8 Real Estate Investment Tax Strategies to Maximize Profits

8 Real Estate Investment Tax Strategies to Maximize Profits

Domingo Valadez

Feb 21, 2025

Blog

Maximize Your Returns with Smart Tax Planning

Real estate investment creates opportunities for significant wealth building through both property appreciation and rental income. However, success in real estate is about more than just purchasing wisely - it's about mastering the intersection of real estate and tax strategy. From basic depreciation write-offs to advanced techniques like cost segregation and opportunity zones, tax planning makes a measurable difference in investment outcomes. Having an effective tax approach is critical, as it allows you to preserve and reinvest more capital while staying fully compliant with regulations.

Key benefits of strategic tax planning include:

- Lower effective tax rates

- Increased cash flow for reinvestment

- Protection of wealth through legal tax reduction

- Greater compounding of returns over time

In this comprehensive guide, we'll explore eight powerful tax strategies specifically developed for real estate professionals, syndicators, and multifamily investors. We'll break down the fundamental principles behind each approach and provide clear guidance on implementation. By the end, you'll have practical knowledge to reduce your tax burden, improve profitability, and generate stronger long-term returns on your real estate investments.

1. 1031 Exchange

A 1031 exchange is an important tax strategy that lets real estate investors defer capital gains taxes when selling an investment property by reinvesting into a similar "like-kind" property. This approach helps investors grow their portfolios by keeping more equity that would otherwise go to taxes. For real estate syndicators, multifamily investors, and sponsors, understanding this tool is essential.

How it Works

The 1031 exchange process allows investors to exchange one investment property for another while deferring taxes. Rather than a direct swap, the exchange uses a qualified intermediary (QI) who holds the proceeds from your property sale and uses those funds to purchase the replacement property.

Key Features

- 45-Day Identification Window: After selling your property, you have 45 days to identify potential replacement properties in writing to your QI

- 180-Day Completion Period: You must complete the entire exchange within 180 days of selling your original property

- Like-Kind Requirements: Both properties must be used for business or investment purposes - typically real estate for real estate

- QI Requirement: A qualified intermediary must facilitate the exchange and ensure IRS compliance

Benefits

- Tax Deferral: Continue deferring capital gains through multiple exchanges to build wealth over time

- More Investment Power: Keep more capital working for you by reinvesting the full proceeds

- Portfolio Flexibility: Ability to diversify across property types or combine smaller properties into larger assets

- Estate Benefits: Capital gains taxes can be eliminated through stepped-up basis at death

Drawbacks

- Time Pressure: Meeting the strict 45 and 180-day deadlines requires careful planning

- Rule Complexity: Professional guidance needed to navigate detailed IRS regulations

- Property Constraints: Finding suitable replacement properties quickly can be challenging

- Added Costs: QI fees and professional advisory expenses increase transaction costs

Real Examples

- A syndicator exchanging several rental homes for a larger apartment complex to scale their portfolio

- An investor trading an older apartment building in a declining area for a renovated property in a growing market

Historical Context

The modern 1031 exchange stems from the landmark Starker v. United States case and Section 1031 of the Internal Revenue Code. This case expanded the definition of "exchange" to include delayed exchanges, making the strategy more practical.

Best Practices

- Early Planning: Start preparing well before selling your original property

- Expert Team: Work with experienced QIs, attorneys and tax advisors who know 1031 exchanges

- Multiple Options: Identify backup properties in case your first choice falls through

- Detailed Records: Keep thorough documentation throughout the exchange process

Following these guidelines helps real estate investors use 1031 exchanges effectively to grow their portfolios while deferring taxes. The strategy requires careful planning but can significantly boost long-term investment returns.

2. Cost Segregation

Cost segregation is a proven tax planning strategy that helps real estate investors accelerate depreciation deductions. This engineering-based approach identifies building components that can be depreciated over shorter time periods, leading to bigger tax deductions in early ownership years. For many investors, this creates substantial tax savings and improved cash flow.

Rather than depreciating an entire building over 27.5 years (residential) or 39 years (commercial), cost segregation lets you identify specific components as personal property with shorter depreciation periods. Items like carpeting, removable walls, and certain fixtures can be depreciated over 5, 7, or 15 years, front-loading your tax deductions.

How it Works:

A qualified cost segregation specialist analyzes your property in detail, categorizing components based on their function and IRS guidelines. They separate building elements into:

- Personal Property (5-15 year depreciation): Carpeting, removable walls, specific fixtures

- Land Improvements (15-year depreciation): Landscaping, fences, paved areas

- Building Structure (27.5 or 39-year depreciation): Core structural elements

Real-World Example:

Consider an apartment complex owner using cost segregation. By reclassifying appliances, carpets and electrical components as personal property, they accelerate depreciation and boost early-year tax savings and cash flow.

Historical Context:

Cost segregation gained acceptance after the Hospital Corporation of America v. Commissioner case validated its principles. Major accounting firms then began offering these services widely.

Pros:

- Larger upfront tax deductions

- Improved early-year cash flow

- Can be applied to past tax years

- Reduces overall tax burden

Cons:

- Professional studies are costly

- Requires specialized expertise

- May trigger recapture if sold early

- Complex documentation needed

Practical Implementation Tips:

- Best for $1M+ properties where study costs are justified

- Use qualified specialists with proven experience

- Coordinate with other tax strategies

- Keep detailed records for IRS compliance

With proper planning and professional guidance, cost segregation can significantly improve your real estate investment returns through accelerated depreciation benefits.

3. Real Estate Professional Status (REPS)

Real Estate Professional Status (REPS) enables active real estate investors to deduct unlimited passive losses from real estate against any type of income by reclassifying real estate activities as non-passive. For investors in syndications, multifamily properties, or sponsorships, this provides a major advantage since passive activity loss rules typically limit deducting passive losses against non-passive income. Having REPS status maximizes the tax benefits from real estate depreciation and other deductions.

Why REPS Makes a Difference

For high earners actively working in real estate, REPS can dramatically lower tax bills by using real estate losses to offset income from any source. This makes it an essential strategy for investors looking to reduce their tax burden.

Key Features and Benefits:

- Unlimited Loss Deductions: REPS allows you to deduct all real estate losses against any income type, far exceeding standard passive loss limitations. This is especially valuable for properties with large depreciation or renovation expenses.

- Offset Various Income Sources: You can use real estate losses to reduce taxes on W-2 wages, investment income, and other gains - providing more flexibility in managing your overall tax situation.

- High-Income Tax Savings: The tax benefits increase with your income level, making REPS particularly valuable for high earners seeking to preserve wealth.

- Works With Cost Segregation: Combining REPS with cost segregation generates bigger losses in early ownership years through accelerated depreciation.

Qualifying for REPS

You must meet two specific tests:

- Material Participation: Spend over 750 hours annually on real estate activities with detailed documentation.

- Time Allocation: More than half of your total working hours must be in real estate businesses.

Real-World Example

Consider a doctor earning $400,000 per year who invests in multifamily properties. Without REPS, their passive loss deductions would be restricted. But by actively managing properties and qualifying for REPS, they can deduct major losses against their salary, potentially saving significant tax dollars.

Growing Popularity

While the core REPS rules remain unchanged, more investors now recognize its power for building wealth and optimizing taxes, especially given rising property values.

Key Advantages and Challenges:

Benefits:

- Deduct unlimited losses

- Offset any income type

- Maximize high-income tax savings

- Enhanced by cost segregation

Drawbacks:

- Strict qualification rules

- Heavy documentation needs

- Higher audit risk

- May require career changes

Implementation Tips:

- Track Time Carefully: Keep detailed logs of all real estate work hours and activities using dedicated software.

- Maintain Complete Records: Document everything related to your real estate business - communications, meetings, contracts, and expenses.

- Consider Spouse Benefits: Explore having your spouse qualify for REPS to potentially double the tax advantages.

- Work With Tax Experts: Partner with qualified tax advisors experienced in real estate to ensure proper compliance and strategy.

With proper planning, thorough documentation, and professional guidance, REPS can be a powerful tool for reducing taxes and improving real estate investment returns.

4. Opportunity Zones

Opportunity Zones (OZs) offer real estate investors a powerful way to reduce taxes while making a positive community impact. Created by the Tax Cuts and Jobs Act of 2017, this program encourages investment in struggling economic areas across the US. By putting capital gains into Qualified Opportunity Funds (QOFs) that invest in these zones, investors can substantially reduce their tax burden.

How Opportunity Zones Work

The program centers on tax benefits. Investors can postpone capital gains taxes by moving them into a QOF within 180 days after selling an appreciated asset. This deferral continues until December 31, 2026, or until they sell the QOF investment. Holding the QOF investment for 5 years reduces the deferred gain by 10%, while a 7-year hold brings an additional 5% reduction. The biggest advantage comes after 10 years - any gains on the QOF investment itself become tax-free.

Key Benefits

- Tax Deferral: Push capital gains taxes to 2026 or beyond

- Tax Reduction: Cut original deferred gain by up to 15%

- Tax-Free Growth: Pay no taxes on QOF investment gains after 10 years

- Community Impact: Help improve struggling neighborhoods

- Portfolio Growth: Access emerging market opportunities

- Value Potential: Benefit from development in growing areas

Advantages and Disadvantages

Benefits:

- Major tax savings

- Social impact investing

- Portfolio expansion

- Growth potential in developing areas

Drawbacks:

- 10-year minimum for full benefits

- Higher risk in distressed areas

- Complex rules to follow

- Limited location options

Real Investment Examples

- Mixed-Use Projects: Converting old warehouses into vibrant spaces with homes, shops and community areas

- Apartment Buildings: Building new affordable housing while capturing tax advantages

- Downtown Revival: Restoring historic main streets to bring back local businesses and jobs

Tips for Investors

- Study area demographics, market trends and growth indicators carefully

- Work with local developers who know the community well

- Learn and follow all QOF and OZ regulations

- Plan for at least 10 years to maximize tax benefits

For more insights, check out: Opportunity Zone Buildings in Austin: An Investment Guide. This resource explores OZ investing in a specific market.

Many real estate investors and syndicators have found success with Opportunity Zones by combining tax benefits with smart market selection. While the rules take time to master, proper planning helps achieve both financial returns and meaningful community impact.

5. Self-Directed IRA for Real Estate

A self-directed IRA (SDIRA) is a strategic way for real estate investors to build retirement wealth with significant tax benefits. Unlike conventional IRAs limited to stocks and bonds, SDIRAs let you invest in alternative assets like real estate. This opens up opportunities for better returns and more diverse investments in a tax-advantaged account.

How it Works:

With an SDIRA, you choose the specific properties to invest in - whether rental properties, fix-and-flips, or raw land. The key is that you can't manage the property yourself. Instead, an IRS-approved custodian holds the assets and handles administration to ensure compliance. All property income, including rent and sale profits, goes back into the SDIRA either tax-deferred or tax-free, depending on if it's traditional or Roth.

Market Adoption:

While self-directed retirement accounts have existed for years, they've gained popularity recently among real estate investors. More people want direct control over their retirement funds, especially given real estate's historical returns compared to traditional investments. Better educational resources have also helped more investors understand and use SDIRAs.

Real-World Example:

Consider a multifamily syndication raising capital. An investor could use their SDIRA to become a limited partner in the deal. Any distributions from the project - both ongoing cash flow and eventual sale profits - would flow back into their SDIRA, growing tax-deferred until retirement.

Key Benefits:

- Tax-Advantaged Growth: Compound returns without yearly taxes. Roth SDIRAs offer tax-free withdrawals in retirement

- Investment Flexibility: Access a wide range of real estate investments beyond traditional IRA limits

- Asset Protection: Get some protection from creditors and lawsuits based on state laws

- Risk Management: Add real estate to diversify your retirement portfolio

Advantages and Disadvantages:

Advantages:

- Tax benefits for real estate investing

- Portfolio diversification options

- Asset protection features

- Potential higher returns

Disadvantages:

- No Personal Use: You and family members can't use SDIRA properties - even overnight stays violate rules

- Complex Regulations: Strict IRS rules govern SDIRAs. Violations can disqualify the account and trigger tax penalties

- Higher Fees: Expect more administrative costs compared to regular IRAs

- Limited Deductions: Property loan interest isn't deductible and special non-recourse financing is required

Implementation Tips:

- Pick an Expert Custodian: Choose one experienced with real estate SDIRAs to navigate regulations

- Know the Rules: Learn IRS prohibited transaction rules, especially regarding disqualified persons

- Document Everything: Keep detailed records of all SDIRA real estate transactions

- Plan Distributions: Remember required minimum distributions start at retirement age

When used properly, SDIRAs give real estate investors a powerful way to build tax-advantaged retirement wealth. Success requires understanding the rules and being strategic, but the benefits can make the extra complexity worthwhile.

6. Real Estate Investment Trust (REIT) Tax Benefits

REITs offer compelling tax advantages while providing real estate exposure without direct property ownership responsibilities. They serve as an excellent tool for real estate professionals seeking portfolio diversification and steady income streams. The main advantage comes from their pass-through tax structure, which helps investors avoid double taxation on profits.

These companies own or finance income-producing properties across various sectors. To maintain their special tax status, REITs must distribute at least 90% of taxable income to shareholders as annual dividends. This high distribution requirement is what enables the tax benefits - since income is taxed only at the shareholder level, REITs bypass corporate income tax entirely.

Key REIT Characteristics:

- Mandatory Distribution: Must pay out 90% of income to shareholders

- Tax Efficiency: Single-level taxation at shareholder level only

- Professional Management: Experienced teams handle all operations

- High Trading Volume: Easy to buy/sell shares on major exchanges

Benefits for Investors:

- Reliable Income: Regular dividend payments from high distribution requirement

- Expert Operations: Professional teams manage all aspects

- Quick Liquidity: Simple to enter and exit positions

- Risk Spreading: Access to diverse property types and locations

Important Considerations:

- Growth Limitations: Focus on dividends may restrict appreciation potential

- Price Swings: Share values can move significantly with market changes

- Indirect Control: No direct input on property decisions

- Tax Complexity: Some aspects of REIT taxation require careful planning

Common REIT Types:

- Equity REITs: Own and operate properties directly

- Mortgage REITs: Focus on real estate financing

- Hybrid REITs: Combine both property ownership and financing

Growing Adoption:

REITs have become increasingly popular as an efficient way to invest in real estate markets. Major companies like Equity Residential, Simon Property Group, and Prologis have shown how the REIT structure can generate strong returns while providing diversification.

Strategic Implementation Tips:

- Research different REIT categories to understand their unique characteristics

- Create a balanced mix of REITs across property types and regions

- Work with tax professionals to optimize REIT investments

- Keep track of market conditions affecting REIT performance

By understanding these core aspects of REITs, real estate professionals can effectively use them to build more robust investment portfolios focused on income generation and diversification.

7. Installment Sales

An installment sale lets real estate investors delay tax payments by spreading capital gains recognition across multiple years instead of paying all at once. This approach works particularly well for syndicators, multifamily investors, and sponsors who want to maintain cash flow while reducing their immediate tax burden.

How Installment Sales Work:

In an installment sale, payments are structured over time rather than received upfront. Each payment includes principal, interest, and a portion of the taxable gain. You only report the gain for each payment in that tax year, which can help keep you in a lower tax bracket and provide better long-term financial outcomes.

Real-World Example:

Consider a real estate syndication that sells a multifamily property for $5 million with a $2 million basis. Using a 10-year installment plan, they wouldn't pay taxes on the full $3 million gain immediately. Instead, they would only pay taxes on the gain portion of each annual payment. This structure works well if the syndication plans to reinvest the proceeds, as it frees up more capital for the next investment.

Background Context:

Installment sales have been an established part of the tax code for many years. Their use tends to increase when capital gains tax rates are high, as investors look for ways to minimize their tax burden. The method's flexibility also makes it useful during economic uncertainty, giving sellers more control over their finances.

Features and Benefits:

- Multi-year income distribution: Reduces immediate tax impact

- Tax bracket management: Helps avoid jumping into higher brackets

- Custom payment terms: Can be structured to fit both parties' needs

- Interest earnings: Creates additional income from remaining balance

Pros:

- Reduced upfront taxes: Keeps more capital available

- Interest income potential: Generates ongoing returns

- Flexible deal structure: Adapts to different situations

- Possible tax savings: May lower total taxes paid

Cons:

- Payment period risks: Vulnerable to buyer financial changes

- Documentation needs: Requires careful legal setup

- Default concerns: Risk of missed future payments

- Tax rate uncertainty: Future rates could increase

Practical Tips for Implementation:

- Check buyer credit: Do thorough financial verification

- Secure the sale: Use appropriate collateral protection

- Consider time value: Factor in inflation effects

- Payment management: Create clear collection procedures

Strategic Value:

For experienced real estate investors, installment sales provide important tax management benefits. The ability to control when income is recognized while maintaining cash flow makes this approach valuable for long-term wealth building. With proper understanding and risk management, real estate professionals can use installment sales effectively to improve their investment outcomes.

8. Conservation Easements

Conservation easements combine tax advantages with environmental stewardship, making them an important strategy for real estate investors. When you donate a conservation easement, you can claim significant tax deductions while helping preserve natural landscapes or historic properties. This approach works especially well for investors holding large land parcels who want to include conservation in their estate planning.

A conservation easement is a binding agreement between a property owner and a qualified land trust or government agency. The agreement permanently limits how the property can be developed and used to protect its conservation value. Property owners keep their land and can continue allowed activities like farming, logging, or recreation, but intensive development, subdivision, and mining are typically not permitted.

How Tax Benefits Work: The IRS considers conservation easement donations as charitable contributions. Donors can deduct the easement's value from their federal income taxes. The deduction amount equals the difference between the property's market value before and after placing the easement.

Example: Consider a 100-acre property worth $2 million. After adding development restrictions through a conservation easement, the value drops to $1.5 million. The $500,000 reduction represents the easement's value and potential tax deduction.

History: Groups like The Nature Conservancy and the Land Trust Alliance promoted conservation easements in the late 20th century. They helped establish the legal framework while advocating for land preservation. The tax benefits and growing focus on protecting the environment have made easements an appealing choice for many property owners.

Key Features:

- Permanent Protection: Ensures lasting preservation of the land's conservation values

- Tax Deductions: Provides substantial income tax benefits

- Continued Ownership: Owners keep their property and maintain approved uses

- Conservation Impact: Helps protect important natural areas and cultural sites

- Estate Tax Relief: Can lower estate value and reduce tax burden

Benefits for Investors:

Advantages:

- Major tax savings: Can greatly reduce taxable income

- Environmental good: Supports conservation goals

- Estate planning: Makes passing property to heirs easier

- Property control: Allows continued land use within limits

Challenges:

- Cannot be undone: Restrictions stay with the property forever

- Valuation process: Must get professional appraisal to determine value

- IRS oversight: Donations face careful review for compliance

- Lower property value: Permanent reduction in market price

Implementation Guidelines:

- Choose quality partners: Work with established land trusts for legal and administrative support

- Get expert appraisal: Use qualified professionals to determine easement value

- Document thoroughly: Record property's environmental or historical importance

- Plan ahead: Consider how restrictions will affect property use and value long-term

Strategic Value: For real estate investors with substantial land holdings and long-term outlook, conservation easements effectively reduce taxes while supporting environmental protection. Though setup requires careful planning, the potential benefits make this strategy worth considering. Learn more from the Land Trust Alliance.

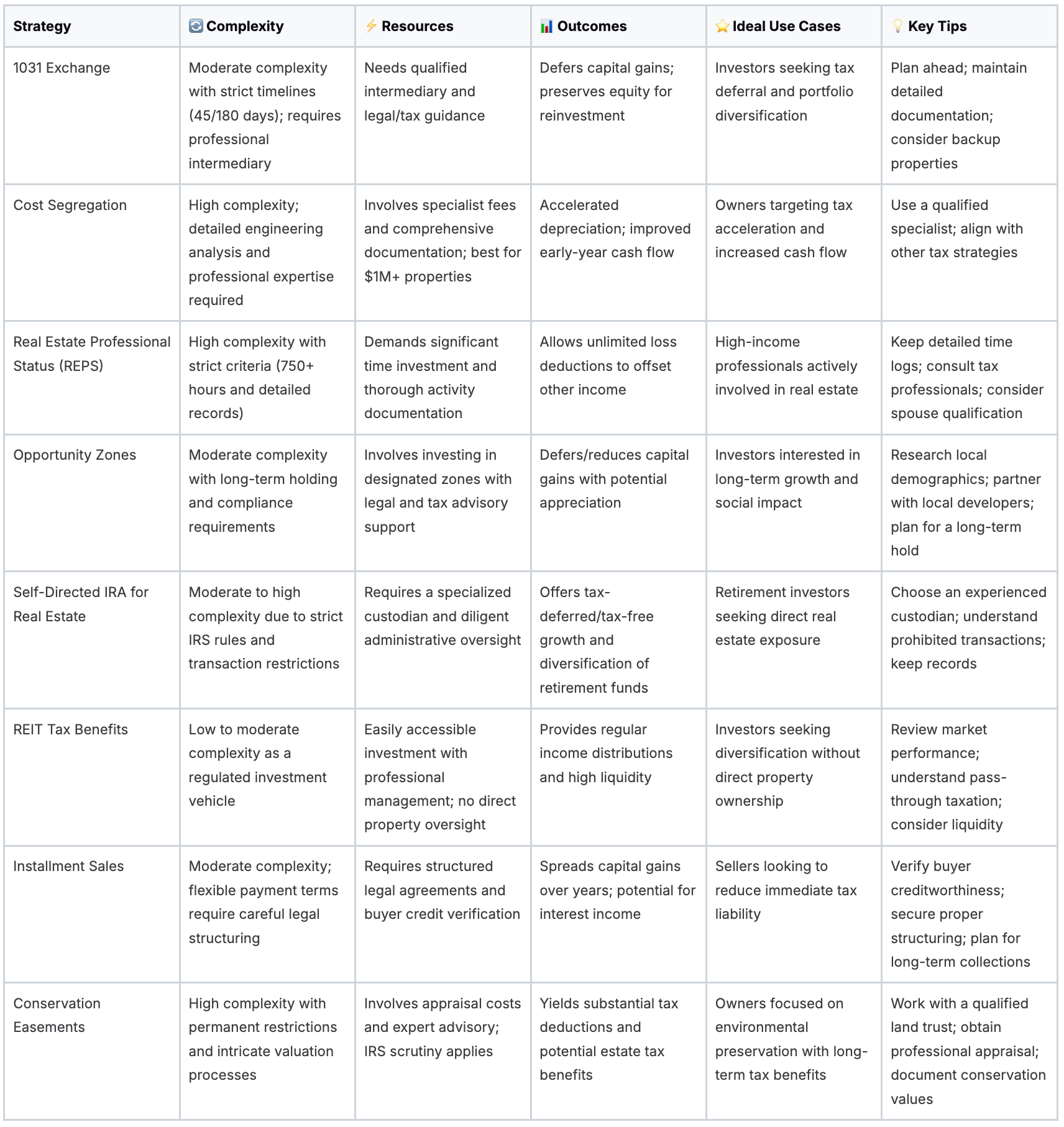

8-Point Comparison of Real Estate Investment Tax Strategies

Start Saving Today with These Tax Strategies

Smart real estate investors know that effective tax planning makes a big difference in investment returns. The eight key strategies we covered - 1031 Exchanges, Cost Segregation, Real Estate Professional Status (REPS), Opportunity Zones, Self-Directed IRAs, REIT benefits, Installment Sales, and Conservation Easements - can help reduce your tax burden when used properly. However, proper implementation is critical. Work with a qualified tax advisor to align these approaches with your specific portfolio and ensure you meet all requirements.

Take a methodical approach to putting these strategies into practice. Start by examining your current investments to identify where you can get the most benefit. Begin with simpler strategies and add more complex ones as you gain experience. Track your results carefully and check in regularly with your tax advisor to keep optimizing your approach.

The rules and opportunities around real estate investing change often. Tax regulations get updated, new investment options appear, and market conditions shift. Success requires staying well-informed. Read industry news, join educational events, and build connections with other investors. Being ready to adjust your strategies helps you succeed over time.

Key Takeaways:

- Tax planning drives returns: Make tax strategy central to your investment planning, not an afterthought

- Get expert guidance: Complex tax rules require professional help - work with a qualified advisor

- Keep learning: Regular education helps you spot new opportunities and avoid pitfalls

- Use appropriate tools: The right systems help you manage deals and investor relationships smoothly

Want to make your real estate syndication more tax-efficient? Homebase helps real estate investors manage their deals with automated fundraising, investor communications, integrated reporting and secure document sharing. Stop wasting time on spreadsheets and focus on growing your portfolio. At $250/month for unlimited deals and investors, Homebase provides excellent value and scalability. Visit Homebase today to learn how we can help optimize your operations and improve investor relations.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

How Do You Value Commercial Real Estate? A Modern Sponsor's Guide

Blog

Discover how do you value commercial real estate with a sponsor-focused guide. Master NOI, cap rates, and DCF to spot profitable investments.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.