A Practical Guide to Real Estate Syndication Laws

A Practical Guide to Real Estate Syndication Laws

Navigate the complexities of real estate syndication laws. This guide breaks down SEC rules, investor types, and legal documents to keep your deals compliant.

Domingo Valadez

Jul 4, 2025

Blog

When you hear "real estate syndication laws," it's easy to get intimidated. But at its core, it's just the rulebook for how a group of people can legally pool their money to buy property. Think of it like crowdfunding a big apartment complex. Because investors are counting on you, the syndicator, to make the deal profitable, the law sees their investment as a security. This means the whole process falls under rules set by the Securities and Exchange Commission (SEC).

These regulations aren't there to trip you up; they exist to protect investors and give you a clear, legal path for raising capital.

Why Real Estate Syndication Is a Security

The moment you bring in passive investors who expect a return from your work—finding, managing, and improving the property—you've crossed a critical line. You're no longer just coordinating a simple partnership; you're selling an investment opportunity. And in the eyes of the law, that's a security.

This classification is the first and most important step in https://www.homebasecre.com/posts/understanding-syndication-in-real-estate. It brings a whole set of federal and state rules into play, all designed to keep things fair and transparent. The main goal is to protect investors from fraud and make sure they have all the critical information they need before writing a check.

The second you ask other people for money to fund a deal where they're just silent partners, you're in the securities world. It’s that simple. This isn’t a gray area; it's a bright, clear line.

Don't see this legal framework as a roadblock. It’s actually a roadmap. It provides a structured, predictable way for you to raise the funds you need. Without these rules, the market would be a chaotic free-for-all, and investors would have little reason to trust sponsors with their hard-earned capital.

To better grasp these foundational concepts, the table below breaks down the key legal components that every syndicator must understand.

Key Legal Components of Real Estate Syndication

Understanding these pieces is the first step toward structuring your deals correctly and confidently.

The SEC’s Role and Your Path Through Exemptions

The Securities Act of 1933 is the landmark law here. It mandates that every securities offering must be registered with the SEC—unless you can find a specific exemption. For most real estate syndicators, a full-blown public registration is completely out of the question. It's incredibly expensive and takes forever.

This is exactly why exemptions are your best friend. In the U.S., almost every syndicator raises money under a set of rules called Regulation D. Within Regulation D, two specific rules are the go-to options:

- Rule 506(b): This is the traditional, private fundraising route. You can raise an unlimited amount of money from an unlimited number of accredited investors and up to 35 non-accredited (but financially savvy) investors. The catch? You are absolutely forbidden from any public advertising. Think word-of-mouth and existing relationships only.

- Rule 506(c): This is the modern, more open approach. You can also raise unlimited capital, but here you can advertise your deal publicly—on your website, social media, or at industry events. The trade-off is significant: you can only accept money from verified accredited investors, and the burden is on you to take "reasonable steps" to confirm their status.

These two pathways are the bedrock of legal real estate syndication. Choosing the right one for your deal is one of the first and most important decisions you'll make with your attorney.

The SEC's Role in Your Real Estate Deal

It might feel strange to think a government agency known for policing Wall Street cares about your plan to buy an apartment building. But the second you bring in passive investors to fund that deal, the Securities and Exchange Commission (SEC) suddenly has a seat at the table. Why? Because real estate syndication laws don't see this as a simple property purchase; they see it as the creation of a security.

You’re not just selling fractional ownership of a building. You’re selling a financial promise. Investors are handing you their hard-earned money because they trust your skills to find a great property, manage it effectively, and hopefully, turn a profit for them. That structure—where people invest money expecting a return from someone else's work—is the very definition of a security. And the SEC’s whole job is to protect those investors.

Why Your Deal Is Considered a Security

The legal bedrock for all this comes from a famous Supreme Court case that gave us the Howey Test. It's a surprisingly simple, four-part checklist to determine if a transaction is an "investment contract" and, therefore, a security.

Here’s the test. A deal is a security if it involves:

- An Investment of Money: An investor puts in cash or another asset.

- In a Common Enterprise: Their money gets pooled with other investors' funds in the same project.

- With an Expectation of Profit: The investor is hoping to make a financial return.

- From the Efforts of Others: Those profits depend on the work of the sponsor (you!), not the investor.

A real estate syndication hits every single one of these points. Investors pool their capital (1 & 2) into your deal, hoping for cash flow and a big payout when you sell (3), all while relying on your expertise to make it happen (4). This is why complying with real estate syndication laws isn’t just a good idea—it’s the law.

The Consequences of Getting It Wrong

Let's be blunt: ignoring SEC regulations is one of the fastest ways to kill your syndication business. The SEC has a long reach and isn't shy about investigating and penalizing sponsors who don't play by the rules. The fallout can be devastating.

This is about more than just fines. If you fail to comply, investors could be granted rescission rights. That means you could be forced to return all of their capital, plus interest—a move that could easily bankrupt your project and your company.

Picture this: you raise $5 million for a great multifamily deal but cut corners on the legal side. You don't file the right exemption paperwork or bother to properly verify that your investors are accredited. A year in, the market takes a downturn, and the property isn't performing as you projected. One unhappy investor talks to a lawyer and learns the offering was non-compliant.

That single complaint can kick off an SEC investigation, which could lead to:

- Hefty Fines: Severe financial penalties against you personally and your business entity.

- Disgorgement of Profits: Being forced to give back every dollar of profit you made from the deal.

- Full Investor Refunds: The nightmare scenario of being legally required to offer a full refund to every investor.

- An Industry Ban: Getting barred from ever raising capital or working in the securities industry again.

Beyond the legal and financial ruin, the damage to your reputation is often permanent. A public enforcement action makes it virtually impossible to regain trust and raise capital for future deals. Following the rules isn't about navigating red tape; it's about building a sustainable, trustworthy business where you, your partners, and your investors are all protected.

Understanding Your Investor Status

In the world of real estate syndication, not all checks are created equal. The difference between an accredited and a non-accredited investor is one of the first and most critical legal lines you'll encounter. This isn't about some exclusive club; it's about the SEC's mandate for investor protection.

The logic from the regulators is pretty simple. They believe individuals with a certain amount of wealth and financial experience are better positioned to navigate the risks of private investments. Essentially, they can afford to take a hit—even losing their entire investment—without it derailing their financial lives. This single classification will shape your entire capital-raising strategy and determine who you can legally invite into your deals.

Before you even think about raising money, you have to grasp the restrictions on accepting capital. This rule of the road applies to everyone raising private money, whether for a tech startup or a new apartment building, because it's all governed by securities laws designed to keep everyone safe.

What Makes an Investor Accredited?

So, what does it actually take to be "accredited"? It’s not a judgment call on someone's smarts or business savvy. The SEC has laid out very specific financial thresholds. An individual has to meet at least one of these criteria:

- The Income Test: They need an annual income of $200,000 (or $300,000 if you include their spouse's income) for the past two years, and they must reasonably expect to earn the same in the current year.

- The Net Worth Test: They must have a net worth exceeding $1 million, either on their own or with a spouse. It's important to note this calculation excludes the value of their primary home.

There are other paths to accreditation, too. Holding certain professional licenses (like a Series 7, 65, or 82) or being a director or executive officer of the company offering the investment also qualifies someone.

Why This Status Is So Important

This distinction between accredited and non-accredited investors is everything. It's the fork in the road that determines which legal exemption you can use to raise capital. As you’ll see, some exemptions are strictly for accredited investors, while others give you a little wiggle room.

Think of it like a driver's license. Someone with a license is presumed to have the skills to handle a car on the highway. In the same way, an accredited investor is presumed to have the financial capacity to navigate the riskier terrain of private investments.

An investor's status isn't just a box to check on a form. It’s a core pillar of your deal's legal foundation. If you get this wrong, you could blow up your securities exemption and face serious legal and financial trouble.

For example, if you decide to raise money under an exemption that lets you advertise your deal publicly (like Rule 506(c)), you can only take money from verified accredited investors. And the burden of proof is on you, the syndicator. You're responsible for taking "reasonable steps" to verify their status, which could mean looking at tax returns, bank statements, or getting a letter from their CPA or lawyer.

On the flip side, exemptions that don't allow advertising (like Rule 506(b)) often let you bring in a limited number of non-accredited investors. But there's always a catch.

The Nuance of Non-Accredited Investors

Even when you can include non-accredited investors, it comes with extra homework. These investors must be "sophisticated"—meaning they need to have enough business and financial experience to understand the risks they're taking on.

You're also required to give them disclosure documents that are just as detailed as what they'd get in a fully registered public offering. This adds a significant layer of cost and complexity, which is why most syndicators find it's just not worth the headache.

Choosing Your Legal Pathway for Raising Capital

Once you have a firm grasp on who your potential investors are—accredited or not—it's time to make a critical strategic decision. This is where you, with the guidance of your securities attorney, will choose the specific legal exemption that lets you raise capital. Picking the right one means you can avoid the incredibly expensive and time-consuming process of a full-blown SEC registration.

This isn't a one-size-fits-all choice. It's a fundamental trade-off between how you can find investors and who is allowed to invest in your deal. Think of it like choosing a door to your investment opportunity. One door is private, unmarked, and only opens for people you already have a relationship with. Another door can have a giant neon sign out front, but the bouncer is extremely strict about who gets in. Your job is to pick the door that best fits your deal, your network, and your overall business strategy.

The Two Pillars of Regulation D: Rule 506

For the vast majority of real estate syndicators, the conversation boils down to two options under the SEC's Regulation D: Rule 506(b) and Rule 506(c). Both let you raise an unlimited amount of money, but they have completely different rules of engagement when it comes to finding and accepting that money.

Rule 506(b): The Private Relationship Pathway

This is the classic, most common route syndicators have used for decades. It's built for those who have a pre-existing network of potential investors and offers a bit more flexibility in who can participate.

- Who Can Invest: You can bring in an unlimited number of accredited investors and, importantly, up to 35 sophisticated non-accredited investors.

- The Big Restriction: You are strictly prohibited from any form of general solicitation or advertising. This means no public social media posts about the deal, no website banners for all to see, and no pitching the deal at a public conference. All of your fundraising must come from people with whom you have a pre-existing, substantive relationship.

While the ability to include 35 non-accredited investors might seem like a great benefit, it comes with a major catch. For those investors, you must provide disclosure documents that are nearly as detailed and expensive to produce as those in a public offering. Because of this complexity and cost, most syndicators using 506(b) decide to keep it simple and raise capital only from accredited investors.

Rule 506(c): The Public Advertising Pathway

What if you don't have a deep Rolodex of wealthy contacts? Or what if your deal is so big you need to cast a much wider net? That's exactly why Rule 506(c) was created. It lets you shout your deal from the rooftops, but it comes with one iron-clad condition.

- Who Can Invest: You can only accept funds from verified accredited investors. No exceptions. Not even one sophisticated, non-accredited investor is allowed.

- The Big Freedom: You can use general solicitation. This is a game-changer. You can advertise your offering online, discuss it in podcasts, run marketing campaigns, and attract investors you’ve never met before.

- The Verification Burden: You can't just take an investor's word for it. You must take "reasonable steps" to verify that every single investor is accredited. This means going beyond a simple checkbox and actively reviewing tax returns, bank statements, or getting a signed letter from their CPA, attorney, or financial advisor.

Choosing between 506(b) and 506(c) is a foundational strategic decision. It dictates not just your legal compliance but your entire marketing and investor acquisition process. One path prioritizes relationship-based capital, while the other prioritizes broad-reach marketing.

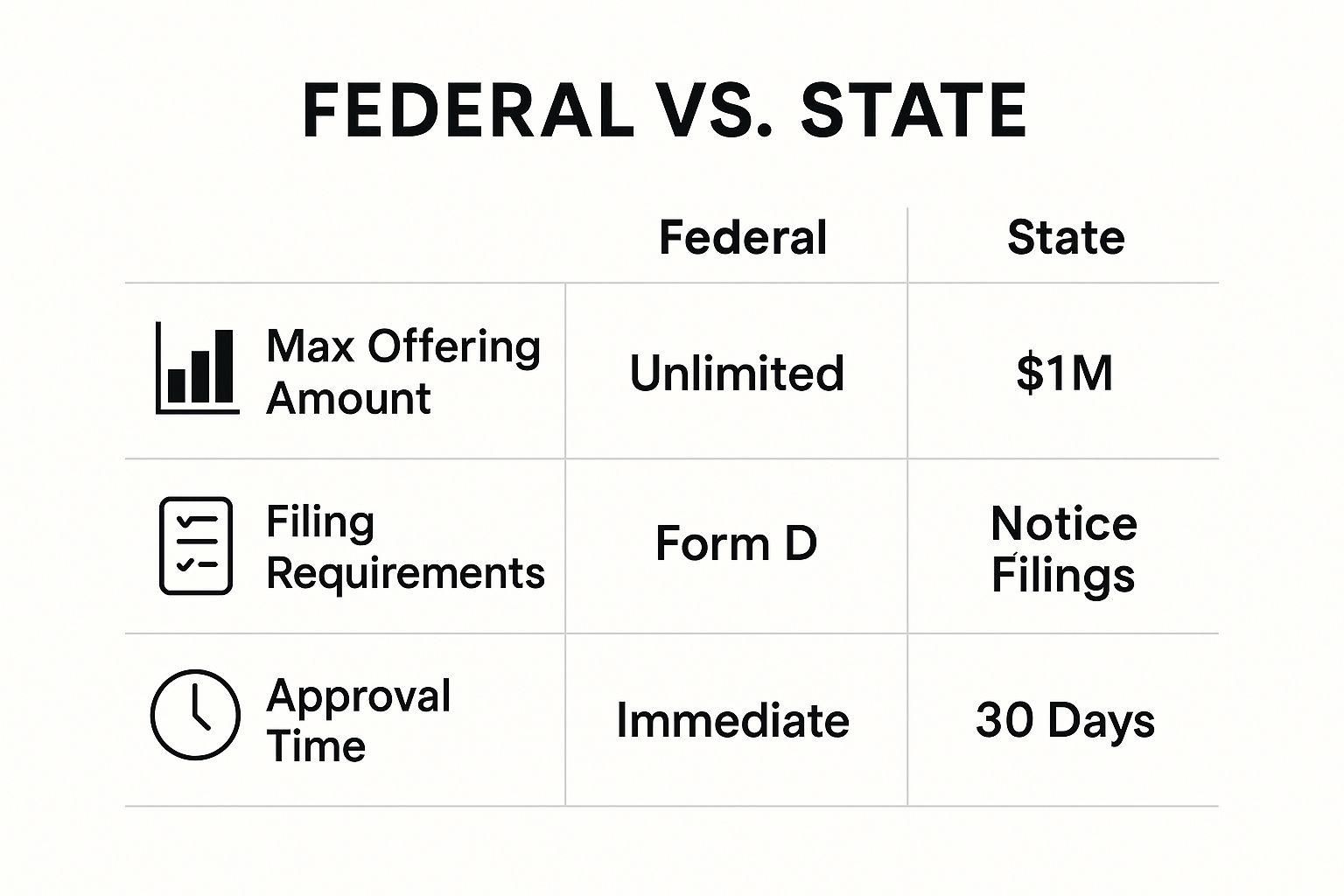

The image below gives you a sense of how these federal rules interact with the state-level regulations you'll also encounter, often called "Blue Sky" laws.

As you can see, federal exemptions like Rule 506 are powerful because they generally preempt, or override, most state laws. This creates a much more streamlined path for raising capital across the country.

To help you see the differences more clearly, here's a side-by-side comparison of the most common SEC exemptions for real estate syndication.

Comparison of Key SEC Syndication Exemptions

This table lays out the core trade-offs. You're essentially balancing fundraising flexibility against investor access and ongoing compliance burdens.

An Alternative Route: Regulation A+

For sponsors looking to fund exceptionally large projects, there's another pathway called Regulation A+. People often refer to it as a "mini-IPO" because it allows you to raise up to $75 million from the general public—including non-accredited investors—with fewer restrictions than a full-blown IPO.

However, this incredible access comes at a significant cost. The Reg A+ process requires a much more intensive and expensive qualification with the SEC, complete with ongoing public reporting requirements. It’s a powerful option for well-established companies undertaking massive projects, but for most real estate syndicators, the proven and more efficient pathways of Rule 506(b) or 506(c) are the most practical choice.

Decoding the Essential Legal Documents

Once you've mapped out your legal strategy for raising capital, it's time to bring it to life with the actual paperwork. These documents aren't just formalities; they are the steel frame of your entire deal. They spell out the rights, responsibilities, and risks for everyone involved, acting as the official rulebook for the investment.

Getting a handle on these core documents is non-negotiable, whether you're the sponsor or the investor. For sponsors, they’re your liability shield and the contract that governs your relationship with capital partners. For investors, they are the most critical source of information for vetting a deal and knowing exactly what you’re signing up for.

Let's break down the big three.

The Private Placement Memorandum (PPM)

Think of the Private Placement Memorandum (PPM) as the official owner's manual for the investment. It's a hefty disclosure document that gives investors the full story—the good, the bad, and the ugly. Its main purpose is to provide complete transparency and protect you, the sponsor, from future claims that you misrepresented the opportunity.

A properly drafted PPM is incredibly detailed. It should cover:

* A full description of the property and your business plan for it.

* Biographies of the sponsorship team, showcasing your experience and track record.

* The complete financial structure, from how profits and losses are split to the fee structure and projected returns.

* A detailed list of risk factors, outlining everything that could potentially go wrong.

That last point is absolutely critical. The risk factors section isn't there to scare people off. It's there to paint a sober, realistic picture of the investment's potential downsides. This is a cornerstone of complying with real estate syndication laws.

The PPM is your commitment to "full and fair disclosure." It's your opportunity to put all your cards on the table, which protects you legally and helps investors make a genuinely informed decision. No one should ever skim this document.

The Subscription Agreement

If the PPM is the owner's manual, the Subscription Agreement is the official purchase order. This is the legally binding contract an investor signs to officially buy into your deal. By signing it, the investor is making a few critical statements.

First, they are formally committing to invest a specific amount of money. Second, they are confirming that they've received and actually read the PPM. Most importantly, they are attesting to their investor status—usually confirming they are an accredited investor and fully understand the risks. This document is your proof that the investor was qualified to invest under the SEC exemption you're using.

Before any investor signs a binding agreement like this, they need to do their homework. A guide to comprehensive commercial property due diligence can walk you through this critical step, which is essential for uncovering risks and ensuring the deal aligns with your goals.

The Operating Agreement

The Operating Agreement is the final piece of this legal puzzle. This document is the internal playbook for the Limited Liability Company (LLC) that will own the property. It governs how the business will actually be run, from day-to-day management to major, company-altering decisions.

Key things you'll find laid out in an Operating Agreement include:

- Management Structure: This defines the roles and powers of the manager (the sponsor) and the members (the investors).

- Voting Rights: It specifies which decisions require an investor vote and which ones the sponsor can make on their own.

- Distribution Waterfall: This section provides the exact formula for how cash flow and sale proceeds are paid out to investors and the sponsor.

- Exit Strategy: It describes the process for eventually selling the property and closing down the LLC.

These three documents—the PPM, Subscription Agreement, and Operating Agreement—work together as a complete legal package. They define the deal, formalize the investment, and govern the business, ensuring everyone is on the same page for the entire life of the project.

Maintaining Compliance After the Deal Closes

So, you've successfully raised the capital and closed on the property. It's easy to feel like you've just crossed the finish line, but for a syndicator, this is really just the starting gun. Your legal duties don't magically disappear once the deal is funded; they stick with you for the entire life of the investment.

In my experience, meticulous post-closing compliance is what separates the true professionals from the operators who leave themselves and their investors wide open to risk. This isn't just about checking boxes to satisfy real estate syndication laws. It’s about building a rock-solid foundation of trust. Consistent, transparent execution is what turns a first-time investor into a loyal partner who comes back for every deal you do.

The Pillars of Ongoing Compliance

Your post-closing responsibilities really boil down to a few key areas. Think of it as the ongoing maintenance schedule for your syndication. It’s a long-term project, and mastering project scoping for legal risk and compliance is a huge part of making sure you don't drop the ball down the road.

First up is investor communication. You have to provide regular, meaningful updates on how the property is actually performing. That means sharing the real numbers on occupancy, how the renovations are progressing, and being upfront about any curveballs you’ve had to handle. Silence breeds anxiety; constant updates prove you’re on top of things.

Next, you've got the financial side of the house. This has two critical parts:

- Managing Distributions: When the property starts kicking off cash, you’re responsible for distributing it to investors based on the waterfall structure you laid out in the Operating Agreement. Those payments need to be on time and accurate, every single time.

- Tax Reporting: At the end of each year, you must prepare and send a Schedule K-1 to every single investor. This form details their slice of the income, deductions, and credits from the LLC, and they can’t file their own taxes without it. Missing the K-1 deadline is a massive red flag.

Let me be blunt: keeping meticulous records isn’t just good business practice, it’s a legal necessity. If you ever face an audit or a dispute, your best—and sometimes only—defense is your ability to produce clean, organized documentation for every dollar, every email, and every filing.

State Laws and Building Long-Term Trust

Even if you used a federal exemption like Rule 506(b) or 506(c), which covers most state registration rules, you’re not totally in the clear. You still have to pay attention to state-level "Blue Sky" laws. This usually just means making a simple notice filing and paying a small fee in each state where you have an investor. Don't skip this. It's an easy box to check, but failing to do so can lead to penalties.

At the end of the day, all of this diligence circles back to reinforcing the trust you worked so hard to build in the first place. By handling updates, distributions, and tax forms like a pro, you show that you're a reliable steward of your investors’ capital. That kind of operational excellence is what ensures you stay on the right side of the law and build the bulletproof reputation needed for a long, successful career in real estate syndication.

Common Questions About Syndication Laws

When you're wading into the world of real estate syndication, it's natural for questions to pop up. The legal side can feel like a maze, so let's clear up some of the most common points of confusion we hear from sponsors and investors alike.

Can I Pay Someone to Find Investors for My Deal?

This is a huge compliance minefield, and the answer is almost always a hard no. You cannot pay someone transaction-based compensation—like a commission or a percentage of the capital they bring in—unless they are a registered broker-dealer.

The SEC is crystal clear on this: if someone is getting paid to sell securities, they need a license. Bringing an unlicensed "finder" into your deal is a serious violation that could blow up your entire exemption and expose you to massive penalties. It’s a shortcut that’s just not worth the risk.

Do I Need to File Something in Every State Where I Have an Investor?

Yes, absolutely. This is where state-level "Blue Sky" laws enter the picture. Even if you're using a popular federal exemption like Rule 506(b) or 506(c), which takes precedence over most state registration rules, you aren't completely off the hook.

You'll still need to make what's called a "notice filing" in each state where an investor lives. This usually just means sending them a copy of your federal Form D and paying a small filing fee. It might seem like a minor administrative step, but skipping it can lead to state-level fines and legal trouble you definitely want to avoid.

Remember: Compliance with real estate syndication laws is a dual-track system. You must satisfy federal SEC rules and state-level Blue Sky notice filing requirements.

What Happens if an Investor's Accredited Status Changes Mid-Deal?

Good question. An investor's status is officially locked in at the moment they invest and sign the subscription agreement. If their income or net worth drops below the accredited threshold later on, it doesn't invalidate the investment they've already made. Their initial commitment is grandfathered in.

However, the key is that this applies only to the current deal. If that same investor wants to join you on a new syndication down the road, you would need to verify their accredited status all over again for that new offering. Compliance isn't a one-and-done event; it's a continuous process for every single deal.

Stop drowning in spreadsheets and start scaling your real estate business. Homebase gives you an all-in-one platform to manage fundraising, investor relations, and compliance with ease. For a flat fee, you get unlimited deals and investors, so you can focus on finding great properties, not paperwork. See how we can support your growth by visiting https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.