Real Estate Fund Administration: Keys to Efficient Operations

Real Estate Fund Administration: Keys to Efficient Operations

Learn essential real estate fund administration strategies to optimize your operations and drive success. Discover expert tips today.

Domingo Valadez

Jun 24, 2025

Blog

Understanding Real Estate Fund Administration Beyond The Basics

Think of a real estate fund as a complex orchestra. The fund manager acts as the conductor, choosing the properties (the music) and guiding the investment strategy (the tempo). But for a flawless performance, the conductor needs a skilled crew working behind the scenes. This is the world of real estate fund administration—the operational core that ensures every part of the fund works in harmony, from managing investor money to maintaining regulatory compliance.

Fund administration is much more than simple bookkeeping. It’s the intricate system of financial and operational tasks that connect investors, the properties, and the fund manager. This includes orchestrating capital calls when a new building is purchased, processing profit distributions after a successful sale, and navigating the complex web of rules across different states and countries. The stakes are high; a small reporting error or a compliance misstep can lead to serious financial and reputational damage.

The Human Element in a Data-Driven Field

While technology is critical, the heart of great administration is handling the unique challenges of real-world assets. Unlike stocks, real estate is illiquid—you can’t sell an office tower with a single click. Administrators must manage investor expectations through various market cycles, especially when volatility might lead to more requests for redemptions. A study of open-end real estate funds revealed that 38% charge a performance fee, which is often tied to a preferred return. This makes precise performance tracking vital for both compensation and maintaining investor trust. For more perspectives on the industry, podcasts like the Commercial Real Estate Podcast offer valuable discussions.

This blend of financial knowledge and real-world asset management truly defines the field. The best administrators provide the structural support that allows fund managers to concentrate on generating returns. They are the partners who turn a collection of physical properties into a smooth, investable financial product.

Evolving from Back Office to Strategic Partner

In the past, real estate fund administration involved a lot of paperwork and manual effort. Today, it has grown into a strategic role supported by advanced digital platforms. This change allows administrators to shift from being reactive record-keepers to proactive advisors. They use data analytics to give fund managers important insights, helping them understand everything from local market trends to global investor attitudes.

The main duties of a fund administrator now cover a dynamic range of tasks:

* Investor Lifecycle Management: Handling every stage of the investor journey, from initial onboarding and capital calls to managing complex distribution waterfalls and creating customized investor reports.

* Asset-Level Oversight: Working with property managers, tracking performance for each asset, and making sure property-level financial data is accurately reflected in the fund's total value.

* Regulatory & Tax Compliance: Keeping up with changing regulations, managing tax requirements across multiple jurisdictions, and preparing for audits to ensure the fund remains compliant.

Ultimately, the objective of modern real estate fund administration is to build an operational foundation that is transparent, efficient, and compliant. This gives investment managers the confidence to execute their strategies, knowing the complex operations of the fund are running smoothly. This operational excellence is what builds lasting investor trust and sets top-performing funds apart from the competition.

The Core Components That Keep Complex Funds Running Smoothly

Think of a successful real estate fund as a high-performance vehicle. For it to run perfectly, every component must work together seamlessly. Real estate fund administration is the engine room that ensures all these parts are synchronized, providing the stability and transparency needed for a smooth ride. These core functions aren't just administrative tasks; they are the critical systems that protect investor capital and free up fund managers to focus on what they do best: finding great investments.

Let's explore the key systems that administrators oversee day-to-day.

Investor Capital and Financial Reporting

The flow of capital is the fuel for any fund, and administrators are the ones managing the fuel lines. This process begins with capital calls, where administrators request committed funds from investors to purchase a new property. This is far more than just sending an invoice. It requires precise timing, clear communication, and careful tracking to ensure the deal closes on time. For instance, a single delay in collecting capital from one of a hundred investors could put a multi-million dollar acquisition at risk.

On the flip side, when a property is sold or generates income, administrators handle distributions. This process is guided by the fund's "waterfall" structure—a complex hierarchy that determines how profits are split among different investor classes and the fund manager. Getting this right is crucial, as any mistake can quickly damage investor trust.

This entire financial journey is documented through meticulous reporting. These aren't your average profit and loss statements. They are detailed packages designed to meet the needs of various stakeholders, from pension funds that need standardized quarterly reports to individual investors who expect personalized updates.

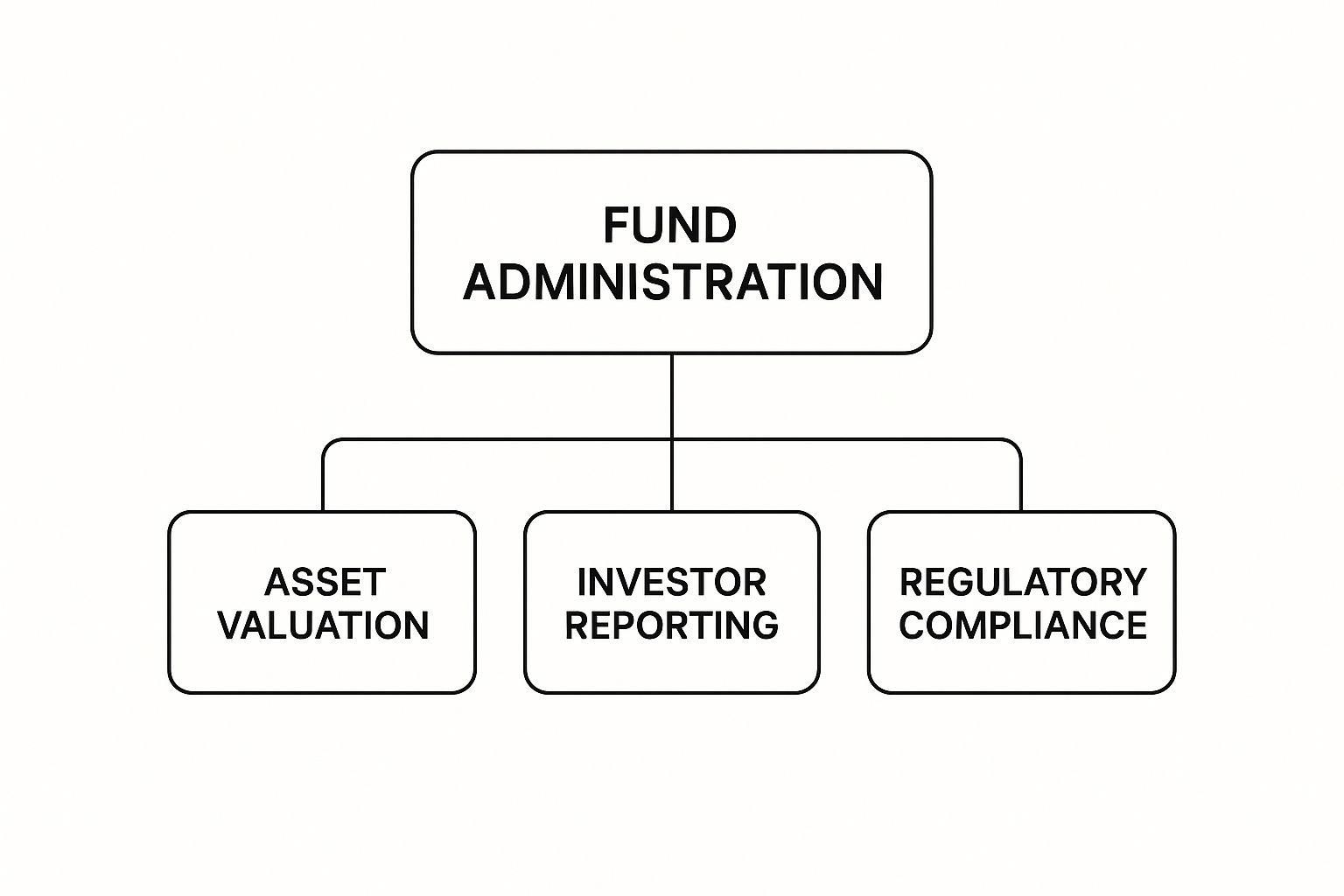

The infographic below illustrates the central pillars of fund administration, showing how asset valuation, investor reporting, and compliance create the foundation of a well-managed fund.

This image makes it clear that while these functions are distinct, they are also deeply connected, each one informing the others to build a complete and accurate operational picture.

Compliance and Performance Tracking

Staying on the right side of the law is another fundamental administrative duty. Compliance isn't a one-and-done task; it's a continuous effort to follow rules that can change significantly from one state or country to another. A fund operating in both New York and California, for example, must adhere to two different sets of regulations. Administrators ensure every activity, from marketing materials to financial reports, meets these legal standards, protecting the fund from hefty fines and legal trouble.

To see how these functions differ between older methods and new, technology-assisted ones, the table below offers a direct comparison.

This comparison shows a clear shift: modern tools replace slow, error-prone manual work with automated, accurate, and transparent systems, boosting overall efficiency.

Finally, administrators are tasked with tracking performance against industry benchmarks. A recent study of open-end real estate funds revealed that 38% charge a performance fee, which is often tied to a 7% median preferred return. This makes precise performance attribution vital for calculating fees correctly and demonstrating value to investors. By managing these interconnected systems, experienced administrators provide the transparency and reliability necessary to maintain the trust that keeps capital flowing. For those looking to go deeper, you can learn more about real estate fund management in our complete playbook for market excellence.

Managing Through Market Turbulence With Professional Precision

When real estate markets get rocky, a skilled fund administrator is the steady hand that keeps an investment fund on course. Like a ship's captain navigating a storm, their role becomes most apparent—and most valuable—during periods of uncertainty. These times test the strength of a fund's operational backbone, showing how well it can protect investor capital and adjust to shifting conditions. From handling anxious investor calls to fine-tuning portfolio performance, professional real estate fund administration is the anchor that prevents a fund from drifting.

Turbulent markets often bring a new level of scrutiny from investors. During downturns, redemption requests might rise, and questions about asset valuations become more common. An experienced administrator sees these pressures coming and prepares for them. They ensure that communication is clear, transparent, and proactive, building confidence instead of letting panic take root. This is more than just sending reassuring emails; it means providing hard data and clear explanations of the fund's strategy for weathering the current climate.

Using Data to Navigate Choppy Waters

Top administrators don't just react to market changes; they use data and analytics to get ahead of them. By watching a wide range of data points, they can spot emerging trends and potential risks before they grow. This involves looking at market intelligence from several angles:

- Macro-Level Analysis: Keeping an eye on big economic indicators like interest rate moves, employment figures, and shifts in consumer spending that could affect real estate values everywhere.

- Sector-Specific Monitoring: Looking at how different property types, such as industrial, multifamily, and office spaces, are performing to find areas of strength and weakness.

- Local Market Intelligence: Diving into specific geographic areas to check local supply and demand, vacancy rates, and new construction that could impact individual properties.

- Asset-Level Performance: Constantly tracking the financial health of each property in the portfolio, including rental income, operating costs, and occupancy rates.

This detailed oversight gives fund managers the timely, accurate information they need to make strategic moves, such as hedging against risks or shifting capital to more resilient sectors.

Communicating With Clarity and Confidence

In uncertain times, how you share information is just as important as the information itself. Market volatility can make investors cautious. For example, recent global trends show how outside events can sway investment decisions. As of the first quarter of 2025, investment volumes in global real estate saw a small 2% year-over-year dip. This slight downturn followed a recovery period and suggests that factors like international trade policies were making investors think twice. To get a better sense of these market dynamics, you can explore the full analysis of global real estate trends.

The best administrators translate this kind of complex market data into clear, meaningful terms for investors. Instead of causing alarm, they frame challenges within the fund's long-term strategy, showing that a plan is in place. This ability to maintain trust is the foundation of a strong investor relationship and is critical for navigating any market storm.

Operating At Institutional Scale With Billion-Dollar Portfolios

Shifting from managing a few properties to directing a billion-dollar real estate portfolio is like going from captaining a small fishing boat to commanding a fleet of supertankers. The basic principles of navigation are the same, but the scale, complexity, and required support system are worlds apart. For large institutional funds, real estate fund administration isn’t just about keeping organized records; it’s about building a powerful operational machine that handles immense complexity with perfect accuracy.

This machine must manage diverse portfolios that cross multiple countries and asset types—from sprawling industrial parks to downtown office towers—each with its own investment strategy. The operational workload is massive. Instead of a few transactions each month, administrators at this level might process thousands, dealing with complex currency conversions, international tax rules, and multi-layered debt arrangements. The investor profile also evolves, from a few wealthy individuals to hundreds of sophisticated institutional partners like pension funds and sovereign wealth funds, all with strict reporting demands.

The Infrastructure of Massive Scale

To handle this level of complexity, institutional-grade administration depends on specialized teams and advanced technology. Picture it as an operational ecosystem where every part is built for high performance and reliability.

This ecosystem usually includes:

* Specialized Teams: Dedicated groups concentrate on specific functions, such as tax compliance for different regions, regulatory reporting for various investor types, and treasury management to handle enormous capital flows.

* Advanced Technology Platforms: Standard software just won't cut it. Large funds use powerful, often custom-built, platforms to automate everything from capital calls and distribution waterfalls to performance reporting.

* Rigorous Processes: Standard operating procedures are meticulously documented and enforced to ensure consistency and reduce the risk of human error, which could lead to multi-million dollar consequences.

For funds working at an institutional scale with billion-dollar portfolios, effective data management is critical. The sheer volume of data from properties, investors, and transactions needs a robust backend. This often requires deep knowledge of mastering database scaling strategies to make sure the technology can manage the load without affecting speed or accuracy. This strong combination of people, processes, and technology generates significant economies of scale.

Achieving Superior Operational Excellence

The quality of administration for top-tier real estate funds is often reflected in their market capitalization. For example, as of April 30, 2025, the PGIM Global Real Estate Fund reported an average weighted market capitalization of about $33.79 billion. Managing a portfolio of this size is only achievable through first-rate operational excellence and institutional-level oversight. You can discover more about the composition of large global funds to understand their scale.

This level of operational skill allows large funds to often achieve better risk-adjusted returns, not just through sharp investment choices, but through an administrative framework that is more efficient, transparent, and resilient. This operational edge is a key differentiator in the competitive world of institutional real estate.

REIT Administration: Where Real Estate Meets Public Markets

When real estate ventures into the public markets, it often takes the form of a Real Estate Investment Trust (REIT). This structure creates a special kind of investment: it’s part complex property portfolio and part publicly traded security. The real estate fund administration for a REIT operates right at this intersection, balancing the hands-on work of managing physical properties with the strict transparency rules of stock exchanges. Imagine managing a real estate portfolio inside a glass box, where every decision is on display for investors and regulators.

This public-facing aspect makes REIT administration a world apart from managing private funds. The demand for accurate and timely information is intense. While a private fund might send a quarterly report to a few dozen investors, a publicly traded REIT is accountable to thousands of shareholders and the market every single day.

Navigating the Dual Compliance Landscape

REIT administrators must become experts in two different rulebooks. On one hand, they manage the tangible aspects of property ownership—leases, building maintenance, and local regulations. On the other, they must adhere to securities laws that require a high degree of financial disclosure and corporate governance. This dual compliance is the central challenge of REIT administration.

Key responsibilities specific to this structure include:

* Stringent Public Reporting: Preparing and filing detailed quarterly and annual reports with securities regulators that are far more exhaustive than typical investor updates.

* Dividend Distribution Management: REITs are legally required to distribute at least 90% of their taxable income to shareholders as dividends. Administrators must manage these complex calculations and ensure timely payments to protect the REIT's favorable tax status.

* Investor Relations Support: Supplying the data and analysis required for quarterly earnings calls, shareholder meetings, and daily inquiries from market analysts.

The operational pace is much faster than that of a private fund. Constant market observation demands an administrative function that is not only precise but also exceptionally durable. Even when the economy is uncertain, REITs must keep this rhythm. For example, during a tough first quarter of 2025, U.S. REITs produced a total return of 0.7%, outperforming the S&P 500's decline. This result shows the sector's unique behavior and the administrative care needed to operate well. You can review the full REIT performance commentary for Q1 2025 for additional details.

Providing Liquidity and Access

Ultimately, the purpose of a REIT is to give both institutional and retail investors a liquid way to access a professionally managed real estate portfolio. The administrator plays a crucial role in delivering on this promise. By ensuring flawless compliance and clear reporting, they help the REIT build investor confidence and maintain a stable market for its shares. This careful back-office work is what allows real estate, an otherwise illiquid asset, to be traded as easily as a stock, making the asset class available to a much broader audience.

Technology Revolution: How Digital Platforms Transform Operations

The traditional world of real estate fund administration once relied on a mountain of spreadsheets, paper documents, and countless hours of manual work. That era is quickly being replaced by a new one driven by technology. Digital platforms aren't just speeding up old tasks; they are introducing new levels of accuracy, transparency, and strategic insight.

Imagine swapping a paper map and a compass for a real-time GPS network. Both tools can guide you to your destination, but the GPS provides instant updates, alerts you to roadblocks, and uncovers efficient routes you never would have found on your own. This is the kind of change technology brings to fund administration.

This shift changes how fund administrators provide value. Instead of spending weeks manually reconciling accounts or piecing together investor reports, modern teams use integrated software to get these jobs done with almost perfect accuracy in a fraction of the time. This frees up professionals to focus on higher-value advisory services, which leads to better results for fund managers and their investors.

The Power of Automation and Integrated Systems

At the core of this transformation is automation. Tedious, repetitive tasks that were once hotspots for human error are now managed by smart software. This isn't just about simple calculations; it covers the entire operational workflow.

Key processes now powered by technology include:

* Automated Capital Calls and Distributions: Platforms can automatically figure out complex waterfall distributions and send out capital call notices with just a few clicks, making sure everything is accurate and on time.

* Streamlined Investor Onboarding: Digital systems handle KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, verify accreditations, and manage e-signatures for subscription documents. This cuts the onboarding process down from weeks to just a few days.

* Centralized Reporting: Instead of pulling data from different places, administrators use platforms that act as a single source of truth. This provides real-time dashboards and on-demand reports for both managers and investors.

The screenshot below from a platform like Homebase shows how these functions are brought together in one clean, easy-to-use interface.

This visual shows how administrators can manage multiple deals, track fundraising, and oversee investor relations from a single hub. This gets rid of the need to juggle multiple spreadsheets and software tools, leading to a huge drop in operational risk and a major boost in efficiency.

To put this efficiency gain into perspective, let's compare the old way of doing things with the new, tech-driven approach.

As the table shows, the time saved and the improvements in accuracy are substantial. Manual processes that took weeks can now be completed in days or even hours, all while nearly eliminating the risk of costly errors.

Shifting From Back-Office Support to Strategic Partnership

This technological progress does more than just make things efficient; it changes the very role of the fund administrator. With the heavy lifting of operations handled by automation, administrators can spend more time on strategic analysis. They can use the data from their platforms to spot performance trends, model future cash flows, and give fund managers insights they can act on.

This turns the modern real estate fund administration team into a vital partner, not just a back-office service. They actively contribute to the fund's success by making sure the operational foundation is not only strong but also a source of strategic advantage. This lets fund managers put all their energy into what they do best: finding and closing profitable real estate deals.

Your Path Forward: Choosing The Right Administration Strategy

Whether you're launching your first real estate fund or reassessing your current setup, your choice of administration strategy is a foundational one. This decision impacts the entire lifecycle of your investments. It's not just about offloading back-office tasks; it's about selecting a partner and a system that will support your growth, maintain investor trust, and free you up to focus on what you do best: making deals.

Think of it like hiring a general contractor for a major property development. You wouldn't bring someone on without checking their past projects, understanding their process, and making sure their communication style fits yours. The same level of care applies to real estate fund administration. The relationship has to be built on trust, technical skill, and a shared vision for your goals.

Key Questions for Evaluating a Partner

When you begin evaluating partners, your focus should extend beyond the price tag. The cheapest option is rarely the best long-term value. Instead, ask specific questions to uncover a potential partner's true capabilities.

- Technology & Investor Experience: How does their platform enhance the investor journey? Request a live demo of their investor portal. Can investors easily find documents, track investment performance, and see their capital accounts? A clunky or confusing system can frustrate investors and cast a negative light on your fund.

- Expertise & Scalability: Does their team have direct experience with your specific asset class and fund structure? A partner who knows multifamily syndications will grasp your needs much better than one focused on hedge funds. Also, ask how their services and pricing will change as you scale from two deals to twenty.

- Onboarding & Support: What does the transition look like? Will they manage the data migration? Who will be your dedicated contact person? Reliable support during the setup process and beyond is critical for a smooth partnership.

Understanding Fee Structures and Service Levels

Administration fees can differ significantly, so it’s essential to understand exactly what you are paying for. Some providers bill based on assets under management (AUM), while others offer a flat-fee model. As a point of reference, a recent study on real assets funds found that management fees for core real estate equity funds had a median of 96 basis points. While this fee applies to the fund itself, it shows how fee structures are benchmarked in the industry.

When examining administration fees, compare the models closely:

- AUM-Based Fees: These fees increase as your fund gets bigger, which can become very expensive for larger funds.

- Per-Investor or Per-Deal Fees: This model can be unpredictable and may penalize you for bringing on more investors or closing more deals.

- Flat-Fee Models: This approach gives you cost predictability. It allows you to manage unlimited deals and investors for one fixed price, making it a great option for growth-minded syndicators.

Just as important is the Service Level Agreement (SLA). This document lays out concrete commitments, like the turnaround time for distributing K-1s or processing investor distributions. A vague SLA is a red flag. A strong one gives you clear metrics to hold your administrator accountable and ensures they follow through on their promises.

Making a well-researched decision on your administration strategy is one of the most significant choices you'll make for your business. The right partner offers more than just software; they deliver a dependable operational foundation that builds investor confidence and clears your path to scale.

Ready to build a stronger foundation for your real estate business? Discover how Homebase streamlines deal management and investor relations with a simple, flat-fee platform.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.