Loan to Value Definition Real Estate Your Guide

Loan to Value Definition Real Estate Your Guide

Unlock the loan to value definition real estate. Learn how the LTV ratio impacts your property investments and financing with our clear, practical guide.

Domingo Valadez

Oct 1, 2025

Blog

At its heart, the Loan-to-Value (LTV) ratio is a simple but powerful tool that lenders use to size up their risk. Think of it as a percentage that shows how much of a property's value is being financed versus how much you're putting in yourself.

A lower LTV means you have more personal investment—more "skin in the game"—which instantly makes you a safer bet in a lender's eyes.

What Loan to Value Means in Plain English

Let's use a simple analogy. Say you're buying a commercial property appraised at $1,000,000. The lender agrees to finance $750,000, and you cover the remaining $250,000 as a down payment.

To find the LTV, you just divide the loan amount by the property's value: $750,000 / $1,000,000 = 75%. That 75% is your LTV ratio. It’s the lender’s go-to metric for measuring their potential exposure before they sign off on the deal.

The Lender's Perspective

From where a lender is sitting, a borrower with a lower LTV is far less likely to default. It's basic human psychology—when you have a significant amount of your own money tied up in an asset, you're going to fight a lot harder to protect it. That equity you've built acts as a powerful financial cushion.

A bigger down payment always means a lower LTV. This sends a clear signal to lenders that you're a committed, financially stable partner. This single number can shape everything from the interest rate you get to whether the loan is approved at all.

If things go south and a borrower stops making payments, the lender feels more secure knowing they can likely sell the property and get their money back without taking a major loss.

LTV at a Glance

This quick table breaks down the core components of LTV, giving you an at-a-glance reference for what each part means and why it's so important for your financing.

Understanding these three pieces is the foundation for mastering real estate financing and positioning your deals for success.

Why This Metric Matters So Much

The LTV isn't just a piece of financial jargon; it's a critical lever that determines the very terms of your financing. Getting a handle on it is absolutely fundamental for anyone involved in acquiring property, from a first-time investor to a seasoned syndicator managing multi-million dollar deals.

It has a direct and immediate impact on a few key parts of any loan:

- Interest Rates: A lower LTV almost always unlocks better, more competitive interest rates. The reason is simple: the lender sees you as less of a risk.

- Loan Approval: Many loan programs have firm maximum LTV thresholds. If your number is too high, it could be an automatic deal-breaker.

- Extra Costs: In the world of conventional home loans, an LTV above 80% usually forces the borrower to pay for Private Mortgage Insurance (PMI), an added monthly expense. Similar principles apply in commercial lending, where higher LTVs might trigger requirements for additional reserves or higher fees.

To get a broader perspective on how this works, exploring the LTV ratio in different loan contexts can add another layer to your understanding. Nailing this concept is truly the first step toward successfully navigating the complex world of real estate finance.

Calculating Your LTV Ratio with Confidence

The Loan-to-Value (LTV) ratio might sound like complex financial jargon, but the calculation itself is surprisingly simple. At its core, it's a single, powerful number that tells a lender exactly how much risk they're taking on with your deal. It’s one of the first things they’ll look at.

The entire concept boils down to one clean formula:

LTV = (Loan Amount / Appraised Property Value) x 100

This gives you a percentage that instantly frames the transaction for any lender. But to really get a feel for how it works in practice, let's walk through a few real-world scenarios.

Real World LTV Examples

Seeing the formula in action is the best way to make the concept stick. The math is easy, but the context is what really matters.

- Example 1: Buying Your First Home

Let’s say you find a great house and your offer of $500,000 is accepted. The bank sends out an appraiser who confirms the home is worth exactly that amount. You’re putting $100,000 down, so you need a loan for the remaining $400,000.Calculation: ($400,000 ÷ $500,000) x 100 = 80% LTV - Example 2: Securing a Commercial Property

Now imagine you're acquiring a small office building. The agreed-upon purchase price is $1.2 million, but the property’s official appraisal comes in a bit higher at $1.25 million. Your lender agrees to finance $900,000.Calculation: ($900,000 ÷ $1,250,000) x 100 = 72% LTV - Example 3: Refinancing an Existing Mortgage

You bought a multifamily property years ago and still owe $600,000 on the mortgage. Thanks to a hot market and some smart renovations, the property now appraises for $1.1 million. You want to refinance to pull cash out or get a better interest rate.Calculation: ($600,000 ÷ $1,100,000) x 100 = 54.5% LTV

A Critical Mistake to Avoid

One of the most common trip-ups for new investors is confusing the purchase price with the appraised value. This is a crucial distinction. Lenders always, without exception, use the lower of the two figures to calculate the LTV.

Why? It’s a safety measure. If you agree to pay more than what an independent appraiser thinks the property is worth, the lender isn't going to finance your overpayment.

For instance, if you agree to a $500,000 price but the appraisal comes back at only $480,000, the lender will base their entire loan decision on that $480,000 value.

While LTV is all about a property's current value, it's just one piece of the financing puzzle. It's also vital to understand metrics like Loan-to-Cost, which is especially important for development projects. You can get a much fuller picture of real estate financing by exploring the differences between Loan-to-Value and Loan-to-Cost.

Why Lenders Are Obsessed with Your LTV

To really get why the LTV is such a big deal, you have to put on a lender's hat. For them, every loan is a calculated gamble. The LTV ratio isn't just another number on a form; it's their single most important tool for measuring how much risk they're taking on before wiring millions of dollars.

Think about it from their perspective. A borrower with a low LTV has a lot of their own money in the deal—they have serious skin in the game. This tells the lender they've found a committed partner who will fight to protect their equity and make the property a success. That substantial down payment is a financial cushion, insulating the lender if things go south.

Risk and Reward: The Lender's Equation

It all comes down to a simple truth: a lower LTV means less risk for the lender. If the worst happens and the borrower defaults, the lender has to sell the property to get their money back. The borrower's equity acts as a buffer against a down market or the costs of selling.

On the flip side, a high LTV leaves the lender dangerously exposed with very little wiggle room.

This direct link between LTV and risk dictates almost every part of a loan agreement. The LTV you bring to the table will directly influence:

- Loan Approval: Most loan programs have hard LTV ceilings. If you're even a single percentage point over, you could be denied on the spot, no matter how strong the rest of your application is.

- Interest Rates: Lower risk almost always means a better interest rate. Lenders reward borrowers who make their jobs safer with more attractive terms. It's that simple.

- Extra Requirements: In residential lending, an LTV over 80% is the classic trigger for Private Mortgage Insurance (PMI). In the commercial world, a high LTV might force a lender to demand higher cash reserves or charge additional fees at closing.

A Global Standard for Measuring Risk

This intense focus on LTV isn't just a local quirk; it’s a global standard for how real estate lending works. For instance, the European Central Bank flagged even a tiny bump in the average LTV for new mortgages—from 80.3% to 81.0%—as a significant trend. Why? Because anything over that 80% threshold is universally viewed as a step up in risk for financial institutions.

Simply put, a borrower with an 80% LTV is a fundamentally different risk profile than one with a 95% LTV. The first has a 20% equity stake, while the second has only 5%. That 15% difference is massive from a lender's perspective.

Getting this mindset is absolutely critical for any real estate investor. If you're gearing up to buy a property, running through a detailed mortgage pre-approval checklist will help you get all your financial ducks in a row.

Ultimately, a strong LTV proves you're financially stable and committed to the deal, making you exactly the kind of borrower every lender is looking for.

How LTV Benchmarks Change Across Property Types

It’s a classic rookie mistake to think the loan to value definition in real estate is a fixed rule. The truth is, the LTV a lender is willing to extend can shift dramatically depending on the property you’re trying to finance. Lenders aren't just underwriting you, the borrower; they are intensely focused on the risk profile of the asset itself.

Think about it from their perspective. A stable apartment complex with a long history of full occupancy is a world away from a speculative hotel development. Each property type has its own unique set of risks—from market demand and operational headaches to tenant stability. Lenders price that risk into their loans, and a key way they do that is by adjusting the LTV and demanding more "skin in the game" for assets they see as less of a sure thing.

Residential vs. Commercial Properties

The most glaring difference in LTVs is between the home you live in and the properties you invest in. For a primary residence, it's not uncommon to see lenders offer LTVs as high as 95%, sometimes even more with government-backed programs. They know homeowners will fight tooth and nail to keep their homes, which significantly lowers the risk of default.

Investment properties are a different beast entirely. Lenders know that if you hit a financial rough patch, you're far more likely to let an investment property go than your own home. Because of this, they'll typically cap LTVs for rental homes or small multifamily buildings somewhere in the 80% to 85% range.

Diving Deeper into Commercial Real Estate

Once you get into the world of commercial real estate, the LTVs get even more specific. The lender's entire decision-making process boils down to one thing: the stability and predictability of the property's income stream. The more reliable the cash flow, the more comfortable they are lending against it.

Let's look at how LTVs stack up across a few common commercial property types.

LTV Ratios by Real Estate Asset Class

The following table breaks down typical LTV ranges you can expect for different commercial properties. Notice how the lender's willingness to finance a deal is directly tied to the asset's perceived risk and operational complexity.

As you can see, the more an asset's income relies on the day-to-day whims of the economy (like a hotel), the lower the LTV a lender will offer. Conversely, the more stable and predictable the income (like a fully leased apartment building), the more financing you can secure.

A recent Property Lending Barometer report from KPMG backs this up with hard numbers. The study found that residential development projects averaged LTVs around 69%, while riskier assets like hotels and resorts required much more equity from sponsors, averaging just 55% LTV. These global lending trends show a clear pattern: lenders demand a bigger cushion for more volatile deals.

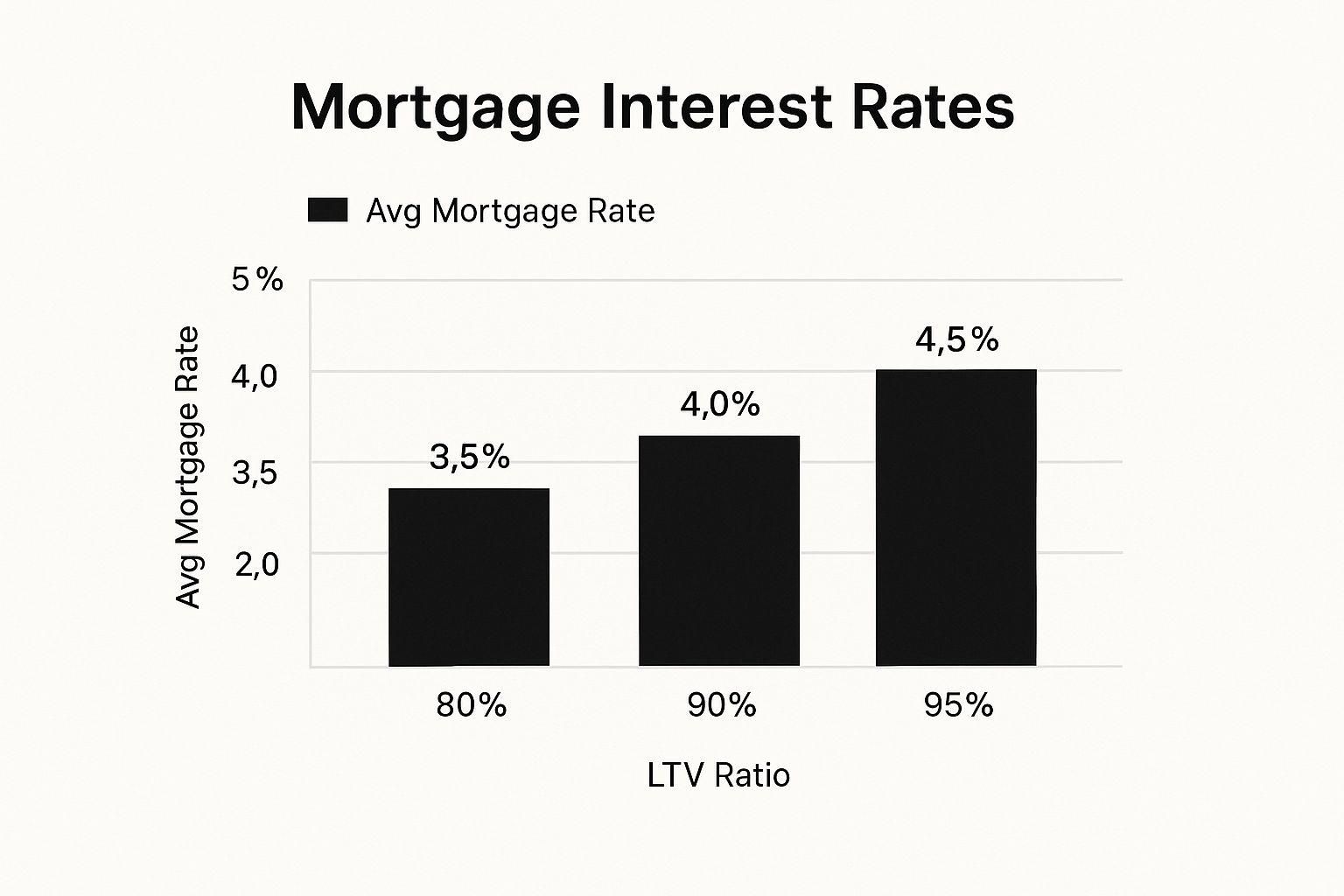

This relationship between risk and financing terms is also reflected in the interest rates you'll pay, as the infographic below shows.

The chart makes it obvious: as your equity stake gets smaller (meaning a higher LTV), the lender's risk goes up. To compensate for that increased risk, they charge a higher interest rate on the loan. It's the fundamental trade-off in real estate finance.

How Government Rules Shape LTV Limits

So, who decides the LTV limits on your deal? While your specific lender makes the final call, they don't just pull these numbers out of thin air. They're actually operating within a framework set by government regulators and central banks.

Think of LTV limits as one of the big levers these institutions use to manage the health of the entire economy. It's a key part of what's called macroprudential policy—a fancy way of saying they create rules to keep the whole financial system stable. By setting a hard cap on how much banks can lend against a property, they can cool down an overheating real estate market before it gets dangerous.

Tapping the Brakes on a Runaway Market

Picture a housing market that's on fire. Prices are jumping, and lenders are getting aggressive, offering loans that require only a sliver of a down payment. That’s the classic recipe for a real estate bubble.

To prevent a messy crash, a central bank might step in and lower the maximum LTV from, say, 90% down to 80%. Suddenly, new buyers need to bring more cash to the table. This simple change pumps the brakes on demand, cools the frantic bidding wars, and helps bring prices back to a more sustainable level. It’s a preemptive strike to protect everyone from the fallout of excessive risk.

Regulators aren't trying to micromanage your specific loan. They use LTV caps to steer the entire market away from systemic risk—the kind of widespread over-leveraging that can trigger a financial crisis.

A Look at LTV Rules Around the Globe

Every country has its own take on this, tailored to its economic situation. For instance, Saudi Arabia’s Real Estate Finance Law is quite conservative, capping residential LTVs at 70%. That’s a good bit lower than the G20 average of 82%.

On the other hand, some countries have pushed the limits higher to make homeownership more accessible. Between 2008 and 2011, Canada permitted LTVs as high as 95%, while Sweden landed on an 85% cap. This global variation really highlights how the loan to value definition in real estate is more than just a lender's calculation; it's a powerful tool for shaping national economic policy. If you're curious, you can dive deeper into a study on these international LTV policies and their effects on financial stability.

Practical Ways to Improve Your LTV Ratio

Getting a good deal on financing is the lifeblood of any real estate investment, and your Loan-to-Value (LTV) ratio is the key that unlocks the best terms. Lenders live and die by this number. A lower LTV tells them you have more skin in the game, making you a much safer bet and paving the way for better interest rates and more flexible options.

The good news is that you're not just a passive observer here. You can actively manage your LTV by focusing on two things: shrinking the loan amount or boosting the property's value. Let's look at how to pull those levers.

Strategies to Lower Your LTV Before Closing

The best time to get your LTV in shape is before the ink is even dry on the loan agreement. A little strategic thinking during the acquisition phase can pay dividends for years to come.

Here are a few tactics that work time and time again:

- Bring More Cash to the Table: This is the most direct route. A larger down payment is the simplest way to reduce the loan amount. For instance, on a $1 million property, bumping your down payment from 20% to 25% immediately drops your LTV from a standard 80% down to a much stronger 75%.

- Negotiate a Better Purchase Price: This is where the art of the deal comes in. If you can get a property under contract for less than its appraised value, you’ve manufactured equity from day one. Say a building appraises for $500,000, but you negotiate the purchase at $480,000. The lender will still base their LTV calculation on that $500,000 appraisal, giving you a powerful head start.

- Hunt for Value-Add Deals: Go after properties with untapped potential—the kind that can appraise for more than what you paid for them right out of the gate. These are often off-market deals or mismanaged assets where you can clearly see a path to increasing its value.

Improving Your LTV Over Time for Refinancing

Your LTV isn't static. It’s a living number that evolves throughout your ownership of the property. This natural shift creates some fantastic opportunities down the road, especially when it comes to refinancing for better terms.

As your LTV improves over the life of the loan, you’re essentially building a track record of success in the lender's eyes. It proves you’re a responsible operator, making them far more eager to offer a cash-out refinance or a lower rate when it’s time to restructure the debt.

This happens in two main ways:

- Pay Down the Loan Principal: It’s the slow and steady approach. With every single mortgage payment, a slice goes toward chipping away at that principal balance. It might not feel like much month-to-month, but over time, this consistent paydown methodically lowers your loan amount and, in turn, your LTV.

- Property Value Appreciation: This is the magic of holding real estate. As the market rises and you make strategic improvements, the property's value goes up. This forces your LTV down, even if the loan balance hasn't changed much. A rising tide really does lift all boats.

Common Questions About LTV in Real Estate

Even after you get the hang of the basic loan to value definition in real estate, a few practical questions always seem to pop up. Let's tackle some of the most common ones that investors run into in the real world.

What Is a Good LTV for an Investment Property?

When you're talking about an investment property, a "good" LTV is generally 75% or lower.

Sure, some lenders might stretch to 80%, but keeping it at 75% or less puts you in a much stronger position as a borrower. It shows the lender you have more skin in the game, which reduces their risk and often gets you better interest rates and terms. That larger equity cushion is a big deal for investment properties, where cash flow isn't always as steady as a paycheck funding a primary home.

Does a High LTV Automatically Mean a Bad Loan?

Not at all. A high LTV just means you're using more leverage. That translates to higher risk for the lender, which in turn means more risk for you. It's not inherently "bad," but you have to understand the trade-offs.

A loan with a 90% LTV, for example, is almost guaranteed to come with a higher interest rate and tighter conditions than one at 75% LTV. It also means you have very little equity, so your investment is more exposed if the market takes a dip. You get to buy the property with less cash out of pocket, but you're definitely paying a premium for that privilege.

A high LTV is a strategic choice. It can be a tool for spreading your capital across multiple assets, but you have to weigh that against the higher cost and increased risk.

How Does Refinancing Affect My LTV?

Refinancing completely resets the clock on your LTV. The calculation is done all over again using the new loan amount and the property's current appraised value. For investors, this can be an incredibly powerful move.

Let's say your property's value has shot up since you purchased it. Your LTV has naturally gone down. This can open the door to refinancing into a new loan with a much better interest rate, saving you a chunk of change every month. On the flip side, you could do a "cash-out" refinance, taking out a bigger loan to pull out some of the equity you've built up.

What Is the Difference Between LTV and CLTV?

This is a really important one to get right, especially if you have more than one loan on a property.

- LTV (Loan-to-Value): This only looks at your primary mortgage—the first loan you took out.

- CLTV (Combined Loan-to-Value): This adds up every single loan attached to the property (like a first mortgage plus a home equity line of credit) and divides the total by the property's value.

Here’s a quick example: You have a $500,000 property. Your main mortgage is $350,000, and you also have a $50,000 HELOC. Your LTV is 70% ($350k / $500k). But your CLTV is 80% (($350k + $50k) / $500k). Lenders always look at the CLTV to get the full picture of their risk.

Juggling investor relations, deal financing, and reporting can feel like a full-time job. Homebase streamlines the entire real estate syndication process—from fundraising and managing your investor portal to handling distributions—all for a simple flat monthly fee. Stop getting bogged down in spreadsheets and start focusing on what you do best: finding great deals. See how Homebase can help you grow.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.