A Guide to Real Estate Fund Accounting

A Guide to Real Estate Fund Accounting

A complete guide to real estate fund accounting. Learn the core mechanics, key challenges, and modern best practices for managing investment fund finances.

Domingo Valadez

Jul 6, 2025

Blog

When you invest in a real estate fund, you're not just buying a piece of property; you're buying into a complex financial partnership. Real estate fund accounting is the specialized practice that keeps this entire ecosystem running smoothly. It's much more than just bookkeeping. This field is all about investor-level reporting, navigating complex profit distributions, and tracking fund performance metrics to maintain transparency and meet strict regulatory demands.

What Is Real Estate Fund Accounting

Think of a real estate fund as a specialized vehicle designed for a very specific mission: acquiring and managing a portfolio of properties. Multiple investors pool their money to provide the fuel (the capital), and the fund manager acts as the driver. Real estate fund accounting, in this analogy, is the mission control center. It's the system that meticulously tracks every dollar, monitors the vehicle's performance, and ensures every passenger—the investors—knows exactly how the journey is progressing.

This isn't your standard corporate accounting. It's not even the same as property-level accounting. A property accountant is focused on the day-to-day finances of a single asset—think rent rolls, maintenance bills, and utility payments for one building. A fund accountant, on the other hand, operates from a much higher altitude, taking a bird's-eye view of the entire investment structure.

The Core Purpose and Objectives

At its core, the main goal of real estate fund accounting is to deliver unwavering accuracy and transparency to everyone involved. It’s built to answer the questions that keep investors and managers up at night: How is the fund really doing? What is my personal stake worth today? And, most importantly, when can I expect a return, and how on earth was it calculated?

To get there, fund accounting zeroes in on a few key objectives:

- Ensuring Compliance: Funds are governed by a dense legal document, the Limited Partnership Agreement (LPA). Accountants are the guardians of this agreement, making sure every financial move—from management fees to profit splits—is by the book.

- Building Investor Trust: Nothing builds confidence like clear, accurate, and timely financial reports. This is the ultimate proof of responsible capital stewardship and the primary way to keep investors informed and engaged.

- Providing a Clear View of Fund Health: By calculating critical metrics like Net Asset Value (NAV), fund accountants create a standardized snapshot of the fund’s total worth at a specific moment.

Fundamentally, real estate fund accounting is about managing the complex financial dance between the fund manager (the General Partner) and the investors (the Limited Partners). It's the translator that turns messy, property-level data into clean, consolidated, fund-level insights.

The table below breaks down the essential components that make this system work.

Core Components of Real Estate Fund Accounting

This structure creates a necessary system of checks and balances for managing large-scale real estate ventures.

Key Players and Their Roles

This whole financial operation hinges on a few key players. You have the General Partner (GP), who is the fund manager responsible for making the deals and managing the properties. Then you have the Limited Partners (LPs)—the investors who put up the capital but have a more hands-off role in the day-to-day.

The fund accountant is the critical link between them. They act as the financial referee, ensuring the GP’s activities are recorded correctly and reported clearly to the LPs. Without this specialized function, trying to track capital, calculate fair returns, and maintain trust across a complex fund would be a recipe for disaster.

Understanding the Core Mechanics

To really get what real estate fund accounting is all about, you have to look past the textbook definitions and see how it works on the ground. Think of it as the engine room of a real estate fund—a constant, cyclical process that turns investor promises into physical buildings and, hopefully, solid returns.

At its heart, this whole system is about carefully tracking the flow of money. It all kicks off when a fund manager finds a great investment opportunity and needs to tap into the capital investors have pledged. That’s the first, and arguably one of the most critical, steps in the entire cycle.

The Lifecycle of Capital

The journey starts with a capital call. This isn't just a casual request; it's the formal process where the fund manager draws down a portion of an investor's total commitment. For instance, if an investor committed $1 million, the manager might "call" $250,000 to help buy a new office building. The accountant’s job here is crucial: they must track every dollar coming in, making sure each investor's capital account is updated to show exactly what's been paid and what’s still on the table.

Once that capital is in the bank, it gets put to work acquiring properties and covering all the costs that come with them. From that moment forward, the accountant is responsible for tracking every single financial movement. This includes:

- Property-Level Income: Think rent from tenants, fees from parking garages, or any other revenue the actual properties generate.

- Operating Expenses: The everyday costs of running a property, like management fees, repairs and maintenance, insurance, and property taxes.

- Fund-Level Expenses: These are the overhead costs that aren't tied to one specific building, such as audit and legal fees or the fund manager's own asset management fees.

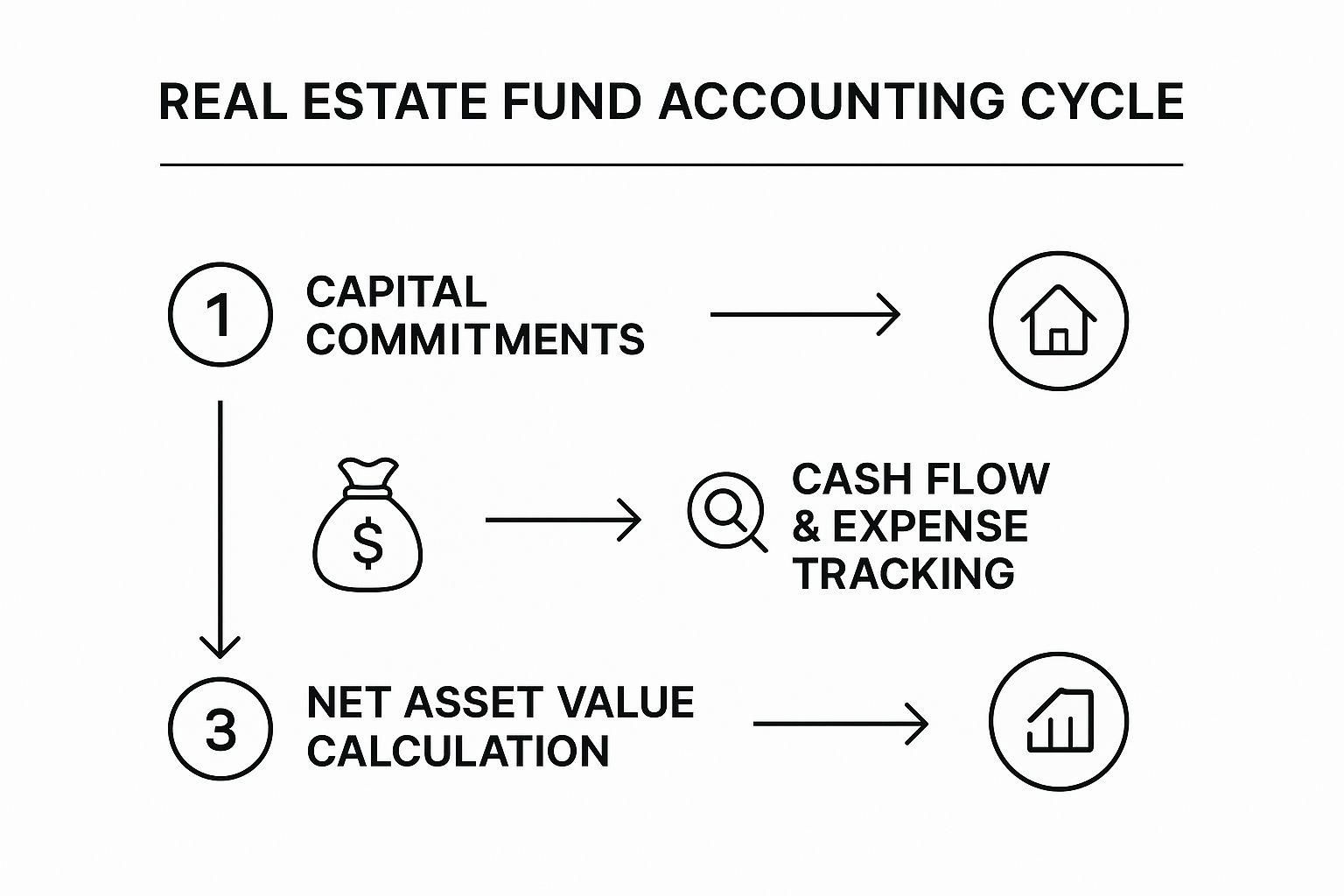

This image below paints a clear picture of this fundamental cycle, from the initial capital commitment all the way to calculating the fund's final value.

As you can see, it’s a continuous loop. Capital comes in, gets deployed into assets, performance gets measured, and that value calculation feeds right back into the next round of investment decisions.

Calculating the All-Important Net Asset Value

At regular intervals—usually every quarter—the fund accountant has to tackle one of the most important jobs in the business: calculating the Net Asset Value (NAV). This number is the single most important metric for understanding a fund's performance; it’s the bottom-line figure that represents the fund's total worth.

The NAV calculation is a snapshot in time, providing a clear, standardized answer to the question, "What is the fund worth today?" It is the bedrock of investor reporting and performance benchmarking.

The formula itself seems simple enough: NAV = Fair Market Value of Assets - Total Liabilities. The real challenge, however, is figuring out the "Fair Market Value" of real estate, which isn’t traded on a stock exchange. This is where independent, third-party appraisals become essential to get an objective valuation. The accountant’s role is to pull all these property values together, add in any cash sitting in the bank, and then subtract all the fund’s debts, like mortgages or accrued expenses, to get to that final NAV.

Managing Distributions and the Waterfall

The last piece of the puzzle is managing distributions. When a property is sold or generates more cash than it needs to operate, profits are paid back to the investors. This isn't a free-for-all; it's governed by a very specific, tiered payout structure called a distribution waterfall, which is spelled out in the fund's legal agreements.

A classic waterfall structure flows in a specific order:

- Return of Capital: First things first, investors get their initial investment back.

- Preferred Return: Next, investors earn their "preferred return," a minimum profit threshold they are entitled to before the manager gets a bigger slice (e.g., 8% per year).

- Catch-Up Provision: The fund manager (the General Partner or GP) often gets a larger share of profits for a period, allowing them to "catch up" to a predetermined split with investors.

- Carried Interest: Once all those hurdles are cleared, the remaining profits are split between the investors (Limited Partners or LPs) and the GP. The GP's share of this final profit is known as carried interest.

The fund accountant is the one who has to run these incredibly complex waterfall calculations with absolute precision. A single mistake can mean paying out the wrong amounts, which can completely shatter investor trust and lead to serious legal trouble. These core mechanics—capital calls, NAV calculations, and waterfall distributions—are the operational backbone of any well-run real estate fund.

Navigating Common Challenges and Complexities

While the theory behind real estate fund accounting seems straightforward, the real world is a different story. It’s a field loaded with hurdles and intricate details where one small mistake can have big consequences. Fund accountants are constantly grappling with issues that go far beyond simple debits and credits, demanding a deep understanding of both real estate markets and complex finance.

One of the toughest nuts to crack is asset valuation. Unlike stocks, which have a clear, publicly traded price, real estate properties are inherently illiquid. You can't just pull up a ticker symbol for a downtown office building. Its true worth is a blend of professional judgment, current market trends, property performance, and future potential.

Placing an accurate and defensible fair value on illiquid properties is a cornerstone challenge. This process directly impacts the Net Asset Value (NAV), and any subjectivity can lead to investor scrutiny and questions about the fund's true performance.

This valuation often leans on third-party appraisals, but even those can differ. The fund accountant is ultimately the one who has to consolidate these values, apply them consistently across the entire portfolio, and stand behind them in financial reports.

Managing Intricate Fund and Deal Structures

The complexity really ramps up when you start looking at how modern real estate deals are structured. It’s pretty rare for a fund to just buy a building outright. Instead, today’s investing landscape is a web of partnerships and legal entities, all created to optimize taxes, limit liability, and bring different expertise to the table.

These structures add serious layers of complexity for accountants:

- Joint Ventures (JVs): When a fund partners with a developer on a project, the accountant has to manage separate books for the JV itself, all while rolling its financial impact up to the main fund. This often means tracking profit-sharing agreements that can be just as complicated as the fund's own waterfall.

- Real Estate Investment Trusts (REITs): If a fund is structured as a REIT or invests in one, a whole new set of strict regulatory rules comes into play. Accountants must meticulously track everything to ensure the fund meets specific income and asset tests to keep its favorable tax status.

- Multi-Currency Transactions: For any fund operating internationally, dealing with multiple currencies is a constant headache. Accountants have to manage foreign exchange risk, translate financials accurately, and account for currency swings that can dramatically affect returns.

Each of these structures demands sophisticated accounting to make sure every dollar is tracked correctly and consolidated into a single, accurate picture of the fund's health. And beyond the operational side, navigating the tax landscape is its own massive challenge. For more on that, you can dig into understanding specific real estate tax deductions.

Operational Pressures and Shifting Market Dynamics

On top of all these structural headaches, accountants face enormous operational pressure. A heavy reliance on manual processes and disconnected spreadsheets is a huge source of risk. Manual data entry is just asking for human error, which can snowball into miscalculated NAVs and incorrect waterfall distributions. A single misplaced decimal can lead to wrong payouts and, even worse, shattered investor trust.

The global investment landscape only adds to the pressure. Shifting market dynamics mean you have to stay on your toes. For instance, cross-border investment activity is always in flux. In 2019, a record 32% of global real estate deals were cross-border, a figure that fell to 23% by 2023. At the same time, global M&A volume in commercial real estate plunged by a staggering 62% in 2023, only to see a dramatic rebound in early 2024.

This volatility puts immense pressure on accountants to deliver faster, more frequent, and perfect reporting. Investors aren't willing to wait around for quarterly reports anymore; they want on-demand access to performance data. Trying to meet these expectations with outdated tools is a losing battle. These challenges make it crystal clear that modern, automated solutions for real estate fund accounting are no longer a "nice-to-have"—they're essential for survival and growth.

Best Practices for Modern Fund Accounting

To succeed in today's demanding real estate investment world, you have to do more than just manage the books. True excellence in real estate fund accounting comes from a proactive, disciplined strategy built on consistency, solid controls, and the smart use of technology. This isn't about making small tweaks; it's about building a solid framework that delivers the kind of accuracy and transparency modern investors demand.

The bedrock of this framework is establishing standardized workflows. When every capital call, expense allocation, and distribution calculation follows the same clear, documented steps, you dramatically lower the risk of human error. This isn't just about being efficient—it’s a fundamental internal control that makes your entire operation more predictable, auditable, and reliable. Without it, your team is forced to improvise, which opens the door to mistakes that can quickly destroy investor confidence.

Think of it like building a high-performance engine. Every part has to work together perfectly, following a detailed blueprint. Using ad-hoc processes is like throwing in mismatched parts; the engine might sputter along for a bit, but it’s going to be inefficient and break down when you put it under any real pressure.

Embrace Technology and Automation

If there’s one practice that will make the biggest impact, it's adopting the right technology. For any fund of a meaningful size, trying to run things with manual spreadsheets is just not a realistic option anymore. It's painfully slow, riddled with potential errors, and creates isolated data silos that make it impossible to get a complete picture of your fund's health.

This is exactly where integrated accounting platforms come in. A modern system acts as a central hub for your fund, creating a single source of truth for all financial data. By connecting everything from property-level performance metrics to individual investor capital accounts, you can finally stop playing the dangerous game of trying to reconcile dozens of separate Excel files.

You’ll see an immediate and significant improvement in a few key areas:

- Automated Reconciliations: The software can match transactions automatically, slashing the time spent on one of the most tedious tasks in accounting.

- Centralized Data Management: All fund, property, and investor data lives in one secure, accessible system, so you can be sure everyone is working from the same playbook.

- Real-Time Performance Dashboards: Instead of having to wait for a month-end report, managers and investors can get an instant, accurate look at key performance indicators anytime they want.

A well-chosen technology stack elevates the accounting function from a reactive scorekeeper to a proactive, strategic partner. It frees up your team's time for high-level analysis instead of mind-numbing data entry.

Fortify Internal Controls and Reporting

Strong internal controls are the guardrails that keep your fund operating safely. This means creating clear approval workflows for expenses and distributions, performing regular internal audits, and ensuring proper segregation of duties. It’s a simple but critical rule: no single person should ever control a financial transaction from beginning to end. For instance, the person who sets up a wire transfer should never be the same person who approves it.

At the same time, your reporting needs to keep up with the times. Investors aren't satisfied with a simple quarterly PDF anymore. They expect on-demand access to their investment data through secure online portals. Best-in-class reporting doesn't just show them what is happening; it explains why. Implementing strong financial analytics is a cornerstone of modern fund accounting, allowing for much deeper dives into performance and risk. These tools help you visualize trends, benchmark properties, and tell a compelling story with your numbers.

For those who want to better understand the administrative functions that support these practices, learning about the key components of real estate fund administration offers valuable context. This broader role works hand-in-hand with the accounting team to create a smooth and professional investor experience.

Ultimately, these practices—standardization, technology, and robust controls—create a powerful synergy. They work together to build a resilient and efficient accounting operation that both earns investor trust and paves the way for sustainable growth.

How Technology Is Reshaping the Field

For a long time, the world of real estate fund accounting was stuck in the past, heavily reliant on manual spreadsheets and a patchwork of disconnected systems. That era is definitively over. Today, technology isn't just a helpful add-on; it's the engine driving a massive transformation in how funds operate.

Automation and artificial intelligence (AI) are at the forefront of this change, turning tedious, manual chores into efficient, automated workflows. This isn't just about speed—it's about fundamentally better and smarter work.

Imagine a tool that can digest a 100-page lease agreement in seconds, pulling out critical dates, financial terms, and renewal options without a human having to read a single line. That capability alone saves an incredible amount of time and slashes the risk of expensive mistakes. This is what modern fund management looks like.

The rapid advances in technology, especially AI, are changing the very DNA of accounting. For example, innovations are now central to tasks like AI-powered financial analysis, where huge, complex datasets are analyzed to spot trends and insights that were once completely hidden.

The Power of Automated Workflows

One of the biggest game-changers technology brings is the automation of complex calculations—the kind that used to be a huge source of operational headaches and risk. Think about waterfall distribution models, with all their tricky hurdles and catch-up clauses. Specialized software can now run these calculations perfectly in a flash, making sure every investor gets paid exactly what they're owed based on the fund's agreements.

But the automation doesn't stop there. It's woven into nearly every aspect of real estate fund accounting:

- Automated Capital Calls and Distributions: Modern platforms handle the entire capital call process, from sending investor notices to tracking payments and updating capital accounts automatically.

- Machine Learning for Cash Flow Forecasting: Sophisticated algorithms can sift through historical property data and market trends to produce far more accurate and dynamic cash flow projections.

- Integrated Reporting: Instead of painstakingly piecing reports together, new systems can pull data from across the fund to generate professional, real-time investor reports on demand.

This shift is so significant that it's seen as the most important development in the field. In a recent global survey, 70% of fund accountants pointed to automation and AI as the number one industry trend. On top of that, 61% of respondents agreed that these technologies would have a major impact on fund accounting, improving everything from data entry to the accuracy of financial reports.

Elevating the Role of the Accountant

Maybe the most profound impact of this technological wave is how it's changing the accountant's job. By taking over the repetitive, everyday tasks that used to eat up their time, technology frees up professionals to concentrate on work that truly adds value. They can finally get out from under the mountain of spreadsheets and become genuine strategic partners.

By handling the "what," technology empowers accountants to focus on the "why." They can analyze performance data, identify risks and opportunities, and provide insights that help fund managers make better investment decisions.

This shift turns the accounting function from a simple back-office cost center into a forward-thinking strategic advantage. An accountant who can tell the story behind the numbers—explaining why one property is crushing it while another is lagging, or what's really driving operating expenses—is infinitely more valuable than one who just crunches the numbers.

The modern real estate fund accountant is evolving into a data analyst, risk manager, and strategic advisor all rolled into one. They are using technology not to replace their expertise, but to supercharge it, delivering the clarity and foresight needed to win in a fiercely competitive market. This isn't just a future possibility; it's the new benchmark for excellence in real estate fund accounting.

Frequently Asked Questions

When you're dealing with real estate funds, a lot of questions pop up, whether you're a seasoned investor or a fund manager just starting out. Here are some straightforward answers to the most common queries we hear.

What's the Difference Between Property Accounting and Fund Accounting?

The easiest way to think about this is to consider the scale. Are you looking through a microscope or a telescope?

Property accounting is the microscope. It focuses on the nitty-gritty financial details of a single property. We're talking about tracking day-to-day income and expenses—rent checks, utility bills, maintenance jobs, and property taxes for one specific building. The end goal here is simple: figure out if that individual asset is making or losing money.

Real estate fund accounting, on the other hand, is the telescope. It takes a big-picture view, looking at the entire portfolio of properties as one cohesive investment vehicle. It rolls up all the financial data from every single property in the fund.

But it goes much deeper than that. Fund accounting is responsible for:

* Managing all the money moving between investors and the fund, like when you call for capital or send out distributions.

* Calculating the fund's total Net Asset Value (NAV).

* Figuring out how to split profits according to complex "waterfall" agreements.

* Putting together comprehensive financial reports for every investor and stakeholder.

So, you could say property accounting is like managing the checkbook for a single house, while fund accounting manages the entire financial world of the investment partnership.

How Is Net Asset Value (NAV) Calculated in a Real Estate Fund?

The Net Asset Value (NAV) is probably the single most important metric for any real estate fund. It tells you what the entire fund is worth at a specific moment in time. This number is what you use to price investor shares and track how well the fund is performing.

On the surface, the formula looks simple:

NAV = (Fair Market Value of All Assets) – (Total Liabilities)

The real work is in figuring out that "Fair Market Value." Real estate isn't like a stock that you can buy or sell in a second on a public market. It's illiquid. That’s why you need independent, third-party appraisals to get an objective valuation for each property.

The NAV isn't just a number on a spreadsheet; it’s the vital sign of the fund's health. Getting this calculation right is fundamental to maintaining investor trust and transparency.

A fund accountant takes the appraised values of all the properties, adds in any cash on hand and other assets, and then subtracts everything the fund owes. That includes mortgages, loans, and any accrued expenses like management fees. This whole process is typically done every quarter to give investors a regular update on performance.

What Is a Waterfall in Real Estate Fund Accounting?

A "waterfall" is just a fancy term for how profits get divided up between the investors and the fund manager (the General Partner, or GP). It’s a cascading, tiered system laid out in the legal documents that dictates exactly who gets paid, in what order, and how much.

Imagine a series of buckets, one after another. The cash flow fills up the first bucket completely before it can spill over and start filling the next one. That’s a waterfall.

A common waterfall structure has a few key hurdles, or tiers:

1. Return of Capital: First things first, the investors (Limited Partners, or LPs) get 100% of their original investment back.

2. Preferred Return: Once their capital is returned, investors earn a "preferred return." This is a minimum rate of profit (often around 8% a year) they must receive before the GP starts taking a bigger piece of the pie.

3. Catch-Up: Next, there's usually a "catch-up" tier where the GP gets a much larger share of the profits until they've "caught up" to a specific profit-sharing split with the LPs.

4. Carried Interest: After all those hurdles are cleared, any remaining profit is split between the LPs and the GP. The GP's oversized portion of this final profit is known as carried interest or the "promote."

Nailing these waterfall calculations is one of the most complex—and most important—jobs in all of real estate fund accounting.

Managing these moving parts, from calculating NAV to executing intricate waterfall distributions, demands a system that's both powerful and reliable. Homebase offers an all-in-one platform designed to simplify fundraising, investor relations, and deal management. It lets you step away from the spreadsheets and focus on what you do best: finding great deals and growing your portfolio. See how Homebase can streamline your operations.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.