Top Real Estate Investment Accounting Software for Portfolio Growth

Top Real Estate Investment Accounting Software for Portfolio Growth

Discover the best real estate investment accounting software to streamline your finances and boost portfolio growth. Try it today!

Domingo Valadez

Jul 27, 2025

Blog

Trying to manage a growing real estate portfolio with spreadsheets is a bit like using a flip phone in the age of smartphones. It gets the basic job done, but you're missing out on a world of efficiency, power, and crucial information that could be at your fingertips. Making the switch to dedicated real estate investment accounting software isn't just about getting a fancier tool; it's a strategic move to protect your profits and scale your business with confidence.

The Hidden Price Tag of "Free" Spreadsheets

Let's be honest, we've all started with spreadsheets. They're familiar and seem free, but that's a dangerous illusion. The real cost isn't the software license; it's the slow, silent drain from data entry mistakes, overlooked deductions, and decisions made on outdated numbers. Many investors stick with what they know, but it’s critical to understand the limitations of spreadsheets for portfolio tracking as soon as you have more than one or two properties.

A single typo—a misplaced decimal point or a miscategorized repair—can set off a chain reaction. Suddenly, your profit and loss statements are unreliable, your cash flow projections are off, and you're making critical decisions based on faulty data. This isn't just messy bookkeeping; it's a direct threat to your bottom line.

Small Errors, Big Financial Consequences

The danger goes beyond simple math mistakes. When your records are a jumble of manual entries, you're almost guaranteed to overpay on taxes. Think about it: did you correctly classify that new HVAC system as a capital improvement instead of a simple repair? The difference can mean thousands of dollars in deductions you're legally entitled to but might miss.

The fundamental flaw with spreadsheets is that they're static. They're a snapshot in time, not a live feed. This completely ties your hands when you need to make quick, smart decisions in a fast-moving market.

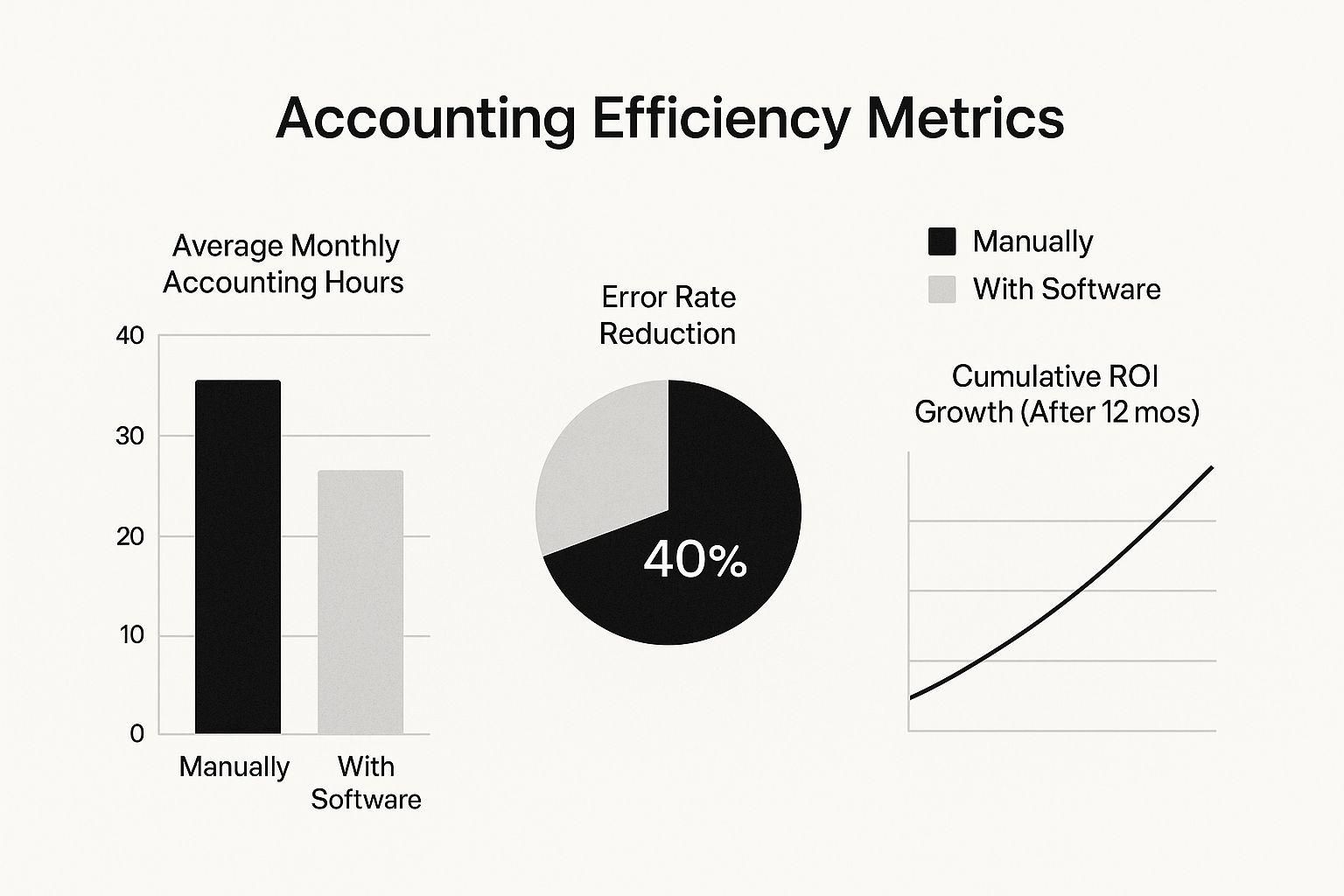

This visual breakdown really highlights the jump in performance you can expect when moving from old-school methods to a specialized platform.

As you can see, the time saved and the accuracy gained aren't minor tweaks—they are game-changers for your portfolio's financial health.

To make the contrast even clearer, here’s a high-level look at where spreadsheets fall short and where dedicated software steps up.

Spreadsheet Limits vs Software Capabilities

This table shows it plainly: spreadsheets just weren't built for the dynamic needs of real estate investing.

Ultimately, sticking with manual spreadsheets means you are actively leaving money on the table. The right platform should deliver clear, actionable insights that empower you, not bury you in administrative tasks.

By investing in proper software, you gain:

* Time back in your day: Automation slashes the hours spent on tedious data entry.

* Maximum tax savings: Every potential deduction is captured and correctly categorized.

* Clarity and control: You get an instant, accurate view of your entire portfolio's performance, right down to the property level.

Making the leap to real estate investment accounting software isn't about spending money—it's about building a financial foundation that allows you to grow your portfolio with precision and peace of mind.

What Is Real Estate Investment Accounting Software?

Let’s get right to it. Real estate investment accounting software is a purpose-built financial command center for property investors. Forget generic bookkeeping tools; this is a system designed from the ground up to handle the unique financial DNA of a real estate portfolio.

Think of it this way: you wouldn't use a standard set of household wrenches to service a high-performance race car. Sure, you might tighten a few bolts, but you'd be missing the precise tools needed for the complex engine. General accounting software like QuickBooks is that basic toolkit—it works for many businesses, but it’s not built for the specifics of property investment. Real estate accounting software is the master mechanic's specialized set.

Every feature is engineered to handle the specific financial mechanics of real estate, from individual tenant ledgers to complex partnership structures. It transforms how you see and manage your assets.

This targeted design means the software solves problems that generic platforms simply can't handle without a ton of clunky, error-prone workarounds.

Beyond Basic Debits and Credits

The main job of this software is to automate and bring clarity to the financial operations that only exist in real estate investing. It does much more than just track income and expenses. Its most important functions are built around the property itself as the central financial unit.

For instance, a core feature is tracking every financial event on a per-property and per-unit basis. Trying to get this granular view in standard software would require creating a ridiculously complicated chart of accounts. A dedicated platform, however, lets you see instantly which units are profitable and which are costing you money.

On top of that, these platforms often come with specialized invoice management for real estate, which is essential for tracking vendor costs and property-specific income. This makes sure every dollar is tied to the correct property, eliminating financial mix-ups.

How It Solves Real-Estate-Specific Problems

The real power of real estate investment accounting software shines when you look at the headaches it eliminates—tasks that drive investors crazy when they're stuck using spreadsheets or generic tools.

Specialized tasks handled with ease:

* Automated Rent Collection: The system handles everything from sending rent reminders and collecting online payments to automatically calculating and applying late fees. No more manual chasing.

* Security Deposit Management: It correctly logs security deposits as liabilities (not income) and manages their eventual return, helping you stay compliant with local laws.

* Investor Payouts & Reporting: For syndicators, it automates complicated distribution waterfalls and generates clean, professional statements for each investor, which is crucial for building trust.

* Depreciation Schedules: It can manage different depreciation schedules across multiple properties, a key piece for maximizing tax benefits that often gets messy.

By mastering these property-focused financial tasks, the software gives you a clear, accurate, and real-time view of your portfolio's health. For anyone wanting to dig deeper, our guide on understanding real estate accounting software provides a more detailed look.

At the end of the day, it's about having a system that speaks the language of real estate. It's not just about recording transactions; it’s about generating industry-standard reports like a detailed rent roll or a schedule of real estate owned with just a few clicks. That’s what empowers you to make smarter, faster investment decisions.

Core Features That Drive Profitability

The market for this kind of specialized software is booming, and for good reason. Experienced investors know that not all accounting platforms are created equal. A generic bookkeeping tool might get the basic job done, but a true investment-grade system has features specifically engineered to boost your bottom line. These aren't just fancy add-ons; they are the financial engines that turn tedious admin work into opportunities for profit.

The numbers back this up. The global real estate accounting software market was valued at around $2.5 billion in 2025 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 12% through 2033. This growth is all about meeting the demands of increasingly complex real estate deals and providing the accuracy modern investors need to stay ahead. You can dig deeper into this trend by checking out real estate technology market research.

So, let's break down the must-have features that separate a simple organizational tool from powerful real estate investment accounting software that actually makes you more money.

Automated Rent Collection And Late Fee Processing

The lifeblood of any real estate investment is consistent cash flow. Manually chasing down rent checks isn't just a drain on your time; it injects a dose of unpredictability into your revenue each month. The right software takes this entire headache off your plate.

And we're talking about more than just an online payment button. A solid system automates recurring invoices, sends polite reminders to tenants before rent is due, and processes payments through ACH or credit card. Crucially, it can also automatically calculate and apply late fees based on your lease terms, making sure you collect every dollar you're entitled to without having to play the bad guy or do manual math. This one feature alone transforms rent collection from a monthly chore into a reliable, automated revenue machine.

Think of it as your own automated accounts receivable department. It works 24/7 to ensure timely payments, freeing you from the role of a bill collector so you can focus on finding your next deal.

Granular Property-Level Expense Tracking

To really understand how your portfolio is performing, you have to get granular. A generic accounting program might tell you your total repair costs for the year, but it won't flag that one specific property is secretly bleeding you dry with recurring plumbing problems. This is where property-level expense tracking becomes a game-changer for profitability.

Good software lets you tag every single expense—from a major roof replacement down to a single lightbulb—to a specific property, and even to an individual unit.

Why This Level of Detail Is So Powerful:

* Finds Hidden Money Pits: You can instantly spot which properties have unusually high maintenance or utility bills, signaling a deeper issue that needs your attention.

* Guides Smart Capital Decisions: By tracking repairs over time, you can make data-driven calls about when a quick fix is no longer cutting it and a bigger capital improvement is the smarter long-term investment.

* Maximizes Tax Deductions: When every expense is perfectly categorized and assigned, your accountant can easily find every eligible deduction, preventing you from leaving thousands of dollars on the table at tax time.

For example, detailed tracking might show that plumbing costs for Building A are 40% higher than for Building B, even though they have the same number of units. That's a red flag. It prompts an investigation that could uncover failing pipes, saving you from a catastrophic and wildly expensive failure down the road.

A Dedicated Investor Portal And Reporting

If you work with partners or syndicate deals, building and maintaining their trust is everything. An investor portal is a secure, private online hub where your capital partners can get all the information they need, anytime they want. This feature is a hallmark of professional-grade real estate investment accounting software.

The portal shifts your investor relations from a mess of scattered emails and confusing spreadsheets into a clean, professional dashboard. It gives them a real-time window into the performance of the assets they’ve put their money into.

Key Functions of an Investor Portal:

* Secure Document Access: Investors can view and download crucial documents like K-1 tax forms, operating agreements, and quarterly reports on their own schedule.

* Performance Dashboards: They can log in to see key metrics for their investment, like total distributions received and the current value of their equity.

* Distribution History: A crystal-clear, transparent record of all payouts eliminates confusion and cuts down on administrative back-and-forth.

This level of transparency doesn't just solidify relationships with your current investors; it becomes a powerful magnet for attracting new capital. When potential partners see you have a professional system like this in place, it screams competence and reliability, making them far more confident about investing in your deals.

How Software Actually Puts More Money in Your Pocket

It’s one thing to say that dedicated real estate investment accounting software makes your life easier, but how does a monthly subscription actually boost your bottom line? The connection might not seem direct at first, but the financial impact is very real. The key is understanding how software features translate into a tangible return on investment (ROI).

Thinking of this software as just another monthly bill is a common mistake. It’s far more accurate to see it as a high-yield investment, and the most immediate return you'll get is reclaiming your most valuable asset: your time.

Investors I talk to who’ve made the switch from manual spreadsheets to a dedicated platform consistently report saving 10 to 15 hours every single month. This isn't just about getting your weekends back; it's a massive strategic advantage. What could you do with an extra 120-180 hours a year? That’s time you can pour back into finding new deals, managing assets more effectively, or building stronger relationships with your investors.

Turning Saved Time Into Profitable Action

That reclaimed time is where the magic really starts to happen. Instead of getting bogged down in administrative quicksand, you can finally shift your focus to activities that actually generate revenue.

Think about how that extra time directly leads to higher returns:

* More Deal Sourcing: You can underwrite more potential acquisitions, which dramatically increases your odds of finding that one undervalued gem.

* Deeper Due Diligence: With time on your side, you can dig deeper into promising deals, reducing your risk and strengthening your negotiating position.

* Proactive Asset Management: You can actually get out and walk your properties, talk to tenants, and spot opportunities for value-add improvements before they escalate into costly problems.

This shift from a reactive administrator to a proactive investor is the first major step toward boosting your portfolio’s performance. You stop working in your business and start working on it.

Unlocking Better Financing With Professional Reports

Here’s another powerful benefit that many investors overlook: securing better financing. Lenders and capital partners need to see clean, professional, and accurate financial statements. Handing them a jumbled spreadsheet full of potential formula errors just screams amateur hour.

When you can instantly generate a detailed, software-driven Schedule of Real Estate Owned (SREO) or a precise Profit & Loss statement for each property, you build immediate credibility. That level of professionalism can lead to lower interest rates, larger loan amounts, and more favorable terms.

Even a small reduction in your interest rate, say just 0.25%, can save you tens of thousands of dollars over the life of a loan. That money goes straight to your cash-on-cash return, and this single benefit alone can often pay for the software subscription many times over.

This screenshot from the Homebase platform shows a clean, professional dashboard that organizes critical deal information.

This is exactly the kind of organized presentation lenders and partners want to see. It projects competence and inspires confidence.

Making Data-Backed Decisions That Boost NOI

Finally, the most direct path to a higher ROI is using real-time data to make smarter operational decisions. It's no surprise the broader real estate software market is projected to hit $20.6 billion by 2026. This explosive growth is happening because investors are tired of guesswork. They want technology that gives them the precision to manage their portfolios effectively. You can learn more about the trends behind this growth and how technology is transforming real estate workflows.

With immediate access to your Key Performance Indicators (KPIs), you can stop reacting and start acting decisively.

Actionable KPI Insights:

* Net Operating Income (NOI): By tracking NOI for each property in real-time, you can instantly see if a recent rent hike is working or if a sudden jump in utility costs is eating into your profits.

* Cash-on-Cash Return: You can easily see which properties are your top performers, helping you decide where to deploy your next round of capital for the biggest impact.

* Expense Ratios: Is maintenance for one building trending way higher than your portfolio average? A quick look at your expense ratios can flag this, prompting you to investigate whether a capital improvement could save you money in the long run.

Using these kinds of insights, you can justify rent increases, strategically plan for capital expenditures, and pivot your portfolio strategy with confidence. Every one of these small, data-backed decisions adds up, contributing directly to a healthier bottom line and a much higher overall ROI.

How To Choose The Right Software For Your Portfolio

When you're picking real estate investment accounting software, you aren't just buying another tool. You're bringing on a new strategic partner. The platform you choose will have a real impact on your portfolio's efficiency, your ability to grow, and ultimately, your bottom line for years to come. A rushed decision can easily trap you in a system that stunts your growth, but the right one can become one of your most powerful assets.

This isn't about chasing the software with the longest list of features. It's about finding the one that truly fits your unique situation—where you are today, and where you plan to be tomorrow. The first step, before you even look at a single demo, is to take an honest inventory of your own portfolio. An investor with three single-family rentals has completely different accounting needs than a syndicator managing large multifamily properties with dozens of partners.

Start with the basics. How many units do you have right now? What kind of properties are they? Single-family homes, multifamily apartments, commercial spaces, or a mix of everything? The more varied your assets, the more complex your operations become, and your software has to keep up.

Evaluate Your Current and Future Needs

I've seen it happen time and again: an investor picks a solution that perfectly solves today's problems, only to find it's a major roadblock a year later. A platform that feels great for five units can quickly become a bottleneck when you scale to fifty. Scalability isn't just jargon; for any investor with ambition, it's absolutely essential.

You also need to think about your ownership structure. Are you the sole owner, or do you work with partners and syndications? If you have investors, features like a secure investor portal or automated distribution calculations stop being "nice-to-have" and become non-negotiable. This is where a purpose-built platform like Homebase shines, offering sophisticated tools that a generic property management app simply can't match.

Choosing software is about forecasting your trajectory. You're not just buying for the portfolio you have; you're investing in a platform that can support the portfolio you want to build.

To help you cut through the noise, I’ve put together a practical checklist. Use these questions to measure up different software options and to make sure you're asking the right things during sales demos. This framework helps you focus on finding a true partner, not just another subscription.

Software Selection Checklist

Here's a straightforward checklist of the key criteria and questions to have ready when you're evaluating different real estate investment accounting software options.

By using a structured approach like this, you can avoid getting distracted by flashy features you'll never actually use. Instead, you can keep your focus on the core functions that genuinely drive efficiency and profit in a real estate business. Taking the time to do a thorough evaluation ensures the software you end up with is a foundational asset that will grow right alongside you.

Answering Your Questions About Real Estate Accounting Software

Even when you see the benefits, bringing a new system into your workflow can feel like a big step. It’s natural to have practical questions. Let's tackle some of the most common ones head-on so you can feel confident about making the switch.

Can I Just Use QuickBooks for My Rentals?

You can, but it’s a bit like trying to use a family sedan to haul construction materials. It'll work for a little while, but it’s not what it was built for, and things get messy fast. Generic accounting software like QuickBooks just doesn't have the real estate-specific DNA you need for true portfolio management.

You’ll quickly find yourself creating clunky manual workarounds for crucial tasks. Think about tracking income and expenses by individual property, managing security deposit liabilities correctly, or calculating complex investor distributions. Dedicated software is built from the ground up to handle these things automatically, saving you a ton of time and, more importantly, reducing the risk of costly errors that skew your portfolio's performance.

When Should I Switch to Dedicated Software?

There isn't a magic number of doors that signals it's time. The real trigger is complexity. For most investors, that tipping point comes around their second or third property—the moment your spreadsheets start feeling more like a liability than a tool.

Here are a few signs you've outgrown your current system:

* You’re spending more than a couple of hours each month just on bookkeeping.

* You're constantly worried about co-mingling personal and business funds.

* You can't get a clear, real-time snapshot of how each property is actually performing.

Getting a proper system in place early on builds a solid financial foundation. It makes scaling your portfolio down the road a much smoother and less stressful experience.

How Difficult Is the Setup Process?

The thought of moving all your financial data can definitely be intimidating. The good news is that modern cloud-based platforms are designed to be user-friendly. The initial lift varies, but the best software providers have streamlined the process with guided setups, simple tools to import your existing spreadsheets, and great customer support to help you out.

Set aside a few weeks to get everything dialed in. You'll need to import your historical data, connect your bank accounts, and just get a feel for the new workflow. The long-term clarity and time savings you'll gain are well worth this short-term effort.

Is This Software a Tax-Deductible Expense?

Yes, it almost always is. For real estate investors, the subscription cost for accounting and property management software is considered an ordinary and necessary business expense. This means the full cost is typically 100% tax-deductible, which directly helps lower your tax bill. Of course, it's always a good idea to run this by your accountant to confirm how it applies to your specific situation.

Ready to stop wrestling with spreadsheets and start managing your investments like a professional? Homebase provides the all-in-one platform you need to streamline fundraising, investor relations, and deal management with clarity and confidence. Discover how Homebase can help you scale your portfolio today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.