Common Questions About Financial Modeling

As you start to get your hands dirty building and analyzing real estate financial models, you'll find certain questions pop up again and again. Here are some of the most common ones I hear from syndicators, with practical answers to help solidify what we've covered.

What Is the Most Important Metric in a Real Estate Model?

This is a classic question, but the truth is, there's no single "best" metric. The most important metrics work together, like a diagnostic panel, to give you a complete picture of the deal's health. You need to look at them as a team.

- IRR (Internal Rate of Return) is your go-to for measuring time-weighted annual return. It’s fantastic for comparing apples-to-apples when you're looking at deals with totally different hold periods because it tells you how hard your money is working each year.

- The Equity Multiple is much simpler: it shows you the total cash you get back for every dollar you put in. A 2.0x multiple means you doubled your money. It’s a straightforward, powerful gut check on total profit.

- Cash-on-Cash Return is all about the deal's annual income. It shows the cash distributions you can expect each year as a percentage of your original investment, which is a huge deal for investors who want regular cash flow.

A sharp syndicator knows how to weave these three together to tell a compelling story about profitability, risk, and cash flow. It’s about showing investors the full return profile, not just one flashy number.

How Can I Model a Distribution Waterfall Correctly?

Modeling an equity waterfall is really about creating a series of logical hurdles that dictate how cash gets split between you and your investors. It’s a step-by-step process.

First, figure out the total cash you have left to distribute after paying all property expenses and servicing your debt. From there, you build the tiers:

- Tier 1 (Preferred Return): The first pot of money always goes to the investors to pay their "pref" until a certain return threshold is hit (say, an 8% annual return).

- Tier 2 (Return of Capital): After the pref is paid, investors usually get all the remaining cash flow until their initial investment is paid back in full.

- Tier 3 (The Promote): This is where you, the GP, get rewarded. Once investors have hit their pref and gotten their capital back, the profit-sharing split changes, and you start earning a larger, disproportionate share of the profits.

The key to getting this right in a spreadsheet is using logical functions like IF/THEN and MIN/MAX. These formulas ensure that cash flows from one tier to the next in the correct order, without any leaks or miscalculations.

What Are the Biggest Mistakes to Avoid?

The most dangerous mistakes I see usually boil down to a lack of discipline and a heavy dose of wishful thinking. Overly optimistic assumptions—like plugging in aggressive rent growth or a rock-bottom exit cap rate without hard market data to justify them—are a massive red flag to any serious investor.

One of the biggest pitfalls is just poor organization. A messy model that's impossible to follow, with hard-coded numbers buried deep inside formulas, will kill your credibility on the spot. Your best defense is always simplicity, clarity, and conservative assumptions.

Another critical error is skipping the sensitivity analysis. If you don't stress-test your numbers to see how they hold up when things go wrong, you're essentially flying blind to the real risks of the deal.

Ready to move from complex spreadsheets to a seamless capital-raising process? Homebase provides an all-in-one platform to create professional deal rooms, manage investor relations, and close deals faster. See how you can streamline your next syndication.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

What Is DSCR in Real Estate A Guide for Syndicators

Blog

Unlock real estate financing with our guide on what is DSCR in real estate. Learn the formula, lender insights, and how to improve your DSCR for any deal.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.