Expert Guide: Raising Real Estate Capital

Expert Guide: Raising Real Estate Capital

Discover proven tactics for raising real estate capital. Learn key strategies to attract investors and boost your real estate success.

Domingo Valadez

Feb 24, 2025

The New Reality of Real Estate Capital Markets

The real estate capital markets are experiencing major changes as economic shifts and new investor preferences reshape traditional funding approaches. Success now requires understanding current market conditions and anticipating where things are headed.

Understanding the Shift in Investor Sentiment

Investors are becoming more selective and risk-conscious due to higher interest rates, inflation, and broader economic uncertainty. They now place greater emphasis on risk-adjusted returns and conduct more thorough due diligence before committing capital.

The numbers tell a clear story - in 2023, private equity real estate fundraising hit an 11-year low. Only $138.83 billion was raised across 309 funds, down sharply from $236.04 billion across 554 funds in 2021 according to Costar. This decline highlights the challenging environment real estate professionals face.

Adapting to the New Normal

Finding success in today's market requires building strong investor relationships, showing deep market knowledge, and creating compelling investment proposals. Real estate professionals must be ready to address detailed questions about strategy, risk management and projected returns. Being open to alternative financing and creative deal structures is also key.

Embracing Technology and Innovation

Digital tools are modernizing real estate capital raising by enabling:

- More transparent processes

- Faster communication between parties

- Automated workflows for tasks like KYC/AML checks

- Secure document sharing

- Enhanced investor experiences

This shift toward digital solutions is gaining momentum and reshaping how capital flows in real estate markets.

Building a Resilient Fundraising Strategy

To succeed in raising capital, focus on:

- Research: Study market dynamics and identify attractive investment opportunities

- Targeted Outreach: Connect with investors whose goals match your projects

- Clear Value Proposition: Develop an investment thesis that resonates with potential backers

- Proven Performance: Show a solid track record that builds investor confidence

Taking this strategic approach helps real estate professionals secure funding even in competitive markets. The key is being proactive and adapting methods to align with current conditions.

Choosing Your Path: REIT or Private Equity Success

When it comes to real estate capital, investors must carefully evaluate two main options - Real Estate Investment Trusts (REITs) and Private Equity. Each path offers distinct advantages and challenges. Making an informed choice requires understanding your specific goals, available resources, and risk appetite.

REITs: Accessing Public Markets

REITs allow investors to access real estate through publicly traded companies that own and manage income-producing properties. Through public markets, REITs can raise substantial capital - in Q3 2024 alone, US REITs raised $23.3 billion through secondary debt and equity offerings, bringing the year-to-date total to $65 billion according to JD Supra.

While REITs offer excellent liquidity and portfolio diversification benefits, they come with strict regulatory requirements. Public company status means detailed financial reporting and specific rules about asset holdings and dividend distributions. Market fluctuations can also significantly affect REIT share prices and capital raising abilities.

Private Equity: Targeted Investments

Private equity real estate funds gather capital from select investors to build focused property portfolios. This model enables targeted strategies in specific property types or value-add opportunities. Many investors prefer private equity for greater control and the potential for higher returns compared to REITs.

The private equity path involves extensive relationship building with sophisticated investors and longer capital raising cycles. Additionally, these investments typically lock up capital for extended periods, requiring investors comfortable with limited liquidity. Success depends heavily on maintaining strong investor relationships and executing specialized investment strategies.

Comparing REITs and Private Equity

Here's a detailed comparison of key features between REITs and private equity:

Making the Right Choice

Your decision between REIT and private equity fundraising should reflect your:

- Project scale and scope

- Existing investor network

- Risk tolerance level

- Long-term business objectives

Each path offers unique benefits and challenges. Success comes from choosing the approach that best matches your specific situation and capabilities in the real estate market.

Investment Strategies That Actually Win Capital

Getting real estate funding requires a carefully planned approach that matches what investors want and how markets are performing. Every strategy has different merits, and some work better than others. Let's examine the most successful methods for structuring deals that appeal to investors.

Understanding the Current Landscape

Modern investors look for opportunities balancing strong returns with protection against losses. Value-add investments, which improve existing properties, have become increasingly popular. The multifamily sector has also seen growing interest due to steady demand and reliable cash flow. Recent data shows value-add strategies now represent 36% of capital raised through Q3 2024, outpacing opportunistic approaches. See the full report here. This signals investors prefer calculated risks with clear paths to increased value.

Core Strategies for Raising Capital

These key approaches have proven particularly effective:

- Value-Add Investments: Buy properties below market value and upgrade them through renovations and better operations. This creates both income growth and appreciation potential.

- Core-Plus Investments: Focus on stable properties with some room for improvement. This appeals to investors wanting steady returns with moderate risk.

- Development Projects: While riskier, new construction can generate substantial returns when market demand and costs align properly.

For more insights, check out How to master real estate capital raising strategies. Pick your strategy based on your specific project and target investors.

Structuring Deals That Attract Capital

Getting funding requires smart deal structuring. Key elements include:

- Clear Investment Story: Explain exactly why the deal makes sense and how it stands out in the market.

- Solid Numbers: Present detailed financial models showing expected returns and risks. Use real data to support your projections.

- Expert Team: Show investors the qualifications of those handling their money. Experience matters.

- Fair Terms: Offer competitive returns, equity splits and exit plans that meet investor needs.

Tailoring Your Approach to Investor Profiles

Different investors have different priorities. Big institutions want thorough analysis and long-term plans. High-net-worth individuals often prefer shorter investments with faster payouts. Match your pitch and deal structure to what your specific audience cares about. A well-crafted investment story that speaks to the right audience significantly improves your chances of raising capital.

Reading and Riding Market Cycles Like a Pro

Success in real estate capital raising requires an understanding of market timing and trends. Smart investors study key indicators to spot patterns and adapt their strategies as markets shift between different phases. This allows them to make informed decisions about when to raise capital and pursue opportunities.

Identifying Key Market Indicators

Several important metrics help signal where we are in the real estate cycle. Key factors to monitor include:

- Interest Rates: These directly affect borrowing costs and investment returns, impacting property values and financing availability

- Vacancy Rates: High vacancies often indicate market weakness, while low rates suggest strong demand

- Rental Growth: Consistent rent increases point to robust market conditions and income potential

- Sales Volume: Declining transactions may precede market slowdowns, while rising activity suggests price appreciation

- Economic Growth: Broader economic health, including jobs and GDP, shapes investor confidence and property demand

Tracking these metrics helps determine the current market phase and potential future direction. For instance, when interest rates climb, it often leads to more expensive financing and slower investment activity.

Timing Your Capital Raises Strategically

Proper timing of capital raises is essential for optimal results. While strong market conditions typically offer better terms and greater funding access, down markets can present buying opportunities at lower valuations.

The cyclical real estate market requires careful analysis. Take the US residential market as an example - it experienced major swings over the past 20 years. A speculative boom peaked in 2006 before the 2008 crash tied to subprime mortgages. Learn more about US real estate price history. This shows why timing and analysis matter.

Adapting to Changing Market Conditions

Successful real estate investors stay flexible as conditions evolve. This means adjusting return expectations, considering different financing approaches, and revising investment criteria when needed.

Market downturns call for patience and selective buying focused on capital preservation and finding distressed assets. Rising markets may allow for growth and expansion. Quick adjustments help navigate market changes effectively.

Risk Assessment and Opportunity Identification

Each market phase brings distinct risks and opportunities. Hot markets increase the chance of overpaying, while down cycles risk further value declines. Smart investors carefully evaluate these factors.

Yet opportunities exist in all phases - strong markets can deliver high returns, while weak ones may offer bargain purchases. Success requires understanding these dynamics and managing risks appropriately. The key is finding opportunities that match current conditions and investor risk tolerance.

Building Your Million-Dollar Investor Network

Successful real estate capital raising depends on building strong, lasting relationships with investors. The goal isn't just finding funding for a single deal - it's developing reliable connections that provide consistent capital over many years through authentic partnerships.

The Power of Authentic Relationships

Think of your investor network like constructing a building, where each relationship represents a critical foundational element. A network based on real connections and trust will better withstand market changes and provide reliable long-term support. This matters tremendously in real estate, where deal flow and market conditions frequently shift.

Networking Strategies That Go Beyond the Surface

Effective networking requires more than just attending industry events and exchanging business cards. You need to create meaningful interactions:

- Targeted Outreach: Research and connect with investors whose goals match yours. Make each interaction personal and relevant.

- Value-Driven Engagement: Share useful market insights between deals. Consider hosting educational webinars, providing market analysis, or offering exclusive property tours.

- Building Trust: Be transparent about both successes and challenges. Open, honest communication builds credibility.

For example, organize an intimate dinner with select potential investors to discuss market trends. This creates deeper connections than brief interactions at large conferences.

Communication is Key

Understanding investor needs and communicating effectively requires:

- Custom Messaging: Shape communications around individual investor priorities - whether that's financial returns, social impact, or specific property types.

- Regular Updates: Keep investors informed about deal progress and market conditions. Consistent communication shows professionalism.

- Active Listening: Be responsive to investor questions and concerns. Take their feedback seriously.

This ongoing communication establishes trust and turns single-deal investors into long-term partners.

Nurturing Long-Term Partnerships

Converting one-time investors into lasting relationships takes sustained effort:

- Personal Follow-Up: Stay in touch after deals close. Send personalized notes and check in periodically.

- Exclusive Access: Give loyal investors first look at new opportunities. This incentivizes continued partnership.

- Community Building: Create opportunities for investors to connect with each other through events and networking.

By treating investors as valued partners and maintaining relationships over time, you build a reliable network for real estate capital. This strong foundation enables bigger projects and consistent success.

Crafting Investment Pitches That Actually Convert

Creating compelling investment pitches is essential for raising real estate capital. Your pitch serves as the critical connection between your project's potential and investor funding. Getting it right means going beyond data to tell a persuasive story backed by solid numbers.

Understanding the Psychology of Investors

Before building your pitch deck, you need to understand what drives investor decisions. They evaluate opportunities across multiple dimensions:

- Team Expertise: Your experience and proven ability to execute are critical - investors invest in people first

- Market Opportunity: The profit potential must be clear and supported by market data

- Risk Management: You need concrete plans for handling potential challenges

- Fair Deal Structure: The terms should benefit all parties to establish trust

For instance, highlighting your team's successful track record with similar projects immediately builds credibility and addresses key investor concerns about execution capability.

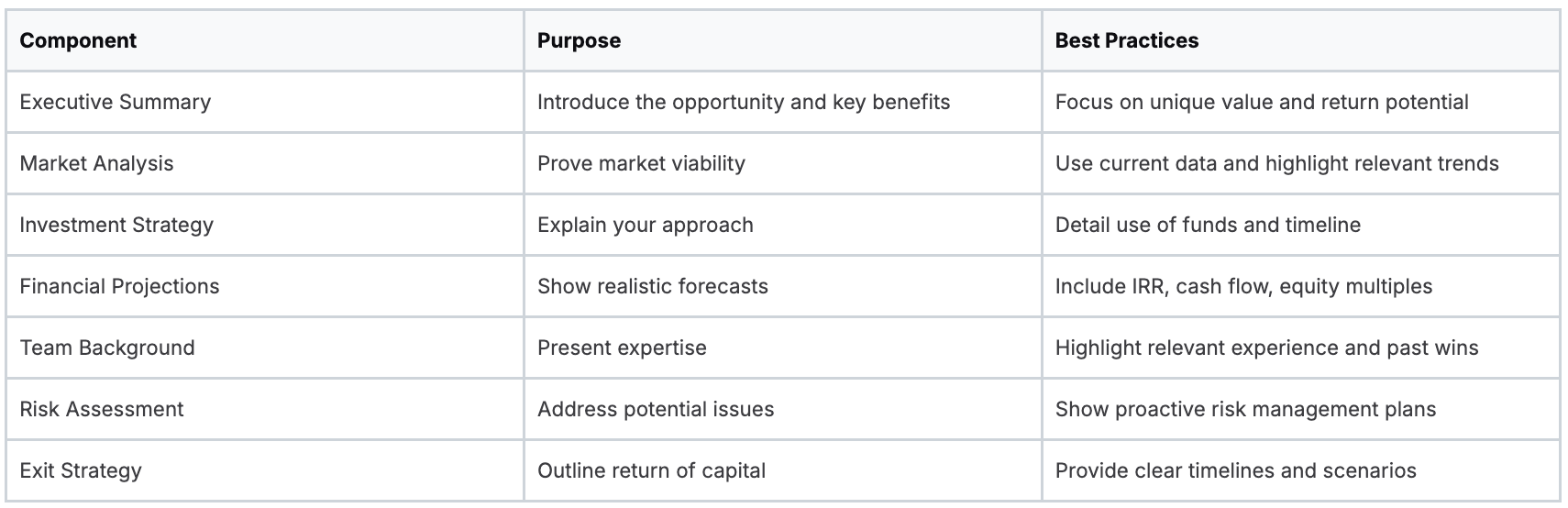

Key Components of a Winning Pitch

Below are the essential elements that make up an effective real estate investment presentation:

Structuring Your Presentation for Maximum Impact

Your pitch needs a clear narrative flow to keep investors engaged:

- Open strong: Start with a compelling hook that clearly presents the opportunity

- Build momentum: Present information logically from market opportunity through strategy and financials

- Close decisively: State your specific ask and remind investors of key benefits

Anticipating and Addressing Objections

Get ahead of common investor questions by preparing clear answers in advance. This shows thorough planning and builds confidence.

For example, if your project carries higher risk, explain your specific risk management approach. Being proactive about addressing concerns demonstrates preparation and thoroughness. Have detailed responses ready about your exit strategy as well.

By creating a data-driven story that speaks to investor motivations, you improve your odds of securing funding. A well-crafted pitch transforms promising projects into funded reality.

Ready to improve your real estate fundraising process? Check out Homebase, a complete platform built for real estate professionals. Visit their website to learn how they can help streamline your capital raising efforts.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.