A Guide to Real Estate Investing CRM Software

A Guide to Real Estate Investing CRM Software

Discover how a real estate investing CRM can transform your syndication business by streamlining capital raising and improving investor relations.

Domingo Valadez

Jan 10, 2026

Blog

A real estate investing CRM is the command center for your entire syndication operation. It's the one place where you manage everything from investor relationships to the nitty-gritty of capital raising. Think of it less like software and more like the brain of your business—it coordinates all your communications, tracks every deal, and keeps you compliant. It replaces that chaotic web of spreadsheets with a single, powerful system.

What a Real estate Investing CRM Actually Does

Let's cut through the jargon. If you’re trying to run your real estate syndication business on spreadsheets, you’re basically navigating a cross-country road trip with a crinkled, folded paper map. Sure, you might get there eventually, but it's slow, full of wrong turns, and a total mess when things get complicated. You’re bound to miss a critical exit—or in this case, a key investor follow-up—and not even realize it until you're miles off course.

A specialized real estate investing CRM is your fully integrated GPS. This isn’t just another generic sales tool; it's a platform built from the ground up to solve the exact problems that keep syndicators and multifamily investors up at night. It's much more than a digital address book. It's the operational hub that manages the entire lifecycle of your investor relationships and fundraising campaigns.

The Air Traffic Control Analogy

Picture your firm as a bustling airport. Your investors are the airplanes, each with its own unique flight plan, destination, and requirements. The capital they commit is the precious cargo they're carrying. Without a central system, you're essentially trying to manage hundreds of takeoffs and landings by shouting instructions from the runway. It’s chaotic, risky, and a disaster waiting to happen.

This is where the CRM steps in as your air traffic control tower. It gives you a clear, real-time view of every "flight" (investor) in your airspace. It safely guides capital from the runway (commitment) to its final destination (a closed deal), all while managing communications and preventing costly "collisions"—like compliance missteps or missed funding deadlines. This system ensures every conversation is tracked, every document is secure, and every investor feels like they're getting first-class service.

From Manual Chaos to Systemized Growth

Moving from spreadsheets to a CRM is a fundamental shift that tackles the biggest pain points for growing syndication firms. Instead of constantly wrestling with disorganized data and administrative bottlenecks, you bring order and efficiency to the chaos.

A dedicated CRM shifts a syndicator's focus from administrative firefighting to strategic growth. By automating the low-value tasks, you reclaim hundreds of hours to spend on high-value activities, like sourcing new deals and strengthening key investor relationships.

So, what specific problems does a real estate investing CRM solve? Here’s a quick rundown.

- Messy Investor Data: It pulls all that scattered information from your emails, spreadsheets, and call notes into one clean, unified investor profile.

- Compliance Headaches: It helps you track accreditation status, manage subscription documents, and maintain a perfect audit trail of all communications.

- Inefficient Capital Raises: It streamlines the entire fundraising process, from an investor showing initial interest all the way to their final e-signature, dramatically shortening your funding cycles.

- Poor Investor Experience: It gives your investors a professional, secure portal where they can access documents, track performance, and get updates. This builds incredible trust and encourages repeat investments.

Ultimately, bringing a real estate investing CRM into your business isn't just about adding another piece of software. It’s about building the professional infrastructure you need to scale your operations securely and predictably. You're turning potential chaos into a reliable engine for growth.

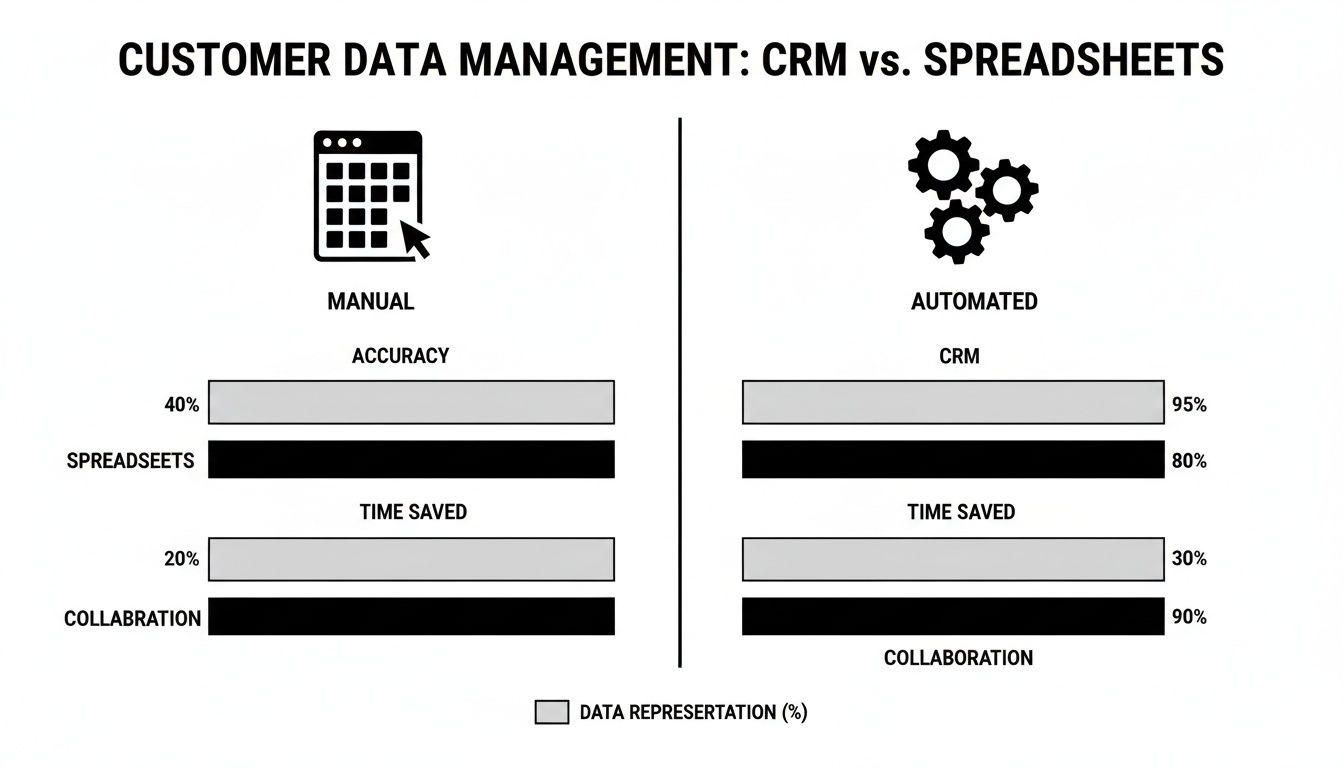

Spreadsheets vs. Real Estate Investing CRM

When you're just starting, spreadsheets seem like a simple solution. But as your investor list grows and your deals become more complex, the limitations become painfully obvious. A specialized CRM is designed for the specific workflows of a real estate syndicator, offering capabilities that a generic spreadsheet simply can't match.

The table makes it clear: while spreadsheets might work for one or two deals with a handful of investors, they quickly become a liability. A dedicated CRM provides the structure, security, and efficiency needed to build a professional, scalable syndication business.

What a Real Estate Investing CRM Actually Does for You

Alright, let's get past the jargon. What specific tools does a real estate syndicator really need? A generic sales CRM is fine for tracking leads, but for raising capital and managing investors, you need a purpose-built toolkit. Think of it less as software and more as the operational backbone for your entire business.

These features aren't just nice-to-haves. They're what you need to run a professional, secure, and scalable operation. The right platform changes how you connect with your capital partners at every single step, from that first fundraising call to the ongoing management of their investment. This is what separates the pros from the folks still wrestling with spreadsheets.

The industry is already voting with its wallet. The Commercial Real Estate CRM market is a $12.7 billion space, and it's expected to grow at 12.2% annually through 2033. You can see the market growth data for yourself over at datainsightsmarket.com. This isn't just a trend—it's the new cost of doing business.

Secure Investor Portals and Deal Rooms

The foundation of a great investor experience today is a secure, branded investor portal. This is your private, digital office, open for your partners 24/7. It immediately gets you out of the risky business of emailing sensitive files like K-1s, subscription agreements, and quarterly updates back and forth.

Inside that portal, you’ll have deal rooms. These are dedicated online spaces for each of your capital raises. When you’re ready to launch a new offering, you invite your accredited investors into a clean, data-rich environment. They can review the pitch deck, dig into the financial models, and look over due diligence materials on their own time, without you having to chase them down.

It’s a world of difference from trying to manage everything manually.

As you can see, a CRM doesn't just organize things—it automates critical tasks, which saves a ton of time and cuts down on the simple mistakes that always seem to crop up with spreadsheets.

Automated Subscriptions and E-Signatures

Let's be honest: the subscription process is usually a nightmare of paperwork and follow-ups. A solid real estate investing CRM takes that entire workflow and puts it online. Investors can fill out their sub docs, verify their accreditation, and sign on the dotted line, all from within the portal.

For sponsors, this is a game-changer. Forget chasing down physical documents or manually updating a spreadsheet to track who has signed. Instead, you get a live dashboard showing you exactly where every investor stands. This not only speeds up your funding timeline but also practically eliminates the risk of human error.

By putting the subscription and closing process online, syndicators often slash the time it takes to close a funding round by 50% or more. That speed gives you a serious competitive edge when you’re trying to lock down a time-sensitive deal.

Built-in Communication and Distribution Tools

Keeping your investors in the loop with consistent, professional communication is how you earn their trust and keep them coming back. A specialized CRM gives you the tools to manage this without breaking a sweat, going way beyond a simple email blast.

Here’s what that looks like in practice:

- Targeted Updates: You can send a renovation update only to the investors in your "Elm Street Multifamily" deal, instead of blasting your entire database. No more cluttering the inboxes of people who aren't involved in that specific property.

- Distribution Management: When it’s time to pay out quarterly distributions, the platform does the heavy lifting. It can calculate each investor's pro-rata share and even handle the ACH payment process for you, killing the need for complex spreadsheets and manual bank wires.

- Secure Document Delivery: Deliver critical tax documents like K-1s directly into each investor's portal. This creates a clean, permanent record for both of you and keeps sensitive information out of email.

When these features work together, every interaction with your investors feels professional and secure. It reinforces their confidence in you and sets you up perfectly for the next deal.

Calculating the True ROI of a Specialized CRM

When you're looking at a specialized real estate investing CRM, it’s easy to get lost in feature lists. But the real conversation isn't about features—it's about return on investment. The true value of these platforms goes way beyond just organizing contacts. It shows up where it counts: on your balance sheet, in how fast you can raise capital, and in the strength of the investor relationships that fuel your growth.

Think of this not as a software expense, but as a strategic investment in the engine of your business. When you can actually put numbers to the returns in key areas, it becomes easy to justify moving on from spreadsheets and getting a platform built to help you scale.

Let's break down how a dedicated CRM pays for itself, often many times over.

The Return on Operational Efficiency

The first and most immediate return you'll see is getting your time back. Administrative work is a black hole for a syndicator's resources, from hunting down signatures to manually piecing together investor updates. A good CRM automates these repetitive tasks, freeing you and your team to focus on what actually moves the needle—finding great deals and talking to capital partners.

Just think about the manual grind of closing one deal. You could easily sink dozens of hours into sending out subscription documents, tracking who has signed what in a spreadsheet, and then chasing down each investor one by one. Now, multiply that by the number of deals you do each year. It adds up fast.

A real estate investing CRM puts that whole workflow on autopilot.

- Document Automation: Instead of emailing PDFs back and forth, the system sends out subscription agreements and handles the e-signatures for you. That simple change can save 10-15 hours per deal.

- K-1 Distribution: Sending tax documents through a secure investor portal is a game-changer. It eliminates the time sink and security headaches of email, easily saving another 5-10 hours during the chaos of tax season.

- Investor Reporting: You can generate and send out professional quarterly reports in minutes, not days. That’s a huge chunk of administrative overhead just gone.

Every hour saved is a direct cost saving. It also means your team can manage a larger volume of deals without you needing to hire more people. The efficiency gains aren't just a concept; they're measurable and you feel them right away.

The Return on Capital Velocity

For any syndication firm, the speed at which you can raise and deploy capital is a critical KPI. A smooth, professional fundraising process has a direct impact on this, leading to faster closes and bigger checks from your investors. This is where a CRM stops being a cost center and becomes a powerful revenue-generating machine.

When an investor can log into a clean portal, review all the due diligence in one secure spot, and commit capital with a few clicks, you remove all the friction. That speed and professionalism give them confidence. And confident investors tend to commit more capital, more quickly.

A professional and transparent fundraising experience builds immense trust. Firms that use a modern investor portal often report that their funding rounds close up to 50% faster and that repeat investors increase their average commitment size on subsequent deals.

This acceleration is a massive growth lever. Closing a deal faster lets you get to the next one, compounding your returns and building momentum. The faster your capital velocity, the faster your AUM grows. It’s a direct financial return, driven by having the right tech in place.

The Return on Investor Trust

Finally, there’s the return that's a bit harder to stick on a spreadsheet but might be the most valuable of all: the increase in investor trust. A modern, secure experience isn’t just about looking good. It signals to your investors that you are professional, competent, and take the stewardship of their capital seriously.

That trust is what builds a powerful growth flywheel for your firm. Happy investors don't just reinvest; they tell their friends. This kind of organic growth is priceless and far more effective than any marketing you could buy. A real estate investing CRM is the infrastructure that keeps that flywheel spinning, turning a one-off investment into a long-term, profitable partnership.

How to Choose the Right CRM for Your Firm

Picking a real estate investing CRM is one of the biggest technology decisions your firm will ever make. This isn't just about buying a piece of software. You're choosing a long-term partner that will serve as the central nervous system for your entire syndication business. The right choice can pour gasoline on your growth, while the wrong one will create constant friction, annoy your investors, and quietly bleed your resources dry.

The trick is to look past the slick demos and flashy features. You need to zero in on the core functions that actually matter to a syndicator's daily workflow. Generic sales CRMs are built for a completely different universe. You need a platform that speaks our language—one that understands deal rooms, K-1s, and accreditation verification right out of the box.

Pricing Models That Align with Your Growth

One of the first forks in the road you'll hit is pricing. A lot of platforms in this space use a model based on your Assets Under Management (AUM), and frankly, this becomes a huge problem as you scale. This approach basically penalizes you for being successful, jacking up your software bill every time you close another deal.

An AUM-based pricing model creates a fundamental conflict of interest between you and your software provider. A flat, predictable pricing structure is far better because it lets you grow your portfolio without facing surprise technology costs that climb with every win.

Keep an eye out for providers with a simple, flat-rate subscription. This model actually supports your growth, letting you add unlimited investors, deals, and team members without your bill spiraling. It’s a straightforward approach that puts you and the vendor on the same side of the table.

Essential Questions to Ask Every Vendor

To cut through the sales fluff and find a real partner, you have to ask the hard questions. Go into every demo armed with a checklist that gets into the nitty-gritty of real estate syndication. This will quickly tell you who's built for this business and who's just a generic tool in disguise.

Here are the non-negotiables every syndicator should be asking:

- Does your platform include a secure, branded investor portal? This is table stakes. You need it to give your investors a professional experience and manage documents securely.

- How do you handle the entire subscription workflow? Dig into the details. Ask about e-signatures, automatic document generation, and how you can track an investor’s progress from commitment to close.

- What are your protocols for security and compliance? Get specific. Ask about their process for KYC/AML checks, accreditation verification, and their data encryption standards.

- Can your system integrate with our existing banking and accounting software? Smooth integrations are a must for automating distributions and making bookkeeping less painful.

These questions will help you see if a platform is genuinely built for what you do. When looking at different CRM options, it's also helpful to see how the best real estate investment software can sharpen your operations and boost your returns.

Don't Overlook Integration and Security

Finally, really poke holes in a CRM’s ability to connect with the other tools you depend on. A great real estate investing CRM can't be a data island. It needs to talk seamlessly with your bank to process ACH distributions and with your accounting software to simplify bookkeeping. Manually moving data between systems is just asking for errors and wasted hours.

Security is just as critical. Your CRM will hold incredibly sensitive investor data, from social security numbers to bank account details. Make sure any vendor you consider has rock-solid security protocols, including two-factor authentication, regular security audits, and a transparent data privacy policy. The trust your investors give you extends to the technology you use to protect their information.

The market for these tools is exploding. The real estate software market is projected to grow from $11.71 billion to $13.65 billion, a massive indicator of the industry's shift to digital. According to one market analysis, this sector is on track to hit $34.1 billion by 2032, showing just how much capital is flowing into property technology. You can discover more insights about these market projections at coherentmarketinsights.com. Making a smart, careful choice now will pay off for years to come.

Implementing Your New CRM Without the Headaches

The very thought of switching systems can be paralyzing. I've seen countless firms stick with clunky spreadsheets or ancient software just to avoid the perceived chaos of moving their data. But let's be clear: a smooth transition isn't just a fantasy. With the right plan and partner, it can be a surprisingly straightforward process.

Think of moving to a modern real estate investing CRM less like a chaotic office move and more like rewiring your building's electrical system. You don't just shut everything down at once. You do it methodically, circuit by circuit, to make sure the lights stay on. The goal is a seamless switch that causes zero disruption and protects the integrity of your most valuable asset—your investor data.

Step 1: Prepare Your Data for the Move

Any successful migration starts with a solid data cleanup. This is your golden opportunity to get everything organized before importing a single contact into the new system. It’s like sorting through your stuff before you pack for a move; there’s no point in bringing the junk with you.

Start by pulling all your investor information from those scattered spreadsheets, email contact lists, and old databases into one master file. While you're at it, standardize your data formats. For example, make sure all phone numbers and addresses follow the same pattern. Weeding out duplicate entries and correcting outdated info now will save you a world of hurt later.

Step 2: Mapping and Trial Runs

With your data squeaky clean, the next step is data mapping. This is a critical phase where you essentially give your new CRM directions. You're matching the columns in your spreadsheet—like "First Name," "Investment Amount," or "Accreditation Status"—to the correct fields in the new platform.

This is where a "white-glove" migration service from your CRM provider can be a game-changer. Having them handle the entire process for you is invaluable. This kind of specialized support nearly eliminates the risk of human error and ensures a perfect transition, saving your team dozens of hours of tedious work.

Before you flip the switch on your entire database, always do a small trial run. It’s simple:

- Pick a Test Group: Choose a handful of trusted, tech-savvy investors to be your guinea pigs.

- Import Their Data: Move only the data for this small group into the new CRM.

- Get Feedback: Ask them to log into the new investor portal and tell you what they think. This is how you catch any quirks before your full launch.

Step 3: Communicate the Transition Clearly

Proactive and clear communication is the secret sauce for a smooth rollout. You want your investors to feel excited about the upgrade, not confused by it. A well-planned communication strategy keeps everyone in the loop and reinforces their confidence in your firm's professionalism. It's also a great time to mention how this new system will improve the investor onboarding process for future deals.

Your communication plan should include a few key touchpoints:

- The Initial Heads-Up: Send an announcement letting investors know a change is coming. Focus on how it benefits them, like better security and 24/7 access to their investment documents.

- The "Go-Live" Email: On launch day, send a welcome email with simple, clear instructions on how they can log into their new portal for the first time.

- Ongoing Support: Make it incredibly easy for investors to ask questions. Set up a dedicated support email or even host a quick "how-to" webinar.

By breaking down the process and leaning on expert support, implementation stops being a headache to fear and becomes a strategic move toward massive efficiency.

Using Your CRM to Scale Your Real Estate Portfolio

Think of a good real estate investing CRM as less of a digital filing cabinet and more of a central command center for your entire operation. It's what allows you to break through the ceiling of managing just a handful of deals and build a truly substantial portfolio. Without it, you’re stuck in the weeds; with it, you’re free to focus on what actually grows the business.

The real magic happens when your CRM becomes the single source of truth for every piece of investor and deal data. As you bring on new team members, from investor relations to acquisitions, everyone is working from the same playbook. This simple fact wipes out a ton of costly miscommunications and empowers your team to act with confidence.

Elevating Your Brand to Attract Capital

Let's be honest: first impressions matter. A professional, seamless experience for your investors instantly elevates your brand. When you can offer partners a secure portal to access documents or view transparent performance dashboards, you’re not just providing convenience—you're building rock-solid trust.

This polished, organized approach signals to high-net-worth individuals and institutional players that you're a sophisticated operator, making your firm far more attractive when it's time to raise capital.

This is how you get a serious competitive edge. Instead of spending your days chasing signatures and manually building reports, your time is freed up for the activities that drive real growth:

- Sourcing better deals by getting out there to network and analyze more opportunities.

- Nurturing key relationships with the capital partners who believe in you.

- Developing a strategic vision for where you want to take your portfolio next.

Investing in the right technology is really an investment in your firm’s future. It lets you step out of the administrator role and into the strategist and dealmaker roles you were meant to play. That shift is what unlocks real, scalable success in this business.

A Foundation for Future Growth

The numbers tell the story. The property management software market, a close cousin to the CRM world for multifamily sponsors, is already valued at $3.61 billion and is expected to hit $5.89 billion by 2033. You can read the full research about this market growth on grandviewresearch.com. This explosive growth just underscores how critical technology has become for managing both assets and relationships. A great CRM is the investor-facing side of that same coin.

Of course, a CRM is just one piece of the puzzle. As you grow, it's wise to build a full tech stack. For instance, exploring the best AI tools for real estate agents can uncover complementary solutions for everything from marketing to lead generation. By layering these tools, you're not just buying software—you're building a durable, scalable infrastructure that can support your ambitions for years to come.

Frequently Asked Questions

Switching from spreadsheets to a dedicated real estate investing CRM is a big step, and it's natural to have a few questions. Let's tackle some of the most common ones we hear from syndicators and multifamily investors.

Can I Just Use a Generic Sales CRM for Real Estate Investing?

You could, but it's like trying to navigate a construction site in a Ferrari. A generic CRM like Salesforce is a powerful tool for selling widgets, but for real estate syndication, it’s a square peg in a round hole.

These platforms are missing the DNA of real estate investing. They don’t have built-in investor portals, they can't handle automated subscription workflows for a new deal, and they certainly don't have features for managing distributions. You’d spend a fortune on custom development just to build the basic features that a dedicated real estate investing CRM offers from day one.

When Is the Right Time to Get a Real Estate CRM?

Honestly, the best time is before your first deal. Starting with a professional system from the get-go shows your investors you’re serious and establishes a scalable foundation for your business. It sets the right tone from the very beginning.

But if you're already in the game and drowning in spreadsheets, that’s your signal. The moment you dread tracking commitments, feel overwhelmed by investor updates, or can't find that one K-1 document, you've hit the wall. That friction is your cue to upgrade to a system built for growth, not just for getting by.

What Is the Biggest Mistake When Choosing a CRM?

By far, the most common and costly mistake is getting locked into a platform that bases its pricing on your Assets Under Management (AUM).

This pricing model is a trap. It punishes you for your own success by making your software bill skyrocket every time you grow your portfolio. It puts your CRM vendor's interests directly at odds with yours.

The smartest move is to find a platform with predictable, flat-rate pricing. This lets you add unlimited investors, properties, and deals without your costs spiraling out of control. It ensures your technology partner supports your growth instead of profiting from it.

Ready to see how a CRM built specifically for real estate syndicators can transform your business? With Homebase, you get flat-rate pricing, white-glove migration, and all the tools you need to streamline fundraising and investor relations. Discover how Homebase can help you scale your portfolio today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering the Cross Collateral Loan for Real Estate Deals

Blog

Discover how a cross collateral loan can help you secure larger real estate deals. Our guide breaks down the process, risks, and rewards for syndicators.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.